Founded in 1959, SHiDax (“Shidax” or the “company”) is a major meal service provider and third party restaurant operator for schools, companies and public offices.

Their business models are driven by three core segments:

School lunch and the third party meal preparation outsourcing.

Transportation outsourcing service such as school bus and limousine services.

Management of public/social service facilities such as assisted living places and municipal buildings.

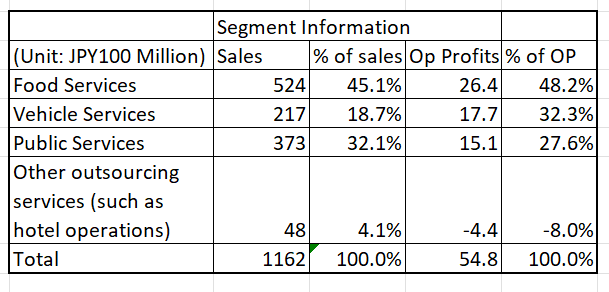

Each segment’s sales and operating profits contribution is shown below:

Why Shidax?

The company went through a period of unprofitable years when their once top-ranked Karaoke/restaurant business started to lose customers while consumers had shifted their entertainment venues from large group gathering with meal services to much smaller Karaoke box with no meal catering.

Their past 4 year performance has shown that it turned around the corner, thanks to its robust turn-around plans. What impressed me about Shidax is management’s “Re-growth plan 25” presentation as of 5/26/22 which details their growth plan. This presentation is very clear and based on “actionable plan and goals”. I believe that management who has taken this much care and efforts in explaining their strategy to the shareholders will likely succeed in delivering the results, ie., share price appreciation should follow.

1. Investment Thesis

1) Profit Recovery after divesting money-losing Karaoke Restaurant

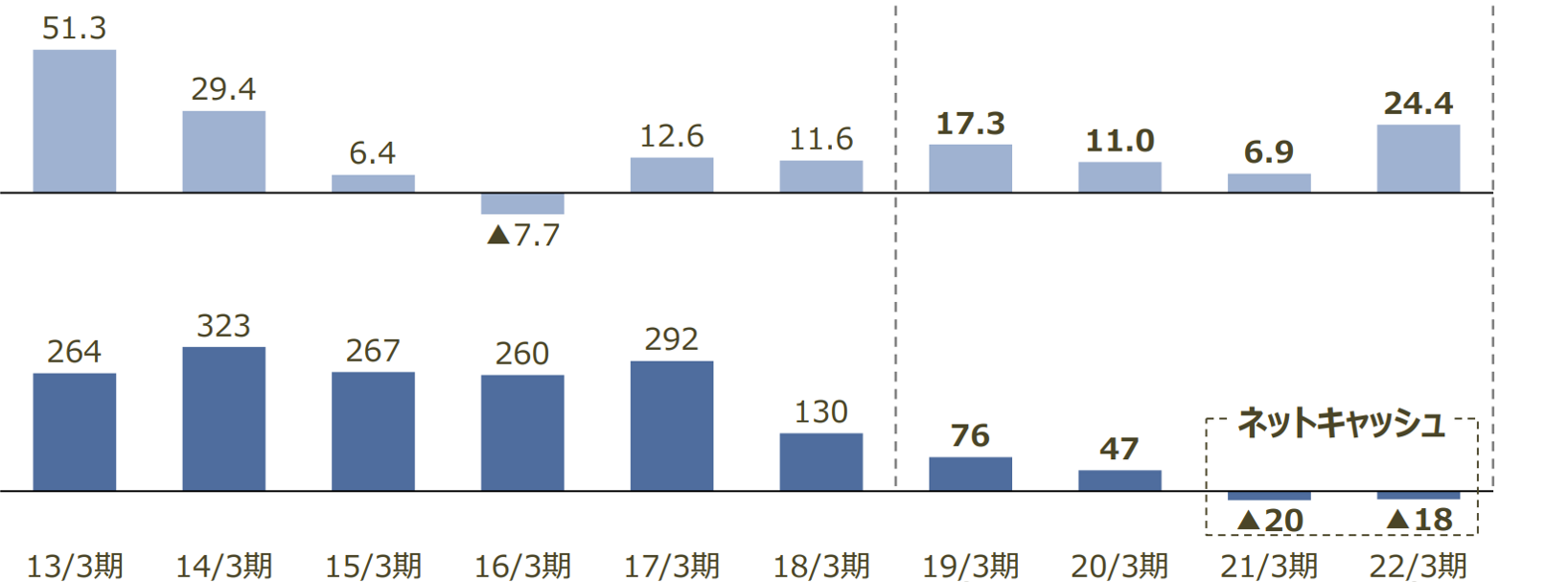

The below two sets of bar charts visualize the trend of operating profits (upper light blue) and net debts(debt balance minus 0cash, lower dark blue).

The years – 3/2013 through 3/2018 – are the period in which the company suffered from profit decrease, due to a declining popularity of Karaoke Restaurants. During this period, debt level got high as well. Their Karaoke division once boasted the largest number of stores but became unprofitable, when the consumers’ tastes had shifted from “a large group with meal” style Karaoke party to a “small no meal” Karaoke box. Karaoke division was sold in FYE 3/2019 to competitor B&V.

To kickstart its business portfolio revamping, Shidax formed a capital and business alliance with Unison Capital in 2019 to commence an organizational reform. Unison, which is well known in its expertise in restaurants investment, helped the company in strengthening the food and total outsourcing operations.

The benefits of turnaround plan

Shidax reported net cash position (i.e., cash balance is higher than debts) in 3/21 and 3/22, thanks to improving profits.

(Source: Re-growth 2025 presentation)

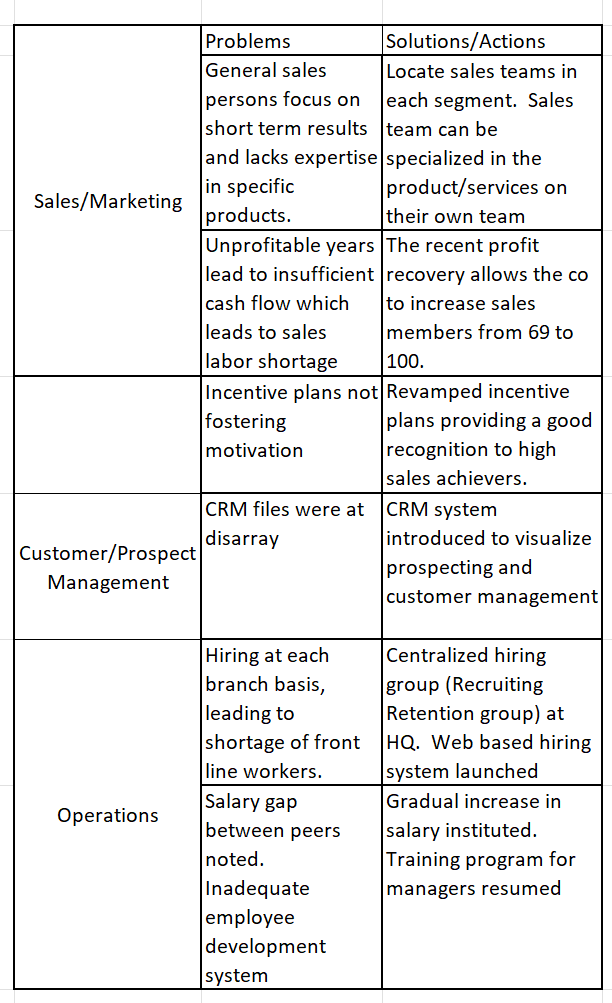

The below comparison table is the best part of the presentation and highlight management’s willingness to communicate their internal problems and the corresponding solutions to each issue.

(Source: Re-growth 2025 presentation)

Note: Translation by www.JapaneeIPO.com

2) Japan’s social issues are Shidax’s growth driver

A) One solution to population decline

Japanese government has instituted a subsided plan to increase kindergarten and after -school programs to support working parents. This has increased a need for qualified operators. Shidax has a top share in a child care outsourcing industry, which makes it one of the first choices as a child care facilities operator. From the perspective of future parents, the ease of child care concerns should encourage them to start a family.

b) A rescue to labor shortage

Many hospitals, schools and municipalities are equipped with cafeteria or meal services but they are suffering from labor shortage or cost overruns which makes it hard to run these services internally. Shidax, as a large meal outsourcer, can offer these services efficiently and at lower costs, thanks to their standardized service model and their large scale.

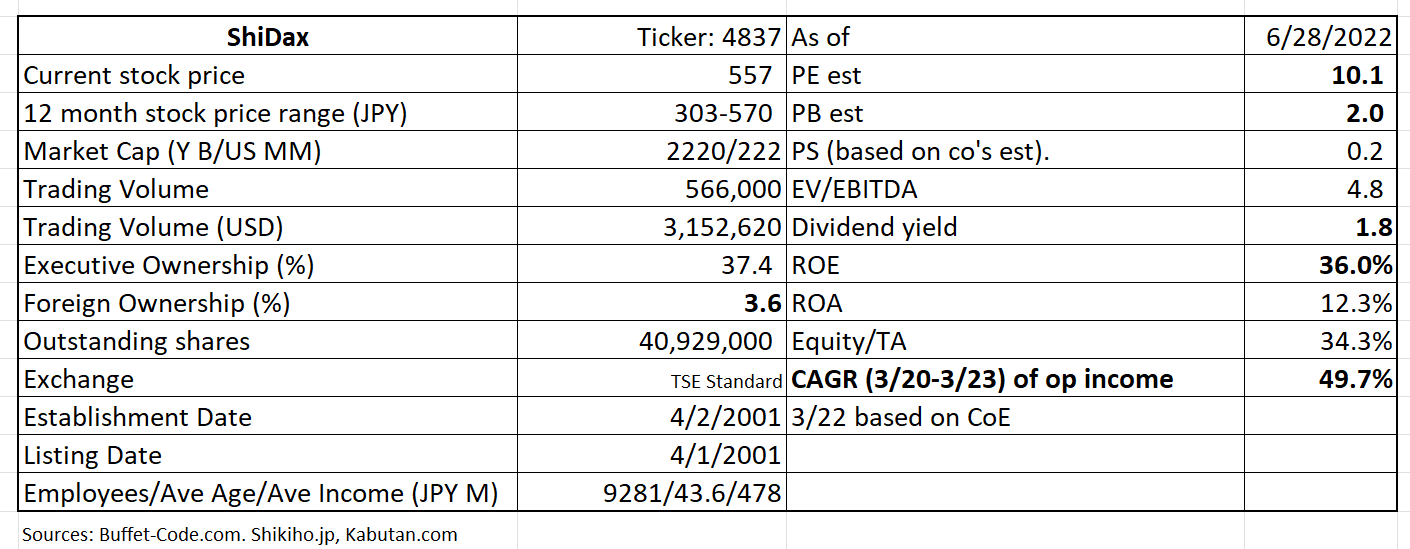

Valuation is quite reasonable at PE 10x vs. Operating income CAGR of 49.7%. The company’s net income fluctuates due to non-core asset divestures, thus, operating income CAGA is used.

2. Technically Speaking

(Source: buffet-code.com)

The stock has taken off following a better than expected FYE 3/33 result announcement in late May. It is about to push through a volume cluster of JPY 550. It is trading with a large enough volume which indicates the high investor interests.

3. Business Model

The company’s 3 core businesses can be divided by client types into two groups:

B to B(business):

The clients are hospitals, welfare facilities, child care facilities.

The services provided are meal preparation, vehicle operations.

A typical contact: annual

B to P(public):

The clients are after-school child care facilities, public school lunch operators, libraries.

The services provided are operations of the facilities on behalf of municipalities.

A typical contact: annual

Shidax’s strengths:

1) Consistent profitability: contacts are at least one year and renewal rate is above 90%.

2) Diversified clientele: The company deals with 1,200 entities/500 municipalities, thus not depending on one client.

3) Asset-light operations: As an outsourcer, the company’s fixed asset investment is limited.

4) Quick cash conversion: The asset-light business model leads to quick cash conversion of a new contract. A new contract can be cash flow positive from a year one.

5) Good personnel development cycle: Cash generated from contracts can be reinvested in new hires of experienced operators such as marketers/sales force, drivers, meal preparators/nutritionists, and Liberians.

6) Low operating leverage: The fact that the company’s business model is low in fixed leverage means the company’s sales and profitability is highly dependent on numbers of capable sales persons to bring in new contracts. This is why its critical that Shidax’s cash flow cycle is turning into positive which provides the company with financial means to attract and retain high achieving operators.

4. Financial Highlights

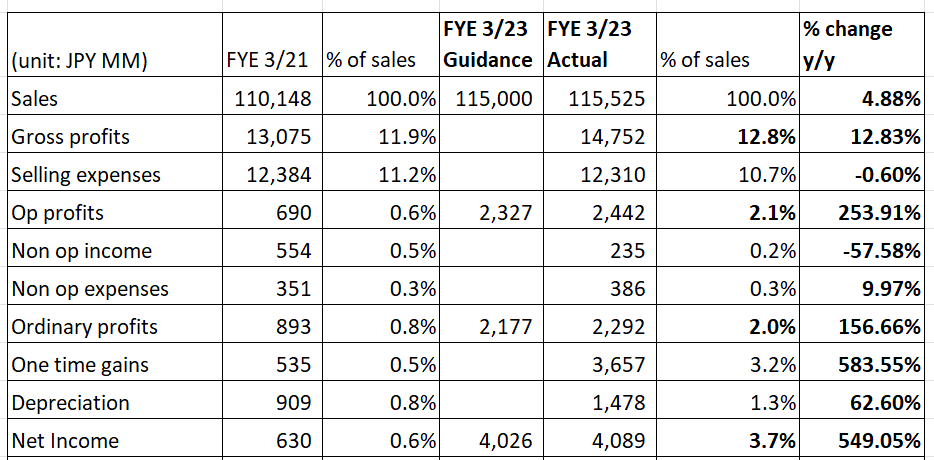

FYE 3/22 results

(Source: Financial results briefing for FYE 3/22)

FYE 3/22 sales went up 5% from a year ago, driven by 1)food service recovery in post-Covid environments and 2)254 contract wins in new after-school programs.

Gross margin improved from 11.9% to 12.8%, due mainly to closure of non-performing food service stores.

Operating profits and operating margin more than doubled, thanks to 1) operation processes being adjusted to Covid environments in food and vehicle services and 2) a rise in one time vehicle service orders.

FYE 3/23 Guidance

The Company expects that the similar recovery in sales (+ 4% year over year) and operating profits (+ 52%) as the gradual normalization of economy, along with improved sales team should lead to group wide higher sales. New contract wins in addition to over 90% retention rate bodes well for operating profit increase.

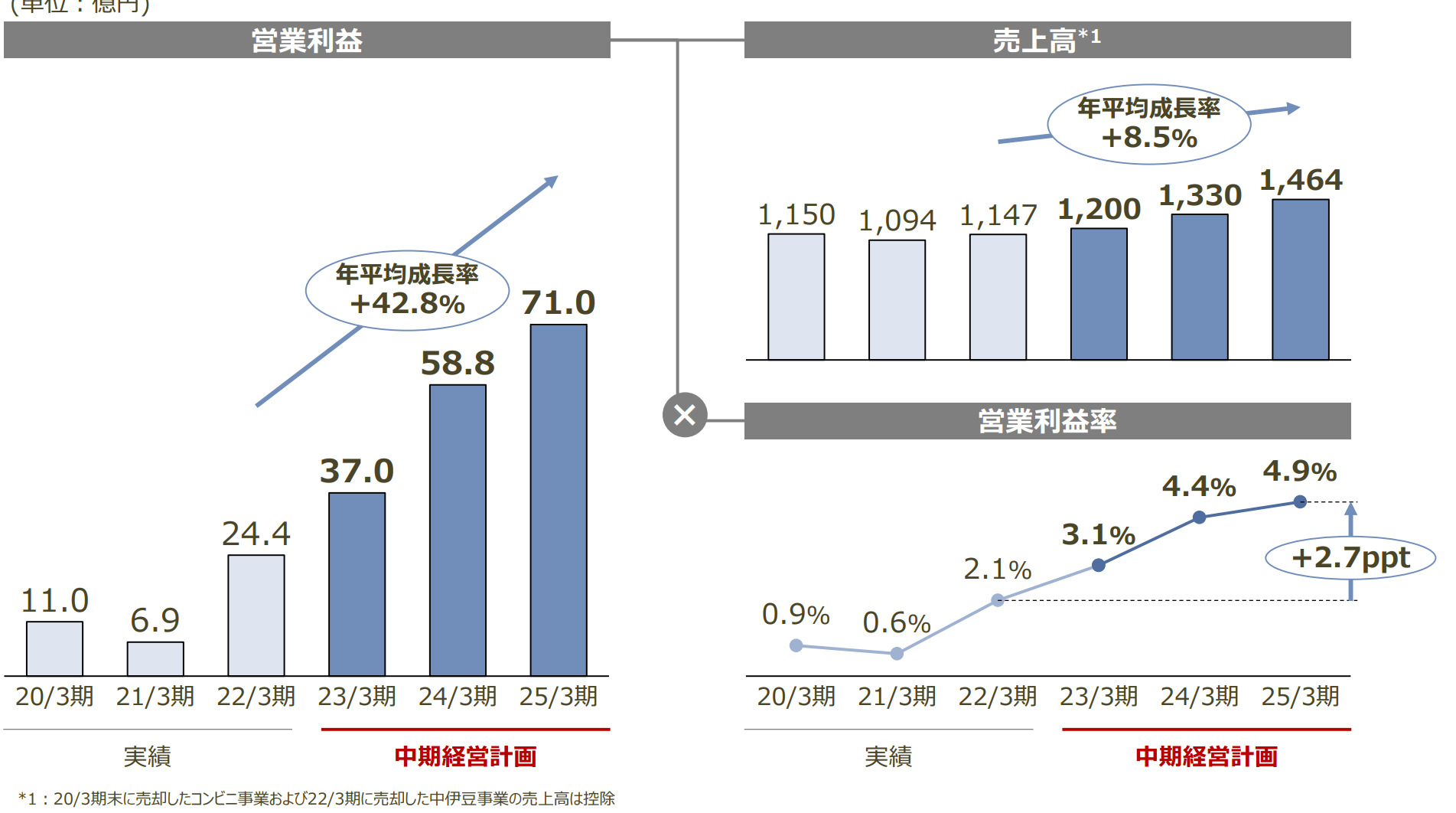

The three year growth plan

Translation of the below three graphs.

Left: Operating profits: average annual growth of 42.8% from 3/23 through 3/25.

Upper Right: Sales: average annual growth of 8.5% from 3/23 through 3/25.

Bottom Right: Operating margin up by 2.7% from 2.1% to 4.9% from 3/23 through 3/25.

These goals seem to be realistic, supported by problem solving solutions laid out in the above Investment Theis 1).

Unit: JPY MM

(Source: Re-growth 2025 presentation)

5. Total Addressable Markets (TAM)

Below, potential market size of the company’s major customer industries is discussed.

The common traits of these industries is that a rate of outsourcing is picking up, as aging Japan is suffering from labor shortage in many segments of the economy.

1. School/Hospital Lunch program industry

The industry size is JPY 3.7 Tn ($37 Bn) of which 70% is outsourced to the 3rd party operators. Top 20 players account for 20% of the market with Shidax among top 10. Remaining 80% is served by small companies. The lunch service industry requires a large scale in ingredients procurement, thus, Shidax expects to absorb smaller companies to augment organic growth.

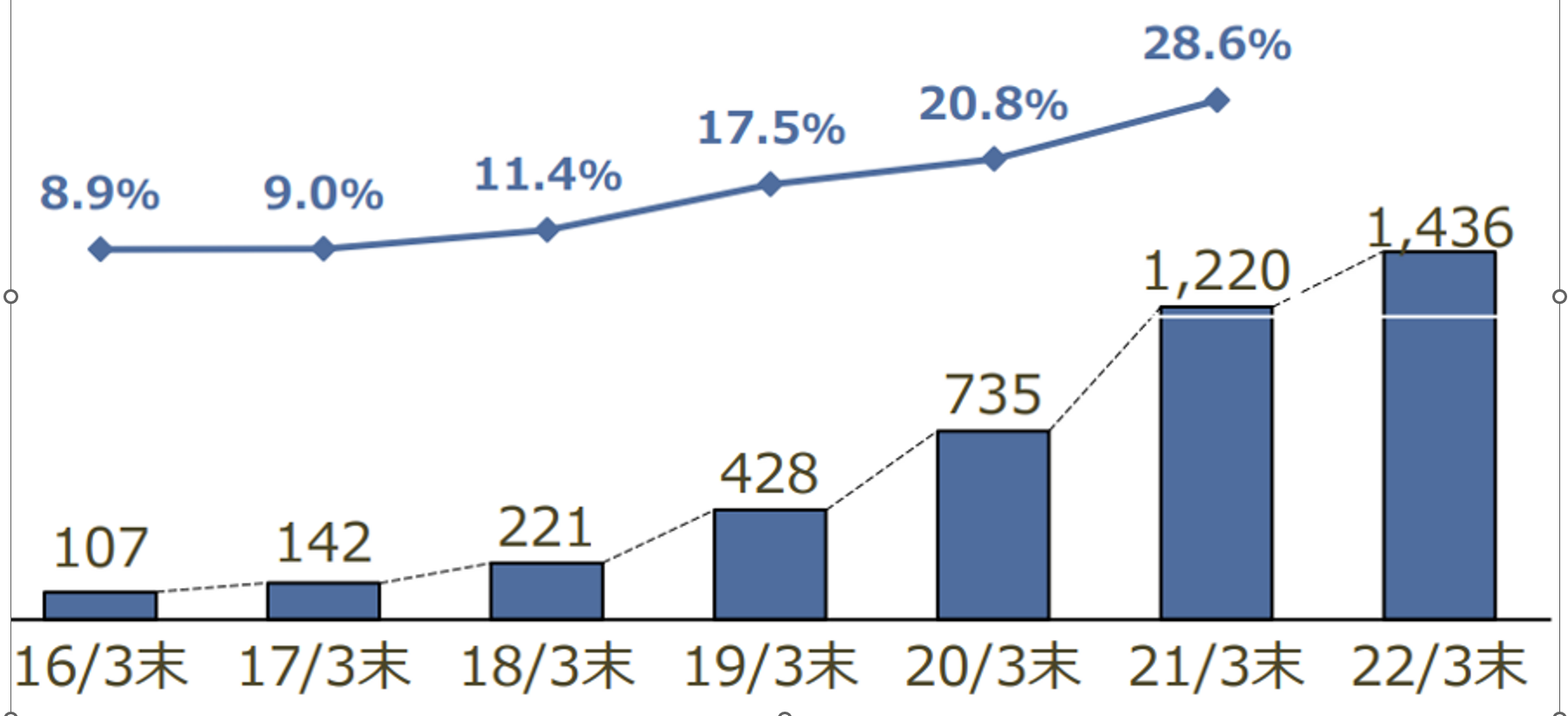

2. After school child care facilities

After-school child care market is estimated to be JPY 466 MM ($466 MM), but outsourcing rate is still low at 13%, giving the players ample room for growth. The company is by far the leader with around 30% share as shown in below bar graph. The company’s share gain is attributable to their standardized operating procedures, ensuring that service levels are maintained at a high quality at all facilities.

Line graph: the company’s market share

Bar graph: number of classes

(Source: Japan National Child Care Association and the company research shown in Plan 2025)

3. VIP limousine services

The industry is JPY 140 Bn ($1.4 Bn) with outsourcing rate of 67%. This rate should increase as the drivers are aging, leading to the industry wide driver shortage. The industry is very fragmented and the company’s 10% share makes it among the top players. Its nationwide network sets Shidax apart and provide them an edge to gain new contracts.

(Source: the company research shown in Plan 2025)

6. Strengths and Weaknesses

Strengths

1) Long history and exposure in government supported industry

The company has a successful track record of running after school child care and municipal buildings. Thus, their mission is in line with the Japanese government’s goal of dealing with aging and labor shortage issues.

2. The sales and profit decline were reversed with a corporation with Unison capital, as discussed in Financial Highlights section.

Weaknesses

Turnaround is still at an early stage

The stock still is a show me story, since the operating profit increase was a recent phenomenon. However, as we can see in TAM section right above, the company’s customer industries are expanding. This bodes well for the company’s continued growth.

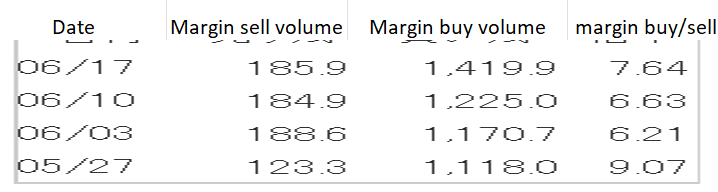

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Shidax, margin sell/buy ratio

Is high at 8x and margin buy volume is 3x of a daily transaction volume. There is a mild selling pressure, but if the stock can maintain the current large trading volume, it can move higher.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance