Silver Life (“Silver” or the company) is the franchisor/operator of a meal delivery service exclusively for the elderly. Its core business is to ship prepacked foods prepared by their own factories to the franchisees.

1. Investment thesis

1) A stable subsector in a growing senior care sector

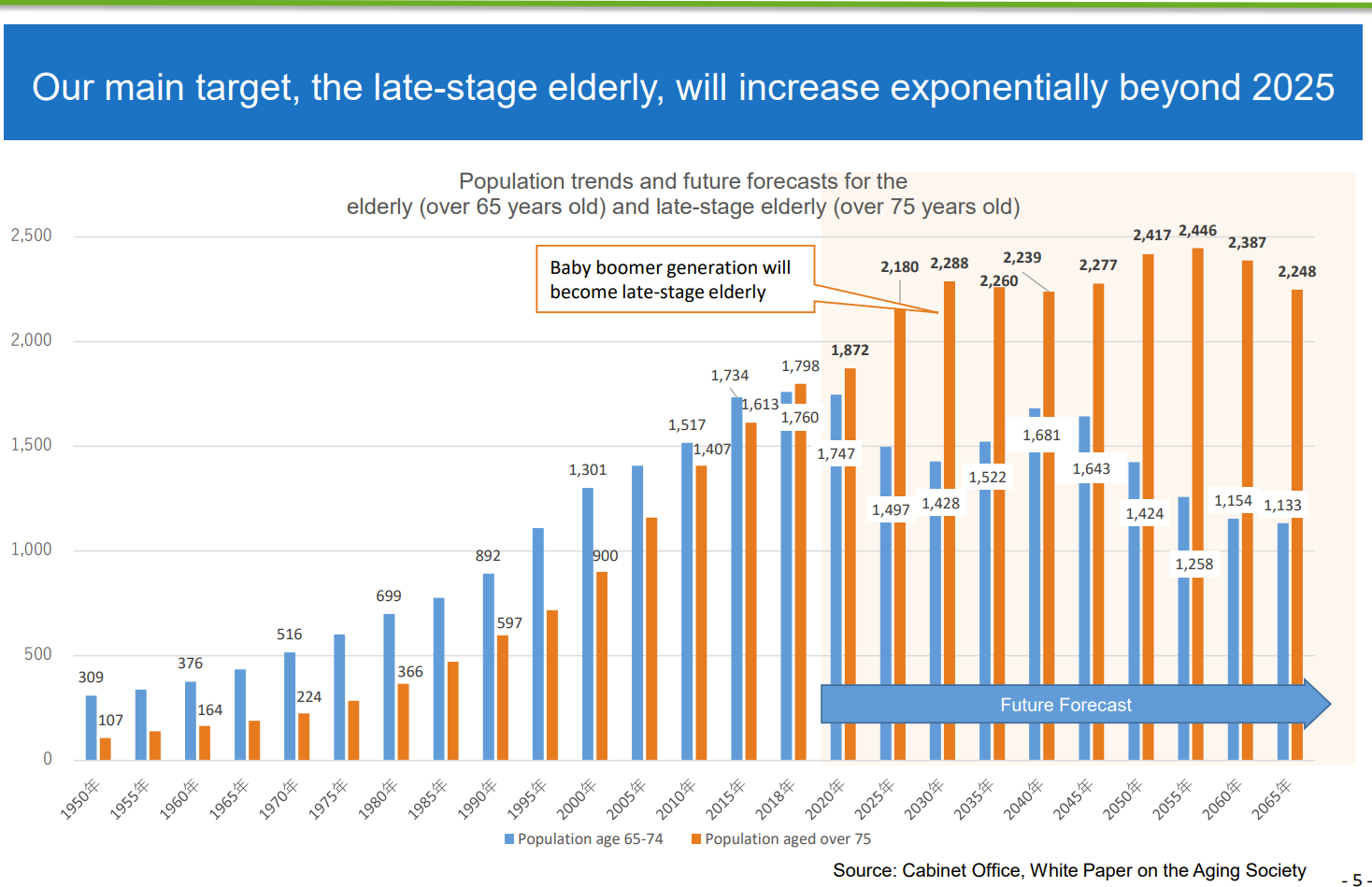

As baby boomers age, the late stage elderly group which is the company’s target segment is rapidly growing.

(Source: Medium Term Business Plan FY 2021- FY 2025, as of 9/2020)

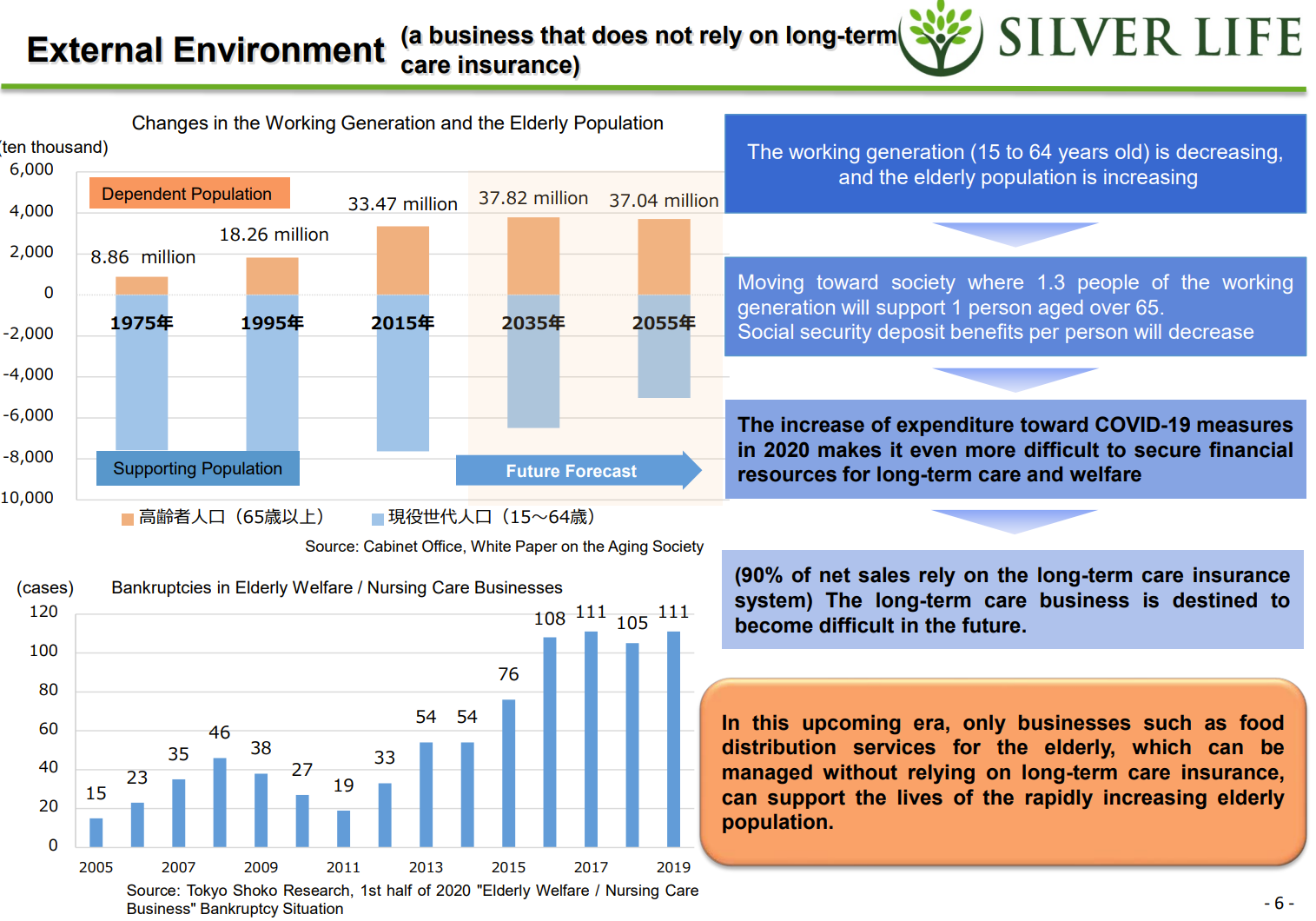

Another trend is emerging along with the growth of the seniors of 75+ years old: The strain on long term care insurance is also rising. However, Silver Life’s meal distribution businesses do not depend on reimbursement from long term care insurance, thus, long term care insurance, insufficient funding thereof, will not impact the company.

(Source: Medium Term Business Plan FY 2021- FY 2025, as of 9/2020)

2. Capacity expansion for future is complete

To prepare for the above mentioned demand growth, the company has increased capacity (the 2nd factory and a new warehouse) to increase production capacity from 50,000 meals a day to 200,000 meals a day. JPY 5,050 MM /USD 40 MM(majority dedicated to the 2nd factory) was spent in 2021.

3. Several revenue sources

The company classifies their operations into 3 segments:

1. Franchise chains:

This department delivers daily meals mainly to elderly people living in their home.

Key factor in this group: The company’s CEO’s track record as creating a top franchising operation aids in attracting many experienced franchisors.

2. The Elderly Facilities:

This group sells the meals to the facilities, such as assisted-living residences and visit-only senior service centers. Covid restrictions were a big negative and chilled meal deliveries were punished. But frozen meals are improving. A new warehouse should help.

3. Direct Sales:

Silver supplies frozen meals to other food preparation companies. It also sells directly to customers via their website. Warehouse operations were launched utilizing one of their distribution centers (in 7/22).

4. Shareholder returns.

As the major capital expenditures behind them, management has decided to start paying dividends. For the time being, a dividend payout ratio of 30% is planned.

2. Technically Speaking

(Source: kabutan.com)

The above chart of weekly candles exhibits the stock’s performance of 1/1/22 through 12/30/22. Silver stocks are currently at the resistant level of JPY 2,100 which it needs to push through with a large volume.

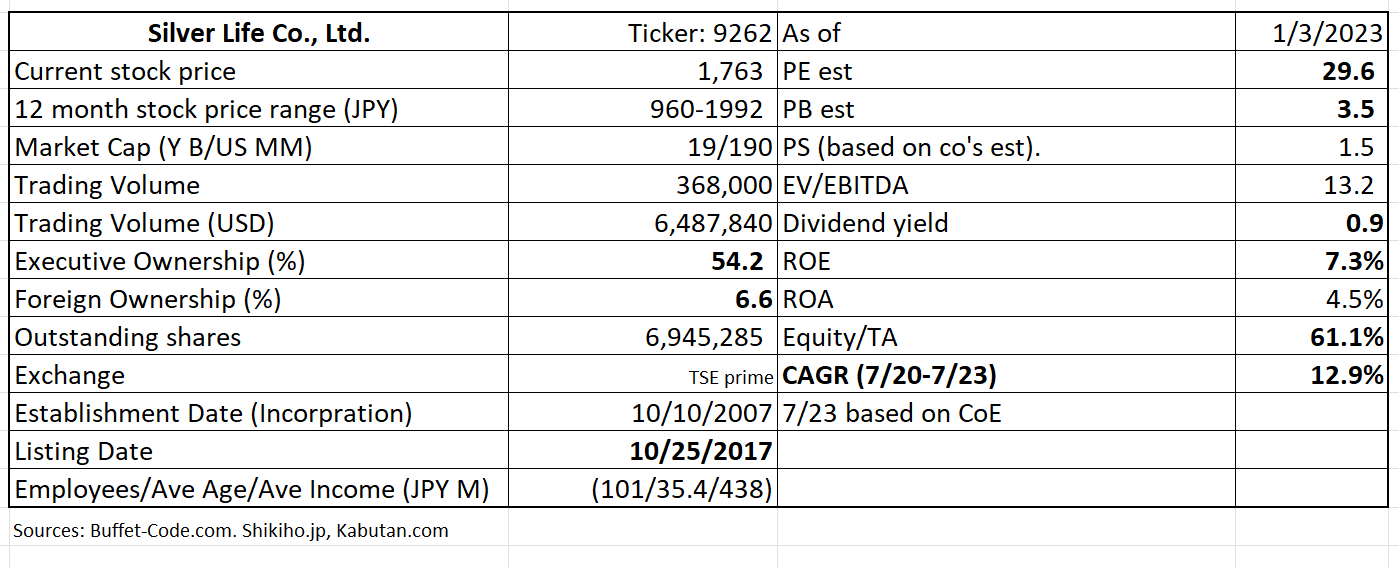

PE of 29.6x appears a bit elevated for sales CAGR of 12.9%. However, many companies in the senior care industry in Japan are not profitable due to high costs and public criticism against high charges by the care providers. Thus, Silver, with positive earnings and improving margins, commands a higher multiple.

3. Business Model

The below two points set the company apart from its peers:

1) The entire meal delivery operations (from meal preparation through delivery to clients’ home) is handled internally by the Company. Competitors are typically specialized a few phases of this operational flow.

2) The franchisees’ responsibility is simple as they only have to put together a meal box using meal items sent by the company. The franchisees enjoy lower initial investments to enter the franchisee contracts since what a franchisee has to do is: 1) assemble food items sent by Silver and 2) no store fronts is necessary.

4. Financial Highlights

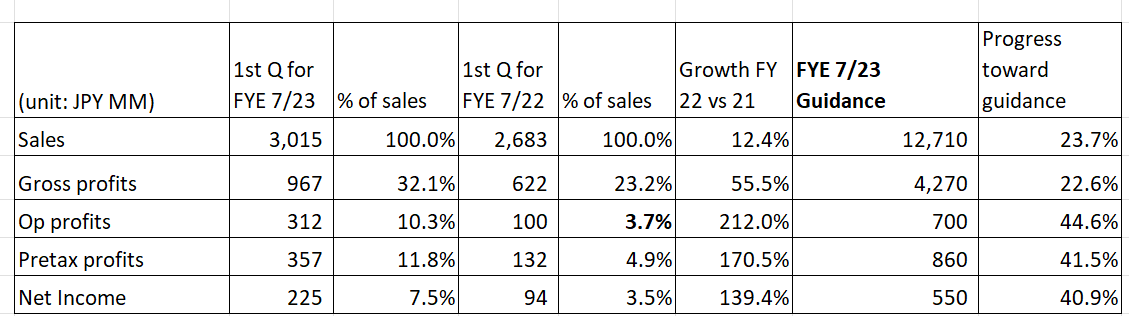

(Source: Financial Highlights for the 1st quarter for the fiscal year ending 7/23, translated by www.JapaneseIPO.com)

Financial results for the fist quarter ending 10/22 vs 10/21

Sales was up 12.4% in 1Q ending 10/22 vs. 10/21, thanks mainly to 1) franchisee sales increase of 10.5%, 2) 5.5% increase of sales to assisted living facilities and 3) 26.4% increase of direct sales of frozen lunch boxes. In the assisted living sales group, chilled meals’ sales continued to decline, and the launch of new brand of frozen meal boxes was delayed. These negatives were partially offset by frozen meals’ sales.

Gross margin substantially went up from 23% to 32%. This improvement was propelled by bringing in 30% of outsourced production of chilled meals to internal factories as of 10/22.

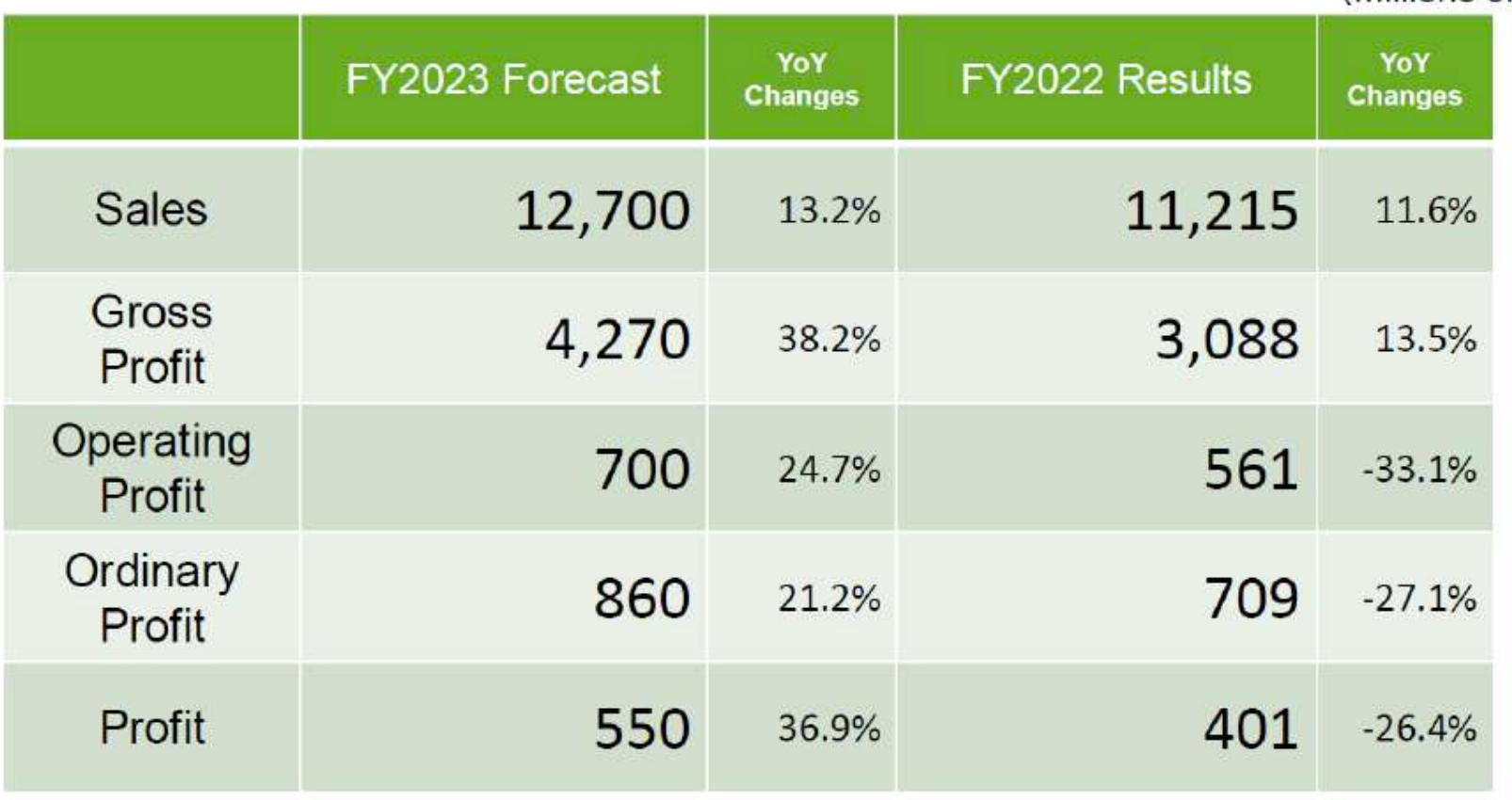

Financial Guidance for FYE 7/23

(Source: Financial Highlights for the 1st quarter for the fiscal year ending 7/23)

The above sales guidance of 13.2% increase year on year is based on:

1) Franchisee sales increase of 10.8% which appears reasonable given Q1 increase of 10.5%,

2) 12.5% sales increase to assisted living facilities which looks a bit aggressive, compared to a 5.5% increase in Q1. However, the company believes that growth in this segment will accelerate, once a new frozen meal brand’s launch is well on its way, and

3) 24.7% increase of direct sales of frozen lunch boxes vs. 26% achieved in Q1.

Gross margin is expected to continue on its improvement as Silver will bringing in more chilled meal production to its own factories.

5. Total Addressable Markets (TAM)

There is no data for an exact size of senior meal service industry. However, as discussed in Investment Thesis 1, Japan is rapidly aging: an increase number of late state elderly will need an aid in daily activities, including receiving meals. This means that the company operates in a space with a good growth potential.

6. Strengths and Weaknesses

Strengths

1) The industry with a huge growth opportunity, as discussed in the preceding section.

2) Competitive advantage

For typical meal delivery firms, the below 3 main functions are handled by the different entities.

1) Development and preparation, done by a manufacturer

2) Logistics, by a shipping company

3) Sales and delivery to the customers.

However,

The company can handle all the three main functions internally, thus, can ensure a quality control and enjoy scale merit i.e., lower costs. Silver also obtains customer feedback which can be fed back into a new product development.

Weaknesses

The company currently is the largest franchisor of the senior focused meal service operations. However, it has faced a challenge in obtaining new franchisees when the franchisees see some other money making opportunities. Nonetheless, the company believes it offers an attractive franchising opportunity, since

1) the responsibility of franchises is to put together meal pieces in one box, thus rather simple. Therefore, catering experience is not required

2) upfront costs is limited to franchisees since there is no need to establish store fronts.

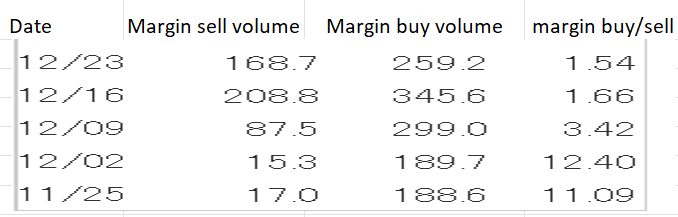

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Silver, margin buy sell ratio has come down to an acceptable level of 1.54x (below 3x). Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance