A Unicorn IPO from Japan on 9/29/21

Safie Inc (Ticker: 4375)

Strong fundamentals and marker issues make this stock a great IPO secondary*. This is a short version of the Safie blog which I would like to let you know before their IPO on 9/29/21. I would likely wait till the stock will form an IPO base, but you may want to buy it on 9/29 just in case it will experience a huge IPO pop. The more detailed report will be uploaded shortly in www. JapaneseIPO.com. Please read on.

*IPO secondary should not be confused with Secondary Offerings or Secondary Markets. IPO Secondary refers to the period after the initial IPO pop. Newly IPOed shares tend to retrace back to the lower share prices after the first couple weeks. Some shares even start to decelerate after the first couple days. Yet, there are the stocks which form IPO base (institutional due diligence/consolidation phase) a while and resume ascending trends to IPO Advance Phase, if the company’s fundamentals are solid. IPO Secondary traders will look for these stocks which can reach these steady upward phases.

Safie is NOT your typical security camera company. It is a cloud video recording platform with No.1 market share in Japan. The “Safie” platform and technology allows you to check video anytime and from anywhere via smartphones or tablets easily and is widely used not only for security and surveillance, but also for efficiency improvement and marketing applications. It is a subscription-based recording service and is a platform that allows you to add various video analytical solutions and linked services in addition to recording.

Safie’s growth profile which supports my IPO secondary candidate thesis:

- Safie offers high image quality, is inexpensive, and secure. It can be used as a surveillance camera service in a wide range of industries such as retail, restaurants, real estate, construction, security companies and government offices.

- The three founders worked together at Sony where they gained expertise to create SaaS based video recording platform which could be vertically applied by many industries and users. It is my understanding that vertical application of Saas requires higher technical acumen to complete.

- Safie will be a beneficiary of the recent popularity of SaaS business model in the stock markets. SaaS operations require a large upfront investment, but the following long tail of recurring revenues makes cash flow predictable which in turn makes working capital management easier.

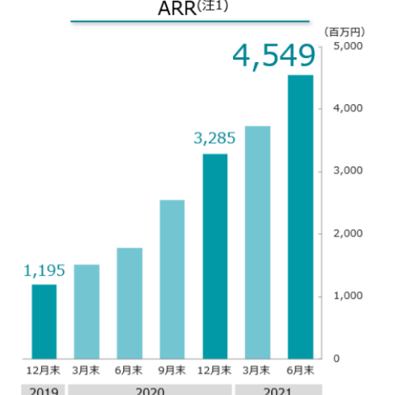

- The impressive growth of ARR (Annual Recurring Revenues) as we can glean from the below chart which shows explosive growth of their quarterly ARR from Q4/2019 through Q2/2021 (my report which will be uploaded shortly discusses their financials in more details).

(Source: IPOKabu.net)

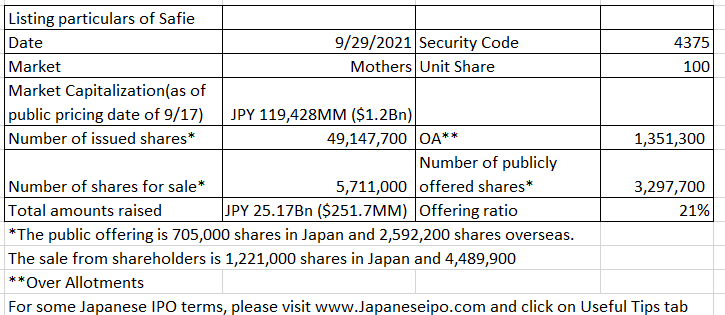

- Supported by the above growth attributes, despite its short life as a company (founded in 2014), it will be listed on Tokyo Mothers’ exchange as a Unicorn.

Despite my excitement on anther birth of a Japanese Unicorn, I am not planning on buying Safie on its public debut day. The reasons:

- IPO trading on the first day has become increasingly difficult. The below table from ipokabu.net shows the initial open prices and closing prices of recent 10 IPOs. Yellow indicates the price is higher than the previous day closing, and blue is vice versa. Clearly, there are more blue days than yellow ones. I suspect the reason is that IPO pops are well known and many investors flock to IPOs and push up the share prices which often attract AI sell programs.

(Source: IPOkabu.net)

- Specific to Safie, there is another attractive IPO (Project Company: 9246) on the same day. Project Company has exhibited very strong sales growth over the last 3 years, and it is already net income positive. This may dilute investor attention and dollars.

- This is a big issuance. Total amount raised is JPY $25.2M. Thus, it may take a while all the selling is absorbed by the new buyers, i.e., high selling pressure.

- While there are not many ventures capital involvement, lock up price of 1.5x may work as a price ceiling.

Nonetheless, if you can watch ITA (an electronic board which displays second to second stock price moves and trading volumes) you may be able to catch a huge upswing before the stock suffers from sharp selling (Uwahige – long upper wick in a candle stick). Note: This piece is for an information purpose only and NOT a stock or a day trading recommendation.