Defense stocks have been attracting global investors’ attention to reflect an increase in unrest both in Europe and Asia. Japan has been nervously watching China’s move re: Taiwan and North Korea’s missile emissions to the direction of Japanese Sea. In fact, North Korea has recently fired 8 missiles toward the direction of Japan, the most one day firing in its history. In response to this hostile action, Japanese Prime Minister Kishida has proposed that Japan will increase its defense spending from the current 1% of GDP to 2%.

It is not clear that how Japan will finance this significant increase in another government spending. However, one fact seems to be clear: defense spending is increasing.

Why Nippon Avionics?

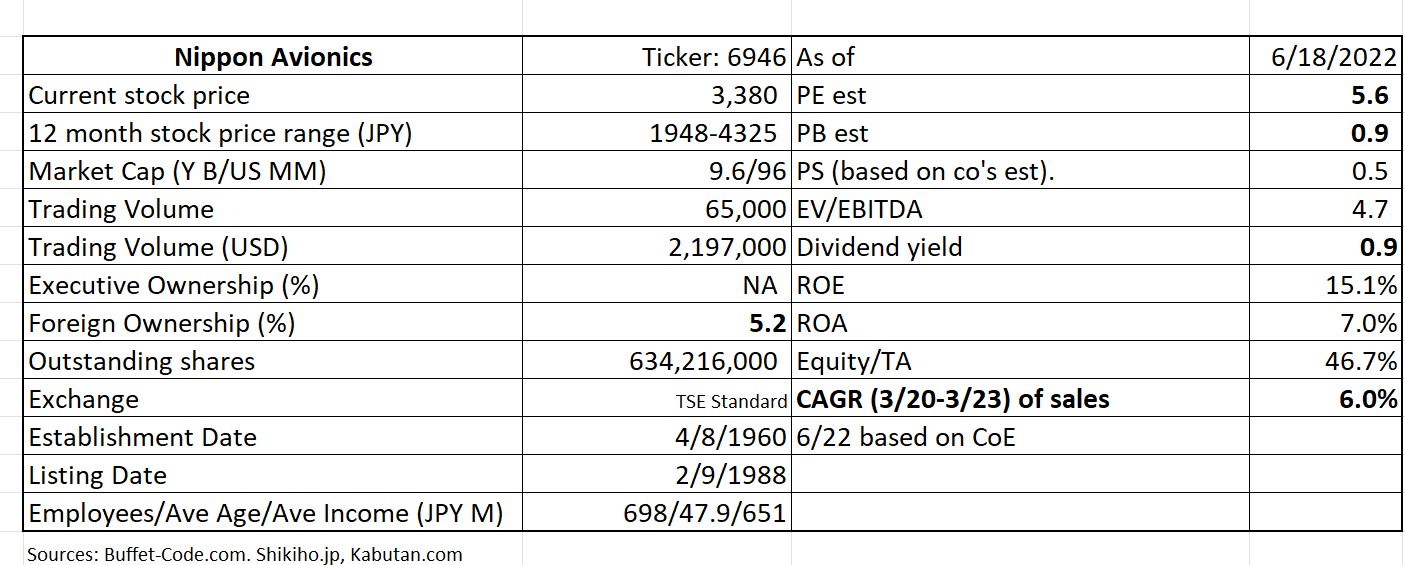

Nippon Avionics (“Avio” or the “company” was #8 in Nikkei’s list of Japanese defense related companies in terms of high operating margin. But PE is very reasonable at 6x. Its defense exposure is relatively high as about 60% of its sales is from “information system products” which provides command system to Self Defense Forces.

Who is PPIH?

In 6/1960, NEC Corporation and Hughes Aircraft Company jointly created Nippon Avionics Co., Ltd. It has now established itself as a major manufacturer of defense electronic equipment.

Two main segments:

1) Information system products 58.3% of the total sales

This group provides command/control systems and display/acoustic systems to all 3 groups (Army, Navy and Airforce) of Japan’s Self Defense Forces.

The company participated in the development of a large-scale defense information system including the first-generation BADGE system (Basic Air Defense Ground Environment). Avio also supplies high speed, high frequency and heat resistant ICs (Integrated Circuits). Hybrid integrated circuits which are installed in artificial satellites and rockets were approved by the Japan Aerospace Exploration Agency (JAXA).

2) Electronic Equipment 41.7%

Welding:

Handles electronic devices includes 1) infrared measuring devices and 2) precision joining/welding equipment. Application of their welding technology is wide and main end user industries are smartphones and automobiles.

2) The company is well regarded as an equipment welding one stop shop. Avio is capable of offering 4 different types of welding product series depending on the clients’ needs.

i) Laser Welder Series: Laser welder, by using light, can weld parts in a narrow area without touching adjacent parts.

ii) Pulse Heat Unit (Hot Bar Bonder): Precise heat adjustment makes “even welding” possible.

iii) Resistance Welder: Used for welding power supply & transformer. Electricity welding allows efficient welding of metals.

iv) Ultrasonic Equipment Series : Using high frequency oscillation, ultrasonic welding can join plastics and metal.

Thermography:

Avio’s thermography technology group boasts the leading edge technology and is expanding its application. The most recent application is for early disease detection. The company’s small thermography devise is capable of checking and displaying a person’s temperature instantly. More upgraded devises can detect the temperature of multiple people who are on the move.

1. Investment Thesis

1) Growing industry

As discussed above, there is heightened awareness among investors of rising defense spending globally. Japan is not an exception.

2) The company is turning around

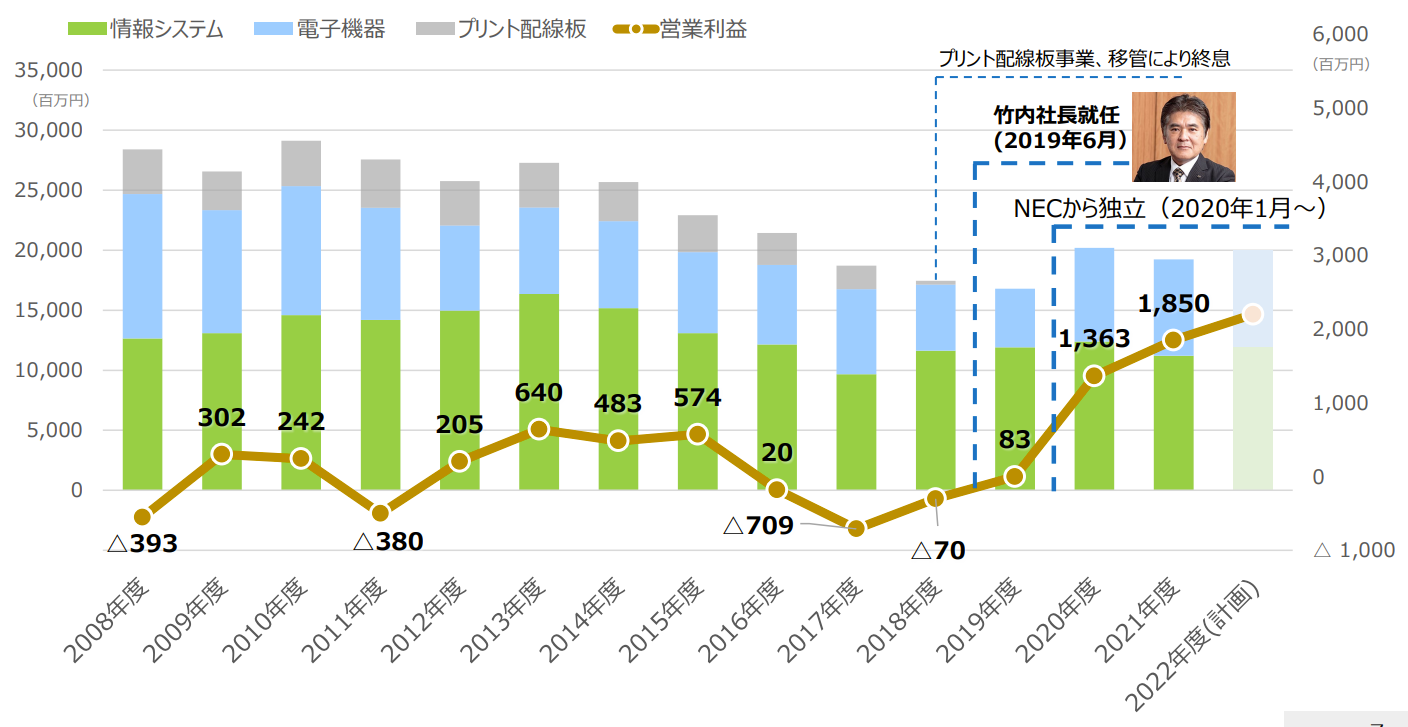

I believe the below graph is the most important one from Avio’s FYE 3/22 financial briefing presentation. The graph illustrates the company’s struggle since FY 2008 though FY 2019.

In an effort to resurrect Avio, NEC (then the parent company) has decided to sell its shares to Japan Industrial Partners (JIP) which acquired 50% of Avio in “2019 tender offer” and replaced NEC as a largest shareholder. JIP is a private equity, well known for their ability to turn around the struggling companies.

Under the new owner, JIP, Mr. Takeuchi has become the President. To improve its sales level and profitability, the company has set a goal to improve the following three key areas: QCD

Q: Improve the product quality from a design through an each step of production

C: Cut cost in both purchase and production

D: Improve Delivery efficiency, on all aspects of distribution to meet a strict deadline.

The above initiatives are bearing fruits. Avio reported record operating profits in FYE 3/20 and FYE 3/21 despite some operating challenges under Covid restrictions.

The bar graph (scale by the left axis) represents sales trend and the line graph is operating profits (scale is by right axis).

(Unit: JPY MM)

(Source: Results briefing for FYE 3/22)

Legends:

Green: Information System Products

Blue: Electronic Equipment

Grey: Printed Wiring Board (This business was sold to Oki/Japanese telecom equipment manufacturer in 2018, to allow Avio to focus on its two core businesses).

3) New opportunities

The company has set “Health care” segment for a next leg of growth area to leverage on its thermography screening technology. Thermography can be used to sense and screen diseases at an early stage. Avio’s knowledge base acquired in information system group can be applied to analyze disease data and present possible treatment options.

2. Technically Speaking

(Source: buffet-code.com)

You can see from the above chart that the stock has come down along with the general markets. Thus, the stock can push it through JPY 4,000 with a large enough volume of good stock market conditions. The support level is JPY 3,040 and then JPY 2,400.

3. Business Model

The company believes that they have a well-established business portfolio:

1) Information system products (defense): This is a cash cow business.

2) Electric equipment: current growth business segment, especially in smart phones (including 5G equipment)

3) Thermography: new opportunities abundant as discussed in investment thesis section.

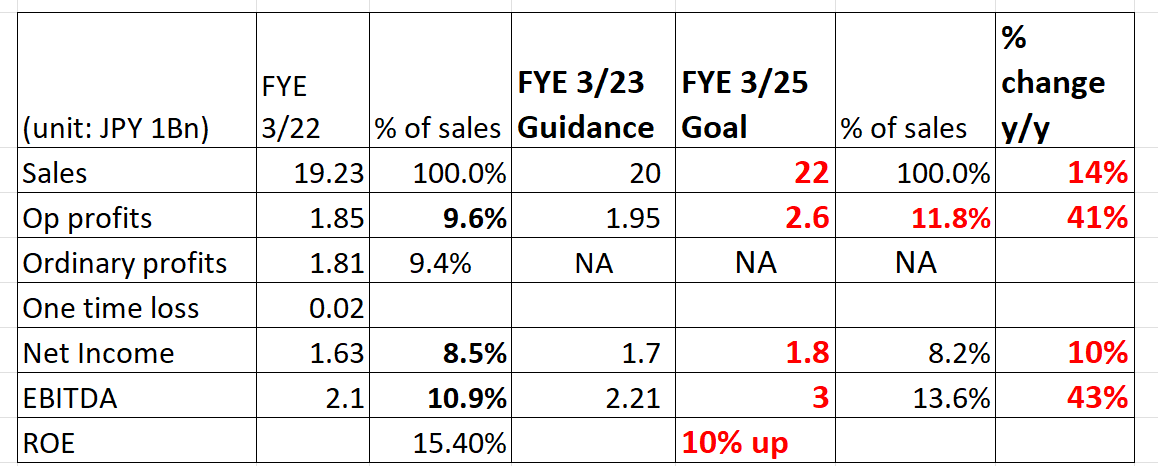

These three main businesses should help the company in reaching FYE 3/25 goal with operating margin of 11.8% and higher than 10% ROE, as shown below.

(Source: Results briefing for FYE 3/22)

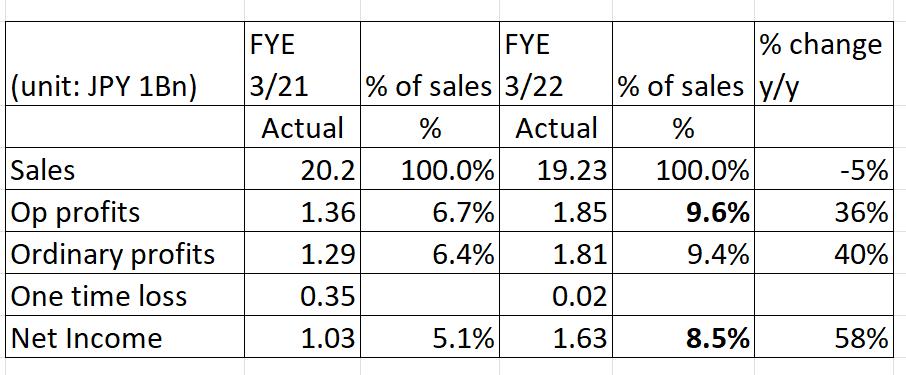

4. Financial Highlights

Financial Results for FYE 3/22

Total sales were slightly down since major projects in electronic system group was completed in FYE 3/21. Furthermore, Covid screening demand in thermography group slowed as Covid cases came down. However, rigorous process control led to operating profit increase of 36% and operating margin rose from 6.7% in FYE 3/21 to 9.6% in FYE 3/22.

(Source: Results briefing for FYE 3/22)

*One time (non-recurring) expense in FYE 3/21 was special financial support plan to employees.

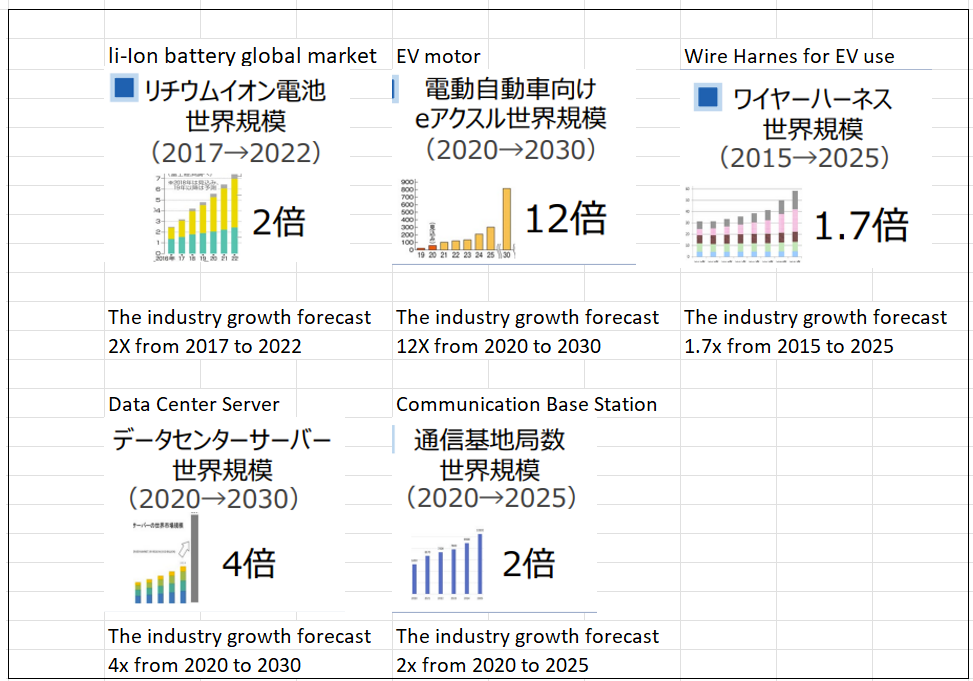

5. Total Addressable Markets (TAM)

(below statistics are prepared by Avio based on data from several research companies such as Fuji Keizai Group, Sougou Technology Research)

1) Electronic Equipment

Application of the company’s 4 unique welding technologies is expected to continue expanding on a global scale. The below 5 bar graphs depict that end user industry such as Li-ion battery and EV motor will likely grow 2x -12x for the next 10 years.

(Source: Results briefing for FYE 3/22)

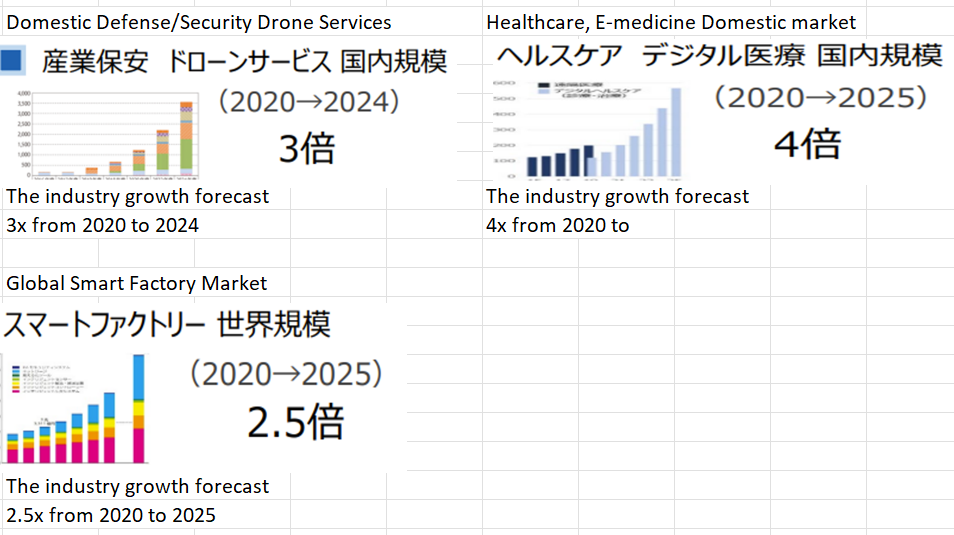

2) Thermography

Similarly, use of Avio’s thermographic technology will expand to the below 3 end industries. The company expects that defense use of drones and healthcare digitization will grow 3x and 4x respectively in Japan. Smart Factory industry size likely grow 2.5x globally.

(Source: Results briefing for FYE 3/22)

6. Strengths and Weaknesses

Strengths

1) Long history and exposure in government supported industry

Avio is entrenched in a defense industry which the prime minister Kishida is willing to increase spending for.

2) The sales and profit decline were reversed under guidance of President Takeuchi

As discussed in Investment Thesis 2), operating margin has reached its historical high level in FYE 3/22.

Weaknesses

Turnaround is still at an early stage

The stock still is a show me story, since the operating profit increase was a recent phenomenon. However, as we can see in TAM section right above, the company’s customer industries are expanding. This bodes well for the company’s continued growth.

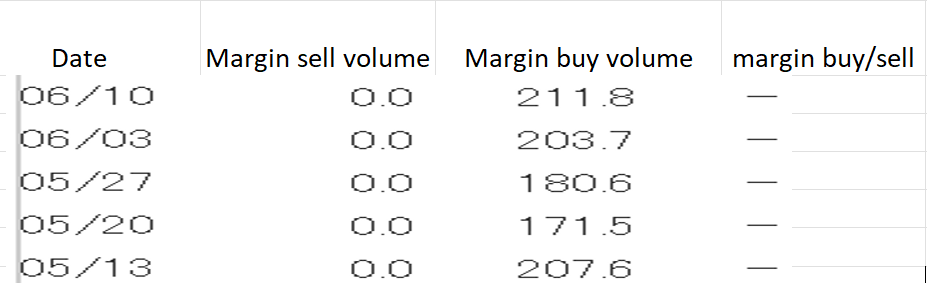

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Avio, margin sell ratio is zero. Margin buy volume is 3x of a daily transaction volume. There is a mild selling pressure, thus, the stock requires a good general market condition to move higher.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance