This will be a short note with an emphasis on a “one-time event” catalyst. I believe there is a strong possibility that this event will drive the stock price higher. However, I also want to ensure that the company can grow its fundamentals without relying on the occurrence of this event.

First off, a brief summary of Tokyo Century.

Tokyo Century (“TC”), a major comprehensive leasing company with roots in the former Dai-Ichi Kangyo Bank (now Mizuho), was formed in April 2009 through the merger of Century Leasing and Tokyo Leasing. The company has increasingly distanced itself from Mizuho, with Itochu Corporation now as its main shareholder (29.8%).

Strengths:

Tokyo Century collaborates with various companies like NTT, Itochu, and Fujitsu. Its ability to collaborate with the major players outside of leasing is a great strength. It owns subsidiaries like Nippon Rent-A-Car and the US aircraft leasing company, ACG.

Recently, Tokyo Century has expanded beyond leasing into environmental and real estate businesses. They are developing the high-rise “Torch Tower” near Tokyo Station with Mitsubishi Estate, aiming to attract a luxury hotel.

To improve liquidity, management has stok-splitted 1: 4 in 3/23.

Upcoming potential event:

One of the industries impacted by the Ukraine conflict is leasing companies. Western aircraft leased to Russia were “confiscated.” The litigation amount between leasing companies and insurance companies over these aircraft is said to be $10 billion (approximately ¥1.5 trillion). Since the return of these aircraft from the Russian government is highly unlikely, leasing companies are forced to focus on negotiations with insurance companies.

A settlement was recently reached between Dubai Aerospace Enterprise, an aircraft leasing company in the Middle East, and AXA, a leading French insurance company. In other countries like the U.S., leasing companies are also negotiating with insurers, and the issue of Russia “retaining” aircraft seems to be moving toward resolution.

In Japan, Aviation Capital Group (ACG), a wholly-owned subsidiary of TC, had eight aircraft seized by Russia, resulting in an impairment loss of ¥46 billion for FY3/23. As a reference, TC expects to generate ¥80 billion net income for FY/24. If negotiations with insurance companies are successful and they receive insurance payouts, market attention will likely turn to how this cash will be utilized.

Likely uses of the payouts are:

1) invest in growth projects/businesses, including M&As

2) share buybacks

3) Increase in already-high dividends payout (currently 3.6%)

Regardless of the final choice, ROE improvement is a result that leads to share price appreciation.

However, the timing and amounts of payouts are highly uncertain, thus, we need to ensure TC offers an investment merit aside from this one-time insurance payout. To this end, I would like to discuss its undemanding valuations vs. its earnings ability.

1. Tokyo Century’s business profile:

Segments

Equipment Leasing (22.3% of total assets: )

Operating and financial leasing of IT, office, factory, construction, and other commercial equipment

Automobility (8.4% of total assets: )

- Nippon Car Solutions (NCS): Auto leasing for corporate customers

- Nippon Rent-A-Car Service: Car rental services

- Orico Auto Leasing: Auto leasing services to individual customers.

Specialty Financing (49.4% of total assets: )

- Real Estate: Large-scale RE investment in domestic office buildings and hotels and overseas data centers. TC investments in 3 data centers jointly with NTT Data in the US. Leasing of logistics and commercial facilities.

- Principal Investments: With its strategic partner Advantage Partners. Focus areas include carve-outs of large companies, renewable energy, and business succession for owner-operated companies.

- Aviation: Their wholly-owned subsidiary Aviation Capital Group (ACG)Solutions handles the entire aircraft life cycle, from aircraft leasing to engine leasing, financing, and sales of used airframes and parts. ACG focuses on leasing narrow-body aircraft.

- Shipping: Loans and leases to finance the vessel construction and purchase. They also operate bulk carriers.

International Business (14.4% of total assets)

- IT Equipment Leasing: CSI, a wholly owned subsidiary, provides IT lifecycle management services that combine Fair Market Value (FMV) leasing of IT equipment with ITAD services (safe, compliant, and appropriate disposal of IT equipment).

- Auto Business: Leasing and financing for passenger and commercial vehicles, mainly in the ASEAN region.

Environmental Infrastructure (4.8% of total assets)

- Renewable Energy Power Generation Business: Through Kyocera TCL Solar LLC, a joint venture with Kyocera Corporation, the company provides solar power, biomass power, and geothermal power generation as well as other businesses.

Storage Battery Business

2. Low valuation and how to correct it

Leasing stocks often suffer from low P/B ratios for several reasons:

1. Accounting Treatment of Leased Assets:

Leased assets are typically depreciated faster than their actual economic useful lives. This accelerated depreciation reduces the book value of assets on the balance sheet more quickly than their real economic value declines.

2. Industry Characteristics

2-a. Leasing is a capital-intensive business, requiring large investments in physical assets, leading to lower P/B ratios compared to asset-light businesses.

2-b. Leasing companies often have high debt levels to finance their asset purchases. This increases financial risk and can lead investors to apply a valuation discount.

2-c. The leasing industry is sensitive to economic cycles. During downturns, the value of leased assets can decline rapidly, impacting book values.

3. There may be concerns about the residual value risk of leased assets at the end of lease terms.

Japanese leasing stocks are no exception.

The below compares TC to the leasing giant, Orix.

Orix:

OP growth 15% y/y for FY3/24.

OP margin and E ROE: 12.8% and 10.1%

PE and PB: 12.8x and 10.1x

TC: OP growth 14.3% y/y for FY3/24.

OP margin and E ROE: 7.7% and 9.5%

PE and PB: 9.61x and 0.84x

Orix’s scale and its lower ROE volatility command a higher PE and PB but are still low given its OP growth profile.

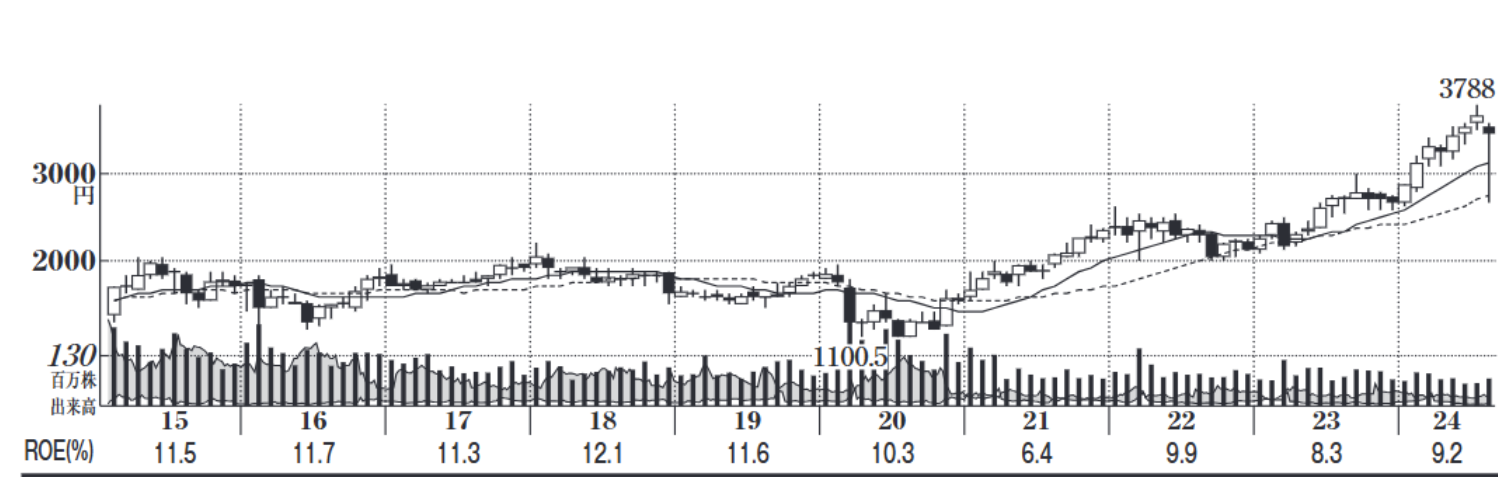

In the below Orix’s ROE and stock price chart, Orix’s lowest ROE was 6.4% in FY3/21

(Source: Shikiho)

As a contract, TC’s ROE dipped to 0.7x in FY3/23 due to the aforementioned Russia-related write-off of ¥46 billion (refer to the table below).

However, while the overall leasing industry stocks command lower valuations, PB naturally tracks ROE trends. In the above table, in FY3/18 when TC reported a 13.7% ROE, TC commanded a 1.8x PB. Therefore, management is keen on improving ROE and PB ratio. How? By enhancing company-wide profitability.

3. The financial profile and future profit drivers

Note: For FY3/25 guidance, management assumes an exchange rate of ¥140.

TC changed its Fair Value Measurement Accounting Standard in FY3/23.

FY3/24 saw record profits of ¥72.1 billion (+¥67.4 billion y/y) thanks to higher operating profits achieved in all segments. Net income has made good progress toward the Mid-term Plan 2027 goal of ¥100 billion. However, ROE at 8.8% is still below the MT goal of 10%. Notably, an ROE of 8.8% is the initial target for Topix companies.

Notable accomplishments for FY3/24

TC has made significant progress in its collaboration with the NTT Group

- Corporate Client Services

Nippon Car Services (NCS), TC’s corporate client-focused division, has achieved record profits through its partnership with NTT.

- Data Center Expansion

TC has expanded its collaboration with NTT in the US data center market, anticipating increased demand driven by AI.

The company aims to improve its ROE by concentrating on 1) profitable ventures, targeting a 10% gain on sales, and 2) the below 3 areas:

1) Automobility

NCS plans to drive further growth by improving branch operations and leveraging on a steady rise in inbound tourists.

2) Specialty Financing

ACG is rebounding quickly from the Covid bottom. ACG’s cost in the US’s rising interest rate environments is increasing, but lease rates are also rising partly due to the tightening supply and demand of aircraft.

ACG currently possesses 120 committed new aircraft on the order book. It is expected that roughly 30 new aircraft will be delivered annually. The possession of this sizable order book represents a significant competitive advantage over industry peers.

The market value of used aircraft is on the rise, and in FY3/25, TC projects a threefold increase in the number of aircraft sales in comparison to FY3/24.

To reduce geopolitical risks, ACG is reviewing the diversification of its portfolio’s geographical exposure.

3) International Business

CSI leasing (IT equipment leasing, including Data Centers)

CSI boasts very high profitability, with a ROA (ratio of ordinary income to segment assets) of around 3.5%. CSI has a business model that earns profits from secondary lease income such as gain on sales.

Since FY3/17 when it became TC’s wholly-owned subsidiary, CSI has achieved a CAGR, of 19% on an ordinary income basis.