| For my first blog, I have chosen Money Forward (Ticker: 3994), although it is not a newly IPOed company which are already discovered and supported by the institutional investors. Money Forward, as a SaaS based accounting and other back office management provider, symbolizes what Japan sorely needs –digitization of Government and private corporations.

In its 1/2/21 article, the Economist called Japanese government as an “e-government failure”. It also noted that, in a survey of 30 counties in the OECD, Japan raked last in terms of providing digital services: only 7.3% of citizen requested anything from the government online in 2018 vs. Iceland’s 80% and behind countries such as Slovakia and Mexico. These are indeed sad and painful (to a Japanese) statistics, especially since Japan has some of the world’s best digital infrastructure, including top notch mobile networks. It appears that the progress toward digitization is minimal even though Mr. Suga, the now outgoing- prime minister, made digitization of government as one of his policy priorities in 2020. Japanese citizens are fully aware that productivity improvement through “process digitization” is the best way to offset labor force shrinkage in the rapidly aging society. Therefore, I believe that digitization initiatives of payment systems at private entities should garner people’s supports. As such, Japan’s Digitization is one of the highly profitable investment themes and it has a LONG runway (a low hanging fruit) since it is coming from a low base. |

|||

|

|||

- Business Summary

Money Forward (“MF” or the “company”) provides SaaS based accounting services to individuals, small to large corporations and financial institutions. Specifically, MF offers Money Forward, Money Forward ME (automatic household account book and asset management services for individuals. “MF Cloud Accounting” and “MF Cloud Finance” are services geared toward enterprises and sole proprietors. The company’s sales have increased exponentially over the last several years, driven by increased user base and recurring revenue sources from monthly subscription fees. MF continues to add several peripheral services including Web media “MONEY PLUS”.

- Investment Thesis

The company is the beneficiary of government’s official mandates, promoting country-wide transition from manual task handling to digitized (often cloud-based) systems. Indeed, the “Digital Agency”, which is a new regulatory body, was launched on 9/1/21 to lift Japan from the bottom of a ranking on fintech adoption in the world. The specific market opportunities for MF are abound, including the revision of the Electronic Books Maintenance Act, the increase of remote work amid the COVID-19 pandemic, the promotion of digitalization by the government, the expansion of the use of open API, the review of the Payment Services Act, and the digitization of salary payment.

- Investment Positives and Risks

Positives:

- Positive operational back drops: As stated earlier, MF operates in the industry segments which are desperately promoted by Japanese government.

- Entry barrier: In Japan, country specific accounting rules are still widely used which makes foreign competitors to simply bring their system to Japan.

- Large overseas growth potential: Expands the foreign partnerships including Mekari, the leading company to offer HR/Accounting/CRM services in Indonesia.

- Steady cash flow: Accounting package has a high switching cost for a client, i.e., clients, who once adopt MF systems, tend to become long term customers. Thus, MF has placed a priority in cross-selling accounting system to clients who are already using MF’s payroll and operating expense management system.

Risks:

- MF provides factoring which requires upfront cash flow investments. The company is handling this increase in cash flow requirements with a tie-up with Mitsubishi UFJ Bank.

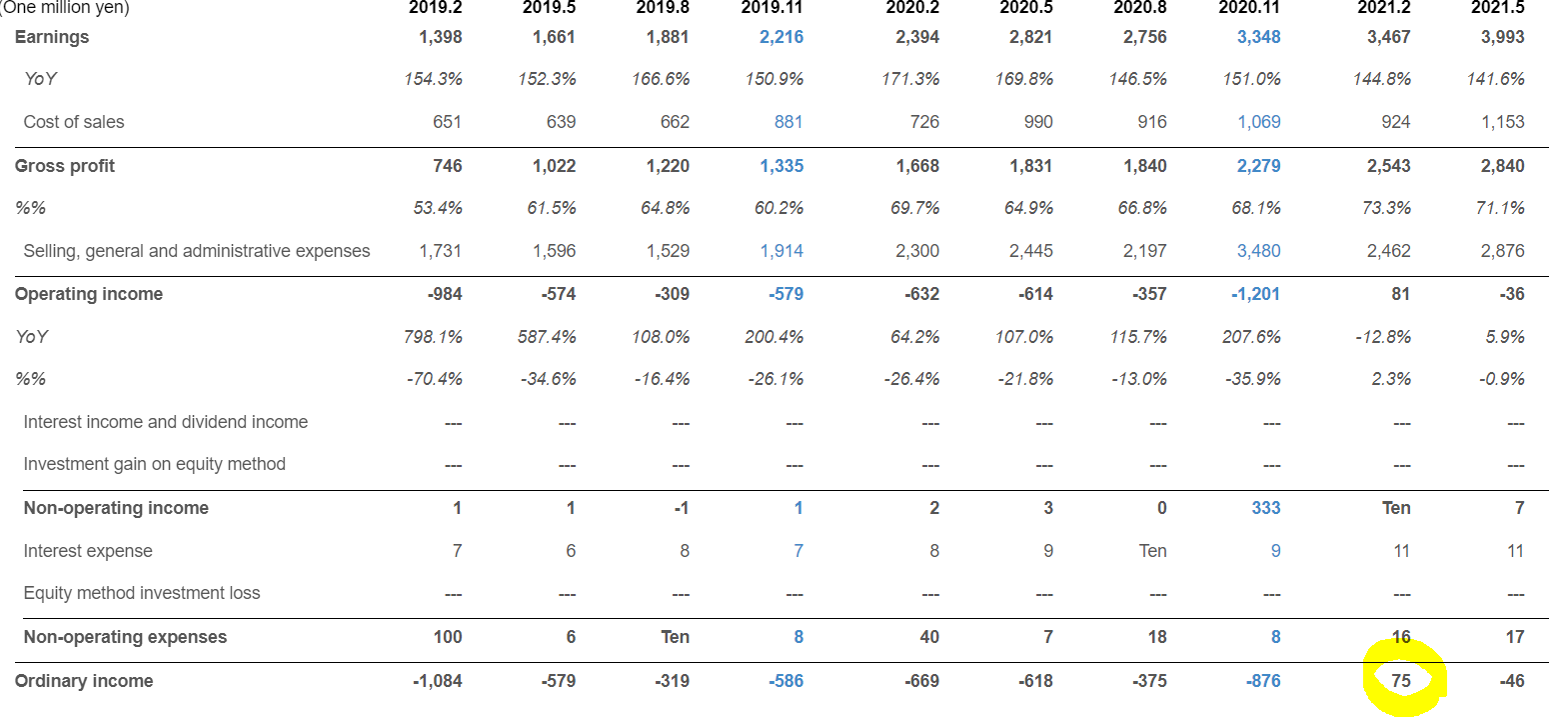

- MF has not generated positive net income. However, in Q2/21, marketing costs were well controlled, leading to net income of $75MM.

- Business Model

The company offer free and paid subscription-based products both for individual and corporate users. This recurring revenue streams support MFs’ steady cash flow.

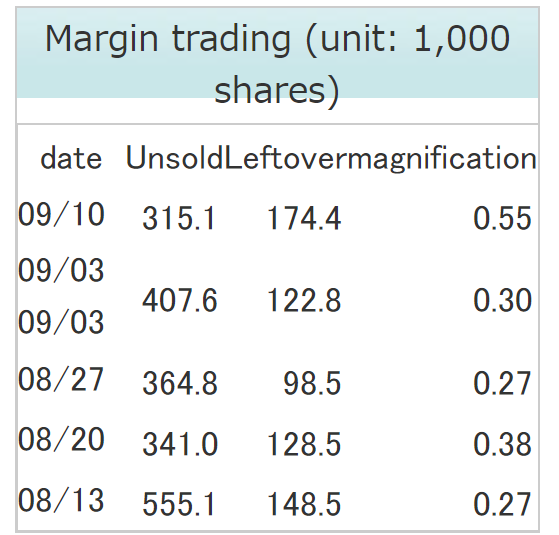

Sales breakdown by customer type as of 11/20 is shown below:

(Source: the company’s financial results briefing for FQE 5/21).

*DX Japanese Abbreviation for Digital Transformation

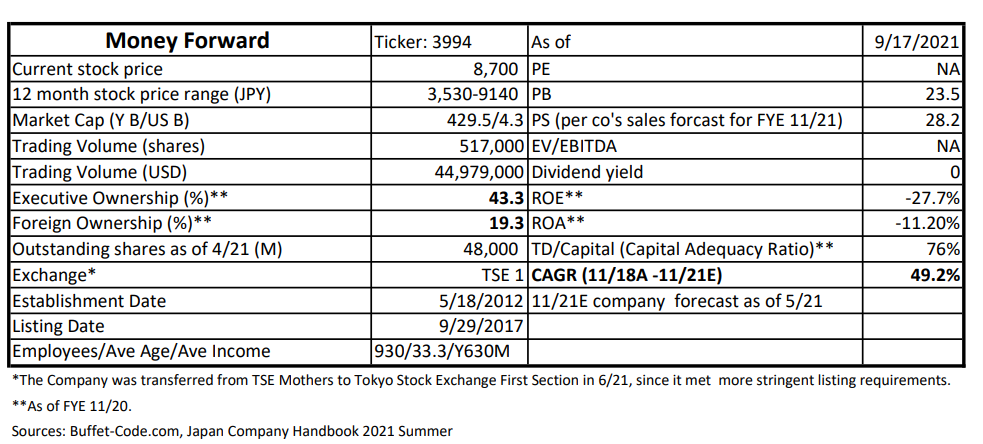

The below table shows how MF is scaling its operations based on their core technologies in data analysis and data security platforms.

- Financial Highlights

*Ordinary Income: net income

(Source: Buffet-Code.com)

- Sales in Q2/2021 increased 42% compared to Q2/2020 driven by SaaS ARR (Average Recurring Revenue) rise of 40% to Y9.7Bn.

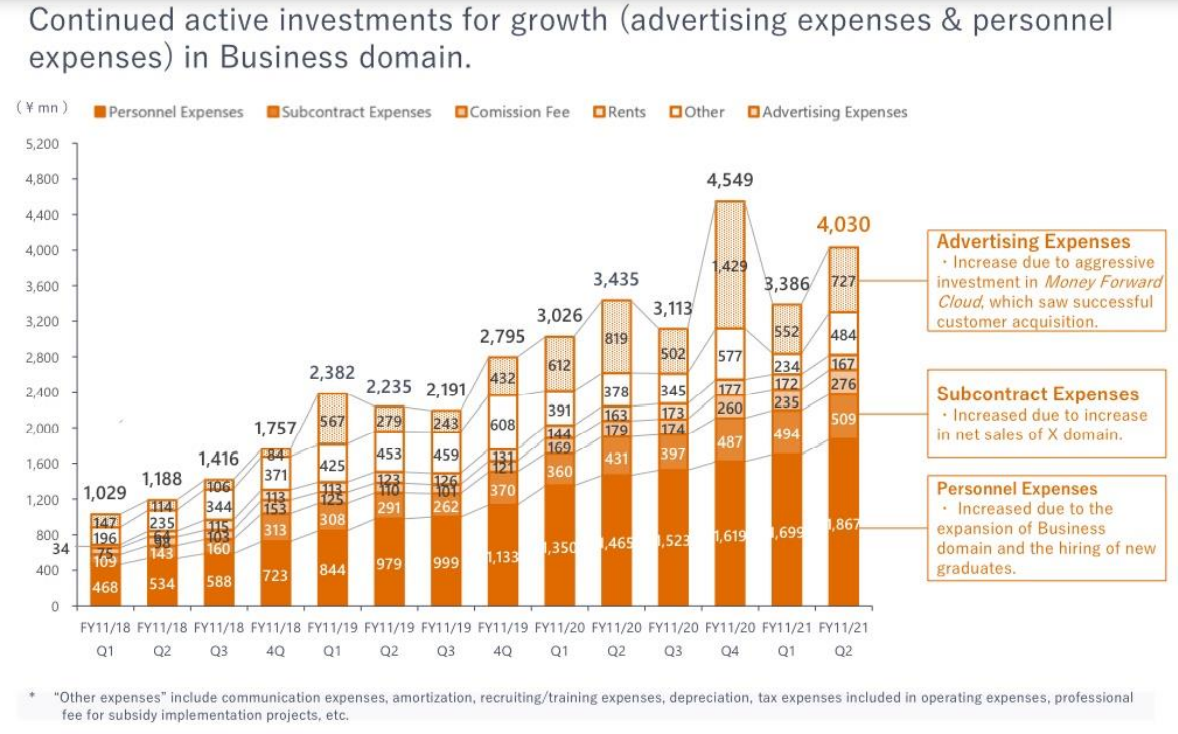

- Positive net income of JPY 75MM was reported, thanks to lower marketing costs as shown in the above table. However, the company focuses on spending on growth initiatives (hiring costs and advisements) as shown in table below.

- No liquidity issues, supported by borrowing relationships with major banks.

- Churn rate 2.5% vs. 2.2% in the previous quarter due to higher ratio of sole proprietors compared to larger enterprises who are stickier client segments.

- Enterprise APRA (average revenue per account) rose, excluding more seasonal “Streamed” which is used by individual accounting firms for Tax Return preparation.

Source: Money Forward: presentation materials for Financial Results for 2nd Quarter of Fiscal Year Ending 11/30/21, as of 7/15/21)

- Corporate Culture/Management

Established in 2012 by President Tsuji formerly of Sony and Monex, Inc. and launched services for individuals in the same year.

- TAM (Total Addressable Markets) is estimated at JPY 4.3Tn ($ 43 Bn), which is huge, driven by Business domain of JPY 2.4 Tn and Home of 0.8 Tn. The company’s TAM estimates for SaaS back-office application are mainly based on public data and Money Forward’s potential clients’ expenditure estimates. TAM estimate for domestic SaaS marketing applications is based on public SaaS firms’ combined marketing expenses % as of total sales.

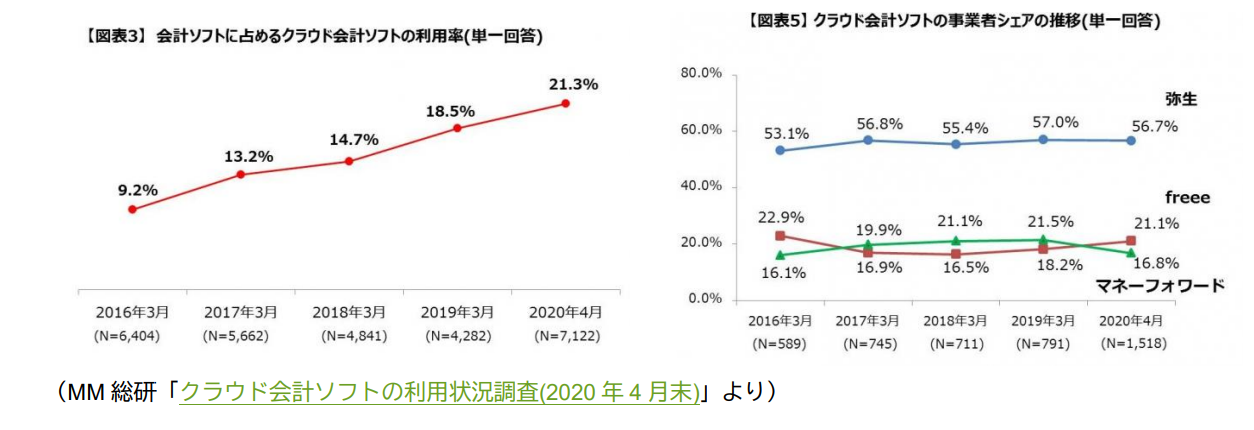

- Competitive analysis: the closest competitor is “Freee” which provides “cloud accounting software Freee” and “personnel labor management system Freee” targeting SME firms.

(Source: MM Research Institute: Survey on Cloud Based Accounting Software Usage in Japan (as of 4/20)

Left graph: Could accounting software as % of total accounting software which is rising every year since 3/2016 through 4/2020.

Right graph. Market Share Trend of Freee and Money forward in Cloud accounting segment in 4/20. Free accounting for 21.1% which was an improvement over 18.2% of 3/2019. Money Forward’s market share went down from 21.5% to 16.8%.

We reached out to MF for a reason behind their market share loss. Their reply: MM Research Institute’s survey focused on accounting software usage by sole entrepreneurs, which is the segment that Freee has targeted their ad resources to. Going forward, MF is also planning to attract more sole proprietor clients through the tie up with CPA firms. The shares of these two companies stayed very close and range-bound over the examined 4 years. It is reasonable to estimate that market share will likely stay neck and neck but both companies’ sales will likely rise, benefitting from wider cloud accounting system adaptation.

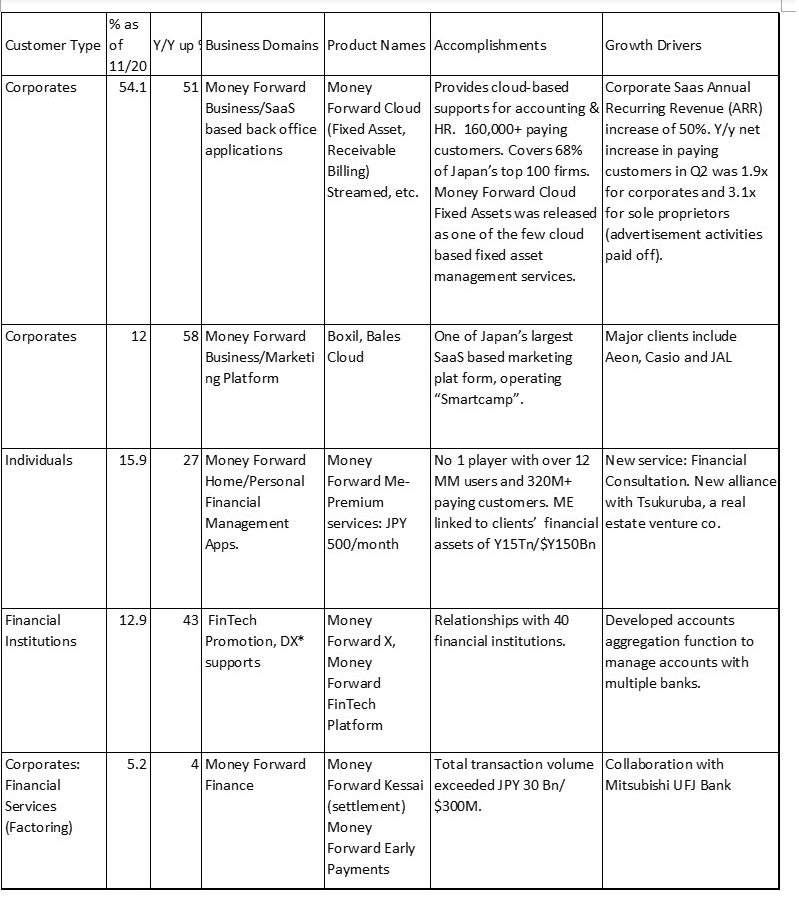

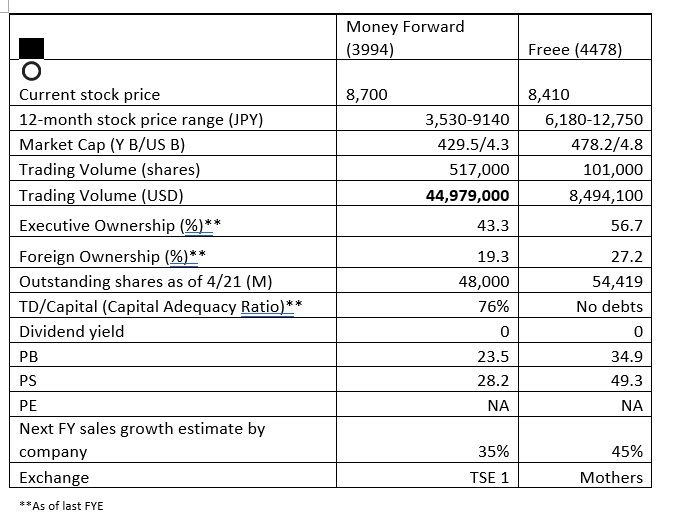

The below table compares two stocks on valuations and other financial metrics.

Sources: Buffet-Code.com, Japan Company Handbook 2021 Summer |

||||

These two companies have similar share prices and market caps. However, Freee’s valuation is higher (PS of 49.3x with Freee vs. 28.2x for MF), likely to reflect the faster annual growth estimate of Freee. The key differences are:

|

||||

| To our inquiry about the company’s view on this valuation gap, MF’s IR declined to comment, stating daily stock valuations are influenced and fluctuated by many factors one of which is investors’ expectations.

IR (Investor Relations) added that they believed their stock price should increase as their business and profits would grow. We also view that MF is a better stock at this point.

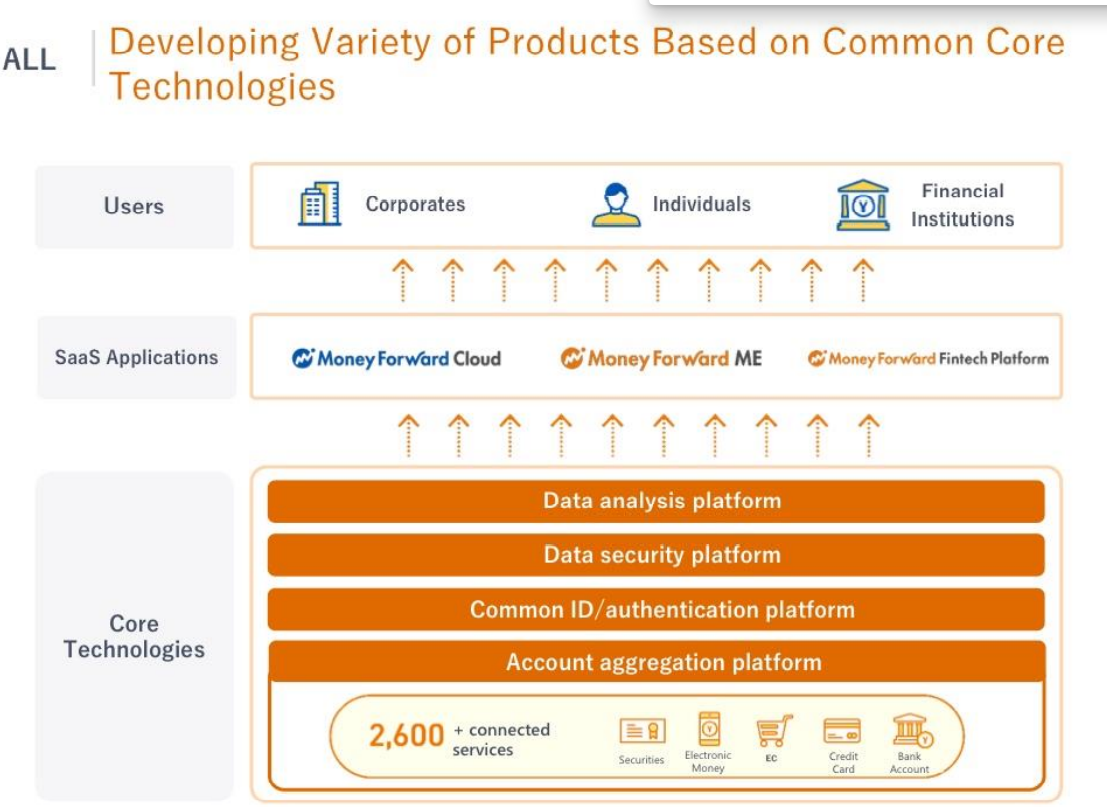

As noted in useful tips section, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For MF, there is no such a concern, as the below table indicates that margin sell (noted as “unsold’ in the table heading) is higher than margin buy (noted as “Left over margin”).

(Source: Kabutan.com) |

||||