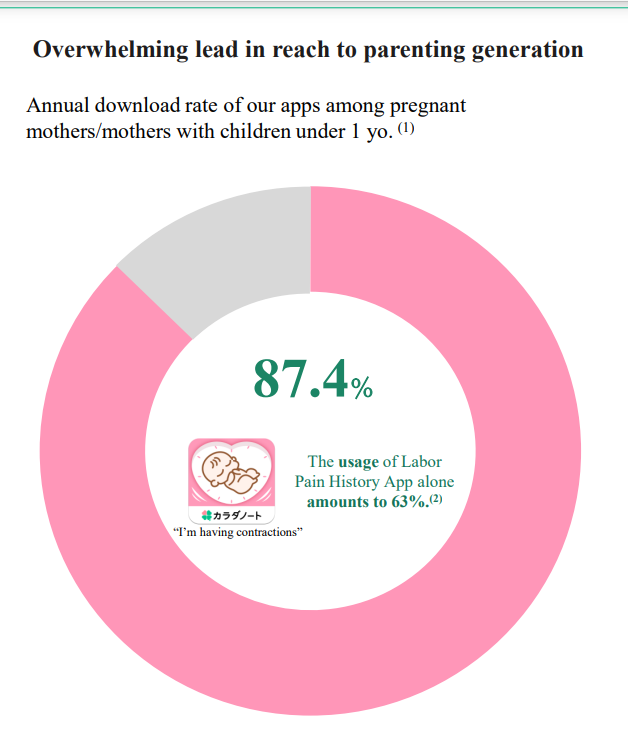

Karadanote is fixing Japanese problems at its core. Therefore, it can grow, and you can benefit from its growth! Technically, it is shifting some of product offering from “one-time sales” to “subscription (recurring) business model”. As the ratio of ARR (annual recurring revenues) rises, so should the stock multiple. However, eagerly waiting for a better entry point. Please read on. |

||||||

| *As of 7/21. (Sources: Buffet-code.com, Japan Company Handbook Summer 2021) | ||||||

Daily stock price chart (10/2/20-10/1/21)

The below stock chart indicates that there are some shareholders with unrealized losses at the share prices of JPY 1800-1900. Therefore, we may want to wait for the share price recovery to JPY 1900 so that the stock can start to appreciate without suffering from constant selling pressure from the holders who are itching to sell their holdings with small gains.

(Source: Buffet-code.com)

1. Mission/Problem the company is solving:

The issues which Karada Note has committed in solving:

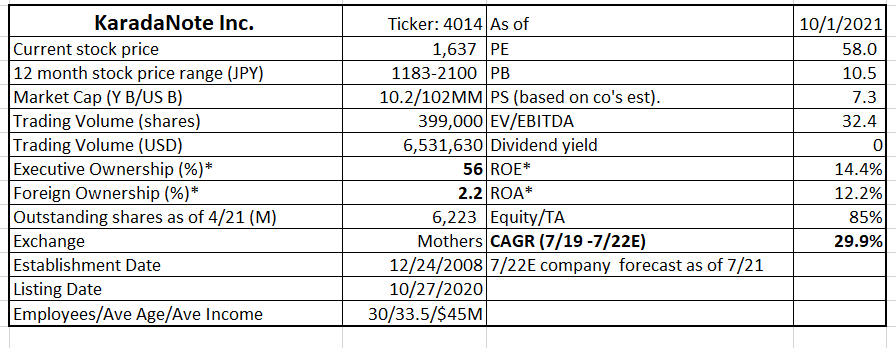

Incessant decrease in population which leads to a decline in productive labor force. That is, rising medical and social security costs are supported by smaller group of working population. Below, the left graph shows that rising medical and social security costs as a result of expansion of aging population.

Karada Note aims to reduce overall medical and social costs by offering applications and websites which can expertise access to good family related services and health care.

(Source: KN’s financial result discussion for FYE 7/21)

2.Business summary

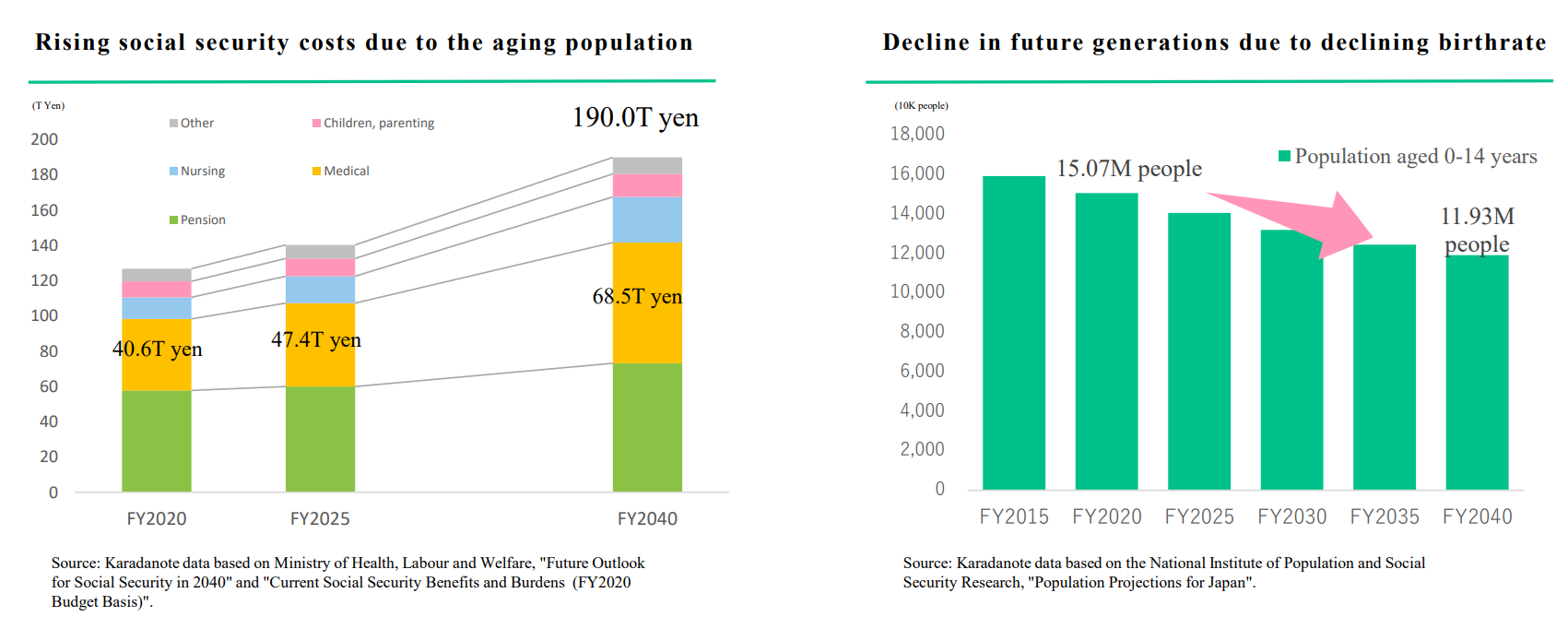

Karadanote Inc. (“KN” or the “Company”) has realized that a child birth leads to births of two generations with distinctly different life styles and needs. The below chart beautifully exhibits many life phases of these 2 generations to which the Company can make a difference.

(Source: KN’s financial result discussion for FYE 7/21)

KN services both groups by operating the following free applications and websites:

- Parent generations: “Mama Biyori (happy motherhood)” “Jintsu Kitakamo (having a contraction?)”, “Step Rinyushoku/Sept Weaning” and others to support childbirth and childcare.

- Grandparent generations (health management apps) such as “Ketsuatsu/Blood pressure Note”.

- Investment Thesis

The company owns the industry: Revenue sharing through data and product recommendations to the partner entities, based on unique user data which is accumulated in family support applications.

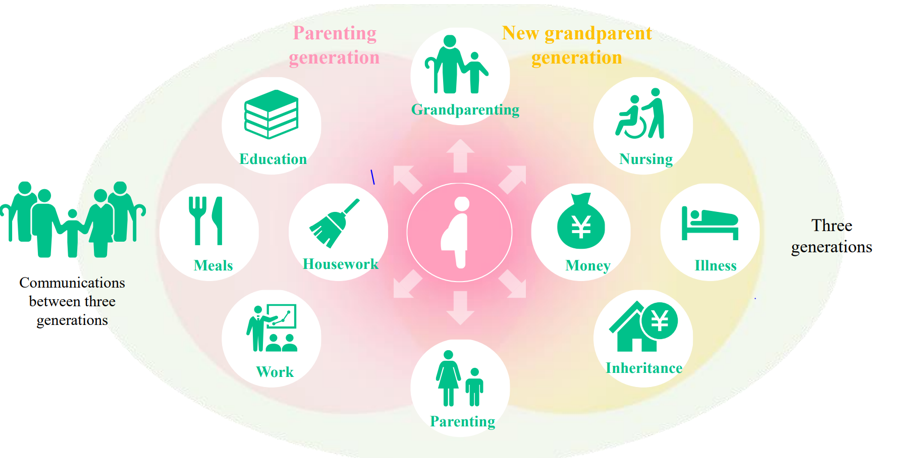

See the below diagram which shows KN’s reach to the pre-moms and new moms with infants who are one year old or younger.

(Source: KN’s financial result discussion for FYE 7/21)

Quality user data is KEY

The company obtains and accumulate application user data by offering them campaigns with thank you gifts for answering questionnaires. Main revenue sources are data sharing and suitable product recommendation to business partners in the industries such as insurance, food delivery and pre-school education. KN obtains user consents prior to sharing their data with outside partners. The recent new initiatives include a) in-house user gift content creation, 2) expanding the reach to other family members (grandparents, aunts & uncles etc.). The company continues to enter ancillary businesses to maintain high sales growth which are discussed in Investment Positives: growth initiatives section.

3. Business model:

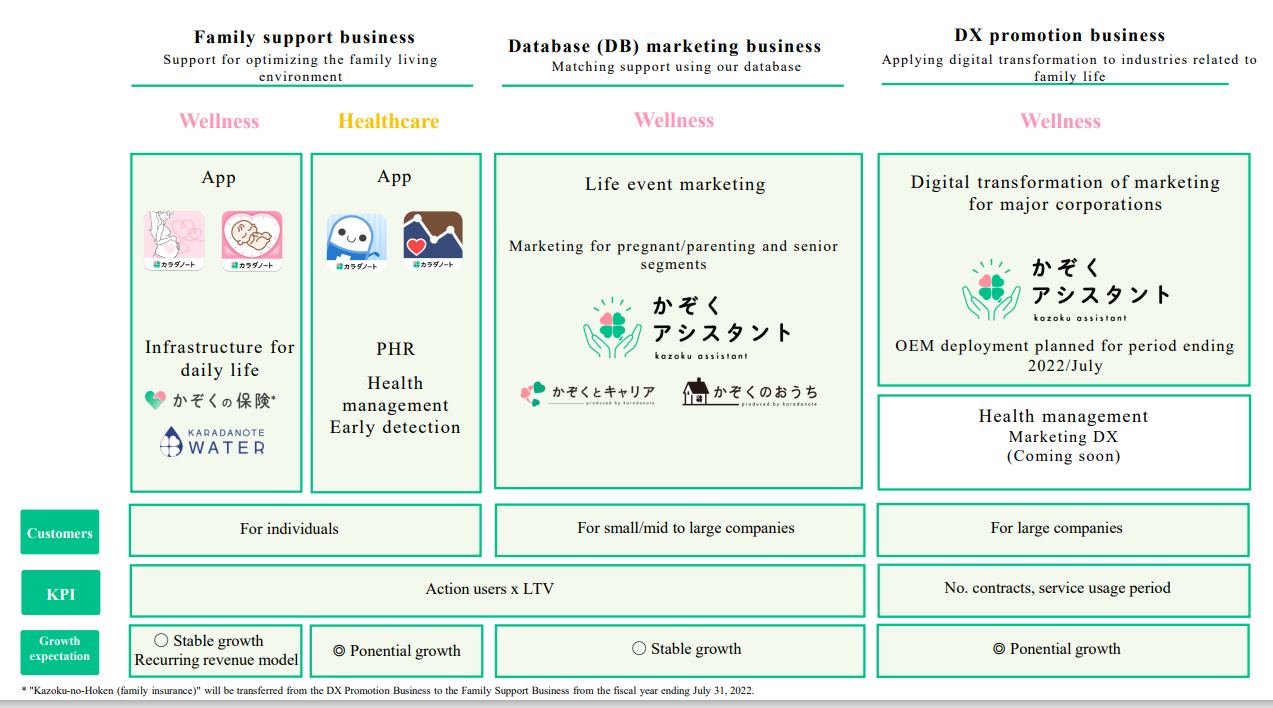

The company operates under one segment which is its vast family database platform business. This platform business is broken into three segments:

1) B to C: Family Support Business

E – commerce (happy motherhood site), PHR (personal health records) App to enhance early disease detection, Family/medical Insurance agency operations, Karadanote Water Delivery (OEM with Pure Water).

2) B to B: DB Marketing Business

Young age education, Career assistance, Real Estate Agency services

3) B to B: DX Promotions: Enterprise/OEM – The initial project is digitized marketing assistance to reginal banks.

(Source: KN’s mid term plan released on 9/10/21)

KPI (Key performance indicator): DATA to watch to gauge KN’s growth potential

Action users: users who generated profits for KN either directly or after being referred to KN’s partner companies and signed up with their services.

Actions: User actions which earns profits to KN. 7/21 actions /user:

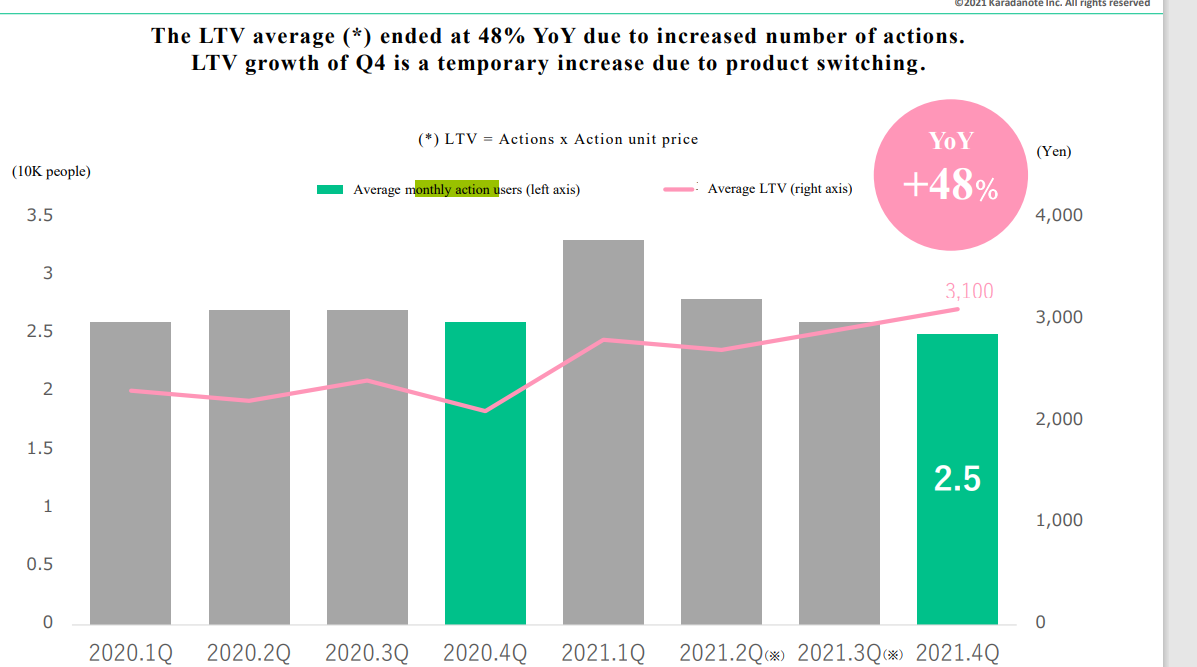

Thus, KN’s KPI is action users x actions = LTV (lifetime value of the action users)

The below graph depicts those monthly average active users in Q4 21 were 250,000 and their LTV was JPY 3,100.

(Source: KN’s financial result discussion for FYE 7/21)

LTV jump in Q1 21 is due to product offering shifts (no further details).

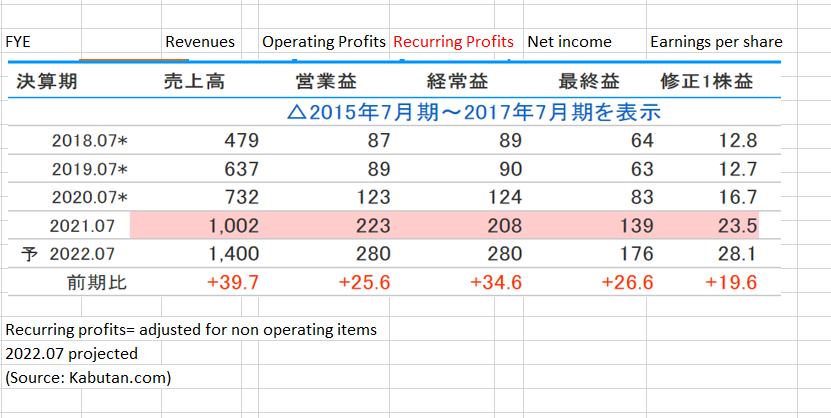

4.Financial Highlights

*Ordinary Income: net income

(Source: Buffet-Code.com)

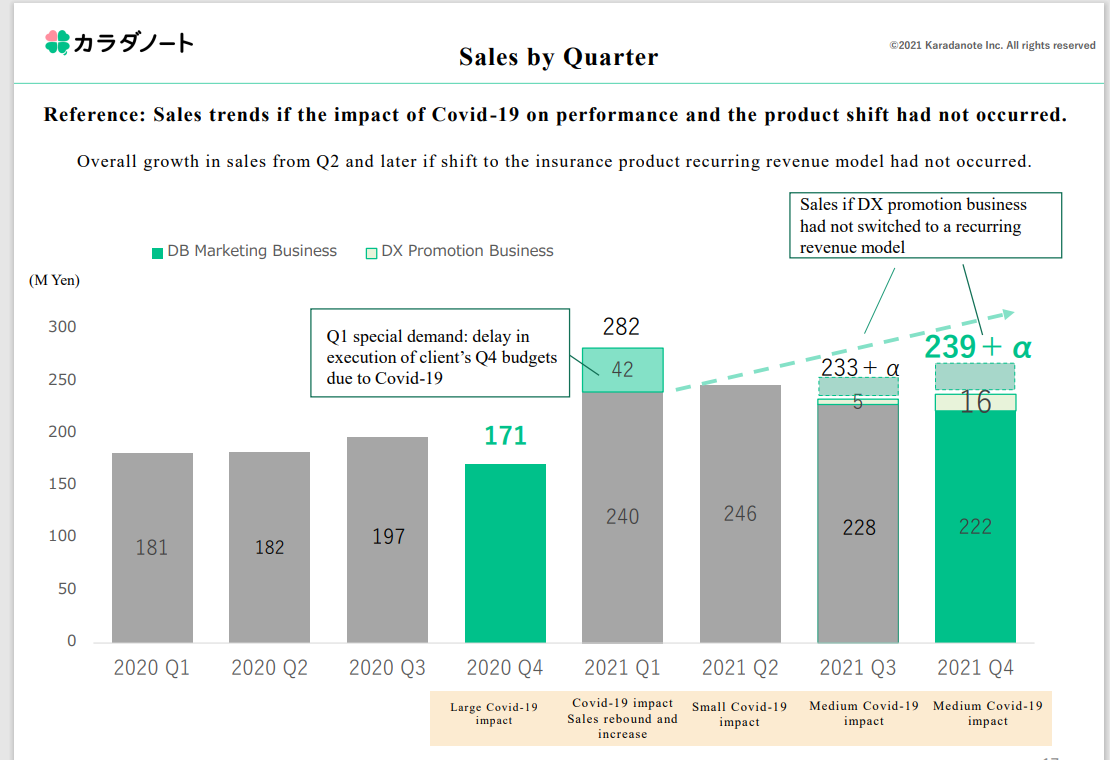

(Source: KN’s financial result discussion for FYE 7/21)

In the above graph, a big drop in quarterly sales in Q4 was Covid-impacts. Some DB marketing businesses were pushed forward to Q1 2021. Insurance business model was switched from one-time sales to subscriptions in Q3, i.e., sales recognition in one quarter was lower. If insurance sale is recognized as one-time sales, Q3 and Q4 sales would have been Y233 MM (vs. Y228 reported) and Y239 MM (vs. Y222 M reported) respectively.

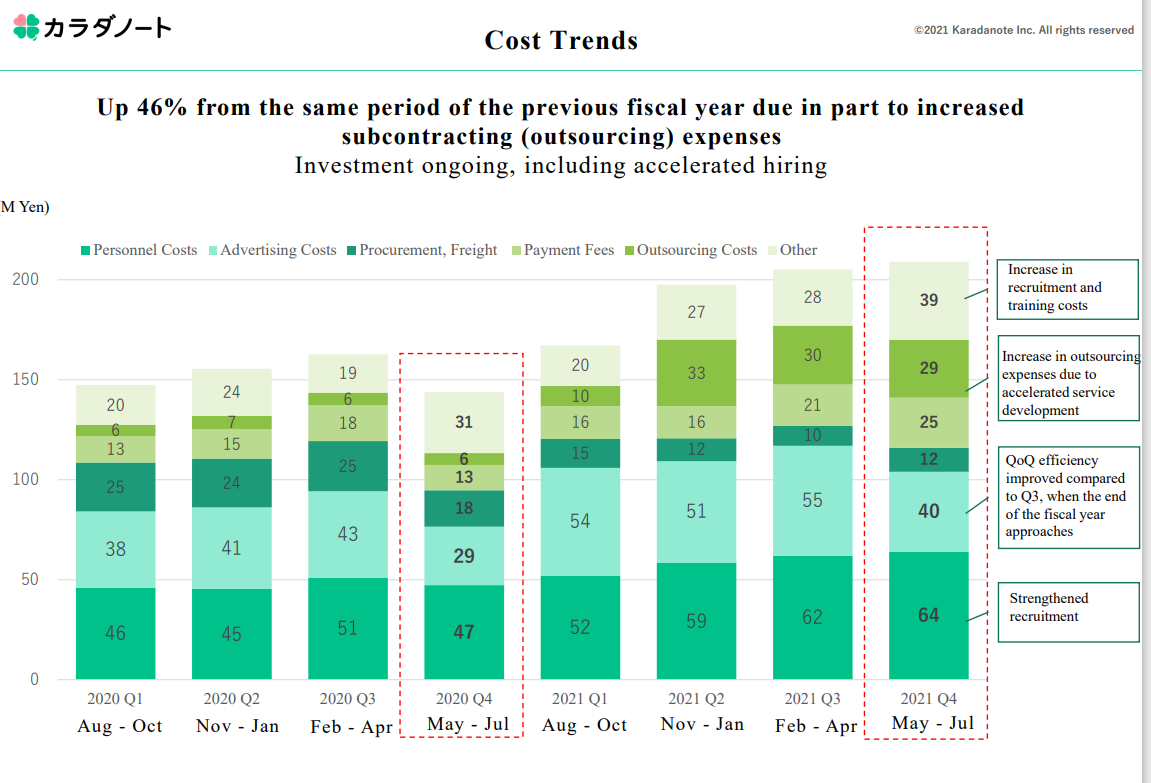

Costs are rising quickly as well to support KN’s growth initiatives. Cost breakdown is below

(Source: KN’s financial result discussion for FYE 7/21)

5.Investment Positives and Risks:

Positives:

1. Aim to achieve long term CAGR of 30% or higher with the below growth initiatives:

Growth initiatives:

1 -a) Convert insurance agency and water home delivery operations from one time referral to in house subscription model.

Why water? Growth in water delivery business as an industry is plateauing after a Covid induced delivery growth, as per data released by JDSA (Japan Water Delivery and Servicer Association).

Year over year water delivery growth in Japan:

2019 101.3%

2020 110.4%

2021 E.103.9%

However, access to high quality water is a priority to KN’s major client base, i.e., families with new-borns. Thus, the company started water delivery service last year by partnering with Premium Water. They then have shifted the service from Premium Water Holdings brand to Karada Note brand water starting this 8/21 via OEM arrangement. Premium Water has 8% market share. While water delivery market year on year growth will be flat, KN expects to increase their market share based on their reach to most promising customer base.

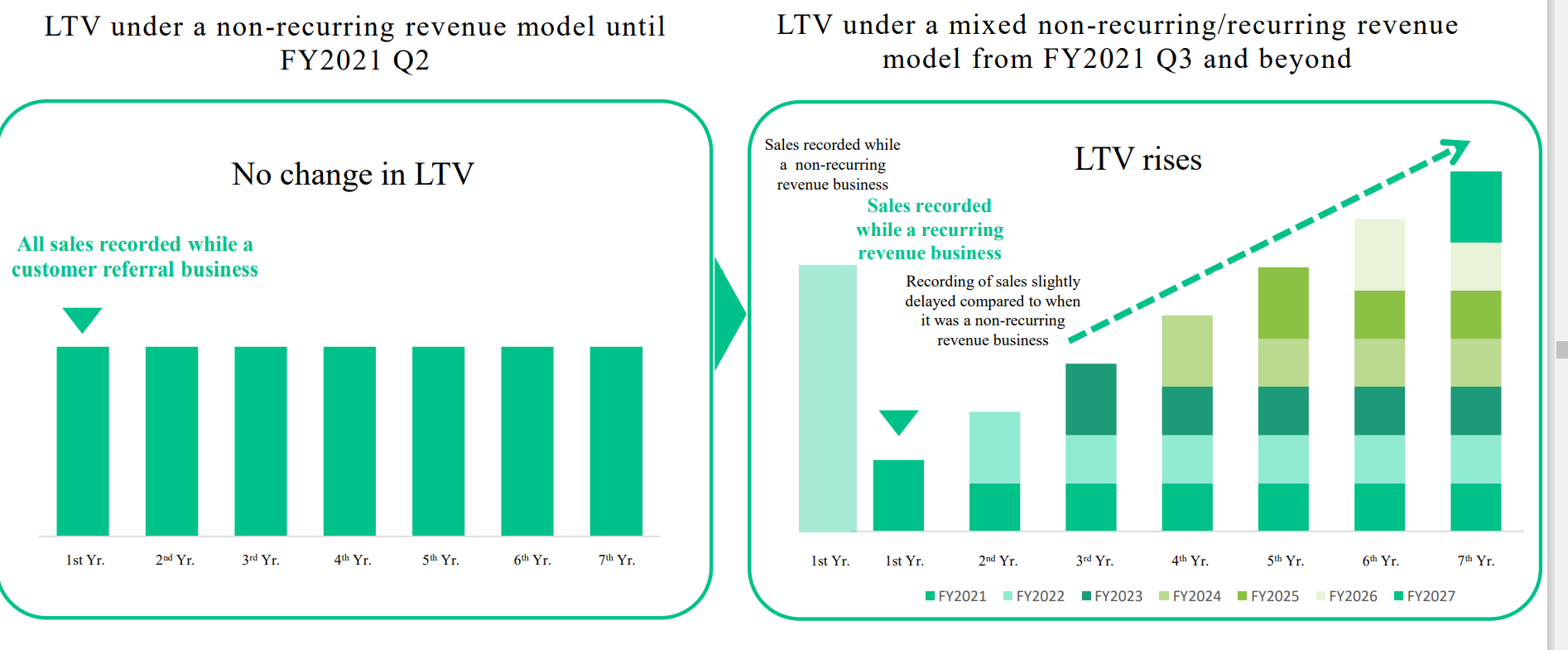

Why shift to ARR model? The benefits on LTV from shift to ARR (annual recurring revenues) models is visualized below:

(Source: KN’s financial result discussion for FYE 7/21)

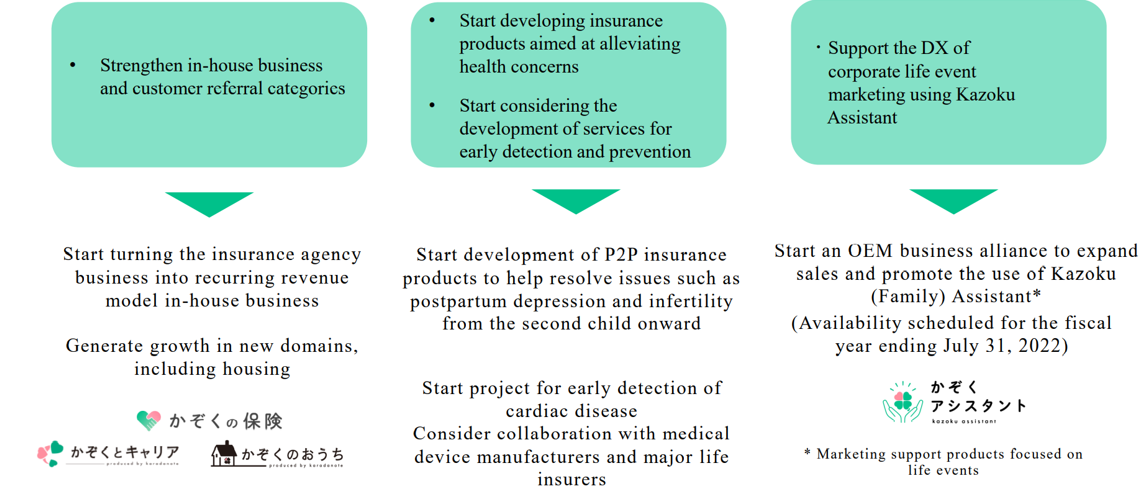

1-b) The below table provides detailed growth Initiatives under Family Support Business (BtoC), DB Marketing (BtoB), and DX Promotions (BtoB), respectively.

(Source: KN’s financial result discussion for FYE 7/21)

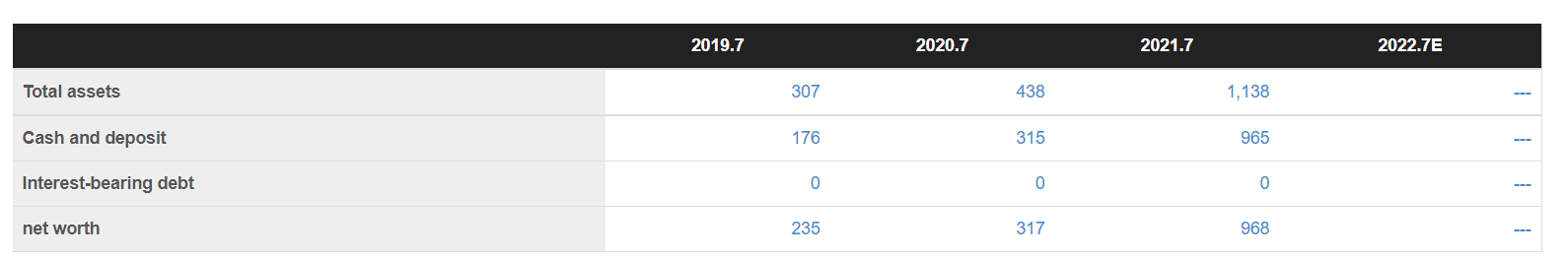

1-c) KN is considering M&A to augment organic growth. Possible M&A area includes pharmaceutical, regional banks, life insurance, and medical equipment. Cash rich strong balance sheet can definitely support accretive acquisitions when good opportunities arise.

(Unit: JPY MM)

(Source: Buffet-code.com)

2. Exposure in both BtoB and BtoC segments: The above structure highlights KN’s competitive advantage which is its ability to reach both consumer/end users and businesses.

3. Ability to continue introducing new contents/applications through which KN gathers high quality data on consumers. The relativeness of family data base is a must-have ingredient for product recommendations/creations and customer referrals to the business partners in insurance, medical care. For example, insurance companies can obtain high quality account opening leads based on family structure data base at PN which is much less costly compared data gathering by agents visiting households on foot.

Another example is banks which don’t need to wait for the openings on the baby’s bank accounts. They can customtize banking services which are best suited for a family based on PN’s data base.

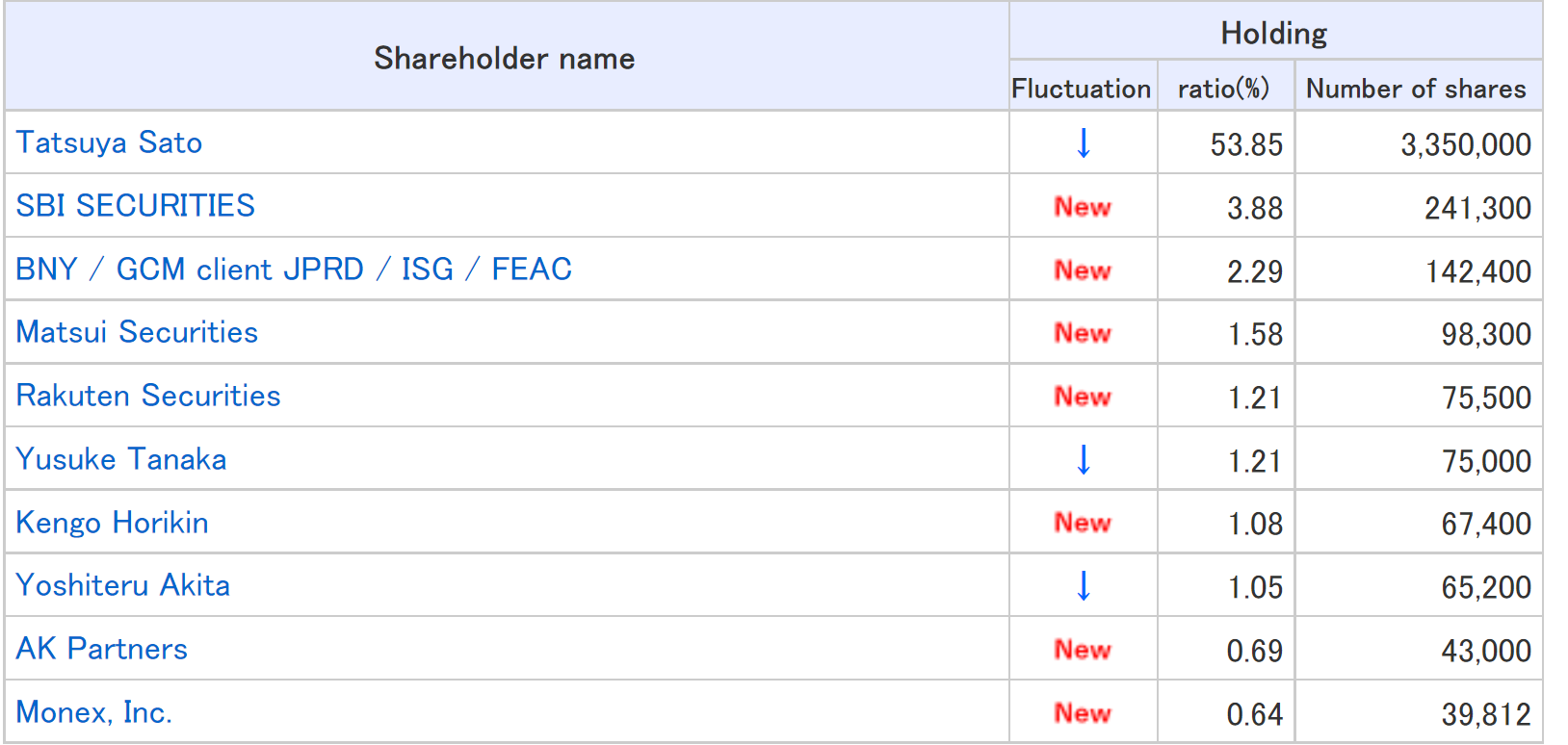

4.High management ownership

The ownership % of Mr. Sato, the founder and CEO, has decreased from 3,848K shares at the time of IPO to 3,350K but still extremely high at 54% as shown below. Mr. Sato has managed to grow his business without substantially relying on outside funding and his financial interests are closely in line with shareholders.

(Source: Buffet-code.com)

Risks:

1.A stubborn decline of child births

“Smaller infant population” can be translated into fewer family app downloads which leads to smaller data base which KN can leverage to offer high product leads to the partner entities. To mitigate this risk, The company is trying to increase LTV of a customer/app user by expanding its reach to extended families and new business/service launches.

2.Customer Concentration risk

The company reported that at the time of IPO (data for Q3 20), iPlanet (a commercial/communication company) accounted for 25.1% of its sales. iPlanet handled KN’s growcery delivery operations. Reliance on iPlanet has been decreasing from 44.4% in FYE 7/18 and 37.5% in FYE 7/19.

6.TAM (Total Addressable Markets)

Market sizes of the company’s focused areas are estimated as below:

- Insurance Agency: JPY 200 Bn ($2Bn), according to Yano Research Institute: Survey on the in-store insurance shop market (2020), reported on KN’s mid-term growth plan released on 9/10/21.

- Water delivery: JPY 170 Bn ($1.7Bn), per The Japan Delivery Water & Server Association, “Estimated Scale of the Japanese Water Delivery Industry”, reported on KN’s mid-term growth plan released on 9/10/21.

- Digital Wellness Care: (not disease care) Expected to grow from JPY 100 Bn in 2021 to JPY 220 Bn in 2025, based on the company’s data base accumulated through Okusuri (Medication) Note app (released in 3/12), Ketsuatsu (Blood Pressure) Note app (2/12) and Tsuuin (Outpatient) Note app (6/13).

7. Competitive analysis:

KN is the only company in Japan with the focus on family with newborns. There are several companies which similar applications, but the target segments differ from KN. For example: Mixi (2121)’s target: mothers with pre-school aged kids. Welby (4438) offers “blood pressure diary”.

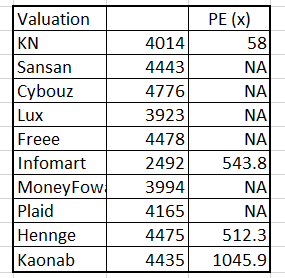

In terms of valuation, JapaneseIPO.com compares KN with other ARR driven stocks. Since KN is still early in the transition to recurring sales model, valuation is low as shown in the below table:

(Compiled from Buffet-note.com)

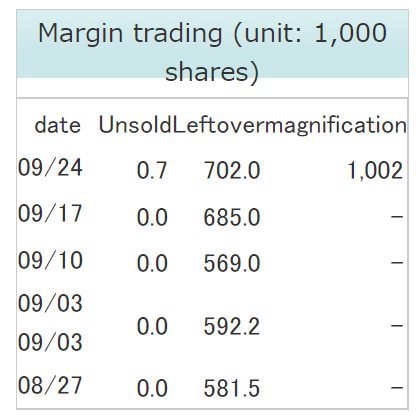

8.Near term selling pressure:

As noted in useful tips section, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For KN, as the below table indicates that there is small number of margin volume. Margin buy volume is high and slightly rising. In fact, it’s even higher than one day trading volume (Noted as “Left over margin”). Therefore, we can assume that there are some shareholders, who bought shares on margin, hold KN shares with unrealized losses currently. They are eager to sell the stocks as soon as losses turn to gains, creating near term selling pressure.

(Source: Kabutan.com)