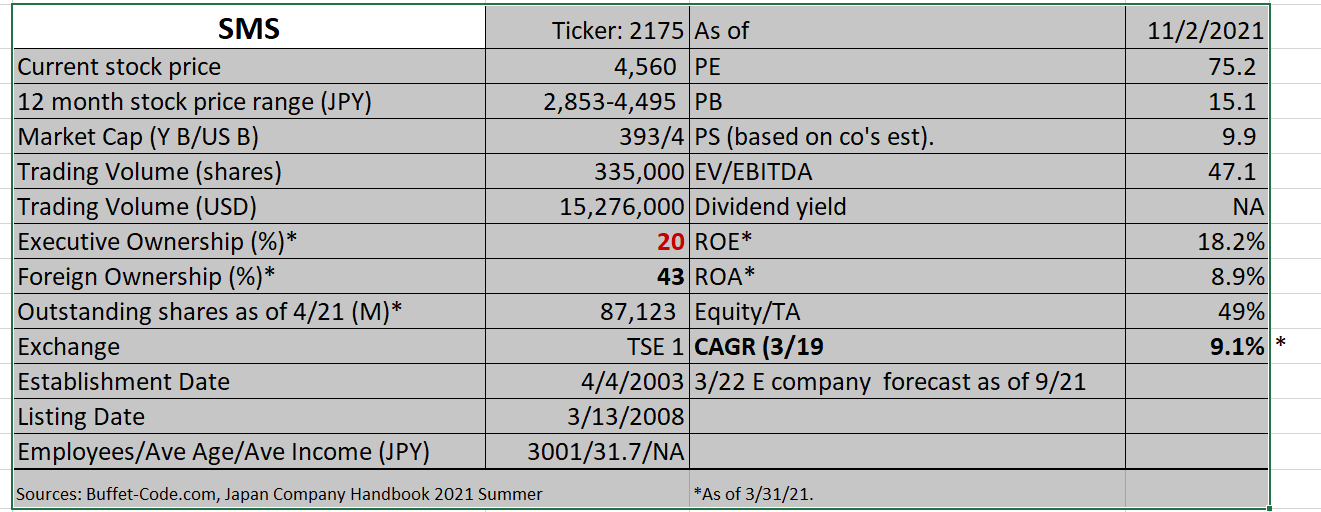

SMS Co. Ltd. (Ticker: 2175) –

3 aging issues in Japan and 3 solutions in SaaS format!

1. Three Aging Related Issues SMS is Tackling

Issue 1. Difficulty in obtaining quality care long term: care provider shortage.

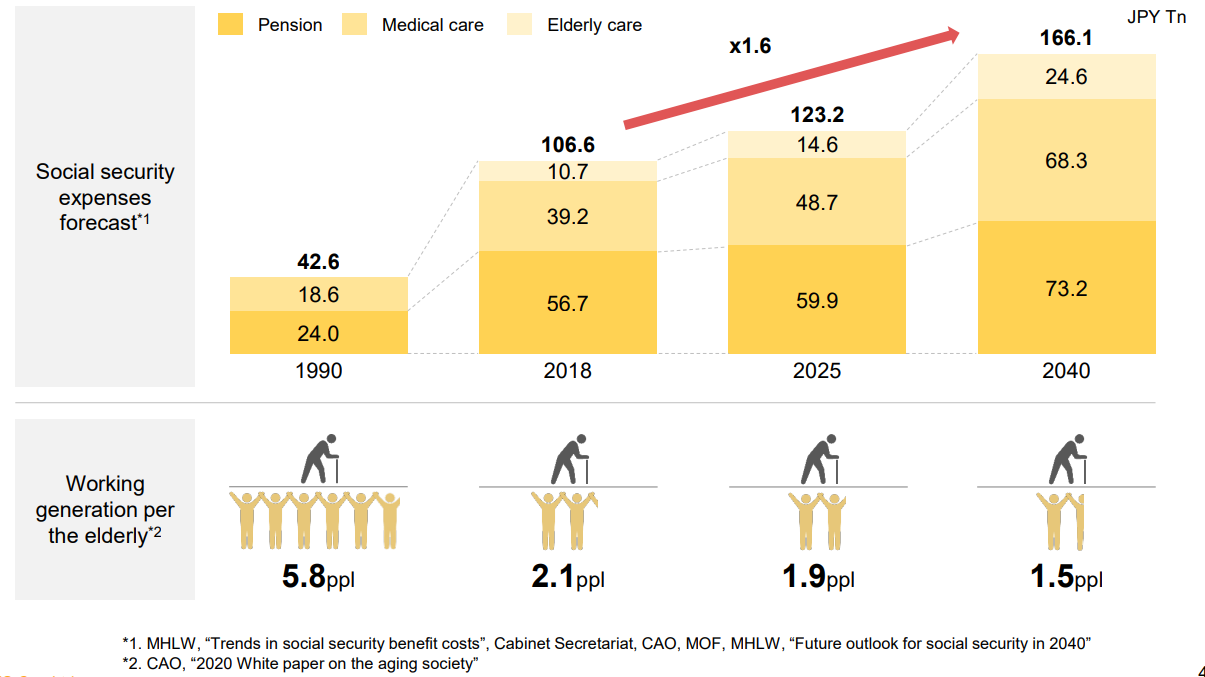

Issue 2. Severe burden on younger generation: In 1990s, 5.8 workers covered 1 senior’s pension, medical and elderly care expenses. In 2040, the ratio will shrink to 1.5 to 1.

Issue 3. Few options available to sustain quality of life during silver years.

2. Who is SMS?

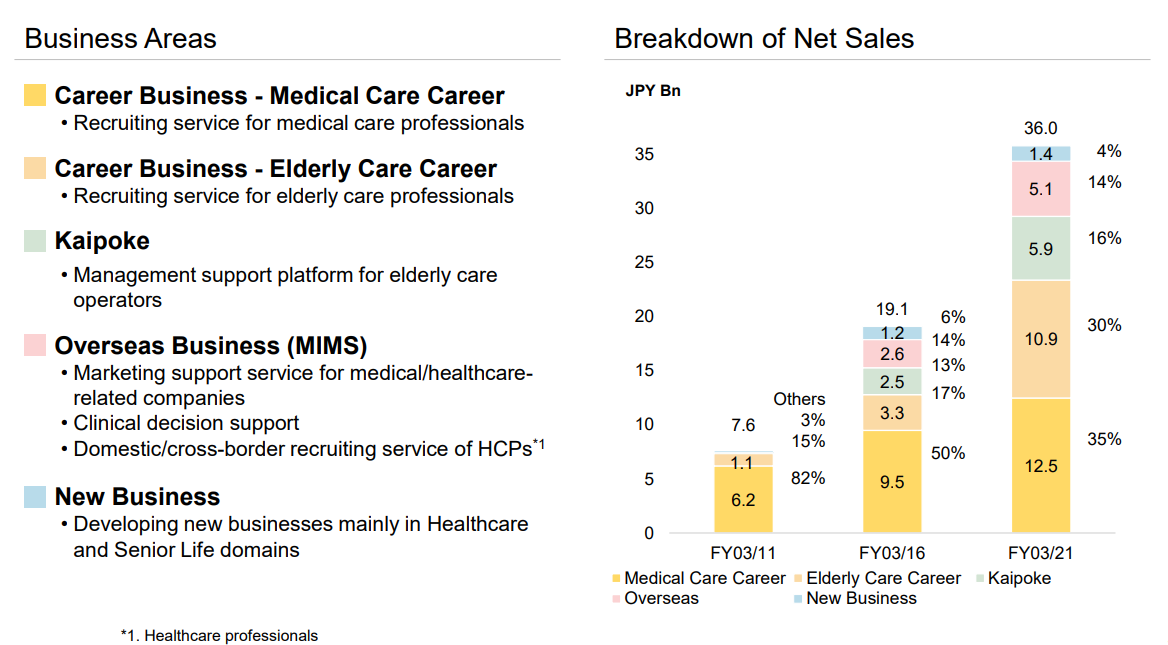

SMS (the “company” or “SMS”) stands for Senior Marketing Systems, which symbolizes its mission: Fend off challenges facing quickly aging Japan through well targeted IT infrastructure. The main profit earner is the placements of nursing and care staff to medical institutions and to nursing care operators. It also developed “Kaipoke’, a management support package offered to nursing care operators on subscription basis in 2014. SMS purchased MIMS Group, providing pharmaceutical information services in Asia and Oceania, a foothold for its overseas expansion.

Please note:

SMS is covered by Shared Research which releases its detailed analysis in English. Also, SMS is widely known globally and 43% owned by foreign institutions. Thus, I am not adding much value by introducing SMS to you. But I just have to discuss SMS which is tackling with the core problem in Japan. I will focus on key differentiating factors. For the detailed discussion of the company’s history and business model, please refer to Shared Research report which is available on their site for free of charge.

(Source: Trading View)

The above chart shows that the stock is trading at a near all time high, indicating that not too many shareholders are itching to sell at any gains.

2. Investment Thesis:

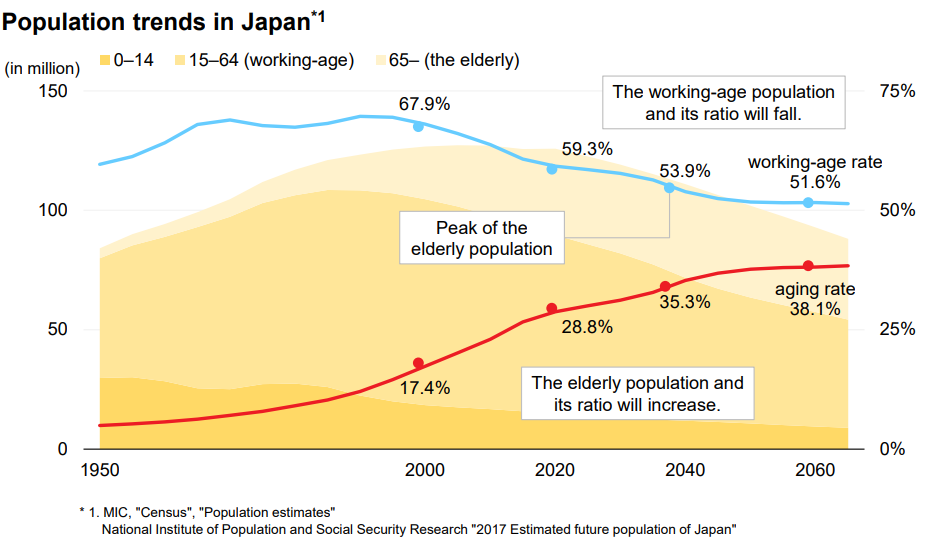

a) SMS is the company which is growing its profits by providing solutions to Japan’s core problems. The blow graph visualizes this well-published population decline i.e., a decrease in productive resources.

(Source: SMS’s financial results presentation for the first quarter for FYE 3/22)

The above graph forecasts that 65 and older population will account for 35% of the entire Japanese population by 2040. The greying population will lead to the following 3 issues. “How is SMS solving these issues” will be discussed in the upcoming sections.

The fact that the company is pretty much one stop shop for aging Japan which sets it apart from its competitors.

b) The general recruiting activities are recovering in the post-Covid Japan, increasing investor appetite for the placement industry.

3. Business summary:

SMS’s business portfolios are created separately in the areas of the above 3 issues.

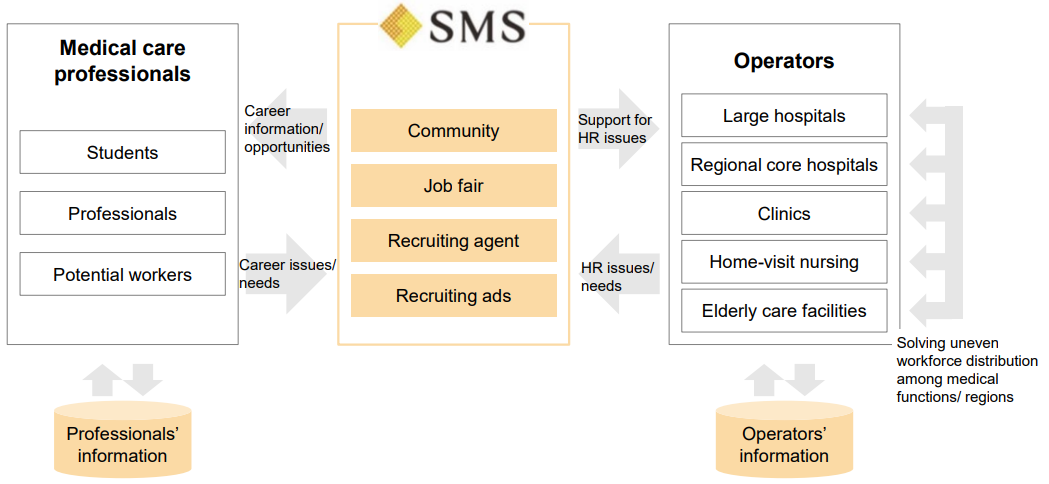

Issue 1- Shortage of quality medical and elderly care providers: Career group to address shortage of these professionals:

(Source: SMS’s financial results presentation for the first quarter for FYE 3/22)

As per governmental agencies’ estimates, Japan will suffer from a shortage of 60-270,000 nurses for medical institutions and 220,000 care workers for assisted living (elderly care) facilities.

SMS’s solution: in the area of medical care segment.

(Source: SMS’s financial results presentation for the first quarter for FYE 3/22)

The above diagram visualizes the way in which SMS matches up care professionals with medical and elderly care institutions and facilities. Focus is on providing supports for professionals in finding/changing jobs, returning to work and developing their career.

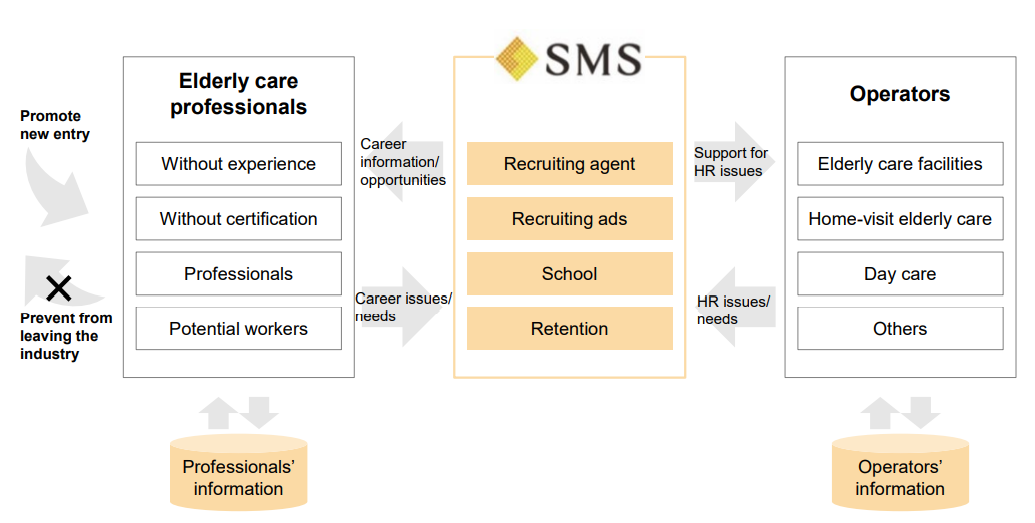

SMS’s solution: in the area of elderly care segment.

(Source: SMS’s financial results presentation for the first quarter for FYE 3/22)

The above diagram demonstrates the ways in which SMS promotes new entrants to the care industry by providing them with requried certificates. The company also aims to lower turnovers by ensuring the optimal matching of job candicates with hiring entities.

SMS even offers free preschool which often leads to the referral of nursery teachers

Issue 2-Burden on younger working generation:

The below graph shows a depressing reality. In 1990s, 5.8 workers covered 1 senior’s pension, medical and elderly care expenses. In 2040, the ratio will shrink to 1.5 to 1.

(Source: SMS’s financial results presentation for the first quarter for FYE 3/22)

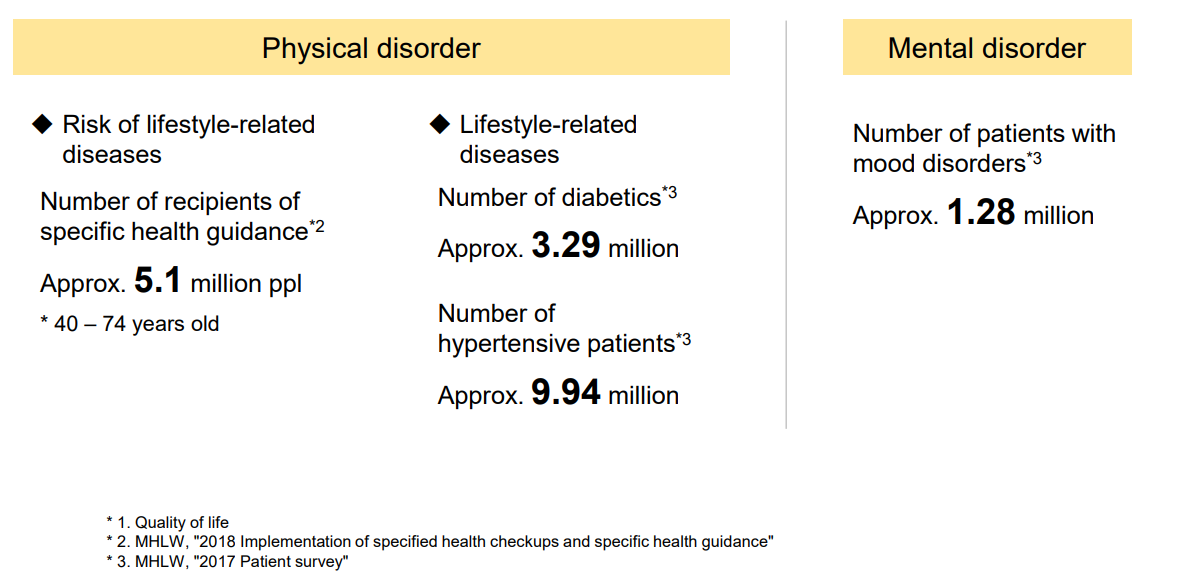

SMS’s solution: a) Healthcare business segment and b) Kaipoke handles myriads of physical and mental disorders caused by overwork and work-related stress.

(Source: SMS’s financial results presentation for the first quarter for FYE 3/22)

a) SMS’ Healthcare business segment provides:

1) digital health services to health insurance associations. The services are mainly specific health issue advice and occupational health advice and provided by seasoned healthcare professional, including doctors, nurses, and registered dieticians.

2) services are provided remotely to enable frequent, timely and continuous interaction.

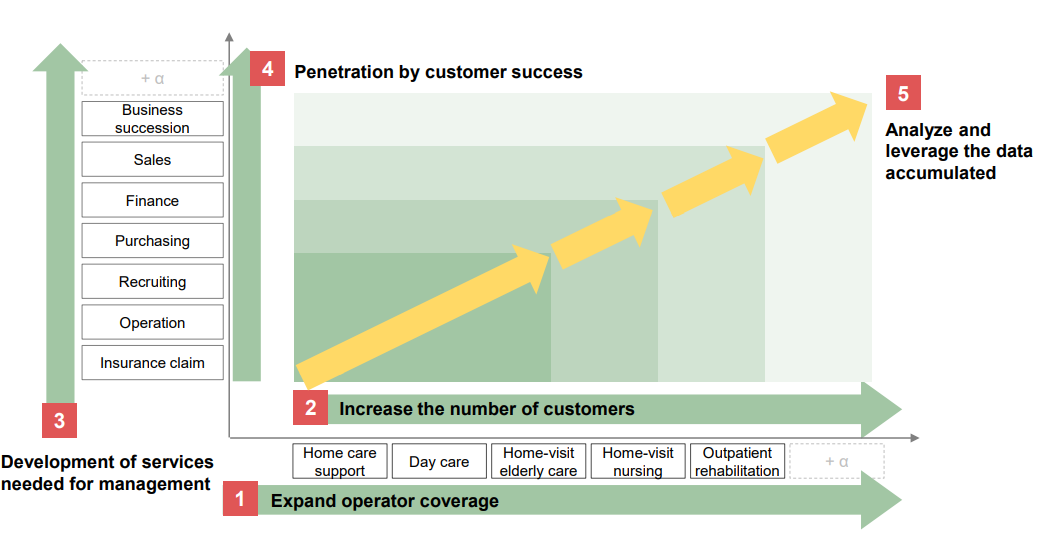

b) What does Kaipoke do?

Kaipoke is a Saas based management support system, which offers one stop shop for all aspect of elderly care challenges. It offers more than 40 services such as recruitment, purchasing, finance, sales, and M&A. It can also handle the insurance claim processes which are essential for elderly care operations. The sheer magnitude of Kaipoke’s service offerings set it apart from its rivals who often offer the insurance claim handling only.

The below graph depicts SMS’s growth plan. X axis shows types of institutions which the company is expanding their service offering to. Y axis lists kinds of services offered to these institutions.

(Source: SMS’s financial results presentation for the first quarter for FYE 3/22)

Issue 3 – Daily Challenges Facing Aging Seniors:

SMS’s solution: Senior Life division which is reported under New Business in income statement

SMS is introducing many platforms designed to address many tasks which are becoming difficulty for aging Japanese.

Elderly care: product name: “Anshin Kaigo” (Web community for care givers), Caremane.com(Web community for care givers),

Housing: Hapisumu (Housing renovation operators search site), Kaigodb.com (information portal of housing for the elderly),

Food: Raifood (meal home delivery site) for home bound elderly,

End of life planning: Annshinn Sougi (carefree funerals planning)

SMS’s new business segment is created to solve the issue 3 and will likely carry SMS to the next growth stage.

4. Growth Plan:

Another pillar to drive the future growth is overseas business- MIMS. MIMS was acquired in 2015 on the heels of its well established brand value in Asia and Oceania, large membership base of healthcare professionals (HCPs) and strong relationships with medical and health care companies and hospitals.

MIMS’ main focus is:

1) Medical marketing: support marketing activities of health care operators.

2) Clinical Decision Support: provide a drug database for prescription filing error checks.

MIMS’ global reach is highlighted below:

(Source: SMS’s financial results p

(Source: SMS’s financial results p

(Source: SMS’s financial results presentation for the first quarter for FYE 3/22)

MIMS is still at a growth stage and SMS views the period though FYE 3/21 as an investment period and forecasts losses due to rising costs. From FYE 3/22, the company plans to realize income growth by promoting cross-selling in the existing Pharma Marketing business, and by getting the Global Career business up and running. Sales group is reorganized from “one specific product focus” to cover “the entire product line of MIMS”.

5. Financial Highlights:

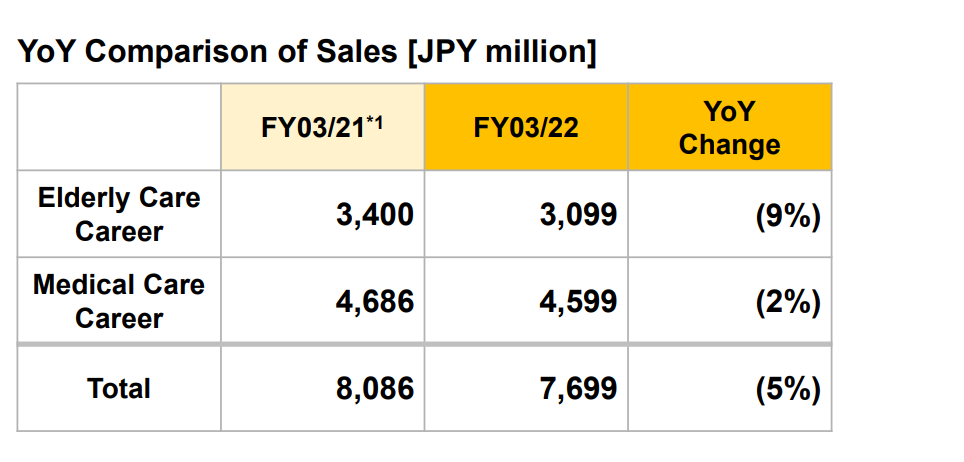

(Source: SMS’s financial results presentation for the first quarter for FYE 3/22)

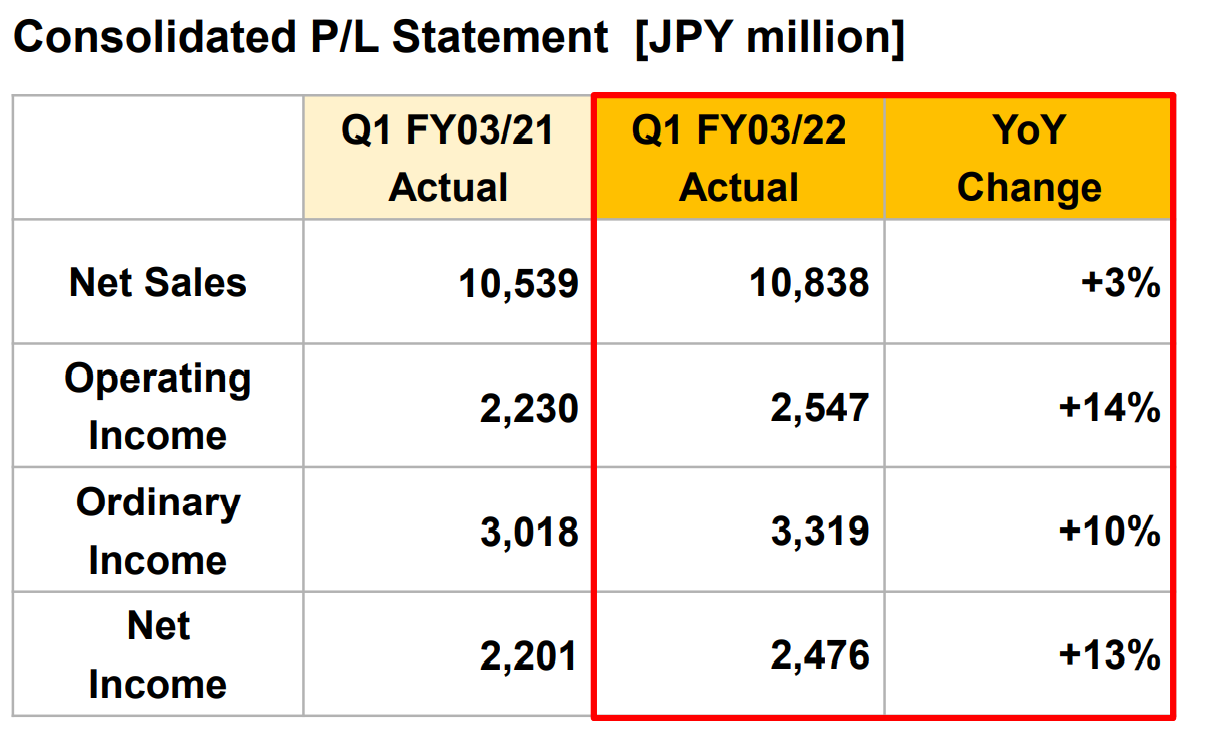

The above sales break down table shows that Career segment is the major sales driver, accounting for 65% of the entire sales for Q1 22. This segment suffered from a 5% sales decline year on year, due to decreased recruiting activities as a result of Covid. This segment decline had led to rather lackluster year on year increase (3%) for total company sales for FYE Q1 3/22. For the rest of FYE 3/22, the company expects the total sales to increase by 11% to JPY 40,043 MM driven by membership increase with Kaipoke which is designed to generate subscription based steady revenues stream.

(Source: SMS’s financial results presentation for the first quarter for FYE 3/22)

(Source: SMS’s financial results presentation for the first quarter for FYE 3/22)

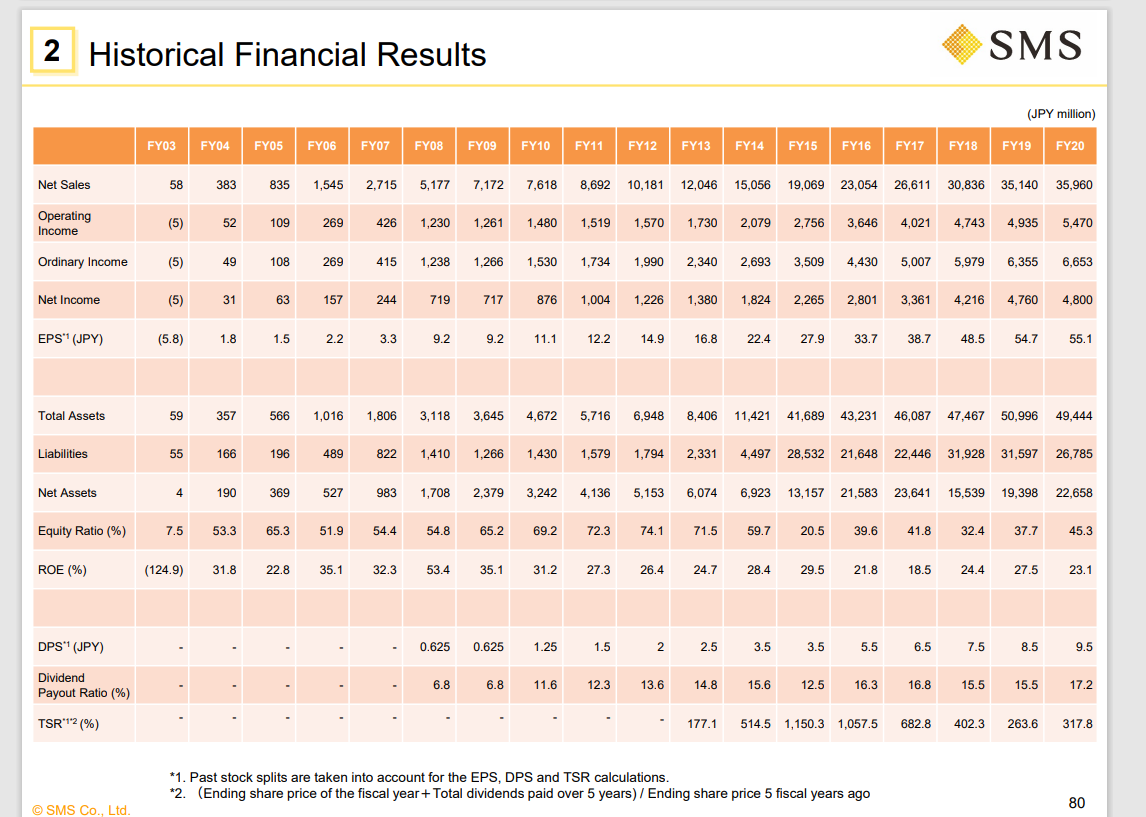

The below historical financial results (FY 2003 through FY 2020) showcase SMS’s ever increasing sales performance, speaking well for management’s ability throughout economic cycles to take the company to the next growth stage.

(Source: SMS’s financial results presentation for the first quarter for FYE 3/22)

6. TAM (Total accessible markets):

a) Japanese aging/medical care career markets.

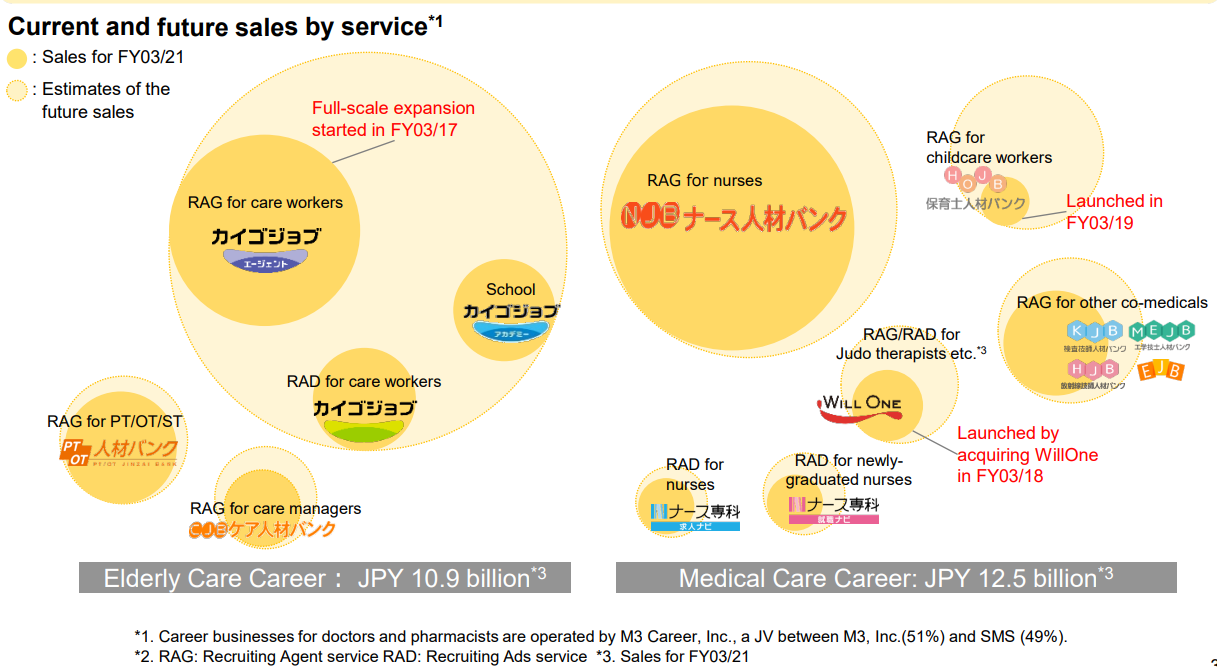

I could only find the below care-market related statistics which are provided by the company. Given the speed at which Japan is aging and existing labor shortage, the company’s assertion that its career segment has huge growth opportunities appears realistic.

(Source: SMS’s financial results presentation for the first quarter for FYE 3/22)

Total JPY 23.4 Bn ($ 324 MM) addressable market is compared to the expected career group revenues of JPY 7.7 Bn for FYE 3/22. Therefore, the company has a 33% of market share. The company has a high market share yet enjoys a lot of room to grow.

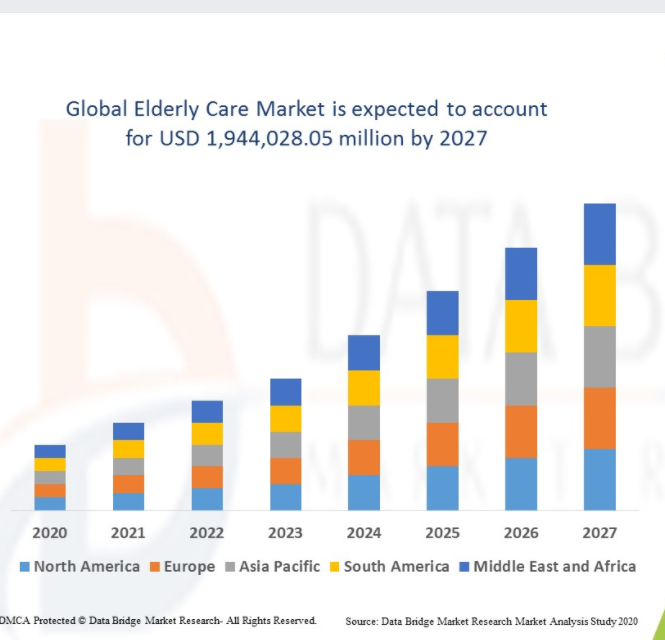

b) Global Elderly Care Market

(Source: Global Elderly Care Market, by regions, 2020-2027)

Data Bridge Market Research estimates that the global elderly care market is growing with a CAGR of 7.0% in the forecast period of 2020 to 202 and expected to reach almost $2 Tn by 2027. Geriatric population, rising chronic illness in ageing population and rising awareness of home care services are the major factors for the market growth.

In 2017, as per the United Nations, there were approximately 962.3 MM of 60 years or older people worldwide. This demographic segment is estimated to increase to 2,080.5 MM by 2070, requiring elder care and supporting the care market growth.

I can’t obtain further breakdown on the above global market forecast. However, it appears that it is safe to assume that SMS’ TAM is large and getting larger.

7. Strength and Weakness:

Strengths

1. High market share:

As one of the pioneers in the staffing services specialized in the nursing and elderly care segment, the Company has been able to enjoy brand name recognition which has led to its high market share (around 33% as mentioned earlier).

2. SMS is operating in the industry which is expected to grow as Japan continues to age.

3. Well thought-out medium to long-term strategy is in place to increase sales by attracting more customers (employees, agencies, users) and increasing types of services it offers to the existing clients. Profitability recovery through enhanced cross selling at overseas operations (MIMS ) should improve the company-wide bottom line.

Weakness

The overseas segment only contributed sales of JPY5.1bn (-2.4% YoY) in FY03/21, with annual sales growth averaging only 1.8% since FY03/17, and appears to have posted a loss. However, as discussed earlier, the company intends to turn MIMS operations to profitability by cultivating cross-selling opportunities.

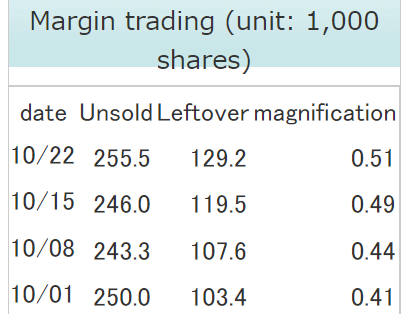

8. Near-term Selling Pressure:

As noted in useful tips section, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For SMS, there is higher short selling volume (noted as “unsold” in the below table) than margin buy volume (“leftover”). Thus, we don’t have to worry about constant profit taking. In fact, we may be able to benefit stock price appreciation through short-covering if the stock price continues to rise,

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance