It’s NOT a Hocus Pocus. It’s Shikigaku!

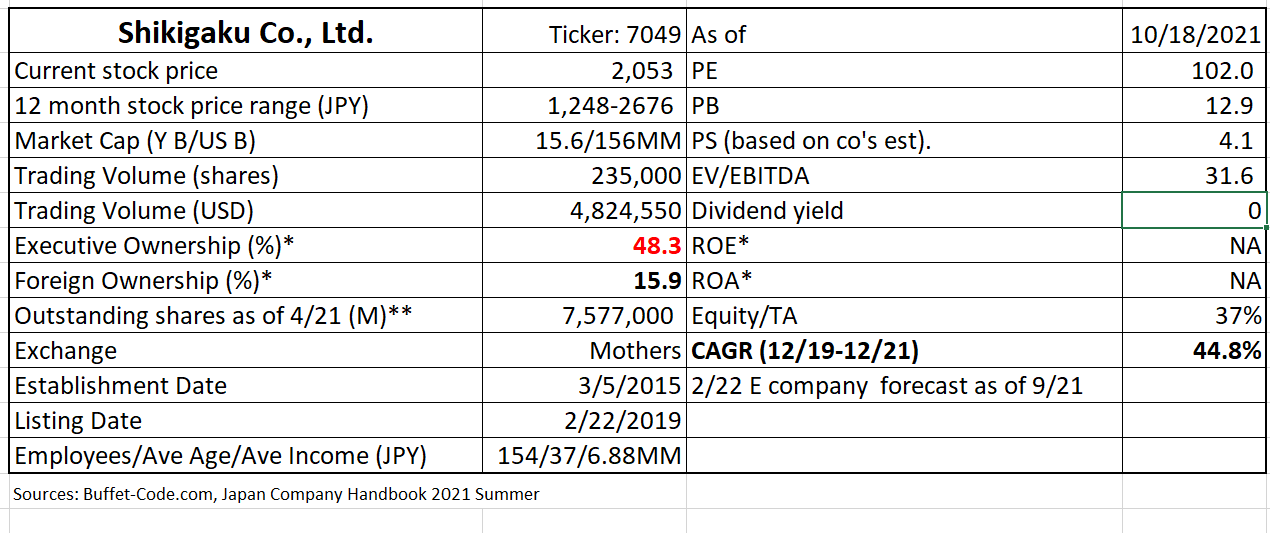

(source: Buffet-code.com)

BEFORE initiating a position, check to see if the trading volume stays high.

1. What is Shikigaku:

It provides consulting services targeting top management and executives, aiming for improving organizational productivity. Established in 2015 by President Mr. Kodai Ando who formerly worked for NTT Docomo and J-Com Holdings (current Like).

2.Investment Thesis:

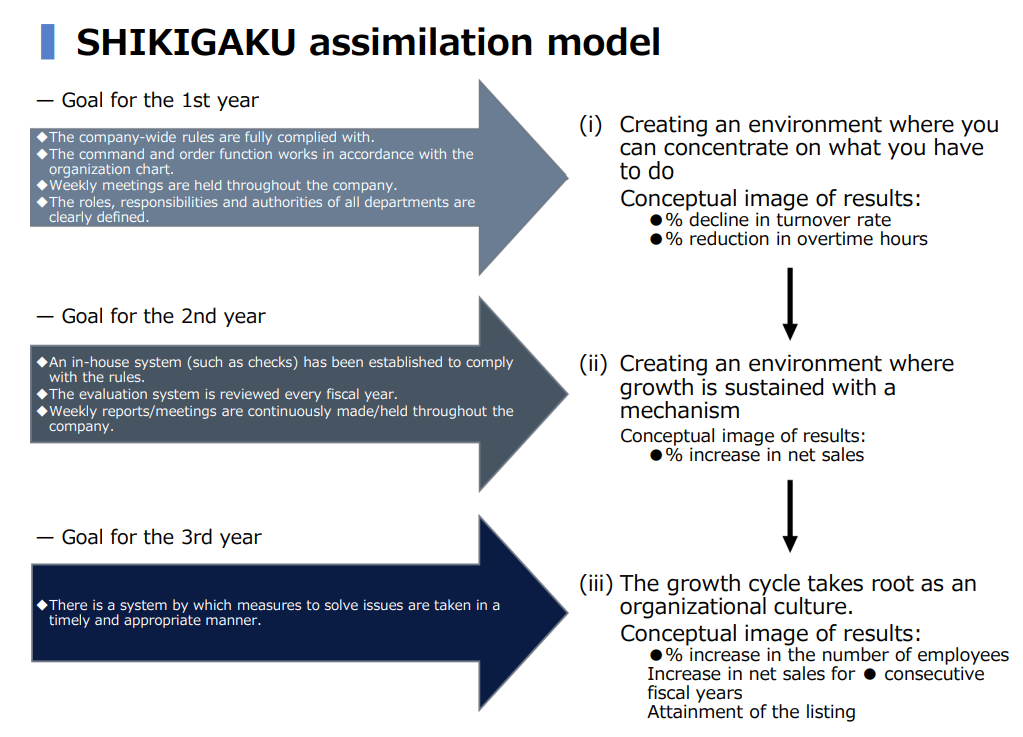

- Shikigaku Co. Ltd., (“Shikigaku” or the “company”) is a company, built and run based on a concept/framework called “SHIKIGAKU”. SHIKIGAKU is an independently developed theory which analyzes our cognitive reactions to events which often lead to misunderstandings. It is characterized by its highly reproducible and logical solutions for these misunderstandings, not depending on specific personality.

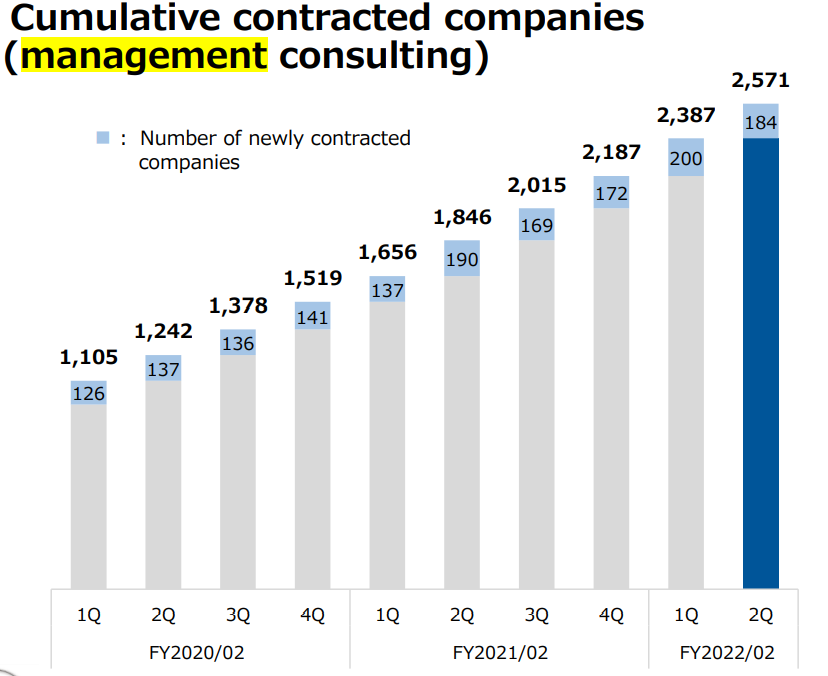

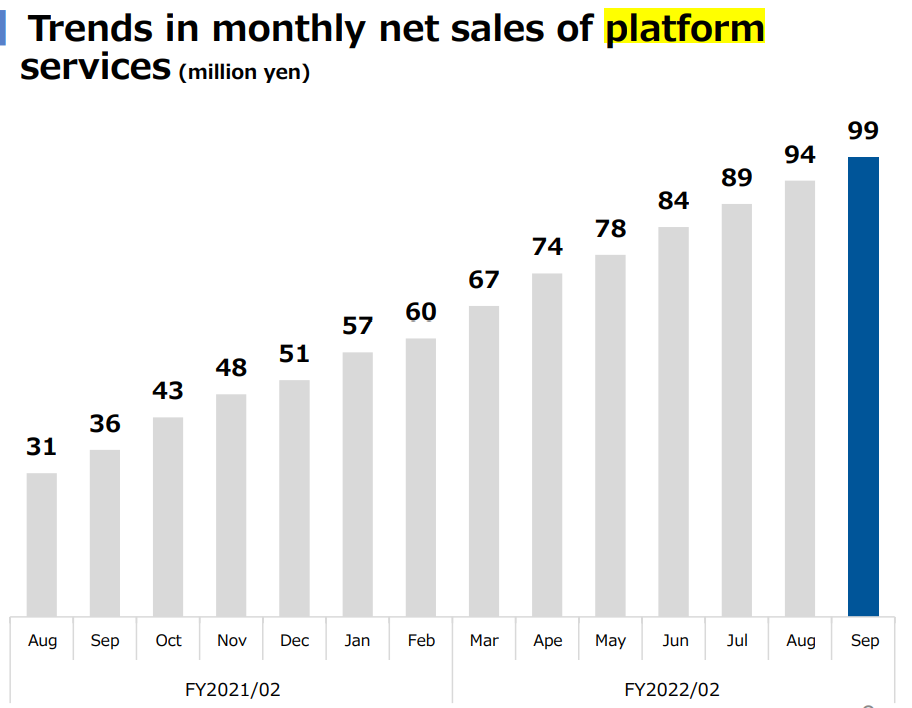

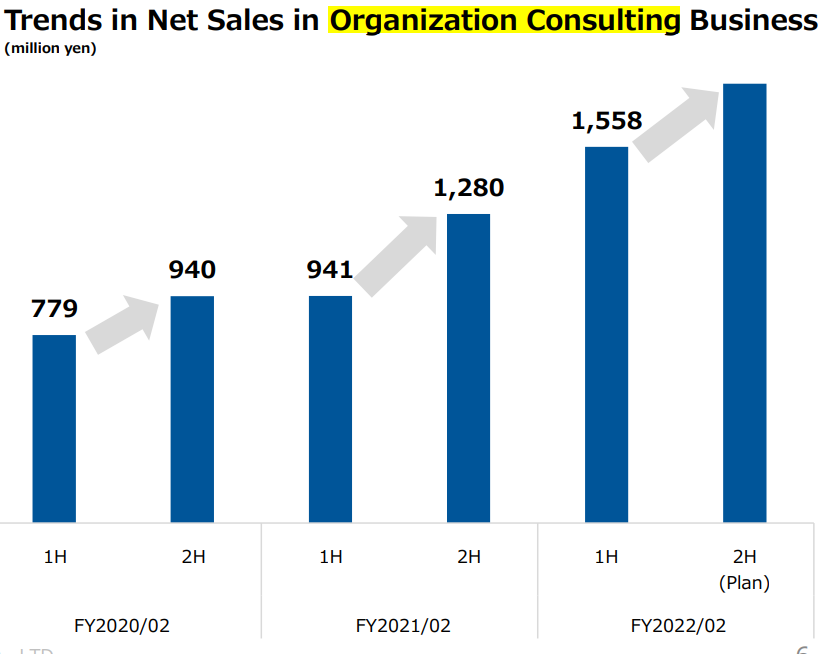

- It is a very hard company to understand. We will do our best here. But even if we fail, their sales numbers speak for themselves. The readers can glean the success of company and acceptance of SHIKIGAKU as a proven management consulting framework by looking at steady upward trends of the company’s two mainstay businesses: SHIKIGAKU basic services and SHIKIGAKU platform services. Shikigaku publishes monthly sales of its platform services (subscription services) in their website.

(Source: Financial Results of Q2/21 for FYE ending 2/22, as of 9/30/21).

(Source: Financial Results of Q2/21 for FYE ending 2/22, as of 9/30/21).

NOTE: By “Shikigaku”, we mean the Company. The framework is referred to by capitalized “SHIKIGAKU”.

3 Japan specific social issue which the company is solving:

Shikigaku aims to turnaround the sluggish Japan Inc’s bottom lines by improving corporate productivity one company at a time.

4.Background:

Shikigaku concept – Structure of Consciousness – is created by Mr. Fukutomi 20 years ago. He is now the head of SHIKIKAGU Research Institute. Mr. Kodai Ando learned SHIKIKAGU in 2012 and started to provide organizational consulting based on it. In 3/15, his sole proprietorship was expanded into Shikigaku Co., Ltd.

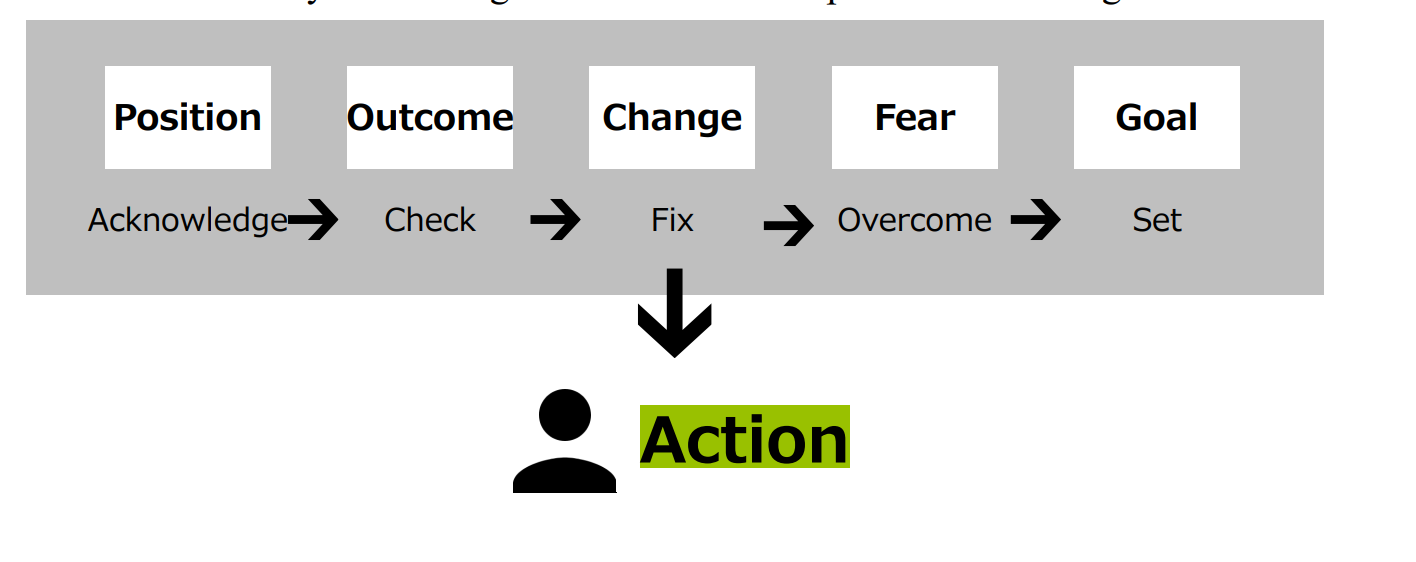

5. More on SHIKIGAKU:

SHIKIGAKU believes that we all have our unique ways of reactions (the below 5 steps) toward an event which often leads to misunderstandings and misconceptions. These misconceptions interfere with desired behaviors as corporate citizens. Shikigaku established a set of predetermined and common rules/frameworks/thought processes which eliminate misunderstandings which in turn improve employees’ productivity.

(Source: Financial Results of Q2/21 for FYE ending 2/22, as of 9/30/21).

In another words, SHIKIGAKU instills the RULES (SHIKIGAKU framework) which guides every employee throughout a client firm to a correct and desire action. The goal is to drive the firm’s sales growth.

Mr. Ando first witnesses the real-life benefits of SHIKIGAKU when the new head coach for rugby team in Waseda Univ., equipped with SHIKIGAKU, took the team to win the national tournament for the first time in 14 years.

6. Business Model:

Currently the company’s organization consulting operations are enjoying the smooth sailing as shown below:

(Source: Financial Results of Q2/21 for FYE ending 2/22, as of 9/30/21).

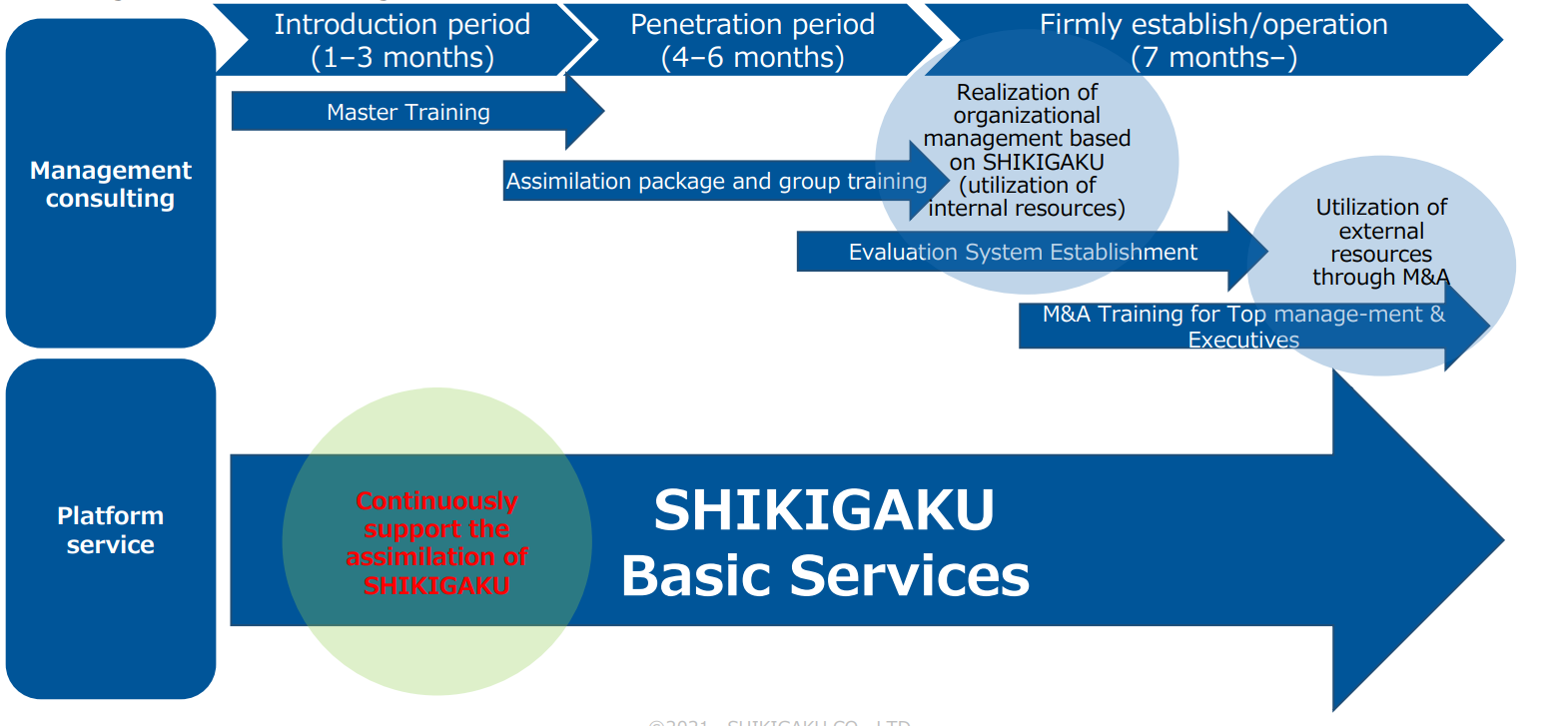

Under This Organization Consulting Business, the company offers 2 separate products which only differs on timing of service offerings: a) Management Consulting – Fixed Contract, and b) Platform – Continuous service based on subscriptions.

(Source: Financial Results of Q2/21 for FYE ending 2/22, as of 9/30/21).

KPI (Key Performance Indicators) for both groups:

1. Management Consulting.

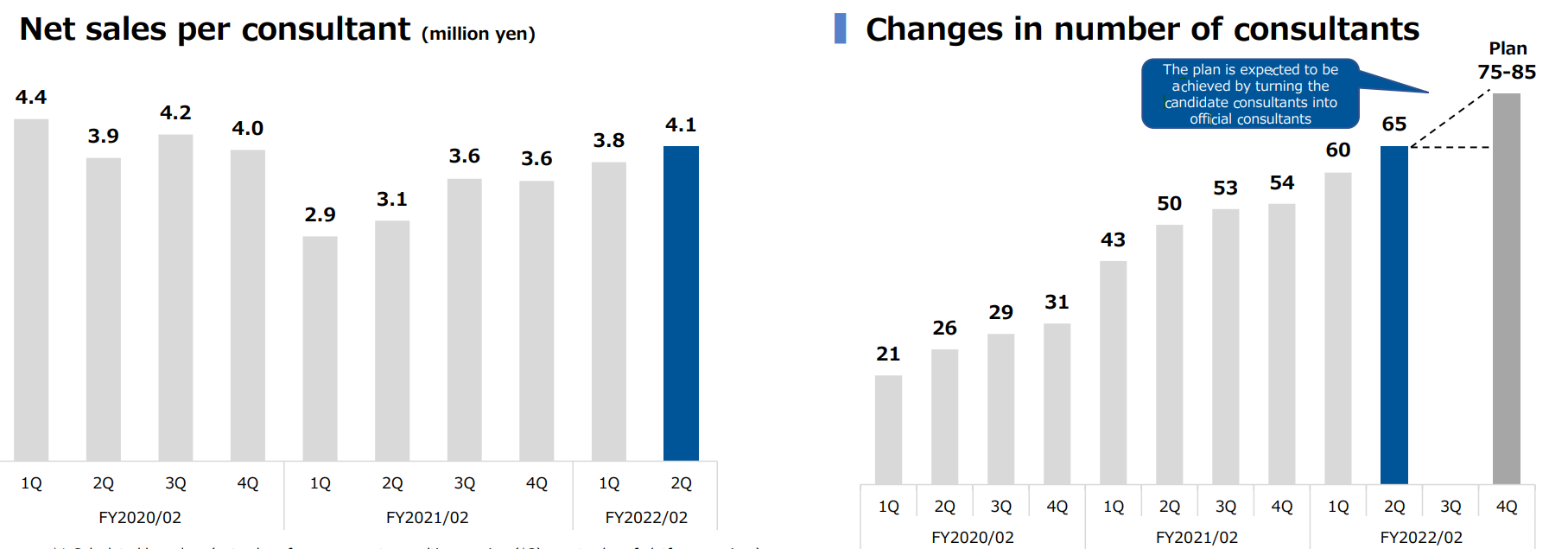

KPI: Number of consultants and sales per consultants since revenues increase in accordance with an increase in the number of consultants.

Net sales per consultant have been on a recovery trend since it dipped low due to negative Covid impacts in 1Q for FYE 2/21. As of 9/21, the company employs 65 active consultants, 8 candidate (trainee) consultants and 8 candidate consultants who had accepted job offers.

(Source: Financial Results of Q2/21 for FYE ending 2/22, as of 9/30/21).

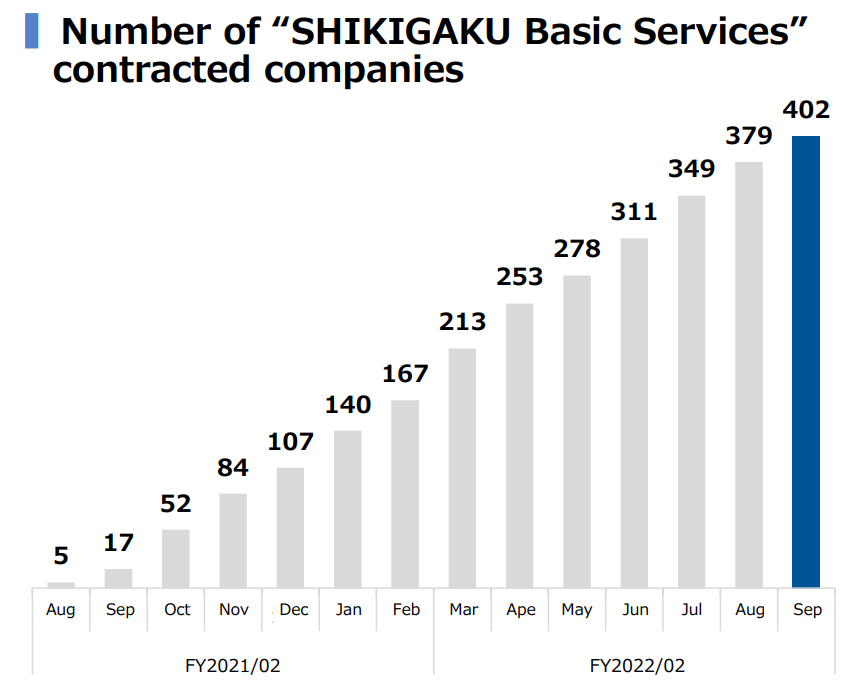

2. Platform Services – Subscription (recurring revenue) services -provides continuous organizational management supports based on SHIKIGAKU. Therefore, KPI in this segment is an increase in number of companies which have signed up for subscription services.

(Source: Financial Results of Q2/21 for FYE ending 2/22, as of 9/30/21).

Platform services can be diagramed as below:

(Source: Financial Results of Q2/21 for FYE ending 2/22, as of 9/30/21).

7. Financial Highlights:

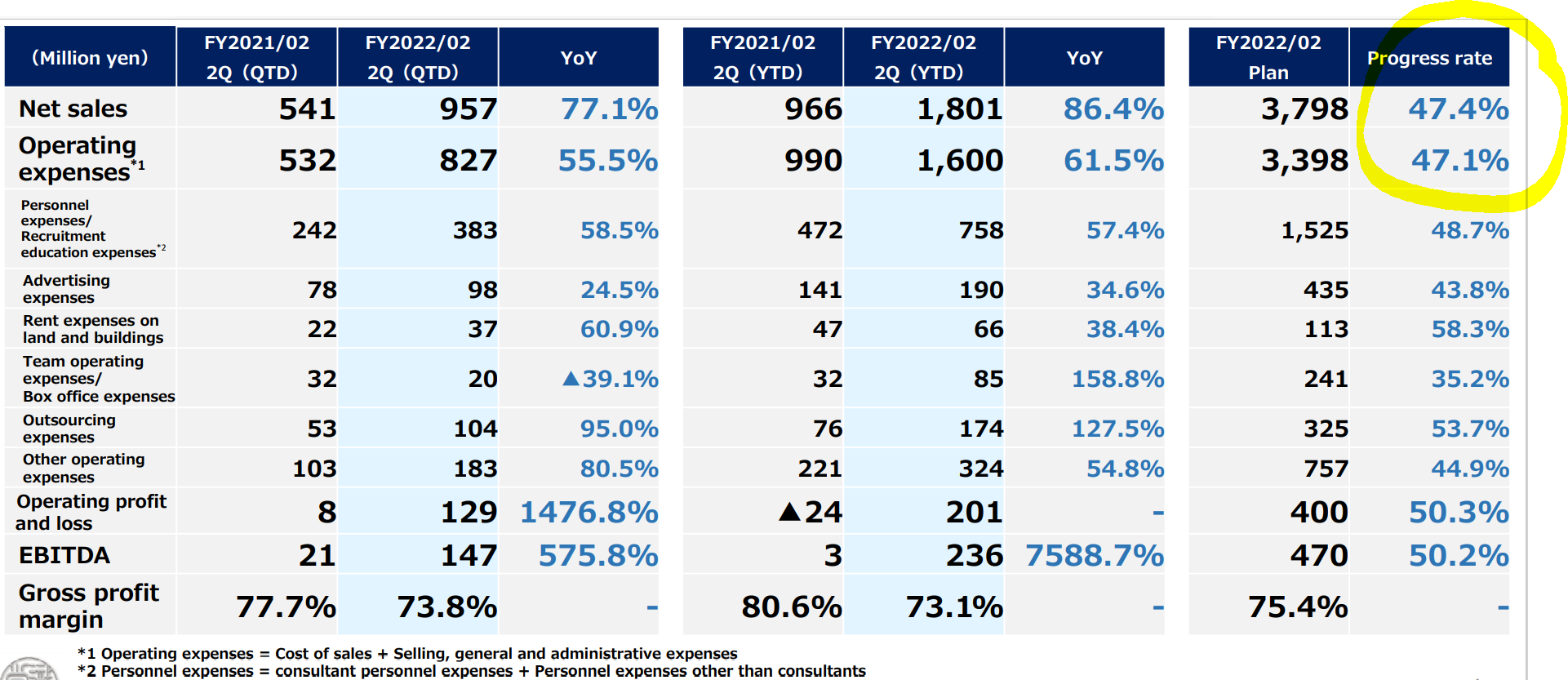

Consolidated results:

(Source: Financial Results of Q2/21 for FYE ending 2/22, as of 9/30/21).

“Progress” column in the above table indicates an achievement % toward annual plan in each line item.

Management has noted that their annual sales have some seasonality. New consultants go through trainings in the 1st half of a year and start billings in the 2nd half of the year. Therefore, the fact that the first 6 months/2021 achieved less than 50% of annual plan is not cause for a concern.

Box office expenses are sport games running expenses.

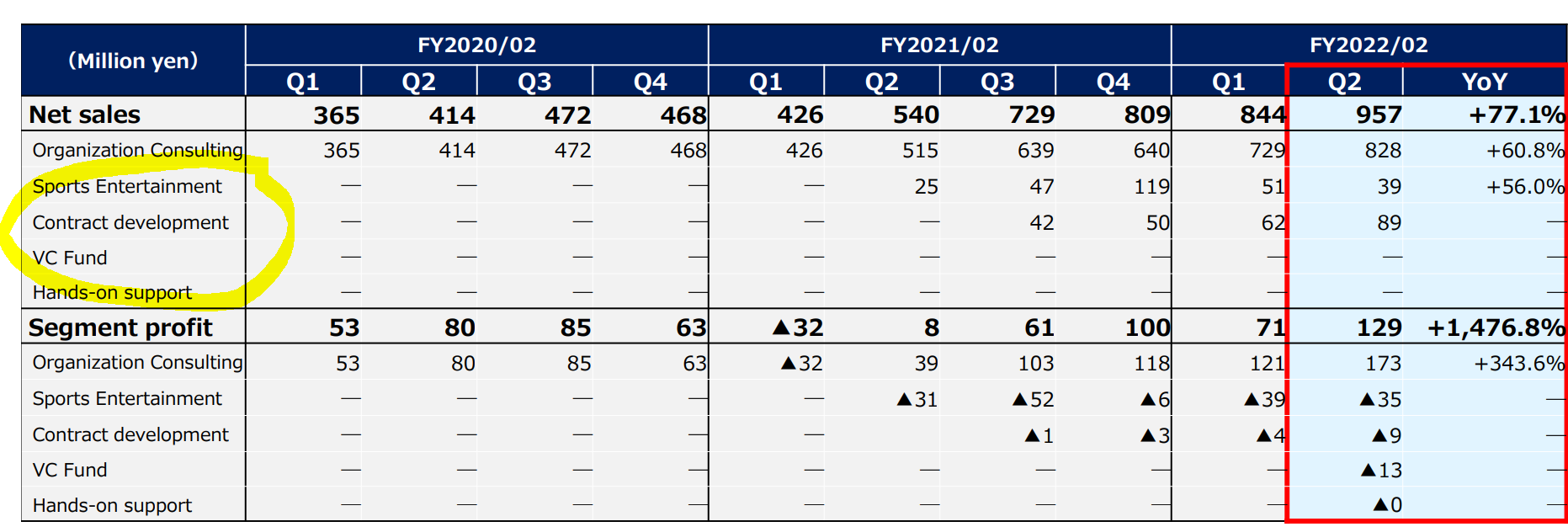

Segmental results:

(Source: Financial Results of Q2/21 for FYE ending 2/22, as of 9/30/21).

The above table showa that organization consulting drives the majority of sales growth for the company. Shikigaku believes that SHIKIGAKU principle can benefit all aspects of our lives and gradually expanding out of organization consulting to, say, sports team operations. These new business endeavors are discussed in the following segment “Investment Strengths and Risks – Big growth potential”.

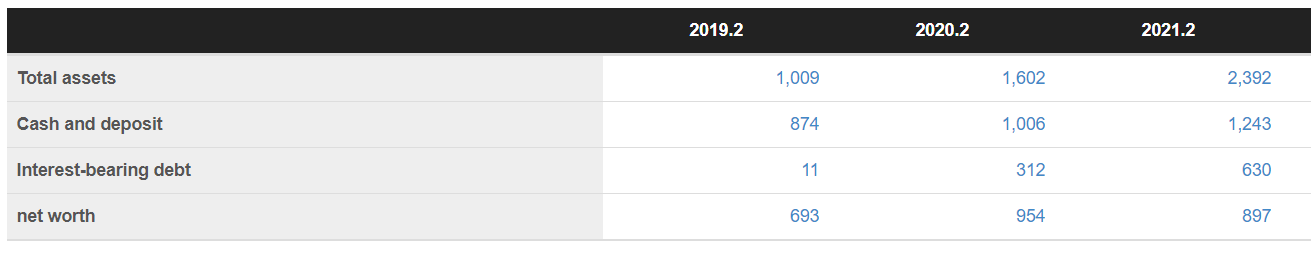

The Company’s Balance sheet is asset light, since its major asset is “consultants”.

8. Investment Strengths and Risks

Strengths:

1.Big growth potential

Versatility of SHIKIGAKU concept means that it can be applied to anywhere as long as there is an organization.

Initiatives currently underway:

1. Sports Entertainment Business:

The company acquired a struggling basketball team in Fukushima prefecture which was consolidated on Q2 FYE 2/21. The company aims to achieve higher sponsorship revenues and ticket sales by improving team performance via application of SHIKIGAKU. This segment shows steady improvement in sales, albeit starting from a low number. Note: The sales of this segment skewed toward the winter months of a year.

2. Contract Development: Shikigaku Careers belong to this group.

Shikigaku Careers:

The company provides “SHIKIGAKU-themed recruitment consulting services” and “Recruitment Process Outsourcing” services. This is a matching service between job seekers who want to work for the companies who adopted Shikigaku principle and firms who run their operations based on SHIKIGAKU.

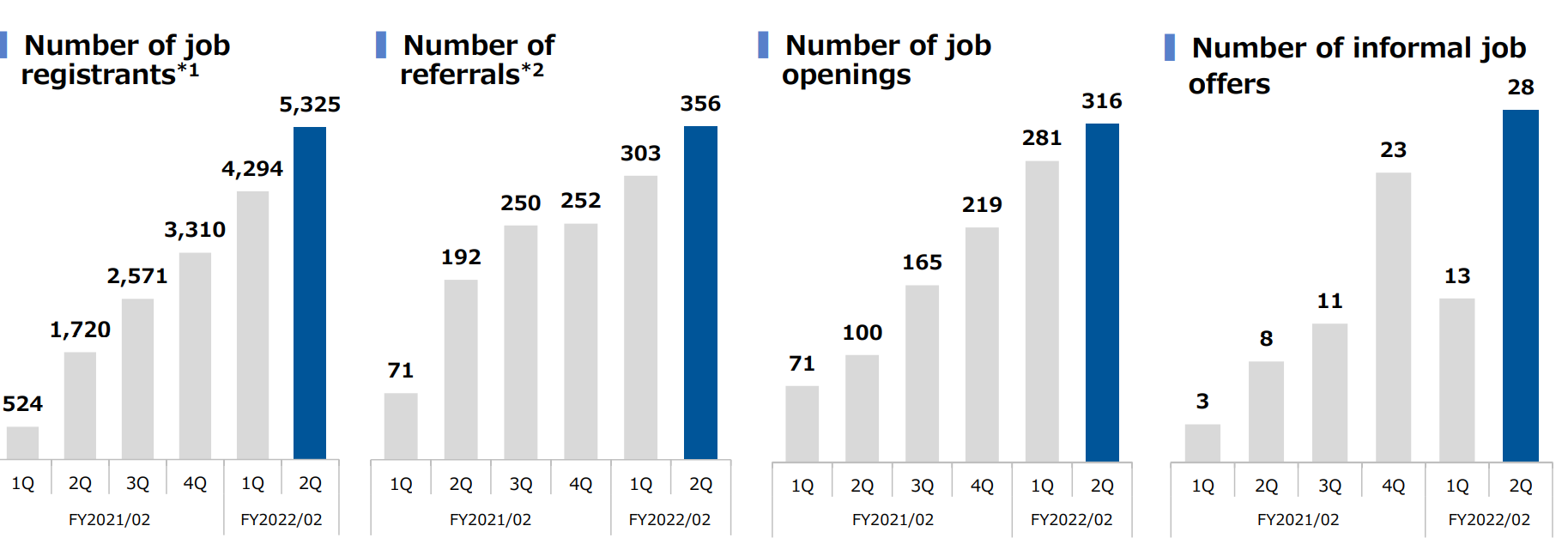

*Shikigaku Career is showing an early sign of success:

*2) Referrals Shikigaku sent to recruiting companies.

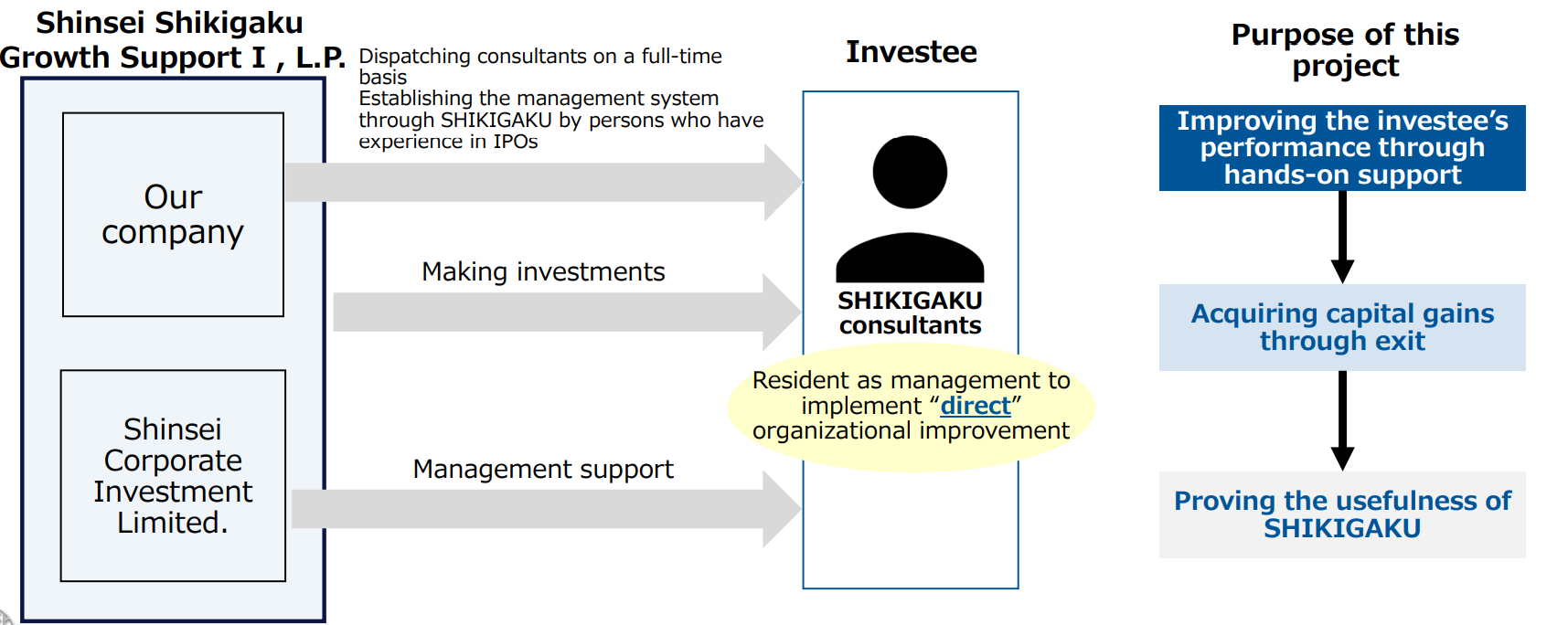

3. Investment Funds.

The company, in corporation with Shinsei Bank, created two investment funds through which Shikigaku provides both managerial and financial supports. These funds serve two purposes:

- Shikigaku seeks to achieve capital gains through exits.

- When investment target companies demonstrate an improvement in its operations, that will prove the effectiveness of SHIKIGAKU.

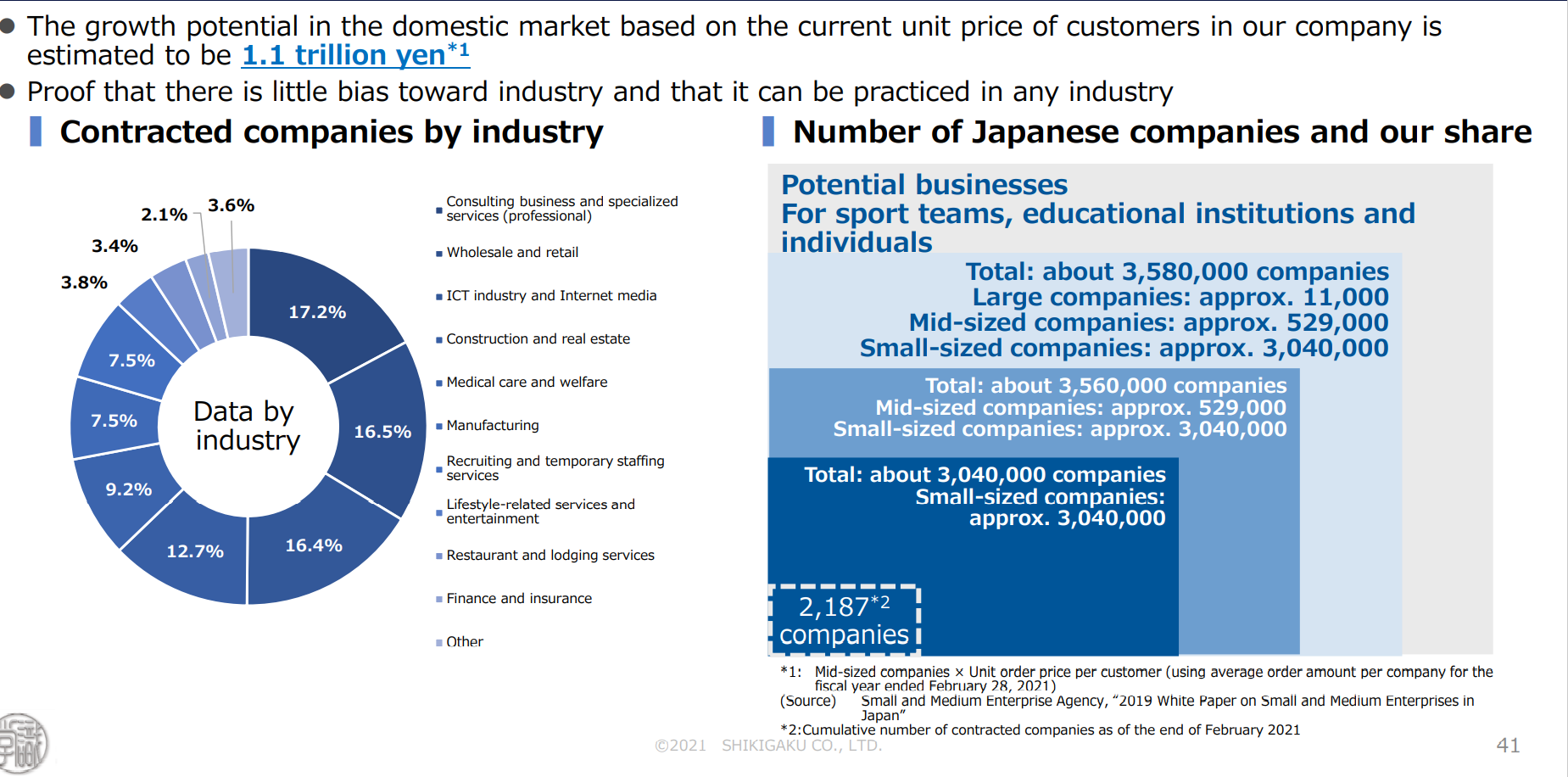

2. Sizable TAM

We believe that the below charts and statistics are the most important data in this report. SHIKIGAKU has wide application and it can be practiced ad beneficial in all organizations in Japan which totals 3,580,000. This equiates to 0.06% market share. Shikigaku has a huge room to grow.

(Source: Financial Results of Q2/21 for FYE ending 2/22, as of 9/30/21).

Risks:

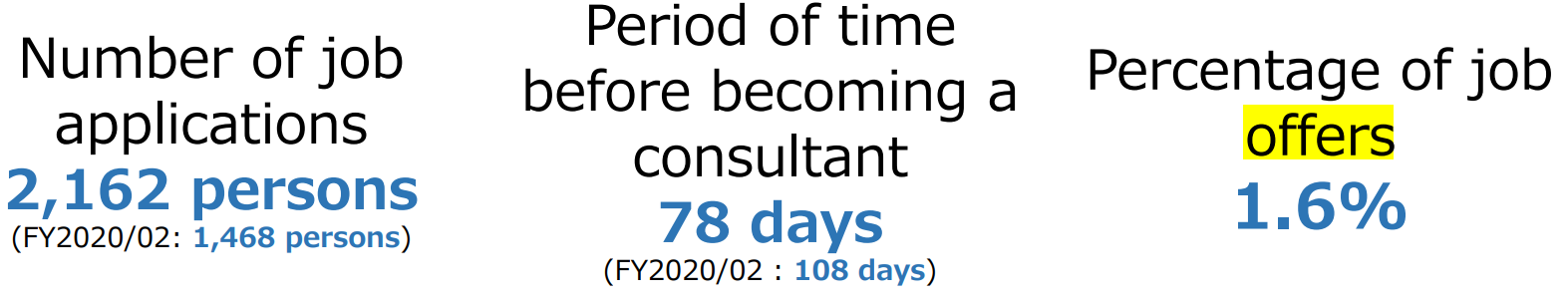

1. Shortage of qualified consultants

As discussed in KPI section, success of Shikigaku is highly dependent on the numbers of qualified consultants. The below statistics highlight the fact that 1) as the company continues to demonstrate effectiveness of their consulting system, the number of the applicants rise as well, 2) acceptance ratio of the final consultants out of the early applicants is low at 1.6%, indicating that the selection process is very stringent.

(Source: Financial Results of Q2/21 for FYE ending 2/22, as of 9/30/21).

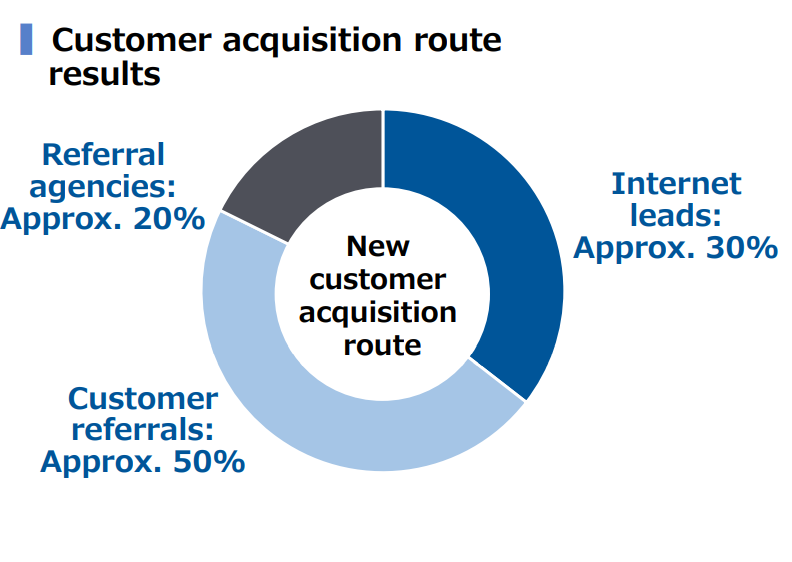

2.Possible slowdown in new customer acquisitions

The below chart shows Shikigaku acquires almost 50% of its customer base from customer referrals. Thus, the company needs to ensure the success of existing clients which will lead to the introduction to the new clients. While the company did not publish the churn rate, it noted that there was no change in churn rate in Q2 21.

(Source: Financial Results of Q2/21 for FYE ending 2/22, as of 9/30/21).

3. SHIKIGAKU is not time-tested (YET)

Shikigaku is still young company (founded in 2015) which can be viewed as a risk or an opportunity. It is still at an early stage of growth and its shareholders can share its growth in profits.

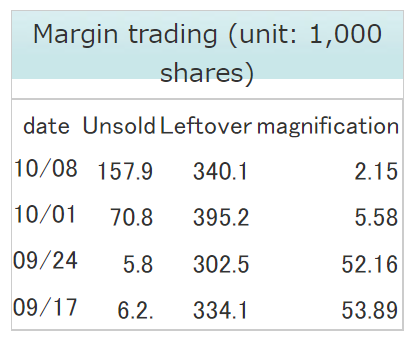

8. Near-term Selling Pressure:

As noted in useful tips section, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Shikigaku, as the below table indicates that there is small number of margin sell volume (157.9M shares), Margin buy volume has been steady at around 350M shares. Margin buy to sell ratio is low at 2.15x, thus, we can conclude that there is not a sifnificant nera term selling pressure.

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance