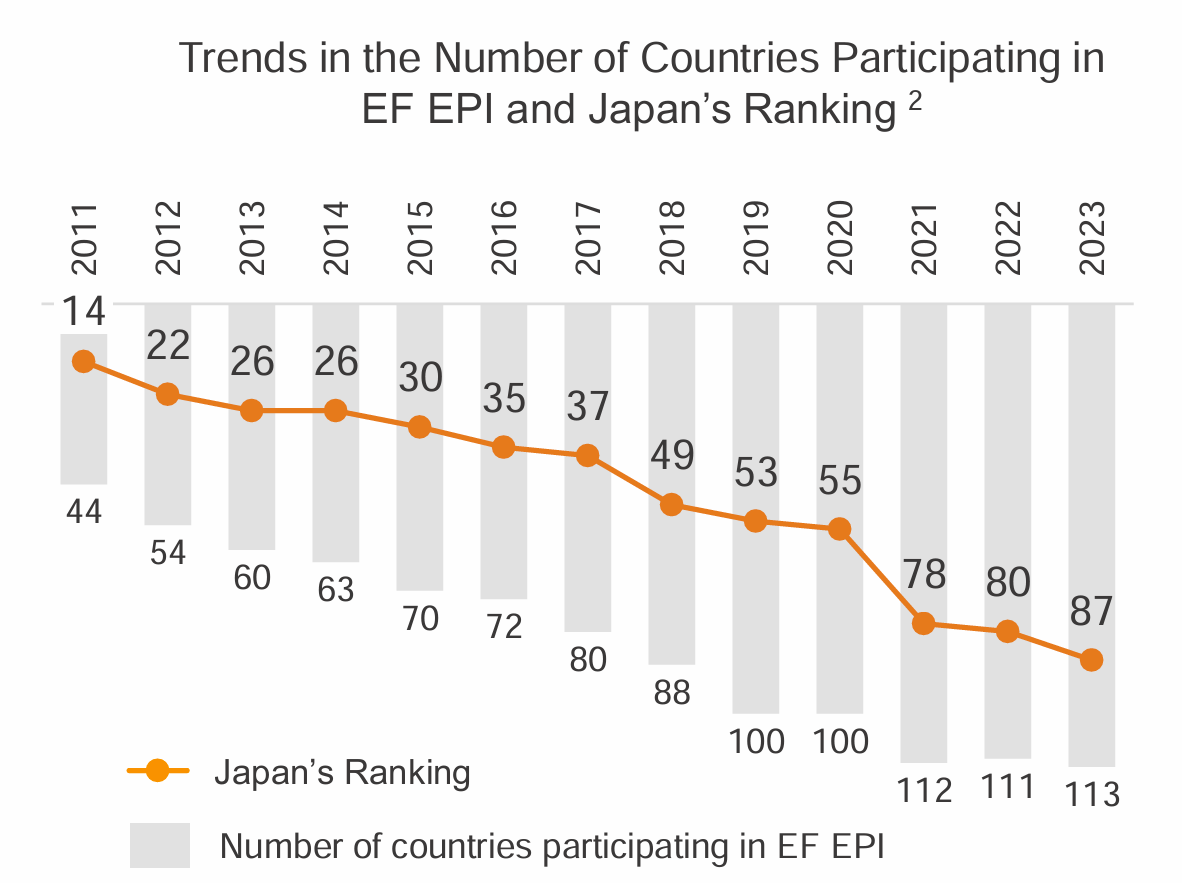

The Japanese collectively spend ¥165 Bn annually on learning English. Despite this investment, their English proficiency ranks 87th in the world and 15th among the 23 Asian countries and regions (by a 2023 survey by the Swiss international education company EF Education First). In fact, Japan’s ranking has kept decreasing since 2011. This discrepancy suggests a significant demand for “Effective English learning”.

(source: company)

The demand for English skills is increasing due to several factors:

- The rising number of visitors to Japan who do not speak Japanese.

- An increase in foreign hires due to Japan’s declining population.

- More workers planning to go overseas for better career opportunities

PROGRIT (“PG’ and the “company”) is not an English school, instead, it provides English coaching services “PROGRIT”. They believe the only way to gain English fluency is to find the right method for a learner and repeat it for a certain time.

The company has proven the effectiveness of PROGRIT by turning profitable in the 2nd year of full operations in FY8/19. Since then, PG accomplished 34% sales’ CAGR for FY8/18-FY8/23.

The company achieved record-high results in all items from sales to net profit for Q3 FY8/24, as rising costs for brand-building commercials and R&D were absorbed by rising sales. The flagship product PROGRIT boasts accumulated user counts of 16,000 as of FY8/23 and the student number of their newer subscription program – SHADOTEN users rose 49.6% from 4,532 in Q3 FY8/23 to 6,780 in Q3 FY8/24.

PROGRIT accounted for 67% of 3Q FY8/24 cumulative sales of ¥3,179 MM and 33% from the company’s subscription products.

PROGRIT with a market cap of ¥15 Bn, is small. BUT,

PROGRIT is popular not only for learners but also for institutional investors. Management noted that they meet 20-30 institutional investors/quarter and 100 investors/a year.

I have discussed how PROGRIT has generated an impressive growth in my detailed report which is available for purchase.