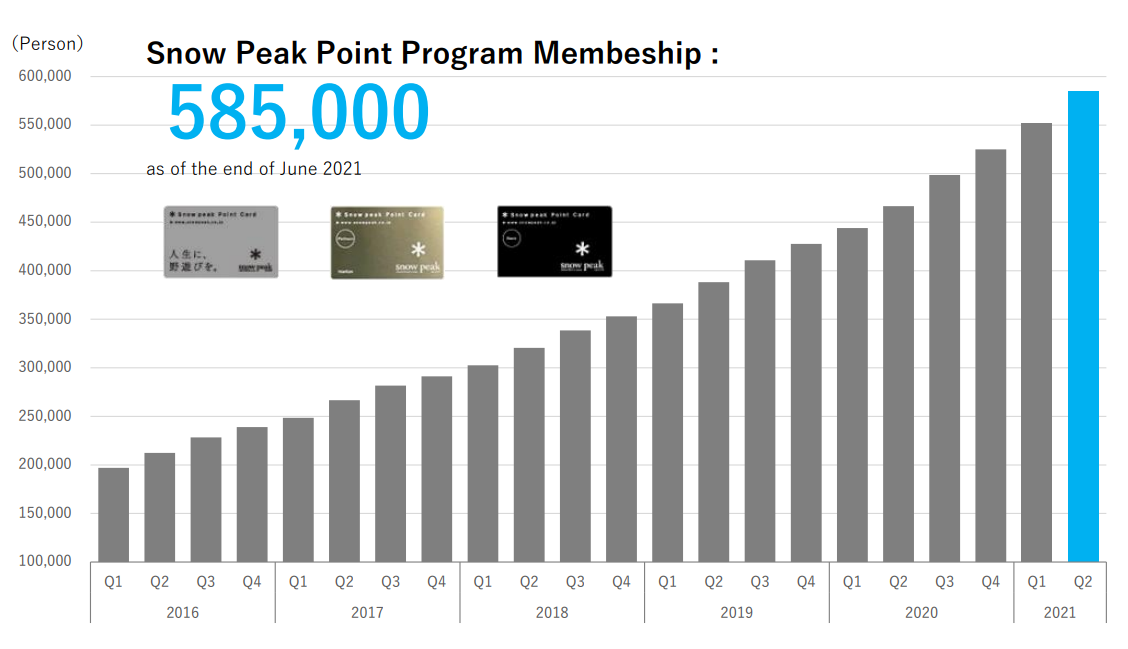

Snow Peak (Ticker: 7816) – it’s not PEAKING!

I have wanted to highlight Snow Peak for a long time. Then what took me so long?

Snow Peak is a company with mainstay activities in the production and sales of outdoor products including camping equipment, climbing gear, garden furniture and apparel.

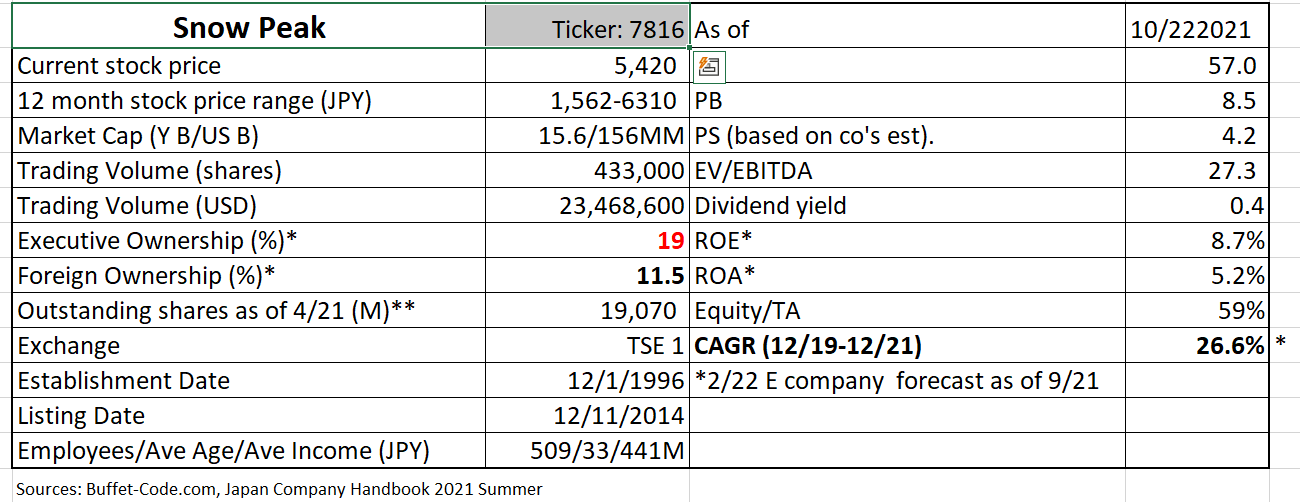

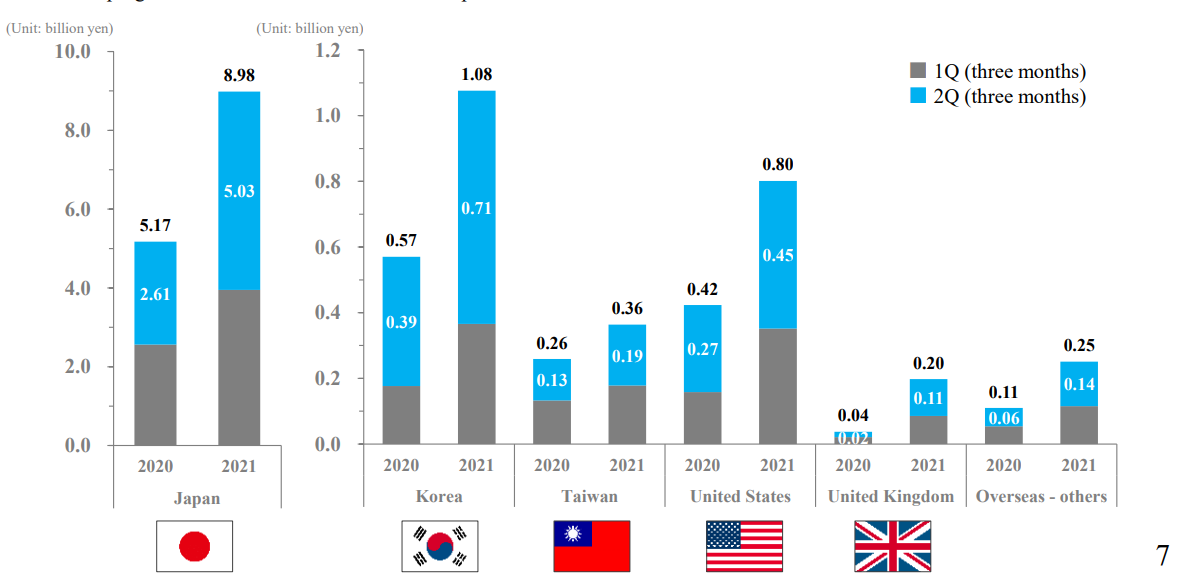

It is a great company, generating sales growth year after year (see the graph below). Furthermore, their products are locally manufactured in Japan, using traditional metal working technique in the Tsubame-Sanjo region of Niigata prefecture, and providing employment to the community (rare in Japan these days). This technique in Tsubame-Sanjo region has been successfully used since the Edo era. The Edo period spanned from 1603 through 1867.

(Source: Snow Peak Financial Results for Q2 2021).

However, I have two reservations.

1) Snow Peak’s products are widely known among the avid outdoor lifestyle lovers for its high-quality and durability. However, their products are priced 2-3x higher than its peers. It aims to differentiate itself by 1) offering higher quality, user friendly and creative products, 2) providing high touch customer services, and 3) creating unique communities which cater to nature lovers’ social needs.

Unfortunately, I am not their target customer. I don’t think I can get a good night rest in a sleeping bag/tent. But I may be a minority and popularity of outdoor lifestyle, which spreads from the camping enthusiasts to the mass markets during the height of Covid pandemic, may be here to stay. Still, how big is a segment of consumers who are willing and able to buy high end camping gear?

Our purchase decision is not solely dependent on our value judgments toward a product. A product may be satisfying our hidden desire. For example, a Tesla buyer is likely not looking for a simple transportation mean, but seeking for “cache” and a “sense of belonging to the exclusive club” to come with a Tesla ownership. Will Snow Peak be able to continue to offer products with these intangible value preposition?

2) The 2nd reason is more nuanced. Snow Peak is covered by “Sheared Research” which produces their reports at the request of a company, thus, Shared Research is compensated by that company and has much better access to management than me. I am not compensated by anybody, including the companies which I discuss. Their reports will likely provide the readers with deep understanding of a company they cover. That is, I may not be adding much value by presenting my blog.

BUT,

I feel compelled to present this stock to you, simply because I believe that Snow Peak’s stock chart currently presents a good upside potential. Please take a look at it and draw your own investment conclusions.

(Source: Trading View)

The above 12-month price chart shows that Snow Peak closed at JPY 5,420 on 10/22/21 which is higher than the JPY 5,360, the price point at which many people traded the stock. Thus, long holders were able to sell at gains and short sellers covered their shorts before their positions generate losses. In another words, the stock can accelerate without suffering from technical selling pressure.

Some people don’t value a chart reading as a viable investment strategy. But I am of an opinion that it may have a positive impact to your investment return to watch an entry point even if you are a long-term holder.

Thus, I have decided to present Snow Peak here, but have taken a new approach. I am not discussing their business model in this report. Please refer to “Shared Research” web site, which is free to public. Instead, I will focus on the major issue I have embarked on addressing which is

Can the company be able to keep generating a current level of same store sales number by offering high quality products at 2-3x higher price points?

1. History of Snow Peak

Snow Peak is not a young company who went through its share of ebbs and flows. I am discussing their history to showcase their ability to address setbacks and reinvest itself.

It was founded as a hardware wholesaler in 1958, by Mr. Yuko Yamai, a mountain climbing enthusiast. Back then, there was no home grown the mountain climbing gear industry in Japan and imported gear from US and Europe was not property sized to the Japanese. Frustrated with too large equipment, Mr. Yamai designed gears himself and finetuned them many times, based on his own climbing experience. Production was done by highly skilled metal craftsmen in Mr. Yamai’s hometown, Trubame Gingyo.

Upon Mr. Toru Yamai (son of Yukio Yamai) taking over the helm of the company in 1980, Snow Peak got on a wave of fledging Car Camping* segment.

In car camping, campers drive their vehicles to campsites and set up tents and tarps alongside their vehicles. Items needed for car camping include tents, tarps, sleeping bags, stoves, and tables (the main products of Snow Peak).

In the five years after 1988, the Japanese car camping population grew to 20 MM people. By 1993, sales had grown from around JPY 500 MM to JPY 2.5 Bn. However, in 1993, car camping started to decline in its popularity, and the company’s sales fell for six straight years.

To counteract declining sales, in 1998, the company held Snow Peak Way to encourage camping fans to share their opinions on their Snow Peak shopping experience. This “the Snow Peak Way” embodies the founder, Mr. Yamai’s motto of “in the users/customer’s shoes”.

The customers’ consensus was the quality of Snow Peak’s products was high, but so were prices. To address these customer concerns, in 2000, the company shifted its distribution route, transitioning from “wholesales to dealers” to “direct sales to authorized retailers” to cut middlemen. The company explains that as a result, its sales have trended upward since 2000, even while the car camping population has continued to decline. The company opened its first directly managed Snow Peak store in 2003. In 2005, it began developing in-store Snow Peak stores, located in a section of high-end stores operated by authorized dealers.

(Source: Snow Peak – Corporate web site).

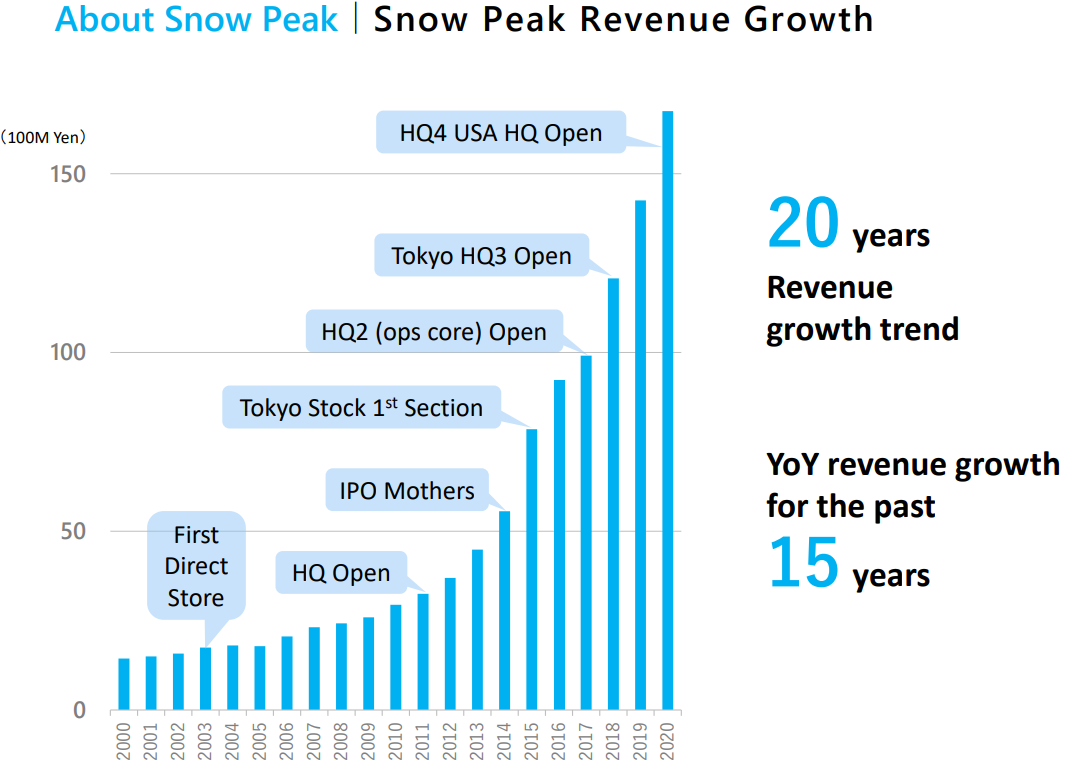

Note on the store types:

In-store: The products are sold in sporting goods retailers and outdoor specialty stores. Snow Peak product sections are staffed by Snow Peak personnel, who can explain the product benefits to the potential buyers.

Shop-in-shop: A section (about 50 sqm) in sporting goods retailers is dedicated to Snow Peak products, but sold by hosting store personnel who have gone through training and become certified “Snow Peak Meister’s”.

Entry store: Similar to Shop -in-shop. The only difference is the dedicated area is smaller at 10 sqm.

The above table show changes in the numbers of the stores in Japan per the store formats in 2021. The number of directly managed stores grew from 7 in FYE 12/14 to 33 in FYE 12/20. Further, under the current CEO of Snow Peak (the granddaughter of the founder), the company made a foray into the apparel business in FYE 12/14. The apparel business grew to JPY 2.1 Bn, accounting for 12.5% of total sales in FYE 12/20.

The company also runs its own camping grounds to 1) foster the relationship with customers, 2) encourage communications among likeminded camping fans/customers and 3) educate camping novices.

They also opened Takibi (Japanese bonfire)- themed restaurant in Oregon where Snow Peak’s US HQ is located.

In sum, Snow Peak has maneuvered through the industry cycles by adjusting their distribution systems and expanding product offerings.

2. Pricing strategy

The company now sells entry level tents at a low price comparable to competitors’ prices. They are strategically low priced despite higher quality with water and wind proof functions. However, their high-end tents are priced 2x of the peers’ with frames enforced with an aluminum alloy which is strong yet light.

Their products are designed to be part of a bigger system, which the buyers can customize to fit their individual needs by buying additional items recommended by the customer community and Snow Peak.

Incidentally, in its 7/16/21 article, the Japan Times called Snow Peak the “Japan’s cult outdoor brand”. The same article discussed the company’s US expansion plan. When the camping ground in the state of Washington is completed, visitors will be able to borrow and test its products on their own from 7/22.

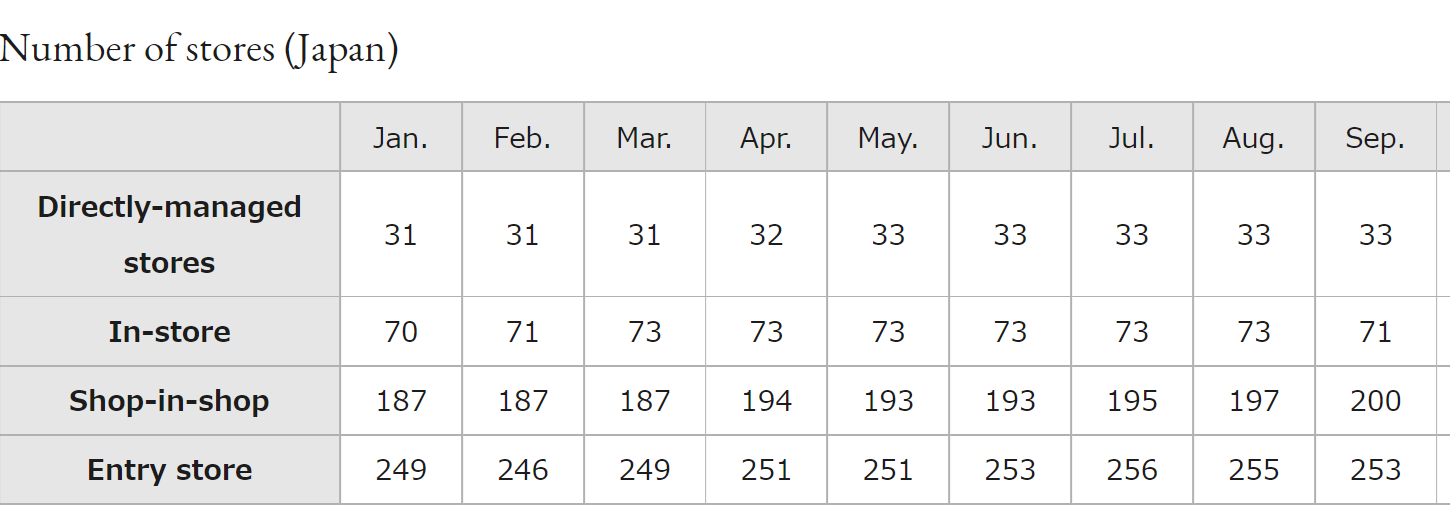

Point cards (KPI)

The company views the trend of the member numbers tracked by their Point Card as their KPI (key performance indicator).

Main customers are parents in their 30s and 40s. The company uses point cards to categorize customers by how much they spend each year. Members accumulate points when they buy the company’s products. When points reach a certain level, card holders receive gift points for unique member-only products (eg special edition items). Core users who spend more than JPY 300,000 on Snow Peak products in a year are ranked platinum or higher. These members make up 6-7% of the company’s customers but account for 20-30% of sales.

3. Global expansion

(Source: Snow Peak – Corporate web site).

Note: the above chart uses different scales for Japan and the rest of the markets. Japan still accounts for about 20% of total sales.

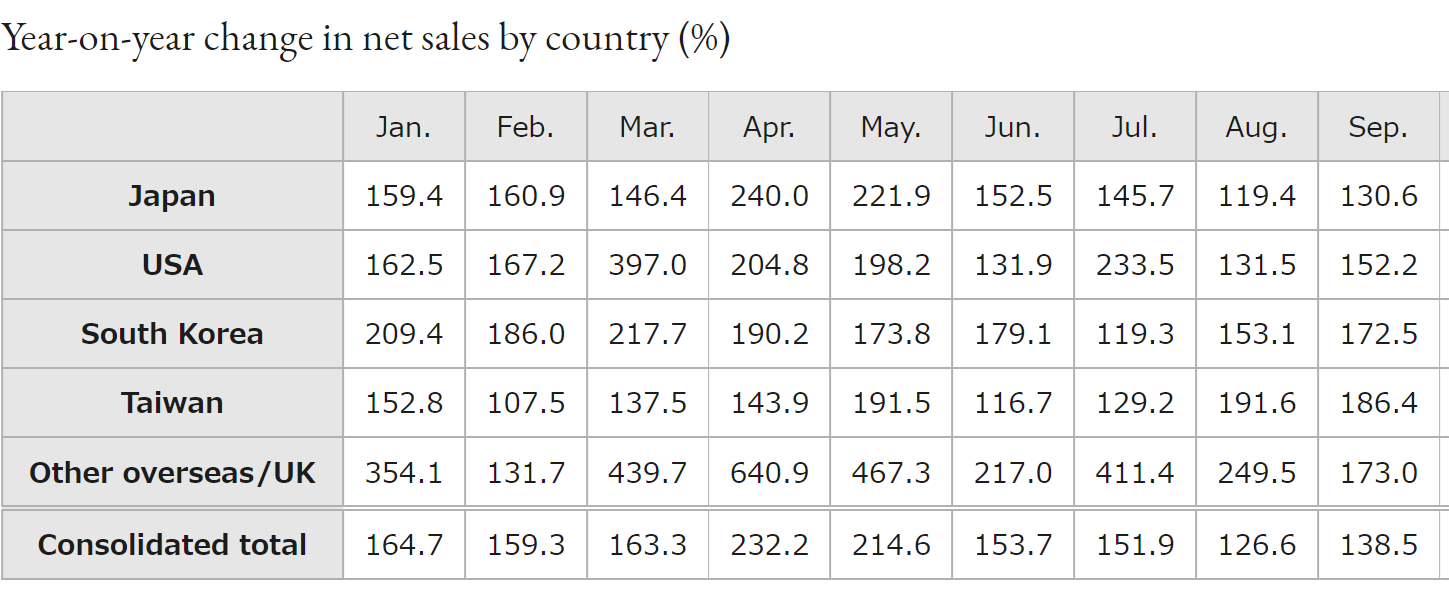

(Source: Snow Peak – Corporate web site).

The above chart and table shows steady year-on-year sales growth in all the regions. The company attributes the growth to a worldwide rise in camping demand and an improvement in the company’s name recognition. Sales in China which are included in sales in Korea, increased 115.4% to JPY 158 MM in the 1st half of FY 2021 from JPY 73.4 MM in the first half of FY 2020.

4. TAM (Total accessible markets)

Global Camping Market

– The Business Research Company published the below forecast in their “Camping and Caravanning Global Market Report 2021 in 12/20.

As per the report, “the global camping and caravanning market is expected to grow from $39.85 Bn in 2020 to $45.07 Bn in 2021 at a compound annual growth rate (CAGR) of 13.1%. The growth is mainly due to the companies rearranging their operations and recovering from the COVID-19 impact… The market is expected to reach $56.6 Bn in 2025 at a CAGR of 6%.”

The report went on to say “Millennial population is driving the camping and caravanning market. Millennials, known as generation Y, are young adults born between 1980 and 2004. Millennials are predicted to outnumber baby boomers by almost 22 million by 2030. A large proportion of this population are showing interest in camping, adventure activities and nature exploration. According to the North American Camping Report, Millennials and Gen Xers accounted for around three-quarters of all campers, with Millennial’s accounting for 40%. This trend is expected to continue in the forecast period driving the camping and caravanning market”.

– Since US is 40% of global camping goods market, I looked at US Millennials’ financial conditions reported by the College Investor, on 9/12/21.

According to the report, starting salaries of Millennials have ranged from $40,818 to $52,569. Against these incoming cash flow, Millennials have graduated with around $18,217 to $31,000 in student loan debt on average.

I interpret these numbers as “the good chunk of potential customers with high priority on outdoor activities have financial means to afford the lifestyle of their choice”

Japanese Camping Market

According to the Japan Times article, I referred to earlier, about 5% of the population took part in camping in 2020, which is a stark contrast to US where 48.2 MM US households (close to 40%) camped once in 2020.

The Auto Camping White Paper 2020, published by the Japan Auto Camping Federation, indicates that the Japanese car camping population was 8.6 MM in 2019 (+1.2% YoY). This population peaked at 15.8 MM in 1996, following the car camping boom of the late 1980s and early 1990s, after which it trended downward until 2012. However, the car camping population has resumed its ascending trend in 2013. According to Snow Peak, the increase stems from junior baby boomers (children of the baby boomer generation) entering their 30s and 40s, Snow Peak’s core demographics.

As we see from the above graph, the company had 525,000-point card members as of the end of FYE 12/20 (vs. 428,000 as of FY 12/19), equal to 6.1% of Japan’s car camping population of 8.6 MM. Taking in account that the typical household with 4 family members have only one point card which equate to the fact that Snow Peak has market share of 25% of the Japanese camping population.

While Snow Peak’s success will undoubtedly invite new entrants to the Japanese camping industry, 25% share provides Snow Peak with ample room to grow in Japan and even bigger growth potential globally.

5. Near-term Selling Pressure

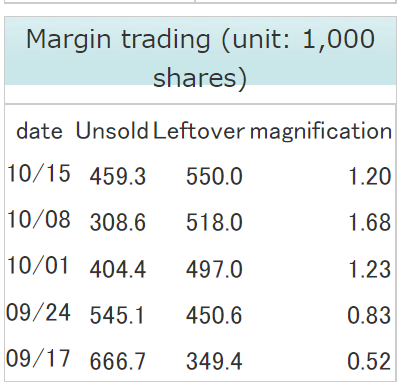

As noted in useful tips section, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Snow Peak, as the below table indicates that there is the similar number of margin- sell and -buy volume. Buy to sell ratio is low at 1.2x, thus, we don’t have to worry about constant profit taking while not being able to benefit from short covering.

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance