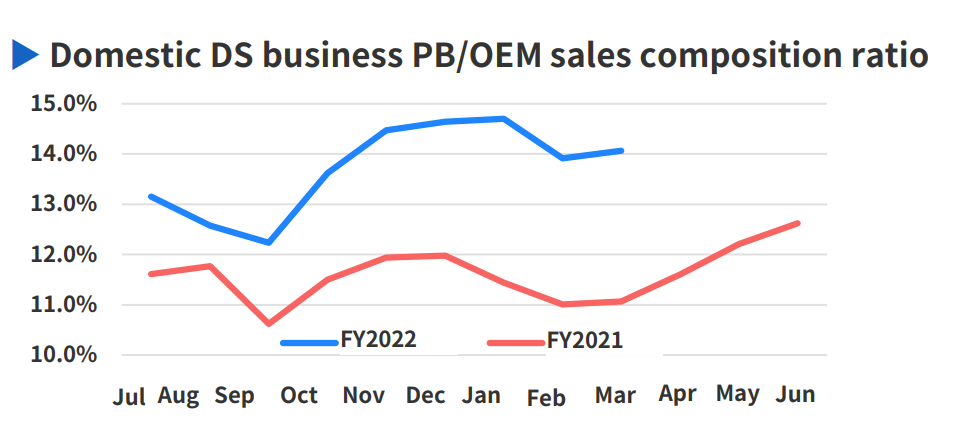

Pan Pacific International Holdings (“PPIH” or the “company”) is not a type of stock which www.JapaneseIPO.com typically chooses to write a report on. It is big and 16 analysts cover the stock, which indicates large institutional holdings. In fact, in 2021 annual report, CFO lamented the fact that PPIH’s retail investor holding is 1.6% which is lower than retail industry average. Since their loyal customers can be their investors, the company has been trying to enhance awareness among individual investors on its growth strategy in a challenging Japanese retail industry. Their efforts can be seen in the company’s coverage by Shared Research, since the companies of their statue does not need to pay to be covered by a corporate research company.

We admire PPIH’s willingness to communicate with individual investors whose investable cash tends to be far less than institutional investors.

Therefore, we would like to play a small role in spreading the words about the company.

Why PPIH now?

Before Covid, foreign visitors who often craved “Japanese experience” accounted for about 10% of PPIH’s sales. These sales evaporated during the entry ban, but will likely slowly return as Japan reopens its heavy doors to visitors. As of 6/1/22, 20,000 foreigners can enter Japan (upped from 10,000 earlier). There is news on easing on lock down of the inbound heavyweight, Chinese, which should have meaningful impacts on PPIH’s top line.

Who is PPIH?

It is a top ranked discount store operator with total 691 stores (globally). The mainstay is “Don Quijote”. The other concepts are:

“MEGA Don Quijote” offers Don Quijote with perishables,

“Apita”, “Piago” UNY” : General merchandising stores, similar to JC Penny in US)

Note: PPIH’s unique management principles and resulting success is well discussed in Shared Research’s report (a English version available). Thus, this report focuses on www.JapaneseIPO.com’s assessment on its ability to fend off the competitors in the ever more challenging retail environment in Japan.

1. Investment Thesis – Winner in a declining industry

Key factors in the growth of retail industry are: economic growth, rising population, growing youth segment, high GDP per capita and rising purchasing power. Japan can cross out pretty much nothing from these lists.

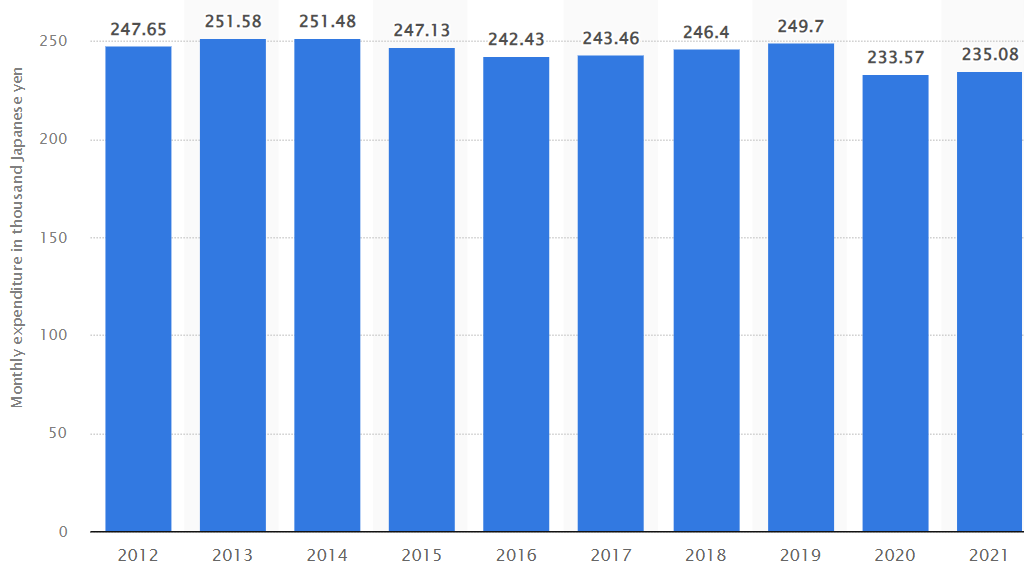

The below bar graph from Statisca says it all: average monthly consumptions peaked in 2013 and have gradually being declining even before Covid.

Average monthly consumption expenditures per household in Japan from 2012 to 2021 (Unit: JPY 1,000)

(Source: Stastica 2022)

Then, why do we bother considering investing in PPIH? It’s simple. By reporting the 32nd consecutive year of sales and operating profits, the company has demonstrated its ability to 1) increase sales via unique merchandising, store advertising and labor management and 2) expand store footprints by acquiring failed brand/stores and/or abandoned location such as Nagasakiya and UNY.

Their unique concept management strategies which allows the company to gain shares in a declining industry, will be itemized in Business Model section.

Given the company focuses on market share gain to be a leader in a declining industry, earnings are suppressed by expenses. However, P/S is quite reasonable at 0.7x.

2. Technically Speaking

(Source: buffet-code.com)

You can see from the above chart that the stock is trading at a resistance price level of $2,180. Thus, if the stock can push it through this level with a large enough volume, selling pressure will not be that substantial.

3. Business Model

1) Unique Store Concept to make shopping an “entertainment”: CV (convenience) +D (Discount) +A (Amusement):

PPIH’s Don Quijote (DQ), its flagship concept, offers adventure shopping. The merchandise are placed on the shelves in “compression display” style: tall shelves packed with up to 40,000-60,000 SKUs (items) decorated with loud POSs (handwritten ad signs) along in narrow pathways. These chaotic displays are well calculated to invite customers to search for the rare finds at bargain prices.

This CVDA sets the company apart from its competitors whose assortments and display of goods promote the ease in finding items the customers need. The customers leave a store as soon as they buy what they want and when they want it.

At DQ, customers spend long hours and often come back to see what they have missed earlier. All available goods are displayed (i.e., no hidden inventory rooms). Long hours at DQ equals more money spent at DQ.

2) All individual stores are run as an autonomous store

A each store of PPIH group is run by the local store managers who can adjust the merchandise to the taste of the consumers n the region. These managers also can gather the intel on local competitors and respond to them accordingly.

Critical factor in keeping this autonomous culture

Performance evaluation system reflects this localized store management system: Employees are evaluated by a score with 50% weight on inventory turnover, 25% on sales and 25% on gross profits.

3) Expansion through well-executed M&As

M&As have been the key growth driver in gaining market share in Japan and overseas. Notable purchases are:

The grocery stores in Hawaii from Daiei (2006)

Nagasakiya (GMS/general merchandise stores, 2007) is now converted into Mega Donki format.

Marukai Corp (supermarkets in Hawaii and CA, 2013)

Uny(GMS)

Gelson’s’ (high end grocery chain in California in 2021)

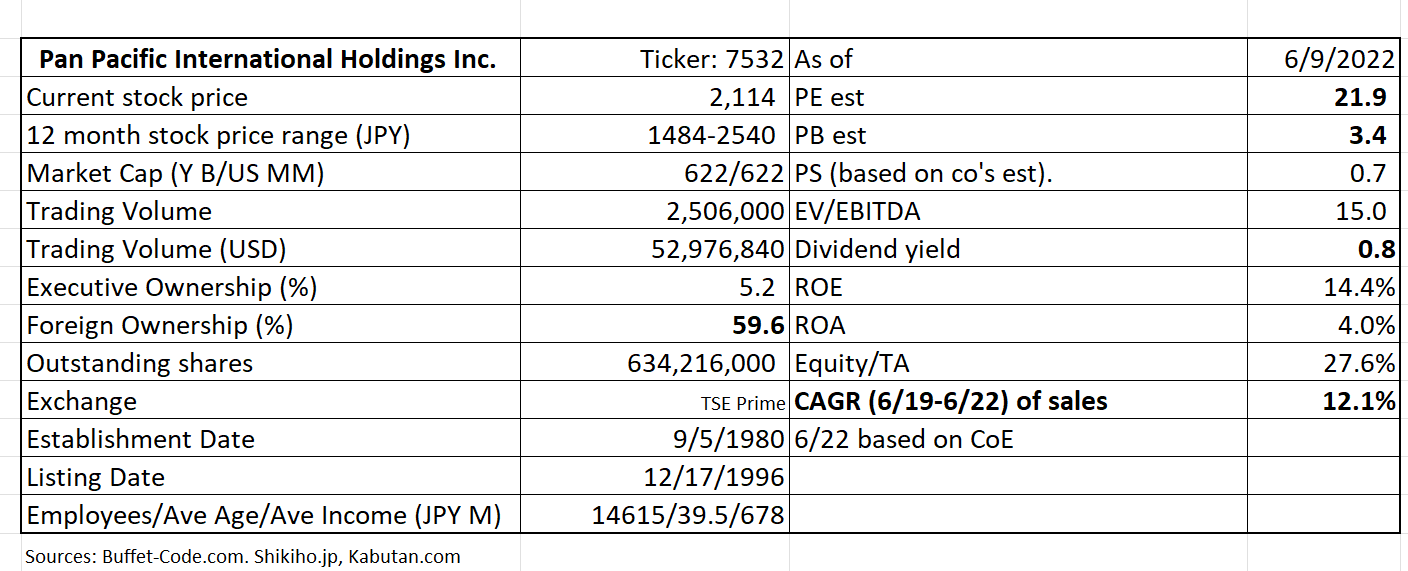

As shown in the below table, 14% of the stores are outside of Japan.

(Source: Q2 financial results for FYE 6/22)

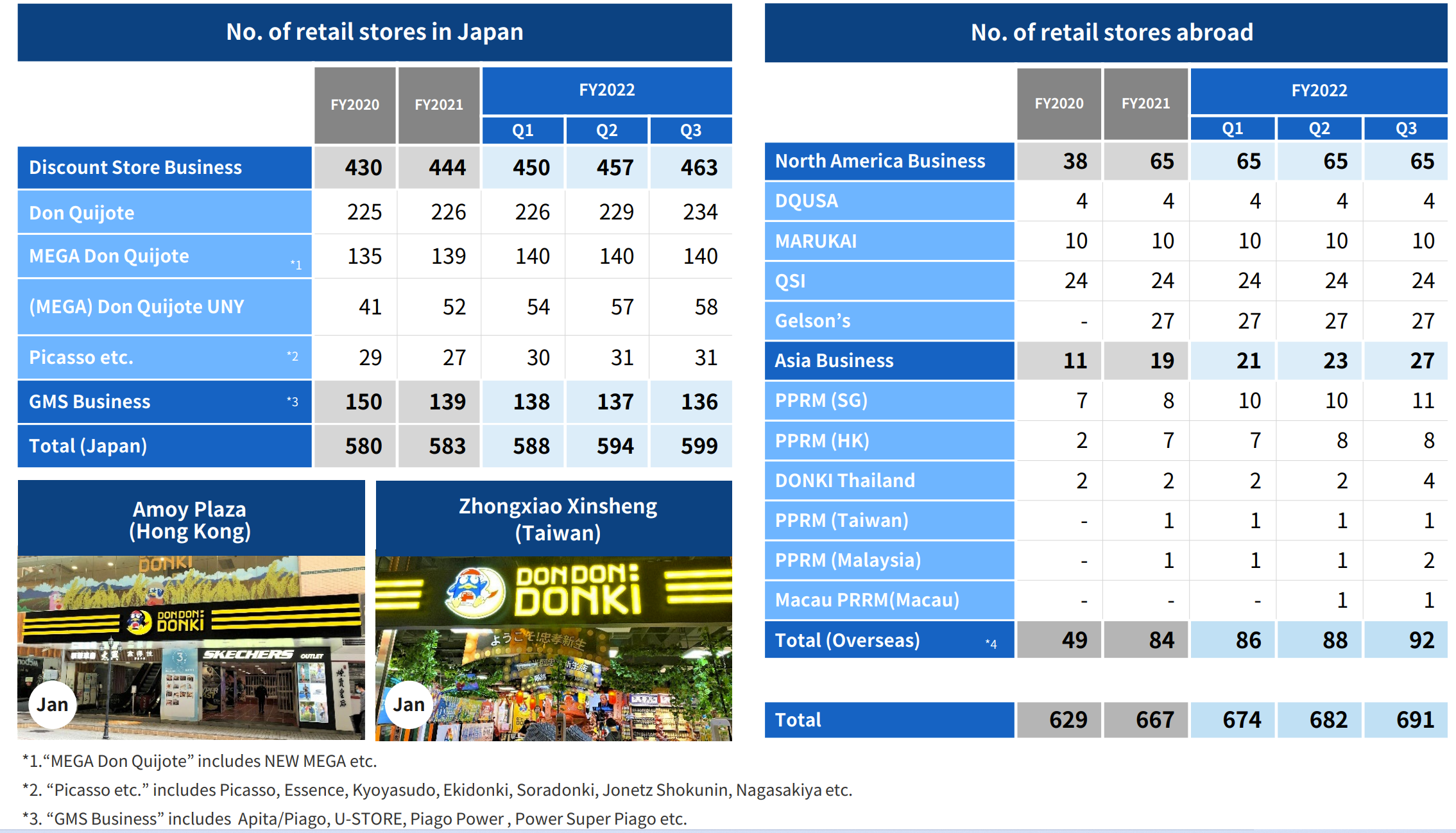

4)PB as a next growth driver

PPIH’s domestic market share gainers are currently the group’s expanding offerings’ of Private Brands (PB).

PB with “Interest Expiration Date”

PB was rebranded in 2/21 to highlight PB’s unique cost/price performance vs. national brands and the rivals’ PB. PB carries higher gross margin and contributed to 0.4% gross margin improvement out of total 0.5% increase in Q3 2022 ending 3/22 vs. Q3/21. Remaining 0.1% came from reduced disposal of obsolete items.

The company has started to add internal “interest expiration dates” on non-perishable items which don’t usually carry expiration dates. Based on these estimated expiration dates, the product purchases (price and quantity) is carefully planned and inventory turnover has shown a sign of improving. Inventory turnover for FYE 6/21 was 6 x vs. 6.4x for FYE 6/20.

(Source: Q2 financial results for FYE 6/22)

5) Financial Services Majica the group’s electronic money app.

PPIH introduced Majica, electronic money app in 2019 with two goals in mind: to improve understanding of their customers and to improve points of contact with them. Membership has reached to 9.16 million as of 3/22. Functionality of Majica has continued to expand, such as 1) easier payment system, 2) targeted sales/new product promotion and 3) enhanced product review and search functions. Internalized payment system should reduce the settlement fees to 3rd credit card companies.

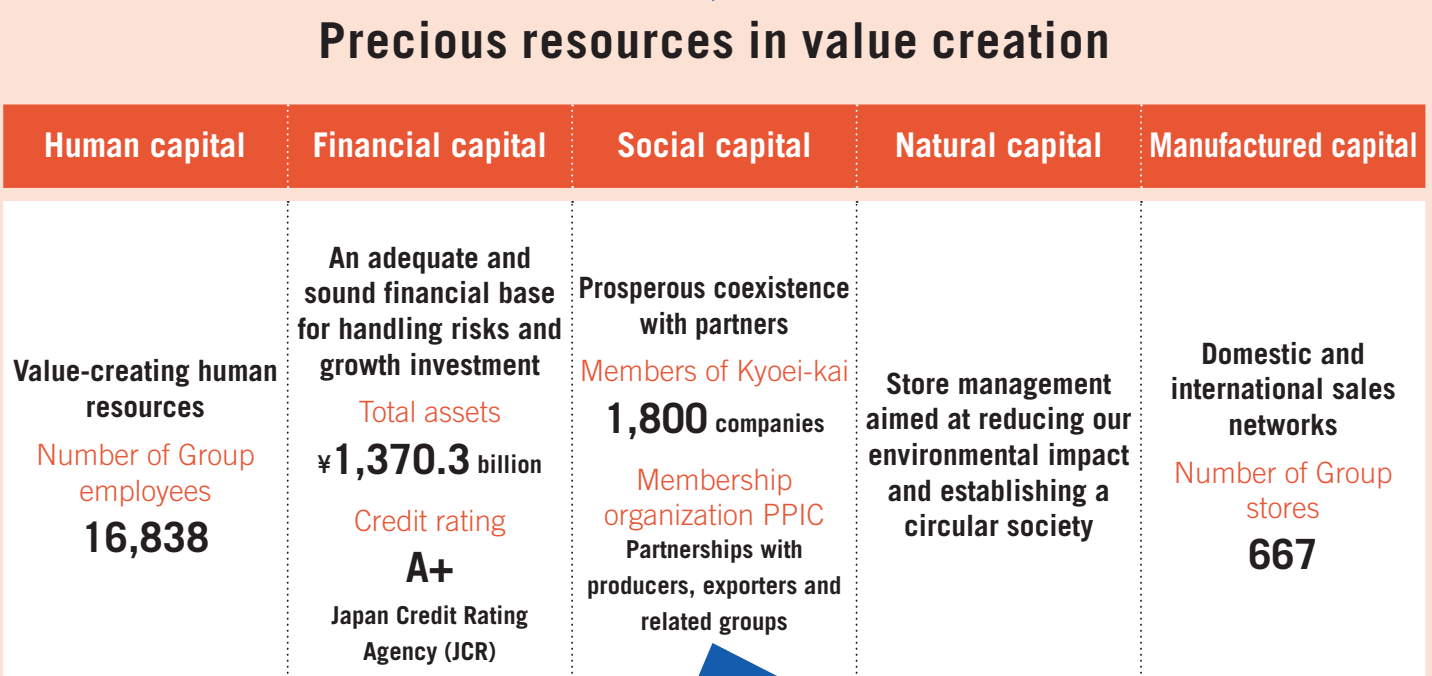

The success achieved from relentless application of the above growth strategies has culminated in the below numbers:

(Source: Annual Report 2021)

4. Financial Highlights

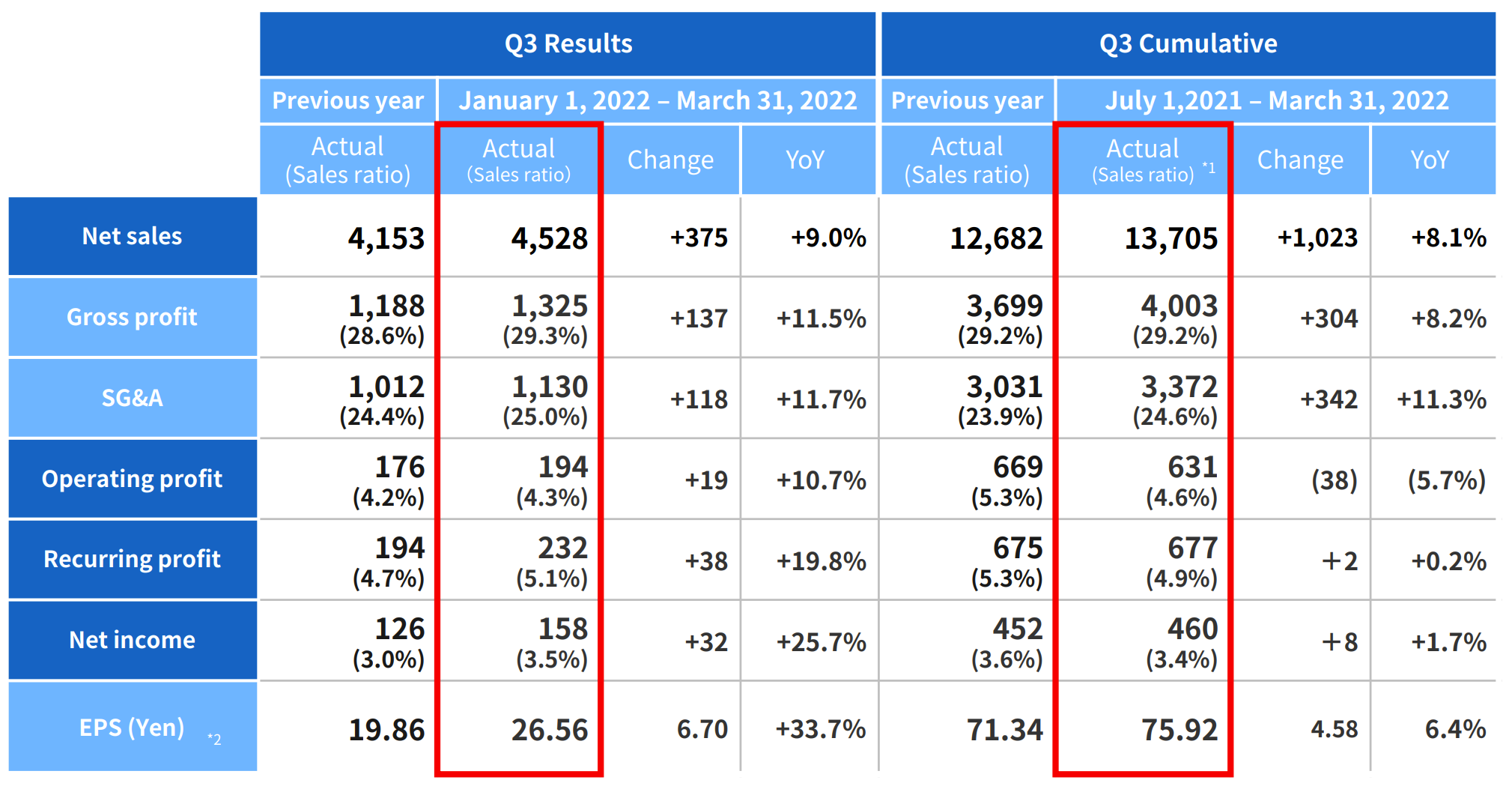

Financial Results for Q3 stand alone and the first 3 quarters for FYE 6/22

(Source: Q3 financial results for FYE 6/22)

The glaring item of the above financials for 9 months ending 6/22 is that despite an 8% growth in sales and gross profits, operating profits declined 6% compared to Q1-Q3/2022. This was mainly due to added operating expenses as a result of continued conversion of “UNY” to “Don Quijote UNY”.

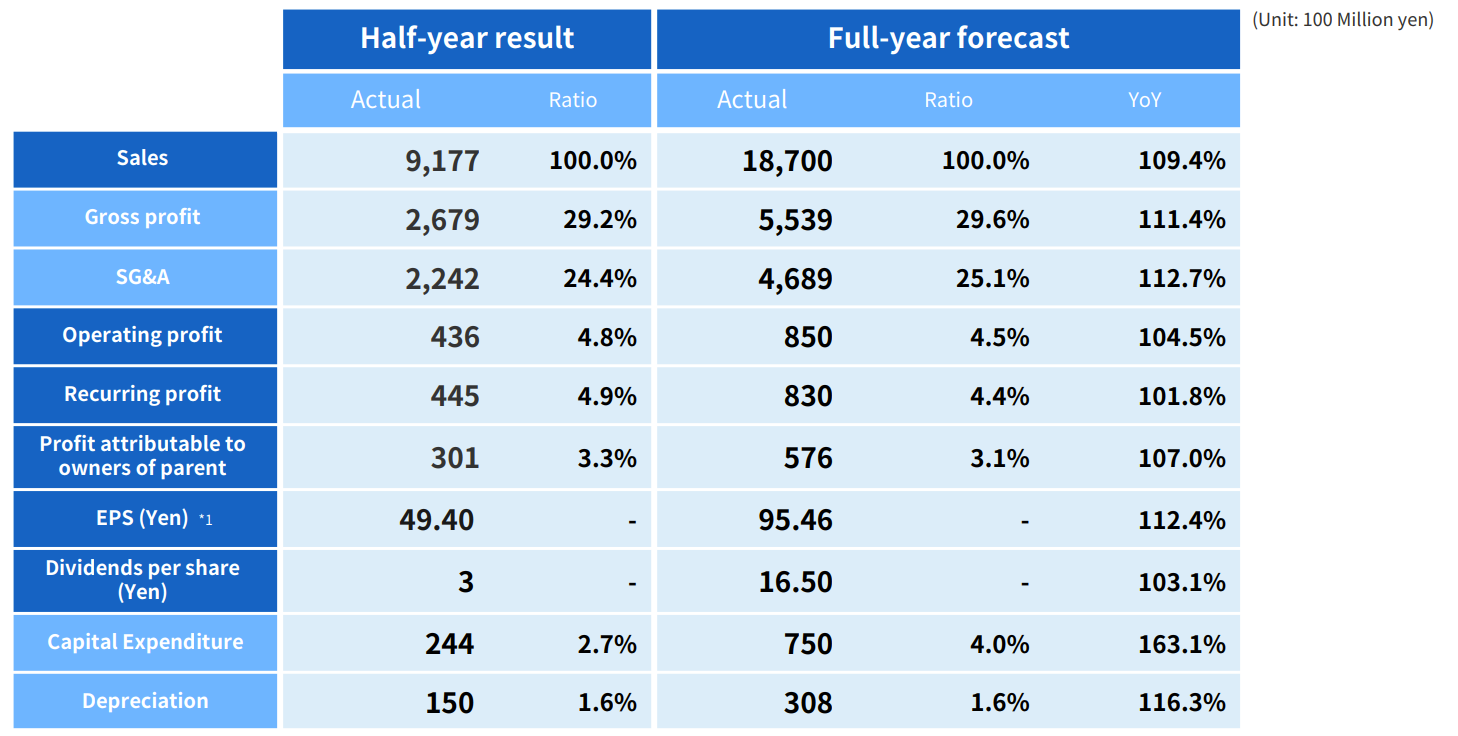

Guidance for FYE 6/22

(Source: Q2 financial results for FYE 6/22)

The above guidance for FYE 6/22 was as of Q2 FYE 6/22. The company’s 9 months achievement of sales, gross and operating profits was around 72%, a bit shy of 75% goal. This is not a big concern since 1) gradual return of foreign shoppers is expected as Japan reopens and Covid restrictions in China is easing and 2) several new initiatives such as PB and Majica are bearing fruits.

5. Total Addressable Markets (TAM)

Discussed as part of the 1st investment thesis.

6. Strengths and Weaknesses

Strengths

1. Management team with swift decision making.

PPIH has built the culture which encourages the head office to listen to the local store management and change the courses, if necessary.

2. Widely recognized store concepts.

PPIH’s each brand is “identified” with fun shopping experiences and with low prices.

3. Solid relationship with wholesale partners.

The company does business with several wholesalers who are willing to give PPIH favorable terms, thanks to 1) the high purchase volume (i.e., scale discount is available), 2) PPIH often buys off-season and low volume items since it is capable of selling them (through appealing display and value adding POPs (hand written ad displays).

Weaknesses

1. Low Barriers to Entry

The retail space is known to have lower entry barrier. PPIH’s peers can and have been trying to mimic intentionally chaotic display style and loud POPs. However, the local autonomous corporate culture and quick decision making is hard to replicate. Also, rivals often can’t meet the company’s low prices which are supported by its size and huge purchase volume.

2. Large company woes.

The above referenced large scale operations CAN become a threat to PPIH’s quick and local decision making culture which has been the main force behind its success. Management is aware of this risk and keeps introducing products attached with “newness” which is one step ahead of its competitors. But this “large company threat” remains and need to be monitored.

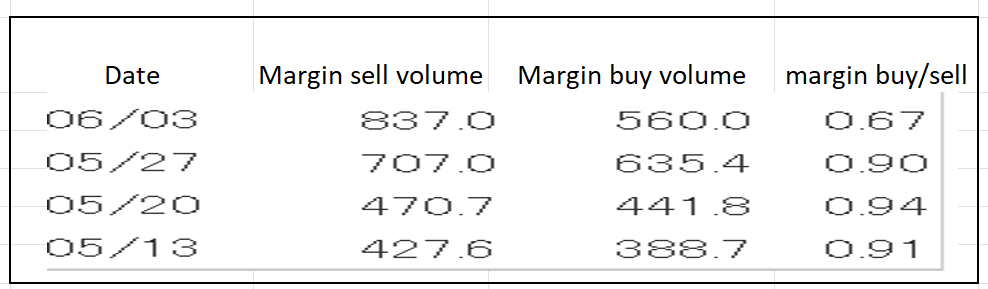

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For PPIH, margin buy/sell ratios has been lower than an acceptable level of 3x, thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance