Orix is a leading leasing company in Japan with 1660 corporate locations in Japan (489 overseas) and market capitalization of $28 Bn.

Why Orix and Why NOW?

We, as stock investors, are heading into a new period of investing and trading i.e., a shift from low interest rate/rising liquidity to a rising interest rate/tight liquidity period. Why is this so challenging to us?

FRB is raising interest rates to fend off strong inflation which is a reasonable policy. Then why the markets are reacting so poorly with Nasdaq (the worst performing US index with year to date return of around 27% loss). I believe that FRB has a “trust” issue. Investors are concerned that FRB is going to overshoot with interest rate hike and bring on recessions. This concern has a root in investor memory of the Volcker Shock*

*Paul Volcker, in order to tame double digit inflation, raised fed funds rate to 20% in 3/1980 and kept it above 16% until 5/81. It ended inflation but also created the 1981 recession.

I am not smart enough to argue the pros and cons of Chairman Volcker’s courageous actions. Instead, I believe we need to acknowledge the market’s negative sentiment surrounding Fed’s rate actions for the next year or so.

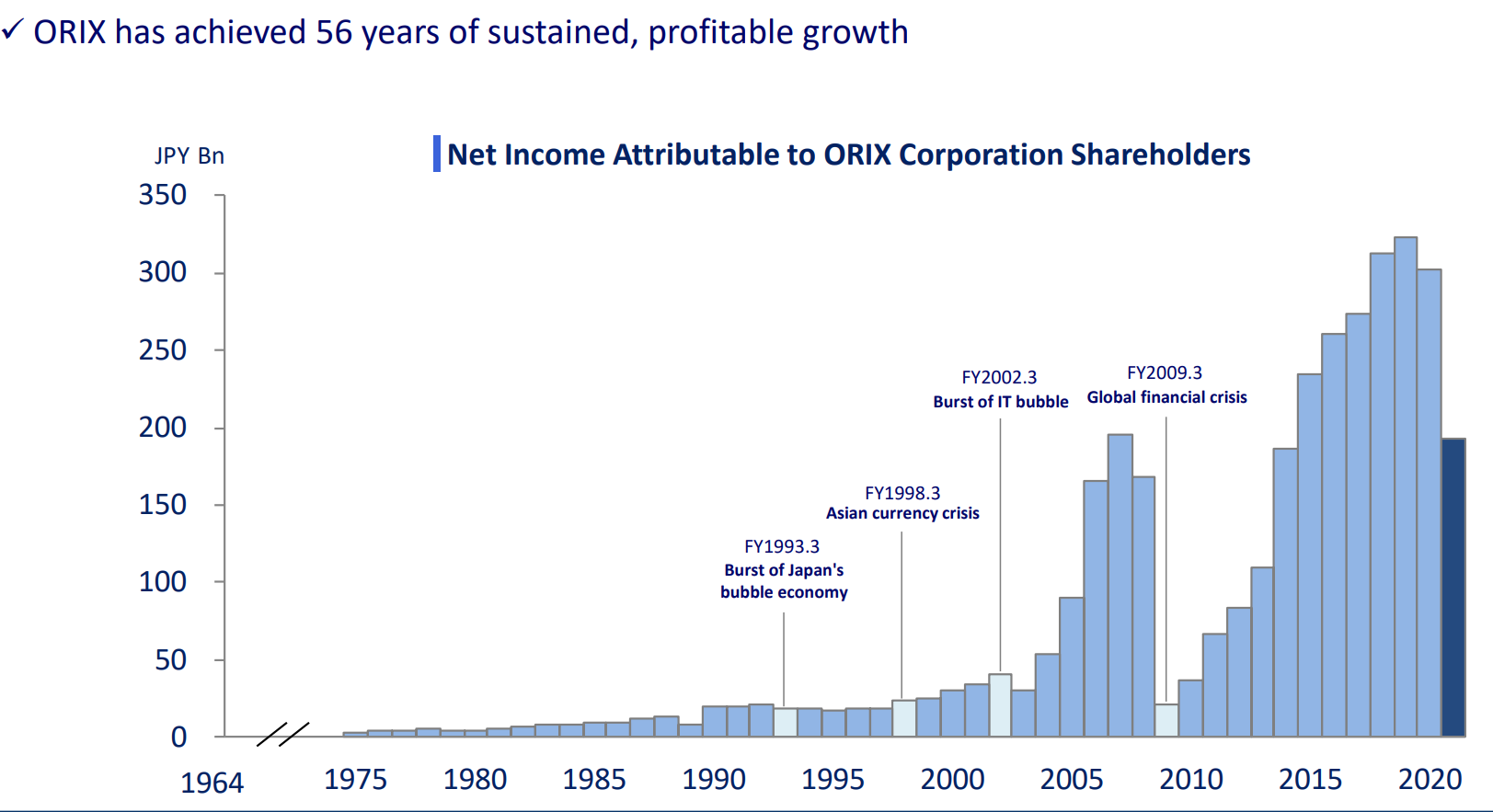

My self-imposed mission is to inform global retail/individual investors of Japanese small capitalized stocks which will grow by helping Japanese economy regain its footing. However, now, it may be prudent to discuss large established companies which have survived through major market turbulence in the past. And I thought Orix would fit the bill, based on its 56 years profit growth history.

(Source: Financial Briefings for the Nine-Month Period Ended December 31, 2021)

Why Orix?

The consistent profit growth is not the only reason for Orix’s attractiveness under the current market conditions. Orix is popular with Japanese retail investors for its generous dividend payout policy and “shareholder benefit program”.

Shareholder benefit program:

Many Japanese public companies offer benefit plans to their shareholders who own the certain numbers of their stocks for a specified period. For example, Japan MacDonald offers 1 coupon book (which are good for 2 hamburgers, 2 sides and 2 drinks) a shareholder with 100 stocks.

A catch is that, to qualify for the benefits, a shareholder needs to have a registered address in Japan. Thus thee benefits are not available for foreign investors. However, these shareholder benefit plans work as a stock price support: many Japanese retail investors hold onto these shares even after share prices suffer from minor bad news.

Orix’s shareholder benefit programs are designed to increase the number of long term shareholders (based on MarketScreener article as of 2/7/22):

“Furusato Yutai” is a shareholder benefit program in which eligible shareholders can select a single product of their choice from a gift catalog. Products featured in the catalog are carefully selected from products of the ORIX Group’s business partners across Japan. Shareholders who have held 100 or more shares for a continuous period of three or more years are eligible to select a single product from a more extensive catalog.

As of September 30, 2021, approximately 737,000 individual shareholders have invested in ORIX; this is a significant increase compared to the company’s 45,000 shareholders, before the start of Furusato Yutai (as of March 2014).

ORIX will also continue its Shareholder Benefit Card program in fiscal 2022. Through this program, individual shareholders are eligible for discounts on a variety of services offered by the ORIX Group.

1. Investment thesis

1) A portfolio business model

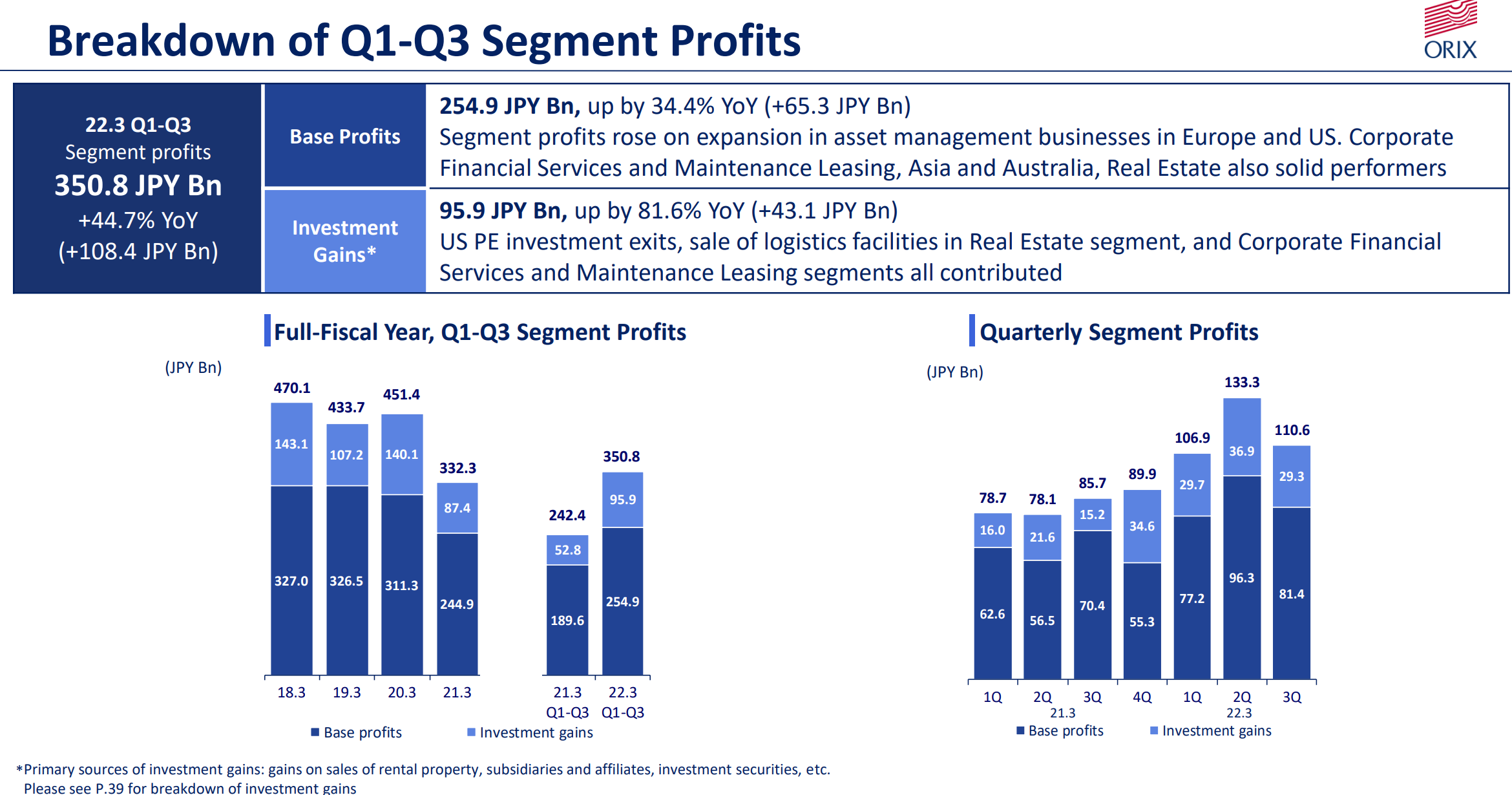

Orix has built a portfolio of growing businesses which should propel the company to achieve a steady growth stage. 9 months profits for FYE 3/21 were up by JPY 108Bn, while they still lag 9 months for FYE 3/20.

(Source: Financial Briefings for the Nine-Month Period Ended December 31, 2021)Source: the company web site)

2) Stable Credit Quality

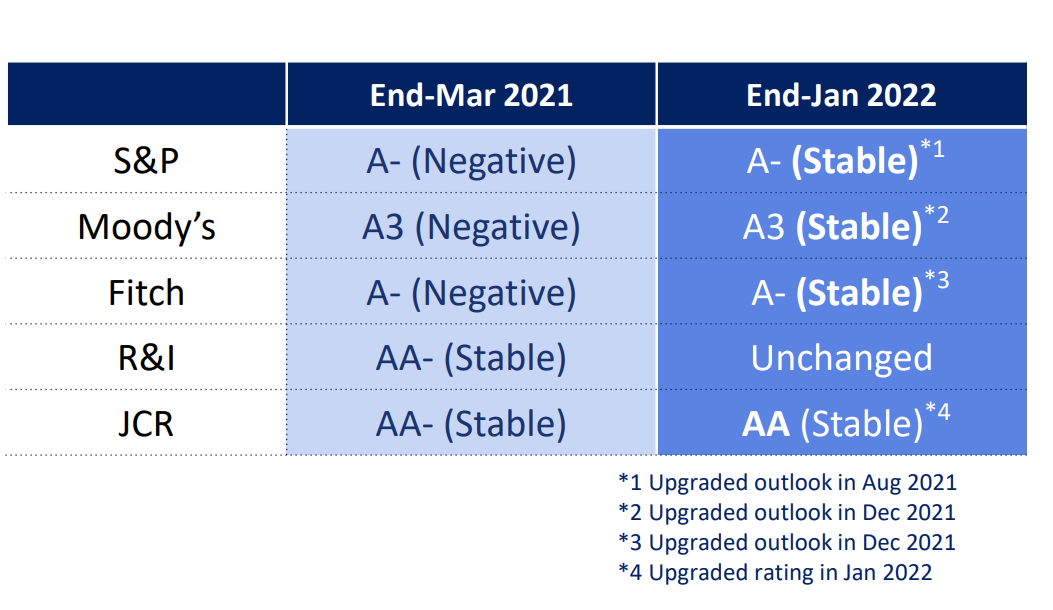

Orix, supported by the above referenced well-put together portfolio of businesses, have maintained solid balance sheet through the pandemic. The recent rating upgrade by 4 major credit agencies (see below) vindicates management’s ability to cope well with challenging operating environments.

(Source: Financial Briefings for the Nine-Month Period Ended December 31, 2021)

3) High shareholder return

Orix currently boasts dividend yield of 3.3% (vs. Japanese government 10-year bond yield of 0.26%). If their generous shareholder gift/benefits program is added, shareholder return is even higher.

They are also active in share repurchase. The most recent buyback is the one announced in 5/21. Details of Share Repurchase: Up to 50,000,000 shares (approx.4.1% of the total outstanding shares (excluding treasury shares)) (3) Total purchase price of shares to be repurchased: Up to 50 billion yen (4) Repurchase Period: From 5/17/21 to 3/3/22

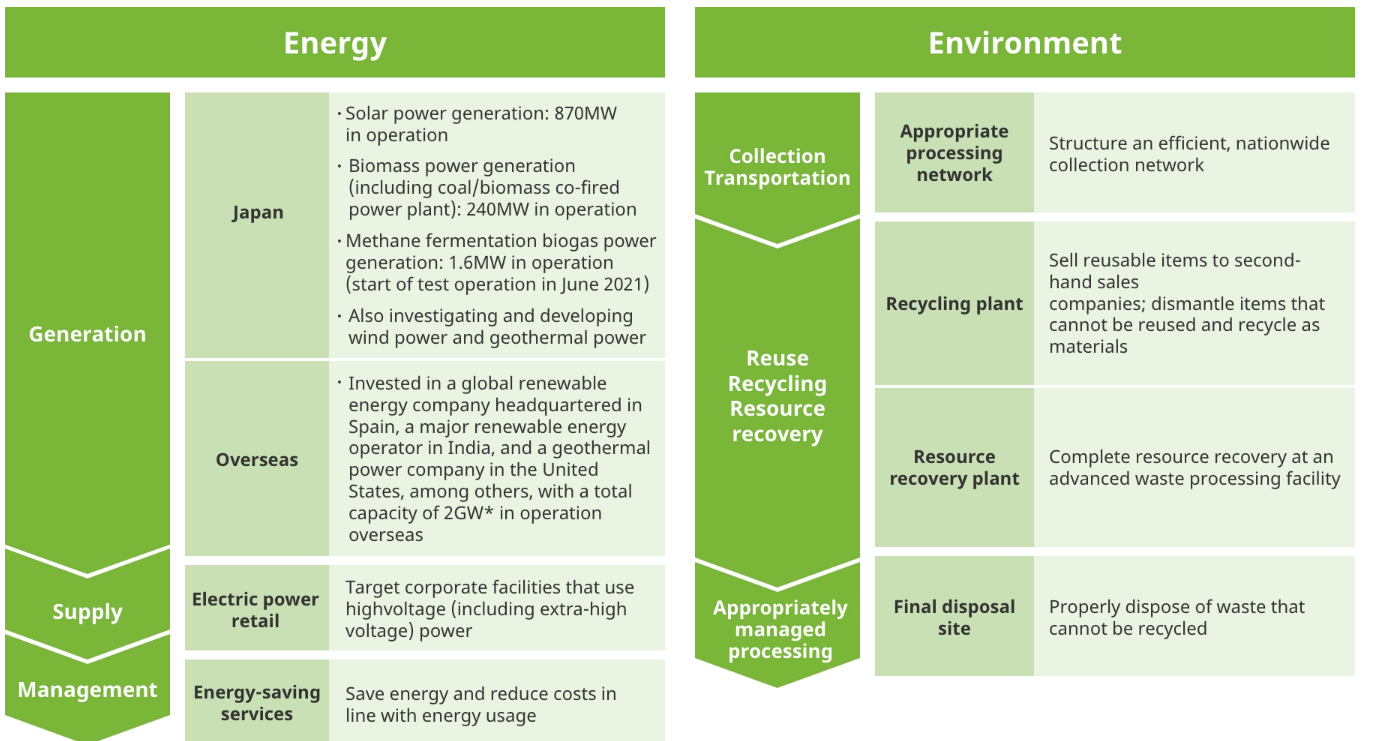

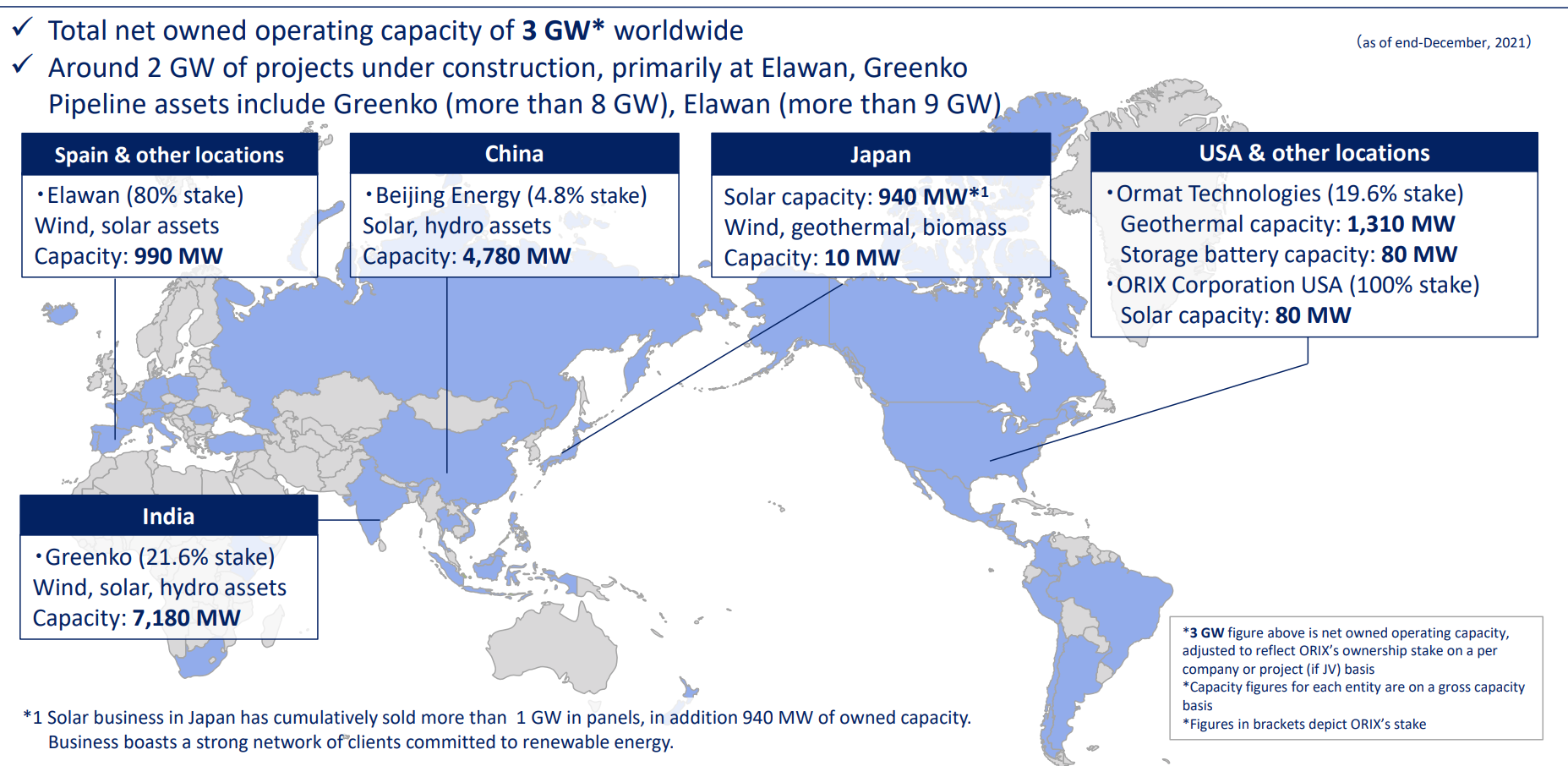

4) Renewable Energy Business, not well known but an extension of leasing skills

Orix entered the environment and energy field by taking a stake in a wind power generation business in 1995. Since then, they have expanded their energy business using their skills in leasing and consulting, and their environmental business (i.e., recycling) by properly disposing of leased items at the end of their useful life. The company now conducts business in a wide range of energy markets such as renewable energy power generation, electric power retail, and energy-saving services, while growing environment businesses such as recycling and waste treatment.

(Source: Financial Briefings for the Nine-Month Period Ended December 31, 2021)

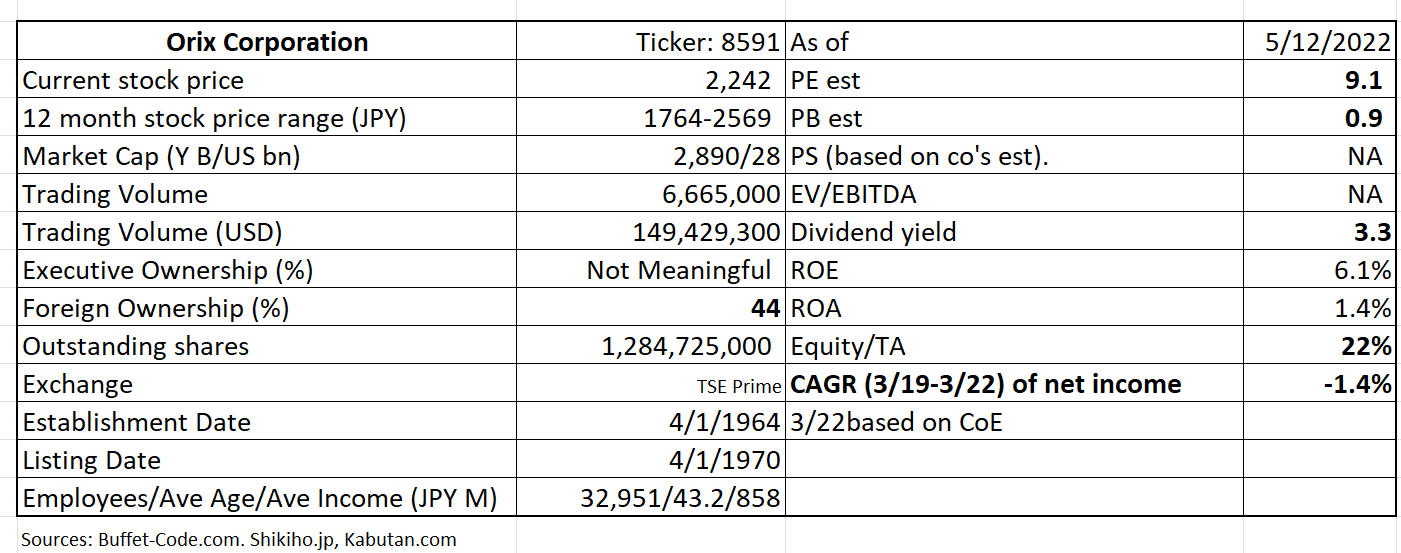

5) Reasonable valuation

3/22 expected PE is 9x and PB is 0.9x, very reasonable for a diversified financial institutions with renewable energy exposure.

Valuation: Orix’s earnings have suffered from negative Covid impacts, thus CAGR of the last 4 years are negative 1.4%. PE of 9x is comparable to pure leasing players. PB of below 1x, at 0.9x, is viewed as slightly cheap for financial institutions. Dividend yield of 3.3% is worth noting.

2. Technically Speaking

(Source: buffet-code.com)

The stock is trading at a lower end of recent price range, given the challenging market we are in. The largest volume cluster is around JPY 2,300. JPY 2,400 is the nearest resistance level.

3. Business Model

-Collection of diversified growth businesses, as discussed above.

4. Financial Highlights

Consolidated results for 9 months ending 12/31/21 (FYE 3/22)

The first 9 months of FYE 3/22 net income (excluding intercompany adjustments) increased 45% vs. 9 months of FYE 3/21, thanks to strong investment gains and solid performance of asset management businesses in Europe and US. The company report one time sales of assets/securities/properties under investment gains. Orix’s asset management handle various investment vehicles (equity, fixed income, commodities and real estate).

(Source: Financial Briefing for 9 months ending 12/31/21 (FYE 3/22) )

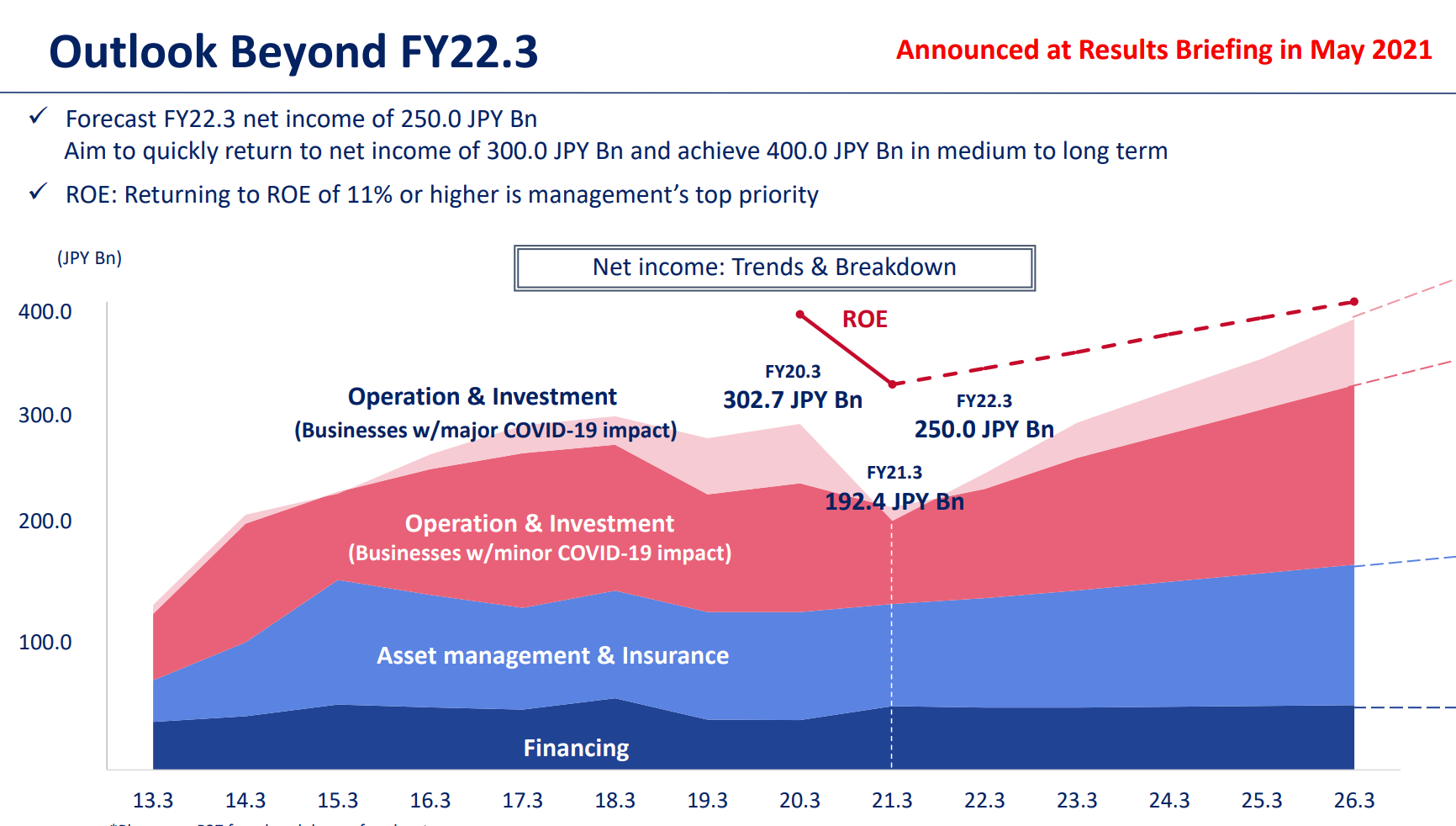

FYE 3/22 Guidance

The company guided FYE 3/22 net income of JPY 250 Bn in 5/21. However, faster than expected post-Covid recovery of many businesses, it upped net income guidance to JPY 310Bn in 12/21. Thus, Orix’s profits have returned to pre-Covid level in 2021. Management’s upmost priority is to reach ROE of 11% (currently 9.1%). Orix believes that it can get back to this FYE 3/19 ROE level via bringing up leasing profitability which was negatively impacted by Covid (e.g., aircraft leasing).

(Source: Financial Briefings for the Nine-Month Period Ended December 31, 2021)

6. Strengths and Weaknesses

Strengths

Well-thought out portfolio of businesses to take the company to a sustainable growth.

Weaknesses

Conglomerate discount?

A conglomerate discount refers to the tendency of markets to value a diversified group of businesses at less than the sum of its parts. A conglomerate discount can occur when there is confusion surrounding the company’s financial reporting and its core values. The discount can also happen when management lacks skillsets to effectively operate diversified pool of businesses.

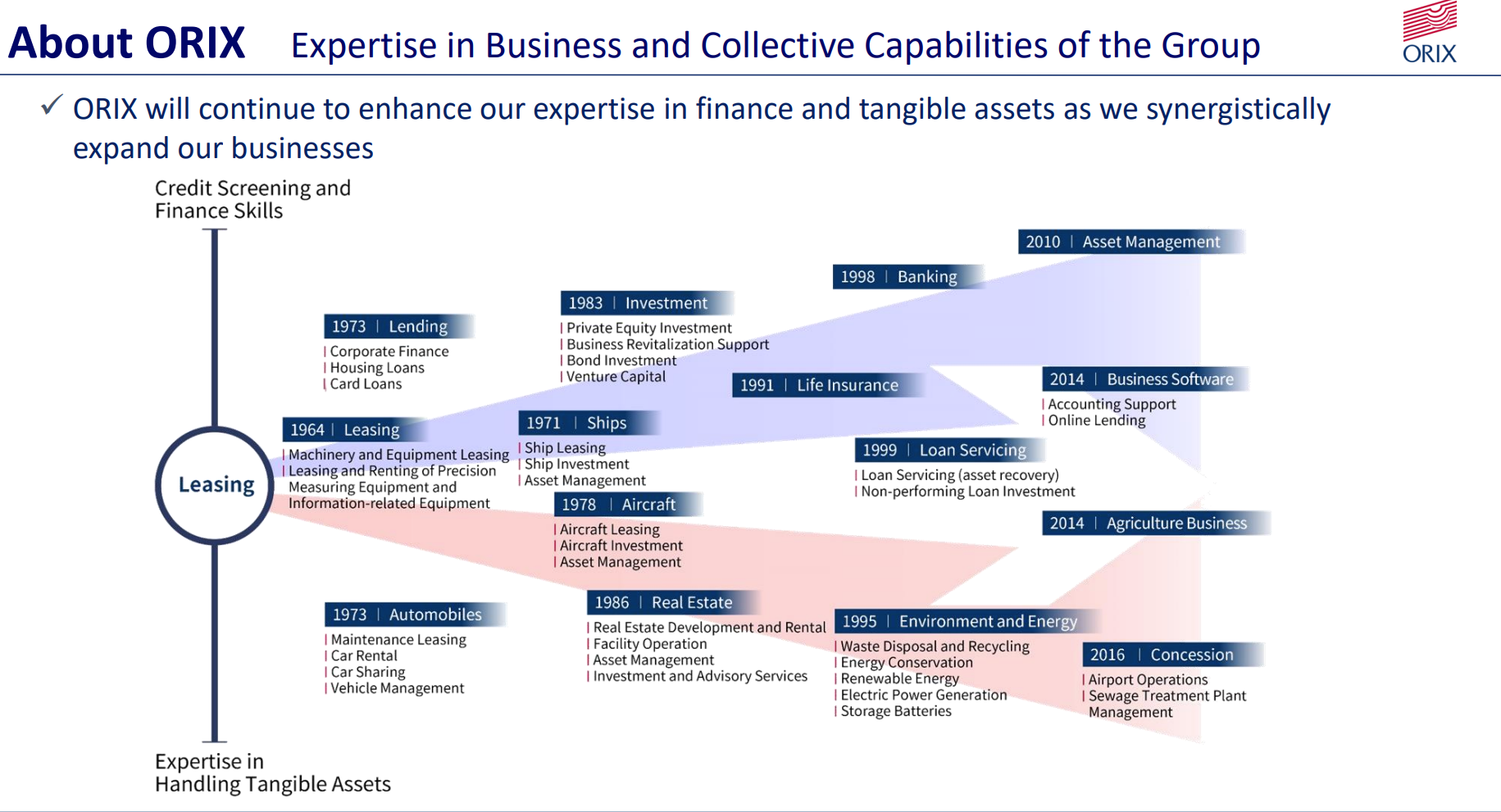

Founded as a leasing pioneer in 1964, Orix has expanded its operations gradually into areas which management could apply its credit underwriting skills (e.g., lending in 1973 and private equity investment in 1983). See the graph which illustrates the synergistical collection of Orix assets. Thus, management might have not been as thinly spread as it may look on the surface.

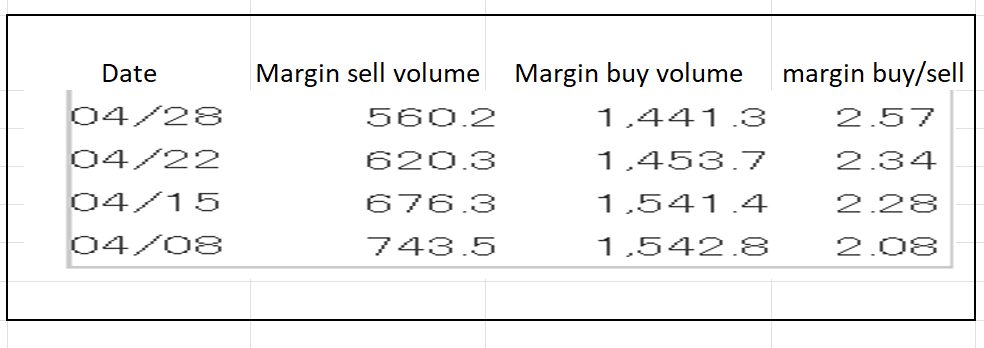

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Orix , margin buy/sell ratios is below 3x, the acceptable level. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance