Summary:

The Japanese equity market is currently experiencing a period of transformation. Some analysts are cautioning against potential overvaluation in certain sectors, such as semiconductors and AI-related stocks. However, this perspective does not overshadow the broader market potential, particularly in light of the Tokyo Stock Exchange’s corporate governance reforms and the Bank of Japan’s recent shift in interest rate policy—the first in 17 years. These developments are expected to foster a more robust and efficient market, offering opportunities for investors in various sectors that stand to benefit from these changes.

I believe that regional banking sector is one of these promising sectors and the Bank of Nagoya is the best stock in the space. Situated in Nagoya, which boasts a more favorable demographic profile compared to Japan as a whole and is home to Toyota’s headquarters, the bank is well-positioned to expand its traditional banking operations and explore new fee-based ventures. Historically, the bank has managed to grow its ordinary profit for the last 6 years at CAGR of 11.9%. Given its superior ordinary profit* growth potential relative to its peers, the bank could see its stock value increase by approximately 50% over the coming year.

*Ordinary profit=a bank’s profits generated from regular operations before taxes and extraordinary gains and losses.

Who is the Bank of Nagoya?

The Bank of Nagoya (“NB” or the “bank”) is a tier 2 regional bank whose main client base is small and mid-sized enterprises (SMEs) located in Nagoya (the main city of Aichi Prefecture). It is a commercial bank with operations in banking (72 %), leasing (25%) and credit cards (3%). Its focus on smaller companies as opposed to large enterprise which are serviced by city banks present it with unique opportunities as a liaison between SMEs and large companies and succession M&As. It boasts the largest branch networks in Nagoya and it has a relationship with 29,000 corporate clients.

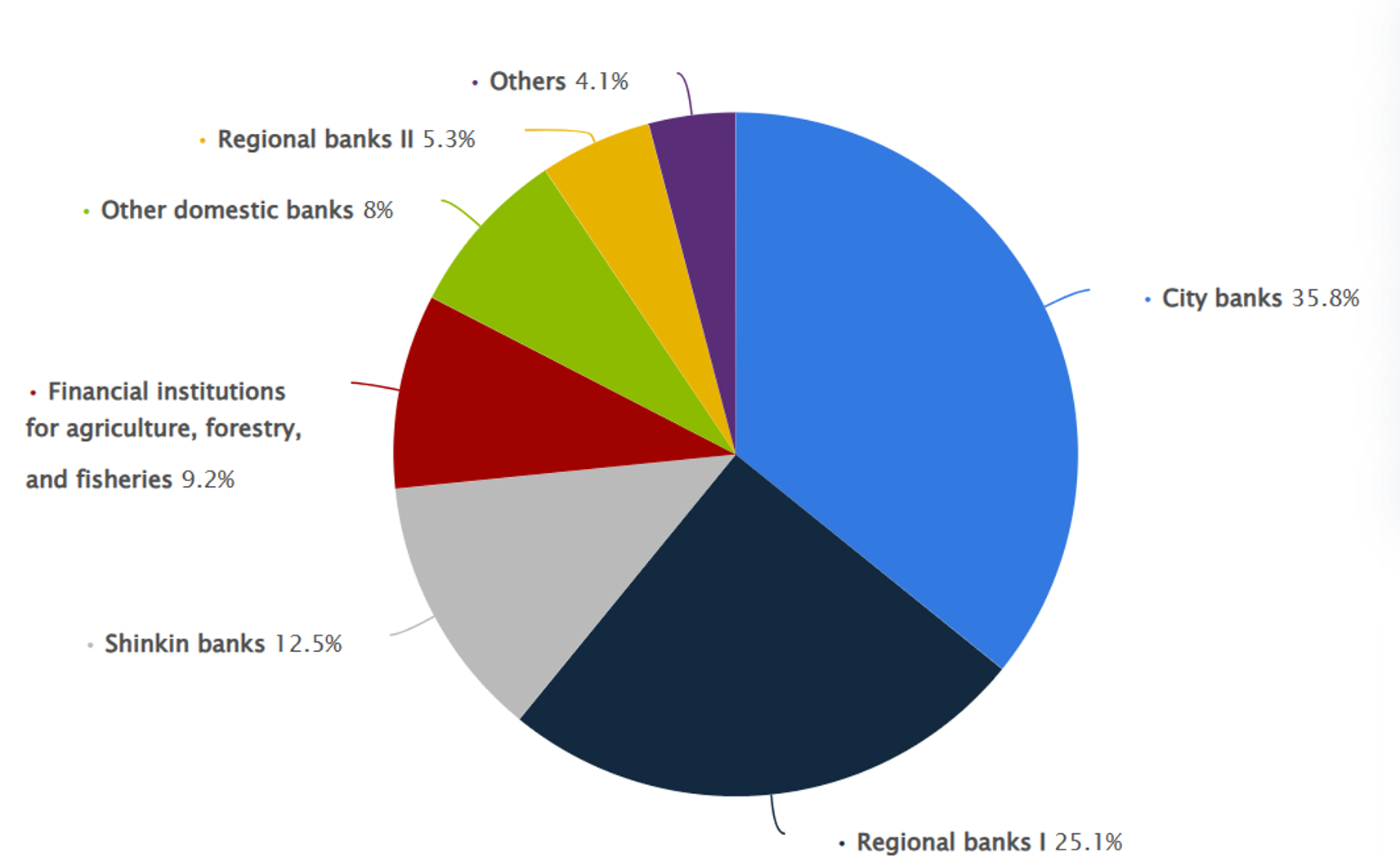

The below is the breakdown of Japanese banking players (per Statista).

I. Investment Thesis

1. Japanese banks – beneficiaries of interest rate normalization and investor sentiment recovery

The Japanese markets have entered a new, more challenging investment phase. The rally, previously driven by the hope of improved governance to lift P/B ratios, appears to have concluded.

Thus, Japan now stands at a pivotal moment to demonstrate tangible change. Early signs of structural reforms are emerging.

The Bank of Japan

On March 19, 2024, the Bank of Japan made a widely anticipated move by ending its negative interest rate policy and Yield Curve Control (YCC). In anticipation of this decision, shares of many Japanese banks have risen, with MUFG (8306) leading the pack, buoyed by substantial capital from foreign institutional investors.

Wage increase

The “shunto,” or spring labor offensive, is a hallmark of Japanese business culture, characterized by more cooperative labor-management relations than in some other countries. In early March 2024, Rengo, Japan’s trade union conglomerate with 7 million members, announced that the nation’s largest corporations had agreed to a 5.28% wage increase for 2024—the most significant raise in 33 years.

The government hopes these wage increases will extend to SMEs, which make up 99.7% of all businesses and employ about 70% of the workforce. However, many SMEs lack the ability to transfer increased costs to customers. Wage negotiations for most SMEs are expected to wrap up by the end of March, with increments likely falling short of those secured by larger firms. Yet, due to widespread labor shortages, many SMEs may still need to offer salary concessions.

Even modest and incremental wage increases are poised to initiate a virtuous cycle, where:

- Higher pay leads to a greater tolerance for higher prices.

- This, in turn, results in higher corporate profits.

- Ultimately, it culminates in higher stock prices.

2. Regional banks – Direct beneficiaries of rebound of Japanese economy

Japanese bank shares (city/money center, regional, and trust banks) have faced prolonged skepticism due to the ultra-low interest rate environment and a shrinking population, both of which have squeezed profit margins. Yet, despite the accelerated population decline, there are emerging signs that Japan’s deflationary period is nearing an end, spurred by economic recovery, partly attributed to the depreciation of the yen.

Japan’s issues listed above have disproportionately affected the profitability of regional banks compared to their larger counterparts in the Kanto region (Tokyo). Regional banks’ reliance on traditional lending within their local economies, which have experienced slower growth, has been a significant factor in this disparity. In contrast, larger banks benefit from diversified revenue streams, including global reach, investment banking and wealth management services. Consequently, this has led to many regional bank shares trading at P/B ratios, reflecting market perceptions of their value.

2-a) Better operating landscape for regional banks

Nevertheless, a recovery is anticipated for regional economies, bolstered by the overall economy’s uplift from escalating prices and profits. Regional banks have higher relative share of deposits and loans in their business portfolios compared to city banks (money center banks) such as Mitsubishi UFG, therefore, are in a better position to leverage on a revival of domestic economy in Japan.

Throughout this resurgence, weaker regionals may be phased out, paving the way for the remaining banks to benefit from decreased competition. Moreover, Japan’s tax legislation provides numerous incentives for prosperous M&As. These incentives include corporate income tax reductions, exemptions from specific asset transfer taxes, and allowances for special depreciation.

2-b) Why Regional bank based in Aichi prefecture (Nagoya is the largest city in the prefecture)?

Nagoya, the central city in Aichi Prefecture, ranks 4th with a population of 2,191K. The largest city in Japan is Tokyo with a population of 8,337K. The 2nd: Yokohama (3,574K) and the 3rd: Osaka (2,592K).

Aichi Prefecture is distinguished by its role as the home to Toyota’s headquarters. Reflecting this, NB caters to the financial needs of SMEs within the automotive sector. The bank’s robust relationship with Toyota’s supplier SMEs is evidenced by the establishment of the Automobile Industry Support Office in 2019. This office was dedicated to gathering insights on the part shortage, faced by auto component suppliers. In January 2022, it evolved into the Automobile Supply Chain Support Office, further emphasizing the bank’s commitment to this vital industry segment.

Aichi area economy:

The January BoJ branch manager meeting reported the steady economic recovery in Kyushu, Okinawa and Tokai, where the bank is located, out of 9 regions.

Notable data points from the meeting include:

Exports and Production: Despite sluggish global economic recovery, automotive-related sectors remain robust due to eased supply constraints.

Employment and Wages: Labor supply-demand imbalances and increased workforce shortages were reported across many regions. Some large companies have already announced wage increase policies comparable to or exceeding last year. Regional variations exist, but wage increase momentum is building earlier than last year, even in rural areas.

Pricing Strategies: While companies continue to pass on past increases in raw material costs, the pace of such adjustments has slowed down. Several reports mention pricing actions that accommodate consumer frugality, including price restraint and occasional product discounts. Simultaneously, some service industries are gradually considering price increases in response to rising labor costs.

Aichi Population: slower decline vs. the national average:

As per the government’s data*, population of Aichi prefecture grew 9.8% from 1995 to 2020 vs. 0.5% rise in overall Japan. Going forward, Aichi is expected to experience slower population decline of 8.1% from 2020 to 2045 vs. a 15.1% decrease nationally.

* National Institute of Population and Social Security Research (issued in 2018)

Given the demographic projections and the economic impetus from automotive product exports, NB is well-positioned to expand its business footprint. Aichi stood out as the second-largest export region in 2023, trailing only the Narita airport area, which has thrived due to the shipment of high-priced semiconductor products.

Thanks to the bank’s efforts to expand the client network in Aichi, NB has managed to increase the number of corporate client every year, which was at 29,306 as of 3/2023, up 7% from 27,321 in FY3/19. Both the loans and deposits have grown for the last 6 years. Deposits’ CAGR for FY3/18-3/23 was 5.1% and loans’ CAGR was 8.1%. Deposits/loans ratio was higher than 120% during the same period, except for 118% for FY3/23.

3. Net interest margin (NIM) improvement potential

The prolonged low interest rate environment has led to gradual decline of NIM of banks. NB’s NIM (net interest income/deposits+loans&bills discounted+securities) was 0.43%in FY3/18 but decreased to 0.38% in FY3/20 and further went down to 0.35% in FY3/23.

However, the bank anticipates generating ¥10 trillion in loans and deposits at FY3/27, which is expected to yield a higher net interest margin and, consequently, greater profits. This loan increase represents a modest increase from the previous figure of ¥7.9 trillion as of FY3/23. The growth in interest-earning assets is underpinned by the strategic expansion efforts outlined later in this report.

4. Solid balance sheet to support growth

Over the past five years (FY3/18-FY3/23), the bank’s total capital adequacy ratio (equity capital/risk-weighted assets) reached its highest level of 13.7% in FY3/21, bolstered by high loan volume. The loan volume rose, aided by government-supported no-interests/no-collateral loans (zero-zero loans) amid the Covid-19 environment*. Although the total capital ratio dipped to 11.9% due to bond write-offs under the rising interest rates in US, it remains above the 9.98% average reported by 90 domestically-focused regional banks. For context, the total capital ratio for 10 internationally-exposed regional banks stood at 13.9% in FY3/23. Both bank categories saw an uptick in their total capital ratios in FY3/23 compared to FY3/22, with internationally exposed banks at 13.41% and domestic regionals at 9.71%.

*Zero-zero loans are discontinued in FY3/22.

More on the lower capital adequacy ratio in FY3/23

In FY3/23, thanks to raising ¥20 billion in subordinated loans, the Tier 2 capital increased. However, due to bond valuation losses and a significant rise in risk assets, the capital adequacy ratio declined to 11.9%. The appropriate level for the capital adequacy ratio is considered to be around 12.5%, allowing for a comfortable margin above the regulatory requirement of 10.5%. The economic scale of Aichi Prefecture and the potential for further growth, the bank aims to maintain an appropriate capital adequacy ratio while balancing risk asset expansion with shareholder returns.

The solid capital ratio will drive NB’s growth plans forward. Major new initiatives are discussed in the below section.

5 Diversified growth plan

In addition to continued focus on traditional deposits/lending operations, NB intends to further expand commissions and fee businesses. Two initiatives are highlighted below:

5-a) Successor resolution M&As

One aspect of the aging society is the persistent shortage of successors for small businesses, as their owners age rapidly. Aichi Prefecture is facing this challenge as well. NB has identified a business opportunity in devising solutions for these client companies. They are swiftly developing expertise in business closure strategies—when it’s the most viable option—and in facilitating the matching of buyers and sellers. Their 190 employees have been awarded the M&A Senior Expert certificate by the Financial and Fiscal Affairs Research Association, equipping them to adeptly serve their clients.

5-b) Shizuoka Nagoya alliance

NB Bank has formed a strategic alliance with Shizuoka Bank, the leading and Tier 1 regional bank in the neighboring Shizuoka prefecture. This partnership is designed to harness the strengths of both institutions for mutual benefit.

NB Bank brings to the table its specialized knowledge in the automotive industry, along with a robust automotive supply chain network.

Shizuoka Bank offers its proficiency in securities, M&A, and venture capital financing.

Together, this alliance aims to create a local powerhouse of financial expertise. The alliance has already provided 5 syndicated loans (¥7.4Bn) and 2 venture fundings (¥2.6Bn).

6. Attractive Valuation

Many regional bank shares have appreciated in an anticipation of normalization of interest rate and wage hikes. However, local growth concerns have still kept many regionals’ valuation at a lower level, including NB’s. This gives room for its multiple to expand once the growth is proven to be sustainable.

NB is anticipated to bolster its ordinary profits by 25% from FY3/24 to FY3/25, propelled by ongoing growth strategies previously outlined, marking the second-highest profit surge among its competitors. Meanwhile, Chiba Bank, a Tier 1 regional bank and #3 in asset size among regionals, is projected to see a 9% rise in ordinary income during the same timeframe. While Chiba Prefecture serves as a suburban area for Tokyo’s workforce, NB has the potential to match Chiba’s 16x P/E ratio once it broadens its non-interest income streams. Achieving this could elevate NB’s share price to approximately ¥10,000, implying a 50% upside.

7. The Blueprint to improve P/B ratio

The Bank’s ROE has remained under 5% from FY3/19 to FY3/23. The lowest point was 2% in FY3/20, attributed to the economic impact of Covid-19, while the peak was 4.56% in FY3/22. The company acknowledges that such a subdued ROE performance is likely to dissatisfy investors, contributing to its lower P/B and P/E ratios.

The Tokyo Stock Exchange’s (TSE) unusual directive to raise the P/B ratio to a minimum of 1 by in 3/23 has spurred investors to begin accumulating stocks with low P/B ratios, anticipating value appreciation following the implementation of P/B enhancement strategies. NB has also garnered investor interest, with its share price increasing by 94% over the past 12 months. Despite this uptick, it continues to trade at a modest P/B of 0.44x, suggesting significant potential for further growth in both P/B ratio and share price. To address its low P/B ratio, management explained their plan to address the low P/B ratio using the below simple formula.

P/B ratio=ROE * P/E Ratio

ROE=ROA*leverage ratio: The bank intends to improve ROA through executing the existing traditional lending and new areas (discussed earlier), coupled with an appropriate use of financial leverage to support these initiatives.

II. Weaknesses/Risks

The persistent challenges in Japan, characterized by a stagnant economy, an unfavorable demographic profile, and subpar corporate governance, have consistently failed to attract global investors. Indeed, despite frequent claims that “this time is different”, Japanese stocks have repeatedly disappointed both large and small investors over time.

However, the current efforts by the Tokyo Stock Exchange (TSE) could mark a turning point. The TSE’s focus on enhancing the attractiveness and transparency of Japanese stocks, including initiatives like supporting smaller companies in developing English communications, is a promising step toward changing investor perceptions.

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance.