Backgrounds: I am currently in Japan, after waiting for 3.5 years for easing Covid related travel restrictions. It is quite shocking to witness a rapid speed at which Japan and my parents have aged. Everywhere, I see verbal warnings and physical accommodations for the elderly. An increasing share of the older folks vs. the working age population seems not to peak at any time soon. This is where I believe eWell can grow its profits by providing solutions the Japanese society needs more than ever.

Who is eWell?

eWell (eWell or the company) develops and Markets Electronic Medical Record Services Exclusively for Home-Visit Nursing. The company went public on 9/18/22 at TSE Growth exchange.

1. Investment Thesis

1) Its target market will grow, driven by the needs of the society

By research of Ministry of Healthy, the size of the visiting nurse industry increased 2.8X from 2009 to 2019, in another words, from JPY 205 Bn to JPY 582 Bn with CAGR of 11% (source: eWell’s IPO filing documents).

Many elders prefer a stay-home care which has expanded the needs for home care professionals. In 2016, the home care industry was estimated to employ 460,000 individuals but the industry will likely need to hire 1,160,000 care workers in a few years to provide an adequate care (by the estimate of Ministry of Health). The possible increase of eWell’s target market is also discussed in TAM section later.

Against this rising needs, however, Japan, with its shrinking working age population, can’t provide sufficient home care to every elderly who needs one.

eWell aims to fill this supply and demand void by improving efficiency with which a home care nurse works. Rising productivity means a nurse can increase the number of patients under their care.

2) The company is rapidly growing by solving the above “care shortage”

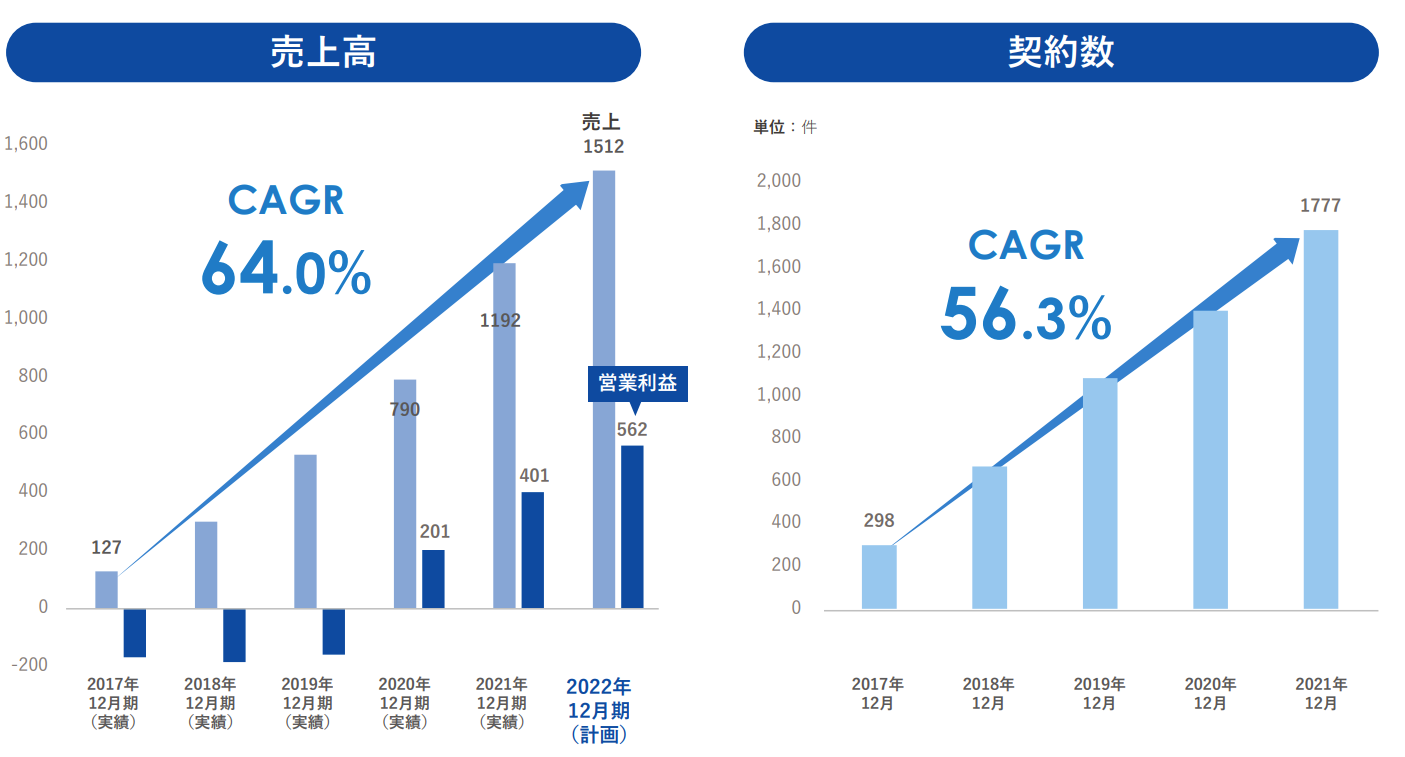

The below chart shows its growth so far:

(Source: Filing memorandum as of 8/22)

Note: the left bar chart – Sales (the light blue) are estimated to grow at CAGR of 64% for the last 5 years. The dark bars are operating profits which turned positive in FYE 12/20.

The right bar chart highlight the number of clients which grew at CAGR of 56.3% from 12/17 through 12/21.

The other key performance indicators (KPIs) stand as follows:

Average contract period: 3.2 years

Average contract price: JPY 69,000

Market share of total nursing stations: 15.2%

Churn:0.09%

3) Competitive Advantage: iBow automates (digitizes) home care

The Company differentiates itself by focusing on digitization of the entire home care process. It created its customer interfaces through a client survey. As a result, eWell is well known for its customizable system. Its peers tend to be bigger and their systems are standardized for large visiting nurse stations. Also, many competitors put emphasis in automating preparation of medical fee statements for the insurance industry, not “nurse visits” specifically.

4) Next Growth with BPO

The company has increased a contract price per a client by adding several auxiliary services to a basic iBow which is a home visit record keeping. A contract price was in JPY 55,600 in 12/19, JPY 59,900 (+7.8% y/y) in 12/20 and increased to JPY 69,000 (+15.2% y/y) in 12/21. These services include iBow Kintai (attendance record keeping) and iBow Rezept (medical service statement creation). The newest service is a BPO which handles the entire home care administration.

2. Technically Speaking

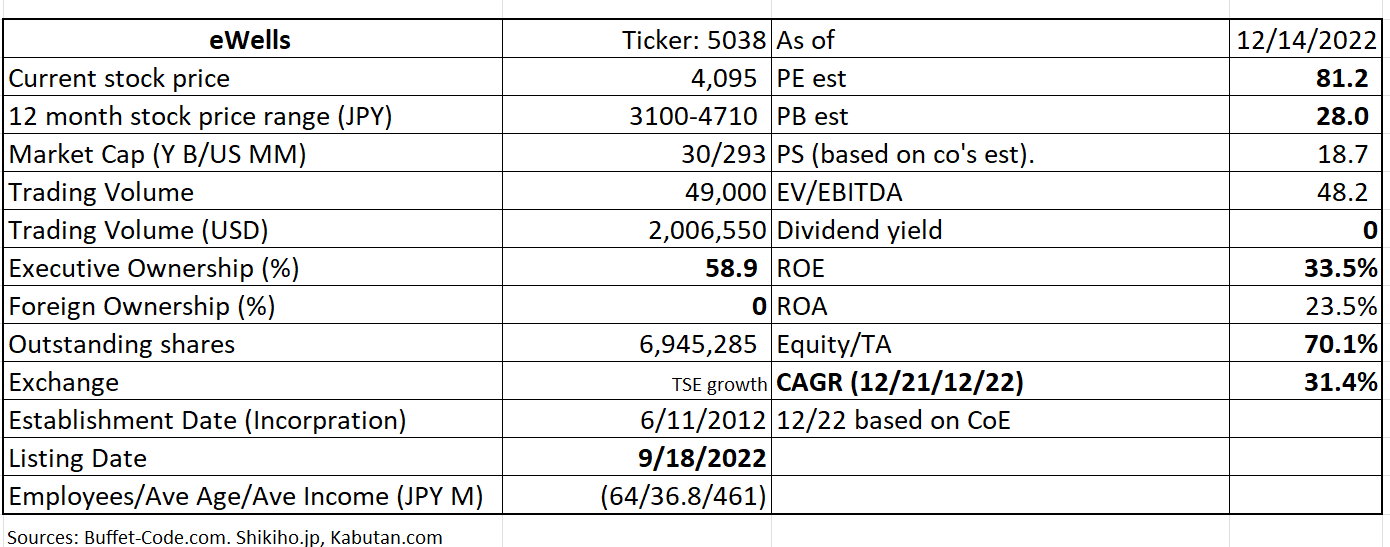

(Source: buffet-code.com)

The Company is a small cap stock and trading volume needs to improve. Also the stock is trading at near pricing cluster of JPY 4,070. The better entry point is after the stock breaks through this price range.

The Company is trading at PE of 81x which is quite high, but this can partially be justified by its high ROE of 34%. Many Japanese companies’ ROE are still below 10%.

Note: The Company should read eWell, not eWells.

3. Business Model

1. iBow

iBow, the company’s core product, is an electronic recording service. It’s offered to visiting nurse stations as a subscription service. It allows nurses and others to easily create records and review past medical records at patients’ homes. By streamlining after-visit recording keeping and reducing the time burden on a nurse, iBow increases numbers of care visits per a professional.

iBow pricing:

Base fee – JPY 18,000 ($180)/month

Additional fee – JPY 100/visit

The other products often offered together with iBow and contribute to a rise of a per client contract price are:

iBow Kintai (automating attendance record)

iBow Rezept (automating insurance billing forms)

2. BPO service

The company has started a BPO service which takes over the entire administrative processing required for home visit health care industry. This BPO admin service offers eWell a great cross sell opportunity.

BPO pricing:

Minimum base fee: JPY 100,000 ($1,000)/month

Additional fee: 5% of the insurance billed

4. Financial Highlights

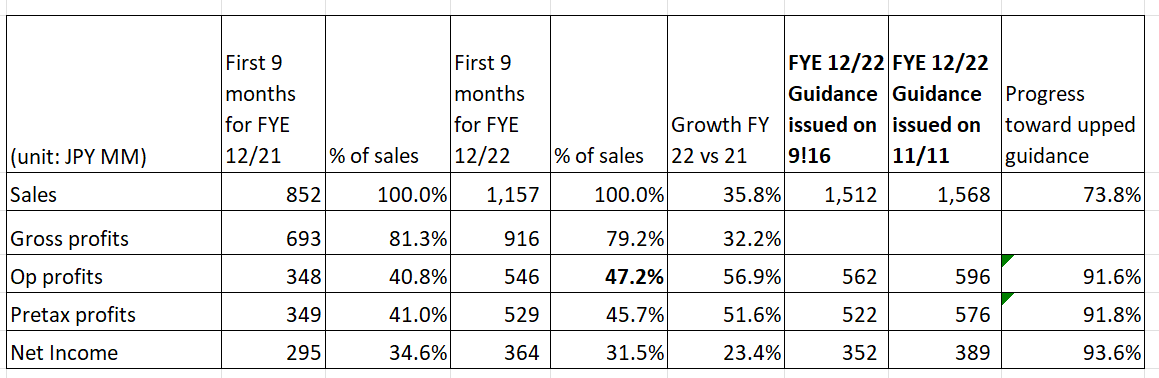

Financial results for the fist quarter ending 9/22 vs 9/21

The company reported solid results in 9/22 compared to 9/21: Sales was up 36% and operating profits grew 52%.

These growth was driven by:

1) The number of the client nursing stations grew 22.4%, reaching 2,067.

2) The contract amount went up 6.5% at JPY 72,000.

3) The client churn rate is low at 0.06%.

(Source: Financial Results Briefing for the 3rd quarter for the fiscal year ending 12/31/22, Translation by www.Japaneseipo.com)

Financial Guidance for FYE 12/22

The last three columns of the above table focuses on the company’s guidance for FYE 12/22 results. The guidance hike on 11/11/22 was driven by strong showings of iBow and iBow Rezept. eWell expects an increase in spending (mainly server upgrading and advertisement) in the 4th quarter, thus, net income had already reached 94% of annual income target in the 3rd quarter.

5. Total Addressable Markets (TAM)

The company’s core target market is visiting nurse stations. Demand for home care nurses and nursing stations will surely increase, since the policy makers view that home care can be economical ways to reduce overall health care costs in Japan. The below bar chart illustrates that the number of home care nursing stations grew at CAGR of 8.5% from JPY 63 Bn in 2012 to JPY 143 Bn ($1.4 Bn) in 6/2022.

eWell has increased its share by being able to focus on “digitization of home care record keeping”: 6.9% in 3/19 to around 15% in 9/12.

6. Strengths and Weaknesses

Strengths

Competitive advantage

The company offers a subscription service which can digitally handle the entire process of home care ie from a visit through insurance billing. The competitors’ main focus is on automating insurance billing for large health care institutions.

Weaknesses

Rising Competition

The company operates in a growth industry, which tends to attract new entrants. The company lists its customer service and flexible system as their competitive advantages to fend off competitors.

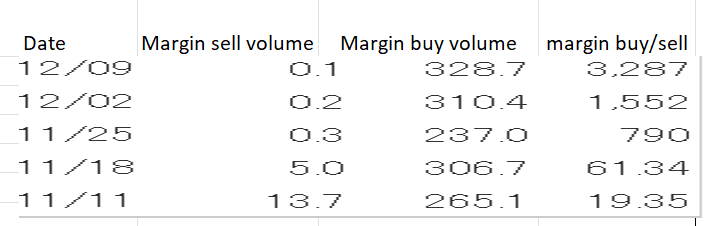

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For eWell, margin buy sell ratio is extremely high and rising. Thus, the near term selling pressure is a bit of a concern. It may be prudent to wait for the stock to break a pricing cluster of JPY 4,070 with large trading volume.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance