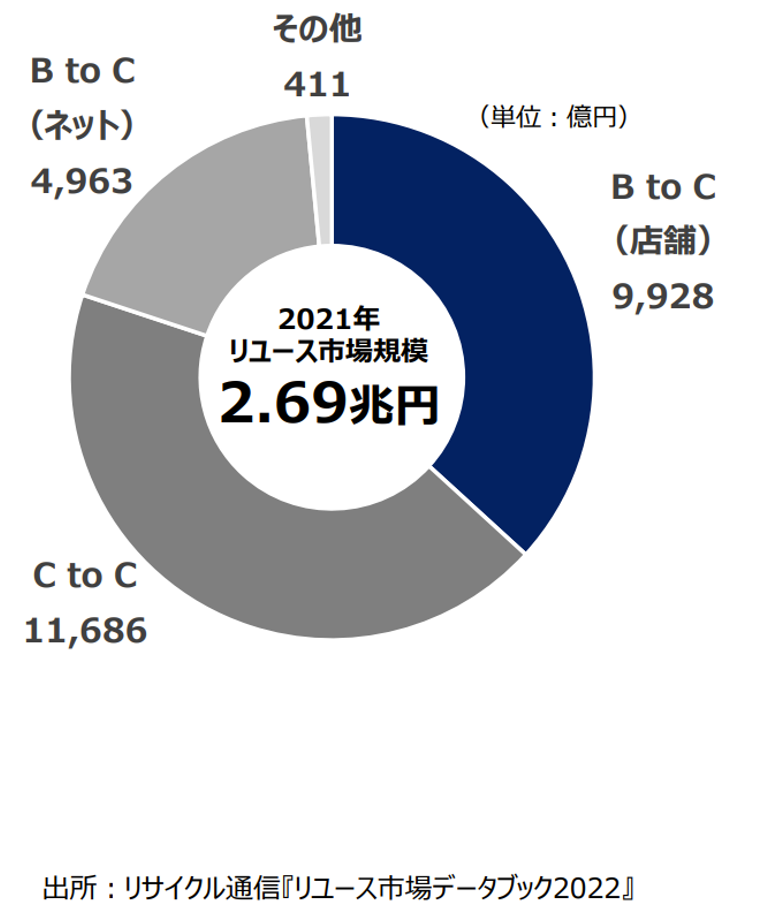

Treasure Factory (“TF” or the company) is one of the major retailers of reuse products retail. Their product lineups span from clothes, sports and outdoor goods. Their subsidiaries include: Kindall (pre-owned brand items) and Golf Kids. It has collaborations with moving service providers to buy items which will be discarded.

Their mission statement well summaries their appeals to customers and investors:

A factory for finding new value in used goods. With a rich lineup of rare “one of a kind” products, the company provides customers with the joy of buying, selling and discovering unique products in one stop and nowhere else.

1. Investment thesis

1) Growth Industry

Japanese reuse industry has steadily grown over the last 10 years and its growth is expected to continue. In 2022, the transaction activities picked up, as the consumers have sought to find bargain- buys in a period of rising inflation.

We presented industry statistics by Statista in TAM section. Stastista does not provide the reasons behind this steady growth. However, we believe that the below factors attribute to the increase in reuse demand:

1) Emphasis on environmental sustainability

2) High living standard in the past has led to an abundance of lightly used quality items

3) No salary increase during the last three decades have created a sense of frugality among many Japanese citizens.

2) Multi products, multi channels strategy

Product procurement –

The Company buys its merchandise through multiple sources:

1) physical stores, 2) online, 3) home visits, 4) professional sellers and 5) moving companies.

Sell points –

Physical stores

Their 10 brick and motor concepts are specialized in type of merchandise, based on price range and product types. For example, Treasure Factory handles all the products and price ranges. Treasure Factory outdoor handles sports, Brand Collect sells used high ticketed brand name goods, and Use Let focuses lower end clothing. These different stores are placed at respectively suitable locations. For example, high end good stores (Brand Collect ) are situated at the center of big cities and large pieces of furniture are sold at Treasure Factory Market built along major road sides.

Online

The 4 online selling sites are also specialized in selling certain product lines. For example, kindale on line focuses on used high end clothing.

Auction –

The company’s own auctioning site provides it with both buying and selling opportunities. Auctions increase product turnovers by allowing TF to liquidate slow moving items and enhance a chance to discover hard to find items.

2. Use of Customized IT System

The company, via its system/IT subsidiary, collects and analyzes customer data and adjusts its product line- ups accordingly. Thus, they can manage their inventories in an attempt to meet capricious consumer tastes.

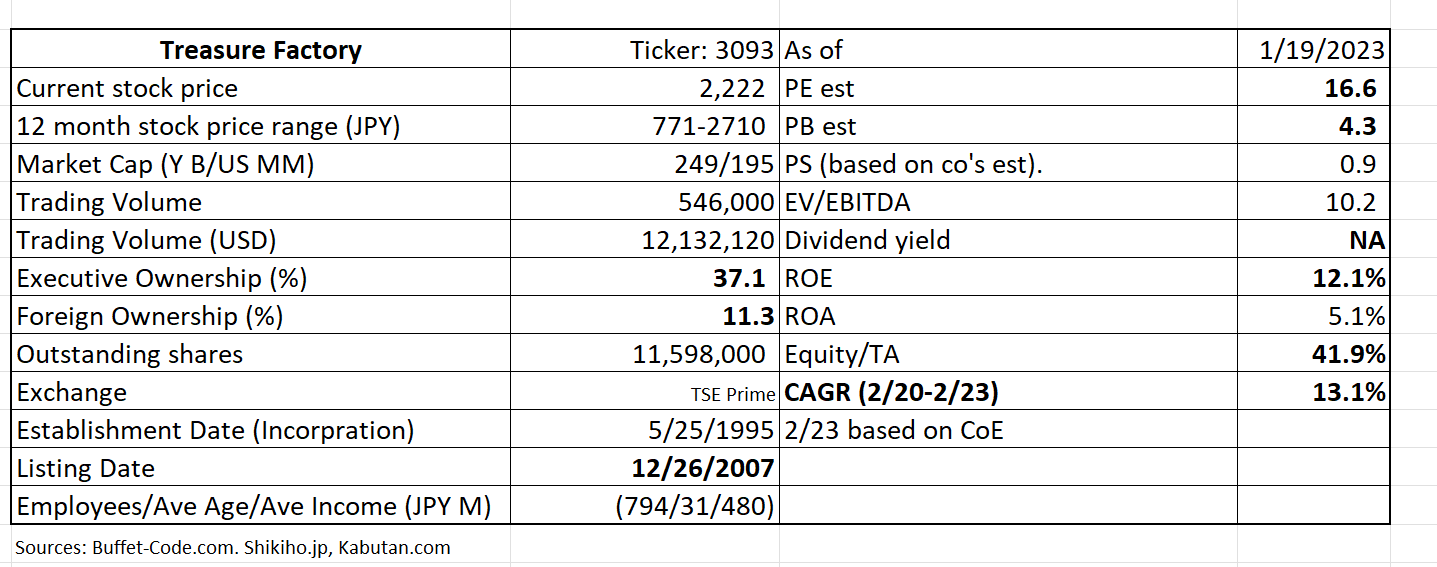

3. Upward revisions of FYE 2/23 results and dividends

The company’s profits reached its historical high levels in the first 9 months ending 9/30/22. As a result, the company upward-revised its full year FYE 2/23 financials on 1/12/23 from guidance given on 10/12/22 as follows:

Sales : JPY 27,667 MM (+4.3% from previous guidance)

Operating income: JPY 2,376MM (+22.3%),

Net income: JPY 1,508 (+23.6%).

Dividends are also upped to from JPY 27 (guided on 10/12/22) to JPY 32 (+19%). Dividend payment for FYE 2/22 was JPY 17.

2. Technically Speaking

(Source: buffet-code.com)

The stock has bounced off at a support level of JPY 2,100. If the stock continues to move higher with large trading volume from here, it should present a good entry point.

TF shares are trading at a reasonable PE of 17x given CAGR of the last three years which includes Covid influence is 13%.

3. Business Model

As discussed above, the company’s multi-products/multi-channel business model is its competitive advantage.

4. Financial Highlights

Financial results for the 3rd quarter ending 11/22 vs guidance

(Source: Financial results briefing for Q3 of FYE 2/23, translated by Japaneseipo.com)

Sales rose 20.7% vs. Q1-Q3/2021, thanks to:

1) Same store sales rose 10.5% driven by strength in all the product categories,

2) At the end of Q3, 20 new stores were launched according to the annual plan.

Robust sales and profit growth drove annual guidance increase, as mentioned earlier. All the profit lines reached 80% of its upped guidance already.

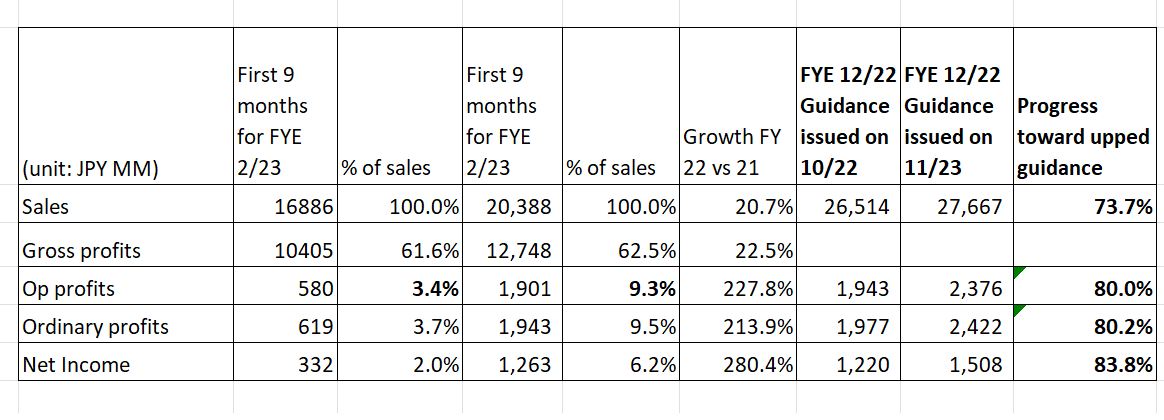

5. Total Addressable Markets (TAM)

Reuse market size in Japan from 2013 to 2020 with forecasts for 2022 and 2025 (In JPY Tn)

In the above graph dated 12/7/22 and prepared by Statista, the Japanese reuse market had been on the upward trend for the last decade. The industry is forecast to reach JPY 3Tn in 2022 and JPY 3.5Tn ($35 Bn) in 2025.

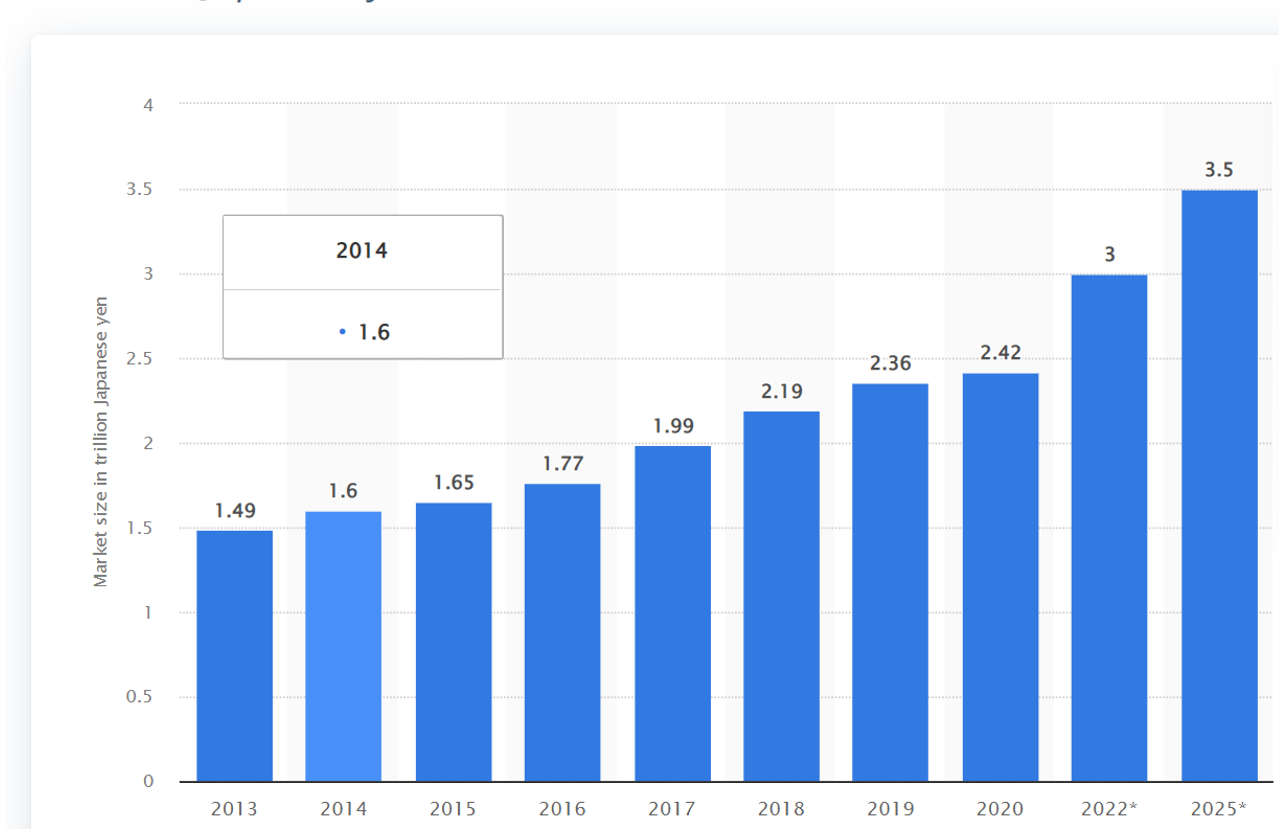

(Source: Financial results briefing for Q3 of FYE 2/23)

The above pie chart highlights an interesting phenomenon. Japanese reuse market was JPY 2.6 Tn ($26 Bn) in 2021. 39% of the trades were still conducted at physical stores. The 2nd largest chunk of trades happens among consumers which account for 46%. 50% of reuse trades was conducted between business and consumers.

The both datasets speaks to the industry which provides a strong tail wind to TF, since it offers many customer contact points through store fronts, auction sites and dedicated websites.

6. Strengths and Weaknesses

Strengths

1. Supportive industry backdrop

As discussed, Japanese reuse market is expected to continue its steady growth. TF is in a great position to benefit fully from this industry tailwind.

2) Strong business model

TF’s multi-products/channels offering is its competitive edge. The company is ready to accommodate any customers’ wants whenever and wherever.

Weaknesses

Competitive market place.

As often the case with an expanding industry, the reuse industry is attracting new entrants. Also, the other players, such as GEO, which are shifting their focus from solely dealing with new products to also offering used items. Nonetheless, TF is in a good position to fend off new and old competitors with its scale and customer recognition.

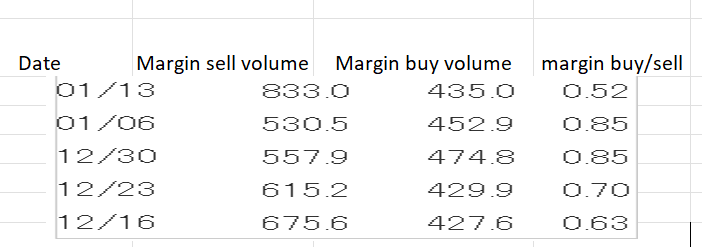

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For TF, margin buy volume is low and margin buy/sell ratio of below 1x is within an acceptable range. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance