The name stands for Total Kukan (Space) Produce

Who is TKP?

TKP is NOT a real estate developer. It IS a space reuse or better-use company. It matches up renovated idled office space with companies with need for space. Profit improvement in the 2nd half was stronger than expected, driven by less-then-feared Covid impacts. Leading to an upward revision of the earnings forecast announced on April. Key metric EBITDA improved 50% year-on-year for FYE 2/22.

Business break down:

Rental office: 43% Brand name: Regus*

Rental conference/banquet room: 30% Brand name: TKP

Food/Restaurant/Accommodation: 8%

Optional service: 7%

Others:13%

*The 2nd pillar of growth has been established when TKP purchased Japanese and Taiwanese subsidiaries of Regus in 2019. Regus belongs to IWG which is a global major rental office company which has chosen TKP as a partner to make it a foothold for Japan expansion. TKP bought 130 flexible co-work centers operated by IWG in Japan and has acquired exclusive usage rights of IWG’s Regus, Spaces and OpenOffice Brands. That is, TKP now is a Master Franchisee of Regus brands in Japan.

Regus Japan, before acquired, was the largest player in the rental office with offices in 26 cities and 130 sites across the country (as of 12/18)

1. Investment thesis

1) The leader in a promising rental/flexible work space.

TKP offers the 3rd place between work and home as a leading flexible office company. At this point, it has 412 properties(177,000 Tsubo/6,049,140 SF) and is far bigger than the 2nd player, WeWork Japan, with 38 properties (60,000 Tsubo/2,134,990 SF)

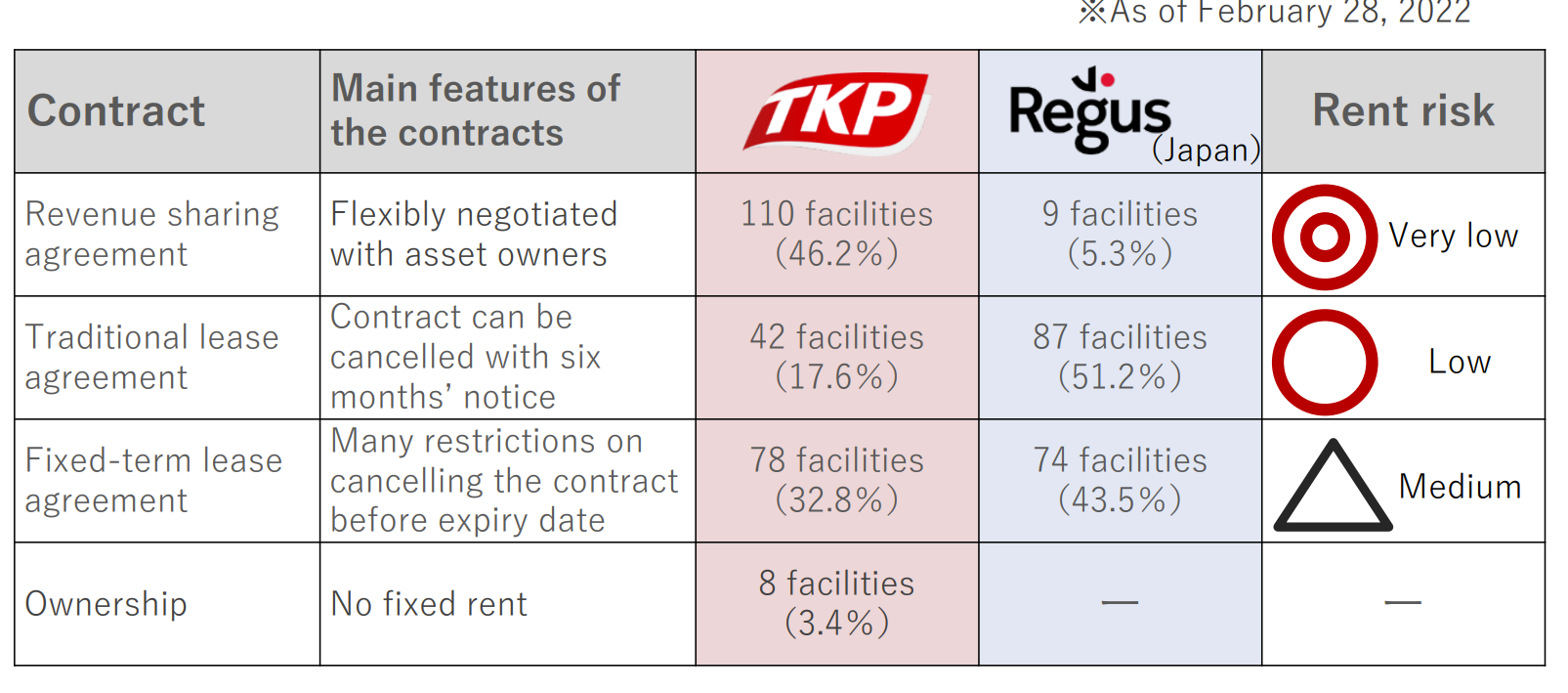

2) Asset light business model

The company does not own their rental properties They lease underperforming and idled properties/space with discounted rates from the owners and put them in the rental market for space seekers. It has diversified its contract types to manage future rent hike risks as below:

(Source: Financial Briefing for Q4 for FYE 2/22)

(Source: Financial Briefing for Q4 for FYE 2/22)

3) Seasoned management team

They have survived two economic downturns: Financial crisis in 2008 and Tohoku earthquake in 2011. CEO has expressed his confidence in managing recovery growth from Covid pressure on rental and meeting demands.

4) Well defined growth strategy

Management lists the below 3 strategies as near term growth drivers:

1) TKP: Measured top line growth

The company believes that the rising number of underperforming buildings will come to market under the weight of Covid. Thus, it intends to ramp up “sourcing” of new facilities, improve on them and make them available for new tenants at reasonable rent.

2) Regus: Occupancy increase with controlled new openings.

The company has built many business relationship via running privately sponsored Covid shot space operations. TKP/Regus will use these connection to cultivate more permanent space rental opportunities.

3) New add-on contents/services for TKP through partnerships with 3rd party providers. The Company calls strategy “Space + alpha” which means “Space + Operations + Contents”.

The company rents rooms while offering other services including food & beverage services. The conference equipment and program operations can be packed together with the room rental.

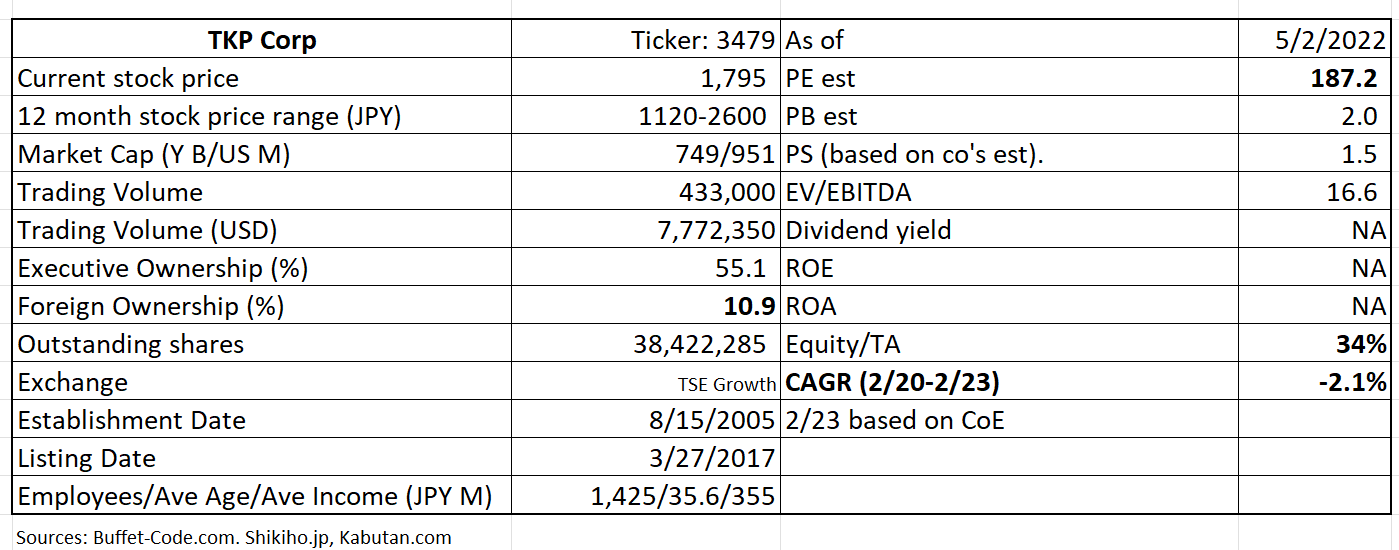

Note: PE of 187x is high, reflecting high expectation on post-Covid recovery and synergy from co-operations of TKP and Regus. Sales CAGR for 2/20-2/23 is -2.1% since 2/20 was pre-covid “normal economy” year.

2. Technically Speaking

(Source: buffet-code.com)

The stock is trading at a upper end of recent price range (JPY 1200-1,900). Investors are aware that the company’s fundamentals are on the mend and post-covid recovery is likely. The rising trading volume in the recent couple months support this improving sentiment.

3. Business Model

TKP and Regis have different business models, reducing the negative impacts of cyclicality of each business.

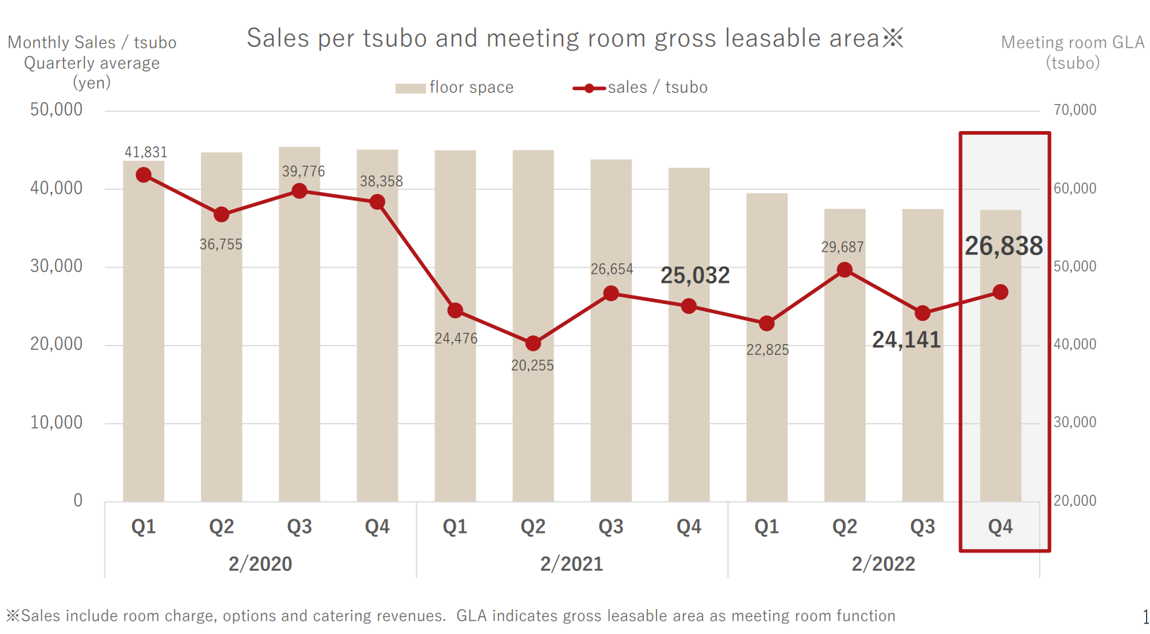

a) TKP’s KPI (key Performance Indicator) is “Sales per Tsubo (SF)” of rental meeting/conference rooms.

Trend is on a steady rebound from Covid low in Q2/2021.

(Source: Financial Briefing for Q4 for FYE 2/22)

b) Regus Japan

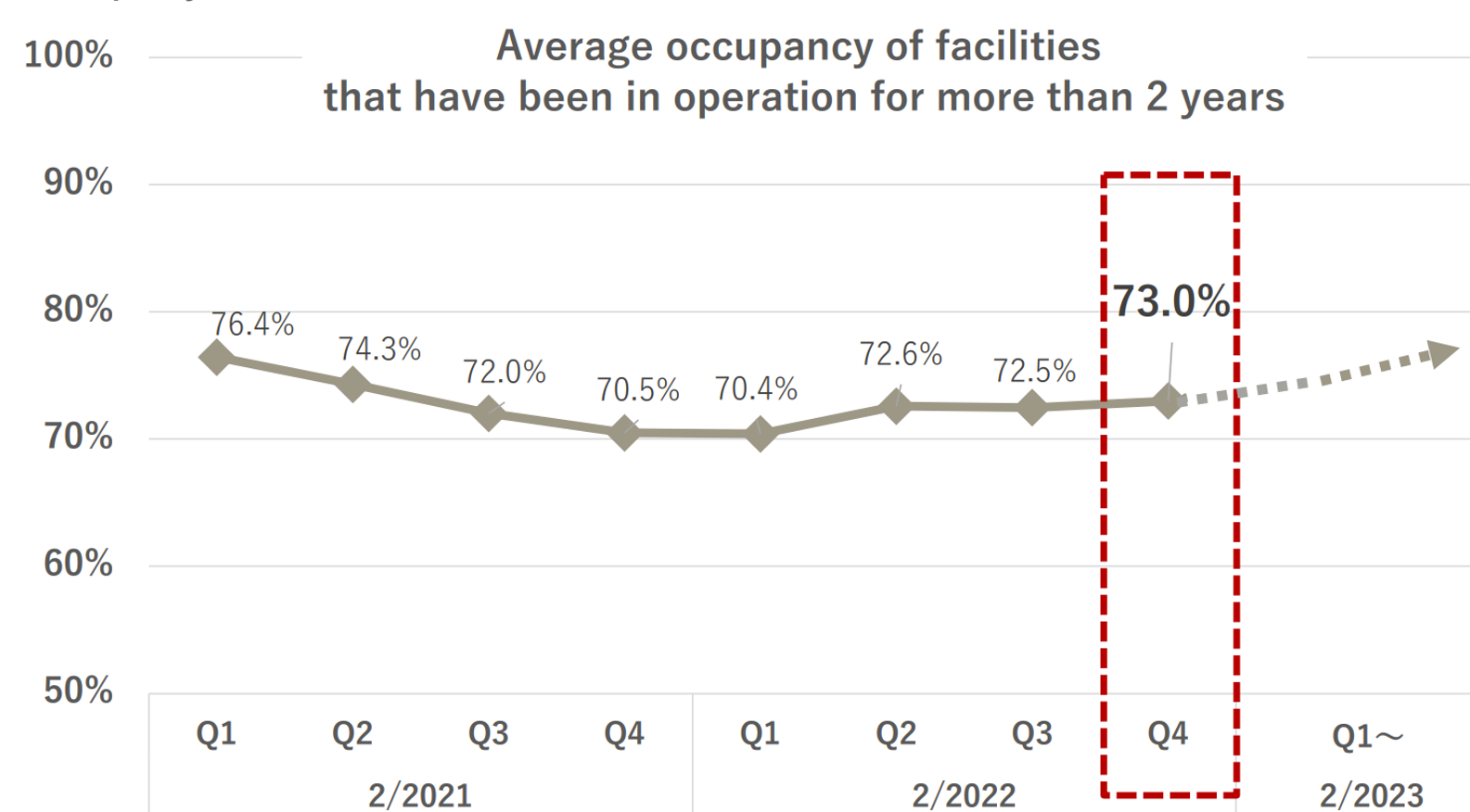

KPI is occupancy ratio of Rental offices.

Regis Japan buys a large underperforming building at a discounted price, improve it and rent each suit out.

(Source: Financial Briefing for Q4 for FYE 2/22)

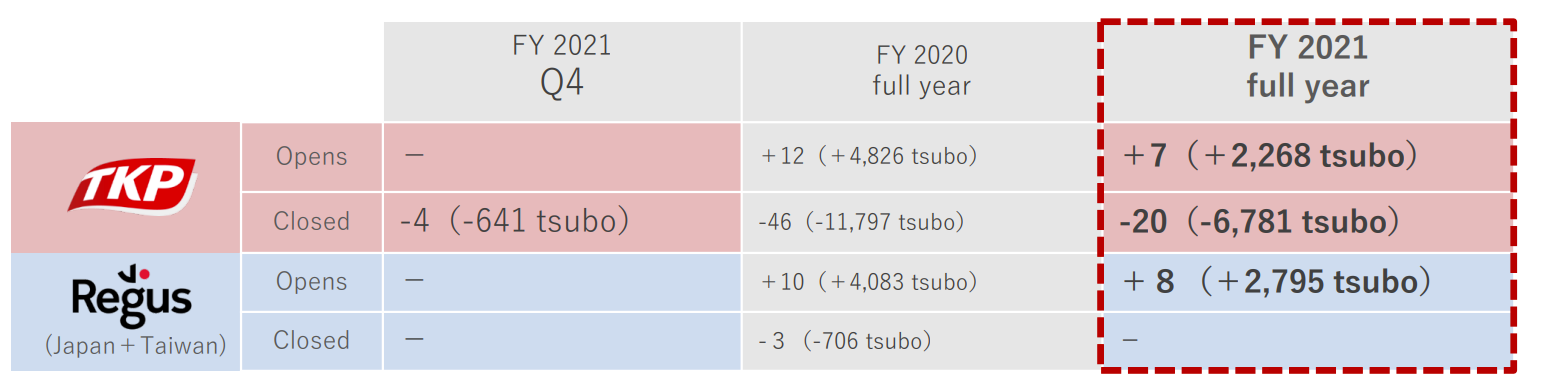

The next task is to improve occupancy rate for ALL THE FACILITIES which stood at 48% as of 2/22. The company closed the underperforming facilities when the contracts under the old Regus management expired (3 in FY 2/21). The company is accelerating new facility acquisitions in anticipation of demand recovery post-covid (10 in FYE 2/21 and 8 in FYE 2/22). It should be noted that new Regus properties typically reaches their break point occupancy of 45% within 8-12 months of opening.

(Source: Financial Briefing for Q4 for FYE 2/22)

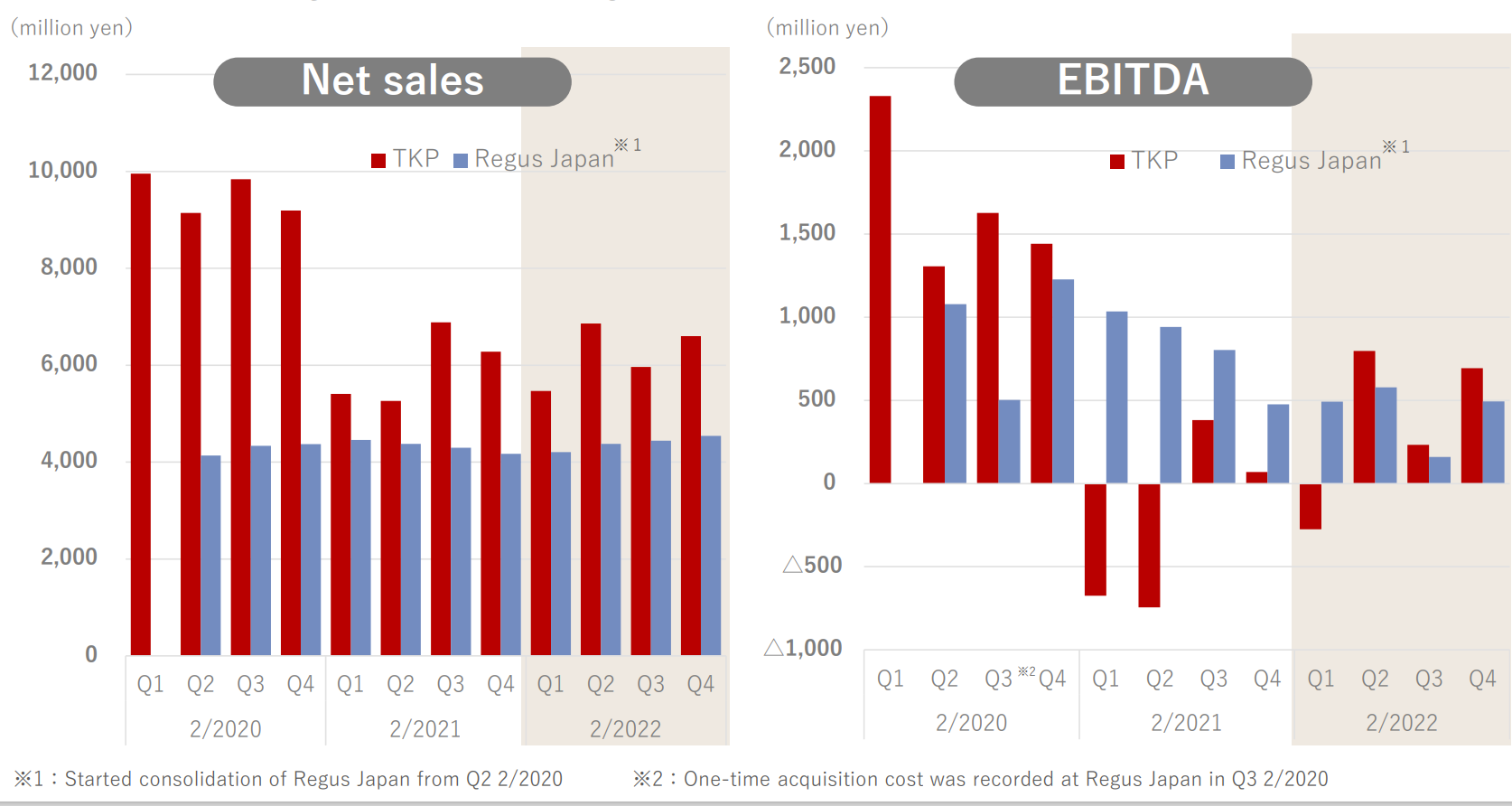

The benefits of having both rental meeting rooms (TKP) and rental offices (Regus) under one roof is evident in the below graphs which show Regus’s sales and EBITDA are less volatile vs. TKP’s.

(Source: Financial Briefing for Q4 for FYE 2/22)

4. Financial Highlights

(Source: Financial Briefing for Q1 for FYE 9/22)

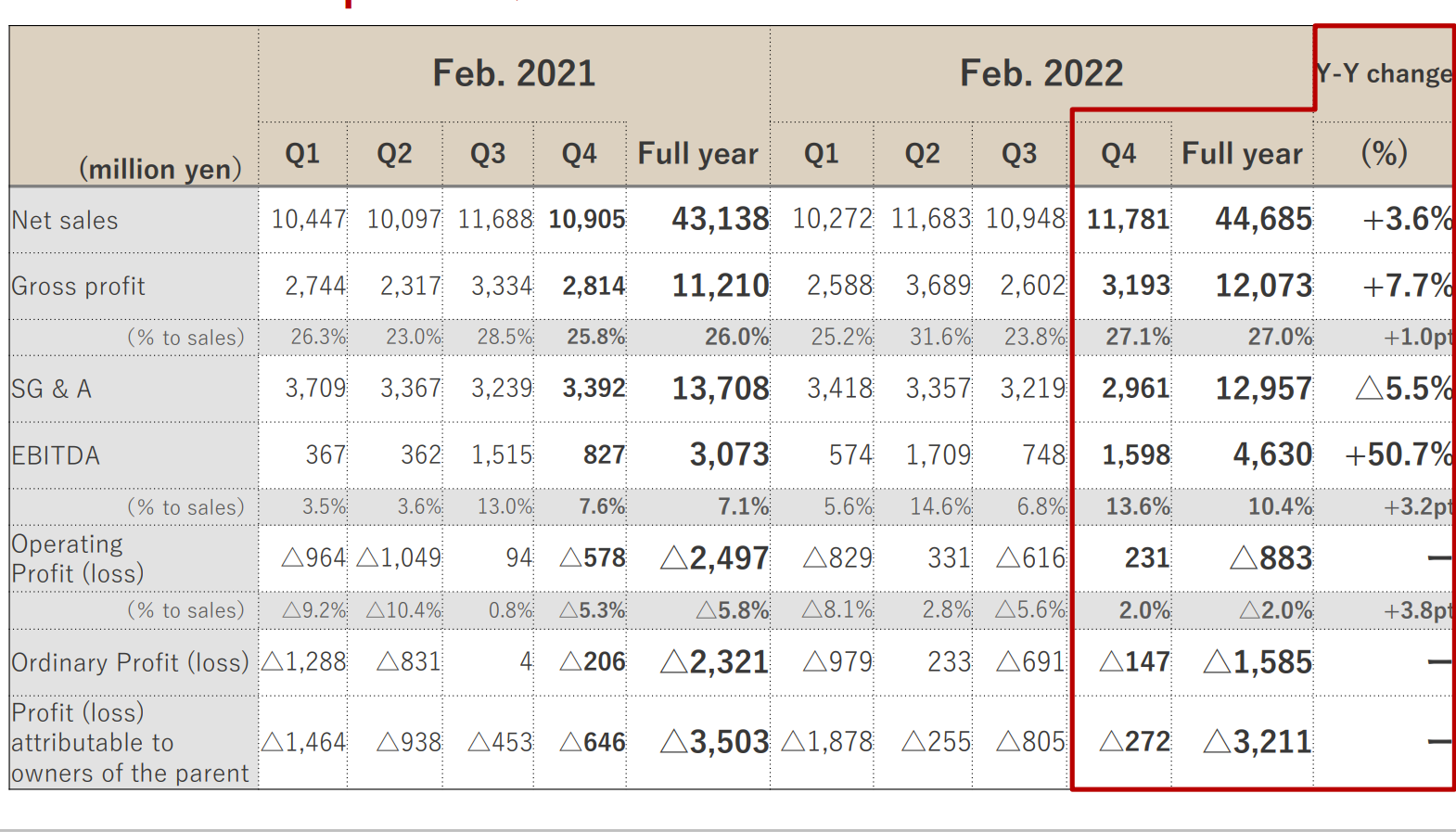

Consolidated results for Q4 and full fiscal year for FYE 2/22

The company has shown steady improvements of sales and profit lines as the company’s sourcing strategy (good priced space inventory expansion) had born fruits. TKP was able to lower operating costs, leading EBITDA improvement of 51% in FYE 2/22 vs. FYE 2/21.

(Source: Financial Briefing for Q4 for FYE 2/22)

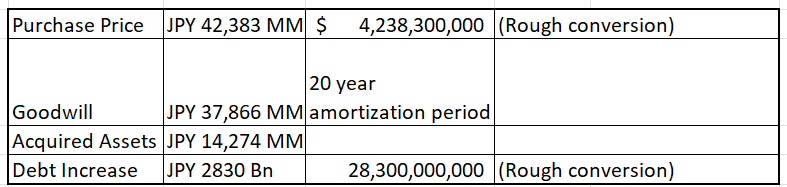

Financial Impacts of Regus Purchase

The acquisition had led to debt increase of JPY 2,830 Bn, but TKP expects to generate total EBITDA of JPY 3,000 Bn, thus non-repayment risk is small.

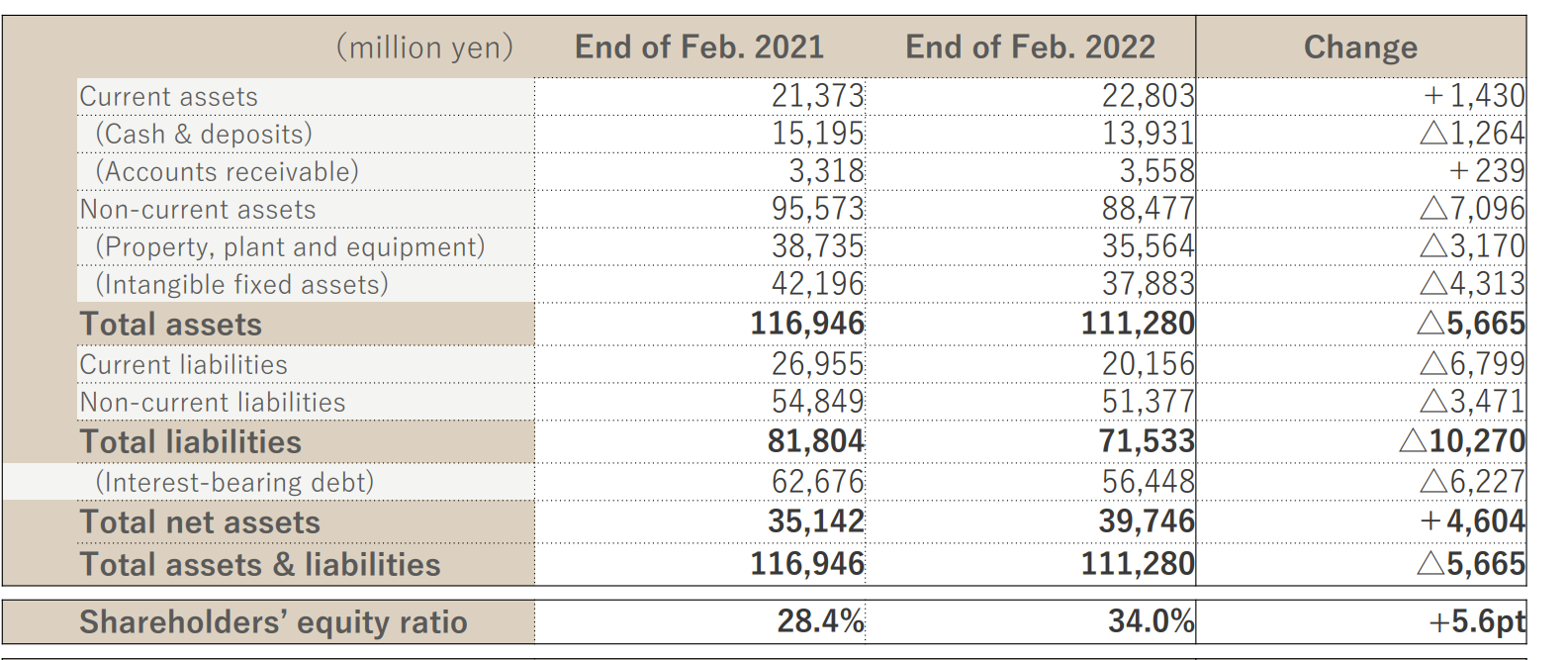

Capital Adequacy Improved

TKP has executed the 7th series of share subscription rights through a 3rd party allotment. As a result, equity ratio improved from 28.4% to 34.1% which is still not high but within an acceptable range of real estate industry.

(Source: Financial Briefing for Q4 for FYE 2/22)

FYE 2/23 Guidance

For TKP (rental event rooms), the Company expects that Covid will be with us but the impacts will be felt less as the year 2022 progresses.

Regus (rental office) will continue opening new facilities with tight cost control in mind.

As a result, top line growth of 14.1% and EBITDA of 62% expected for FY 2/23.

5. Total Addressable Markets (TAM)

Rising needs for flexible work arrangements will provide supports for both TKP and Regus.

Looking around the post-Covid world, it makes an intuitive sense that we will have many work-location options.

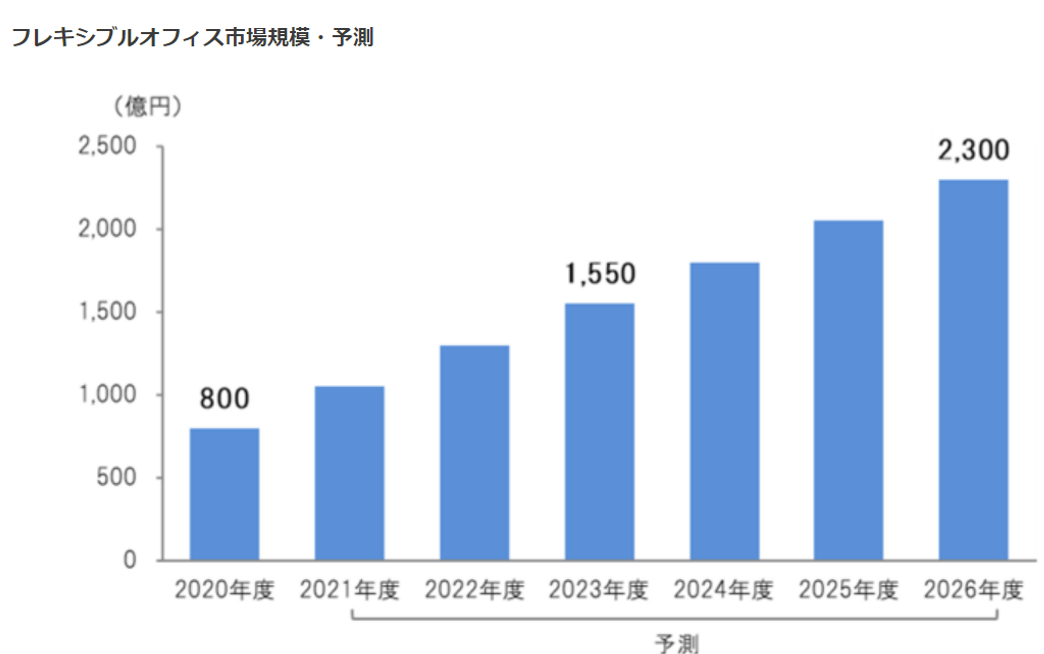

JMAR’s 12/24/21 survey confirms this intuition as it expects that flexible office industry size in Japan will grow from JPY 1,500 Bn ($1.5Bn) in 2023 to JPY 2,300 Bn ($2.3Bn) in 2026 with the increase of 50%.

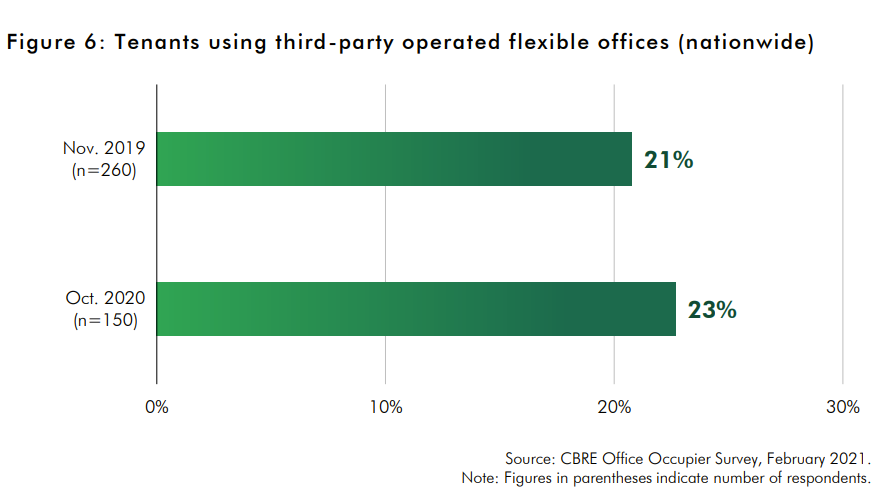

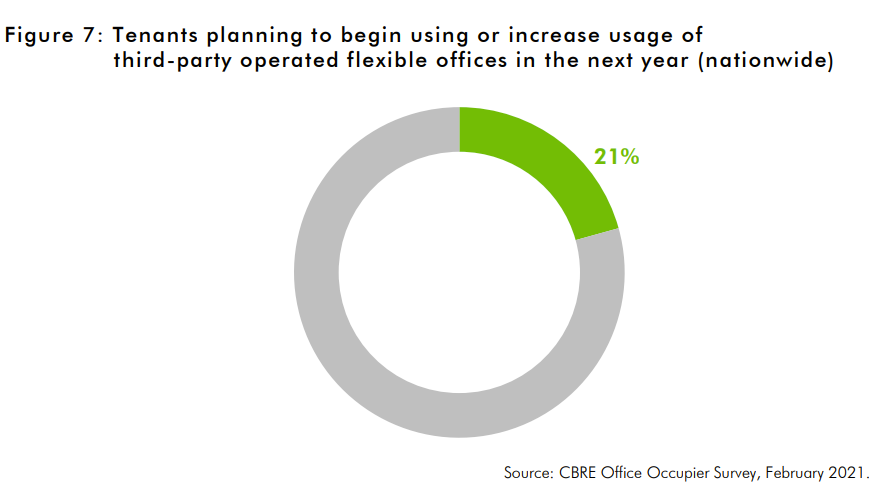

CBRE Tokyo office occupier survey as of 2/21 also found that slight increase in willingness to use flexible offices as the below two graphs illustrate. As the reasons for this higher acceptance of rental offices, CBRE notes that:

1) Flexible work space arrangement will allow quicker establishment of start up companies whose growth is one of Japanese government’s main policy initiatives.

2) Demand for remote work space is rising.

3) In Tokyo, as the new buildings are coming to the markets, vacancy rates, which are still low, but slowly rising. High vacancy will incentivize owners to offer flexible lease terms to entice new tenants.

4) Companies are waking up to a reality that several offices throughout Tokyo will increase office access which results in improvement of productivity.

6. Strengths and Weaknesses

Strengths

1. Growing industry backdrop.

As discussed in total accessible market section, the growing share of business are willing to shift at least certain work life to shared and rented space.

2. Asset Light

As discussed above, their asset light business model allows them to diversify its contract types to manage future rent hike risks.

Weaknesses

1. Covid is still not completely behind us. Office space demand may not recover as smoothly as management expects.

2. Office related businesses are sensitive to economic cycles

3. Sales per unit now stands JPY 30,000. Management was asked when this level would return to a pre-covid level of JPY 40 000. Their reply: At this point, they are focusing on profitability of a unit, which can be seen in FY 2/22 EBITDA improvement of 50%. They believe sales/unit level improvement can be achieved through add-on ancillary services.

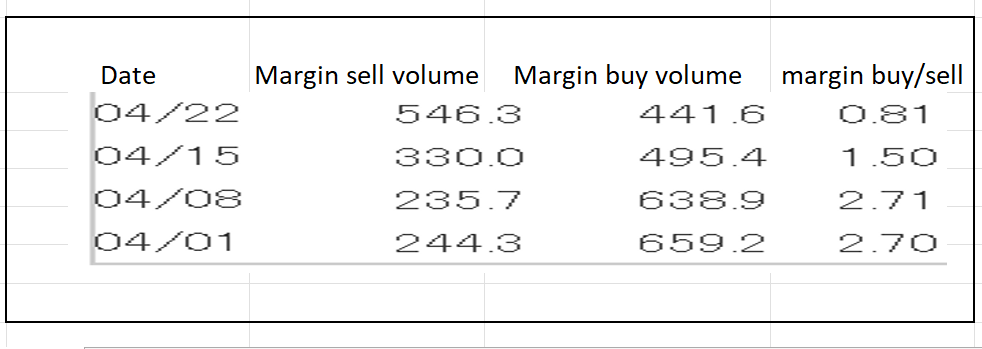

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For TKP , margin buy/sell ratios is below 3x and decreasing. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance