“Investor-Management United as One” MAY lead to outperformance.

There is an intriguing ETF that I believe is worth discussing. While I don’t recommend adding this fund to your portfolio, their investment theory is undeniably fascinating.”

投資家経営者一心同体 (translated as Investor-Management United as One) ETF is created by Simplex Asset Management (a Japanese hedge fund founded in 1999) and began trading on 9/7/23

This ETF selects stocks from companies with a significant total percentage of voting rights held by management ( board members, their families, and their asset management companies. The companies’ financial strength and other factors are also considered.

Alignment of interests between investors and management

Rationale behind this investment focus is when management owns a large number of shares, they are expected to manage the company from a long-term perspective, regardless of their tenure. This is also beneficial for investors because the goals of management and investors are aligned, leading to enhanced corporate value.

Investing in “charismatic” leaders

Many companies with high management ownership ratios are led by charismatic leaders. Charismatic leaders have strong leadership and a clear vision, and they have the ability to drive rapid growth in their companies.

Nidec (6594) and Fast Retailing (9983) are examples of companies with high management ownership ratios. These companies have achieved remarkable growth under the leadership of charismatic leaders and have received high evaluations.

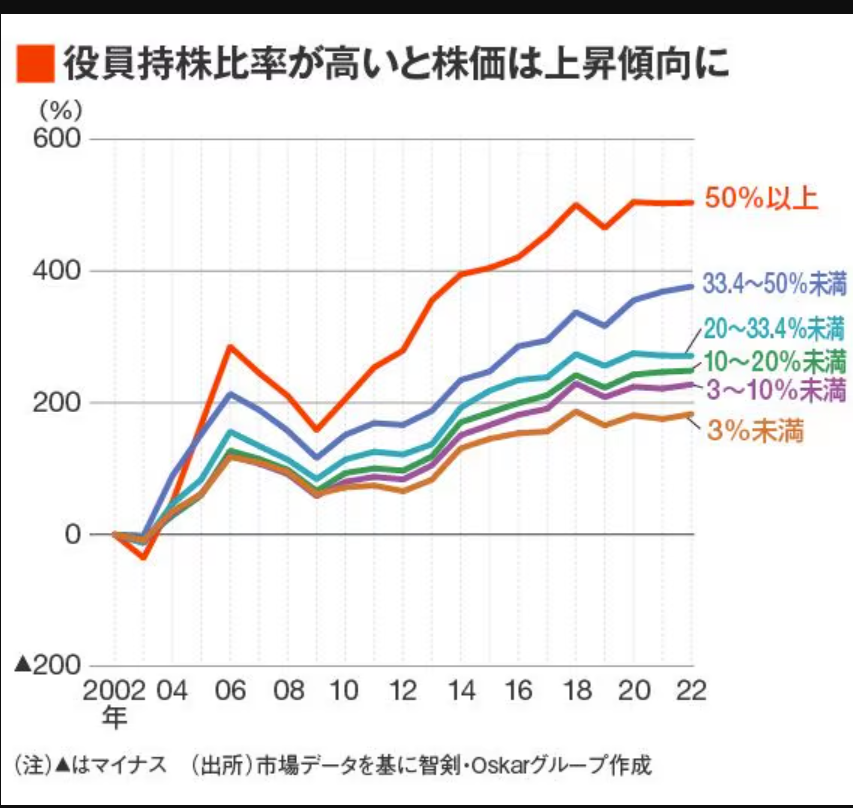

Shikiho (Japan Company Handbook) has tested this thesis over the past two decades, utilizing Topix as a sample universe. The compelling graph below seems to affirm the validity of this hypothesis. Specifically:

- Companies with management ownership exceeding 50% consistently outperformed stocks where management ownership was lower.

- Remarkably, the degree of outperformance directly correlated with the ownership ratio.

- Conversely, the worst performers were companies whose management owned less than 3% of the shares.

I don’t propose that you rely on management ownership as a sole stock selection parameter. But it is worthwhile to track the performance of the Investor-Management Unite as One ETF (code 2082). One caveat: this fund owns 192 shares which you may find too diversified to consistently generate outperformance over an index.

I will follow up with a stock with such high founder/manager ownership: Temairazu (2477).

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance.