In a recent brief (the link below), KPMG offered an enlightening analysis of the current IPO market in Asia. The report accentuates the escalating IPO markets and VC fundings in Japan, a phenomenon that starkly contrasts with the rest of the Asian markets. An active IPO (Initial Public Offering) market is generally interpreted as a positive sign, mirroring the confidence in a country’s stock market.

According to KPMG, “IPO activity in Japan has been robust in recent quarters, bucking trends seen globally. At the end of Q3’23, the number of IPOs for the year was well positioned to exceed 2022. The positive activity may be a reflection of the smaller IPO deal sizes in Japan compared to other jurisdictions. The Japanese government is proactively encouraging M&A activities to help scale companies prior to IPOs.”

The report draws attention to the “smaller deal sizes” in Japan.

Why are Japanese IPOs smaller?

The most often cited reason is as follows:

Despite having a large economy, Japan’s startup ecosystem is still in its infancy and lags behind other major economies. Unlike their counterparts in other countries, Japanese companies tend to go public at an earlier stage, which may result in less capital being raised during their Initial Public Offerings (IPOs).

In contrast, startups based in the U.S. have the ability to secure significant venture capital (VC) funding at later stages. However, Japanese startups often struggle to raise comparable amounts of venture capital due to the relatively small size of local funds.

This unique situation has led many growth-stage startups in Japan to focus their resources on investor relations and consider going public before they reach the coveted ‘unicorn’ valuation status.

However, while change in Japan tends to be at a snail pace, there may be a glimmer of hope in the VC channel in Japan.

KPMG reports, “VC investment in Japan was relatively strong during Q3’23, with a growing number of companies able to raise larger funding rounds, including Telexistence ($170 million), Gojo & Company ($101 million), Josys ($93 million) Mujin ($85 million), and CADDI ($89 million). The VC ecosystem in Japan continues to evolve rapidly, with increasing participation from corporates and financial institutions. During Q3’23, megabank Sumitomo Mitsui Financial Group (SMFG) announced plans to launch a $210 million fund aimed at helping startups grow into unicorn companies. Other financial institutions also increasingly accelerated loans to startups and provided debt financing to venture capital backed companies.”

KPMG further identifies the following trends to watch for in Q4 2023: “VC investment in Asia is expected to remain soft in Q4’23 given ongoing economic and geopolitical uncertainties, although Japan is well positioned to remain an outlier as it continues to mature its VC market and ecosystem.”

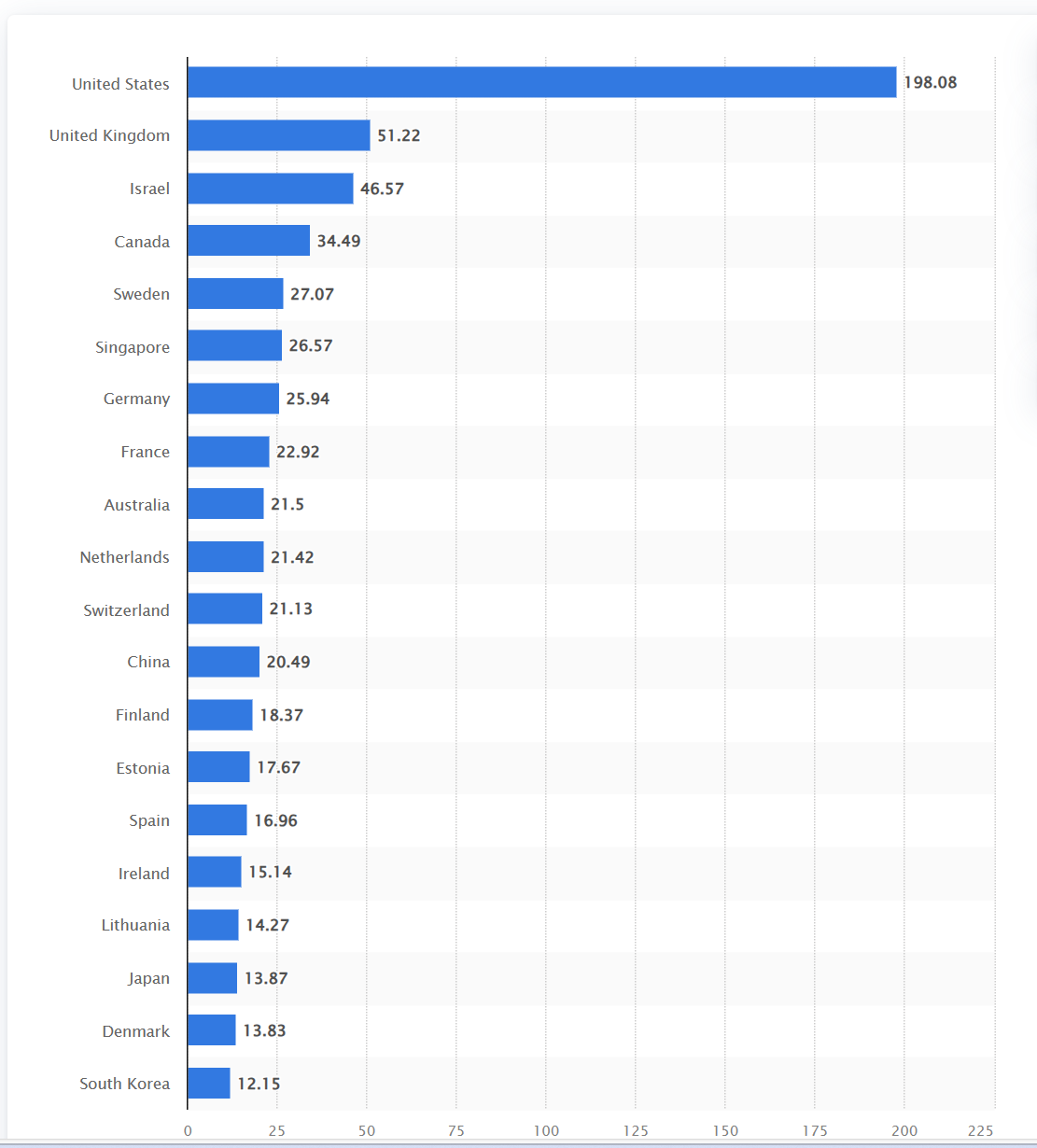

This long-awaited rise in VC fundings may finally bolster the still small startup ecosystem in Japan. As shown in a chart from Statista below, Japanese startup numbers are smaller than those of countries with smaller GDP.

(Source: Statista, “Leading countries for startups worldwide in 2023, by total score” published by Einar H. Dyvik, 6/9/23

Separately, but relatedly, the Financial Times reported on October 24, 2023, that Japan’s equity fees have surpassed China’s for the first time since 1999. This shift is attributed to a sustained rally in Tokyo stocks driving listings and global investors shunning Chinese markets.

According to the article, Japan’s contribution to banker fees has exceeded $440 million so far in 2023, accounting for about 30% of the total in the Asia-Pacific region (vs. China at around 25%).

To be fair, this “victory” is not entirely Japan’s doing. Regulators in Beijing have restricted the flow of Chinese IPOs to New York and Hong Kong, directing many listings from strategic sectors to Shanghai and Shenzhen. US investors are also shunning China over concerns about deteriorating relations between Washington and Beijing.

Part of the fee flows come from Japanese companies, which collectively hold vast portfolios of shares in other listed companies.

Regardless, I remain hopeful and appreciative of these developments, irrespective of how they come about or the scale at which they occur. These changes are vital in shaping the future of Japan’s economic landscape. They represent the potential for growth and the promise of a more diverse and dynamic startup culture.

Reference:

KPMG: Q3’23 Venture Pulse Report-Asia

IPO market in Japan bucks trends; Continued slowdown China and Hong Kong

https://kpmg.com/xx/en/home/campaigns/2023/10/q3-venture-pulse-report-asia.html