https://www.nb.com/en/global/insights/japanese-small-caps-may-hop-in-the-year-of-the-rabbit

Did you know that Japanese small cap stocks outperformed US and European peers by a wide margin last year?

In the linked report by Neuberger Berman, Kei Okamura, Portfolio Manager, pointed out that Japanese small was down just 0.33%, while their U.S. and European peers dropped 7.98% and 18.01%, respectively.

Mr. Okamura cites the critical parameters which show these outperforming Japanese small caps are still trading discount to its peers in the developed economies.

Attractive valuation and low analyst coverage  (Source: Japanese Small Caps May Hop In the Year of the Rabbit, by Kei Okamura with Neuberger Berman)

(Source: Japanese Small Caps May Hop In the Year of the Rabbit, by Kei Okamura with Neuberger Berman)

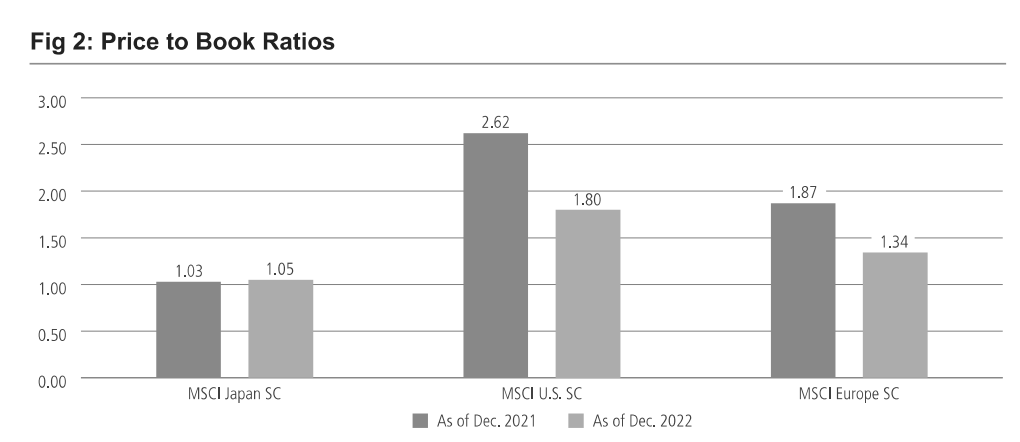

The above chart highlights that MSCI Japan Small Cap group is trading at a substantial discount at P/B of 1.05 at year-end of 2022 vs. MSCI US SC with 1.8x and MSCI Europe SC of 1.34x.

Institutional Analysts are less compelled to cover Japanese names, leading to the high possibility that many great small cap names have not been discovered nor property valued by global investors who don’t have resources nor inclination to search for undervalued Japanese names on their own.

Mr. Okumura goes on to list three macro forces to drive Japanese small caps steady performance in 2023. These are 1) post-covid reopening of Chinese economy, 2) relatively stronger domestic year-over-year demand increase in Japan vs. US and Europe and 3) broad corporate governance reform

I am not in a complete agreement with him on these reasons, since: 2) painfully snail pace increase of wages will make it difficult for consumers to loosen their wallets amidst rising inflation, and 3) corporate governance report appears to take longer to be realized than market participants have hoped.

However, I concur that China reopening will likely provide small caps in Japan with tail wind, many of which had suffered from “Zero Covid policy” which Chinese government had instituted for almost three years. In fact, selectively investing in Japanese small caps may be a cost effective way to benefit from expected Chinese consumer spending recovery in 2023. As Mr. Okumura has adeptly illustrated in the linked report, China is the largest trading partner of Japan. The tie may go stronger amidst heighten US-China political tension.

I highly recommend you take a read at Mr. Okumura’s well laid-out for your global portfolios.

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance.