The company (“MC” or the company) is the first company which industrialized and commercialized microwave chemical process in the world. The company has chosen not to be specialized in one industry/product segment, but to rather differentiate itself as a “promoter of microwave technology platform” and “a partner with many commercial partners.

What is Microwave?

A microwave is an electromagnetic wave with a wavelength ranging from 1mm to 1m.

It is widely used in home appliances, such as microwave ovens, and industrial fields such as radars and accelerators, radar-communication systems and microwave ovens.

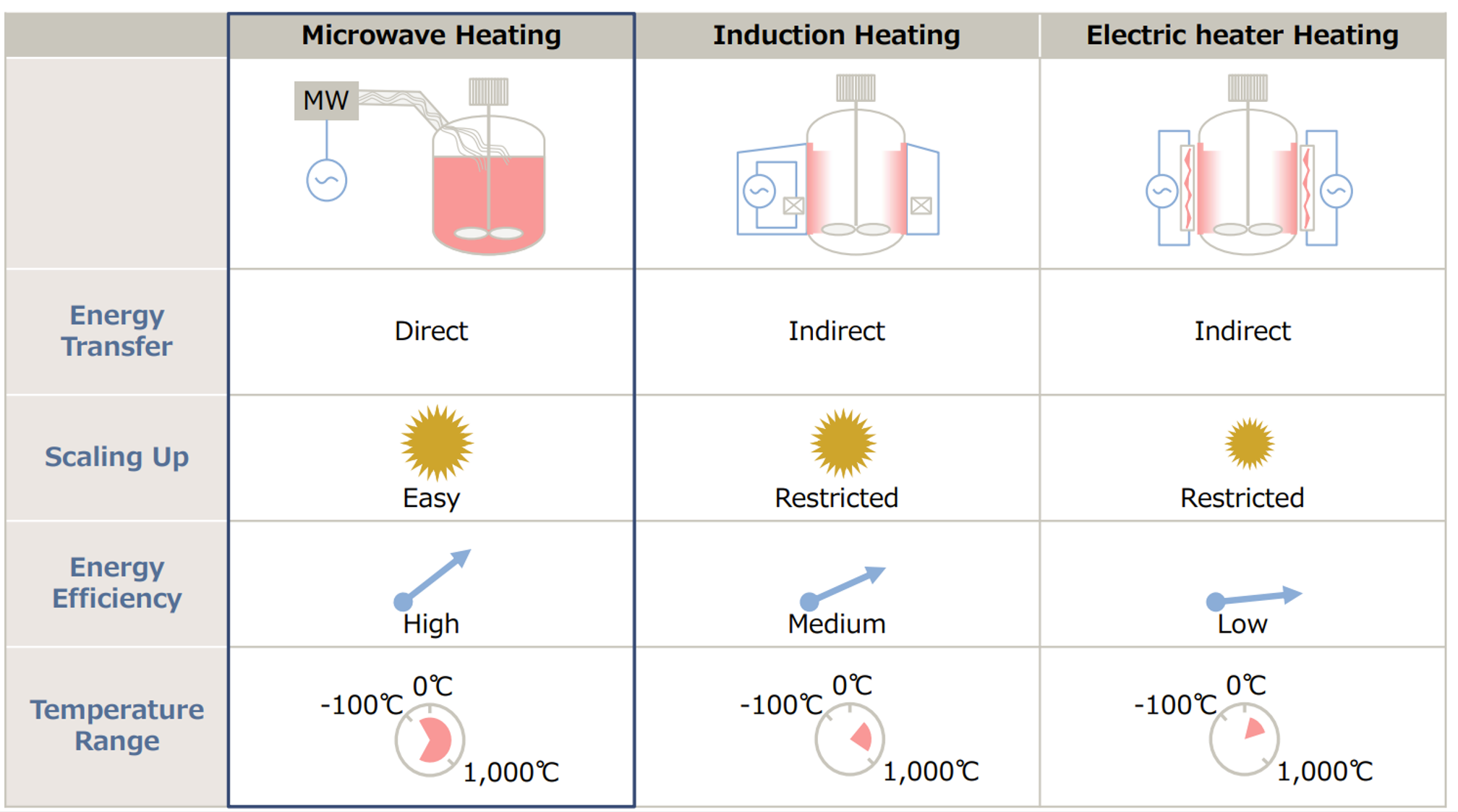

The benefits of microwave vs. legacy energy sources

The below table clearly summarizes the benefits of microwave which arises from its ability to transfer energy directly. This makes it easy to scale up the efficient energy production and allows a wide temperature range.

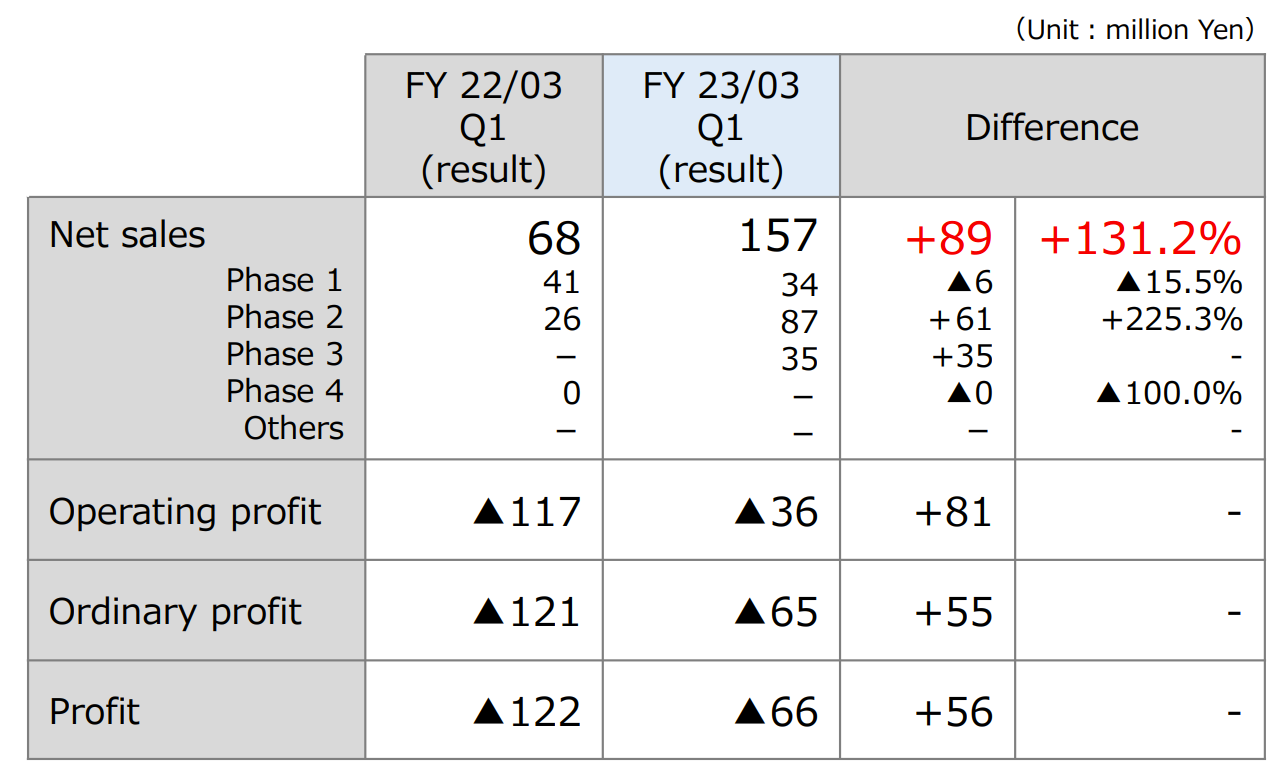

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

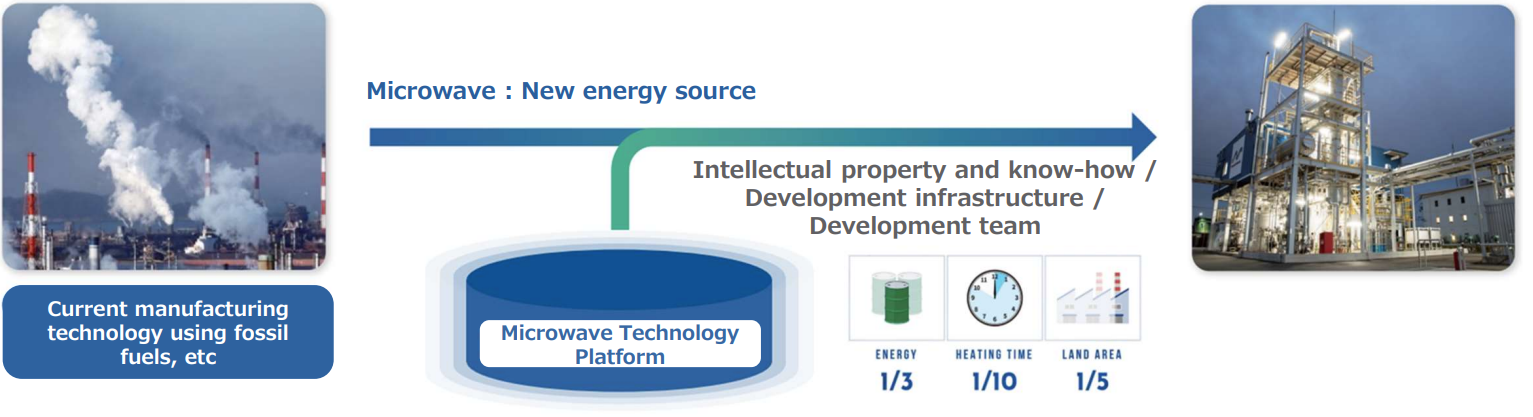

The efficiency improvement is evident in the stats in the following chart:

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

1.Investment thesis

1) Scalable business model

The company’s business model allows it to scale by standardizing its technology platform. In another words, the company is providing solutions beyond industry and company boundaries, from chemical waste recycling to food freeze drying.

By scaling, MC can lower the processing costs and cost savings can be passed onto the customers.

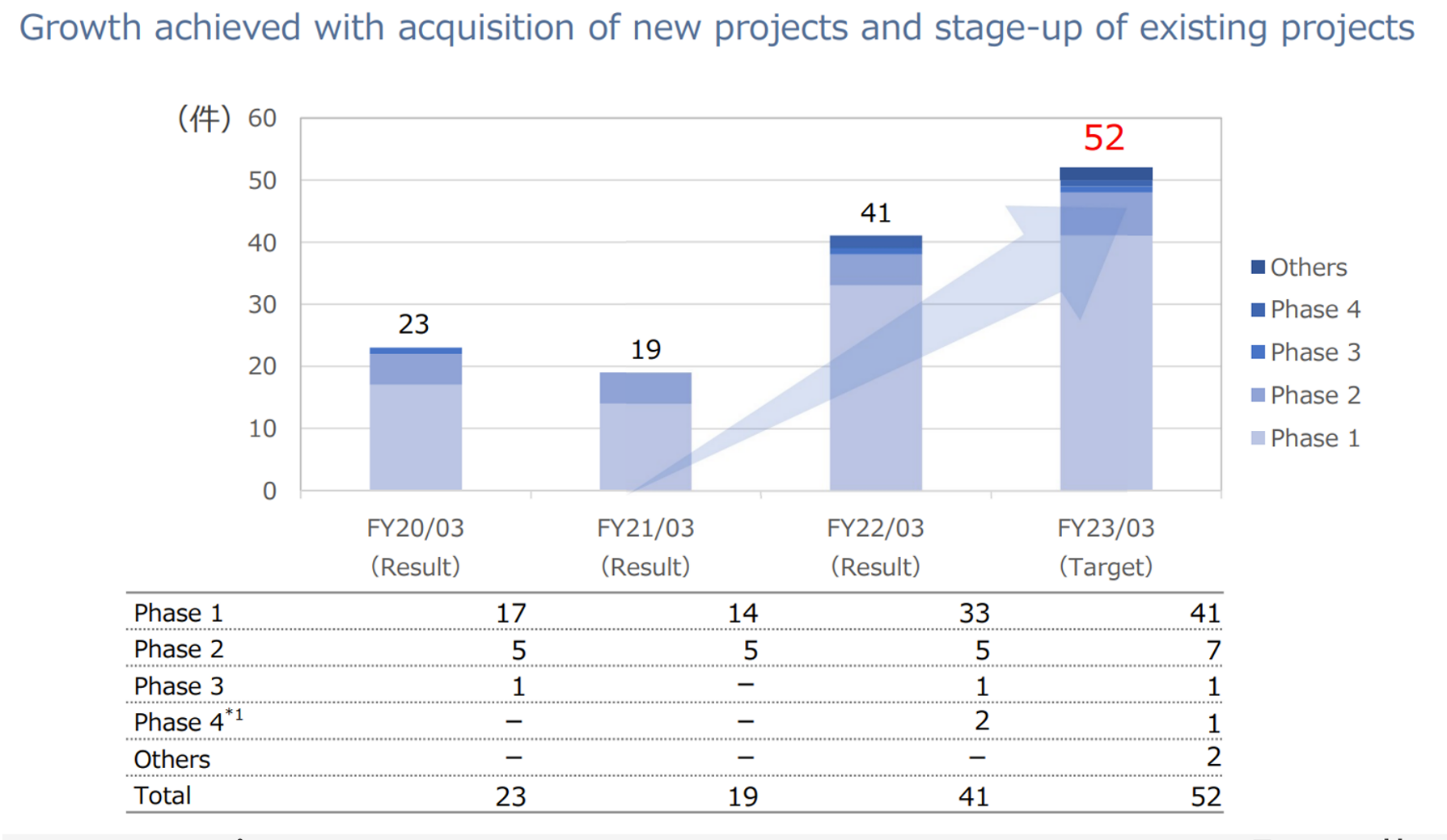

2) Ability to support every phase of a customer’s product cycle and generate profits in each cycle

As discussed earlier, MC can provide the clients with supports for all the 4th phases of a product development, i.e, R&D through engineering.

This ability to earn fees in each phase is MC’s unique business model, which will be discussed in Business Model section.

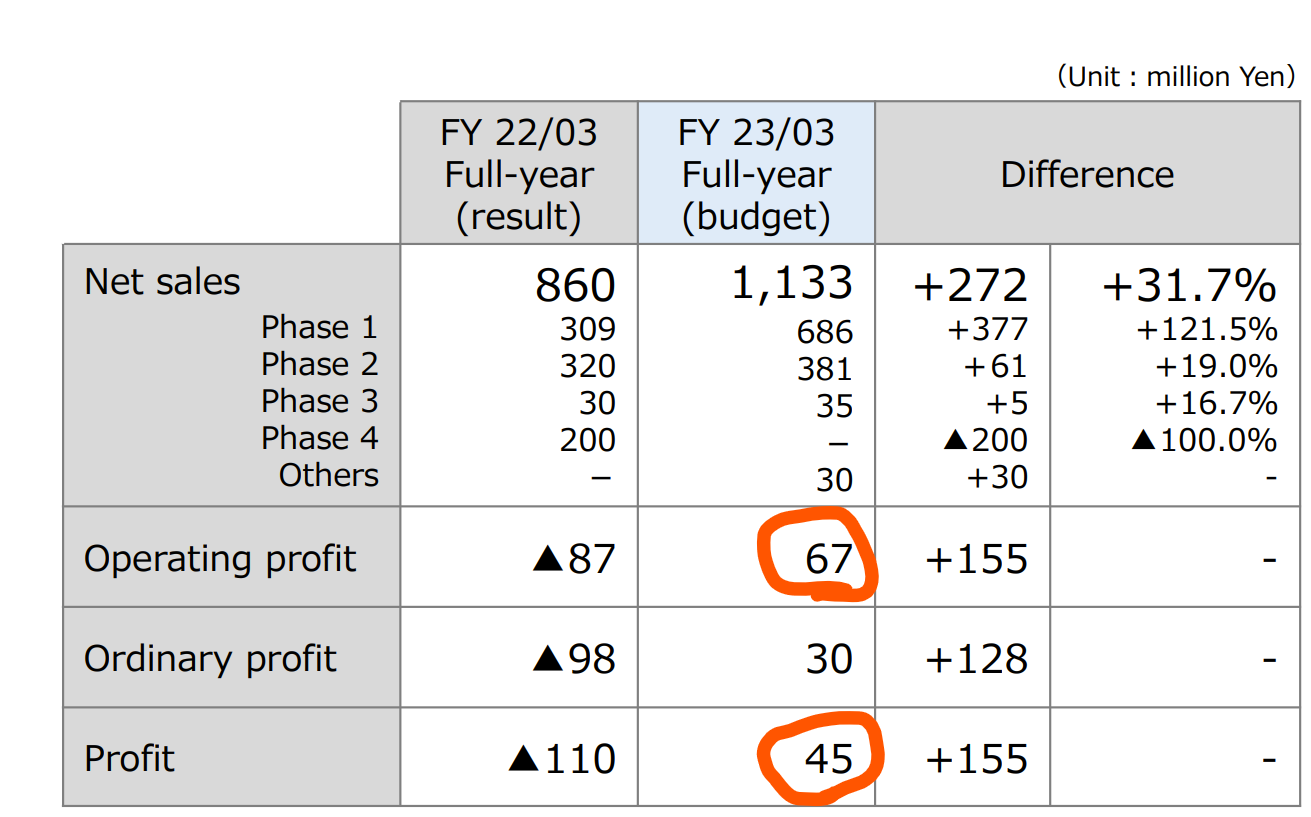

3) Positive operating income in sight for FYE 3/23

The stock tends to act positively when a young company has moved into a profitable phase.

(Source: Financial Results Material for the first quarter for FYE 3/23)

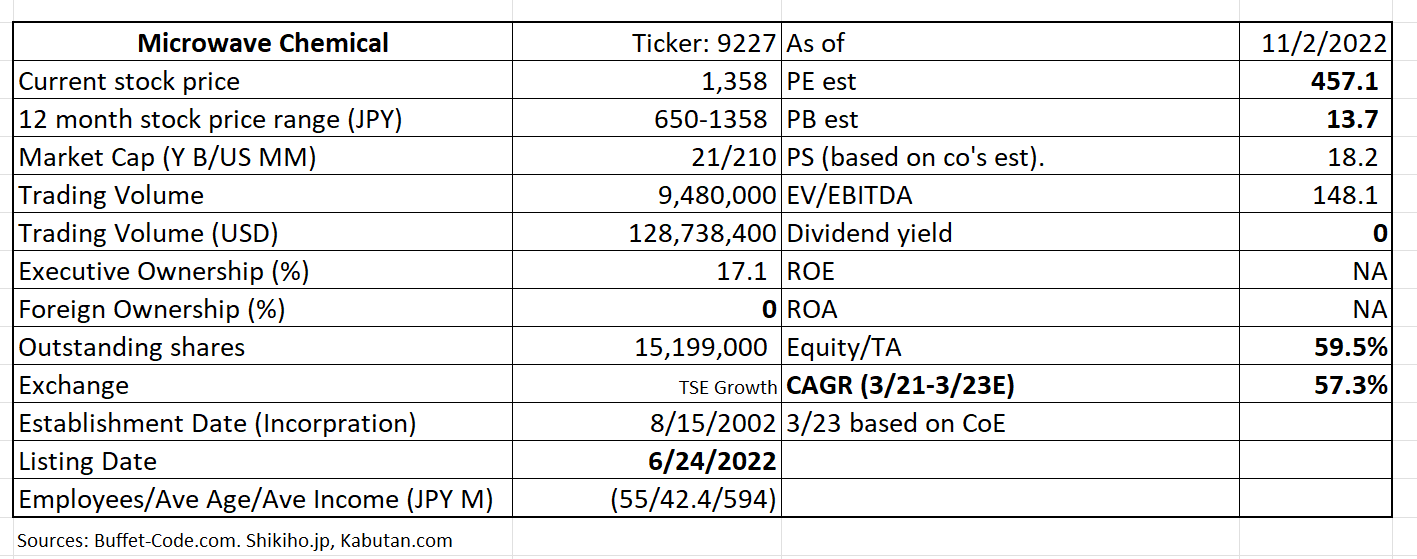

As typical with a company in a rapid growth stage, MC’s valuation is elevated. Thus, buying the shares requires a strong conviction in its investment merits discussed above.

2. Technically Speaking

(Source: buffet-code.com)

The shares are trading at its listing high with relatively large volume which is positive. However, we should be also aware that possible good earnings release on 11/11/22 (JST) may be baked in the stock.

3. Business Model

MC’s business model is its competitive advantage and is two pronged:

1) When a company is reviewing its existing production process, it often contacts MC as part of its process. Microwave is often considered as one of power reactor options and a prospect requests information and feasibility study from MC. The company estimates about 30% of prospects moves to phase 1 after contacting MC.

2) MC earns fees on each step (typically 4 steps) of a project development

Phase 1: Proof of concept: The process of testing feasibility of new concept before actual development.

MC earns fees on analysis and report.

Phase 2: Verification/Development of Reactor Vessel Design

MC earns fees on analysis and report

Phase 3: Commercial Reactor

MC earns fees on implementation and project management.

Phase 4: Support and maintenance: Support customers who have installed microwave reactors in their manufacturing process. Implement remote monitoring system.

In Phase 4, the companies earns license fees which are recurring. This phase offers highest gross margin since it takes least amounts of engineering hours.

The next profitable phase is 1, followed by Phase 2 and 3.

4. Financial Highlights

Financial results for the fist quarter ending 6/22 vs 6/21

Sales increased by JPY 89 MM (+131.2%) YoY due to strong growth in sales from Phase 2 and 3. The company still incurred operating losses* since

1) A first quarter of a year tends to be low sales volume season**,

2) Operating expenses are mainly fixed, thus, putting negative pressure on income.

3) Ordinary profits is lower than operating profits, due to interest/leasing expenses and listing related (one time) costs.

*Black triangles in tables denote negative numbers.

**The reason for the seasonality is explained at the end of this section.

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

FYE 3/31/23 Guidance

As discussed in Investment Thesis 3, the company is expected to turn profitable on operating and net profit basis. This is based on the fact that projects in all 4 phases are increasing as shown below:

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

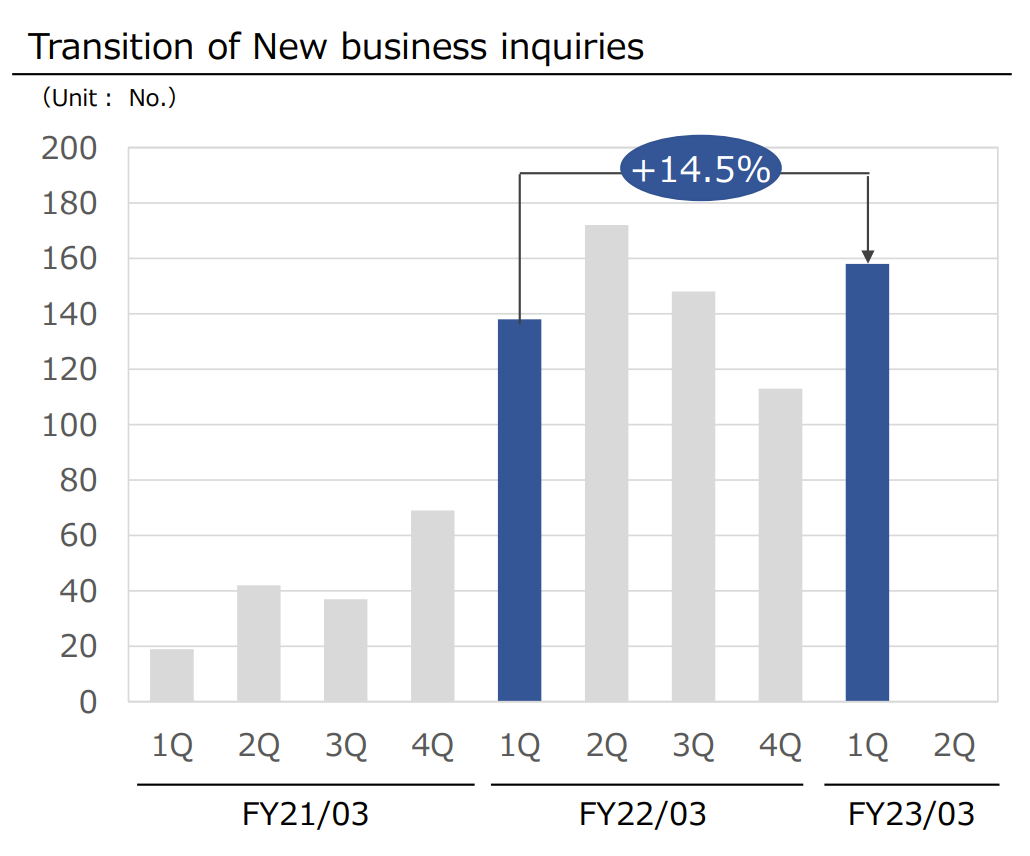

This increase in contracts will likely continue since the business inquiries which lead to new contacts are steadily on a upward trend.

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

**Seasonality of their operations: The number of business inquiries show some seasonality since clients will start their contract review process as per their new fiscal budgets which are decided in their 1st quarter (typically March quarter).

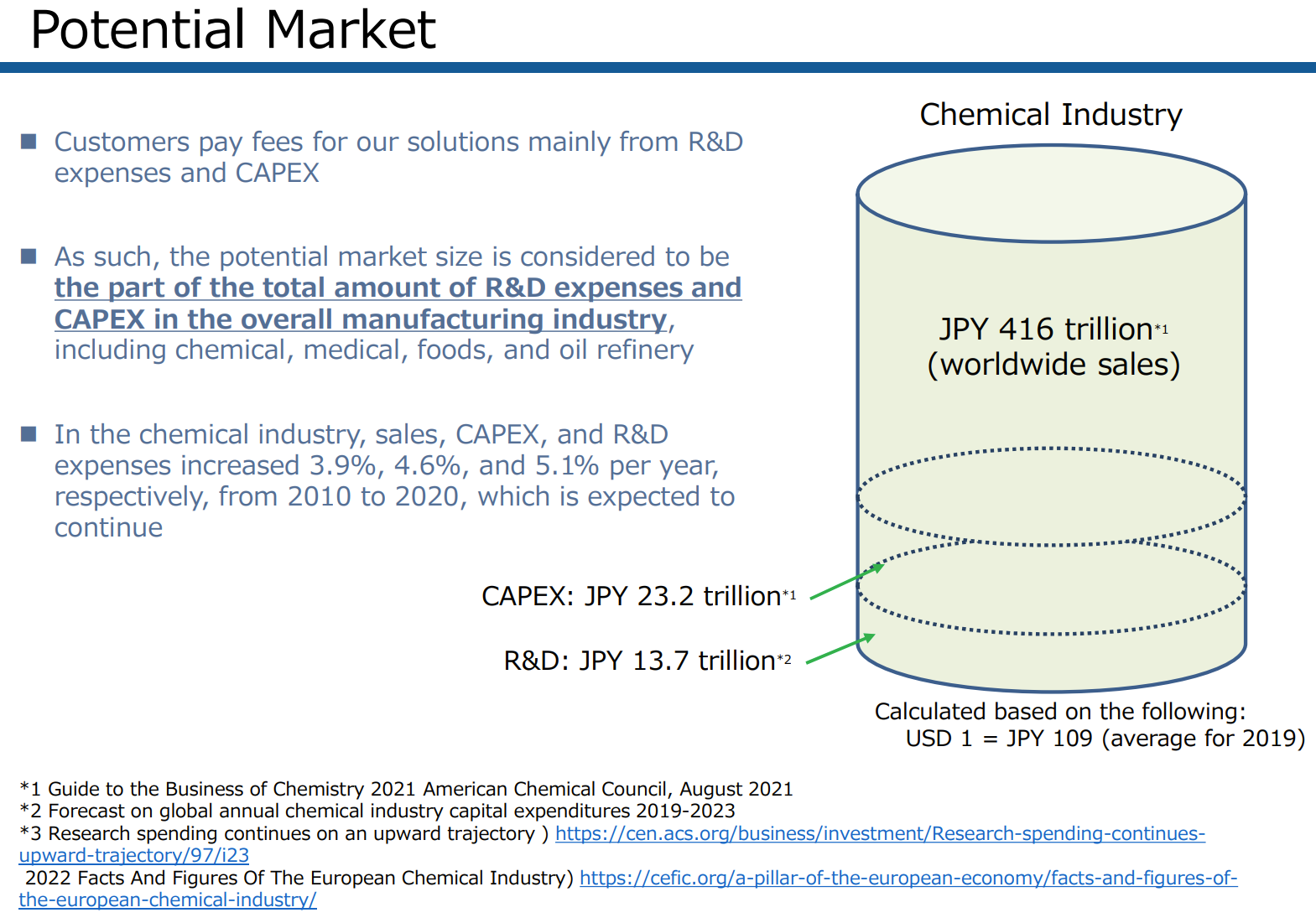

5. Total Addressable Markets (TAM)

Since the industrialization/commercialization of microwave is in its nascence stage, public market size analysis is not available. Thus, the company estimates their target industry size as the global chemical industry’s capital expenditure. This estimate seems a realistic one since the chemical industry is the main user of microwave reactor.

As per American and European Chemical industry report cited by the company shown below, sales, capex and R&D (research and development) grew 3.9%, 4.6% and 5.1% annual from 2010-2020. The trend is expected to continue which bodes well for MC’s top line growth.

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

6. Strengths and Weaknesses

Strengths

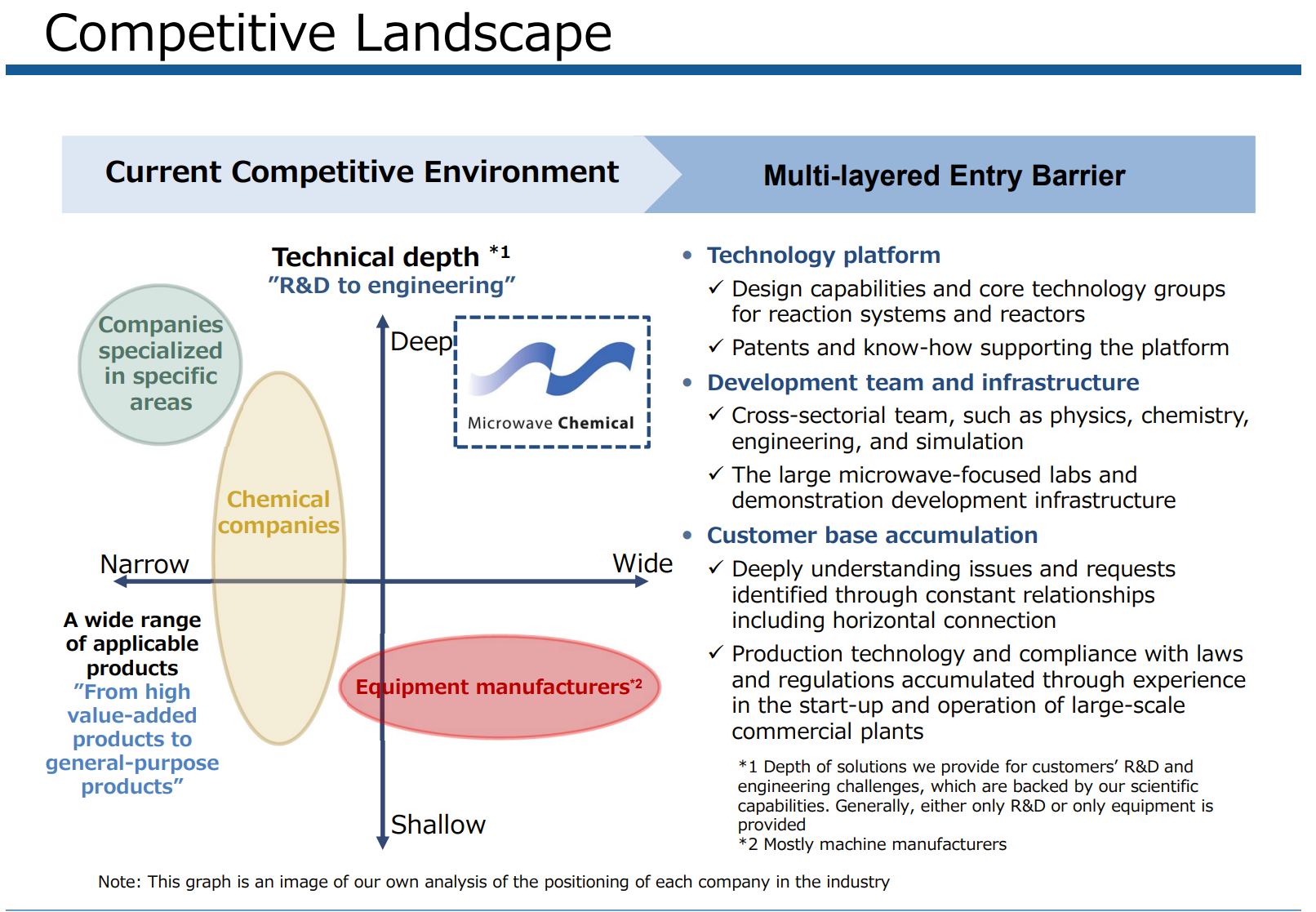

1. The only one player

As the first company which enables industrialization of microwave, the company enjoys a unique position to be the entire production line provider. In another words, it can provide solutions for customers’ R&D AND engineering challenges, the competitors tend to offer supports in certain specialized areas.

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

2. Profitability in sight

As pointed out earlier, the company’s current project pipeline suggests that it is on its way to profitability for FYE 3/23.

Weaknesses

1. Reliance on chemical industry

Currently majority of clients are domestic large chemical companies which have wherewithal to contract with MC’s services. Thus, MC’s performance can be swayed by the cyclicality of the chemical industries. However, as the requirements by “carbon neutral” regulations become more stringent, the number of inquiries by smaller companies would likely increase.

2. Low liquidity

The company’s shares are mainly owned by management and banks (80.8%) and liquidity is at 19.2% which is below 25% required for a listed company at Tokyo Growth Market. This liquidity issue needs to be resolved within a year, otherwise, the company may face delisting. We have inquired the company regarding their plan on increasing the liquidity. The detailed plan is not available, but the company appears to be aware of this liquidity issue.

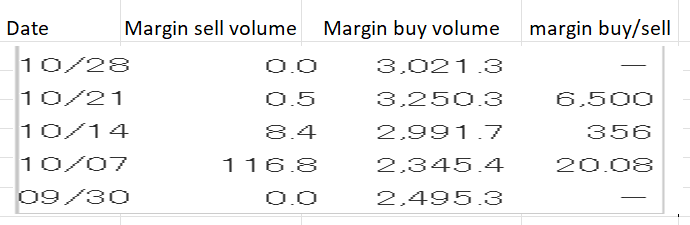

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For MC, margin buy volume is slowing rising but the current outstanding margin buy volume can be easily absorbed in one day trading. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance