Hotto Link Inc. (Ticker: 3680): An “answer” to one of Web 2.0 issues

Hotto Link (the Company or “Hotto”) has 20 years of operating history but has reinvented itself in 2020 from a data analysis company to a data-supported marketing service provider. As a result of this pivoting, the Company offers the below investment thesis:

1. Investment Thesis

1) Hotto is the answer to the global marketers’ dilemma/Web 2.0 issues. Marketers face on ongoing struggle to balance competing interests of 1) limiting the uses of shoppers’ data to respect their privacy, while 2) simultaneously using data for personalized marketing.

Hotto highlights their ability to help marketers to personalize their promotional campaigns without infringing the buyers’ privacy too much.

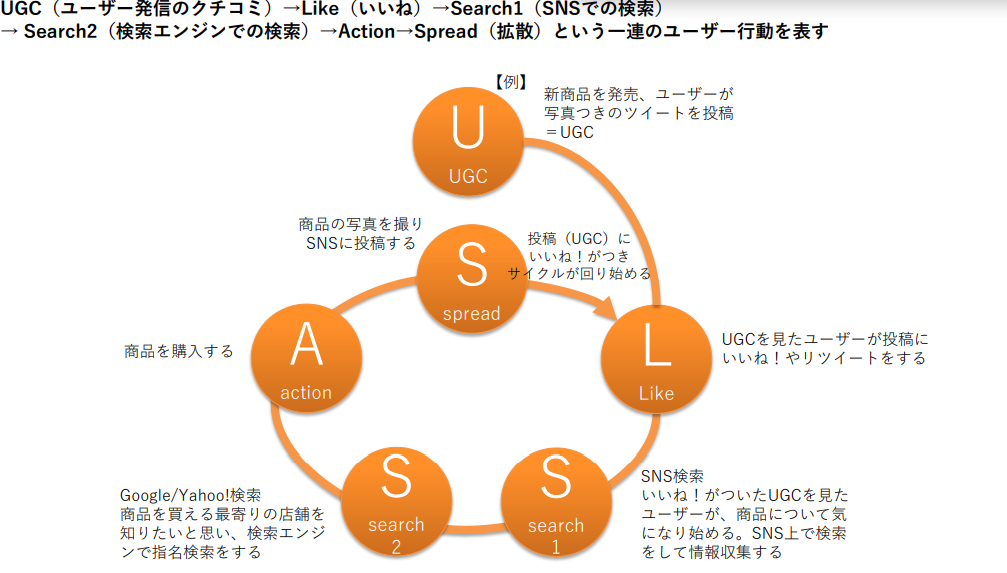

The below diagram shows the consumers’ buying behavior – ULSSAS. Explanation in English is provided below.

(Source: Company’s financial presentation for Q3/21).

(Source: Company’s financial presentation for Q3/21).

*ULSSAS: consumer buying behavior coined by Hotto. The cycle begins when a consumer posts a blog/tweet/Instagram picture on the service/product they have enjoyed.

U (UGC user generated contents such as blogs, tweets etc.)

L (A user sees the above contents and put a LIKE or Retweet)

S (Search 1: another user sees the contents above and got interested in products which got many LIKEs. New users’ online search about the product/service follows)

S (Search 2: Google/Yahoo search expands to shops which sell the items above in S1)

A (Action: buy the items)

S (Spread: Happy buyers take the item’s picture and post it on SNS. Thus, unsolicited marketing campaigns will start as a new ULSSAS cycle)

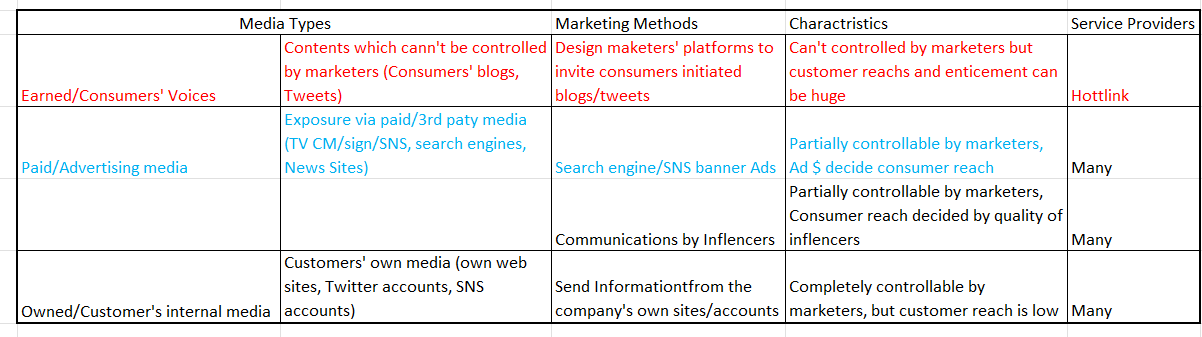

The blue section in the above table represents the “changes/threats” to the marketers due to “privacy protection movements”.

The red section indicates Hotto’s unique service offering which is designed as a solution to the issues in blue section, i.e.. its competitive advantage.

(Source: Prepared by www.JapaneseIPO.com based on Company’s financial presentation for Q3/21).

(Source: Prepared by www.JapaneseIPO.com based on Company’s financial presentation for Q3/21).

Media Types in the above table explained

1. Owned media: owned and operated by a company such as a company’s websites, SNS accounts.

2. Paid media: owned by a different advertising company. The client company gains market exposure by paying fees.

3. Earned media: comments and referrals by consumers/users who the company can’t control. Examples are blogs, tweets and Instagram posting.

2) In the first 9 months of FYE 12/21, the company reported a historically high sales and all profit lines turned positive. In fact, the company revised up its full year 2021 guidance as discussed in Financial Highlights section.

3) Hotto is one stop shop, offering both marketing and platform services, which is its competitive advantage. It is the only one company who can COLLECT, ANALYZE and USE them for marketing. By offering marking services, Hotto now deals with clients’ sales/marketing departments which have larger budgets than their research and development departments.

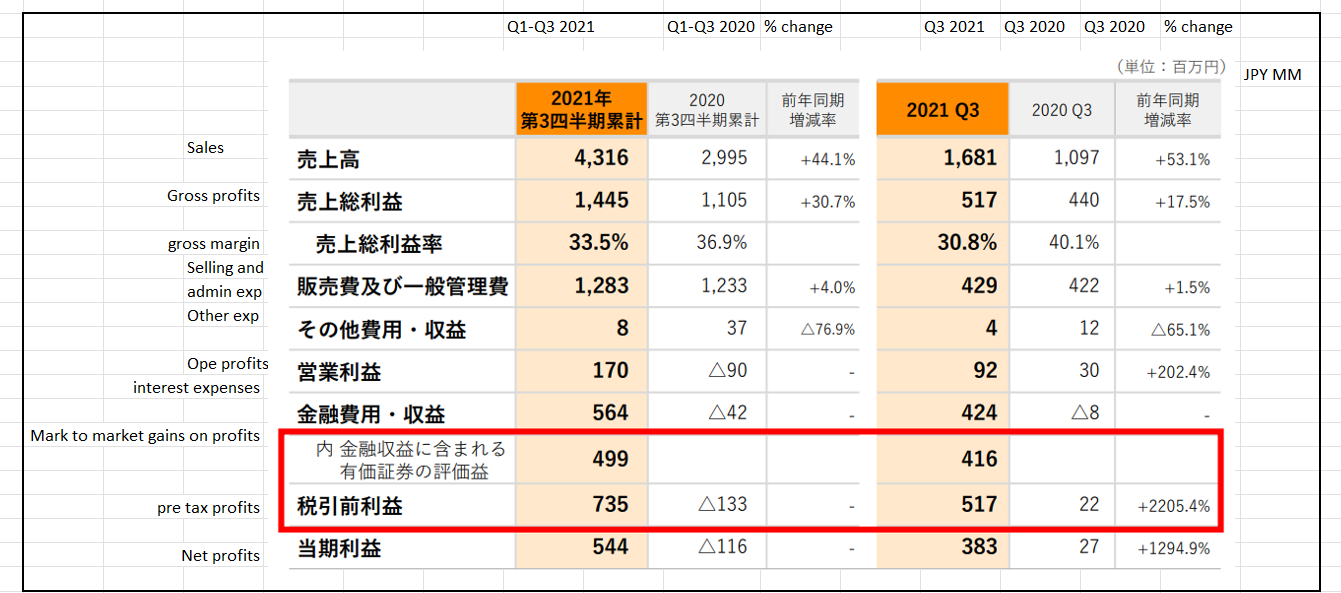

4) Since 2018, in order to diversify growth venues, the company has started a blockchain R&D project and invested in several domestic and overseas blockchain funds. Hotto reported mark to market gains from one of these overseas funds in Q3 2021 in the amounts of JPY 416 MM.

5) The company is a perfect fit for a changing customer buying behavior from a just product purchase to a story purchase through “process economy”, e.g. I buy this product since I like this person’s story behind the product creation.

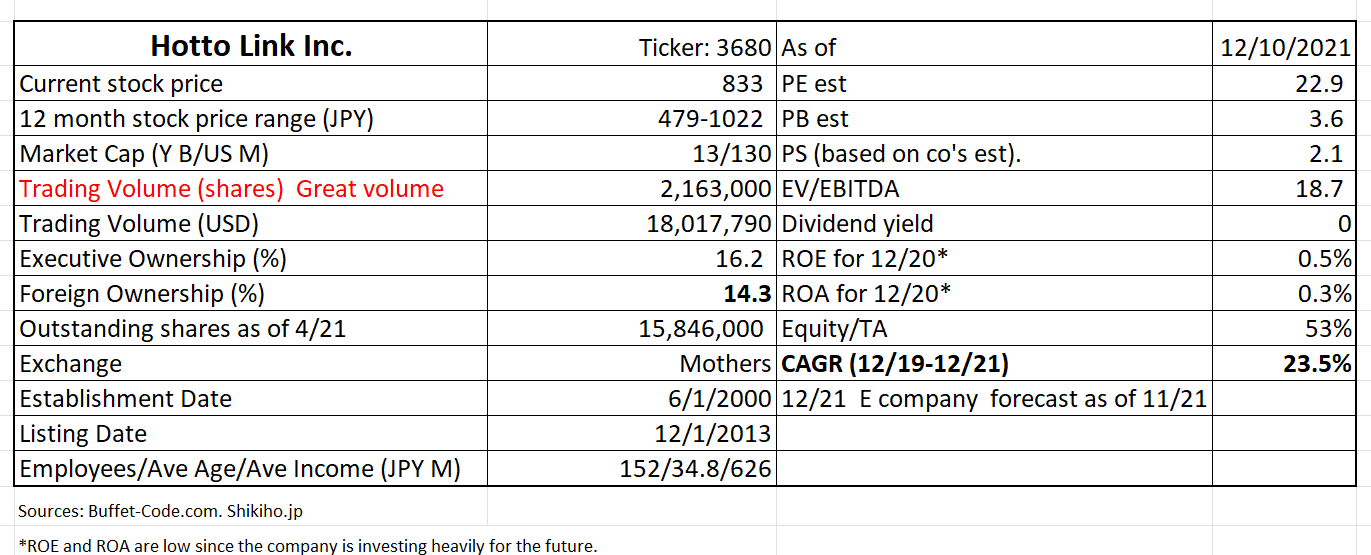

2. Technically Speaking

The stock shot up 17% on 11/15/21, reacting to the company’s increased guidance for FY 12/21. Sales guidance was upped by 50% compared to the previous guidance. The stock has come down after that, due partly to the general market weakness and profit takings. The below volume cluster shows that the stock is currently trading at JPY 833, below an initial ceiling of around JPY 940. If the daily trading volume stays at a current high level, it has a good chance of pushing through this ceiling.

(Source: TradingView)

3. Who is Hotto Link?

The company has grown through its three business segments:

1) Aforementioned digital marketing supports, collecting and analyzing SNS (social networking services)/social media) data.

2) Sales of big data access rights to major social media through its US subsidiary (Effyis, Inc. purchased in 2015).

3) Provides web promotion-support service and cross border EC (e-commerce) service in China via its subsidiary (TrendExpress Inc.) The company called this business “Crossbound” business

In addition to the above core segments, Hotto is exploring new businesses leveraging on blockchain technologies. It spun off the SNS risk surveillance business in 12/18, making it an equity-method affiliate. The current investment focus is the cross bound (Chinese) business.

4. Business Model

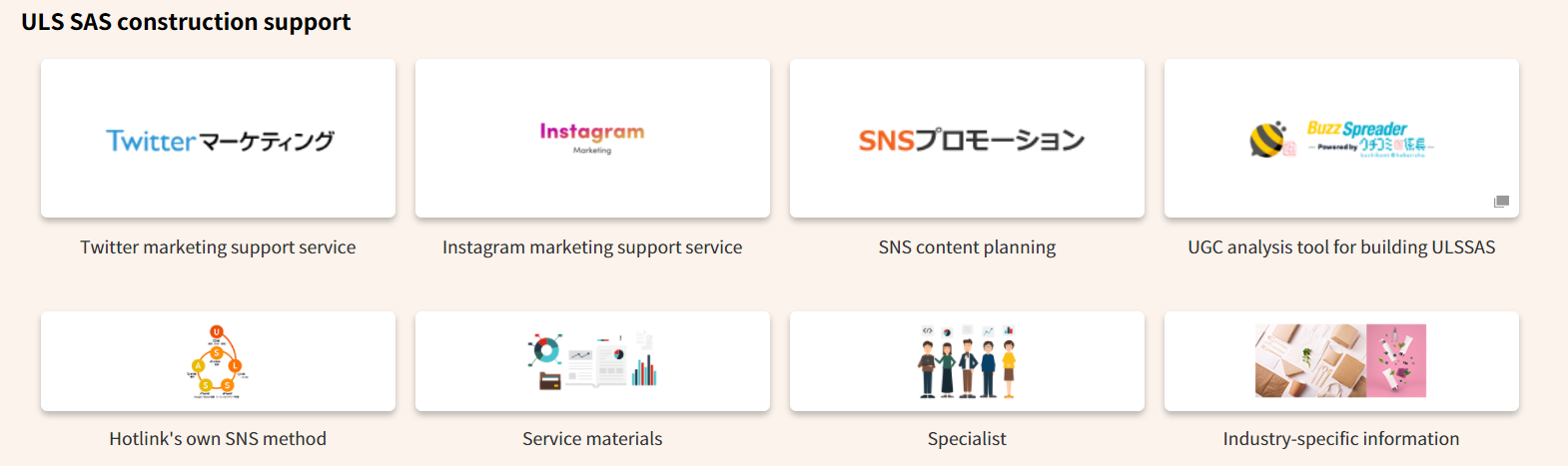

1.SNS Marketing support

This group consists of a)domestic SNS advertising and consulting business and b) the Kuchikomi@kakaricho (means “chief” in Japanese) which is SNS analysis tool.

a) In the SNS ad group, the company conducts an analysis that brings together all UGCs, collected from Twitter, blogs, word-of mouth sites. Then, it distributes advertisements for the products in ways which invite the ideal UGCs selected by AI. Hotto is known for high cost to benefits performance.

b)Kuchikomi@kakaricho is an SNS analysis tool, and boasts Japan’s largest social media coverage and offer easy to conduct “trend and attribute” analysis. Kuchikomi can also conduct cross-media analysis spanning TV and News sites. It can even mine data held by customers. Hotto has noted that it covers 90% of all blogs in Japan.

Kuchikomi is noted as “BuzzSpreader” in the below table.

(Source: Hotto corporate site)

The below 2 firms represent some of the company’s many success cases.

2. Socialgist (for US market)

This group is the largest index of human-to-human conversational content (as noted in their home page). In another words, Socialgist is the data access layer between social media networks and the analytics community. Its platform connects the clients to the global public online conversational data with the aims to uncover insights and identify trends. This is done with appropriate privacy protocols.

The below companies are listed as content partners in their home page.

3.TrendExpress Inc. (China focused)

This group houses two below operations

China Trend Express China Promotion

(Source: Presentation Material for financial results of Q3 of FYE 12/21)

a) China Trend Express: This segment provides information necessary for making decision on Chinese business by reading and analyzing Chinese society. The clients are Japanese entities which are aiming to grow Chinese consumer business.

b) China Promotion: This segment distribute data on “true consumer needs” in the Chinese market. Marketing and promotion plans are executed without relying on intuition and experience and leading to high probability of success.

5. Financial Highlights

The company’s sales were up 44% in the first 9 months of 2021 compared to the same period in 2020, thanks mainly to strength of core SNS marketing business and Chinese crossborder marketing operations. Operating profits was negative in 2020 due to high expenses but turned positive of JPY 170MM in 2021. Net income was high at JPY 735 MM, thanks to 1) expense control and 2)mark to market asset gains of the company’s US blockchain investments.

(Source: Presentation Material for financial results of Q3 of FYE 12/21)

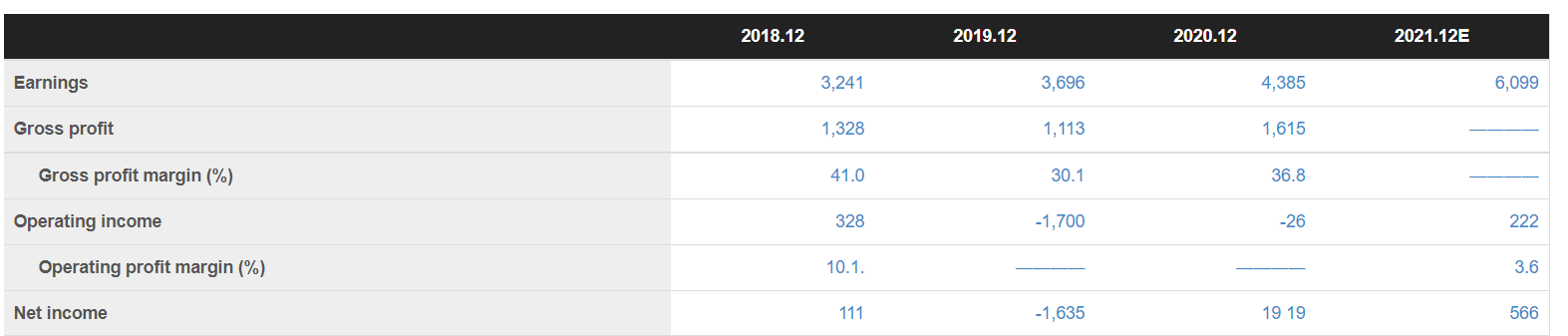

Over the last three years, as we can see from the below table, the company’s top line has grown steadily.

(unit:JPY MM)

(Source: Buffet-code.com) Note: 12/20’s net income should read JPY 19MM.

The company expects sales for 12/21 to increase to JPY 6,099 MM (+39%) driven by China business’ exceeding expectations.

6. TAM (Total accessible markets)

Japanese market

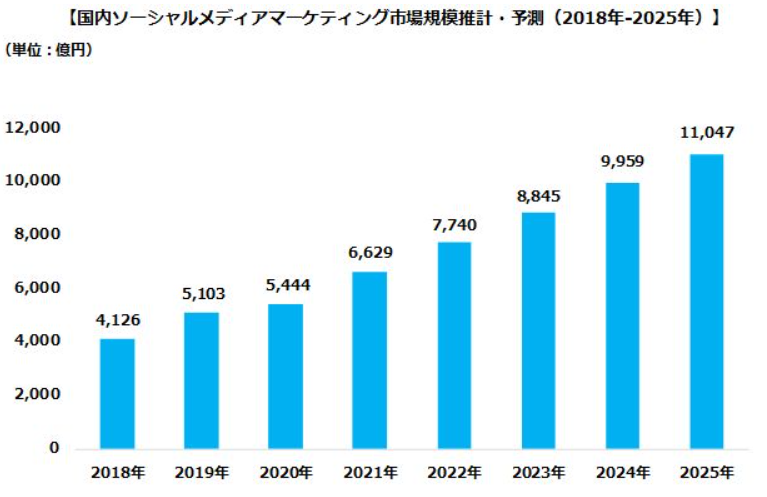

The below chart is from 10/12/20 research by “Cyber Buzz Inc.” which estimated Japanese social media marketing industry was JPY550 Bn in 2020 and would likely increase to JPY 11 Tn ($9 Bn) in 2025.

(Source: Digital Buzz Inc.)

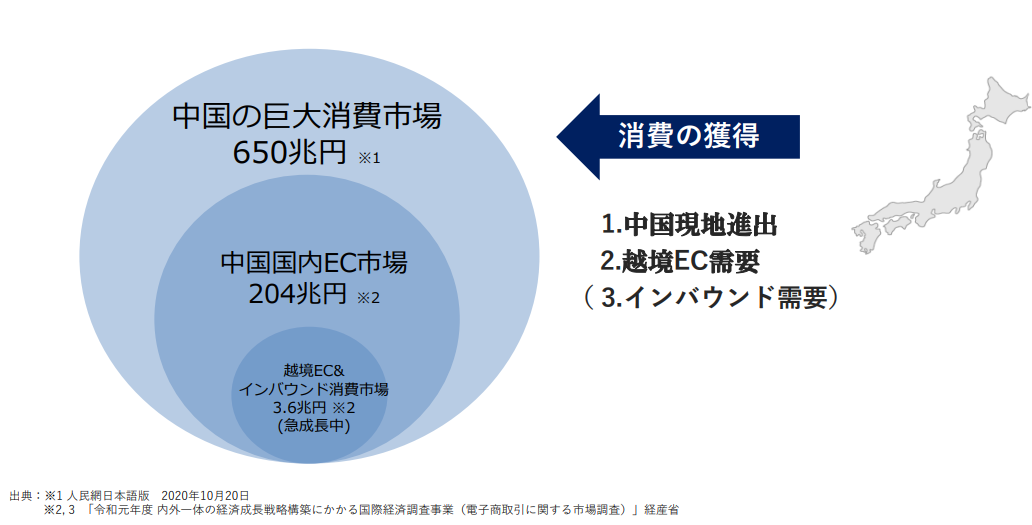

Chinese consumer and EC Market (analytics market data is not available).

Chinese government data obtained by Hotto indicates that Chinese consumer market is as large as $6 Tn. Chinese EC market amounts to around $2Tn (estimated by Japanese Ministry of Finance).

(Source: Presentation Material for financial results of Q3 of FYE 12/21)

Global Markets

The below data is gleaned from “Global Social Media Analytics” report, as of 11/21 and published by “Markets and Markets” on their website.

The social media analytics market size is projected to grow from $3.2 Bn in 2021 to $9.3Bn in 2026, at a Compound Annual Growth Rate (CAGR) of 24%. The listed growth drivers are:

a) Rising number of social media users supported by growth of digital technologies,

b) Increased focus on the market and competitive intelligence by marketers, and

c) Rising need for social media measurement to enhance the customer experience.

The above growth estimates are a bit confusing since Japanese social media analytics market in 2025 is estimated as large as global market in 2026. Nonetheless, it is safe to assume that social media analytics market will GROW at a strong pace.

7. Strengths and Weaknesses

Strengths

1. Industry Tailwinds

As we just witnessed in the preceding section, the business environment surrounding the company is very favorable at CAGR of 24% from 2021 to 2026.

2. Competition well controlled

SNS analytic market’s rapid growth is attracting entry of many competitors. However, the company is uniquely positioned with three layered services: Data Collection, Data Analysis and Data Utilization for Marketing. Its clients can choose just one aspect of these three offerings or can obtain the three services as a package.

On top of this vertical service line up, the company has huge global UGC data base built through many years of operations.

The company is in the market share expansion mode in both Japan and overseas via its US subsidiary Effyes and China operations (TrendExpress Inc.). This way, the company is improving its market presence and build long term (sticky) relationships with its customers.

Weaknesses:

1. Regulatory concerns

Consumer privacy concerns seem to be a hot topic among regulators. Thus, restrictive rules can be introduced to the social media analytics market. This threat is mitigated by the fact that Hotto’s marketing assistance service is based on data which is originated and willingly shared by consumer themselves.

2. Entry of New Technology

Web 3.0 may change the social medial player landscape. However, at a current rate, it may take several years before Web 3.0 becomes a formidable force.

8. Near-term Selling Pressure

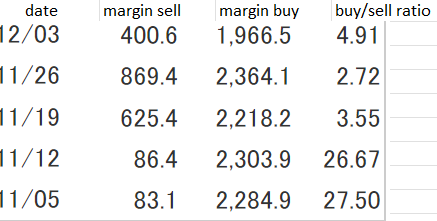

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Hotto, buy/sell ratio for 12/3 was 4.91x, higher than 3x which is a level we like to see. But, margin buy volume is on a steady decline. Therefore, we can assume that not much near-term selling pressure exists at this point.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance