Disclaimer: this is NOT an investment recommendation. Before investing in this stock, please do your own research and due diligence.

Sunwels (“SW” or the “Company”) operates a specialized nursing facility for Parkinson’s disease called PD House. PD House’s main service is rehabilitation programs but medical attentions are provided by visiting doctors and nurses.

I initially wrote about Sunwels in 9/22. The company’s stock declined by more than 30% over the two days following the Kyodo News report on 9/2/24. This significant drop prompted me to take another look at Sunwels.

I believe that stocks which experienced a sharp decline due to negative media reports present an interesting investment opportunity. While some may face prolonged sluggish performance, others, like Kawasaki (accused of falsifying test data), have suffered relatively minor damage.

Since Bigmotor’s insurance fraud scandal broke out in 2023, media companies have been scrutinizing various industries involved in filing insurance claims, searching for the next big scandal. It seems that young, fast-growing companies are the main targets, with Sunwels being the most recent one.

On 9/2/24, an article by Kyodo News argued that at Sunwels,

- there were instances of excessive home nursing care, and

- fraudulent insurance claims at the facilities operated by SW.

Promptly on 9/3/24, Sunwells issued their reply which refuted the Kyodo article, adding the comment that “the article’s headline and the facts stated in the article were reported without legal basis, damaging our company’s credibility. Therefore, we are considering legal action, including litigation”

SW maintained that

- At PD House, residents are mainly patients with severe Parkinson’s disease, classified as stage 3 or higher on the Hoehn and Yahr scale. The home nursing care provided at PD House is based on care plans created from the instructions of each patient’s primary physician. Additionally, as PD House facilities nationwide, there are detailed arrangements by each municipality, and the company conducts home nursing care while confirming with the Health Bureau as needed.

- The company has multiple management systems in place, and in cases where actions deviating from the standards, i.e., violations were discovered, it does not make insurance claims for those that do not meet the calculation criteria. If discovered later, the company returns the insurance claims.

SW went on to say that to ensure the transparency of facility operations and business, it is considering requesting an investigation from the Health Bureau and other relevant authorities as soon as possible.

SW conducted an analyst meeting on 9/4/24, and the stock rose by 12% on 9/5 before pulling back around 3% on 9/6. While there is no 100% guarantee that the company is completely innocent of wrongdoing—after all, where there’s smoke, there’s fire—it seems that the issues raised by Kyodo can be addressed through system changes and appropriate instructions from the authorities.

Again, the company attracted media attention as its explosive growth raised questions about the legitimacy of its operations. Its sales CAGR for FY3/18 to FY3/24 was 42%, and its ordinary profits CAGR was 132%. However, Japan’s aging society creates a demand for its specialized services for PD patients. The growth of its peers also adds to the legitimacy of its expansion.

Below, I update the company’s growth initiatives and recent financials. For the business model, please refer to my 9/26/22 note attached.

1 Better liquidity

Two years after its initial listing on the Growth Market on 6/22, Sunwells achieved a swift transition to the Prime Market on 7/18/24.

2 Demand for SW’s services remains strong.

The waiting list was 300 at the end of FY3/24 but increased to 370 by May 2024. PD House accounts for 86% of their sales, which total ¥21.3 billion. In Hokuriku (Northern Japan), SW handles a wide range of care services, including regular paid nursing homes, group homes, day services, and home-visit nursing and care.

3 Still a long runway

PD houses’ current market share is 3% = 2,325 (SW’s expected beds for FY3/25) out of 78,000* PD patients in assisted living. If we expand the Total Addressable Market (TAM) to include 119,000* stay-at-home PD patients, the market share is 2%, giving SW significant room for growth.

*Ministry of Health, Labor and Welfare’s “Health Administration Report,” for 2022.

4 Growth plan

Recently, the company has focused on establishing new PD Houses, rapidly expanding from 12 facilities in FY3/22 to 31 in FY3/24. This expansion has significantly boosted sales. Compared to other listed companies with similar business models, Sunwells has secured the second position, following Ambis (7071), which operates medical facility-type hospices for terminal cancer patients, with sales of ¥31.9 billion in FY 9/23.

In 5/24, Sunwells announced its medium-term management plan for FY3/25 to FY3/27. The company updates its medium-term plan figures annually using a rolling method. The new expansion plan for PD House openings is:

- 12 in FY3/25 (cumulative total of 43),

- 15 in FY3/26 (cumulative total of 58), and

- 18 in FY3/27 (cumulative total of 76).

This expansion plan appears aggressive, but the company’s below strengths, which function as entry barriers, should support it:

- Specialized Design: Sunwells’ PD House is specifically designed for Parkinson’s disease patients. With appropriate treatment, patients can live a normal life for about ten years after onset, but many eventually require assistance or care. The waiting list for PD House has increased by about 170 people over the past year, now totaling over 370, including patients from other facilities.

- Competitive Services: PD House offers three key services that provide a competitive advantage over general care facilities:

- Rehabilitation programs supervised by Parkinson’s disease specialists.

- Home visits by neurologists.

- 24-hour home care and medication management.

- Specialist Collaboration: The company collaborates with 100 specialists out of an estimated 600 neurologists in Japan for home visits to facilities.

- Academic Connections: Sunwells has deepened connections with academic authorities on Parkinson’s disease, such as Juntendo University School of Medicine, Kansai Medical University, and the University of Florida Hospital in the United States. The effort required to replicate these connections from scratch makes the barriers to entering the market for nursing homes specializing in Parkinson’s disease quite high.

5 New growth initiatives

Management has announced their plan to start home health care nursing services for homebound patients in Hokkaido and Fukuoka Plans in 6/24 and eventually increase to 19 locations nationwide. Visiting nurses requires less fixed costs compared to PH houses and, thus, comes with a better margin. This new service will be offered to 300 waiting patients first, starting the relationship with patients before they enter PD houses.

6 1Q FY3/25 highlights

The Company has accelerated the nationwide development of its PD House, opening the 4 news facilities in Tokyo, Sapporo, Fukuoka, and Saitama in Q1.

Occupancy rates

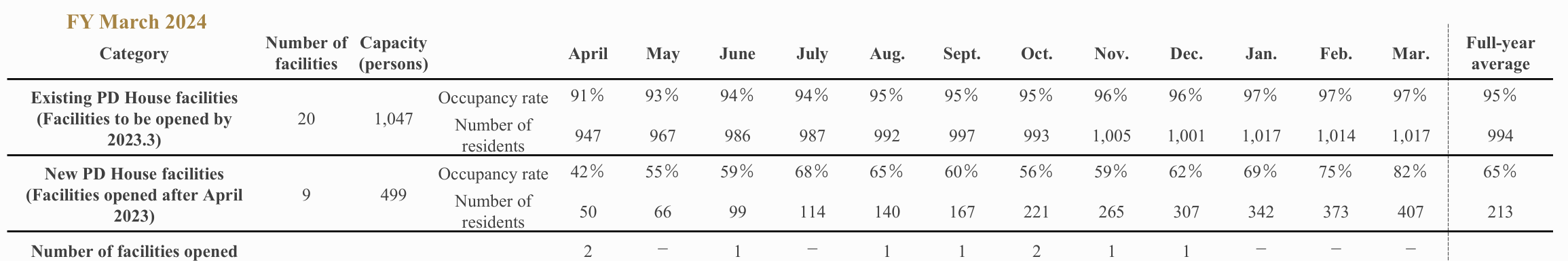

As shown in the below table, the FY3/24 full-year average occupancy rate was high at 95%. The new facilities’ full-year average occupancy was 65% but the rate did gradually improve throughout the year.

(source: company)

As a result of the above,

Net sales were ¥6,636 million (up 43.5% y/y),

Operating profit was ¥981 million (up 53.8% y/y),

Profit was 520 ¥million (up 30.9% y/y).

7 Risks

The Total Addressable Market (TAM) is ample, and management has noted that banks are willing to provide loans to support PD House expansion. However, the major risk is a labor shortage. According to the Ministry of Health, Labor, and Welfare, there will be a shortage of approximately 340,000 care workers by 2025. Management plans to address this issue by:

- Enhancing Employee Experience: Providing training and ensuring employees understand the impact they have on patients’ lives to improve their motivation.

- Introducing Technology: Implementing new technologies where possible. For example, in November 2023, the company announced a collaboration with a startup from Keio University to develop an AI-based motor function evaluation system for Parkinson’s disease patients.