RareJob (“RJ” or the “company”) provides one-on-one online English speaking lessons. To diversify its growth engines, in 6/20, RJ launched an AI based English speaking exam platform PROGOS. Furthermore, the company is now expanding PROGOS offering from the individuals to companies/universities. Its competitive edge is its vast user data accumulated from the exam/assessment results which allows RJ to finetune its products.

Japanese can’t speak English.

I have heard this comment more than I can count. I have also heard that some Japanese don’t believe they need to learn English since they have no plans to travel or interact with foreigners. Nonetheless, Japan needs to welcome more immigrants to offset dwindling working population. Therefore, more Japanese will be working side by side with non-Japanese speakers. Next, English proficiency will open up a wide window to data in many fields which are predominantly written and communicated in English. The improved access to data will surely shore up the Japanese economy.

In sum, English speaking ability is a necessary skill set.

So I went to look for statistical proof of the above unflattening statement: Japanese can’t speak English. This is what I found in Wikipedia. According to EF English Proficiency Index (EF EPI)* 2022, Japan ranked 80 out of 111 participating countries. At this rank, Japan is noted as a country with “low proficiency” as of 11/22.

The below is EF website explanation of EF English Proficiency Index:

The EF SET is an online, adaptive English test of reading and listening skills. It is a standardized, objectively scored test designed to classify test takers’ language abilities into one of the six levels established by the Common European Framework of Reference (CEFR).

I took a 15 minute quick quiz which tested me on reading and listening. For listening, a native speaker with a various county accent reads a sentence and a test taker needs to pick the best reply from 4 selections. I thought the selection was very tricky.

Regardless of my take on EF EPI, it is an undeniable fact that there is room for improvement in the English proficiency of Japanese speakers.

This need to improve English skill sets for Japanese is the foremost investment thesis of RareJob.

1. Investment Thesis

1. Provides a solution for the main pain point for Japan

Value prepositions of Rarejob Eikaiwa, which is the company’s original product, are many.

(Source: Financial Results for 9 months ending 12/31/22)

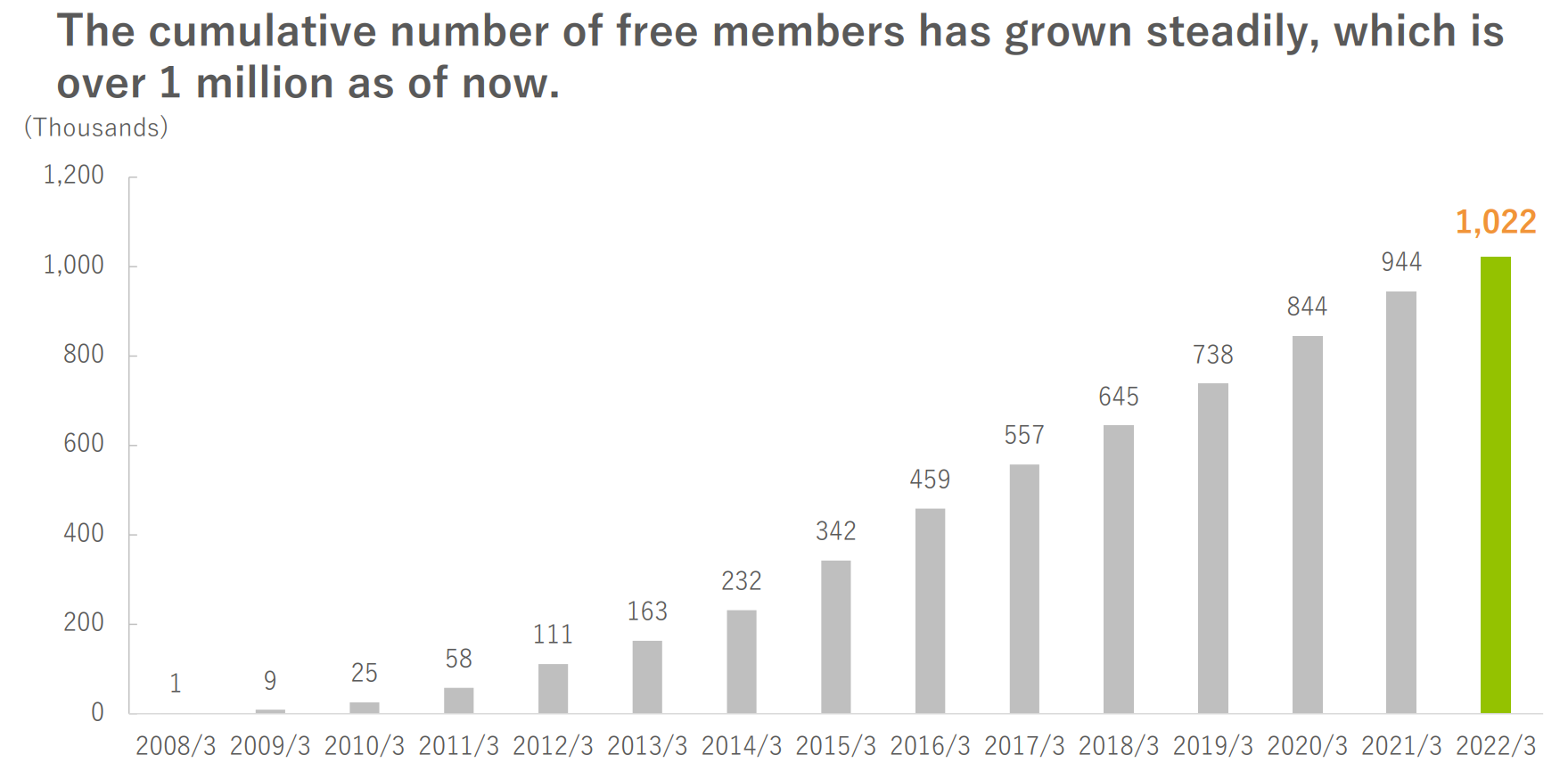

*Its tutorial lessons have been so far offered to 1 million cumulative free subscribers (two lessons are offered at no-charge) and Rarejob has typically 90,000 registered users/year. Learners tend to stop lessons after achieving certain level of proficiency which is one year on average. RJ has taken initiatives to lower churn rates through lesson quality improvement. Also, offsetting the churn rate is 1) the company’s expansion into new growth area (lessons to businesses/schools) and PROGOS.

*RJ boasts 6,000 Philippine tutors who are hired through a stringent selection criteria (about 1% hiring rate).

*The company offers flexible lesson hours: from 6 am to 1 am.

*Reservations can be made up to 5 minutes before the lesson.

* A 25-minute plan is priced at JPY 7,980/month.

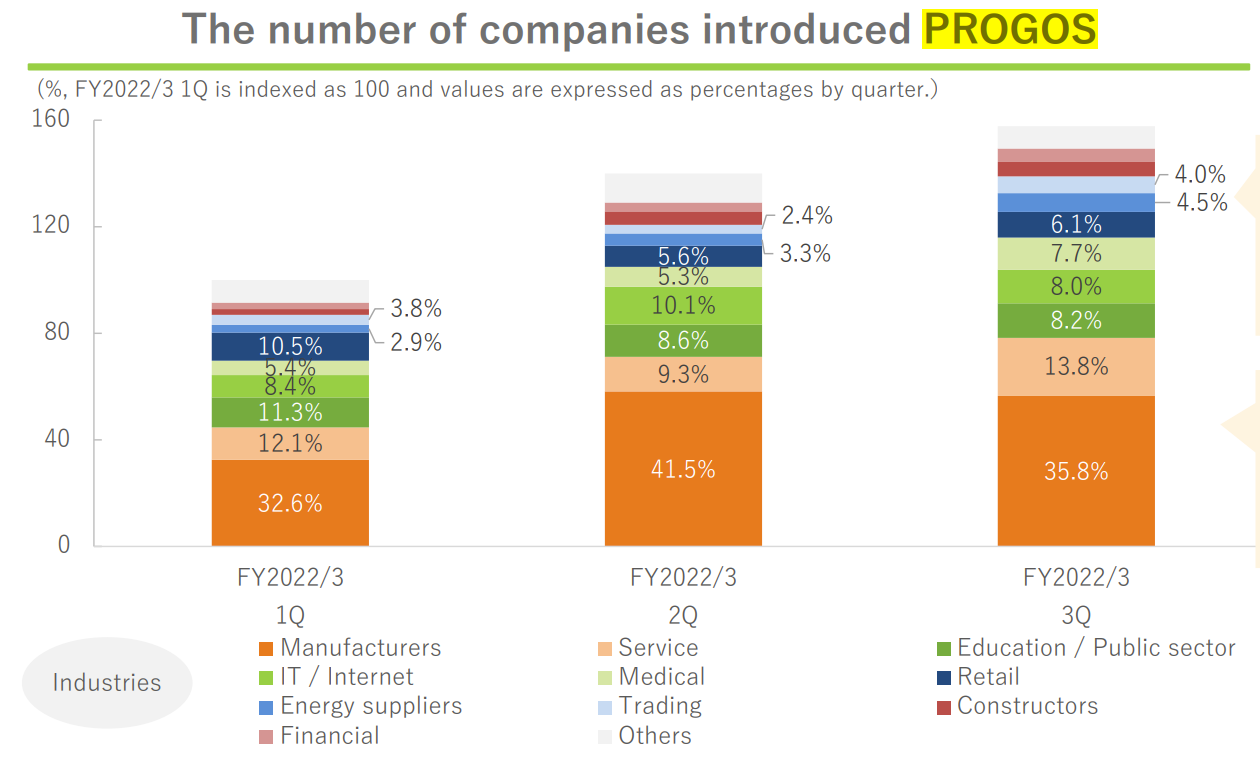

2) The company’s next growth engine, PROGOS, is steadily adding user companies, as shown in the below graph. (PROGOS is the AI based scoring system to gauge the applicant’s English speaking skill sets.

(Source: Financial Results for 9 months ending 12/31/22)

The number of adopting companies in trading, manufactures and hotel industries has increased due to a lifted travel restriction. Manufacturers and trading companies actively dispatch expatriates overseas. Hotel industry forecasts an increase in foreign visitors.

PROGOS is the Automated AI based exam which visualizes English speaking ability. Automated AI scoring makes it quick, inexpensive, and easy to take. PROGOS had over 70,000 examinees which means it has the biggest number of examinees among English speaking exams in Japan for the last one year since its release in June 2020. (*1). PROGOS was awarded the silver prize of Reimagine Education Award 2020* last year as the first Japanese organization. In addition to PROGOS for Japanese-speaking people, PROGOS for non-Japanese-speaking people with English guidelines, questions and feedback is now available. This update has made it possible for RJ to expand our business overseas.

*Reimagine award, “Oscar of education”, is co-organized by QS Quacquarelli Symonds and the Wharton School’s Alfred West Jr. Learnings Lab.

3) Growth through business alliances

RJ has chosen business alliances in order to penetrate into Japanese corporate language and leadership training markets. Notably,

*In 2015, RJ entered into capital and business alliances with Mitsui & Co (one of the major trading companies in Japan), in order to leverage on Mitsui’s network to enter into domestic and overseas’ training market. Mitsui is a major shareholder.

*In 10/21, RJ acquired a 49% stake in BORDERLINK, Inc. whose main operations are in dispatching ATLs (Assistant Language Teachers) and running English language schools.

*In 12/21, the company took over shikaku square, Inc. which was engaged in operating online classes for professionals interested in obtaining technical certificates.

*Most recently, in Q3 for FYE 3/23, RJ acquired ISC Co, Ltd to strengthen its presence in preschool children’s education market. ISC also provides supports to enterprise in running child care services for their employees.

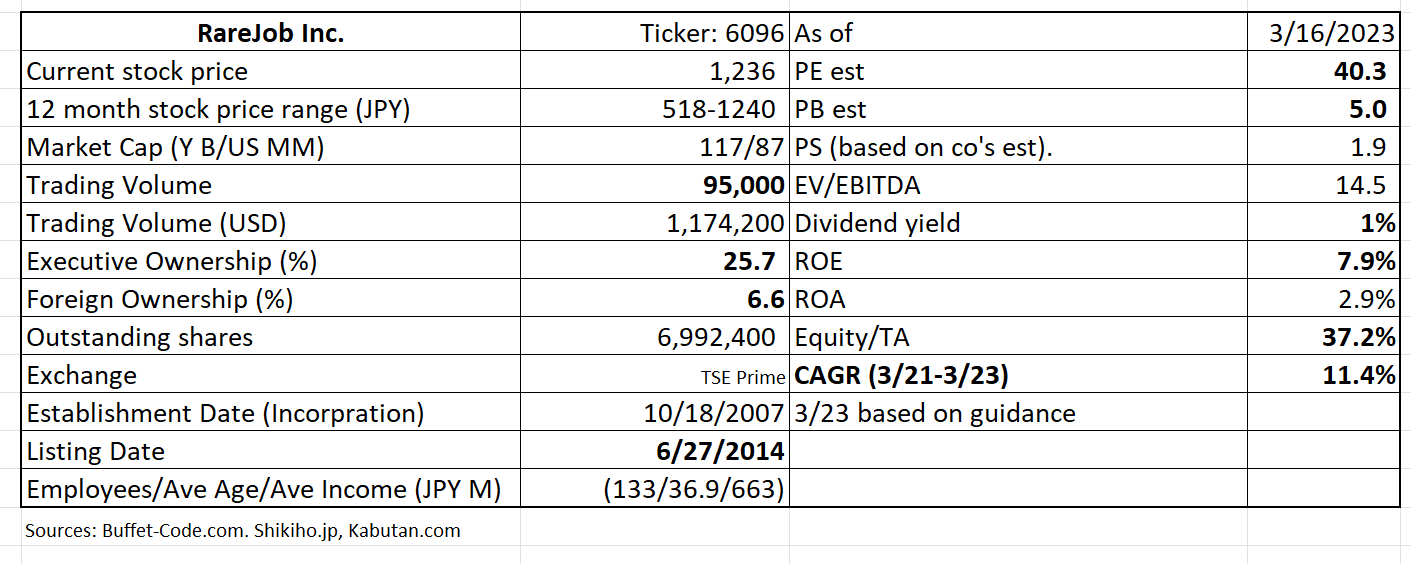

The company’s PEG is at an elevated level at 3.5x, reflecting 1) temporarily depressed earnings due to upfront spendings geared toward new businesses and 2) a high growth expectation for RJ’s expansion into business training and certification operations. Trading volume needs to improve as well.

2. Technically Speaking

(Source: buffet-code.com)

The above chart shows that the shares has shifted its range-bound patten on an upward-revised guidance on 2/14/23 and pushed through its resistance level of around JPY 1,200. The stock can climb higher with an increased volume. The company also announced that it would pay JPY 12/share dividends for FYE 3/23 (JPY 11/share for FYE 3/22). while management withheld its payout decision in 5/22.

3. Business Model

The business flow of original product: “RareJob Eikaiwa”/on line consumer English conversation classes is:

1) Customer acquisition: Direct first time users to RareJob Eikaiwa site through social media, listing ads, affiliate advertisements

2) First time users register at the site as a non-paying member and can try out two free lessons.

3) If satisfied, the users sign up as paying members.

Thus, RJ’s KPIs (key performance indicators) are

1) numbers of first time users/non-paying members

2) conversion rate of members from non-paying to paying

3) time length of members staying with RJ (churn rate).

The company has accumulated 1MM non-paying users and 90,000 registered members. Thus, a crude conversion rate is 9%. The company is working on the following to improve conversion rate and a churn rate:

1) lower access hurdles to the lesson system

2) Continue to improve lesson quality and materials

As stated earlier, the lesson fees are paid per month and if a member takes a lesson daily, one less costs a mere JPY 206 ($1.5).

The company can increase its lesson fee in the tune of 30% since 1) the company keeps adding features and 2) there are huge price gap between its online courses and in-person schools.

4. Financial Highlights

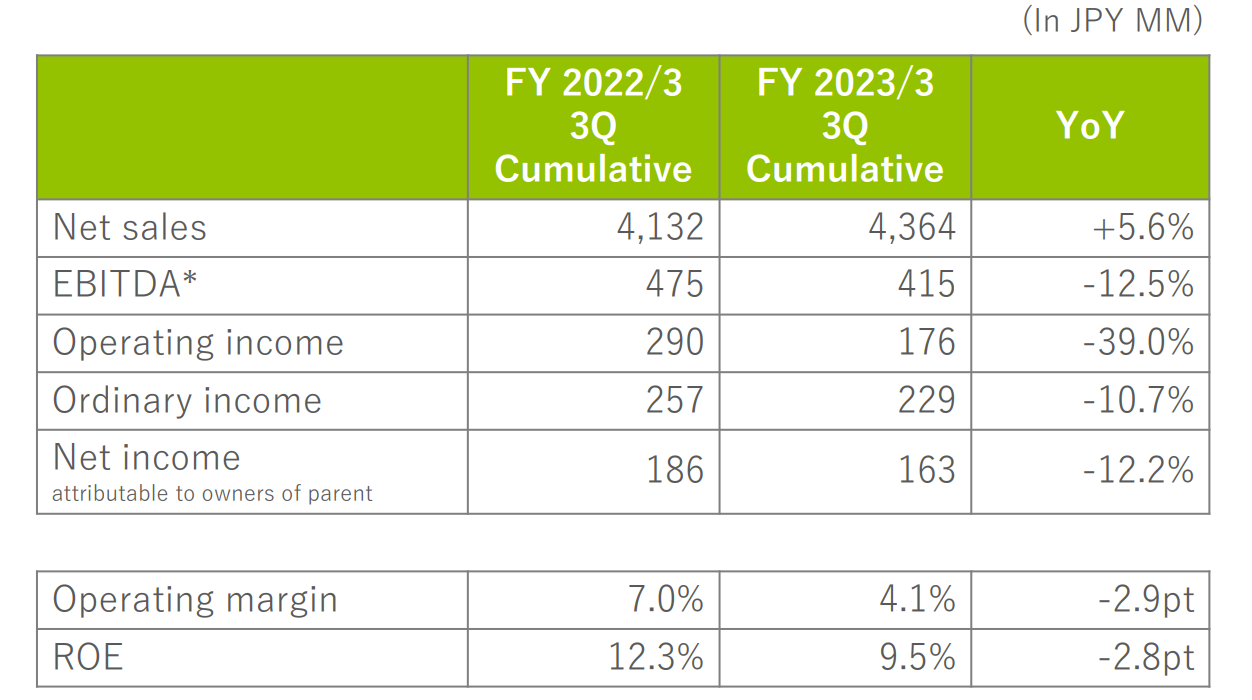

1) Financial Results for the 9 months ending 12/31/22 vs. 12/30/21:

(Source: Financial Results for 9 months ending 12/31/22)

Sales:

Total net sales rose by 5.6% vs. Q3 2021 and hit record highs for Q3. The contributors are

1) B2C(onsumers): Shikaku Square (bought in 12/21) contributed to B2C sales increase of 3.7%

2) B2B(usiness) and B2S(chool): joint service offerings with partner training companies helped the segment saw sales increase of 9.8%.

Notably, PROGOS adoption is picking up its speed as post-covid lifting of travel restrictions has encourages companies to increase English education budgets.

Operating Income

Operating income, however, fell by 39% year over year, due mainly to initial personnel and advertising expenses related with Shikaku Square purchase increase.

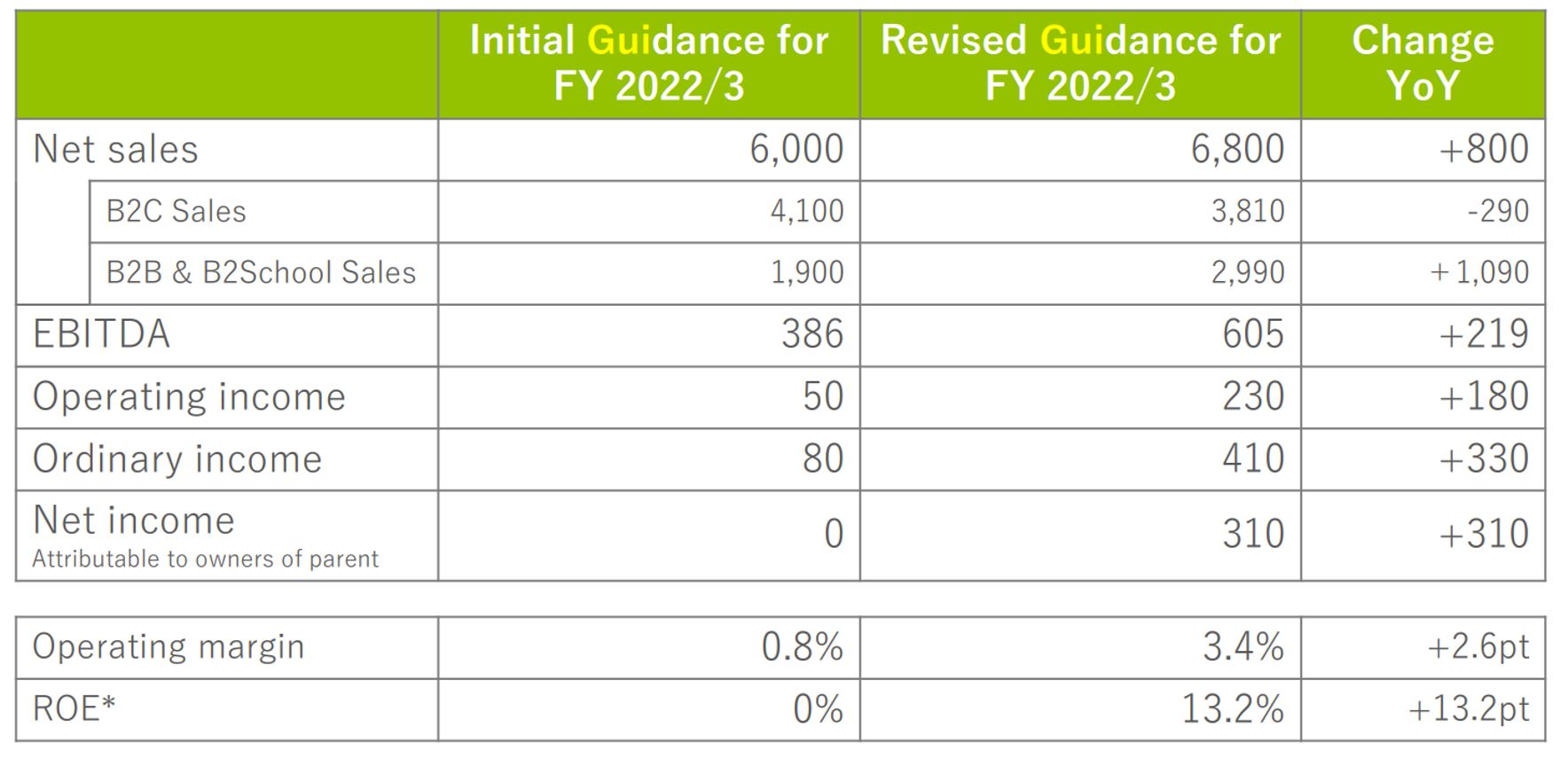

2) Upped guidance for FYE 3/23.

The company upped its sales guidance to reflect ISC acquisition and growth in BORDERLINK’s sales. Notably, significant upside is expected for on a profit front, driven by new segments (BtoBusines and BtoSchool) progressed better and costs were well controlled at BtoC segment.

(Source: Financial Results for 9 months ending 12/31/22)

Note: the headings of the above table should read Initial Guidance for FY 2023/3 and Revised Guidance for FY 2023/3.

5. Total Addressable Markets (TAM)

The company defines its target industries from two segments: 1) on-line English learning market and 2) corporate training market. This makes sense, since RJ is transforming from an on-line English conversation site to a broader global leader training firm.

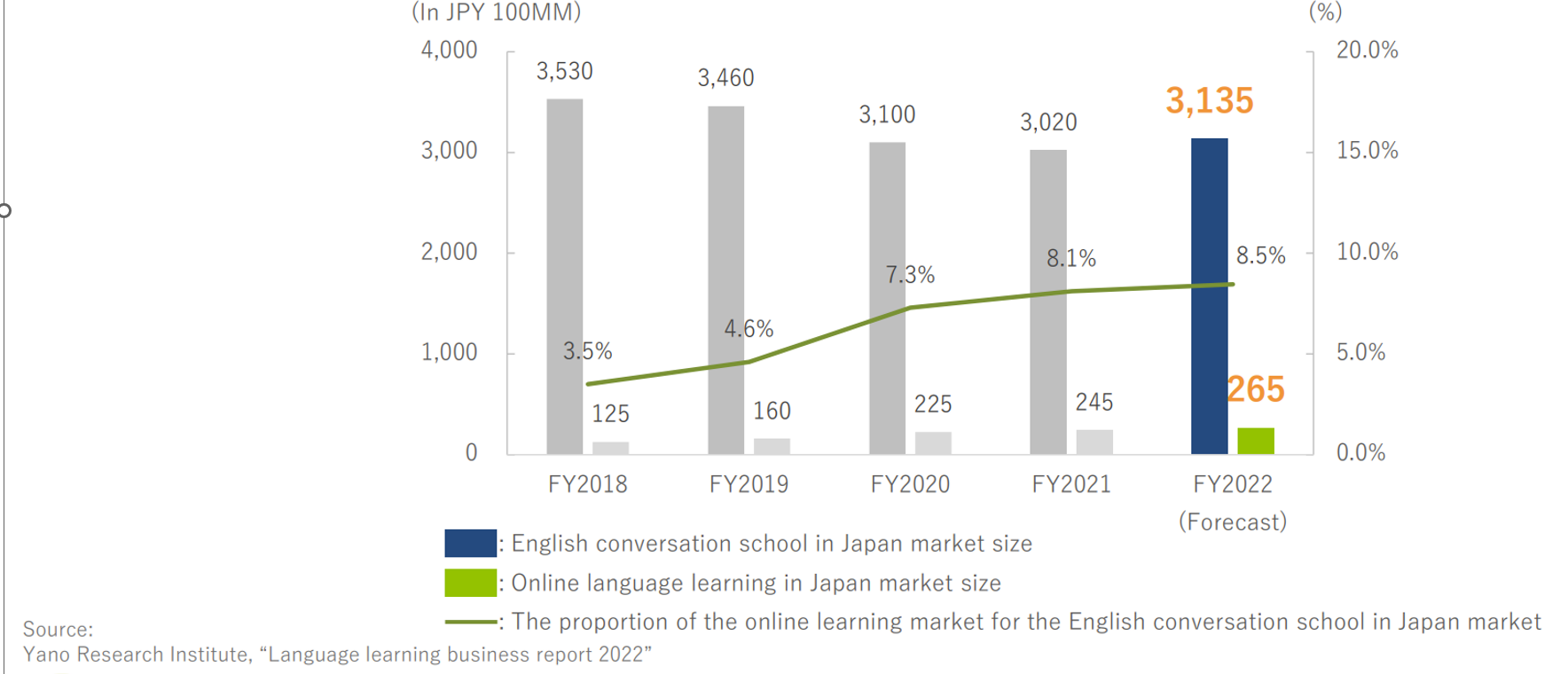

1) The online English learning market

(Source: Yano Research Institute report, taken from RJ’s Financial Results for 9 months ending 12/31/22)

The above bar charts highlight Covid’s negative impact on in-person English schools. However, online English learning schools’ share in the industry has steadily increased from 3.5% in 2018 to 8.5% 2022 (expected). As the border reopens in Japan, demand for English learning should slowly come back, which bodes well for RJ. Furthermore, online learning share is still small at 8%, providing RJ an ample room for growth.

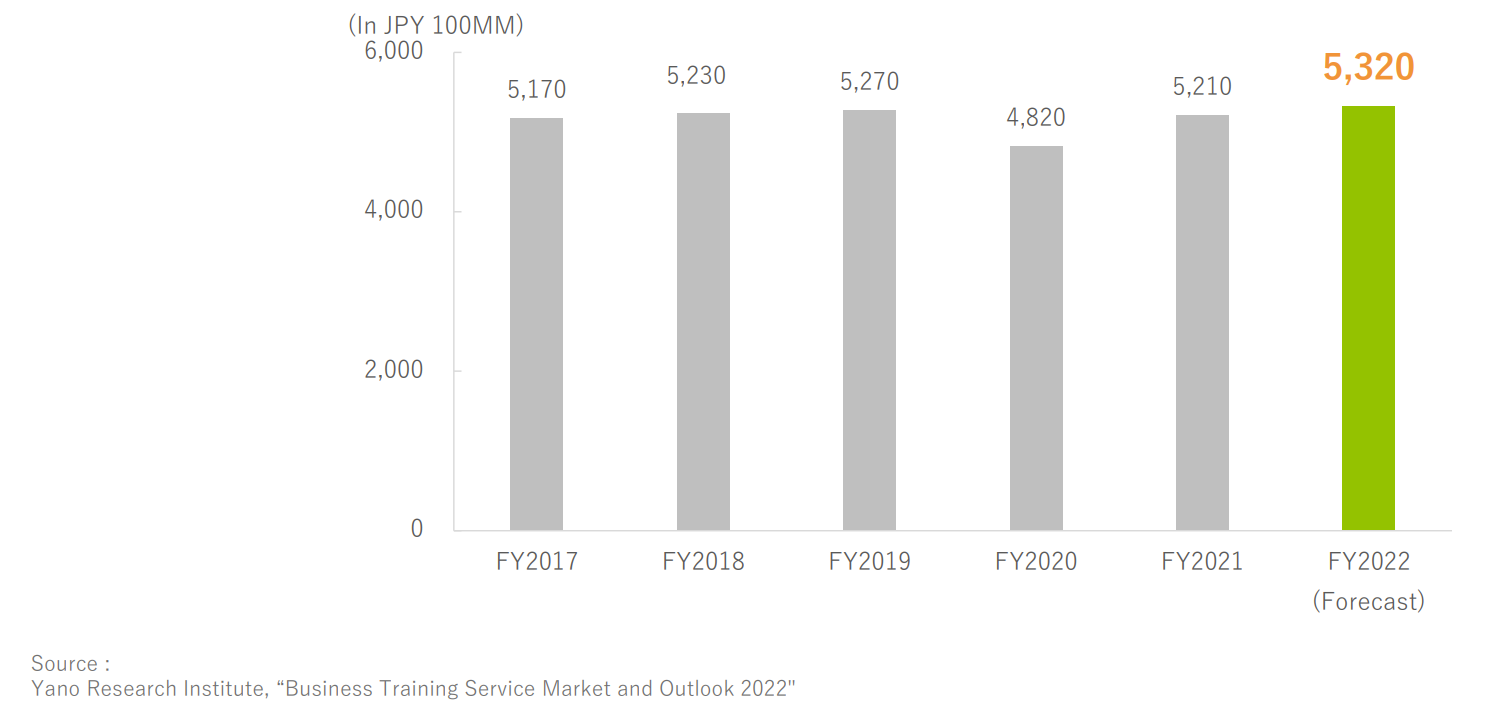

2) Business Training Industry

The below chart illustrates business training industry has resumed its growth after a Covid-related pause which also bodes well for RG’s continued foray into this segment.

(Source: Yano Research Institute report, taken from RJ’s Financial Results for 9 months ending 12/31/22)

6. Strengths and Weaknesses

Strengths

1. There is a constant demand for effective English learning needs in Japan.

2. A large network of highly qualified tutors.

There are 6,000 Pilipino tutors who have been selected and trained under a stringent selection and training regimen.

Weaknesses

1. Since their tutors live in Philippines, there is an exchange risk. If Yen depreciates against Philippine Pesos, RJ will face cost increase. The company believes it can deal with this by raising lessen fees which are extremely low at this point.

2. Strong industry growth will attract competitors. Since the general costs are rising, English learners may opt to choose on-line options vs. in-class venue. Among on-line English class providers, the company has an early mover advantage and a name recognition thanks its quality tutors and materials.

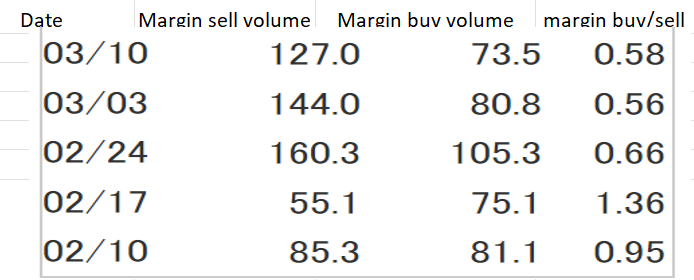

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For RareJob, margin buy sell ratio is very low at 0.58x (below 3x is acceptable), thus, the near term selling pressure is not an issue.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance