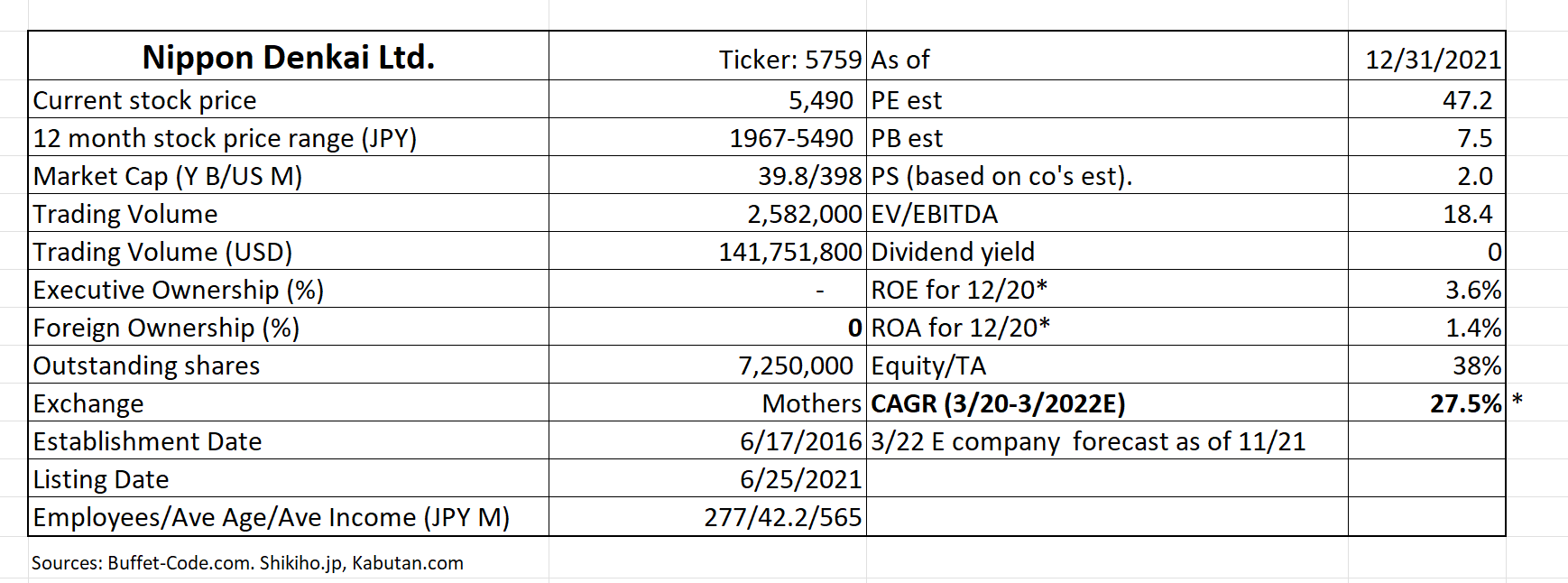

Nippon Denkai (Denkai or the Company) is a leader in development, manufacturing and sales of electrodeposited copper foil, used for EV batteries (64% of total sales) and PCB (printed circuit board/36%) for 5G applications.

1. Investment thesis

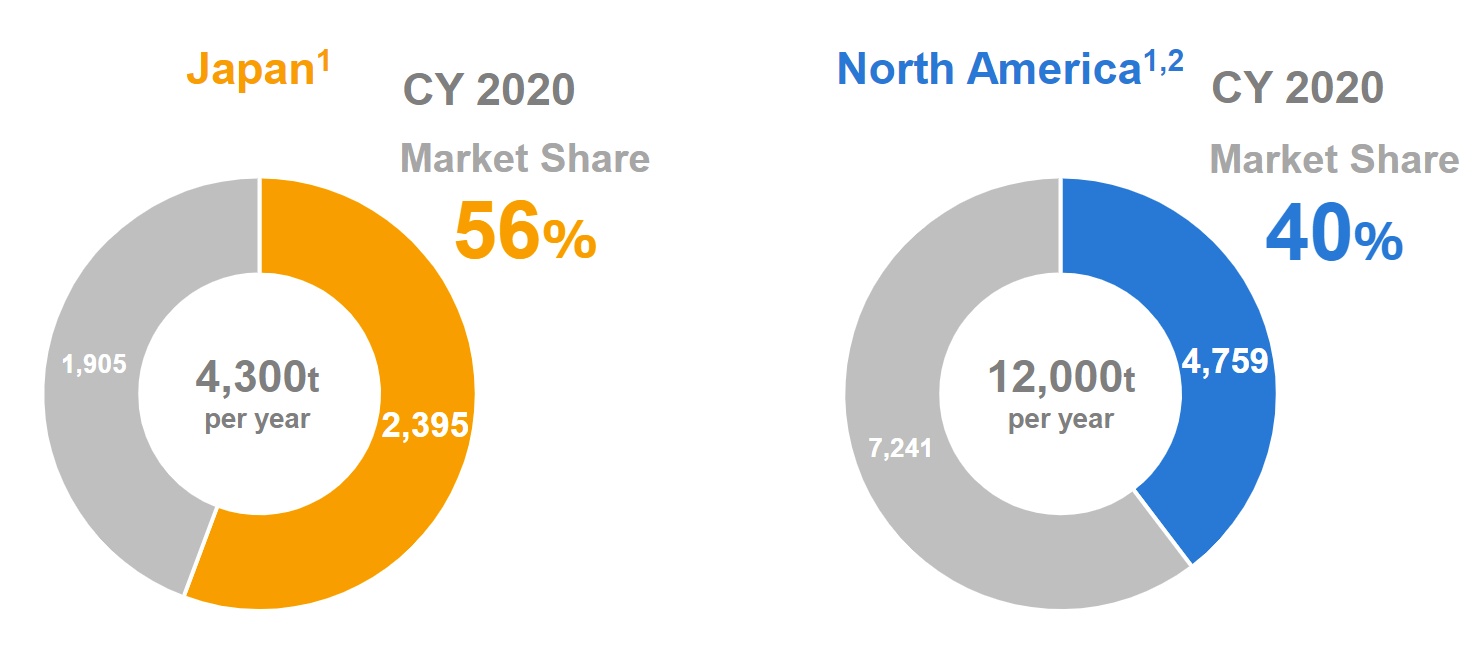

1) The leading electrodeposited copper foil* producer with high market share in both Japan and North America as shown below:

(Source: Company Profile as of 11/24/21, published on the company’s website)

*Copper foil is a type of metal tape used for electromagnetic shielding, and is used for electrical signal shielding and magnetism. Foil has a low surface oxygen and can adhere to various substances such as metals and insulating materials and has a wide temperature range.

2) Unique market position supported by the company’s high research and development capabilities.

Denkai has numerous US and Japanese patents on composite copper foil and method for production thereof.

3) Denkai America (“DAI”): is the North America’s only electrodeposited copper foil producer.

IPO proceeds are used for facility improvement of this US sub since 5G demand of US companies is rising. DAI has 30 years of history and name recognition in US. Having a local US production is important since 1) it reduces delivery lead time and transportation costs, and 2) it contributes to reducing inventory level at the customers.

4) Steady sales growth expected for FYE 3/22.

Sales is expected to grow to JPY 20,282 MM even after lowered guidance which is discussed in “Technically Speaking” section below.

5) Dealing with copper price hike.

Denkai is not immune to rapid price hike of copper which is the highest portion of cost of goods sold. Copper price doubled since it hit bottom during the height of Covid pandemic. The company’s pricing contract is based on sliding system in which company can pass on cost hike to its selling prices. However, there is 3 month time lag between purchase cost increase and selling price increase, but some portion of cost hike can be borne by the customers.

6) Production capacity increase in the works.

In 2021, the company has transformed part of DAI’s existing production line to EV battery copper foil line. DAI’s production process will be optimized in 2022 and the company will start selling EV battery copper foil in the US in 2023. Denkai also has a plan to build a new factory in the US, if demand requires it.

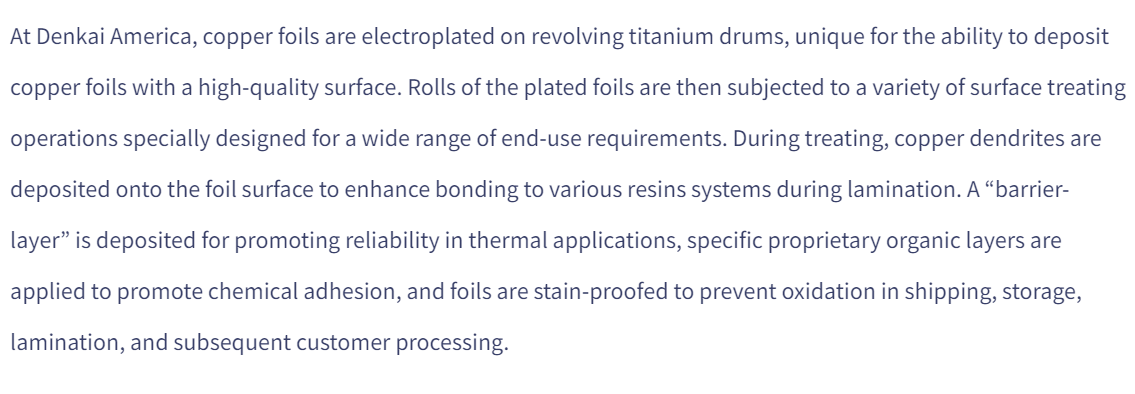

*ROA and ROE are low due to high depreciation expenses. This is rather typical for manufacturing company which is rapidly adding production capacity.

2. Technically Speaking

(Source: Buffet-Code.com)

On 11/10/21 the company revised its FYE 3/22 guidance (sales is higher and profits lower) as follows.

Net sales: JPY 20,282MM (+ 7.5% vs. the previous guidance)

Operating profits: JPY 1,051 MM (-19.4%)

Net profits: JPY 1,000 MM (-18.5%)

Based on the first 6 months of market conditions, the company saw the demand for its products will be lower than previously expected, due to:

1) Global overall semiconductor shortages, which has led to lower demand for smartphones

2) Production cutbacks at major auto makers, driven by part supply chain issues,

3) Prolonged trade negotiations between the US and China, casting negative impacts on smartphone shipments.

4)In light of the above three issues, the company has lowered the expected production volume of all products from 12,512 tons to 11,885 tons (down by 5% from the previous guidance)

5) The price assumption of copper is raised to JPY 1,808 per Kg from the earlier JPY 760 Kg given the market price of copper remained high.

As a result of this guidance cut, the stock went down by around 10% on 11/10. However, since this drop the stock has slowly rebounded and reached its historically high, driven by:

A) The stock is supported by favorable industry growth outlook as a player in EV and 5G space

B) Management team tried to provide more color on the first three issues above during Q&A session at their earning presentation on 11/16/21.

For 1) and 2) management felt that the tight supply chain issue and low semiconductor availability will be gradually solved around the year end of 2021.

For 3) while US China situation is beyond the company’s control, the company is trying to be diligent in managing their production process and overall expense controls.

3. Who is Nippon Denktai?

The Company is a newly IPOed company, but has a long operating history, founded in 10/1958 by three companies – Hitachi Ltd., Sumitomo Bakelite Co., Ltd., and Kosoku Denki Chuzo Co., Ltd*.

*These 3 entities no longer own the company. Furthermore, MSD Corporate Investment which owned 30% of the company at the time of IPO, has since gradually reduced their holdings to 0% at this point. MSD is a private equity firm, founded by Mitsui & Co., Ltd.. Sumitomo Mitsui Banking Corp., and the Development Bank of Japan Inc.

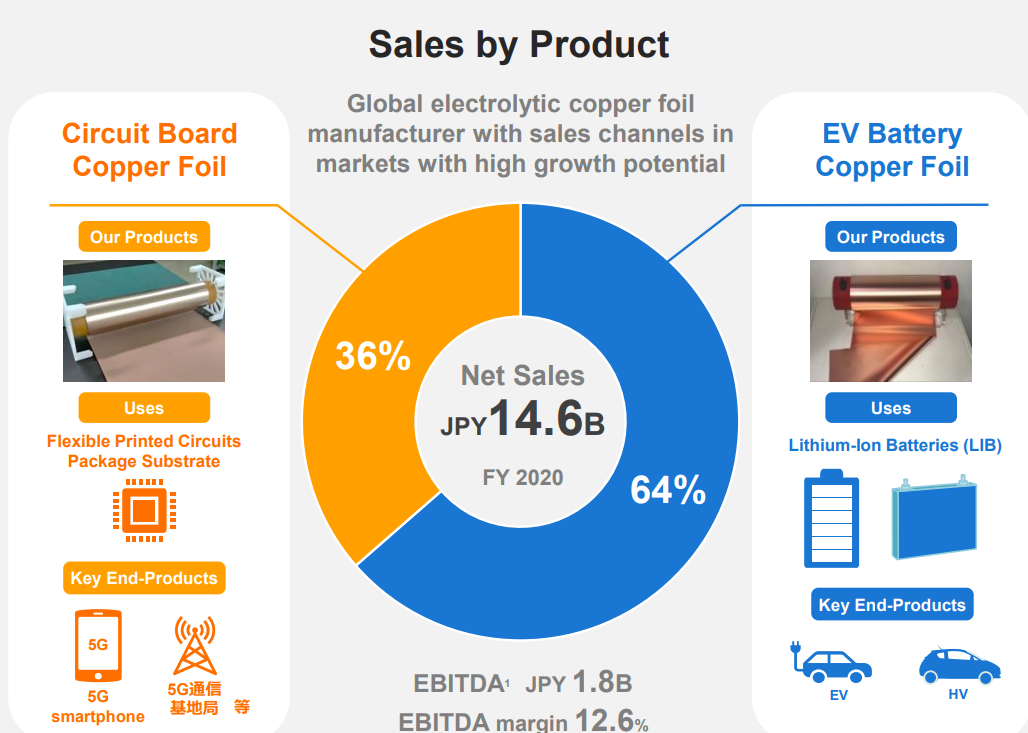

Denkai is mainly engaged in electrolytic (electrodeposited) copper foil. The products include copper foils for in-vehicle batteries, high-strength copper foils, copper foils for microcircuit substrates, and ultrathin copper foils. These products are mainly used for lithium-ion secondary batteries (LIB) installed in electric vehicles (EV) and hybrid automatic vehicles (HV). The company’s products are also used for circuit boards mounted on electronic devices including 5G related communication system and phones.

4. Business Model

The company has one business segment (electrolytic copper foil) with two distinctively different end user markets: Circuit Board Copper Foil accounts for 36% of net sales and EV Battery Copper Foil 64%.

(Source: Company Profile as of 11/24/21, published on the company’s website)

Key end products for Circuit Board Copper Foil are 5G smartphone and 5G transmission stations.

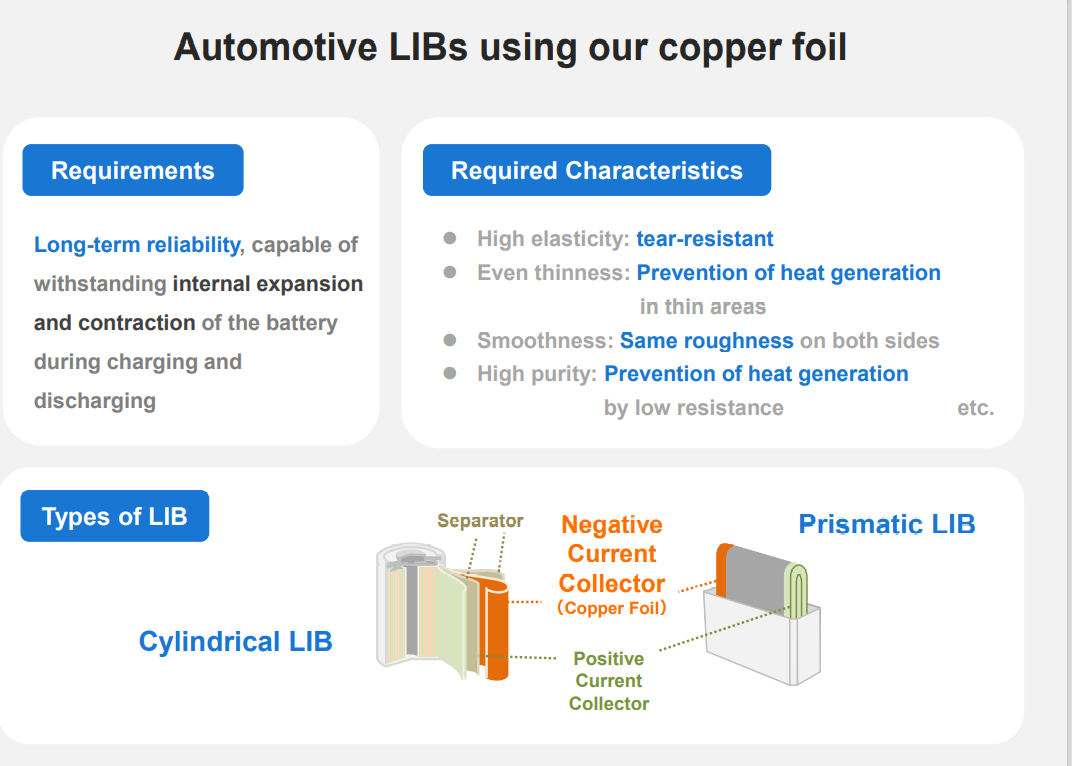

The qualities of Denkai’s LIB (Lithium-Ion Batteries) which set them apart are:

Long term reliability, capable of withstanding internal expansion and contraction of the battery during charging and discharging.

This high specification can be achieved through their unique manufacturing process* which allows the company’s copper foils to be used for a wide range of end user markets and to be shipped in good, stain-proofed condition.

*The below paragraph taken from Denkai America’s website explains their unique manufacturing process as follows:

Note: The below table describes high quality of automotive LIBs using Denkai’s copper foil in more details.

(Source: Company Profile as of 11/24/21, published on the company’s website)

5. Financial Highlights

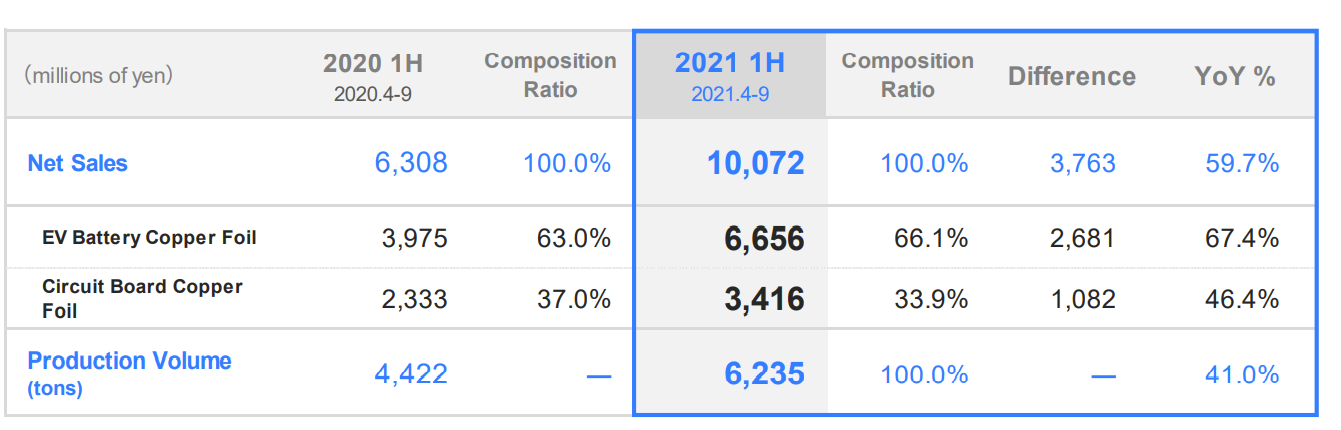

Financial Results for the first 6 months of FYE 3/22 (4-9/2021):

As shown in the below table, Denkai enjoyed sales increase of 60% year on year. Operating profit increase was even bigger at 120% year on year. The robust sales of both EV and circuit board copper foils supported sales hike, as shown in the below table. Production which drives the sales was up 40% year on year.

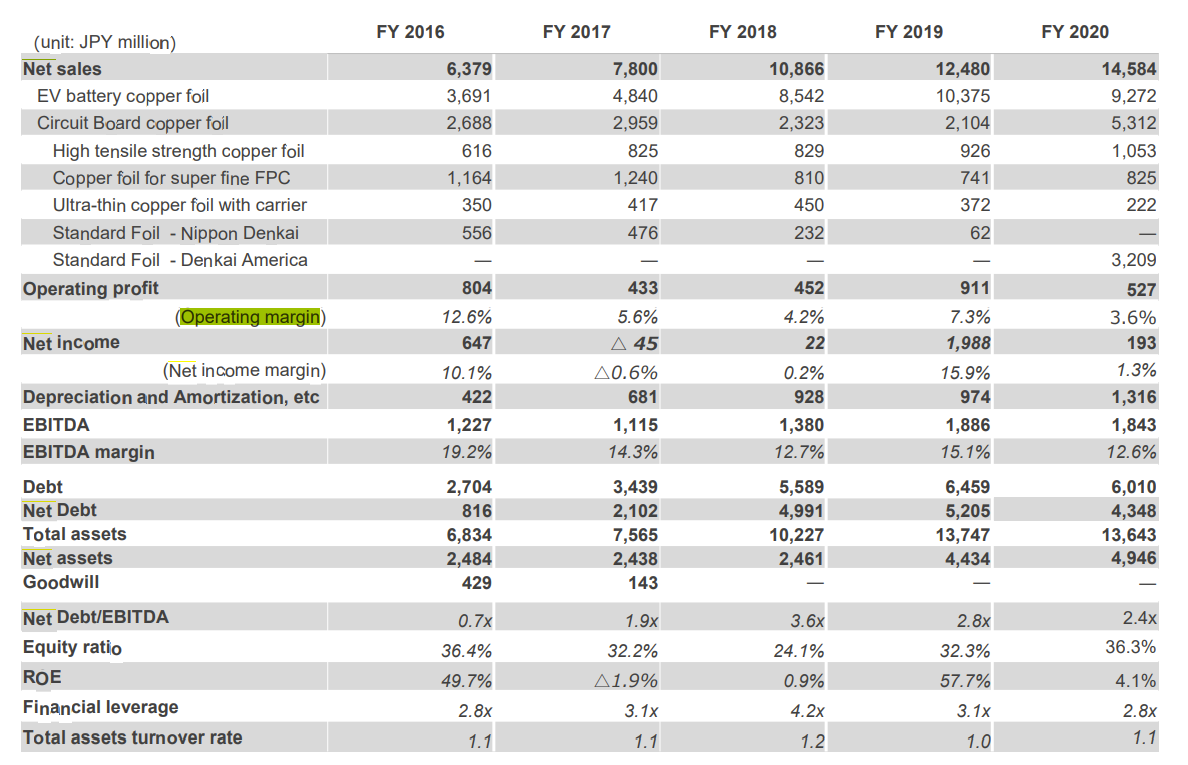

Denkai’s financial profile for the last 6 years

During the past 6 years, FY 2018 and FY 2020 experienced lower operating margin vs previous years despite net sales increase in both years.

This reflects the company’s income structure is highly susceptible to price fluctuation of copper.

In FY 2018, copper price increased by JPY 153 to JPY 757/kg. Operating margin was down to 5.6% in 4.2% from5.6% in FY 2017. In FY 2020, copper price increased by JPY 277 to JPY 937, thus, operating margin was low at 3.6%. On the contrary, in FY 2017, copper price declined from JPY 676 to JPY 604, contributing to the recent margin high of 12.6%. Similarly, in FY 2019, copper price declined from JY 747 to JPY 682 leading to operating margin increase of 4.2% in FY 2018 to 7.3% in 2019.

This high operating leverage to copper price fluctuation is one of the company’s inherent weaknesses. However, the company is partially mitigating this susceptibility by using sliding selling price structure and focus on high end markets such as 5G in PCB space which carries higher margin.

(Source: Company Profile as of 11/24/21, published on the company’s website)

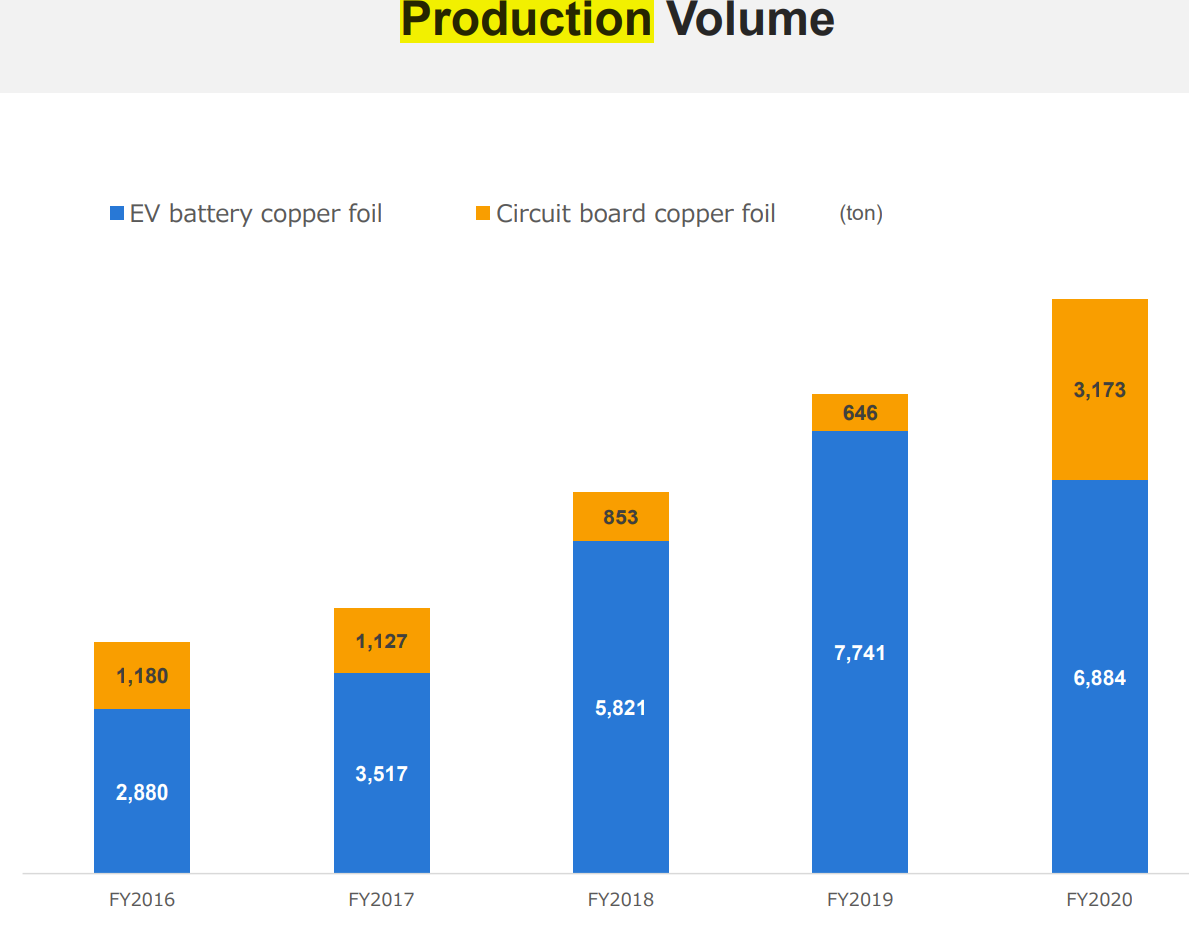

Production volume (KPI – key performance indicator)

The below graph indicates that production volume has increased, supporting steady sales growth. In FY 2020 ending 3/21, the company was able to offset lower EV battery copper foil (due to auto production cut in Covid era) with an increase of circuit board copper foil production.

(Source: Company Profile as of 11/24/21, published on the company’s website)

6. TAM (Total accessible markets)

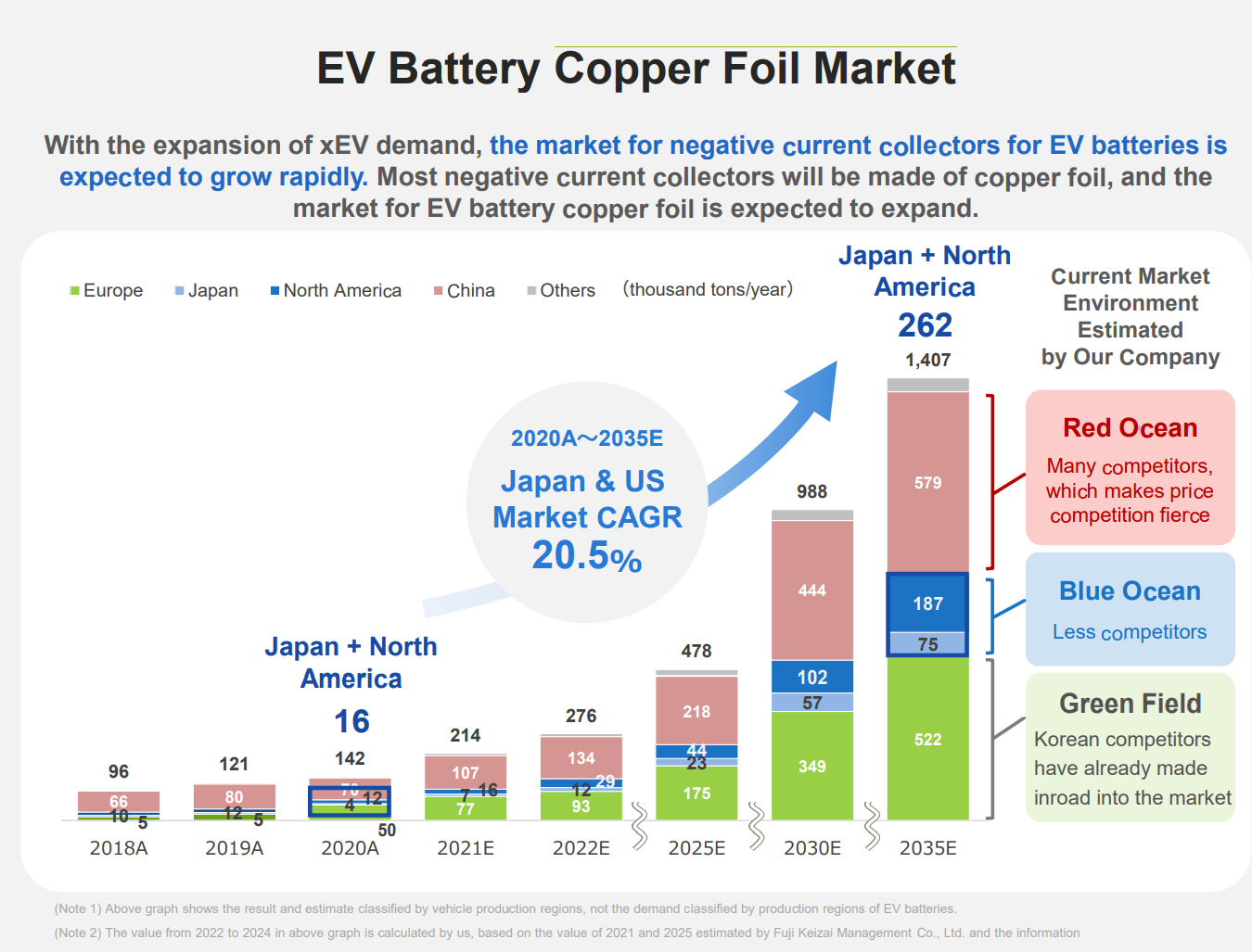

EV Battery Copper Foil Market

(Source: Company Profile as of 11/24/21, published on the company’s website)

The above industry growth estimate for 2021-2025 is prepared by Fuji Keizai Management Co. 2025 through 2035 growth is estimated by the Company who is planning on focus on so called “Blue Ocean/wide open” market which is the market for negative current collectors for EV batteries. In sum, EV Battery Copper Foil market is expected to grow from 2020 to 2035 at CAGR of 20.5%.

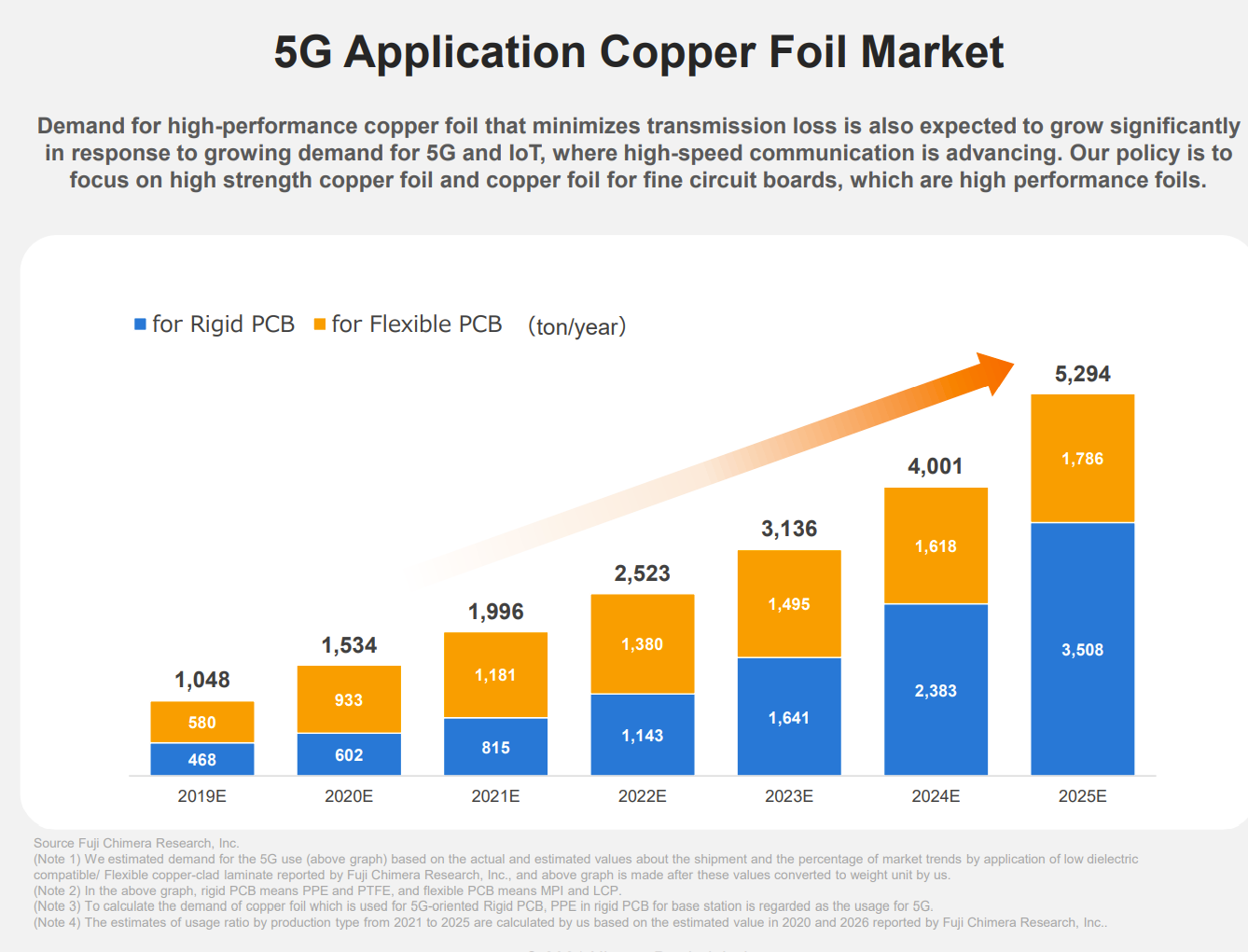

5G Application Foil Market

The above 5G application industry growth estimate was prepared by Fuji Chimera Research with adjustments by Denkai. The growth is expected to be strong at 2020-2025 CAGR of 28%.

7. Strengths and Weaknesses

Strengths

1. Industry Tailwinds

As we just witnessed in the preceding section, the business environment surrounding the company is very supportive. The company’s two end user markets are expected to grow strong at 20.5% for EV Battery and 28% for 5G applications.

2. Established market presence/market leader

The company operates in a highly competitive industry. However, it has achieved high market share (Japan: 56%, North America: 40%) through its advanced technical capabilities.

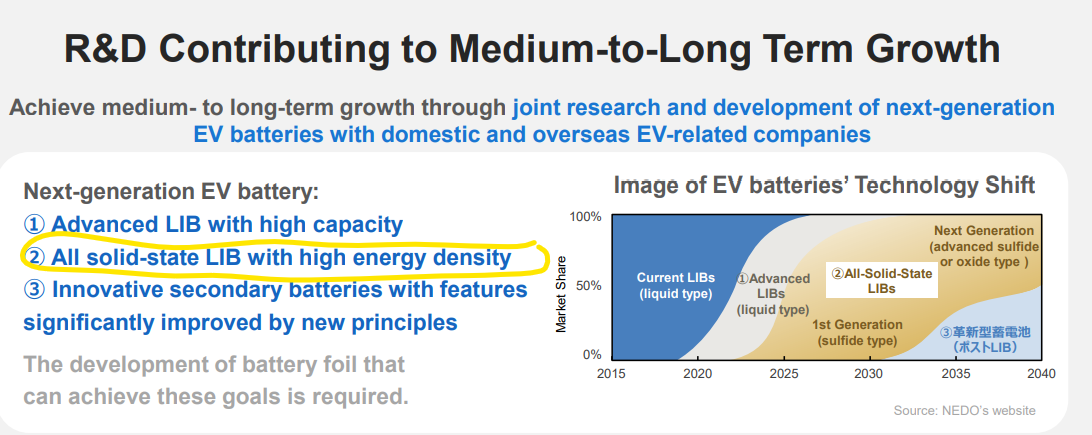

Denkai intends to continue focusing on R&D to ensure its long-term leadership position. The current focus is on all solid-state LIB which can offer exponential increase of safety and reliability via its high energy density noted 2) in the below slide.

(Source: Company Profile as of 11/24/21, published on the company’s website)

Weakness

1. Rising Copper Prices

As discussed in “Financial Highlights” section, . The company’s EBITDA is inversely related with the copper price trends. There is 3 month time lag between purchase cost increase and selling price hike, therefore, in case of a rapid copper price jump during a short time period, Denkai can’t reflect their selling prices in a timely basis. The company plans to mitigate, at least partially, these rapid price hikes through production efficiency improvements.

2. High Key Customer Concentration

The company’s FYE 3/21 sales show that Denkai is highly dependent on two key clients: Panasonic 55.8% and Primeearth EV Energy (a JV of Toyota and Panasonic): 8.4%. This is reasonable at this point since these two companies are leaders in EV battery in Japan. Nonetheless, Denkai believes that the company can diversify its client base through its US subsidiary Denkai America

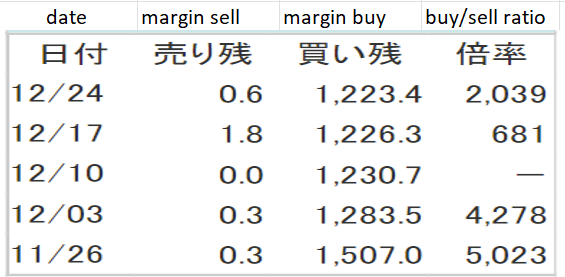

8. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Denkai, margin buy balance has slowly come down. Furthermore, the stock has reached its historical high on the last trading day in 2021. Therefore, we can assume that very little near-term selling pressure exists at this point.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance