Summary:

Temairazu (Hussle-free) makes hotel booking fast and easy for hotels and quests. Currently, there seems to be disconnect between flourishing tourism in Japan and downbeat Japanese travel related stocks. Travel reopened in oct 2022 and overseas visitor arrival has rebounded. But many of travel related stocks has decreased over the last 12 months. Why? Will travel related stocks experience resurgence once the markets close this gap?

Who is Temairazu (“Tema” or the “company”)?

Tema is a site controller company and has two segments.

Business model:

1) Application Services Business (99% of total sales):Tema runs the “TEMAIRAZU” series, which acts as a centralized controller for booking sites. This controller allows management of inventory, pricing, and other factors across multiple reservation sites and the company’s own booking engine.

Revenue sources of this segment: monthly fixed basic usage fees, optional usage fees, and commissions based on the number of reservations.

2) Internet Media Business (1%): This group operates advertising media primarily centered around the comparison site “Hikaku.com”. This platform provides information related to various products and services in areas such as shopping, internet service providers, travel, and asset management, catering to the needs of internet users..

Revenue sources: monthly fixed advertising income and performance-based advertising income.

1. Investment Thesis

1) An opportunity arises from the gap between “Industry recovery” and “sagging travel stocks”

Visitor numbers are rising

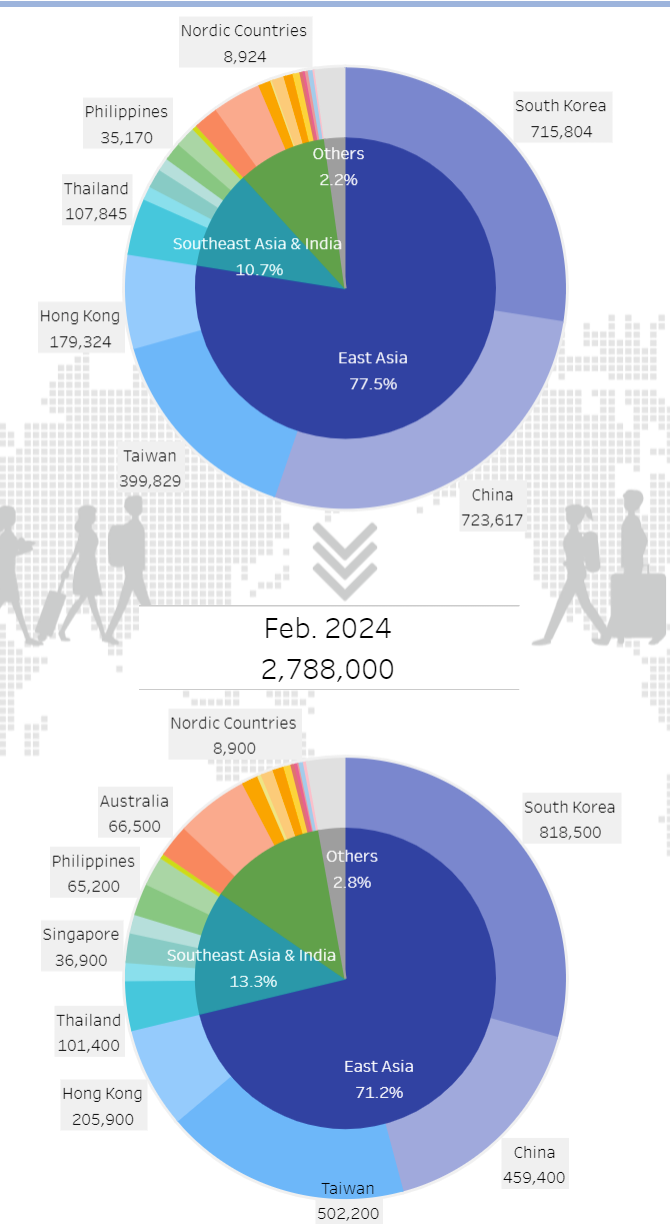

- Japan National Tourism organization (JNTO/a government agency) has published the strong travel recovery stats. In 2023, there were 25.1 mn international visitors to Japan vs. a record high of 31.2 mn in 2019, indicating 2023 tourists reached 80% of 2019 level. The recovery trend has continued in 2/24 which saw 2,788 K monthly visitors (+89% YoY and +7.1% vs. 2/19).

The below two pie charts compare visitor countries breakdown in 2/19 vs. 2/24. The only one country shows a decline (by 40%) in visitor number which is China.

While Chinese group tours have indeed resumed, the influx of Chinese tourists to Japan has only seen a partial recovery. This can be attributed to a couple of factors:

1) There was a delay by China in including Japan in its list of approved destinations for group tours, which only occurred on August 10, 2023.,

2) The Chinese government has expressed strong criticism of the Japanese government’s decision to release treated (not wasted) water from the Fukushima reactors into the ocean, describing it as an “extremely selfish and irresponsible act”. These developments have likely influenced the pace at which Chinese tourists are returning to Japan.

Nonetheless, the recent data shows an uptick in the number of Chinese visitors. Jan and Feb/2024 saw the number of Chinese visitors exceeded 400,000/month, the level not seen throughout 2023. Anecdotally, wealthy Chinese tourists are increasingly visiting Japan for high-end medical services. There are clinics in Tokyo’s upscale Ginza shopping district which now offer personalized preventive healthcare services to cater to health-conscious Chinese visitors.

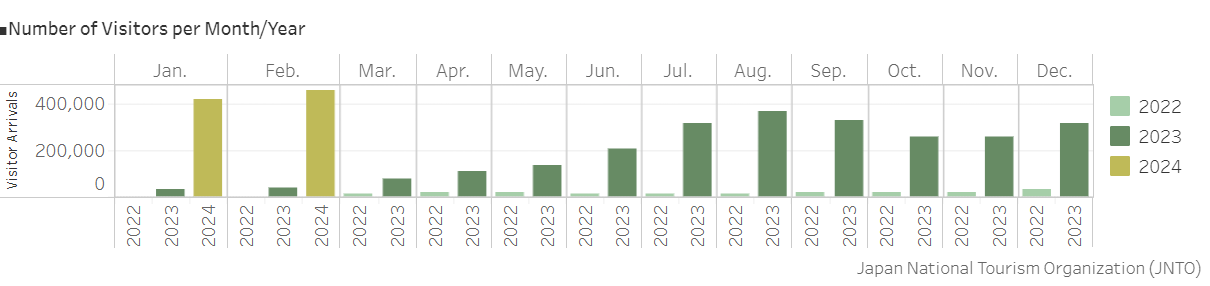

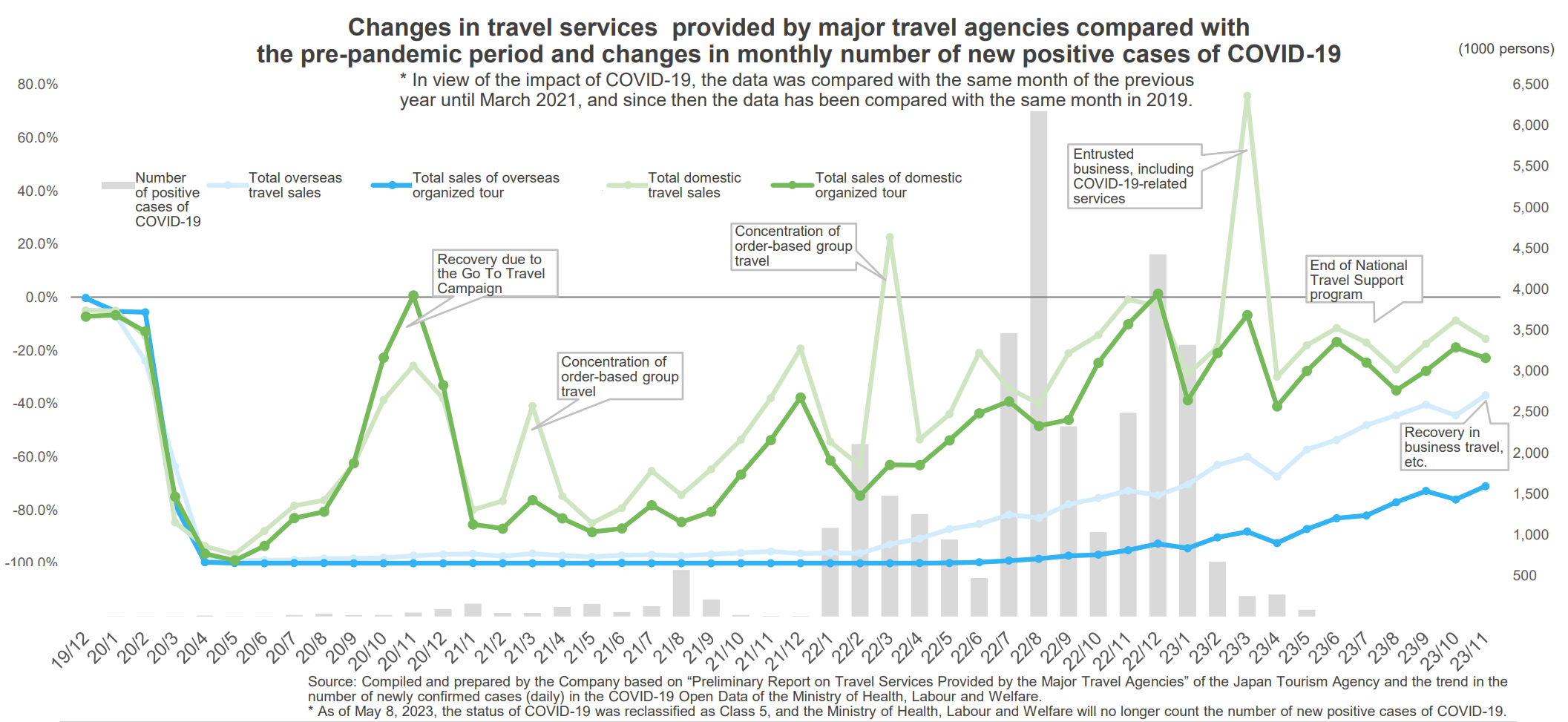

Domestic travel statistics (green line in the below graph) are on a upward trajectory as well, as shown in a graph prepared by Opendoor (3926).

(Source: Opendoor (3926) financial results presentation for 3Q FY2024/3 issued on 2/9/24)

*Entrusted services=orders from official/governmental entities.

Travel Voice Japan reported on 11/10/23 that in September 2023, the total number of guest nights in Japan finally exceeded pre-pandemic levels.

But the stocks are lagging

Travel related stocks have been out of favor in Japan. The below table of Tema’s peers show that all the stocks were down (-6-60% range) over the past year compared to Nikkei’s around 50% appreciation.

There seems to be disconnect between flourishing tourism and lagging travel stock performance. Several reasons can be pointed out:

Industry related factors:

- Domestic travel volume has recovered first fueled by “Go to travel” subsidy from government, but come down when the subsidies ended.

- Chinese visitors which were 30-40% of inbound volume to Japan pre-Covid have not fully returned yet.

- Foreign visitors are undoubtedly lured to Japan to experience Japan relatively inexpensively thanks to cheaper Yen. Some investors are concerned about the negative impacts of strengthening JPY after widely anticipated removal of minus interest rate by the Bank of Japan.

- Business travel has not returned to the pre-Covid level.

- there is a severe labor shortage in Japan, including Hotel industry, impacting the hotel operations.

Market related factors

- These stocks have started to run late 2022 when inbound travel restrictions were lifted, in an anticipation of a rise in travel demand post Covid.

- Tavel stocks are not associated with AI and semiconductors which have been darlings of investors over the last year.

- The Japanese domestic retail investors have flocked to the high dividend yielding stocks in 2024. This is because dividends are tax-exempted under the new NISA (Nippon Individual Savings Account) program. Temairazu with low 1% yield, tend to be low on their buy list. Nonetheless, Tema has set forth dividend payout ratio of 22.5%. As the profits continued to increase, the company raised dividends two years in a row.

When/if will the above conditions be reversed or work themselves out?

With the consistent influx of tourists, travel related stocks are poised to maintain strong profit growth. The current valuations offer an appealing entry point to establish a position and await a favorable shift in sentiment change.

2) Why Temairazu among many travel stocks?

I believe Temairazu offers the best option to take advantage of unjust discount placed on travel stocks, since a) it is a best site controller stock and b) currently investors are misunderstanding it due to its lower than expected guidance, i.e., its valuations are attractive vs. its earnings power.

a) Benefits of using a site controller

There are many benefits to using a site controller, including:

- Improved efficiency: Site controllers can help accommodation providers save time and effort by centralizing the management of their reservation services.

- Reduced errors: Site controllers can help to reduce errors by automating tasks such as inventory management and pricing.

- Increased visibility: Site controllers can help to increase the visibility of accommodation providers by making their properties available on a wider range of reservation services.

- Improved customer service: Site controllers can help to improve customer service by providing guests with a more convenient and efficient booking experience.

Overall, site controllers can be a valuable tool for accommodation providers of all sizes. By centralizing the management of their reservation services, accommodation providers can improve efficiency, reduce errors, increase visibility, and improve customer service.

Entry barriers

Site controllers are customized to a client’s specific needs, making it difficult for others to easily imitate them. Thus, established players such as Tema has an early mover advantage. To future differentiae, the company plans to allocate 10% of ordinary profits to investments in both existing services and the creation of new products and services.

b)Valuation

Tema has managed the Covid induced travel downturn relatively well, since hotels recognized the need to stringently manage the bookings especially under the low volume environment. The company’s CAGR ratios for sales, operating profits, and net profits over the period of FY6/17-6/23 were 14.5%, 21.5% and 25% respectively. Against these stellar growth, the company is trading at FY6/25 PE of 19x and Net Cash Ratio (market cap/(current assets + marketable securities *0.7 – total liabilities) at 3.37X.

The company’s high P/FCF of 20x may indicate that, given its extreme low capex needs, the investors expect future free cash flow generation to be high. The company’s main expenses are system development and maintenance costs (cost of sales) and wages (SG&A).

Its high operating margin of 74% is impressive compared the peer average of around 35%. 6/24 E P/E seems reasonable vs. the peer average P/E of 17-19x and a 25% net income CAGR of the previous 6 years which includes Covid period.

The company’s reasonable valuation and solid balance sheet (equity ratio of 96%) should provide the stock price support.

Disappointing guidance

The company has a history of slightly undershooting its annual plan during the early part of a year with a tendency to recover by year-end. On 7/30/23, the company issued its annual guidance with a 3-5% decline in all the profit lines despite a 6.5% increase in net sales. Management team gave the below rationale which I believe makes sense.

To meet the recovering demand in the hospitality industry, the company continue to invest in talents and system enhancements. Additionally, new business developments for medium to long-term growth remain ongoing, leading to higher sales and lower profits.

Markets did not like this lower guidance and the stock sold off 5% and continued to go down to JPY1989 in 10/23. The stock has been on a recovery since then and now trading at JPY 3,050 which put its YTD performance at -39%.

3) Investor-Management United as One

Tema’s management holds a significant stake in the company, owning 59.7% of the shares. This substantial ownership aligns management’s interests with the long-term success of the company, as they are likely to make decisions that benefit shareholders over time, leading to enhanced corporate value.

Shikiho (Japan Company Handbook) has tested this thesis over the past two decades, utilizing Topix as a sample universe. The compelling graph below seems to affirm the validity of this hypothesis. Specifically:

- Companies with management ownership exceeding 50% consistently outperformed stocks where management ownership was lower.

- Remarkably, the degree of outperformance directly correlated with the ownership ratio.

- Conversely, the worst performers were companies whose management owned less than 3% of the shares.

4) Sustainable profitability

P&L for FY6/2017 through FY6/23

The company maintained a consistent growth trajectory until FY 6/20, when the global impact of Covid-19 began. Remarkably, even during the peak of the Covid-related shutdowns, the company’s revenue remained relatively stable, buoyed by the demand for accommodations during the Tokyo Olympics in July 2021. This resilience can also be attributed to the fact that hotels relied on site controllers to manage their bookings effectively.

Tema’s operating margin is high at 74% for FY6/23 and rising since the sales bottomed in FY6/21. The company’s primary operating expenses, such as system maintenance and labor, are relatively fixed. As sales volume increases, these stable costs provide an opportunity for enhanced profitability.

FY6/24 guidance and FY6/25 expectation

As discussed earlier, management conservatively guided with a 6.5% sales increase and slight decline in profitability. Management guided its profits lower since 1) the company continues to spend on talent development and system enhancement and 2) spend at least 10% of ordinary income for developing new businesses for long term growth.

Shikiho which sits down with management every quarter is more positive on the company’s ability to generate both sales and profits in FY6/24 and FY6/25. It forecasts that sales and profit lines will rise 16% range vs. FY6/23 and the same momentum should continue in FY6/25. Shikiho expects that contributions from the recently formed partnerships are higher than management’s forecast. Notable contributors include the hotel subscription services provided by Tokyu Hotels and a booking platform for Japanese guests in Taiwan, managed by a BEENOS subsidiary (Ecommerce operator).

2. Weaknesses/Risks

1. Slower than expected rebound of Chinese tourist numbers

While the resurgence of Chinese tourists may be gradual, the company’s recent partnerships are poised to generate revenue that will compensate for the diminished income from Chinese visitors.

2. Investor confidence slow to thaw for Tema and other tourism-linked stocks

The company’s attractive valuation and robust balance sheet, with an equity ratio of 96%, are expected to support the stock price.

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance.