Warning: Do you think NFT, Crypto and DAO are simply the hypes and fads? Do they remind you of the Dutch tulip bubble in the 16th century? If so, I am afraid that you will not find this blog useful.

The two mainlines of Kushim (“Kushim” or the “Company”) have been 1) the training of IT engineers for corporate clients and 2) the sales of e-learning materials, the development and sale of learning management system “iStudy”. The corporate name was changed from iStudy to Kushim in 5/20 in order to grow the 3rd growth engine (formerly housed in Incubation group). Now the company reports its earnings by the following three groups:

1) Blockchain Services

The current focus is to support the penetration of blockchain technology into Japanese daily lives.

2) System Engineering

Houses the previous two growth engines: Training and Offering of iStuty

3) Incubation

Provides “management and IT consulting”. Also houses the company’s investment initiatives.

1. Investment Thesis

1) Transforming into a growth company

As mentioned earlier, the company is adding an exposure to explosively growing blockchain industry. In order to accelerate a profitable expansion, the company has raised JPY 1,469 MM ($14.7MM) via rights-offering to fund future small M&As in blockchain space. The recent notable acquisitions are: Turingum and Seventage which are discussed in Business Model section.

The fund raising phase is now behind them and the company has entered into a growth phase.

2) Transforming into a profitable company

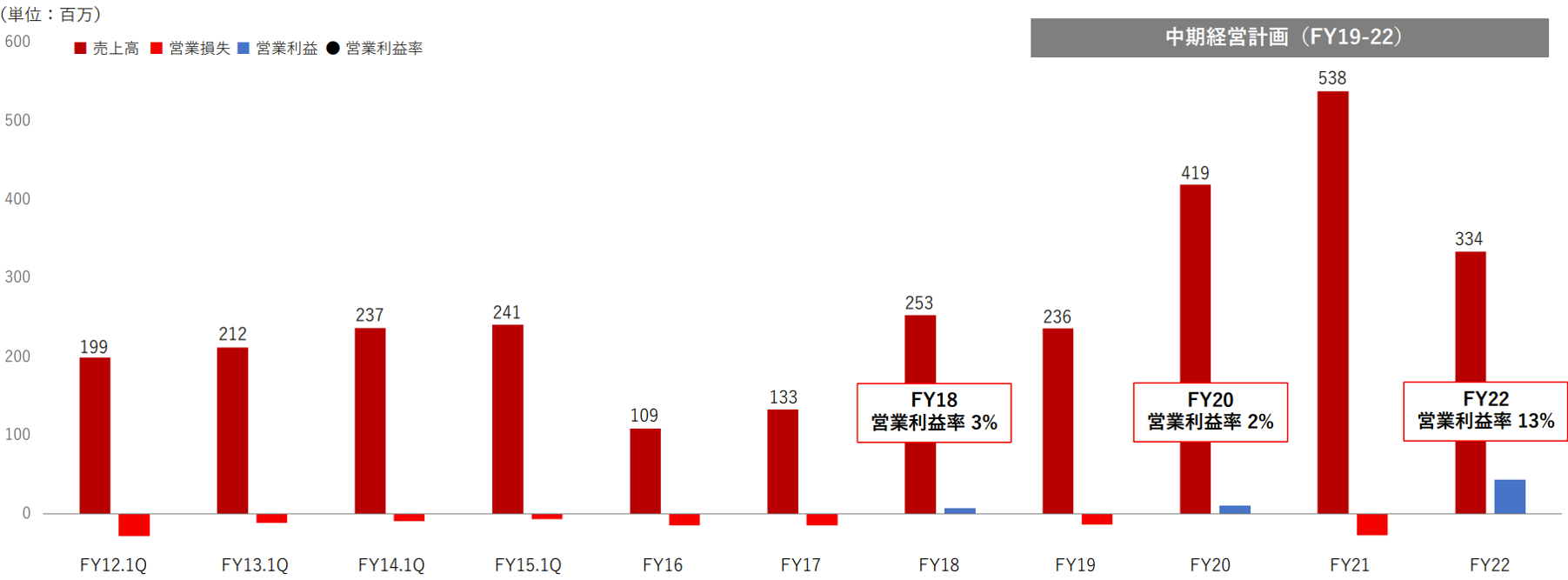

The above new organizational framework is still under “construction”, but is showing its benefits as Q1 FYE 10/22 recorded highest operating margin of 13%. The below bar graphs illustrate a 10 year trend for the first quarter sales and operating profits.

(Source: Financial results briefing for Q1 ending 1/31/22 for FYE 10/22)

Note:

Dark red: sales

Red: operating losses

Blue: operating profits

In the square: operating margin

The company has not issued its guidance for FYE 10/22, since the company is negotiating one acquisition which will likely be finalized in Q2. Once this transaction is complete, Kushim is planning on reporting the full year FYE 2022 expectation.

2. Technically Speaking

(Source: buffet-code.com)

The stock shot up when Kushim announced its profitable Q1 for FYE 10/22 in early March. Since then, the stock has come down to around JPY500 which is the heaviest price cluster. If the stock can keep the current volume (around $5 MM), it can push through it and will face lesser resistance.

3. Business Model

Their two fee-based main businesses – eLearning and training – have been under a rising competitive pressure. This has prompted the company to pivot to focus on the areas which have been natured in “incubation” group.

While it is in a middle of transformation and its blockchain service is at a very early stage of growth, it has generated profits in Q1 22 which bodes well for the company’s future growth trajectory.

The section below discusses the company’s 3 groups:

A) Blockchain Services

The Company acquired two startups in 2021 to jump start its advance in both blockchain space. These two companies (Turingum and Seventage) will be run as subsidiaries and are expected to contribute to the company-wide EBITDA starting in 2nd quarter.

Turingum: Founded in 2019 to focus on blockchain R&D and to develop blockchain applications.

Seventage: Founded in 2019 to develop blockchain games. The main game is RPGChojo.

As part of the blockchain services, Kushim has opened “NFT Marketplace” in 2/22 where investors can trade cryptocurrencies.

Furthermore, Kushim is working on transforming Cosplay phenomenon as a legitimate profit generating industry. To this end, it has published white paper on “cosplay token”. Their cosplay exchange “Curecos” is a promising platform which I discuss in detail below. If you would rather skip a lengthy cosplay explanation, you can move straight to B) System Engineering section.

What is cosplay?

It is the practice of dressing up as a character from a movie, book or video games.

Cosplay as an industry

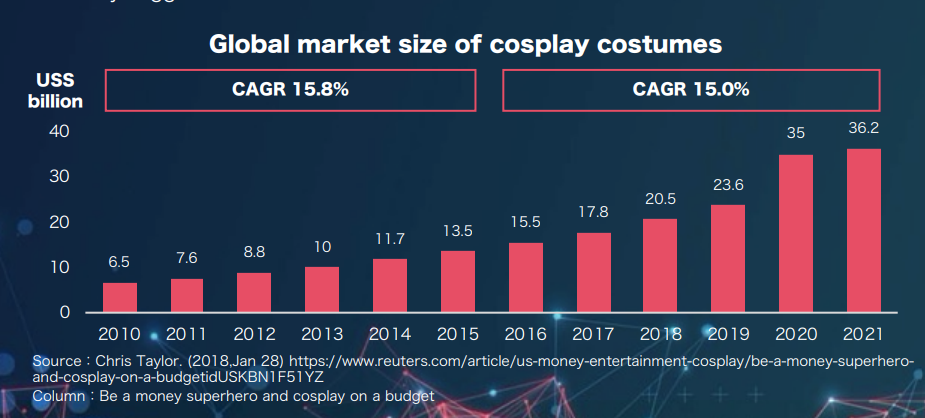

(Source: White Paper published by Kushim in 3/22)

According to a study by China Research and Intelligence (CRI), the amount of money spent on cosplay wigs and costumes reached $17.8 Bn in 2017. The industry is expected to have grown at CGR of 15% from 2016-2021. If costs associated with event tickets (photo shoots, accommodation and transportation) are included, the amount would be much higher. In addition, as per EventBrite, 59% of event attendees purchases around $100-$500 worth of merchandise per event, with 10% of them willing to spend even more.

COT (explained below) is a DAO (decentralized autonomous organization) where cosplayers can enjoy convenient payment methods which properly reward them while their copyrights are protected.

The film, anime, manga and gaming markets total $180Bn which have not been easily accessed by cosplay industry due to several challenges we will discuss shortly. COT aims to address these challenges and let cosplayers tap into $180Bn total accessible market.

“Curecos” is the world’s first and largest platform that connects cosplayers and their fans through the use of blockchain. Corecos is designed to become a cosplay ecosystem where cosplayers and their supporters can gather via using NFTs. Curecos has evolved from “World Cosplay”, a website for sharing cosplay photos with 1 MM registered users in 180 countries. World Cosplay, launched in 2017, has become one of the largest as of 2021 with over 110,000 cosplayers and 1 MM fans. In World Cosplay, cosplayers and fans can connect through “social tipping” i.e., give money (“nagesen” in Japan) to favorite cosplayers. The problems World Cosplay, since 2018, has tried to solve:

1) Cosplayers have access to many SNS platforms, however, it is not easy for them to be discovered by cosplay enthusiasts, expand fan base AND monetize their engagements. To ease these challenges, Kushim has created the Ethereum-enabled “Cosplay Tokens (COT)”. The technological advancements in the Ethereum DeFi space has enabled Kushim leveraging on this. World Cosplay has now transitioned into Curecos, which is a cosplay social networking service that provides social tipping feature to increase revenues for cosplayers and market liquidity for COT.

Challenges/Hinderance in the current cosplay industry and Kushim’s solutions.

1. Lack of Access to Financial System

The current micropayments and currency risks of traditional payment solutions do not allow safe and convenient social tipping.

Solution

The Cosplay Token (COT) can be sent across borders and there is no currency conversion involved. It can be exchanged with other crypto assets as well. It also offers those who do not have a bank account the opportunity to enjoy the world of cosplay.

2. Allocation of profits to content creators

The problems around copyrights and revenue sharing prevents digital cosplay from growing and players from getting compensated.

Solution

COT is the token economy and a smart contract/mechanism that distributes revenues to all parties (cosplayers, copyright holders and photographers).

3. Lack of trust and evaluation

There are mistrusts between cosplayers and their employers. Employers are weary of lack of a way to authenticate cosplayers via SNS platforms. In turn, there have been some incidents of employers not fulfilling the obligations under the contracts with cosplayers.

Solution

A DAO comprised of cosplayers can evaluate the authenticity of each cosplayer’s identity by using a Decentralized identifier (DID), thereby making the authentication process transparent.

4. Underappreciated Value of Cosplay

Many cosplayers spend countless hours and money perfecting their work which often lead to little or no income.

Solution

Cosplayers’ on line contents can be created as NFTs which allow all the parties monetize their contents efficiently.

Curecos as a Token Economy

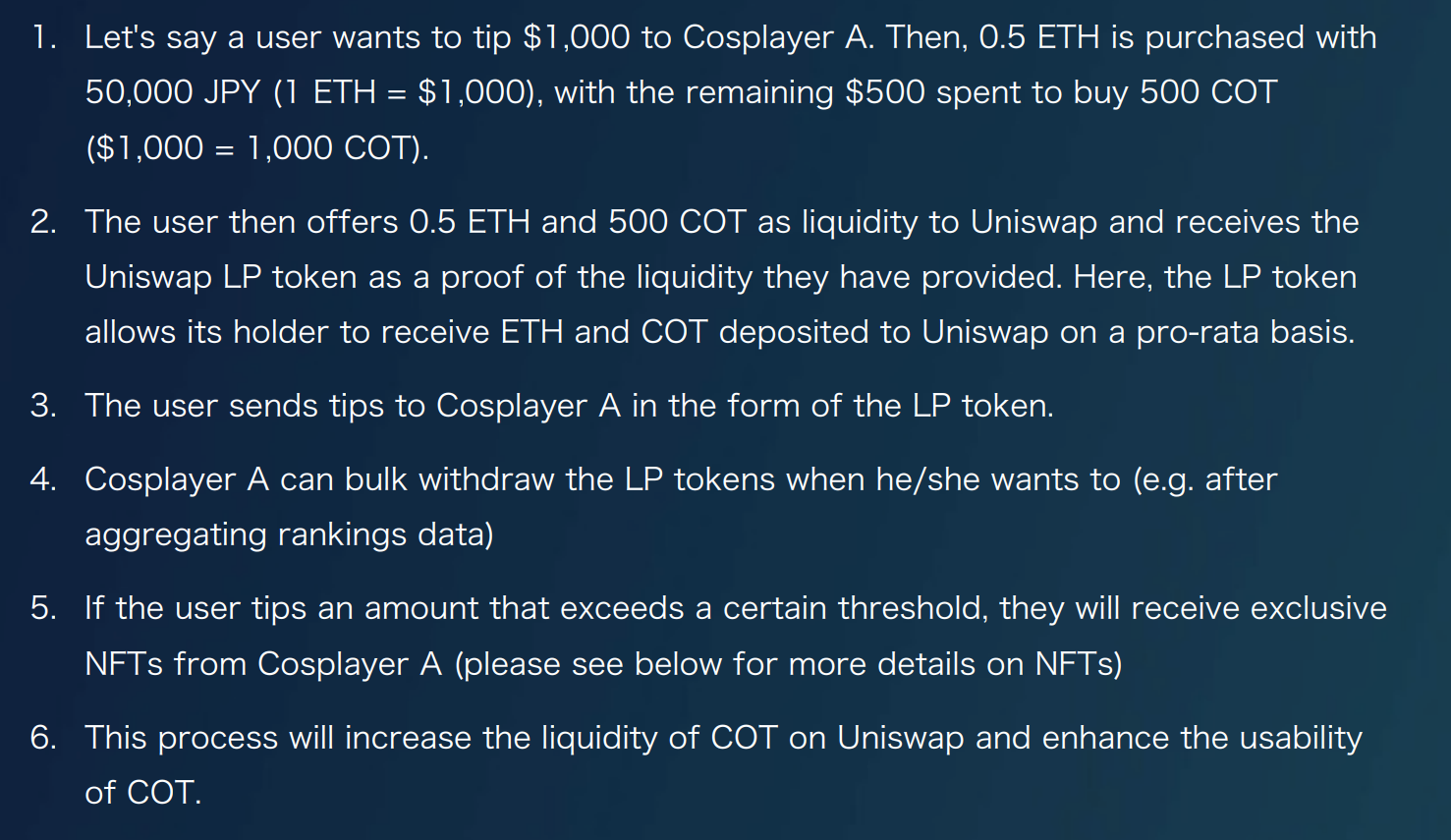

Corecos will make it easier for users to support cosplayers using COT via a decentralized exchange mechanism.

In another word, Curecos enhances ease of social tipping and liquidity of Cosplay transactions.

Here is how:

Uniswap Is the world’s largest decentralized exchange on Ethereum with a daily trading volume of $3 Bn – $10 Bn. Uniswap uses the AMM (Automated Market Maker) system, which allows users to deposit their favoriate token pair (e.g. COT/ETH). Uniswap then automatically determines the price at which these tokens are traded on the platform and allows the token pair to be traded on the platform.

This process of depositing tokens is called liquidity provision and the depositor is referred to as the Liquidity Provider (LP). As a reward for providing liquidity, the LP receives 0.3% of the exchange fee for the token pair.

By promoting the above sequence of transaction, Curecos aids in the increase in the liquidity of COT on Uniswap.

B) System Engineering – combining two groups formerly known as eLearning and Academic

This group has witnessed a rise in RFP (request for proposal), fueled by proliferation of remote work post-Covid. Also many companies have relaxed a rule against side jobs.

iStudy LMS and SLP – flagship products

(iStudy)

Slides created with Power Point can be converted into a professional traning material with ease and one click of a button built in “iStudy Creator”. The learning materials can be accessed “on demand” and with any devise (PC, tablets and smartphones). iStudy LMS also includes a package to manage a training program from a program design to a progress monitoring.

(Slap)

Allows the training content created by Power Point to include a voice narration.

(Training)

Fee based career introduction service “iStudy ACADEMY”.

IT engineer placement and freelance matching (Kushim Soft and Kushim Technologies)

(Consultation)

Engineers with all around experience provide IT consultation in management of general IT system, security IT system and crypt/blockchain focused developments.

C) Incubation

Several growth initiatives are housed in this group, such as

1) AI based research (eg. accident detection at caregiving facilities)

2) A collaboration project with Zettant Inc. which has developed e-Signature program “SecureHub” which was adopted by Ministry of Economy.

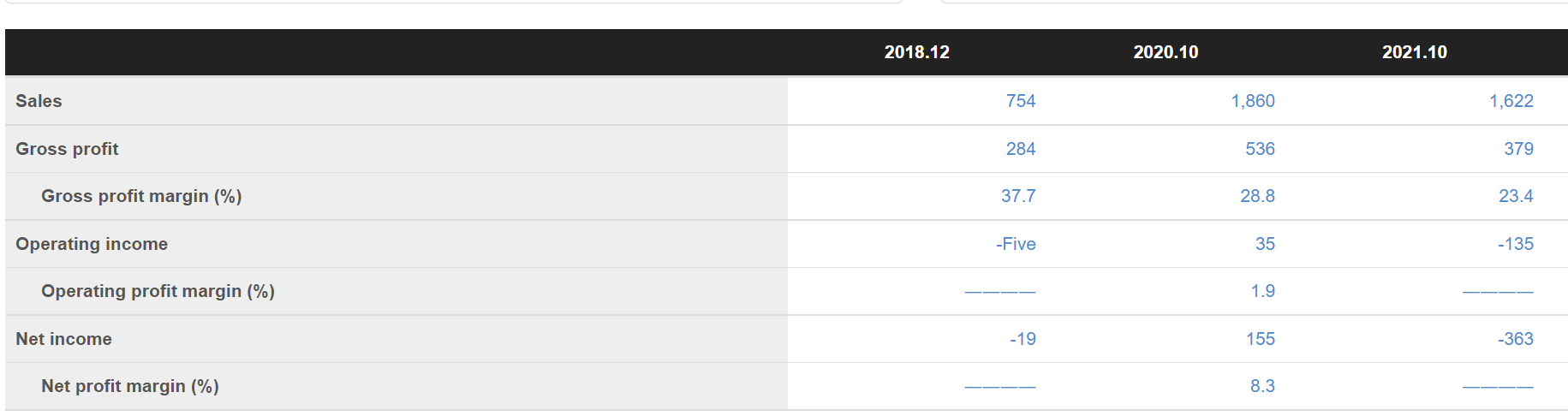

4. Financial Highlights

The below historical financial results show unprofitable historical operations.

(Source: Buffet-code.com)

Note: 2018.12 should read 2019.10.

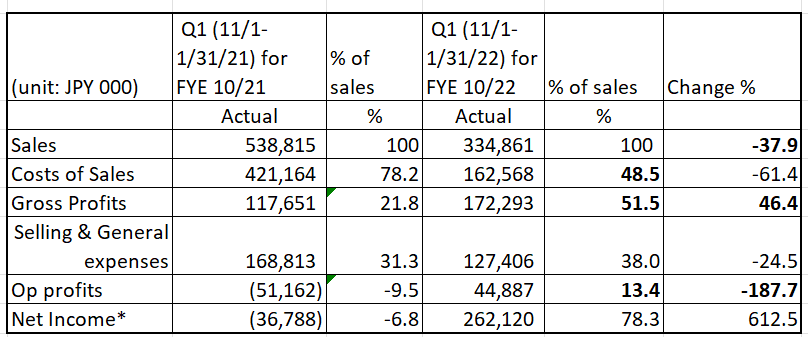

Financial results for Q1 FYE 10/22 (11/1/21-1/31/22)- a sign of change into a profitable organization

The company felt a negative impact from fewer e-learning area engagements due to Covid, resulting in sales decline of 38% in Q1 FYE/22. However, a successful cost control (pruning out of unprofitable projects and cut backs on advertisement) has led to gross margin improvement from 22% in Q1 FYE 10/21 to 52%.

5. Total Addressable Markets (TAM (Source: Fortune Business Insights/Blockchain Market, issued in 3/2022)

The global blockchain market where Kushim’s focus lies is projected to grow from $7.18 billion in 2022 to $163.83 billion by 2029, at a CAGR of 56.3% in forecast period, 2022-2029. Rising identity and data theft activities are cited as one of the reasons for surging demand for Cryptographic Ledger Solutions.

6. Strengths and Weaknesses

Strengths

As discussed in Investment Thesis section, the company has taken a bold first step in shifting from a slow growing eLearning sector to blockchain supported endeavors. While the final outcome is “uncertain”, it has shown an early sign of success.

Weakness

For Kushim, its strength can be viewed as “weakness in disguise”. The fact that it is transforming its business model can carry substantial execution risks. To mitigate, the company has completed its right issuance to strengthen its balance sheet and its capital ratio now stands at a healthy 84.5%.

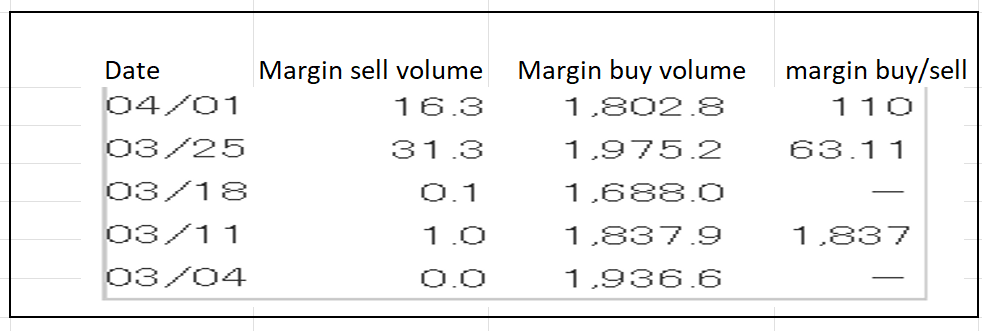

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Kushim, margin buy sell volume is pretty much non-existent and margin buy volume is consistently high. However, current margin buy volume is a two day worth of trading volume. Thus, the near term selling pressure is not a significant concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance