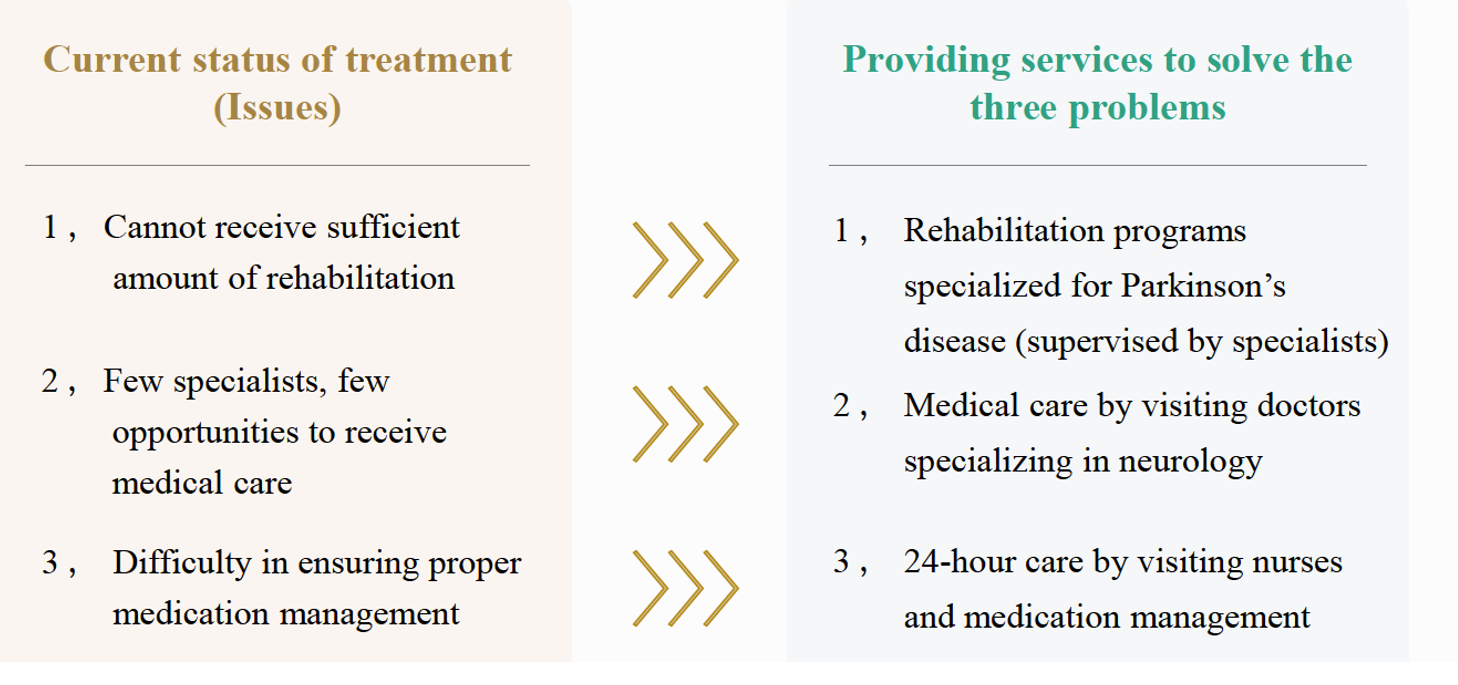

Sunwels (Sunwels or the “company”) is an operator of “PD House”, the assisted living facilities specialized in the care of patients with Parkinson’s disease (“PD”). PD House’s main service is rehabilitation programs but medical attentions are provided by visiting doctors and nurses.

The PD House’s founding story itself speaks for the company’s strong commitment to provide unparalleled care to patients with progressive disease. Mr. Naoshiro (CEO) has founded Sunwels’ predecessor company in 9/2006 after suffering from a long term kidney disease for 6 years in his early twenties. The first PD houses were opened in 2019. PD House generates 70% of the Sunwels’ sales and medical facilities specialized in serious illness such as cancer account for 22%. The other services include day care facilities and medical equipment rental.

1. Investment thesis

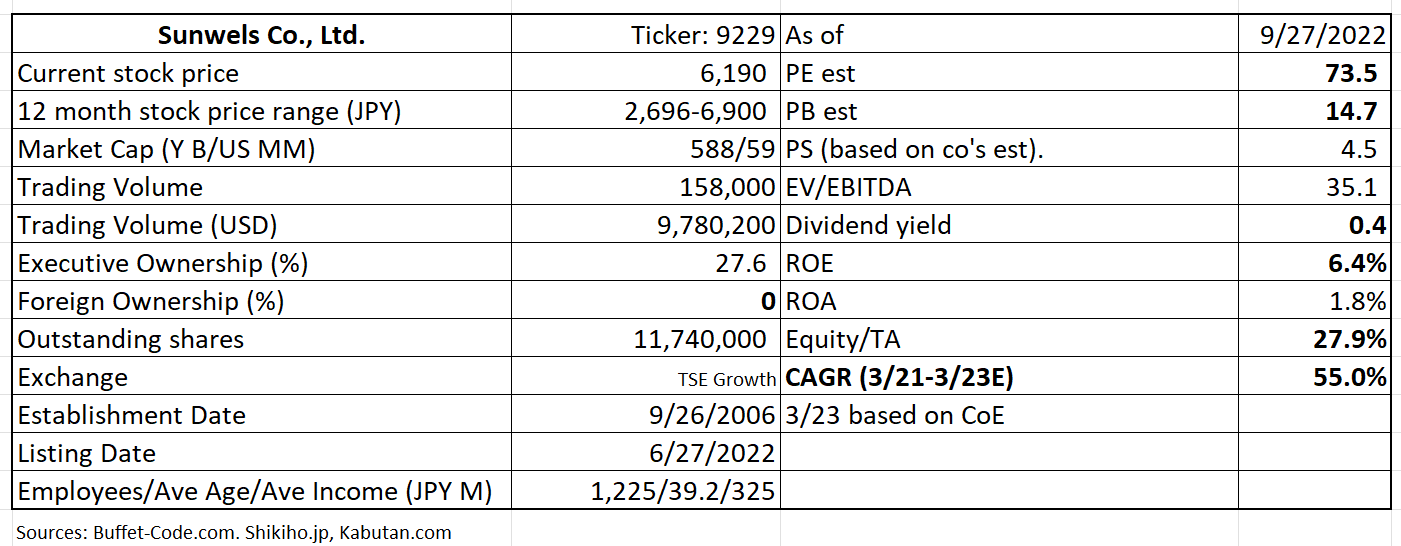

Investment thesis behind Sunwels is simple. As the only one operator of a PD-focused assisted living, our investment evaluation can focus on: 1) the potential of top line growth (i.e., the size of accessible market) and 2) Sunwels’ ability to protect its leading position if/when the new players enter the PD care market.

The below section addresses these two points:

1) The only pure play in a growth industry

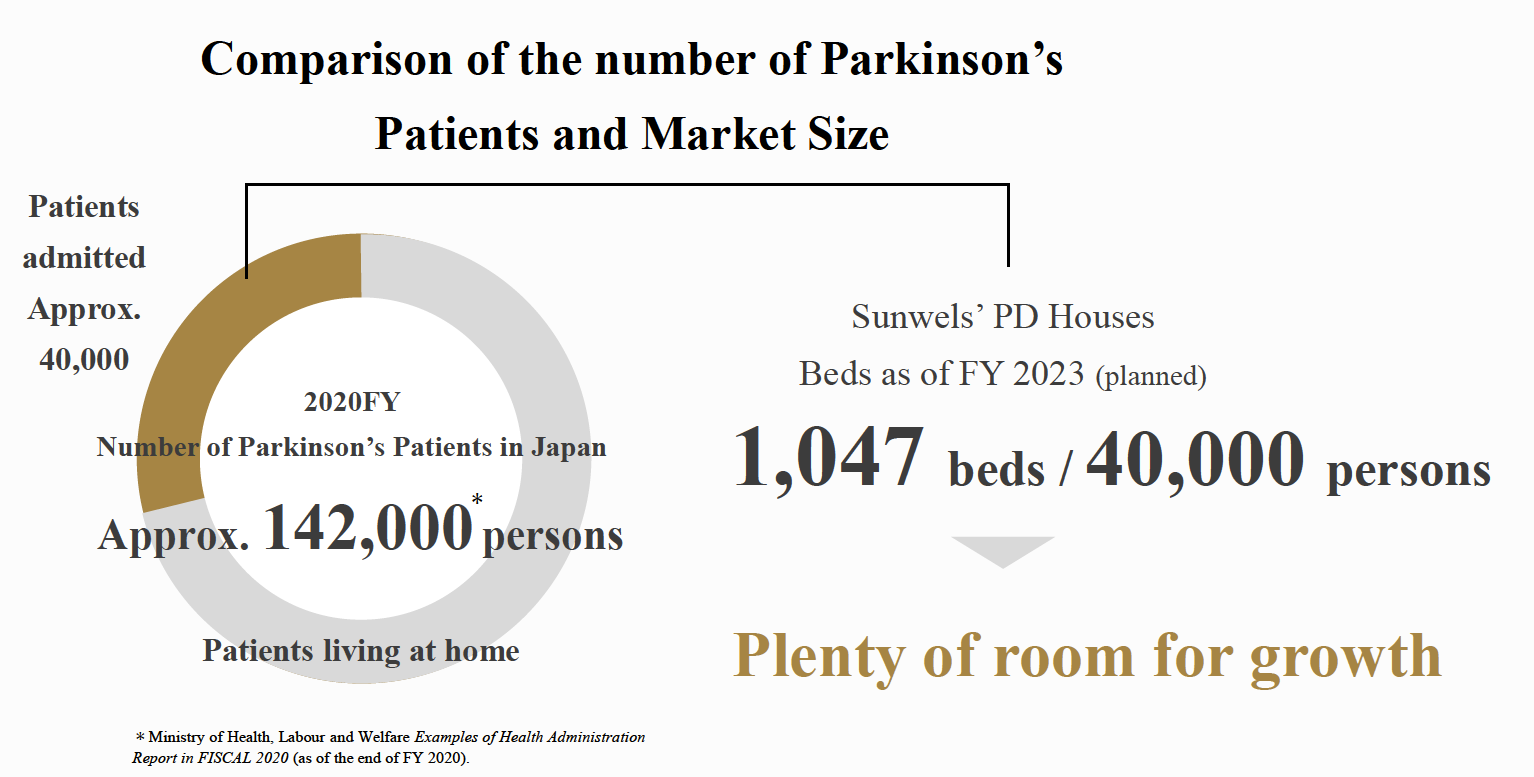

Parkinson’s disease (PD) is an age-related degenerative disorder of certain brain cells. It is a government designated intractable disease, affecting 142,000 people in Japan. The number of patients will likely increase, as aging of population continues to accelerate.

However, treatment options of this incurable disease are limited, particularly once patients leave the hospital. Sunwels is uniquely positioned to address the three issues of current treatment as shown below:

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

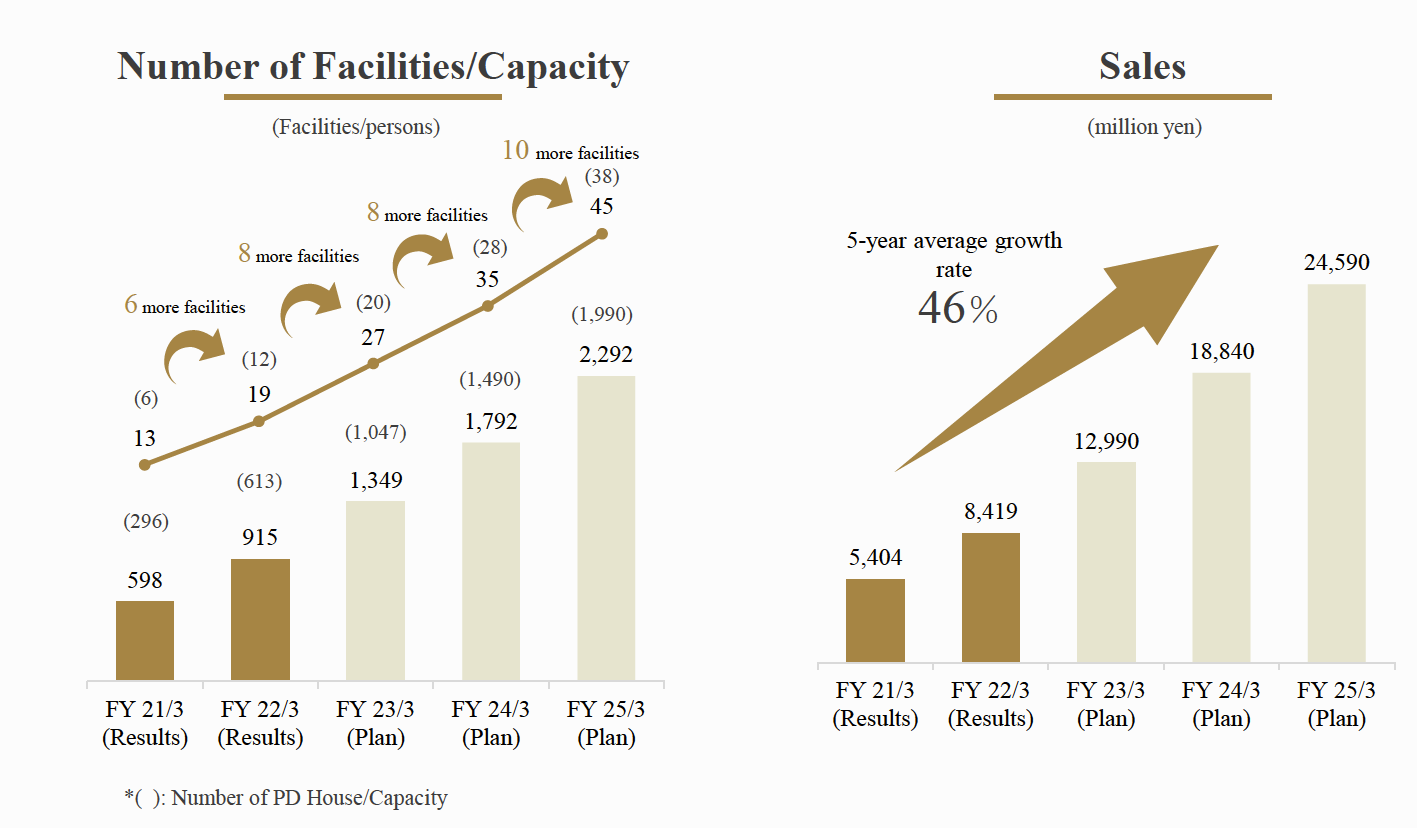

As discussed in TAM section, it is the unfortunate fact (socially) that the patient universe will grow in Japan, providing the company with ample room to grow.

2) The defendable leadership in the industry

The company is the only player which have focused on running assisted living facilities for PD patients in japan (also globally), which is the main differentiation factor. There is one competitor, Super Coat, which has just opened one PD focused senior housing in Osaka area in 2022. Super Coat is different in that their majority of operations is to run regular senior housing.

There exist several more characteristics which set it apart:

A) The company, in cooperation with the medical universities and doctors, is accumulating knowledge base on PD through daily contacts with PD patients in their facilities. These data is in turn helping Sunwels fine-tuning their service offerings. This is their main competitive advantage. It will take a while for new entrants to catch up with the Company’s service level and establish the “trust” with doctors.

B) Another competitive advantage of the company is its ability to fill a newly opened facility quickly: 80-90% occupancy rate is already achieved pre-open. Sunwels’ only-one player status and 10 + year’s successful track records affords them with a marketing edge. At the 3rd month, a monthly P&L turns positive and at the 10th month, a new PD house can absorb opening costs and reach a breakeven point.

C) The Company believes that their ability to attract experienced personnel has improved thanks to better public recognition through IPO and established training system.

D) The company operated 20 PD Houses as of 3/22. They plan to open 8 PD houses with a goal of owning 20 PD Houses(capacity 1047 residents) at FYE 3/23. Further, Sunwels has contracts to build 9 more PD houses by FYE 3/24. This industry leading scale should help them maintaining a top player status.

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

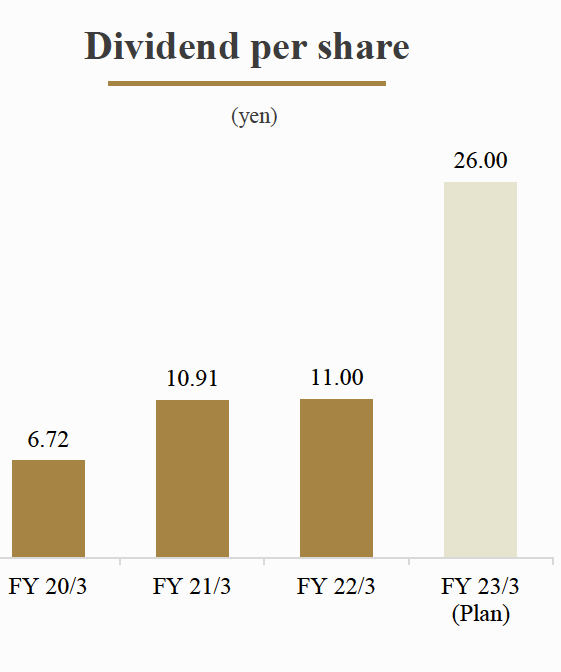

The company is in an early expansion phase, which requires a substantial capital commitment. This explains high valuation metrics overall and low equity ratio. Nonetheless, Sunwels is profitable and pays dividends.

2. Technically Speaking

(Source: buffet-code.com)

The stock has been on a steady upward move since its IPO on 6/27/22. The big gap up in early Aug was the result of a strong earning and interim dividend announcement on 8/10. The next volume cluster is around JPY 6,000. The next earning release will be around early Nov. which may require a caution in trading.

3. Business Model

Main source of the company’s sale is residents’ insurance coverage, thus, bad debt risk is limited.

10% – 30% of sales: from residents to cover food, utilities.

70-90%: from insurance coverage

4. Financial Highlights

Financial results for the fist quarter ending 6/22 vs guidance

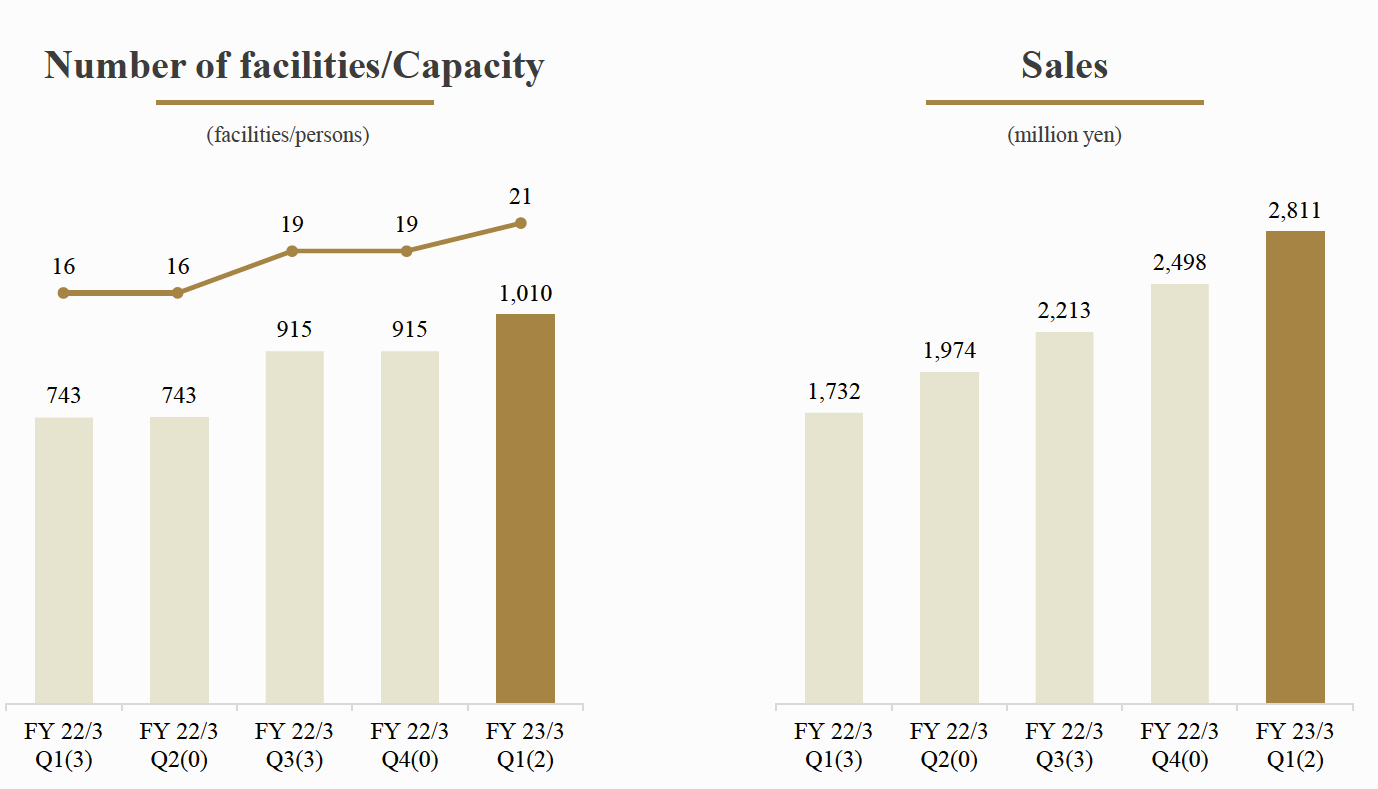

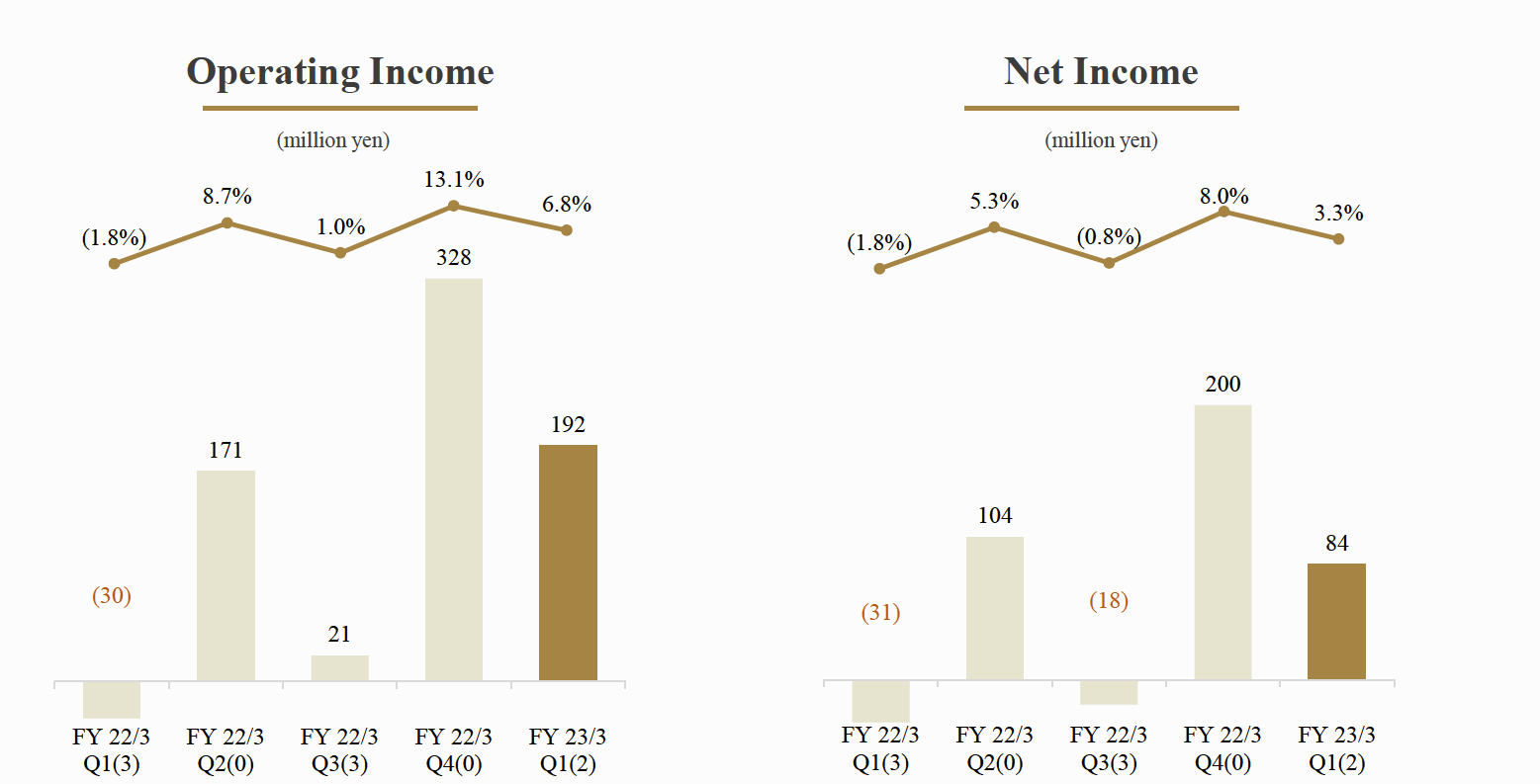

The below two graphs illustrate the company’s business model in which sales grows in accordance with the facilities/capacity increase.

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

Sales was JPY 2,811 MM (year on year increase of JPY 1,079 MM/$7.5 MM) and operating income was 191 MM (year on year increase of JPY 223MM), driven by 5 facilities addition for the last 12 months. In Q1 2021, opening of 3 facilities led to the large cost burden but these operating costs were absorbed in the past 12 months.

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

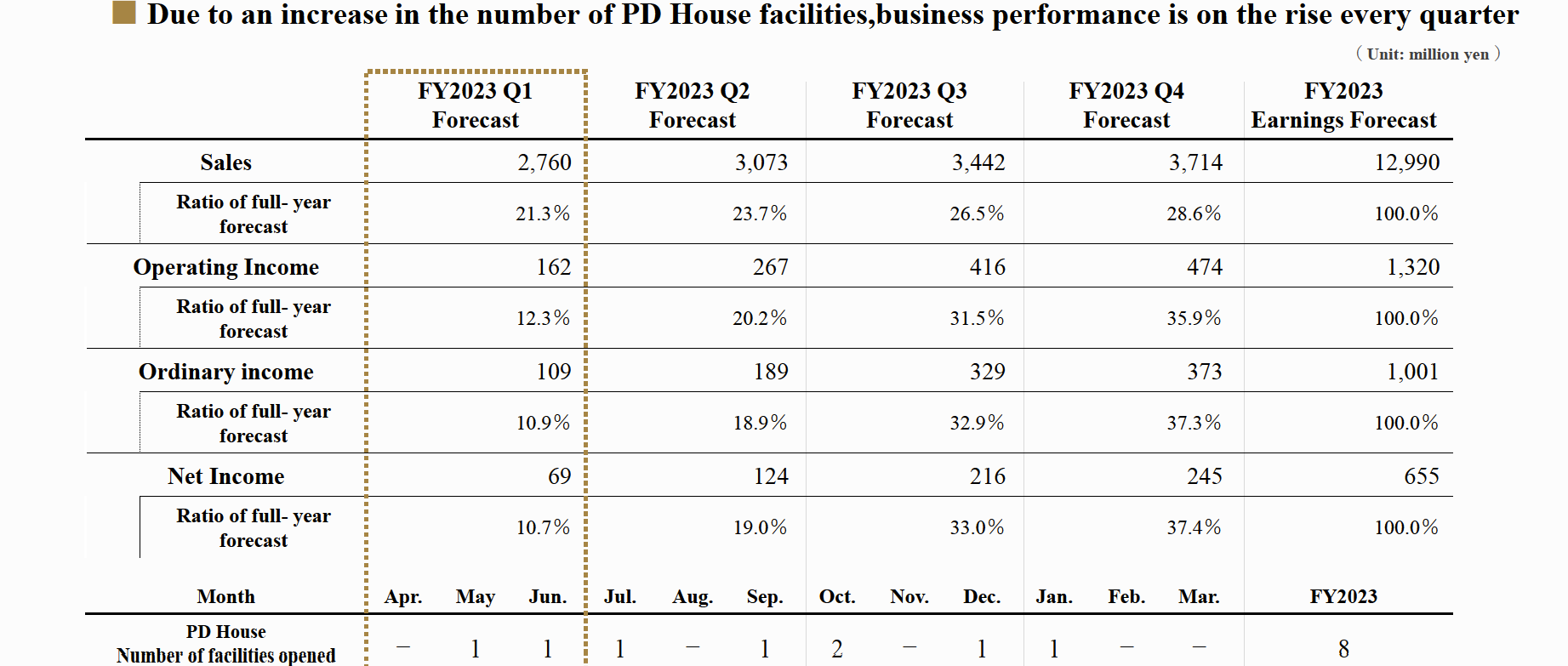

FYE 3/31/23 Guidance

The company is on pace to achieve a full 12/31/22 guidance, although none of the line items in the dotted box in the below table has achieved 25% which one quarter should typically reach. The company’s business model is as such that both sales and profits are building up throughout a year since facilities opened during the early part of a year will increase its sales and profits contribution as a year progresses.

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

5. Total Addressable Markets (TAM)

The company enjoys a unique position as the sole provider of assisted living catered to the specific needs of Parkinson’s disease (PD) patients. For a fiscal year ending 3/20, around 142,000 PD patients were estimated to live in Japan, 40,000 of which were residents of the company’s PD houses. Thus, 70% of PD patients live at home without a proper rehabilitation access. Not all of these home-based patients can afford to live in a PD house, but it is safe to say that a large market opportunity exist for Sunwels.

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

6. Strengths and Weaknesses

Strengths

1. Supportive industry backdrop

The company operates PD houses which offer a rehabilitation program, specially designed to meet the needs of PD patients. Parkinson’s patients are expected to increase in Japan, which continues to support growth for Sunwels services.

2. Unique service offerings as competitive edge

The company, in corporation with medical universities, is engaged in research program to 1) develop new, improved PD treatments and drugs, and 2) more effective rehabilitation equipment and program using VRs. These universities and doctors are willing to team up with Sunwels, based on its track record which functions as an entry barrier to the new entrants.

3. Shareholder friendly management

Management has implemented a performance driven shareholder return program. Sunwels is paying special dividend of 13 yen and another 13 yen at year-end for FYE 3/23.

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

Weaknesses

1. Insurance dependency

70-90% of the company’s sales is from long term care and medical insurances. In Japan, these insurances often are government- funded. As the increase in aging population will lead to a rise in medical expense allocation of public budgets, government may be forced to reduce insurance coverage of PD patients. This may in turn put a negative pressure on the company’s profitability.

2. Skilled labor shortage

The company’s growth hinges on new house opening which requires hiring of experienced medical and administrative professionals. Shortage of qualified professionals may slow opening of new PD houses. Sunwels has established their own training program to attract promising personnel.

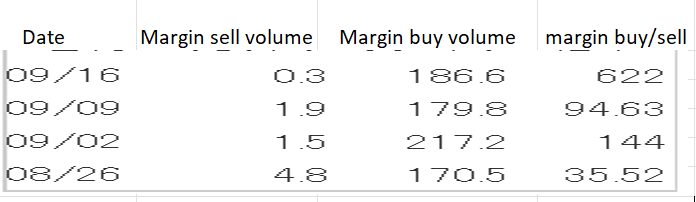

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Sunwels, margin sell volume is non-existent and the outstanding margin buy volume can be absorbed in one day. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance