Hybrid Technologies (“Hybrid” or the “company”) supports digital transformation implementation at client companies by providing a range of services starting planning through execution. It provides this one stop services seamlessly via a hybrid of “Japan – Vietnam” team;

1) Hybrid Technologies in Japan mainly handles upstream processes such as service and system design engineers, AND

2) Vietnamese subsidiary to handle development, implementation and maintenance. The solutions offered by the Group address the issues faced by client companies such as engineer shortages, development of business models leveraging digital technology. The wide range of services it provides include operation improvement, sales support, and customer relationship management.

1.Investment thesis

1) Access to qualified engineering talents in Vietnam

Tran Van Minh, the founder with Vietnamese background, established Hybrid (it was known as “Eva” then) in Tokyo in 2016. He believed that Vietnam was at the early growth stage, similar to that at which Japan was on a sharp growth trajectory. The company exemplifies the concept of “Hybrid” as its resources and assets are located in both Japan and Vietnam. Also, the company’s service offering is the hybrid of “business acumen” and “technological expertise” which are both required to digitize the Japanese companies saddled with “old system”.

The benefits of the founder’s tie with Vietnam and established track record are apparent in that Hybrid ranked number 1 in 2019 and 2020 by ITviec which is IT engineers focused recruiting site in Vietnam.

Having access to Vietnamese engineers affords the company with an ample opportunity to fill the acute engineering talent shortage in Japan. Why Vietnam? We will address this in Total Accessible Market section.

2) Recurring (i.e., Stable) business

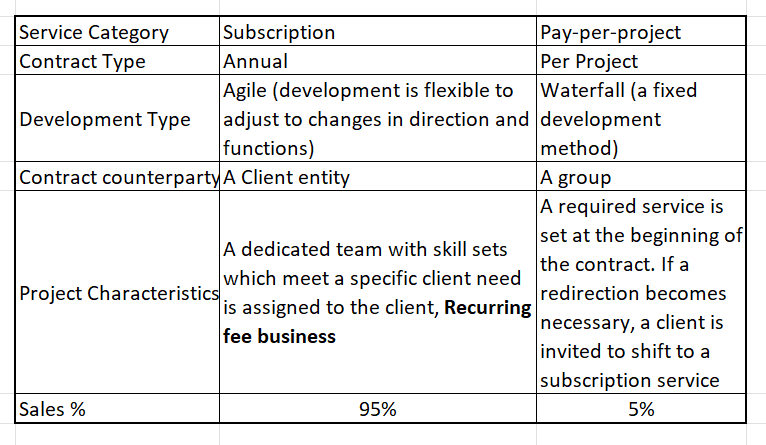

While the sales composition varies by fiscal year, the majority of net sales are from subscription services which accounted for 93.9% in FYE 9/20, 88.8% in FYE 9/21 and 95% in FYE Q3/22. The difference between Hybrid’s subscription services and per-per project (one-off) is explained below.

(source: Financial Results presentation for the 3rd quarter of Fiscal Year ending 9/22, translated by JapaneseIPO.com)

3) Proven and Accelerated Growth

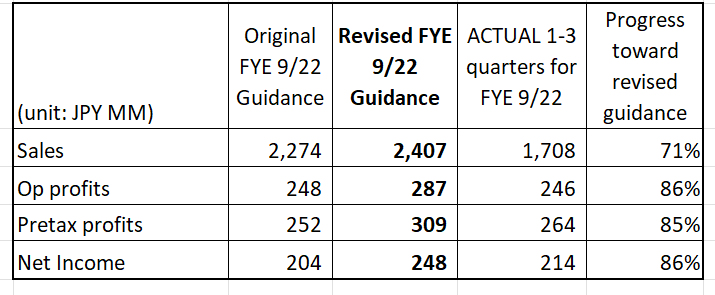

The company has built its successful track record with 250 clients. This has culminated in the recent financial performance as shown below. The company has witnessed a solid success with existing projects which enabled them to upward-revise its full year FYE 9/22 guidance on 10/14/22. The original FYE 2022 guidance was issued on 5/13/22.

(source: Financial Results presentation for the 3rd quarter of Fiscal Year ending 9/22, translated by JapaneseIPO.com)

2. Technically Speaking

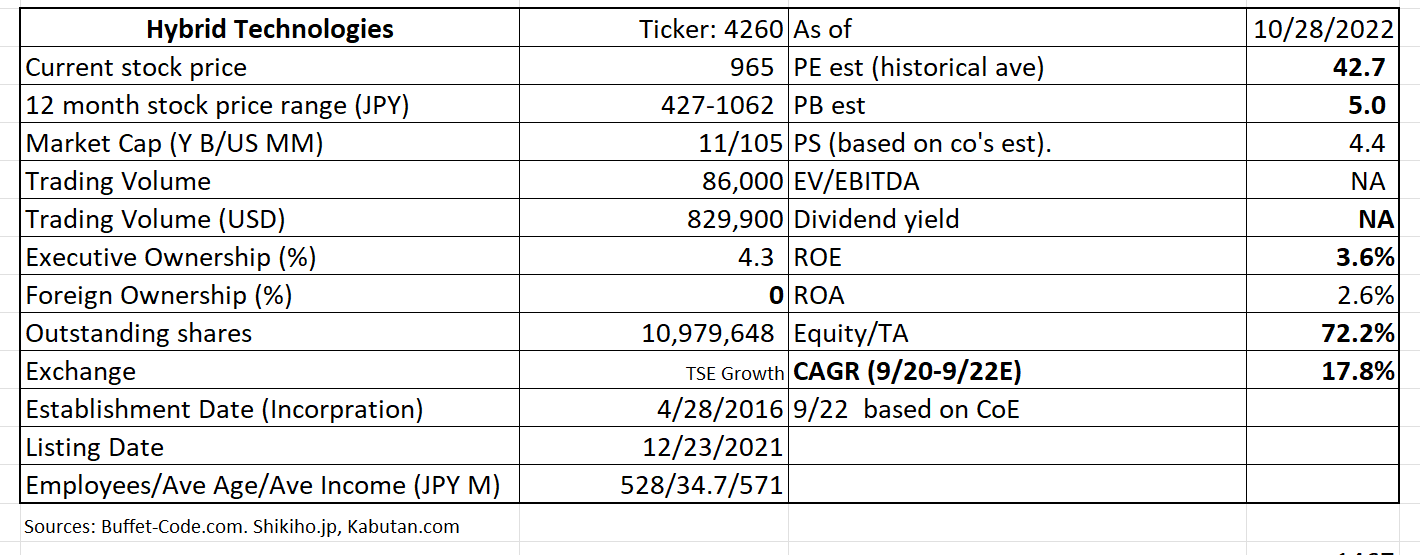

(Source: buffet-code.com)

The shares are trading at a lower end of trading range of JY 931-1,064. This can be viewed “positive” , since this indicates rotation of stock holders, i.e., willing sellers had sold already less upward resistance.

3. Business Model

Subscription model as discussed above

4. Financial Highlights

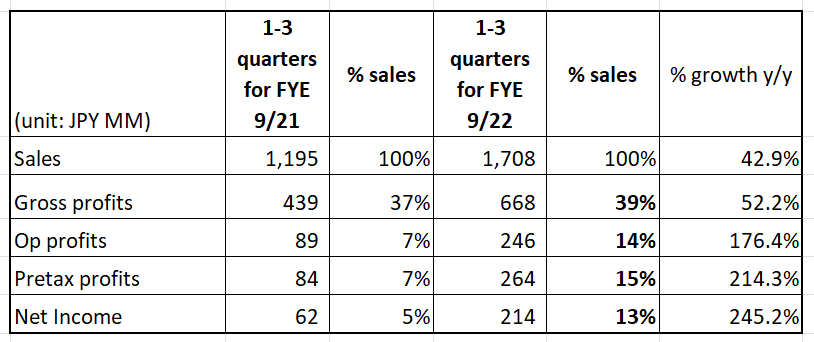

Financial results for the 3RD quarter ending 9/22 vs 9/21

*The sales increased 43%: The company assigned many project managers to the existing projects which improved development quality. As a result, the additional orders were received, the project sizes got larger and average revenues per clients improved from JPY 2,213,000 in FYE 9/21 to JPY 3,000,000 in the first 3 quarters of FYE 9/22, much higher than JPY 2,705,000 planned for FYE 2/22.

*Gross margin improved by 2 % to 39% due to positive scale impact of sales increase

*Also operating leverage benefits were seen in operating margin improve by 7% to 14%.

(Source: Financial Results presentation for the 3rd quarter of Fiscal Year ending 9/22)

5. Total Addressable Markets (TAM)

A couple of Japanese research firms estimate that “Digitization Initiatives” in Japan will create the IT industry in the size of JPY 3 Tn (roughly $30 Bn) by 2030(1). However, by Mizuho Research estimates, Japan will suffer from qualified engineers shortage of about 790,000 (2). This skill shortage is most felt in SMEs (the companies with employees of 500 or less).

(1) Source: Fuji Chimera Research, cited by the company in Financial Results presentation for the 3rd quarter of Fiscal Year ending 9/22)

(2) Source: Financial Results presentation for the 3rd quarter of Fiscal Year ending 9/22

Here comes the benefit of the company’s tie with Vietnam.

Vietnam boasts highly educated engineers as Vietnamese government sets creating 1,500,000 engineers by 2030 as its public policy. Vietnam is #4 by Global innovation index among Aasen peers. Domestic universities are equipped with 153 engineering schools with 50,000 newly minted engineers graduating each year*

*These statistics are based on the company’s Financial Results presentation for the 3rd quarter of Fiscal Year ending 9/22)

6. Strengths and Weaknesses

Strength

Truly Hybrid Business Model

The well though-out blend of two countries, which stands at a different stage of maturity, provides a good balance of supply and demand of talents. In another words,

1) Growing population and rich supply of young engineers in Vietnam offer synergistic benefits to offset a shortage of engineering talents in Japan.

2) Japanese offices which are physically close to Japanese clients are responsible for initial planning stage of a contract but system development process is handled by engineers who often reside in Vietnam.

Weakness

Strong competitor Sun Asterisk (4053)

Sun Asterisk offers similar IT development services mainly to start ups. It is bigger than Hybrid in terms of number of Vietnamese engineers (2x of that of Hybrid) and its sales is 2 times as big as Hybrid’s. However, Sun has recently guided down their FYE 12/22 profit estimates since their ARPU was down in the recent quarter. In a stark contrast, Hybrid has reported its average contract price increased in the first 3 quarters of FYE 9/22 (as discussed in Financial Highlight section).

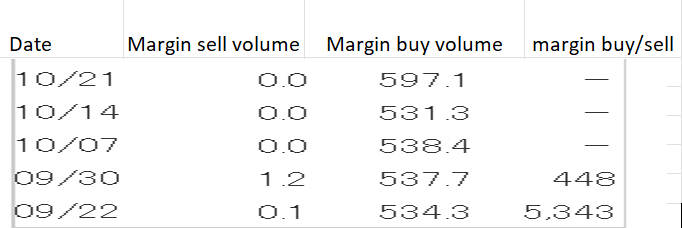

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Hybrid, margin buy volume is slowing rising but the current outstanding margin buy balance can be absorbed in a one day trading. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance