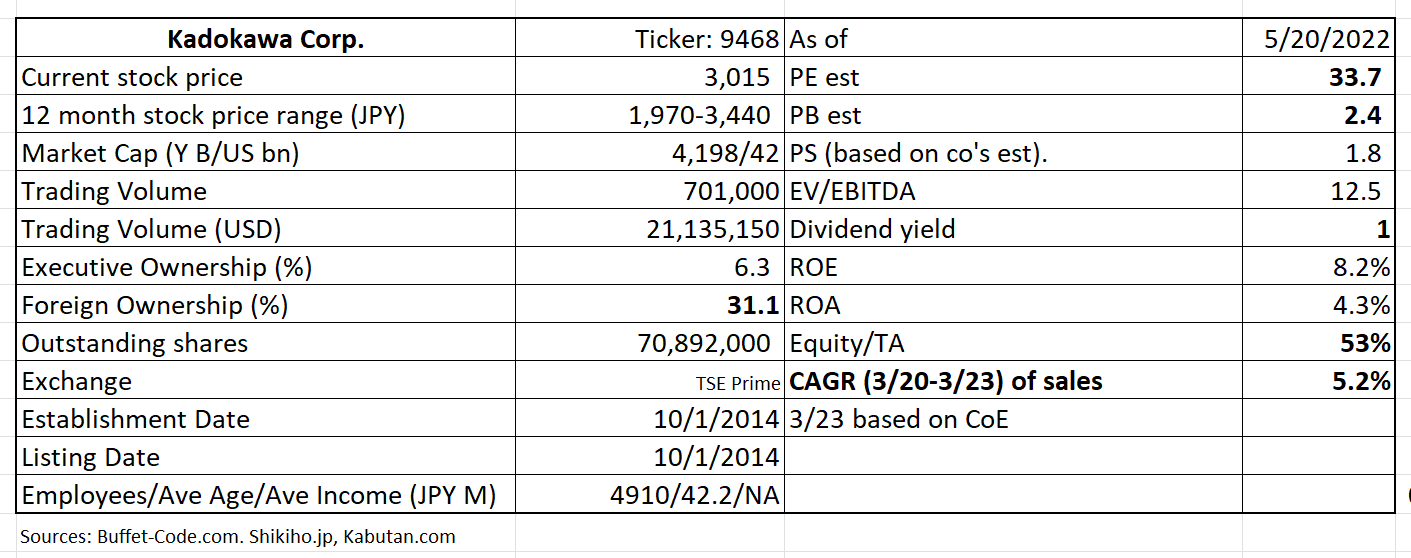

Kadokawa (“Kadokawa” or the “company”), founded as a publisher in 1940, has revamped its business categories in tandem with the shifting needs of the markets. The main thread is to grow its IP (intellectual Property) in a variety of forms, such as books, movies, animation, UGC (User Generated Content).

1. Investment Thesis

1. Some risks are out of the shares

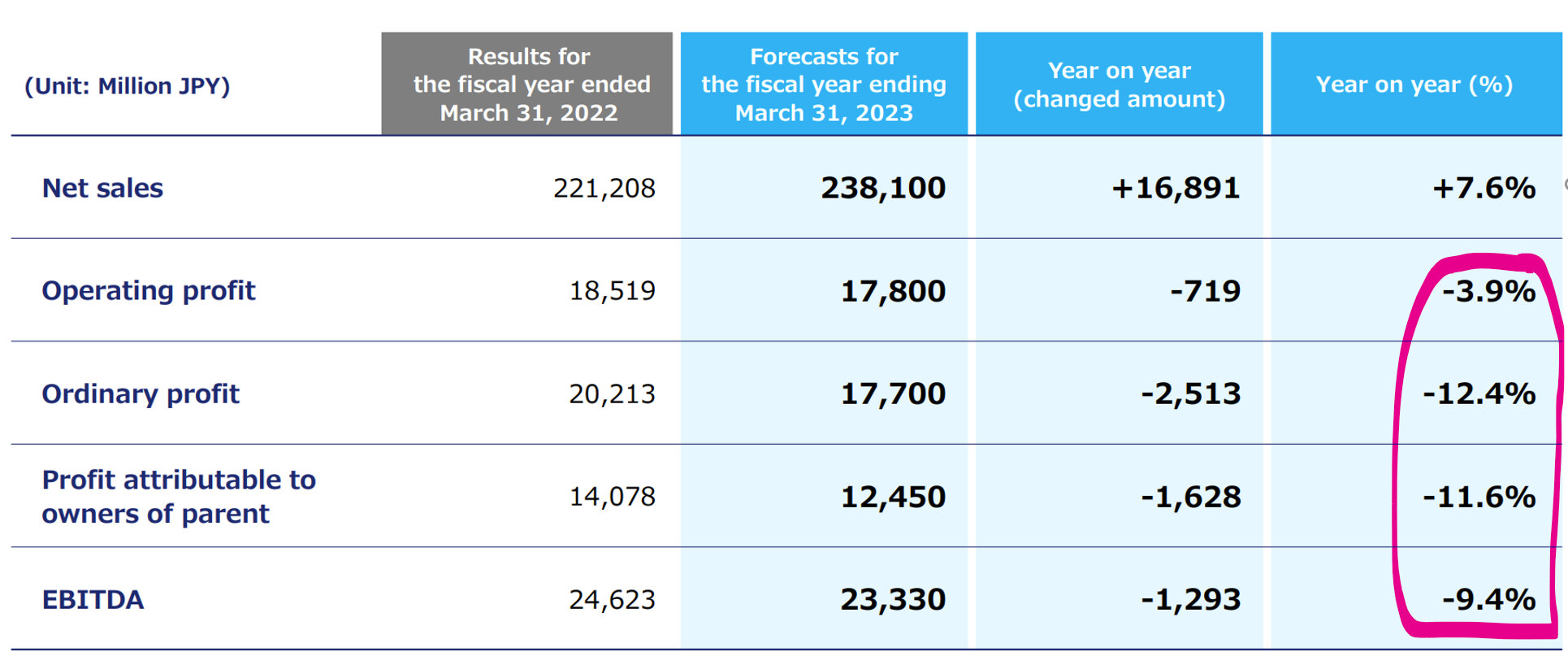

Kadokawa shares plunged 16% after announcing a better than expected FYE 2/22 results on 5/12/22. Markets were disappointed with FYE 3/23 guidance which expected that operating profits would decline. This share drop reduced the risks of future share underperformance since the major reason behind the operating profit decrease was a potential absence of profit contributions from mega hits such as Elden Ring (a RPG game). This inherent volatility of IP/content businesses is partially mitigated by the company’s policy of launching many titles and in many formats each year. Many titles=diversification.

2. Education segment as extension of IP and a social help

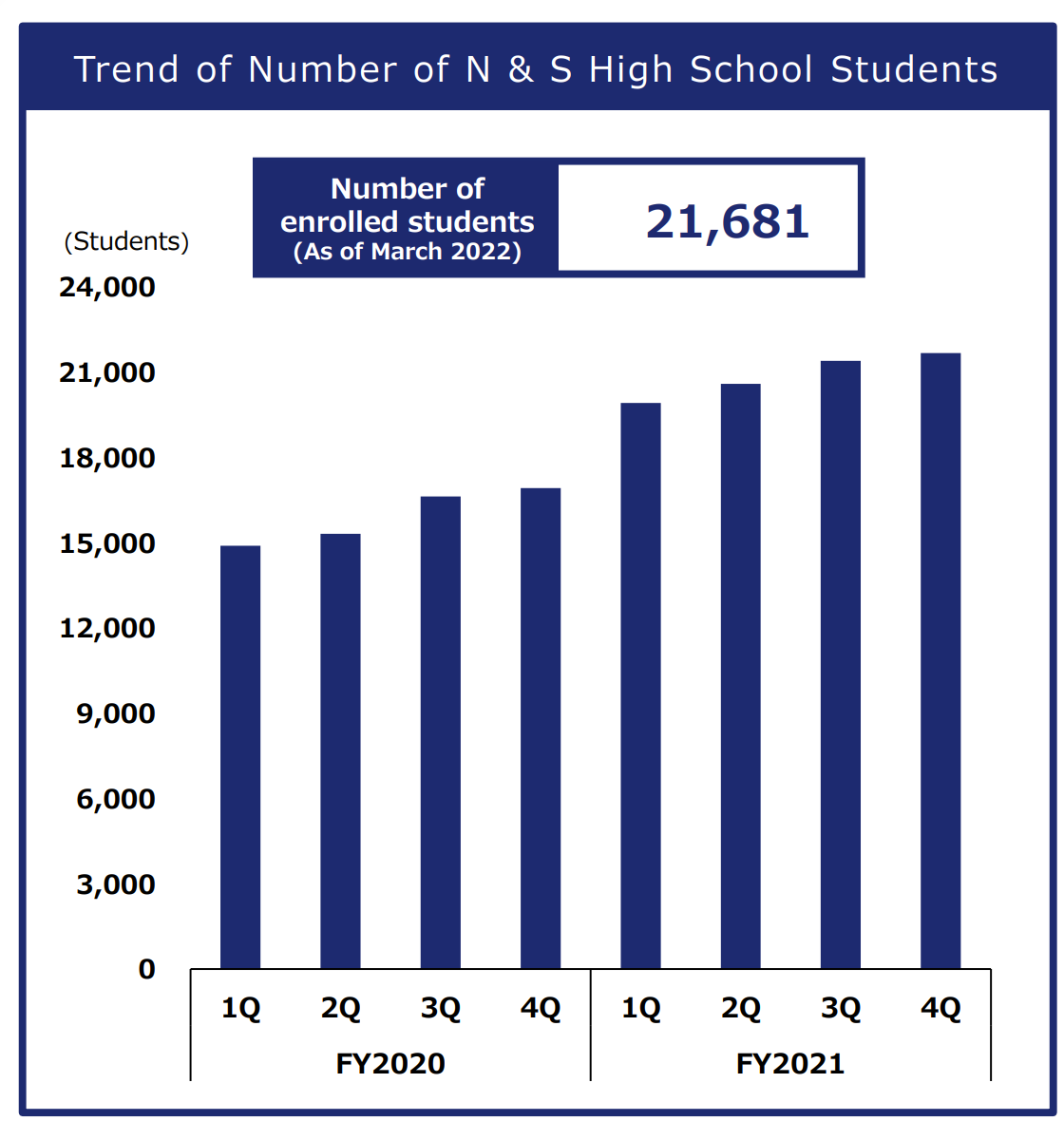

Kadokawa founded “N High School” on 4/1/16. N High School is unique, as all the school activities can be experienced on line, using Dwango* EdTech capabilities. Students, who come from all walks of lives, have many options in terms of 1) programs, 2) after school curriculums, 3) the number of in-person classes, and 4) communities. The company has subsequently opened “S High School” in 4/21 whose classes are offered on VR.

*Dwango Corp is Kadokawa’s main subsidiary which runs “niconico”, one of the popular video sharing services in Japan.

The viability of high school is hotly debated. Some criticize the school for giving students too much flexibility and leeway. Others praise it for providing the saving hands with kids who have not been able to fit in the traditional high school systems and have been bullied.

N/S schools can be evaluated from different perspectives as well. In Japan, there are severe shortage of teachers whose job responsibilities are far beyond “teaching” and include counselling and guidance on family issues of underprivileged children. If N/S school business models can be proven “successful” in educating next generations of Japanese children, “on-line school model” can teach large # of students at one sitting and other teachers can focus on non-academic aspect of schooling.

At this point, supporters of N/S High School are rising:

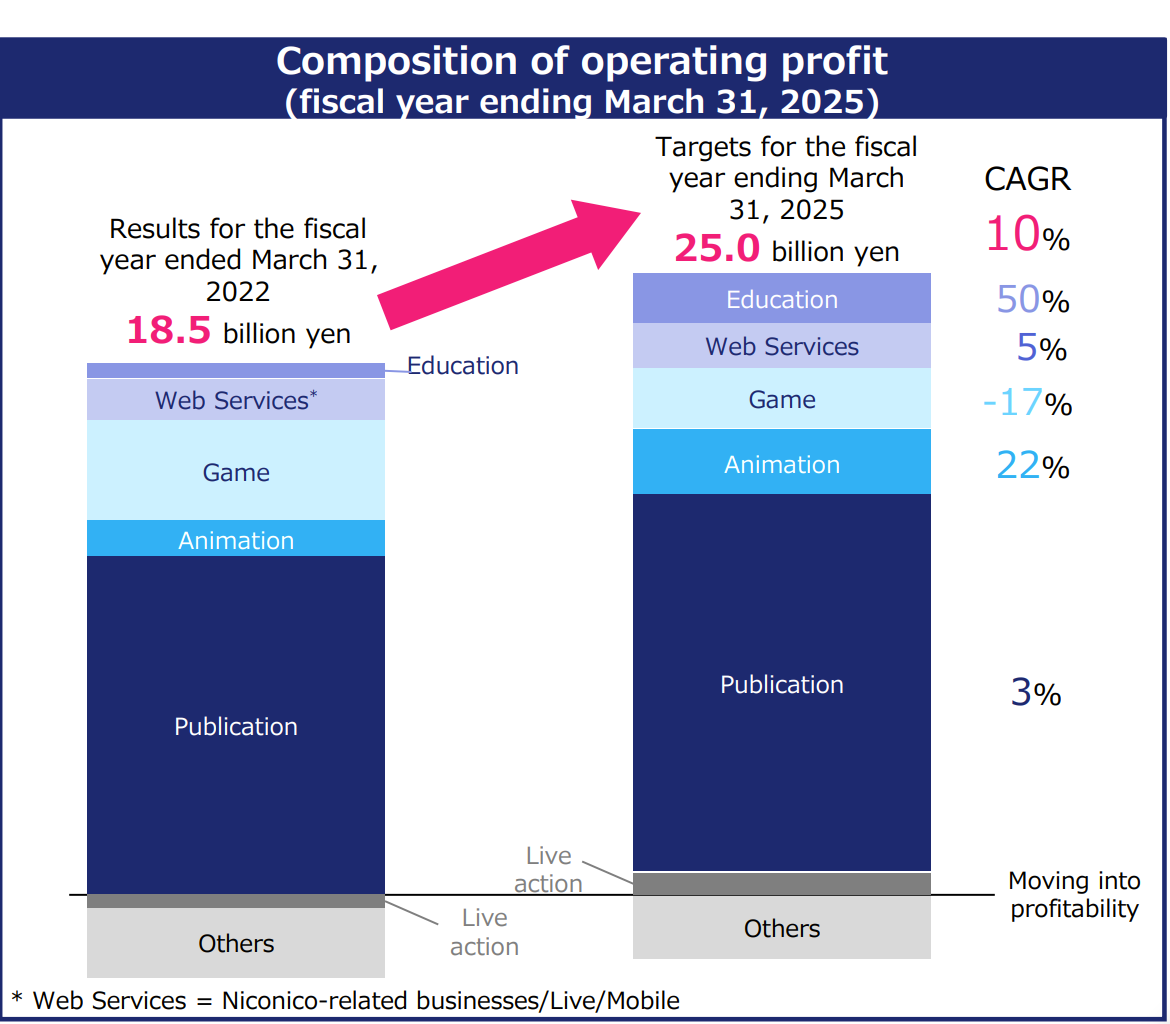

(Source: Full Year Financial Briefing for FYE 3/22)

3. An expanding pool of IP contents in 4 areas:

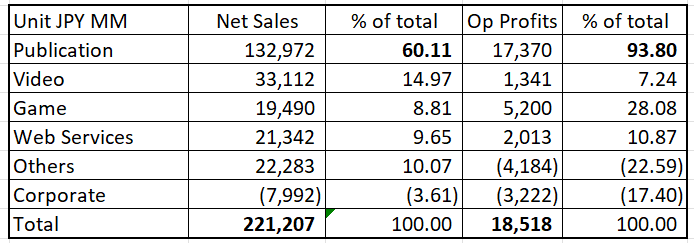

The above breakdown of sales and operating profits highlights that the publication group still carries a huge weight, especially in operating profits by accounting for 94% of the company wide operating profits.

Below is the summary of main activities of the individual groups:

1)Publication:

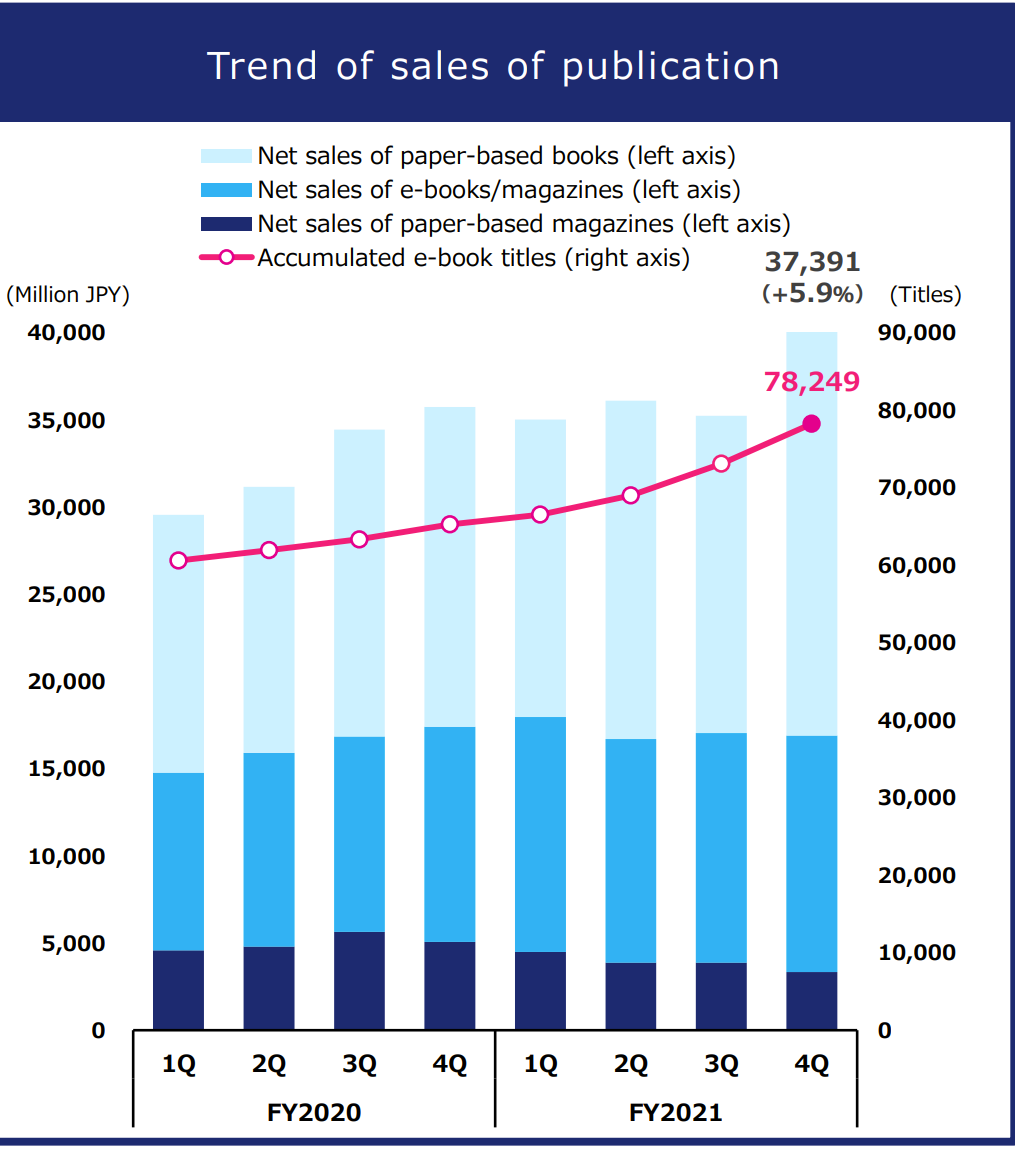

Kadokawa’s breadwinner. The company publishes and sells paper-based books, comics, e-books and magazines. Its massive title archives (110,000 books and 60,000 e-books) is their differentiator. Also, it published 5,000 new titles a year based on its market research, thus their book return rate is in the 30% range which is lower than the industry average. E-books and e-magazines carry higher profit margins vs. printed ones.

2)Game:

The Kadokawa group plans, develops and sells packaged game software, network games, and app games. The most recent blockbuster title is Elden Ring which was released at the end of 3/22 and its cumulative worldwide shipments surpassed 13.4 millions. Cumulative domestic shipments are over 1 million units. The company does not disclose the sales number of Elden Ring.

3)Video:

The company creates videos (films/anime titles) from IP/contents of Publication and Game businesses.

4)Web Services:

Carried out by the subsidiary, DWANGO which operates the niconico video services (a video portal).

5)Others:

Main activities are 1) education and 2) the MD business.

1) Education segment runs N and S High Schools which offer on-line, distance learning schools.

2) MD group is engaged in sales of character (anime/celebrity) goods.

4. High shareholder returns

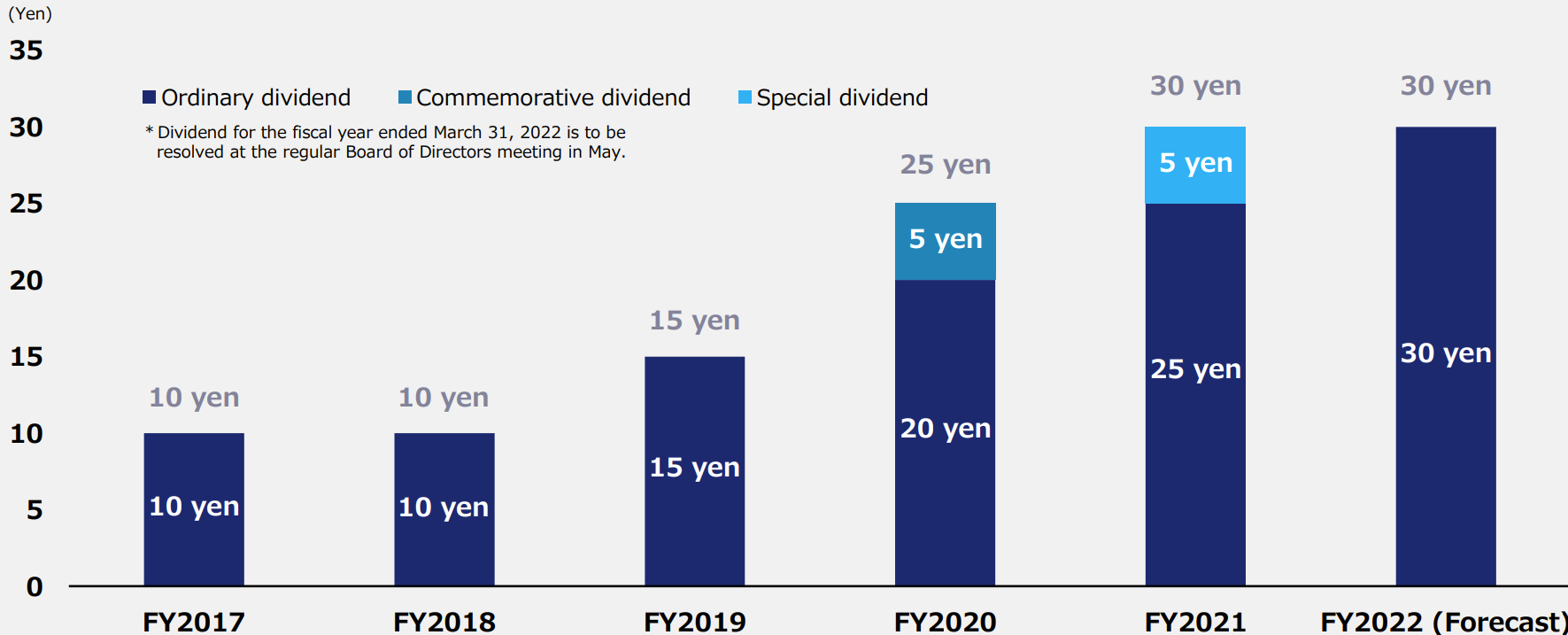

The company executed a 2 for 1 stock split on 1/1/22. Further, it has been consistently raising dividends as shown below: For FYE 3/22, Kadokawa paid JPY 30/share, up from JPY 20 of FYE 3/21 + JPY 5 special dividends.

(Source: Full Year Financial Briefing for FYE 3/22)

5. Major capex is behind them

Tokorozawa Sakura Town was opened in 11/6/20 as a large scale commercial campus which hosts Kadokawa Musashino Museum, Anime Hall and an event/concert hall. The company’s office, a new printing facility and logistics center are also located here. This Sakura town is the integral part of the “Cool Japan Forest” project and financed 50/50 by Kadokawa and the City of Tokorozawa (located from 10 miles from mid-point Tokyo). Total cost was JPY 39.5Bn ($395 MM).

The amount of capital investment in FY3/21 on a cash basis is forecast to be JPY 19Bn. Tokorozawa Sakura Town has its grand opening in 11/20 and this concluded the large investment.

Depreciation of the project is expected to be JPY 1.8 Bn for FYE 3/31/23, JPY 2.0 Bn for 3/31/24 and JPY 2.5 Bn for FYE 3/31/25 and thereafter.

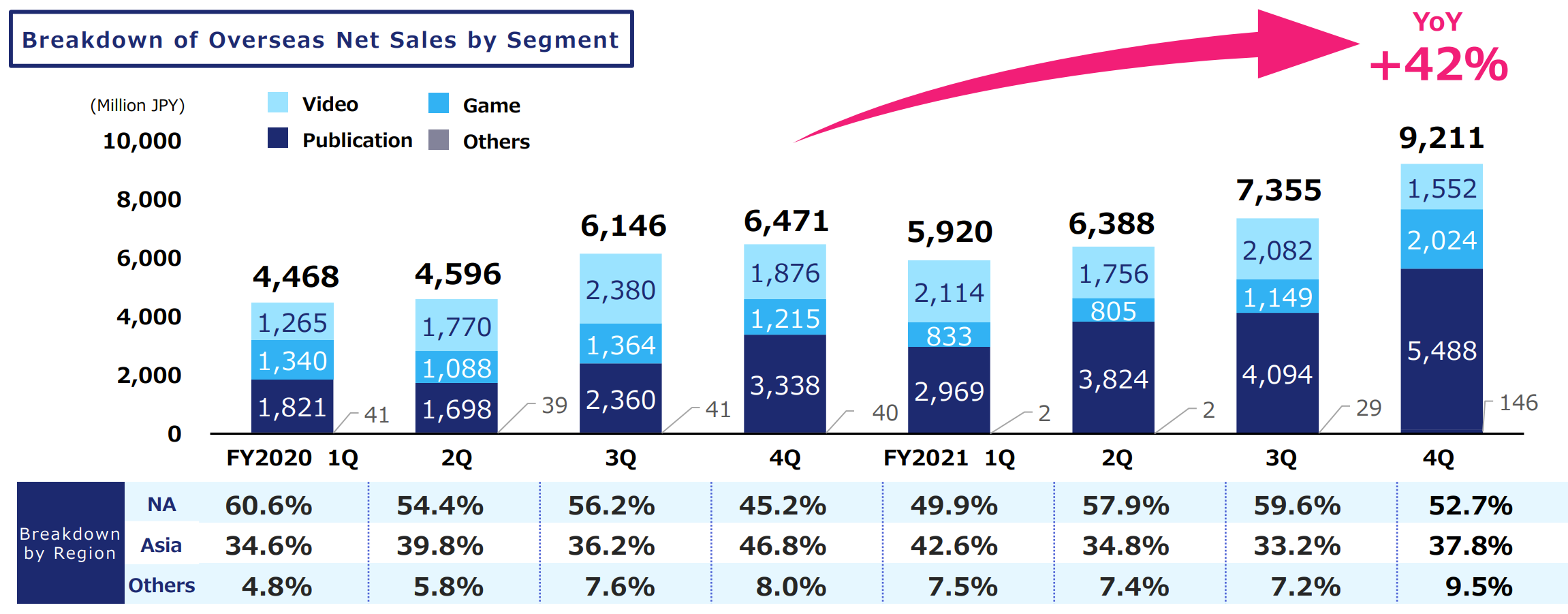

6. Rising global reach

The overseas sales increase, especially in comics and games, has been robust as shown below. Non-Japanese sales now accounts for 13% of total sales.

(Source: Full Year Financial Briefing for FYE 3/22)

High PE of 34x is partly due to suppressed net income as a result of high depreciation and currently subdued bottom line expectations.

2. Technically Speaking

(Source: buffet-code.com)

The stock dropped sharply due to a disappointing guidance. Since then, it has been closing the gap. I wish I was able to finish my report sooner, to pick up the stock at a lower point. Still, I believe Kadokawa presents many faceted investment merits as discussed above.

3. Business Model

The Company aims to grow their sales by executing the below strategies:

1. Publishing:

1) Expand market share

Mainly through an increase of comics content

2) Profitability improvement

a) Management of book returns from book stores: Creation of timely contents via ongoing marketing research

3) New digital printing plant in Tokorozawa (located in earlier mentioned Tokorosawa) to expertise printing and distribution.

The below bar graphs emphasize the strength of e-books/e-magazines which helped the sales of publication group. Book Walker, Kadokawa’s own digital book sales site, helped to push the e-books’ sales.

2. Video:

Increase production capabilities of new animated titles from 30 episodes/year to 40, via inhouse digital production.

3.Game:

Developing games, originating from Kadokawa’s internal content IP(books/animes) to optimize the release timing and improve profitability.

4. Financial Highlights

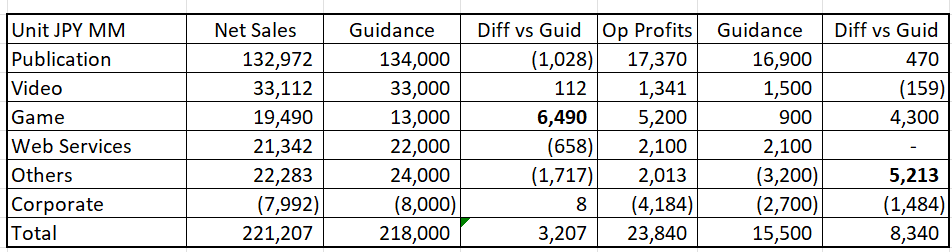

FYE 3/22 results vs. guidance

(Source: Full Year Financial Briefing for FYE 3/22)

Net sales were in line with guidance, but operating profits beat the guidance by 50%, thanks to strong showing of Elden Ring.

FYE 3/23 Guidance

Net sales is expected to continue its growth, driven by 1) overseas expansion and 2) e-books and education segment. Profit lines will feel the impacts of tough comparison with Elden Ring.

(Source: Full Year Financial Briefing for FYE 3/22)

5. Total Addressable Markets (TAM)

I. Market size of Japanese publishing industry

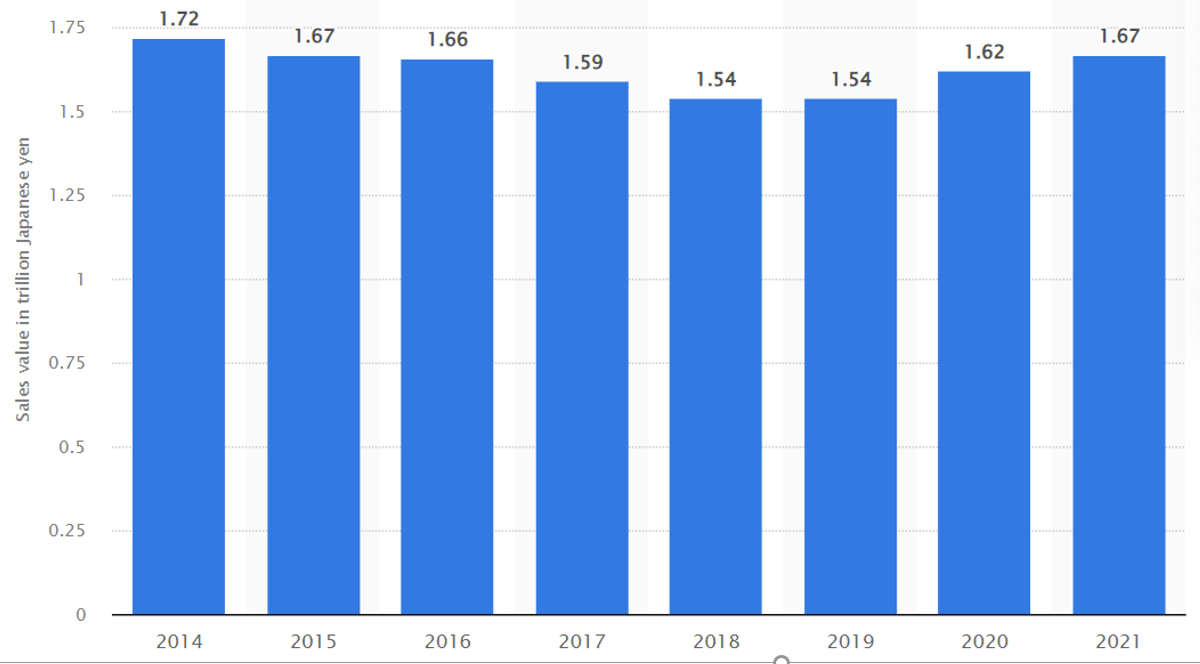

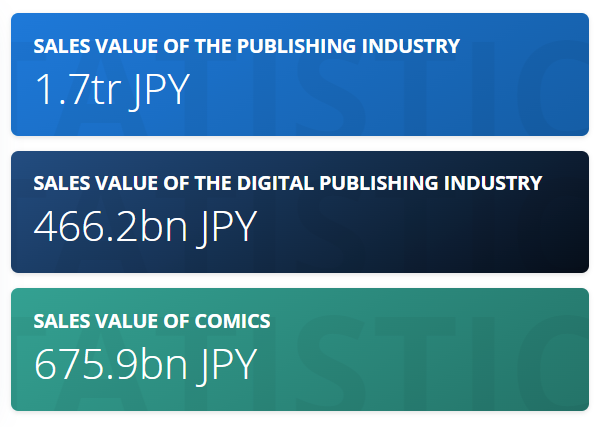

As of 2021, the size of the Japanese publishing market amounted to JPY 1.67 Tn, making it one of the largest publishing markets in the world. Although print publications continue to make up the lion’s share of the market, has declined steadily in recent years, digital publications have consistently expanded their market share.

Sales value of the publishing industry in Japan from 2014 to 2021

(Source: Publishing Industry in Japan-statistics and facts, by Statisca Research Department, as of 4/14/22)

One noteworthy aspect of the Japanese market is that the manga industry accounts for a significant part of the total sales generated within the publishing market. Manga are among the most popular genres both in the case of printed books and e-books. One notable trend are vertical scrolling comics, which contributed to an expansion of the user base. The growing adoption of online services resulted in digital comics overtaking the combined sales value of comic books and magazines for the first time in 2019.

2. Free video streaming and video sharing services in Japan

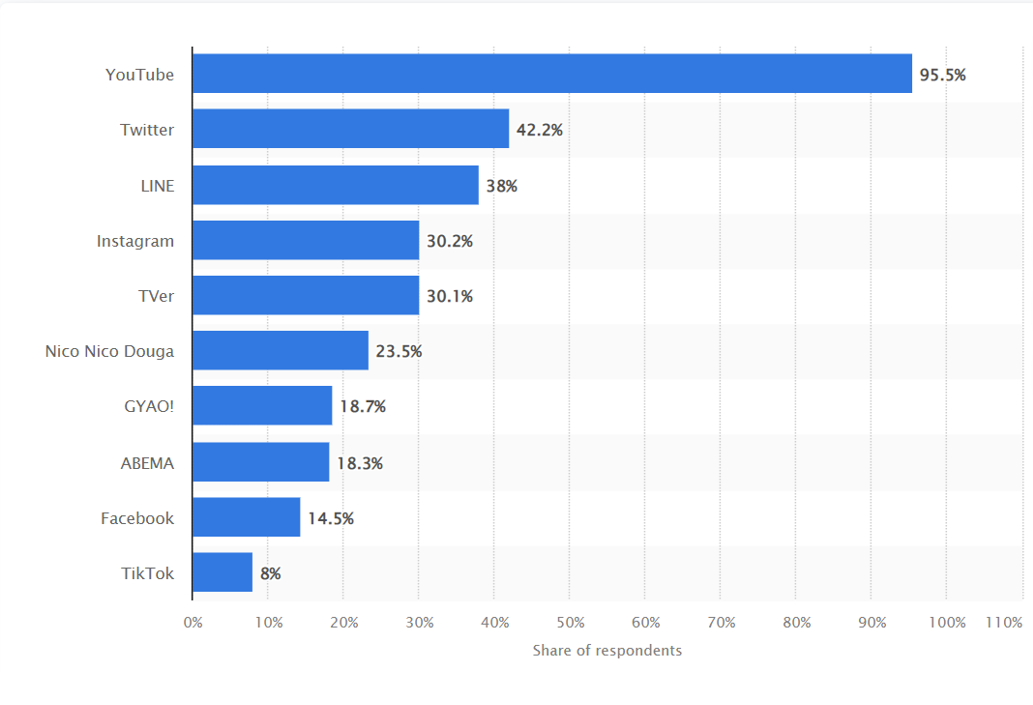

The below graphs highlights absolute strengths of YouTube in free video streaming and video sharing services in Japan as of 4/21 (per Stastica, multiple choices were accepted).

ICT Research Institute surveyed 4,407 Internet users on usage trends of paid video sharing services in 4/21. 55% of respondents used only free services and 31.3% used paid services including PPV. The same survey estimated the paid video service users would increase from 31.6 MM in 2021 to 39.7 MM (+27%) in 2023.

Kadokawa’s strategy

Japanese publishing industry is large but sales growth has plateaued. Nico nico video sharing faces tough competition. In order to compete successfully, Kadokawa aims to expand market share by exploiting its IP contents in many formats using AI and digital production and distribution.

6. Strengths and Weaknesses

Strengths

Expectation reset

Some hits and misses of title releases are not avoidable in the entertainment industry. However, Kadokawa has set a realistic expectation for FYE 3/24 since it is hard to repeat the outsized success of Elden Ring.

Weaknesses

Publication and entertainment industry is highly competitive and susceptible to unpredictable taste shift of consumers. To offset this, the company has put forth global IP deployment strategy.

The below operating profit by segments embodies reasonable exceptions for each segment.

*Live action: characters/influencers based concerts and other live events which will slowly open up post-covid.

7. Near-term Selling Pressure

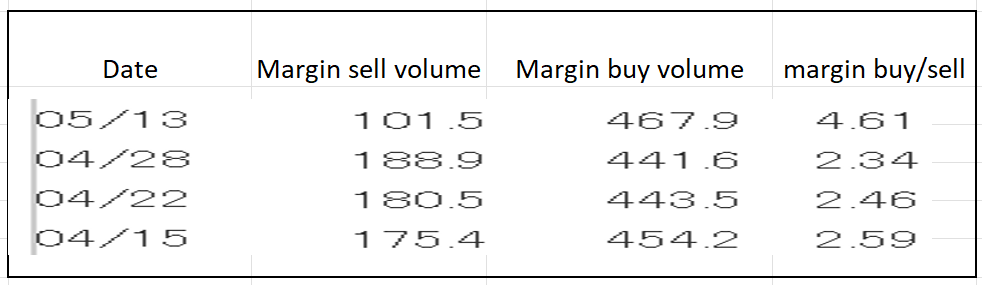

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Kodokawa , margin buy/sell ratios has been rising and recently reached 4.6x. However, margin buy volume is easily absorbed by one day. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance