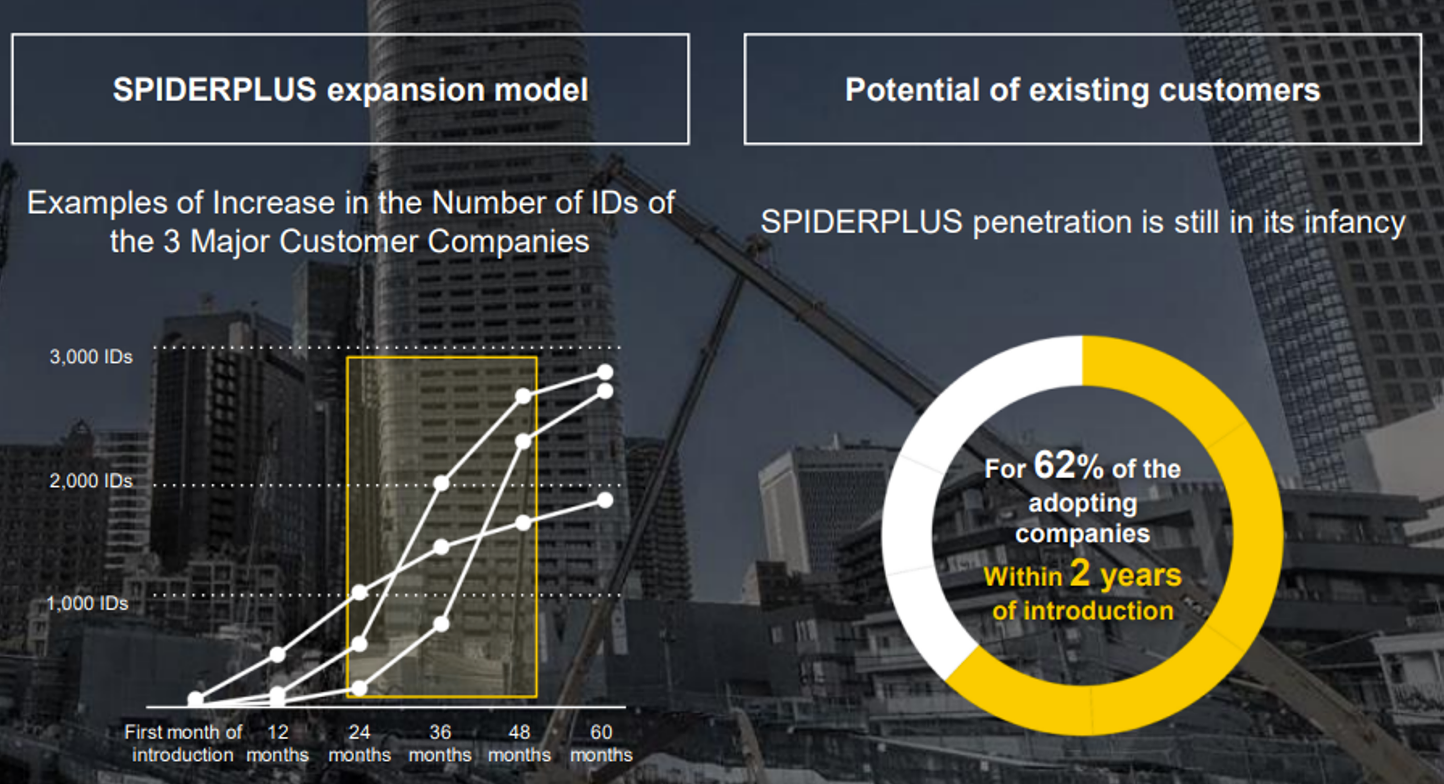

SpiderPlus & Co. (“SP” or the “company”) is a provider of SPIDERPLUS, a cloud-based application for architectural drawings and construction site management.

Note: Shared Research provides a detailed analysis on SPIDERPLUS as a product and as a company. Thus, in this report, I would like to focus on how we should assess management’s decision to expand its infrastructure (mainly labor force) in anticipation of a crisp market growth in 2024, rather than controlling expenses to become profitable. Please see “STRENGTHs and WEAKNESSES” section for my take on this.

1. Investment thesis

1) A player in one of the important industries in Japan

(Source: Construction industry in Japan – statistics & facts, issued in Statisca Research Department dated 11/22/21)

The construction industry is an important pillar of the Japanese economy and accounted for around 5.3% of GDP in 2019. The industry has experienced an overall upward trend in recent years, driven by:

1) Reconstruction after the Great East Japan Earthquake and the Tokyo Olympics, before sales decreased by 6.6% during pandemic.

2) Continued growth in construction industry is expected since major projects for the World Expos 2025 in Osaka and the construction of the Chuo Shinkansen (bullet train) maglev line are expected to have the similar impacts as in 1) above.

3) Japan’s major infrastructure and urban developments were built in 1960s and 1970s which need to be rebuilt, i.e. a boon to construction industry.

2) Supportive regulatory backdrop

Japan’s construction industry faces a major challenge which is a shortage of skilled labor since increasing number of skilled construction workers are aging and retiring. To combat this industry-wide challenge, the government implemented the following initiatives:

1) In 2015, the Ministry of Land, Infrastructure, Transport and Tourism introduced the i-construction initiative. To improve productivity in the construction sector and compensate for labor shortages, the government encouraged the increased use of ICT (Information and Communication Technology), such as IoT, BIM (Building Information Modeling), and CIM (Civil Information Modeling) software at construction sites.

2) The Act on the Arrangement on Related Acts to Promote Work Style Reform allows the exemption period of the application of this low but this exemption will expire in 4/24. The result of this law is overtime reduction which further increases the need for productivity improvement in light of labor shortage.

This law change is the main reason that SP is in a heavy human resources and skill investment phase in an anticipation of demand explosion. The company plans to use IPO proceeds to fund these growth expense. Post IPO employee jumped from 100 to 230.

3) 10 year lead in product effectiveness vs. peers

SPIDERPLUS is mainly used at construction sites for large buildings. It is particularly effective in cases where a single site is managed by multiple site supervisors from different companies. Such situations involve numerous paper drawings and inspections at each construction process. SPIDERPLUS made drawings digital which can be linked with inspection equipment and sharable among multiple companies. Per management, some clients saved 20 hours per month via use of SPIDERPLUS.

The company has accumulated massive data on the diverse needs of customers in construction industry, which sets them apart from its newer pees. In fact, the company will introduce a renewal version of SPIDERPLUS which offer 636 added functions. These updates are based on the company’s review/comments gathered over the last 10 years.

4) Expansion into new customer segment – Municipalities

SP has entered a partnership with Change. Change boasts a large network with municipalities which uses Change’s services to manage “Fususato Nozei” *promotion. This partnership has opened many doors for SP. For example, Toshima – ward is engaging SP in a progress control for facility management and repair work throughout the ward.

*The Furusato Nozei Program is a tax scheme that exempts taxpayers from income and resident tax if they make donations to a municipality that they wish to support. The goal is for donors to support local governments while receiving gifts for their tax money they donate.

5) Narrow its business focus

The company sold its engineering group to Armacell, a Germany-based leading provider of engineered forms, to focus on faster growing ICT business SPIDERPLUS. The engineering group manufactures and supplies thermal insulation solutions for piping and duct works to

6) Achievable growth plan

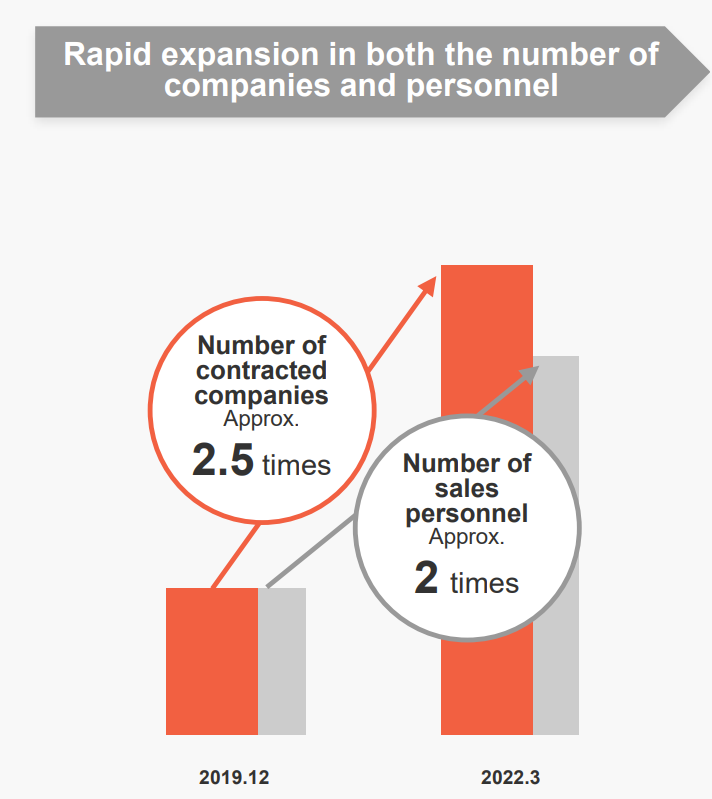

As noted earlier, the company is gearing up to be ready for demand increase in 2024.

(Source: Financial briefing for FYE 12/2021)

2. Technically Speaking

(Source: buffet-code.com)

The above chart tracks SP’s weekly stock price moves since its IPO in 3/21. The stock has come down this year along with many other SaaS stocks but is showing the sign of a recovery. The first volume cluster is at JPY 900, after which the stock has a relative smooth ride till JPY 1,820. I believe the stock supports a country wide digitization effort in Japan, thus, makes sense as a long term hold.

3. Business Model

SAAS model

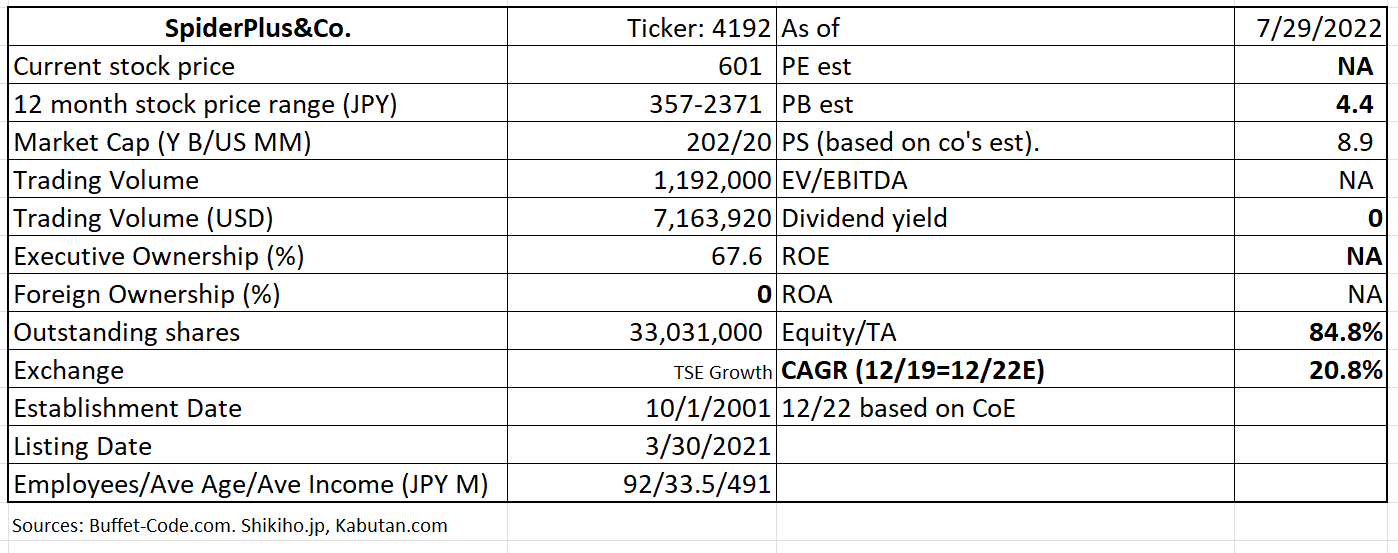

SP earns monthly usage fees: JPY 3,000/month + taxes. This subscription based recurring revenues account for over 95% of their revenues. Thus, their success depends on an increase in ARR (Annual Recurring Revenues) which can be measured by the number of user IDs, ARPU (Average Revenue Per User) and number of customers.

(Source: Financial briefing for FYE 12/2021)

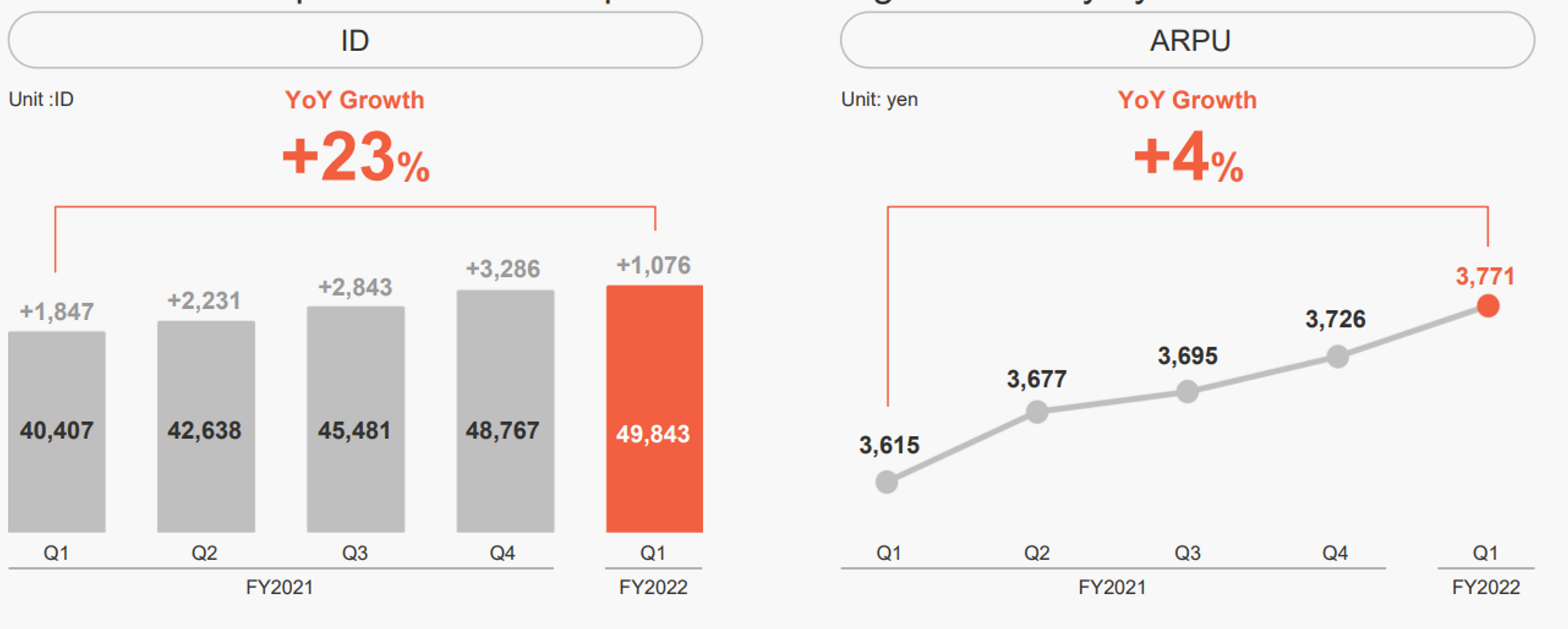

Gradual penetration in a customer provides a steady sales expansion.

SPIDERPLUS is typically introduced to a supervisor of one segment of a client company. The adoption to the other groups of the client (ie. Saturation at one client) will take 2-3 years, proving SP with steady sales increase at the client. At the 3/22, about 62% of customers are using SP for two years or less. The typical adoption rate at the large customers (3,000 IDs range) is illustrated at the left group below.

(Source: Financial briefing for FYE 12/2021)

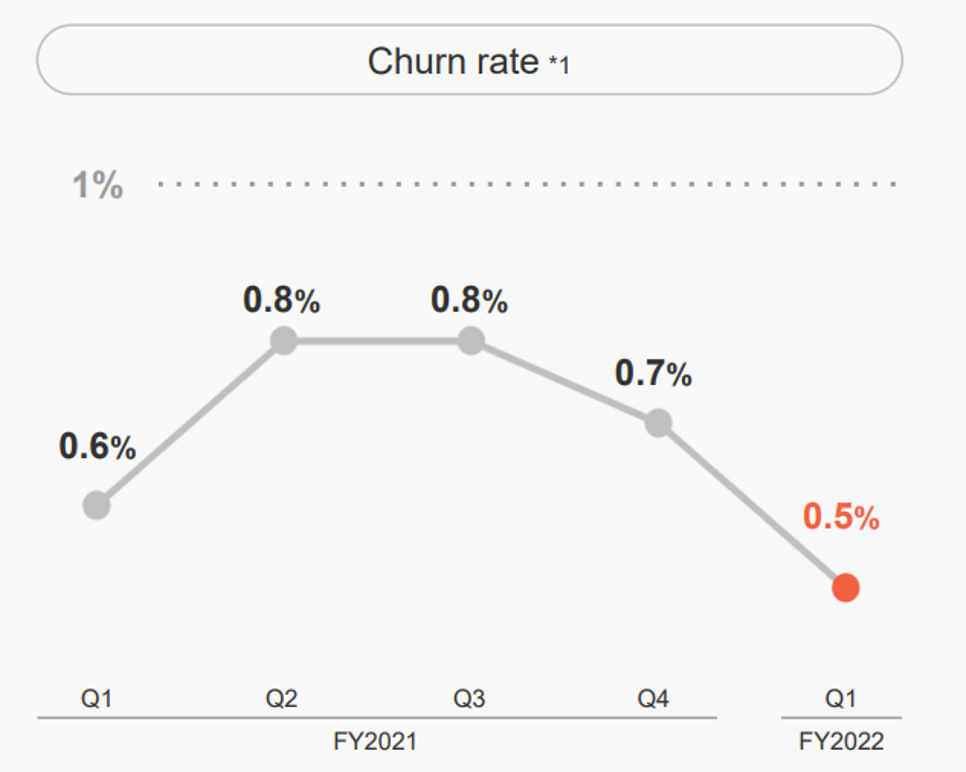

Low Churn Rate

The company boasts an extremely low churn rate of 0.5% at 1st quarter ending 3/22. The churn’s rate’s downward trend shown below indicates customer’s high satisfaction rate.

(Source: Financial briefing for FYE 12/2021)

4. Financial Highlights

Financial results for the fist quarter ending FYE 3/22

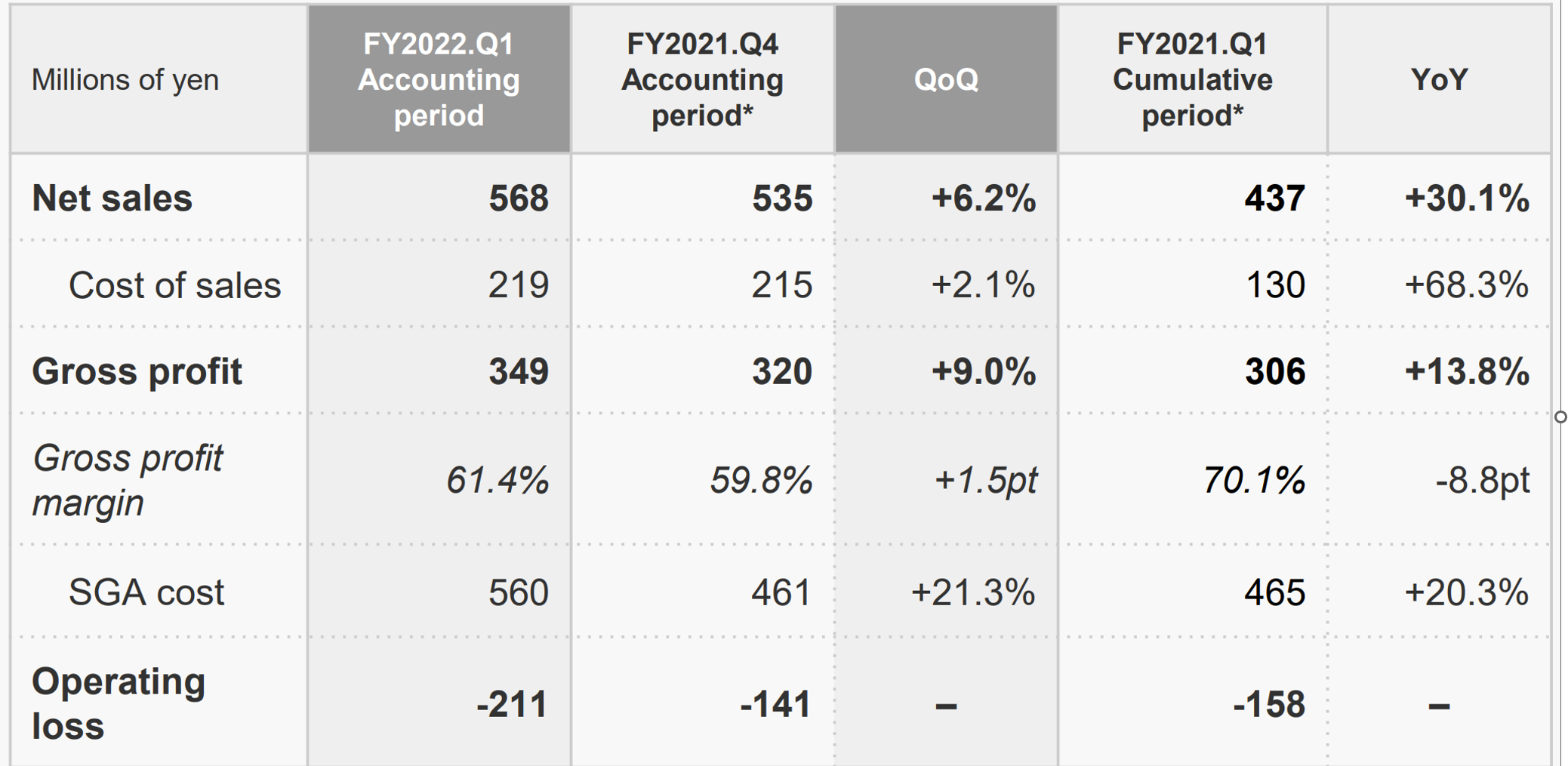

Note: the below numbers exclude divested engineering business and only include the remaining ICT (SPIDERPLUS) results.

(Source: Financial briefing for FYE 12/2021)

Net sales has continued to increase in Q1 2022 vs.Q4 2021 (+ 6.2%) and Q1 2021 (+30.1%). Gross profit rose by around 10% from Q4 2021 and Q1 2021.

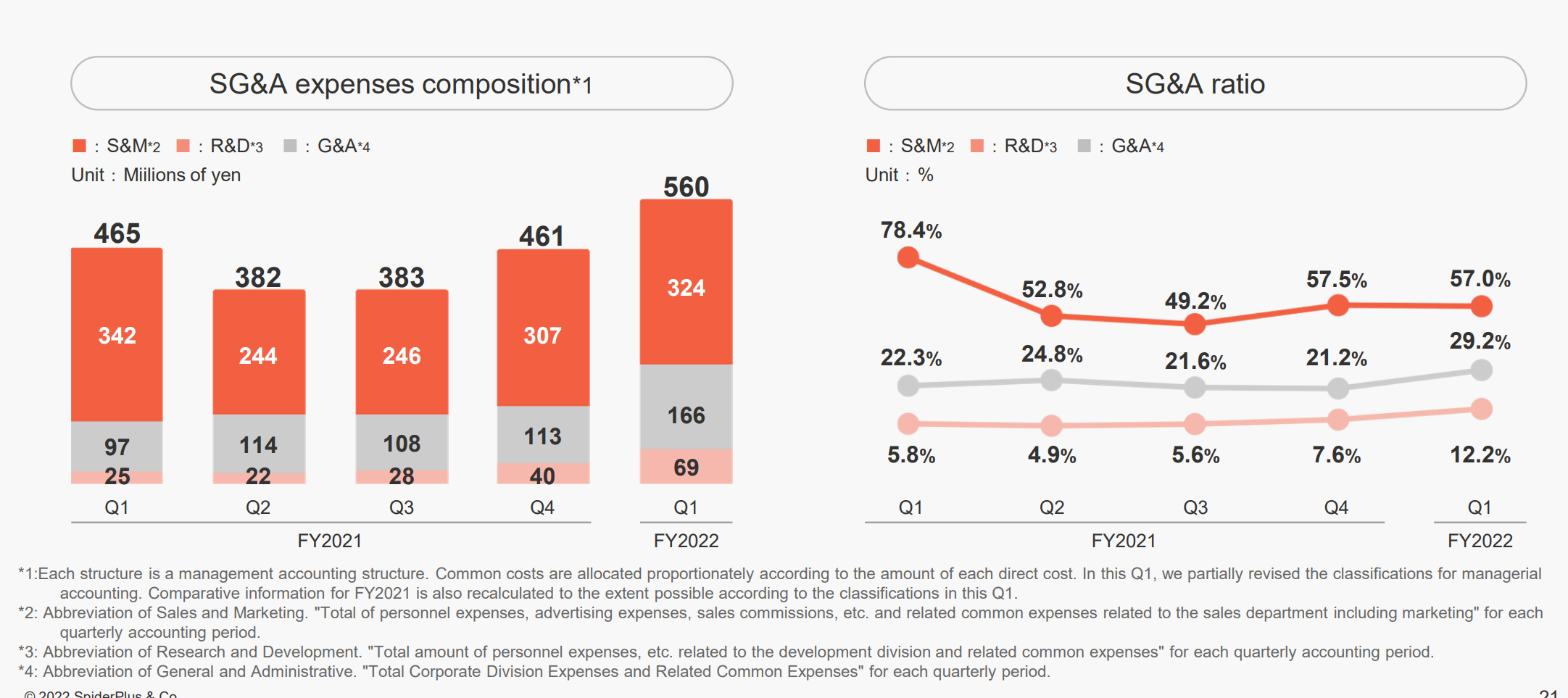

Operating losses were reported, due to high upfront investments in preparation of anticipated demand increase in 2024. However, margin profit ratio indicates that “profitability” is improving.

As shown below, the company highlights that they are targeting expenses to support future growth effectively.

(Source: Financial briefing for FYE 12/2021)

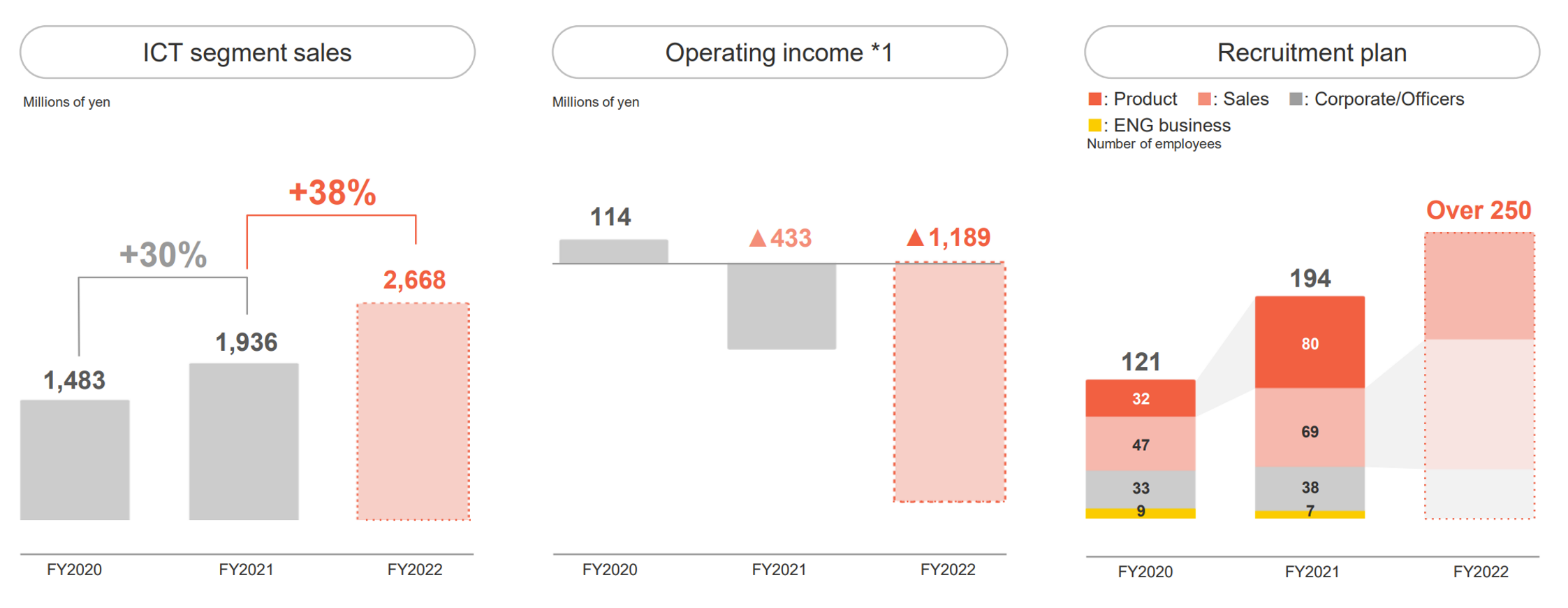

FYE 12/31/22 Guidance

(Source: Financial briefing for FYE 12/2021)

SP expects that digitization-driven efficiency improvement in Japanese construction industry which is plagued with chronic labor shortage will support rising demand for SPIDERPLUS. Its sales is expected to increase 38% year over year in FYE 12/31/22, as shown in the left graph of the above exhibit. The company wide operating income, however, will continue to be negative due mainly to upfront investment in recruiting area.

5. Total Addressable Markets (TAM)

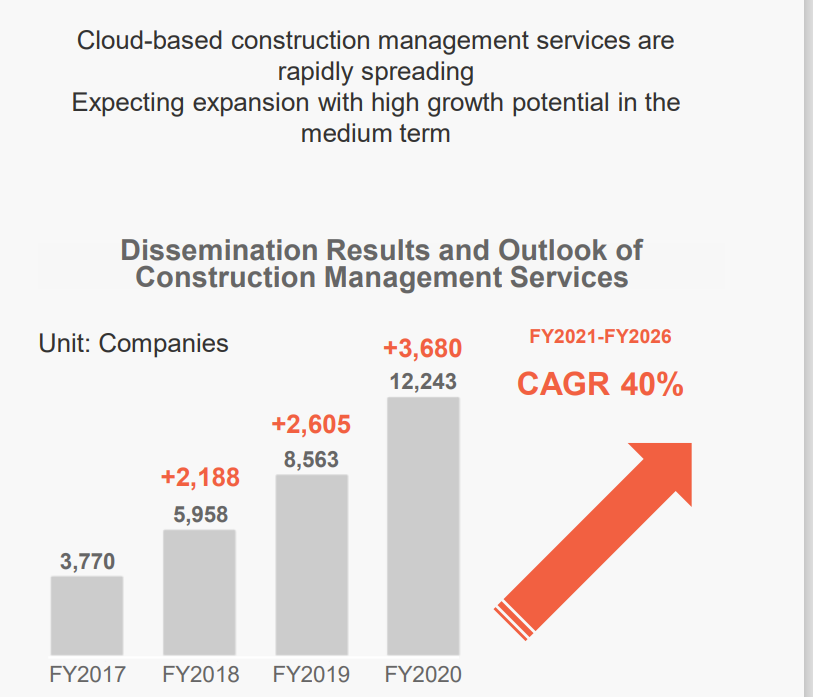

Cloud-based construction management services is expected to grow at CAGR of 40% from FY 2021 to FY 2026. Thus, SP has an ample room to grow.

(Source: Market Trends and Vendor Share of Cloud-Based Construction Management Services” by MIC KEIKENKYUSHO CO., LTD, taken from the Company’s FY 2022.Q1 results briefing)

6. Strengths and Weaknesses

Strengths

1. Supportive industry backdrop.

Japanese construction industry’s labor issues need to addressed by process digitization, which lifts demand for SPIDERPLUS.

2. SP’s established history provides it with a virtuous cycle.

The company’s 10 year operating history gives it a head start in building a customer network. This established relationship affords the company with vast knowledgebase. SP uses this database to update SPIDERPLUS and this updates/improvement gives SP an edge over its peers.

3. The company’s IPO in 3/21 and divesture of the engineering operations will likely fund SP’s growth near term, i.e., limited dilution risk.

Weaknesses

As repeatedly discussed earlier, the company is still not profitable at operating income level. However, management has made it clear that it has chosen the growth over the near term profitability. SP strongly believes that it will become profitable in 2024. I concur that it is probable that they can generate operate income in 2024, since 1) Japanese construction industry desperately needs digitization products such as SPIDERPLUS and 2) its leading position leads to a high mindshare of client companies.

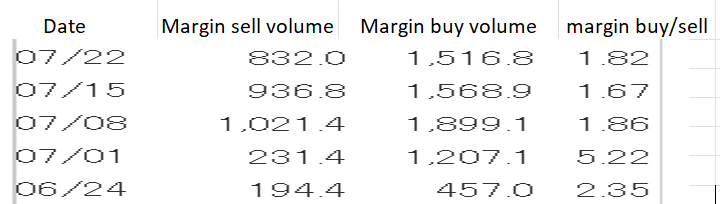

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For SP, margin buy/sell ratios has been declining and coming down to an acceptable level of below 3x. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance