Who is W-Scope?

W-Scope (“WS” or the “company”) focuses on manufacturing of separators for lithium-ion (Li-ion) secondary batteries. The company is founded in Yokohama in 2005 by president, Won-Kun Choi, a former employee of Samsung Electronics in South Korea. Its head office is in Tokyo, but development and manufacturing functions are in South Korea. The main end user industries are consumer appliances such as mobile devices and in-vehicles batteries. Its Korean subsidiary (production hub) has rapidly expanding its capacity as European automakers are increasingly adopting Korean battery makers which use WS’s separators. W-Scope Korea has announced that it will go public in Korean exchange in 6/22.

Before you go on:

To be interested in W-Scope, you would ultimately have to believe that 1) EV adoption will continue and 2) the sustained growth of lithium-ion battery will last for the next several years. If you predict that solid state battery will replace Li-Ion battery shortly (say, by the year end 2022), this report is not for you.

I. Investment Thesis:

I. Favorable Industry Backdrop

1 EV (Electronic Vehicle)’s future

1-a) Global EV market is expected to remain strong

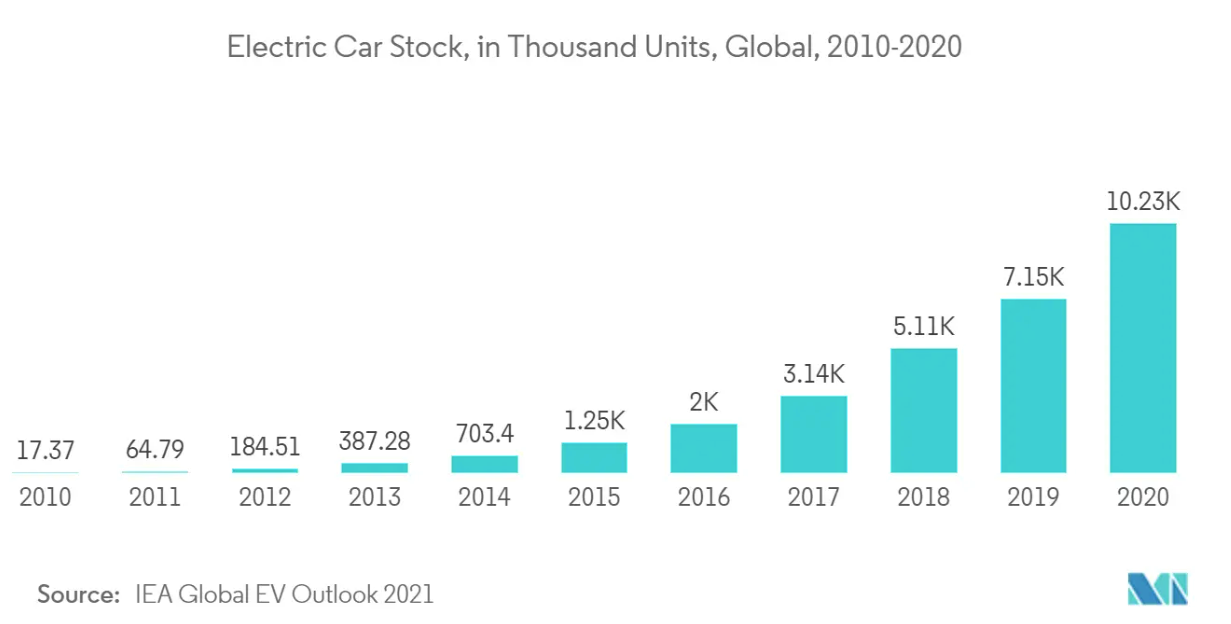

The below bar graph illustrates the consistent growth in EV adoption over the last decade.

(Source: IEA Global EV Outlook 2021 updated 4/28/21)

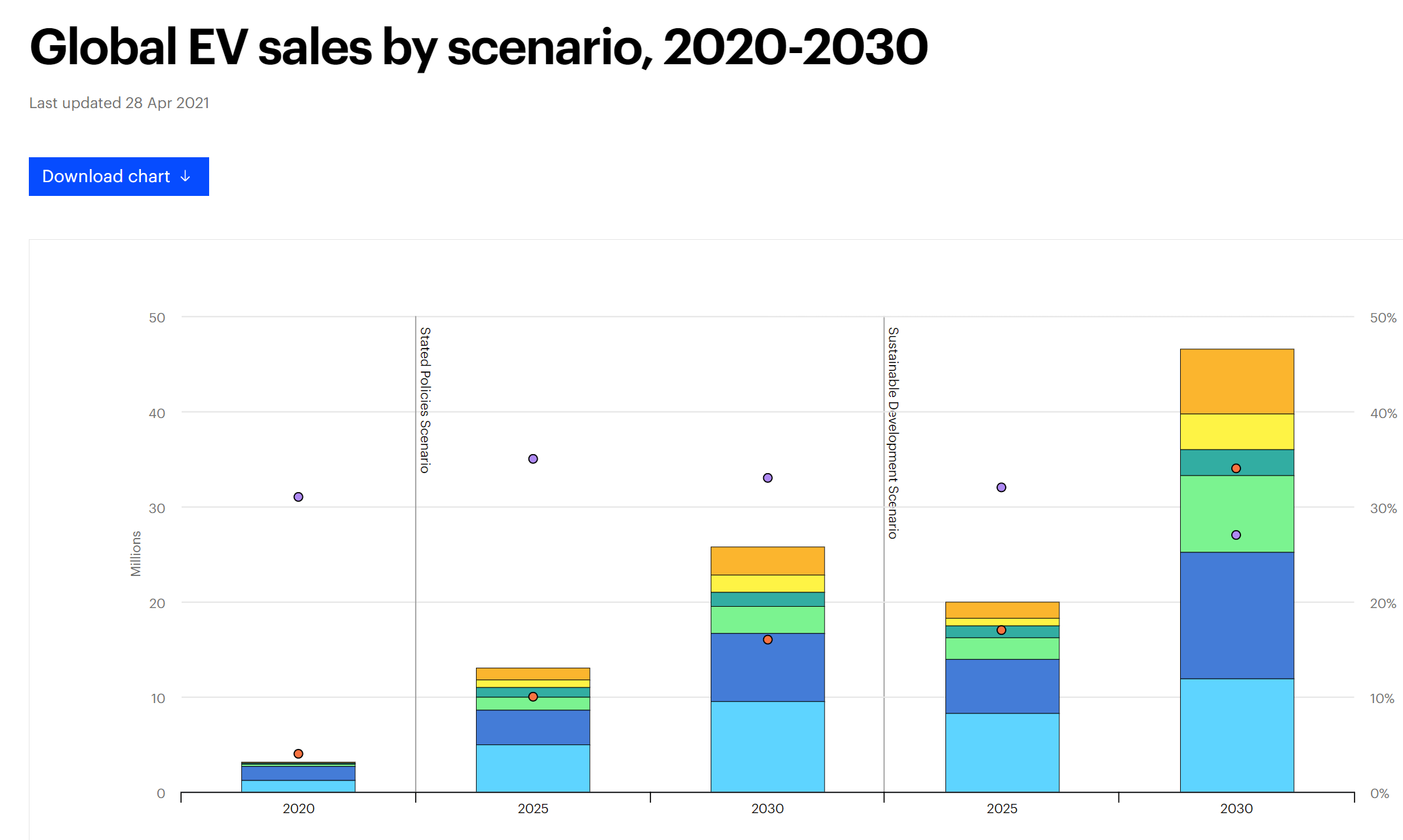

IEA predicts that continued growth in EV sales under the two scenarios: (1) under STEPS, EV’s share of total auto sales is 16% in 2030, (2) under SDS: 34% in 2030, as below:

1). The Stated Policies Scenario (STEPS) is the baseline scenario which reflects all existing policies, policy ambitions and targets that have been legislated for or announced by governments around the world.

EV share out of all the car sales:

2025 10%

2030 16%

2). The Sustainable Development Scenario (SDS) rests on three pillars: ensure universal energy access for all by 2030; bring about sharp reductions in emissions of air pollutants; and meet global climate goals in line with the Paris Agreement.

EV share out of all the car sales:

2025 17%

2030 34%

(Source: IEA Global EV Outlook 2021 updated 4/28/21)

1-b) Finally affordable EVs in Japan:

Minicars are very popular in Japan. After being introduced into the Japanese automotive market in the late 1940s, Kei cars (small cars in Japanese) quickly gained popularity and now more than one in three vehicles owned or in use are small cars in Japan (by Statisca).

kei cars are automobiles defined by being shorter than 3.4 meters (11 feet) with a maximum height of two meters and a maximum width of 1.48 meters (4.9 feet). The engine capacity is restricted to 0.66 liters (660 cubic meters). Kei cars are often box-shaped to minimize the overall size of the vehicle while maximizing

interior space.

To some extent, its success is attributable to Japan’s road infrastructure. Japan‘s cities are densely constructed, with small vehicles naturally better navigating its narrow roads. Moreover, real estate is expensive – so is parking.

Available kei cars are mostly gasoline-fueled – and few hybrid-electric models – yet their size poses structural problems for battery-electric versions.

However, in early 5/22, Nissan has announced that the Nissan Sakura EV will be available in Japan, starting this summer. Sakura means “cherry blossom” in Japanese. Pricing ranges from ¥2,333,100 ($18,221) to ¥2,940,300 ($22,964) but if you include the clean energy vehicle subsidy that is available in Japan, you can buy a Sakura EV for as low as ¥1,780,000 ($13,912). Furthermore, Japanese customers will be able to purchase the Sakura EV online, communicating with a sales representative through a video chat.

Sakura is the product of 50/50 joint venture of Mitsubishi and Nissan. The footprint is tiny to comply with kei car regulations. The Sakura measures 3,395 mm (133.7 inches) long, 1,475 mm (58.1 inches) wide, and 1,655 mm (65.2 inches) tall, with a 2,495 mm (98.2 inches) wheelbase. Those figures make the Fiat 500 and the Honda e urban EVs look large in comparison. The turning radius is just 4.8 m (189 inches), allowing it to easily navigate on narrow Japanese roads.

The weight is rather high for kei car standards, ranging between 1,070 kg (2,359 pounds) and 1,080 kg (2,381 pounds) depending on the equipment due to the weight of electrification.

This affordable EVs will likely expedite adoption of EVs in Japan

2) Lithium Ion (Li-Ion) Battery vs. Solid State Battery

The first real solid-state batteries were originally developed in 1970. However, the technology still hasn’t broken through on a large scale yet.

What is the difference between the two batteries?

There are a lot of discussions on the topic, but below I summarizes findings from two articles:

The key difference: lithium-ion battery uses a separator and liquid electrolytic solution as the way to exchange lithium ions between the positive and negative electrodes. Solid-state batteries opt for a solid electrolyte which functions as a separator. A battery’s electrolyte is a conductive chemical mixture that allows the flow of current between the anode and cathode.

“What’s the difference between a Li-ion and solid-state battery?” by Android Authority dated 11/8/16.

Solid-state batteries are safer, can pack in more juice, and can be used for even thinner devices.

The benefits of shifting from a liquid to solid electrolyte is 1) space saving, 2) longer life spans:

1) This is because instead of requiring large separators between the liquid cells, solid state batteries only require very thin barriers to prevent a short circuit.

2) Solid-state electrolytes are typically less reactive than today’s liquid or gel, so these batteries can’t explode or catch fire, thus safer for the consumers.

Then, why are the solid state batteries with “lighter, with greater energy density, more range, lower cost, and faster recharge times” far from ready?

Autoweek’s 2/1/21 article “The Eternal Promise of Solid-State Batteries” explains,

One major hang-up for workable solid-state batteries is that when they use lithium-metal anodes, small crystal branch-like spikes called dendrites develop, leading to shorter cell life and safety issues.

It seems that it will be a while for solid state batteries will pose serious threats to W-Scope.

II. SBI Securities (a subsidiary of SBI Holdings*) announced the purchase of WS stocks,

up to 3,000,000 shares and 5.1% of the company, by 5/31/22. The stock reacted positively to this news and good results for Q1 for FYE 12/22. The dead line 5/31/22 has past, but SBI’s confidence in the company speaks well for WS’s potential.

*SBI Holdings was founded in 1999, as part of the Softbank group. The company was listed on the Osaka Stock exchange in 12/2000 and on the Tokyo Stock Exchange in 2002. The SBI Group became completely independent from Softbank in 2006.

III. Li-Ion Battery Pure Play

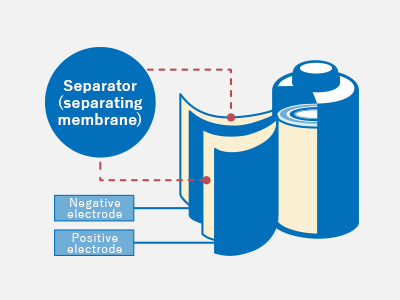

(Source: the company website)

MS’s main (and the only) product is Separator which is one of core components of lithium-ion secondary battery. It allows electric current to go back and forth between negative and positive nodes while preventing overheat and ignition caused by short-circuit.

Four core components of lithium-ion secondary battery are positive and negative electrodes material, electrolyte and separator. In addition, there are between 20 and 30 materials such as metal foil, binder and additive agents. Performance and material cost of lithium-ion secondary battery are mostly determined by those 4 core components.

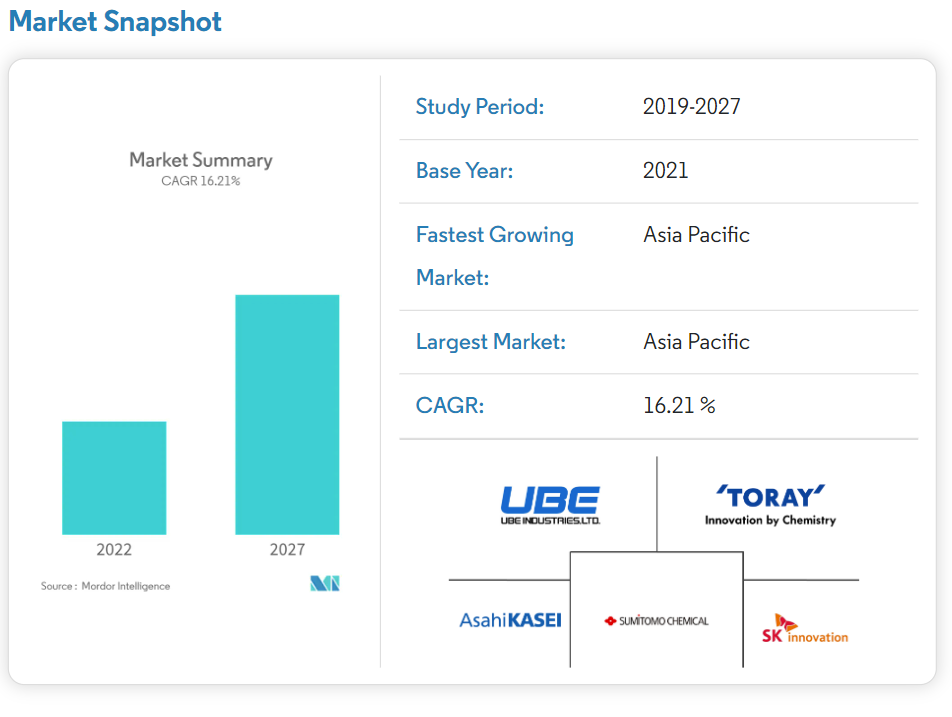

The below study by Modor Intelligence estimates that The Li-ion battery separator market was valued at $5.32 Bn in 2020 and is expected reach $14.43 Bn by 2027 with a CGR of 16.21%. As you can see from the above diagram, 4 of 5 major players are large chemical companies in Japan (SK is a Korean company). WS is a pure play focused on separator and can benefits from a rapid growth of separators.

(Source: Mordor Intelligence: Li-ion battery separator market-growth, trends, Covid-19 impact, and Forecast (2022-2027) )

IV. Subsidiary on KRX

In 2/22, WS announced that W-Scope Chungju Plant Co., LTd will be listed on the Korea Exchange (KRX) in around 6/22. Proceeds finance production expansion in Korea to support continued demand increase.

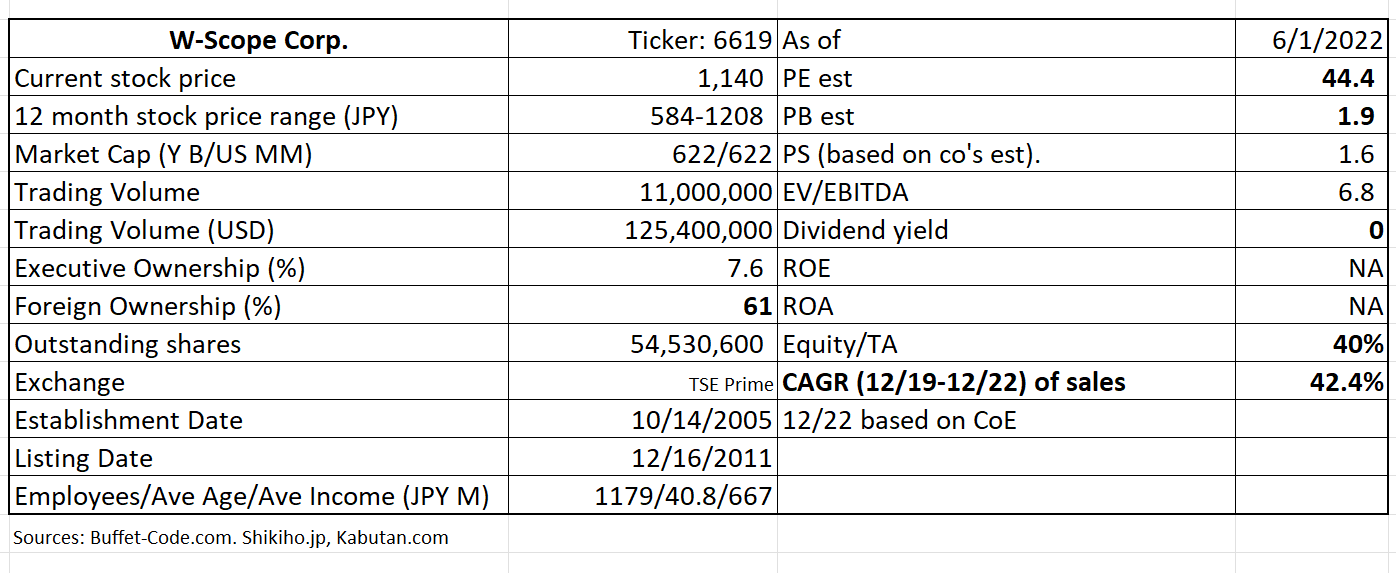

PE is elevated at 44x based on COE 12/22 due to high depreciation expenses depressing net income. However, when viewed in terms of sales, the company is trading at a reasonable P/S of 1.6x compared to sales CAGR of 42%.

2. Technically Speaking

(Source: buffet-code.com)

However, the stock has pushed through the volume cluster of JPY 1,200. Thus, if the stock can maintain the current high trading volume, the near term selling pressure is not a big concern.

3. Business Model

WS’s business model is supported by its production and R&D which are specialized in membrane films.

The “successive biaxial orientation method” is employed in production. The method stretches membrane separately to mechanical and perpendicular directions.

This method is a key to their success, since it improves mass production capability by maximizing usable area dimension of membrane film.

4. Financial Highlights

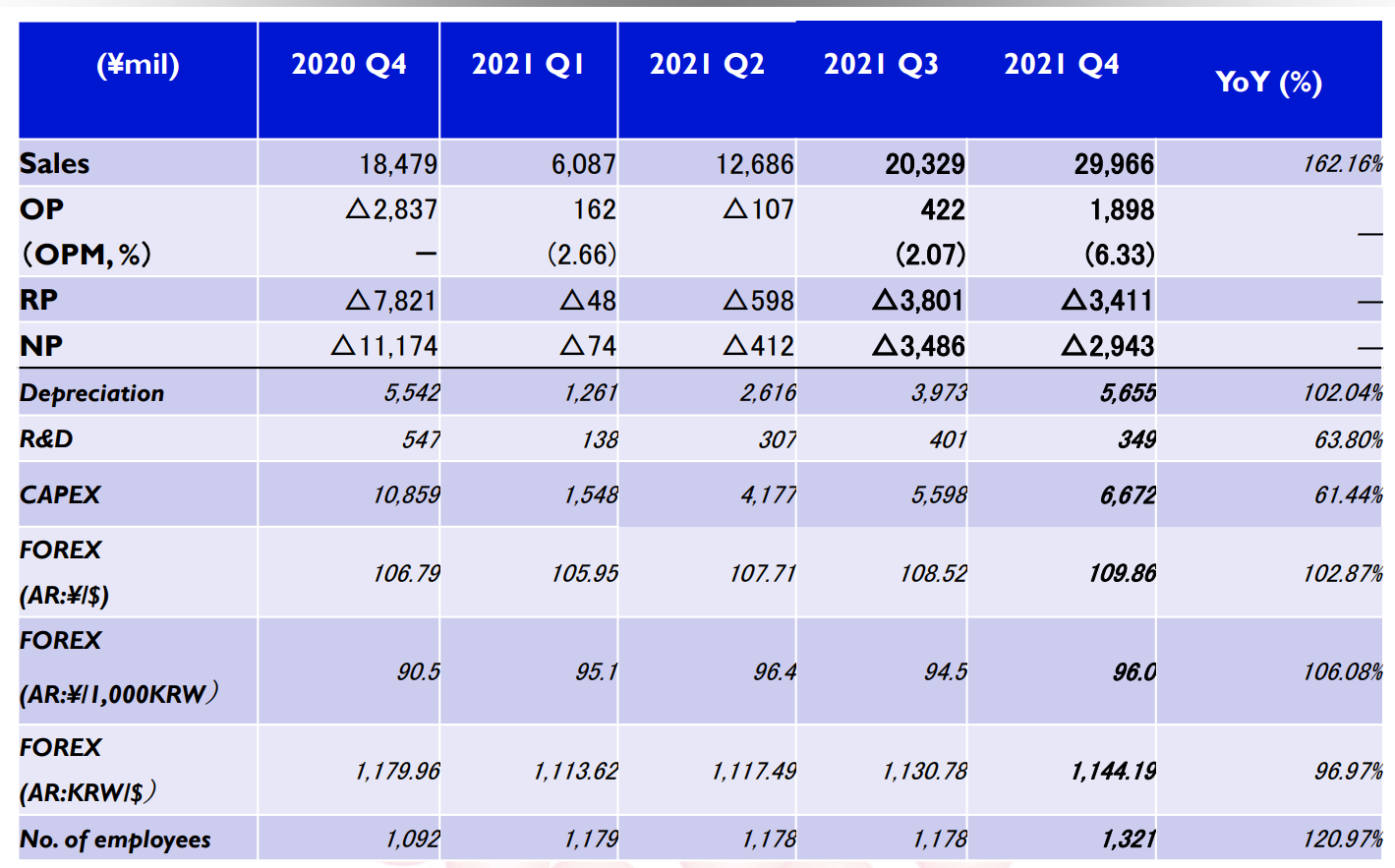

FYE 12/21 Results (Cumulative)

(Source: Full Year Financial Briefing for FYE 12/31/21)

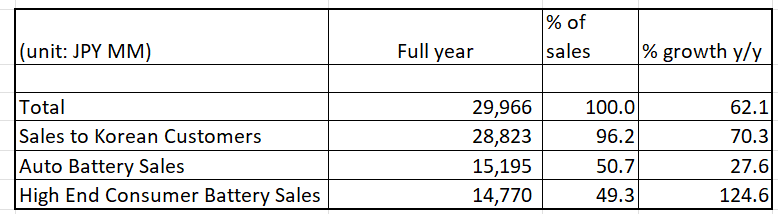

Sales were up 62.1% year on year as high end consumer battery sales saw a tremendous growth at 124.6% y/y. Automotive battery growth was robust as well at 27.6% y/y. The below table shows sales break down.

(Source: Full Year Financial Briefing for FYE 12/31/21)

Operating profits turned positive in FYE 12/21 driven mainly by sales volume increase and sales mix (an increase of high margin consumer products).

CAPEX

Thanks to robust demand, automotive battery separator production lines are operating at their full capacity. As stated earlier, the company’s Korean subsidiary will be listed at Korean Stock Exchange in 6/22 with an intent to use IPO proceeds for capacity expansion.

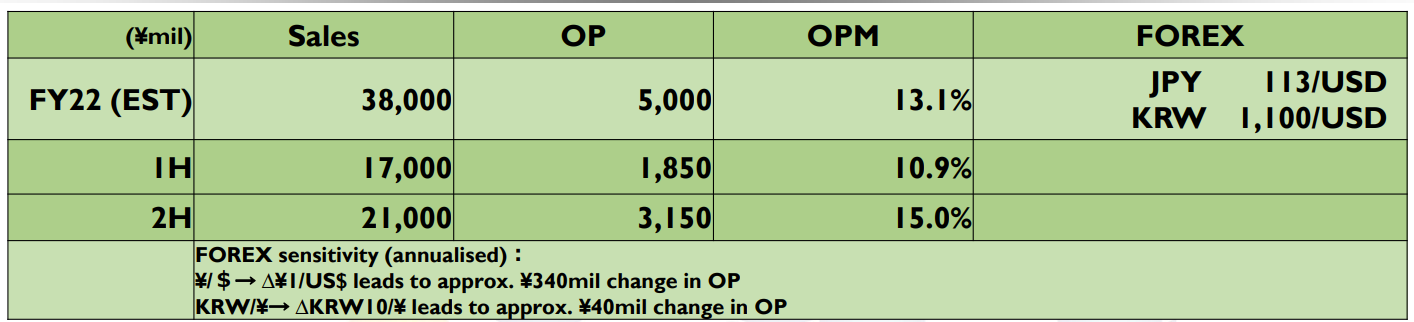

FYE 3/23 Guidance

(Source: Full Year Financial Briefing for FYE 12/22)

Sales forecast of JPY 8,000 MM (27% increase y/y) looks to be reasonable, driven by continued strong demand in both auto and consumer battery demand.

The 1st half year of operating margin is expected to be 10.9% to reflect an assumption that negative impacts of high shipping cost will continue throughout the period. Overall inflation pressure is expected to subside in 2nd half. Along with stronger consumer battery demand toward holiday season, operating margin will improve to 15%.

5. Total Addressable Markets (TAM)

Discussed in the Investment Thesis section.

6. Strengths and Weaknesses

Strength

As discussed in Investment Thesis section, the company operates in an industry whose growth is supported by worldwide environmental policy initiatives.

Weaknesses

1. Over the long term, Li-ion battery may be replaced by solid state battery. To mitigate this risk (likely not near term), the company has identified the below growth segments which the company can apply its membrane production technology.

- Energy: Next generation battery, capacitors.

- Water: Ion-exchange membrane, water treatment filter

- Air conditioning: Irreversible Filter

- Medical: Dialysis filter, Artificial Skin

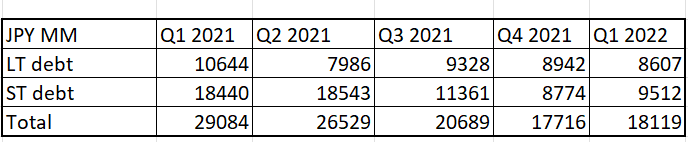

2. Some investors were concerned with high levels of non-operating expenses.

Two major ones are

1) Valuation loss arising from an increase in the value of the option liability on convertible bonds. Valuation loss of options associated with CB were: JPY 2,766 MM in FY 20 and JPY 4,491 MM in FY 21

2) High interest expenses.

Both expense lines should come down, since

1) As the conversion was complete in 1/22.

2) The Company has been paying down debts (see the below table for decreased level of debts) which will reduce interest payment from JPY 1,500MM in FY 21 to about JPY 800MM in FY 22.

(Source: Full Year Financial Briefing for FYE 12/31/21)

7. Near-term Selling Pressure

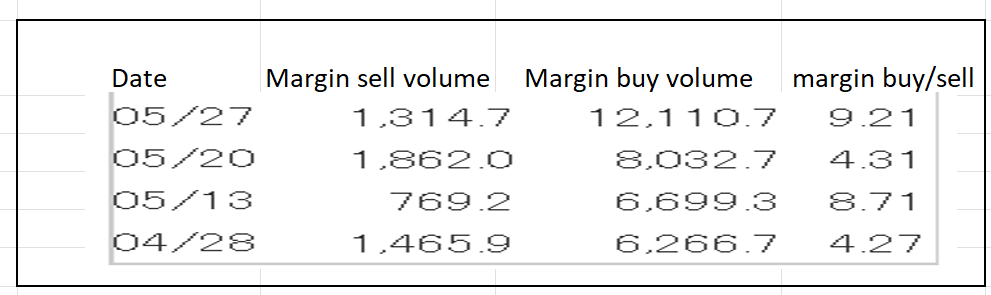

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For WS, margin buy/sell ratios has been rising and recently reached 9.21 (vs. acceptable level of 3x). However, the stock has pushed through the volume cluster of JPY 1,200. Thus, if the stock can maintain the current high trading volume, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance