Robot Payment (Ticker: 4374): A Software as a service (SaaS) company for SaaS clients and profitable at that!

Robot Payment is a great stock with supportive SaaS industry back drop. The SaaS industry growth potential is well known. Thus, I would like to focus on the company’s competitive edge against its peers and new entrants.

Two technical points:

1) Robot Payment went public on 9/28/21. The stock is still within 90 days of lock-up period.

Lock-up periods refer to the time between when a company lists on a public stock market for the first time and when insiders are allowed to sell their shares. For the case of Robot Payment, venture capitalists are allowed to sell their holdings after 90 days of the initial day of trading and if the stock is higher than 2x of listed prices. The company IPOed on 9/28/2021 at JPY 3,725. The currently stock is trading at around JPY 3,700, thus, venture capitalists are still the owners of the shares. The stock can be exposed to selling pressure when the price reaches to 2x range.

The mitigating factors for this IPO specific risk is:

a) Venture capitalists accounts for 18% of total shareholders which is lower than typical IPO shareholder composition.

b) There is still room before the stock reaches 2X trigger price point.

2) Robot Payment shares have fallen about 30% from its high which means shareholders who bought the stock at its high is facing margin calls from their brokers. Many of these shareholders will likely choose to sell rather than meeting the brokers’ margin calls. This, in turn, will remove constant selling pressure and often lead to an ascending trend of share prices.

(Source: Trading View)

1. Who is ROBOT PAYMENT (“Robo Pay” or the company)?

ROBOT PAYMENT (“Robo Pay” or “the company”) provides an online payment settlement agency service since its establishment in 10/23/2000. It focuses on services targeting subscription business operators. In 2015, it has started an invoice management automation service, also responding to unique bookkeeping needs of subscription business providers. Both services are offered as SaaS type services, which generates stable sales. The recurring revenues accounted for 96.6% of total sales in Q3 for FYE 12/2021. Robot Payment does not sell robots.

2. Investment Thesis

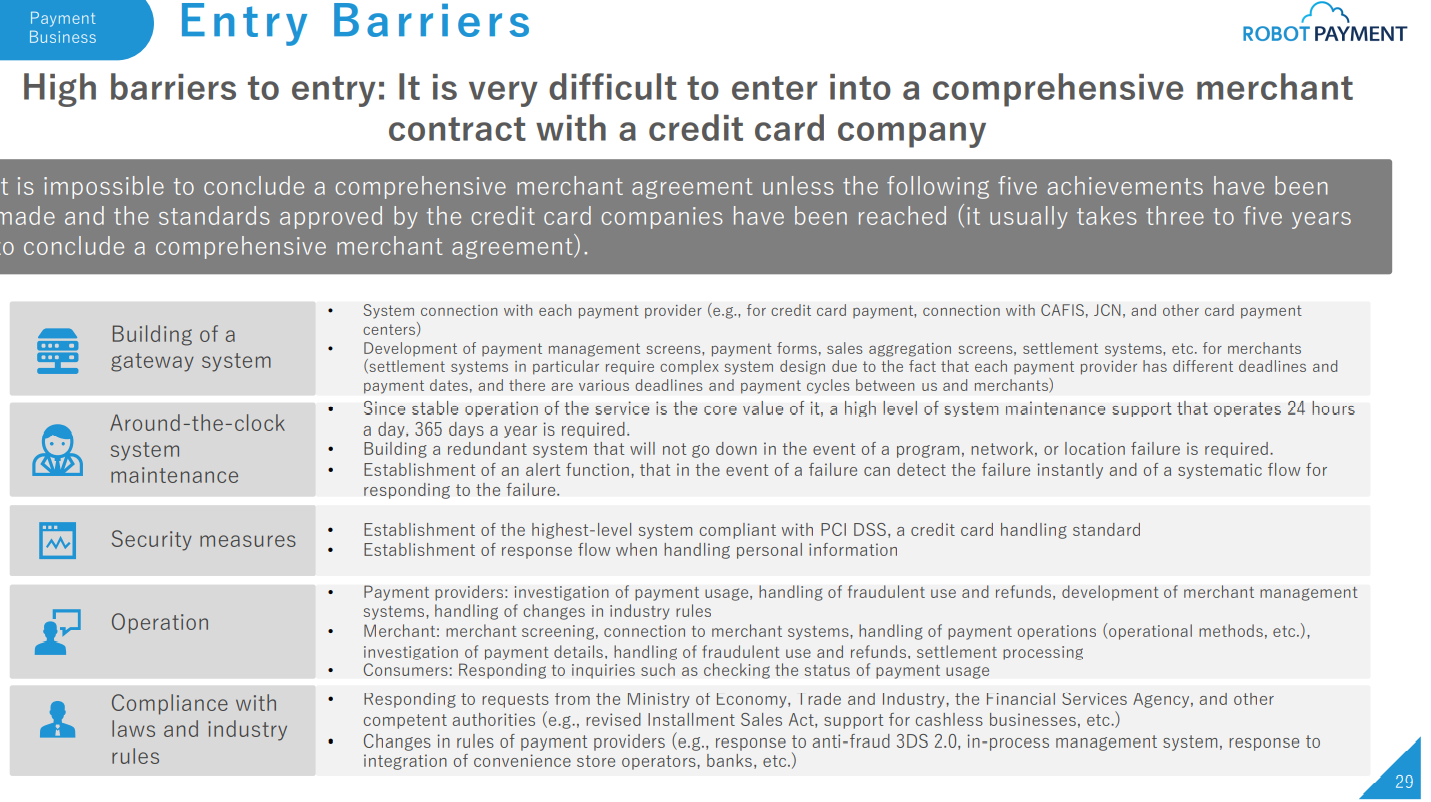

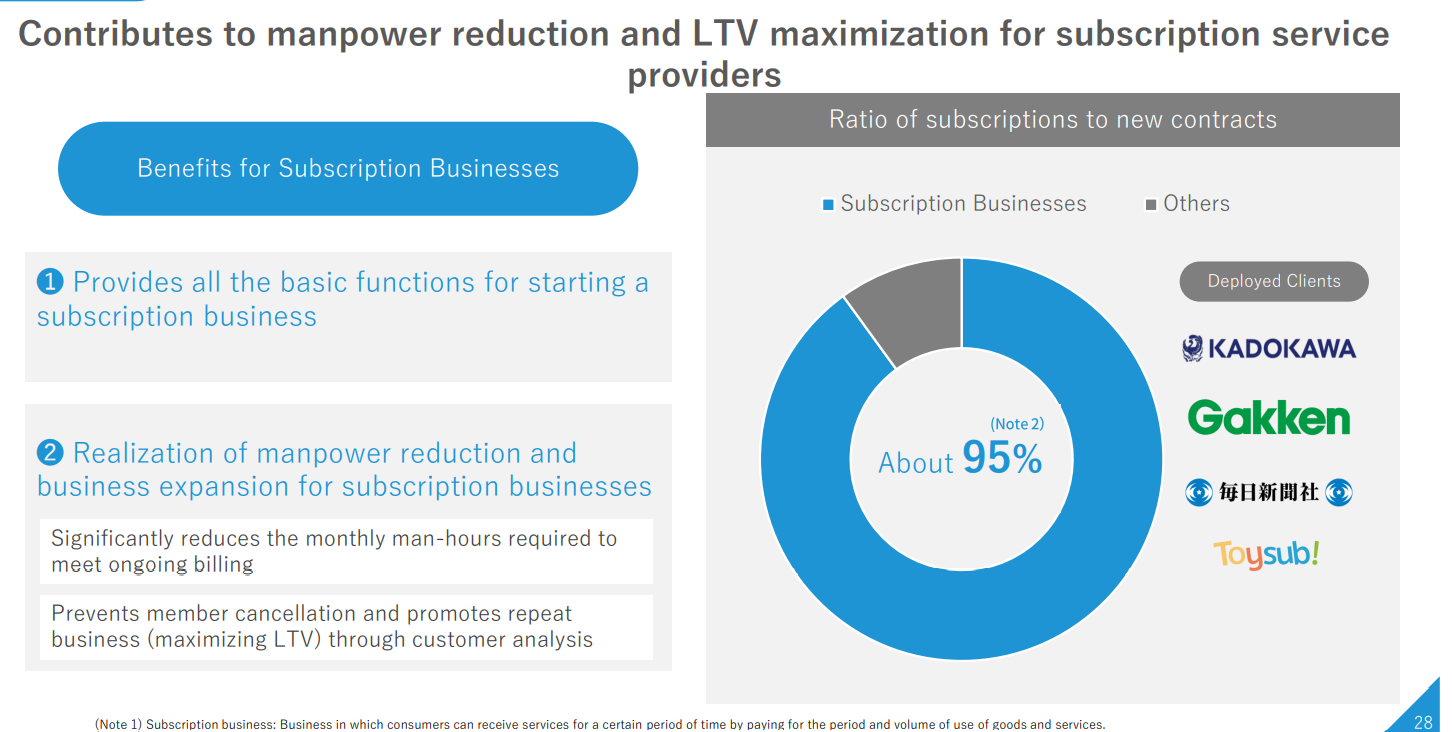

1) The company focuses on catering to the needs of the growing subscription industry. This focus is their competitive edge, supportive by their versatile system, long proven history and trust gained with credit companies. There are few other entry barriers which are discussed in “Business Model” and “Strengths and Weakness” sections.

2) The Japanese government is keen on digitizing Japanese companies.

The company is the beneficiary of government’s official mandates, promoting country-wide transition from manual task handling to digitized (often cloud-based) systems. Thus, Robo Pay is similar to Money Forward which I discussed in September. Indeed, the “Digital Agency”, which is a new regulatory body, was launched on 9/1/21 to lift Japan from the bottom of a ranking on fintech adoption in the world.

3) Robo Pay is itself a SaaS company, which enjoys the steady sales stream, and is already net income positive. This ARR focus business model tends to command higher stock multiples such as price to earning ratio.

3. Business Model

The company’s businesses are divided into two reporting segments:

1) the payment business that provides the online payment settlement agency service, and

2) the financial cloud business that provides the invoice management automation service.

The payment business (1) accounts for around two thirds of net sales, but the financial cloud business (2) is achieving higher revenue growth recently.

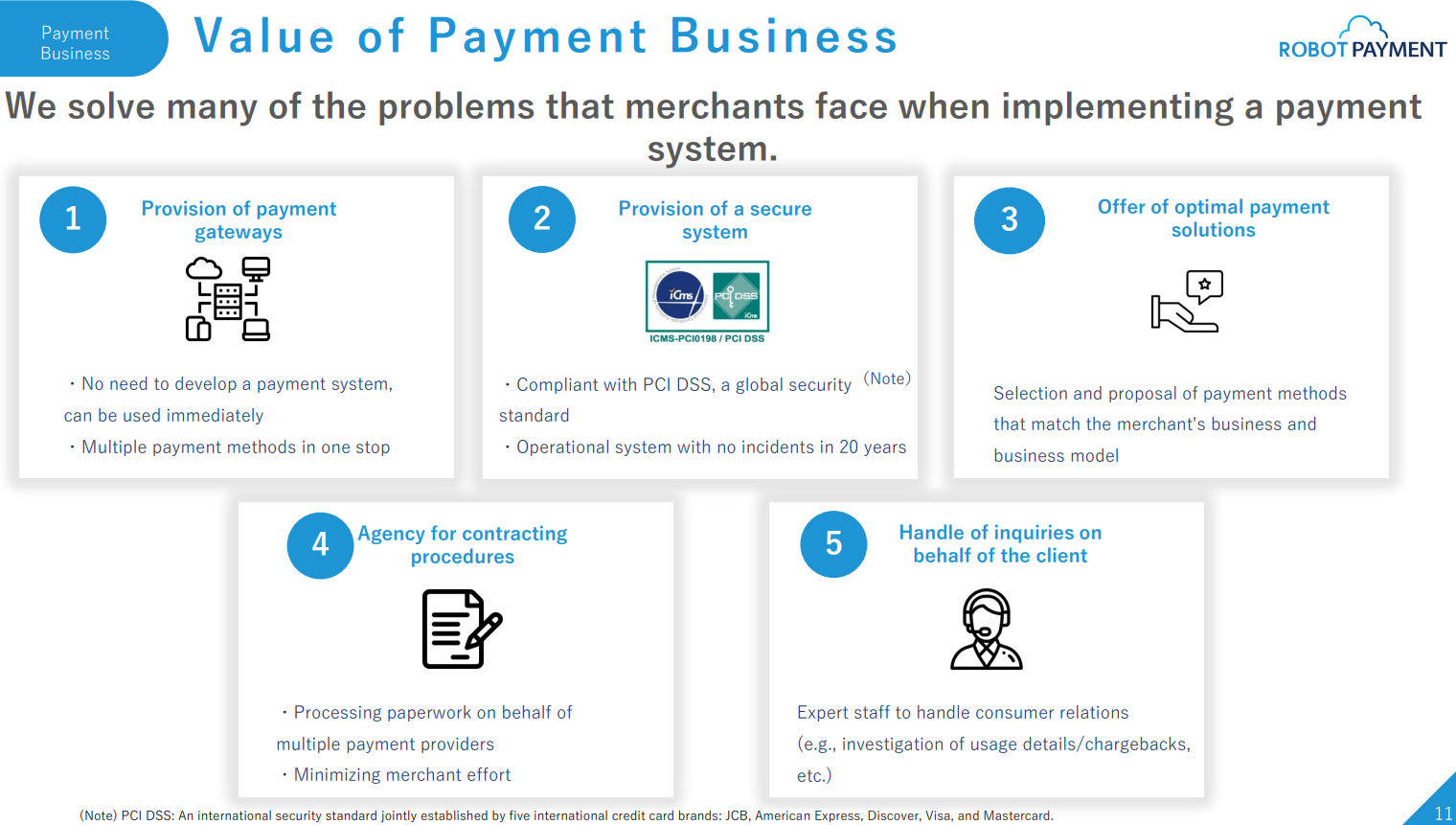

1) The Payment Business

The company provides an online payment settlement service by integrating contact points between various payment settlement operators such as credit card companies with their member stores. As shown in the below chart, the company can handle most payment settlement methods which can widely differ based on merchant’s type of businesses and their customers’ preference. Robo Pay’s clients include companies in wide range of industries, such as Kadokawa, Toysub, Japanese red cross society, and municipalities.

(Source: Disclosure of matters related to business plans and growth potential as of 9/28/21, posted on the company’s website).

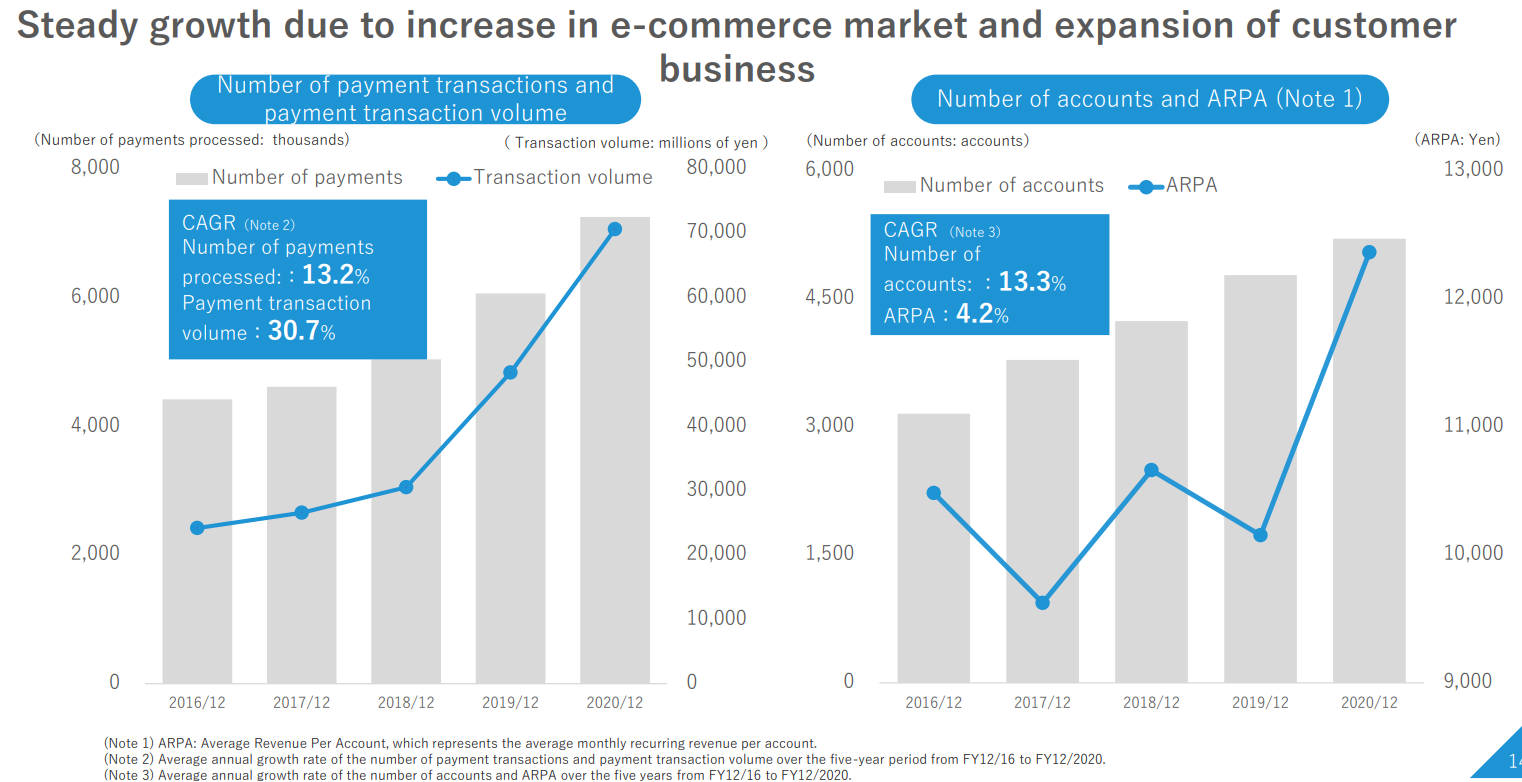

The below two graphs show the steady growth of payment transaction volumes since 12/16.

(Source: Disclosure of matters related to business plans and growth potential as of 9/28/21, posted on the company’s website).

Strengths and Differentiating Factors of the Payment Services

1) Multi-faceted supports. The company supports each subscription providers’ unique needs. Subscription providers can offer various settlement methods, periods, frequency based on their customers’ needs and preferences.

2) Gateway: Robo Pay offers payment settlement gateway which works as a window to all other settlement services such as credit card companies and convenience stores. In Japan, it is common for consumers to pay their bills (utilities, online stores, etc) at convenience stores.

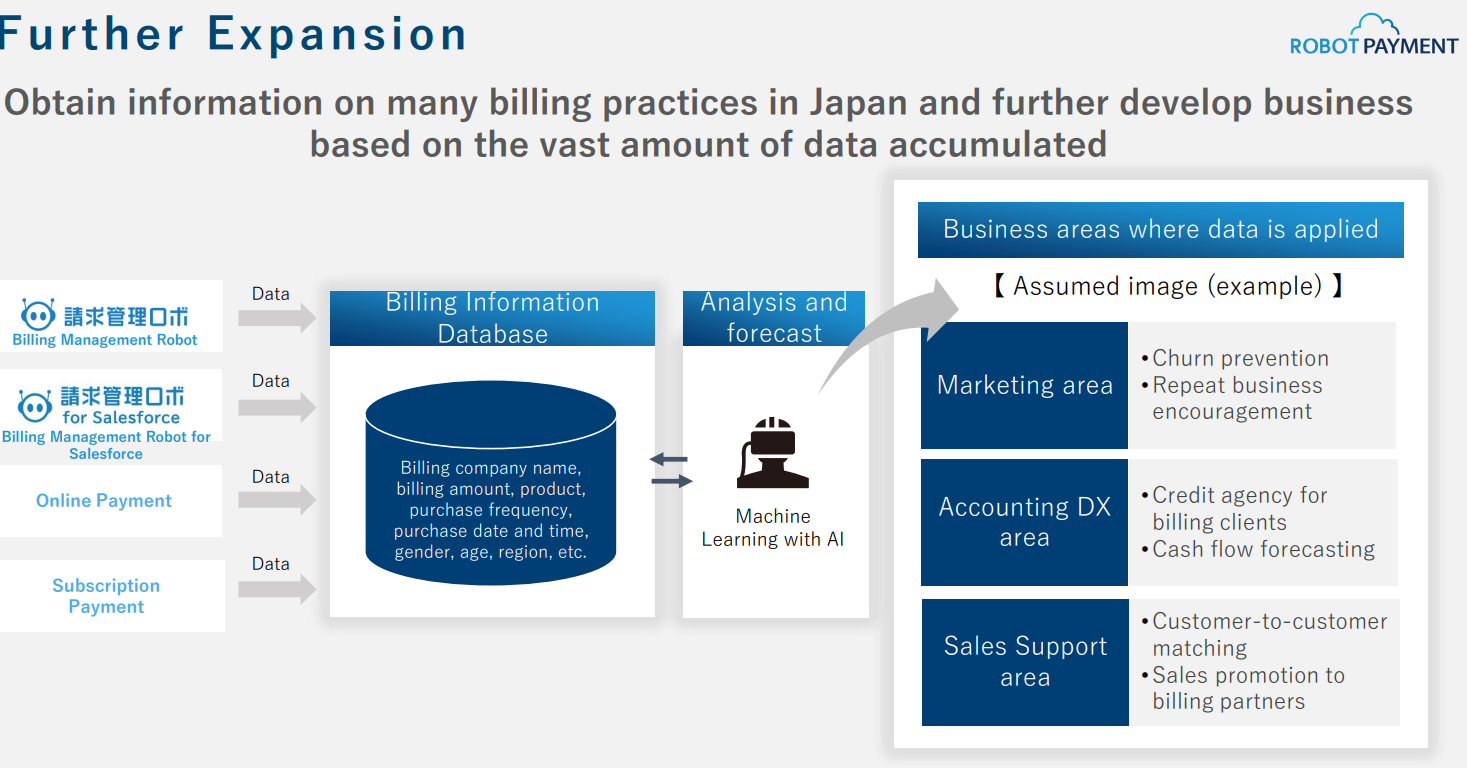

3) Customer Data Base: The company has accumulated data base on end users which their clients can use to manage the relationship with end users. Robo Pay believes that this huge data can help them in offering fine-turned marketing supports refer to the below chart).

(Source: Disclosure of matters related to business plans and growth potential as of 9/28/21, posted on the company’s website).

4) Relationships and Trust gained with credit card companies via working with them since 2000: This is a big entry barrier since it will take 3-5 years for new entrants to earn trust from credit card companies.

Sales Avenues (there are 4!)

1) Initial: the customers (subscription providers) pay one-time Robo Pay installation fee.

2) Monthly fees: system usage monthly fees

3) Settlement commissions: Commissions paid per sales volume of the customers

4) Settlement fees: Fees based on numbers of payments processed

2-4) are recurring revenues.

2. Financial Cloud Business:

There are two different types of the products

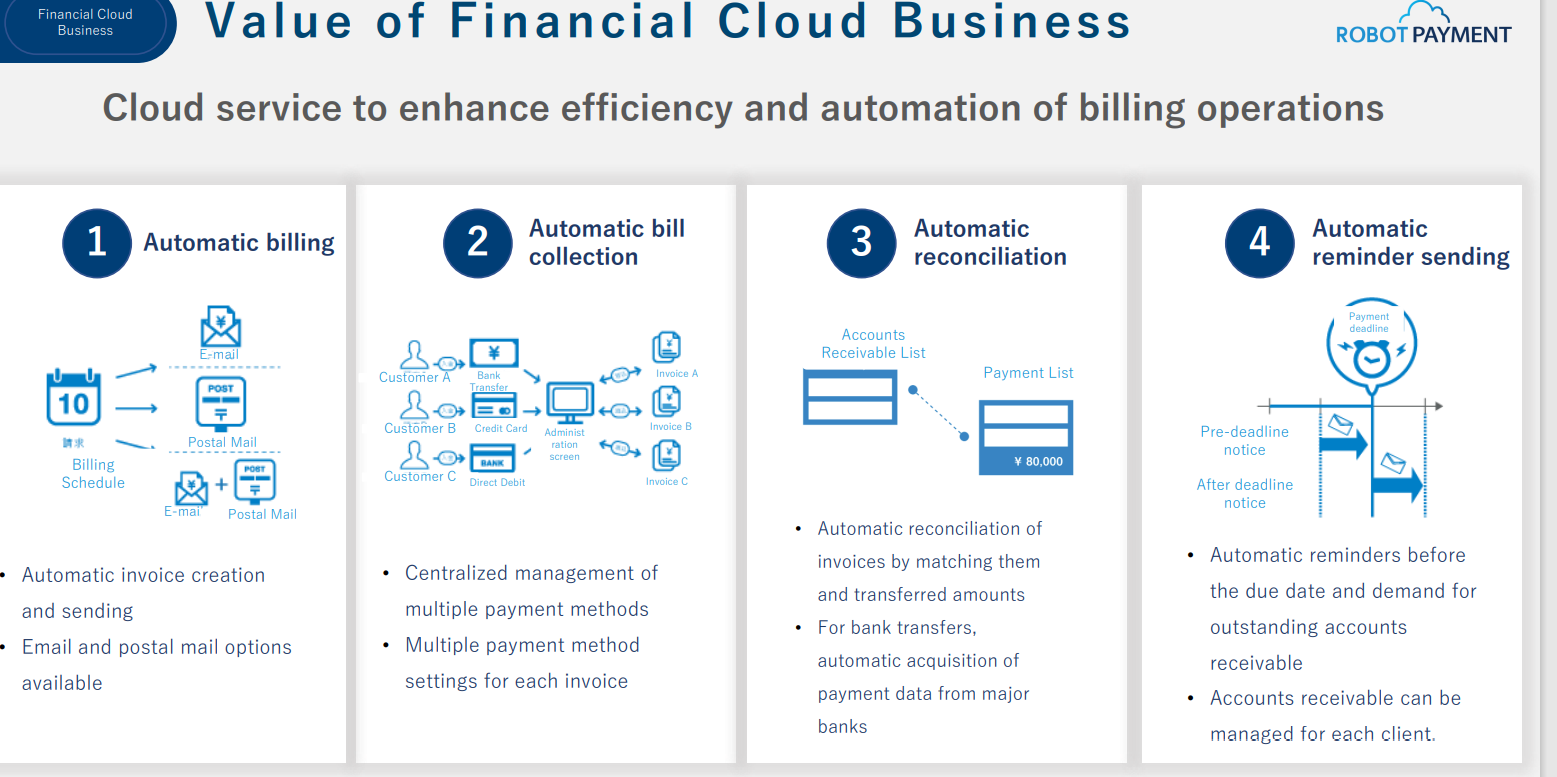

1) This division offers “Billing Management Robot” Payment Settlement Services (“Seikyu Kanri Robo”). Billing Management Robo streamlines and automates monthly invoice management operations, including credit/background check on new accounts, invoicing, payment collection, payment recording and payment reminding, which are large in volume and could be complex. This service is available for anyone with Internet access.

2) Billing Management Robot for Salesforce: This product is designed to be used in SalesForce environment which allows users to combine CRM function of SalesForce with the billing processing of Robo Pay. As such, users can enjoy efficient client management from “marketing” through the collection of accounts receivable. The company even offers “Factoring” service for clients who would like to receive funds before accounts receivable due date.

(Source: Disclosure of matters related to business plans and growth potential as of 9/28/21, posted on the company’s website).

Sales Avenues

1) Initial account sign-up fees

2) MRR (Monthly Recurring Revenue): Fixed monthly usage fee + Pay-as-you-go fees (such as postage and additional usage fees beyond the set numbers of usage by the contract).

Strength and Differentiating Factors of Financial Cloud Business

1) Strength lies in the company’s ability to manage the entire billing process for clients, starting from the initial billing, collection, appropriate accounting of the received funds, and contact to the end users who are behind payments.

2) Collaboration with other accounting software and CRM will entice new users to sign up with Robo Pay’s Billing management service.

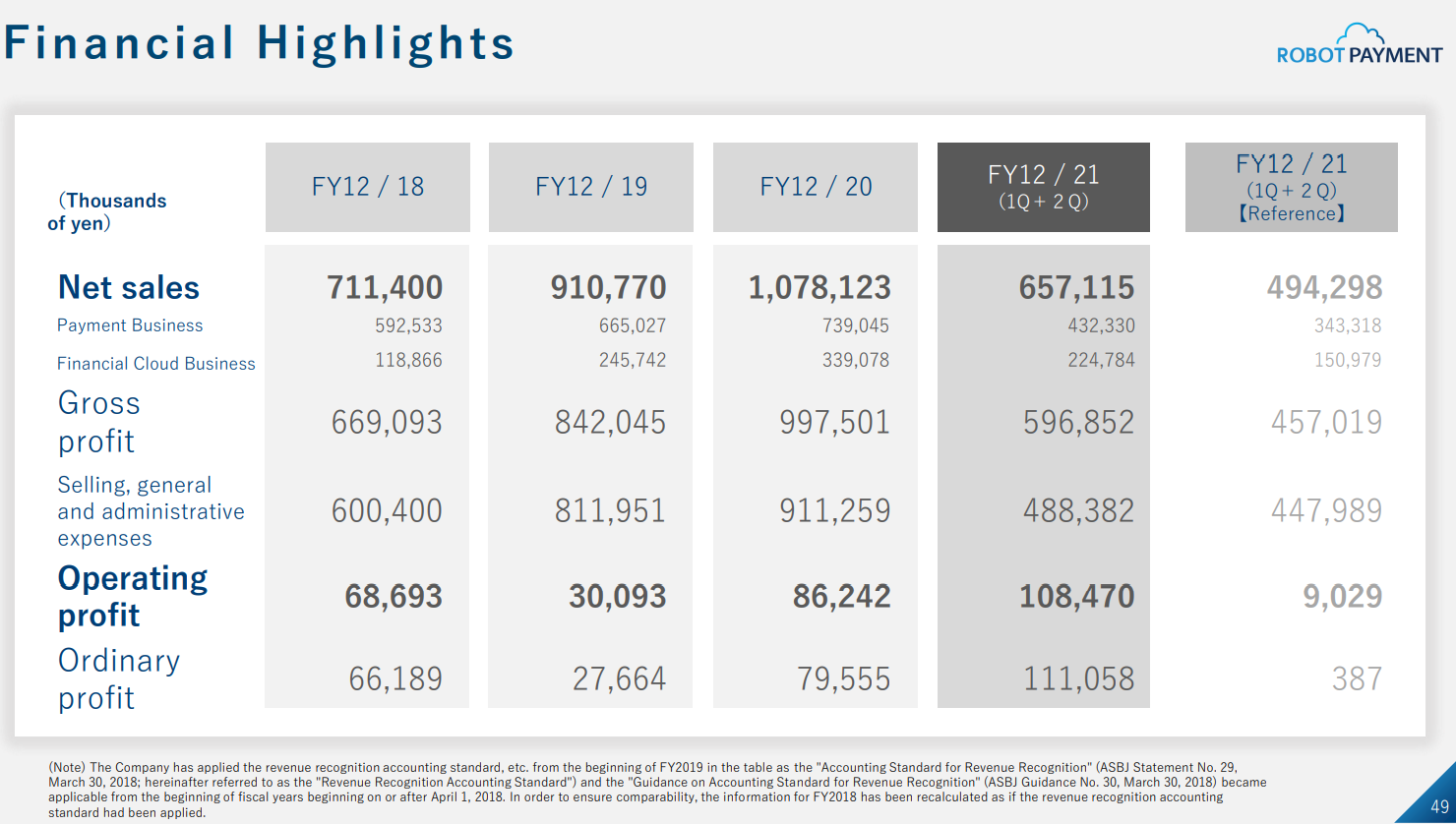

4. Financial Highlights:

(Source: Disclosure of matters related to business plans and growth potential as of 9/28/21, posted on the company’s website).

(Source: The company’s Q3/21 financial results presentation as of 11/12/21)

The company upped the full year sales guidance by 3% to reflect the good progress toward a full year plan. Increase in operating profits are driven by strong showings of two groups and lower interest expenses after paying down some debts.

5. TAM (Total accessible markets)

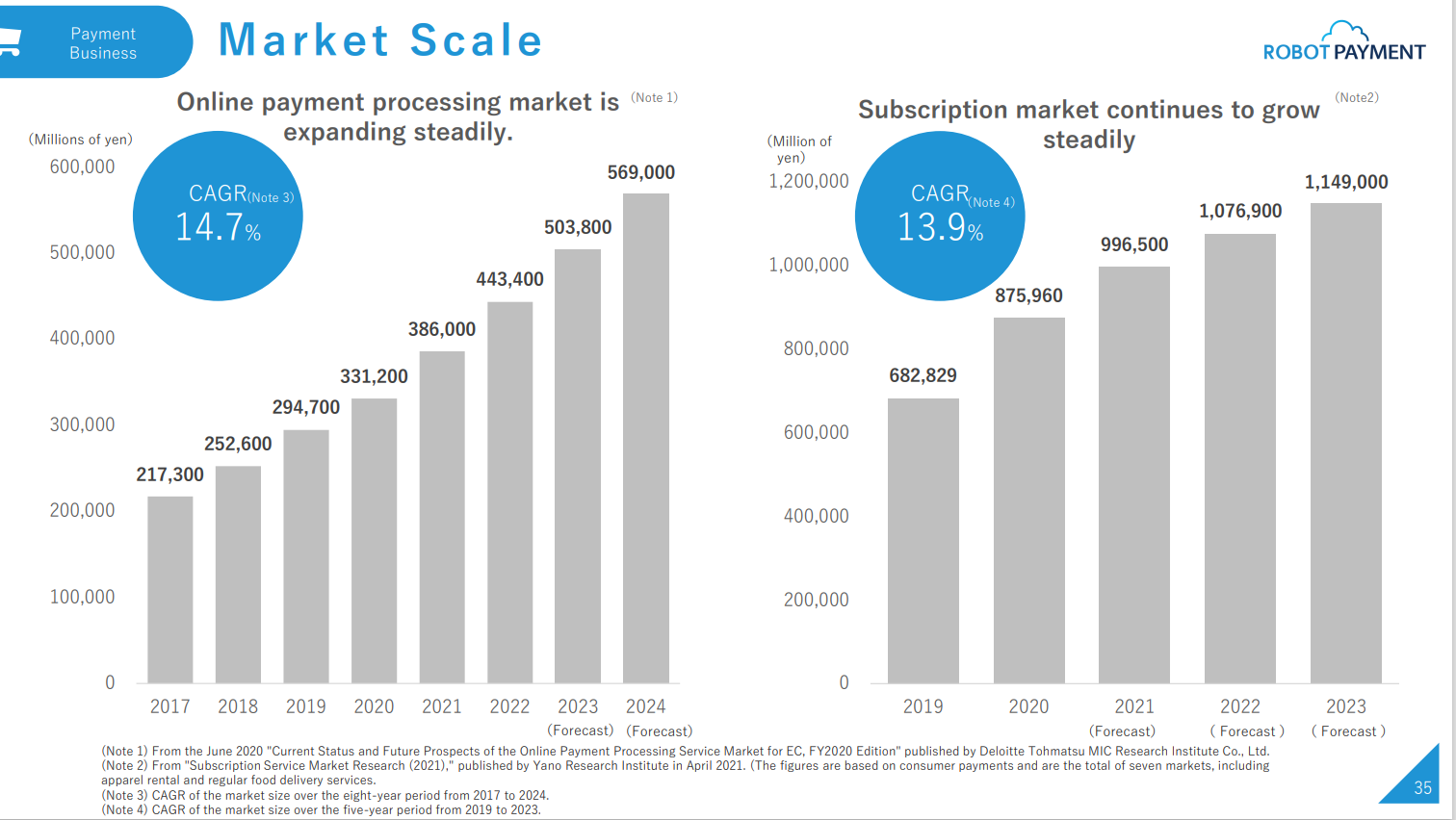

1) Market potential for Payment Services:

The below two graphs show steady industry growth of Japanese domestic online payment (left graph) and subscription market (right).

(Source: Disclosure of matters related to business plans and growth potential as of 9/28/21, posted on the company’s website).

Note: The above graphs are taken from Robo Pay’s presentation material at the time of IPO in 9/21. Thus, we tried to get more recent data as follows. The industry growth was slightly better than earlier estimate.

According to MIC Research Institute (a Deloitte Tohmatsu business), In FY2020, the online payment agency service market was about JPY 357Bn, 118.8% of the previous year, driven by the growth of the domestic EC market. In 2021, high growth continues, due to steady increase in stay-home consumption, which is about JPY 417Bn, 116.9% of the previous year number.

For subscription market, Yano research has not updated the numbers. The size of the domestic market for subscription services in 2020 is JPY 875,960 MM up 28.3% from the previous year based on end-user (consumer) payments. In 2021, it is forecast to increase by 13.8% to 996.5Bn. Yano included the below industries in their subscription market estimate: 1) apparel, 2) restaurants 3) consumer electronics, 4) shared living services, 5) tutoring, 6) entertainment contents, 7) cosmetics.

Market share of Robo Pay: The company’s payment service group generated JPY 739MM in sales for 12/20. It is hard to get their market share since the payment group belong to both of the above two industries. Nonetheless, it is safe to conclude that Robo Pay currently accounts for a small portion of the industry, enjoying large growth potential.

2) Market Potential for Financial Cloud Services:

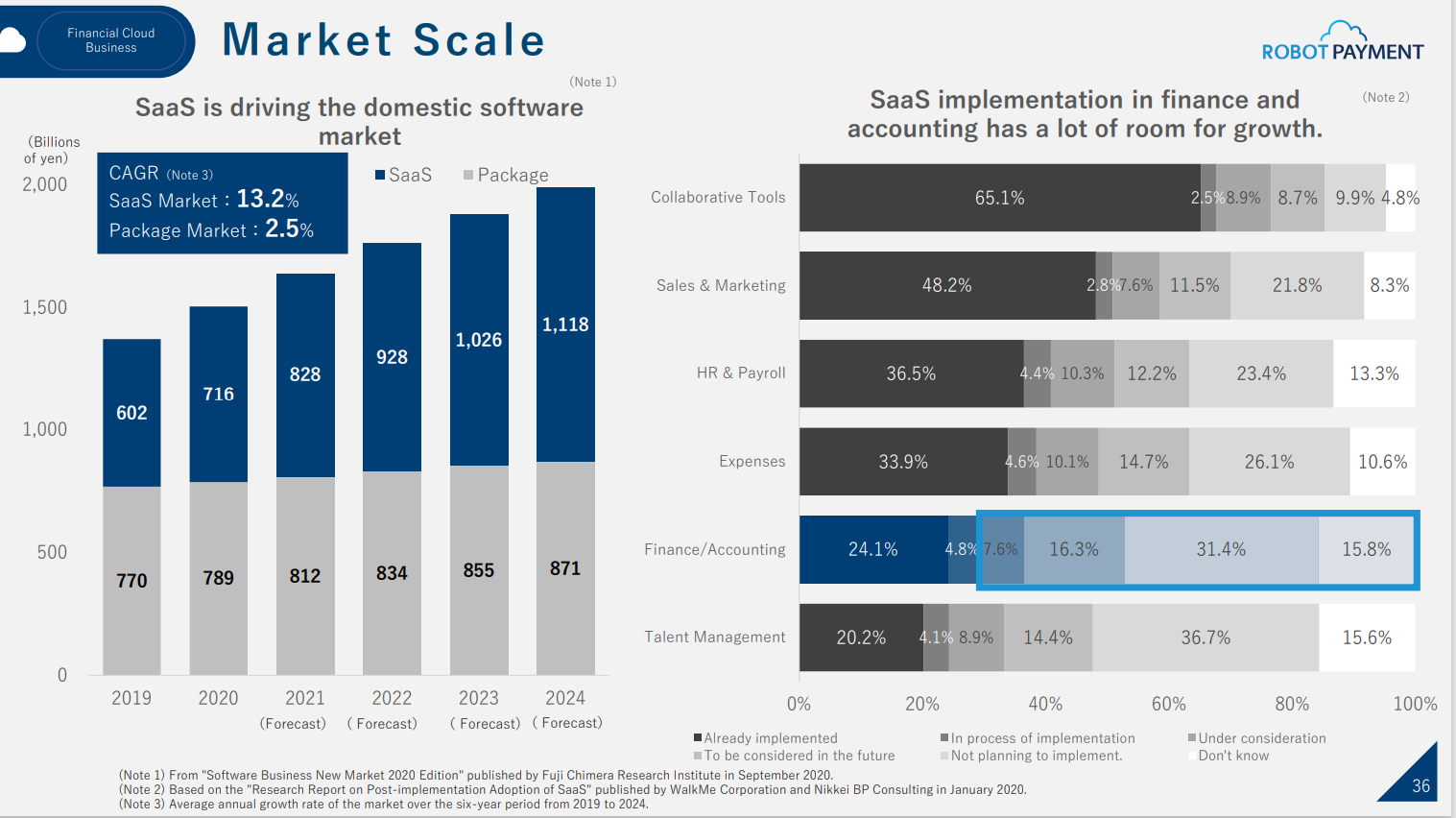

The below graphs are also presented in the company’s IPO presentation materials.

(Source: Disclosure of matters related to business plans and growth potential as of 9/28/21, posted on the company’s website).

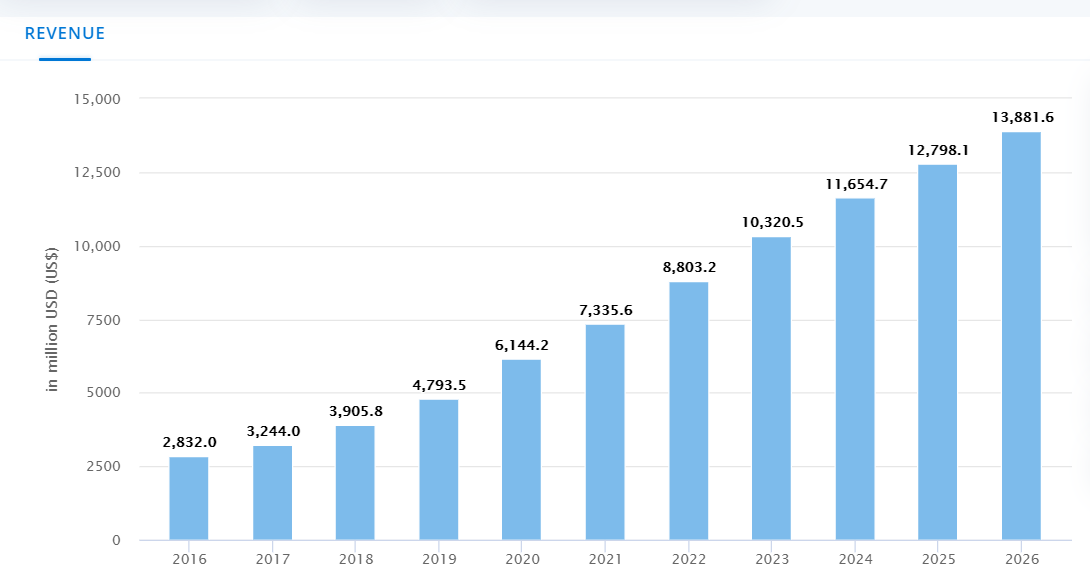

As a reference—

Statista estimated in 12/2020 that the Japanese SaaS market to reach US$ 7,336 MM in 2021. Its CAGR (Compound annual growth rate for 2021-2026 is 13.6% (vs. 13.2% in the left graph above)resutling in a market volume of US$ 13,882 MM by 2026. As a comparison, US number will be $98 Bn in 2021.

(Sources: Statista, Financial Statements of Key Players, National statistical offices)

Market share of Robo Pay: The company’s financial cloud group generated JPY 339 MM in sales for 12/20, vs. JPY 7,116 MM for the entire Saas industry. Thus, its market share was 5% in 2020, which indicates that the SaaS industry also presents the company a large growth potential.

6. Strength and Weakness

Strength

1. Industry back drop

As discussed in TAM section, the industries in which Robo Pay operates are estimated to enjoy 10-15% CAGR. The company is well positioned to benefit from the industry backdrop, since it empowers its clients to launch their own subscription operations and realize labor reduction and maximization of LTV (long term value from an account). Robo Pay’s customers can focus on their product development and marketing efforts and leave post-sales process to Robo Pay. The below graph explains this well.

(Source: Disclosure of matters related to business plans and growth potential as of 9/28/21, posted on the company’s website).

2. Entry barriers

The company is deeply entrenched in the eco-system of major credit card companies which works as a high entry barrier to new market entrants (see below).

Differentiating factors to fend off competitors:

1. Payment Services segment:

There are many players including GMO Payment Gateway, SB Payment Services (a subsidiary of Soft Bank), Sony Payment Services, DG Financial Technology (a subsidiary of Digital Garage). However, Robo Pay is the only firm specialized in “subscription service providers” which is the company’s competitive edge.

Furthermore, for companies like GMO payment, partner SIs(System Integrators) are writing individualized programs for them. GMO has established relationships with their SI partners, which works as a more costly option for their customers. However, it will be hard for GMO to severe relationships with their SI partners.

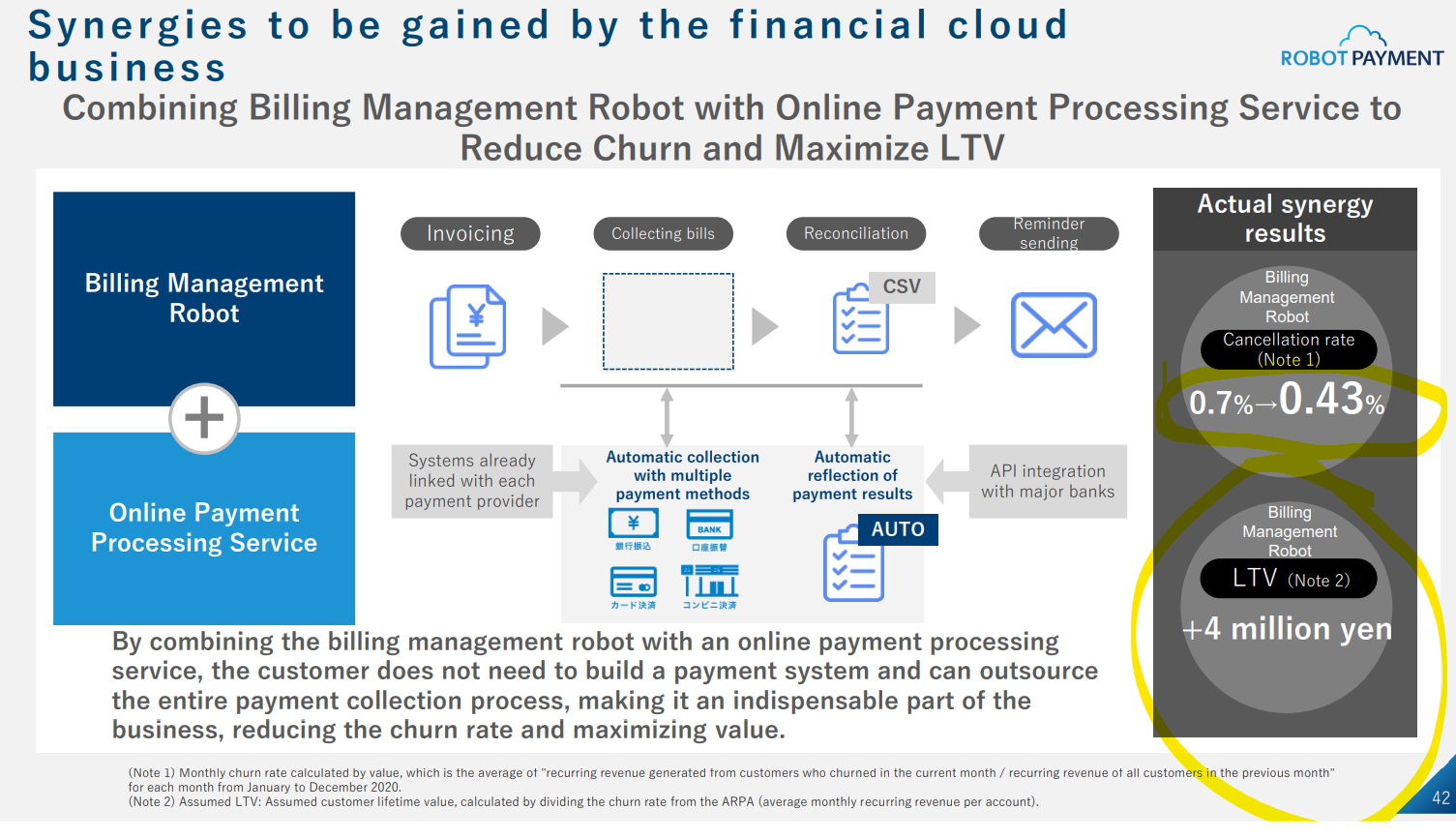

2. Financial Cloud segment:

There are many competitors which are larger than Robo Pay, including Rakus, Money Forward, Infomart, and Freee. They offer invoicing functions but don’t have settlement services. In order to offer payment settlement services, these compares need to change Data Base which carries a risk of personal data leakage.

The below charts highlight the benefit of having online payment AND billing management services under one roof. The clients tend to stay with Robo Pay (lower churn rate), as a result, one account’s LTV (lifetime value) increased by JPY 4MM ($40,000)

(Source: Disclosure of matters related to business plans and growth potential as of 9/28/21, posted on the company’s website).

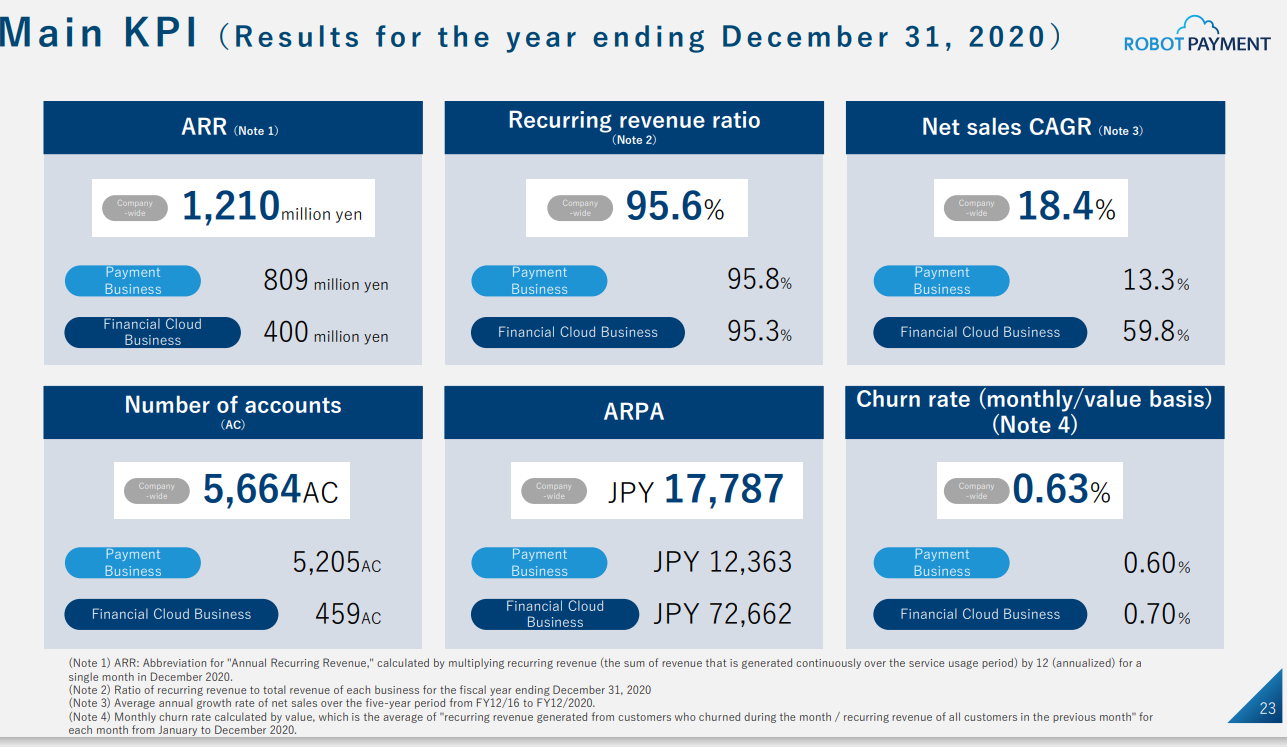

KPI (key performance indicators)

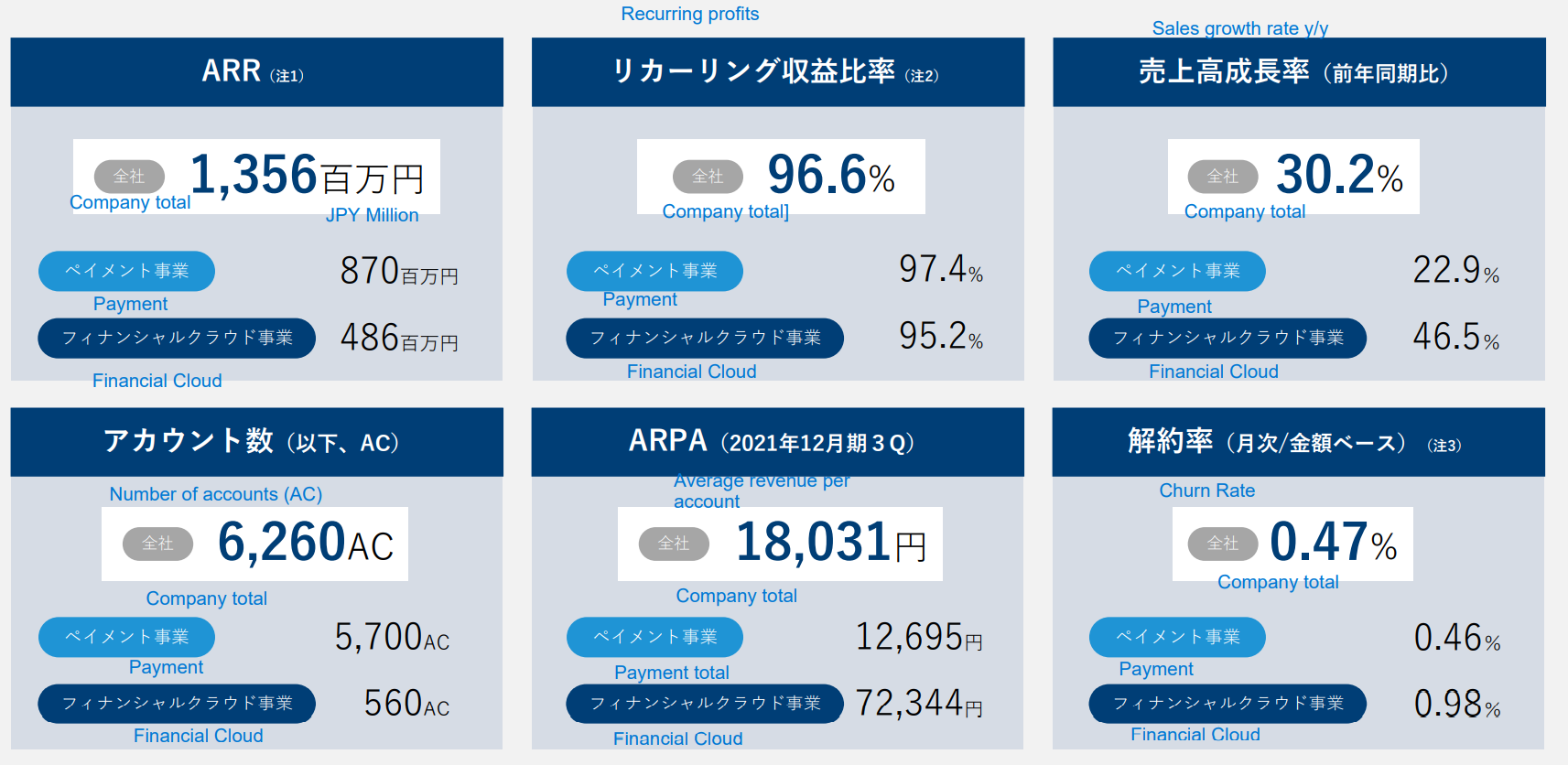

Another benefit of having all-inclusive payment and account management services is seen in the KPI improvement from 12/20 KPI and 9/21 KPI. It is noteworthy that sales CAGR for 12/20 was 18.4%, but sales CAGR for 9/21 was 30.2%.

(Source: Disclosure of matters related to business plans and growth potential as of 9/28/21, posted on the company’s website).

(Source: The company’s Q3/21 financial results presentation as of 11/12/21)

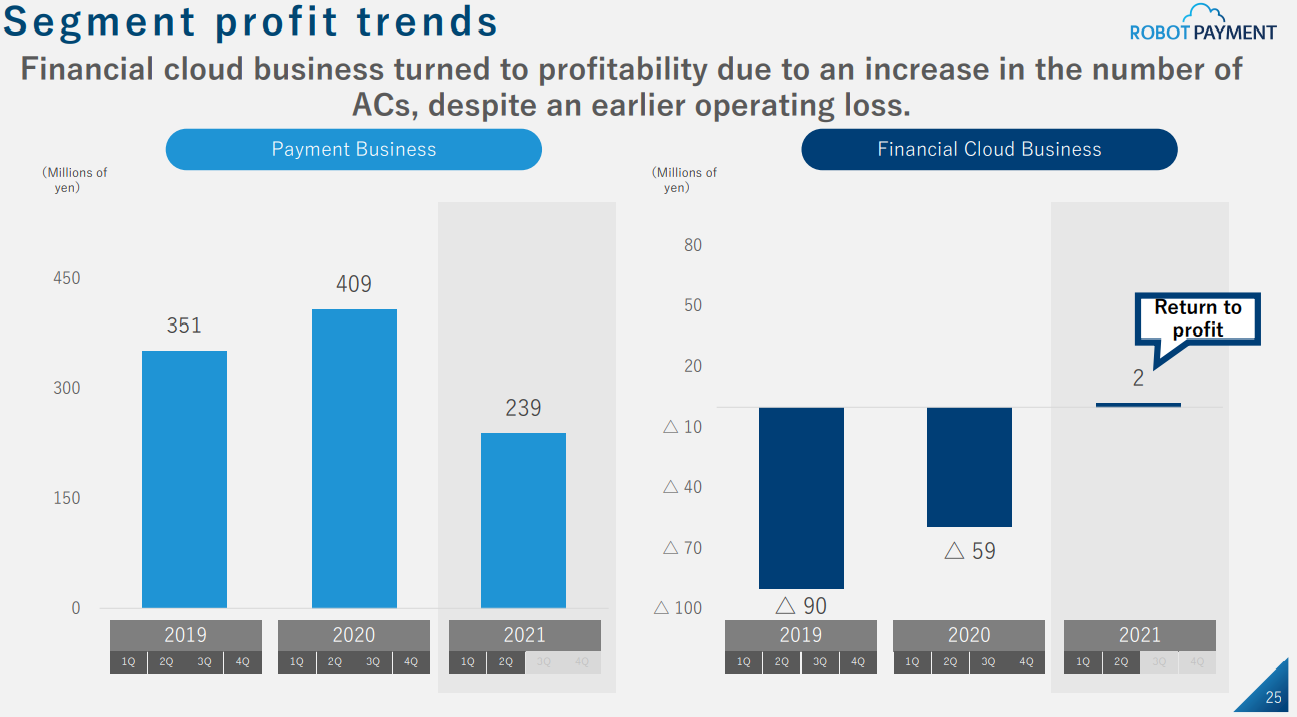

Finally, Financial Cloud group’s net profit turned positive, an impressive progress for this SaaS business which tends to be slow in becoming profitable.

Weakness

There are several near-term selling pressures as discussed in the very first section of this report. However, this short-term negative is well mitigated by long term and sustainable positives which Robo Pay represents.

7. Near-term Selling Pressure:

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Robo Pay, there is large margin buy volume still outstanding. This explains the recent downward trend of the stock. However, as noted at the beginning of this report, the stock is near 30% margin call line, thus, margin buy volume should gradually come down, leaving room for new buys to come in.

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance