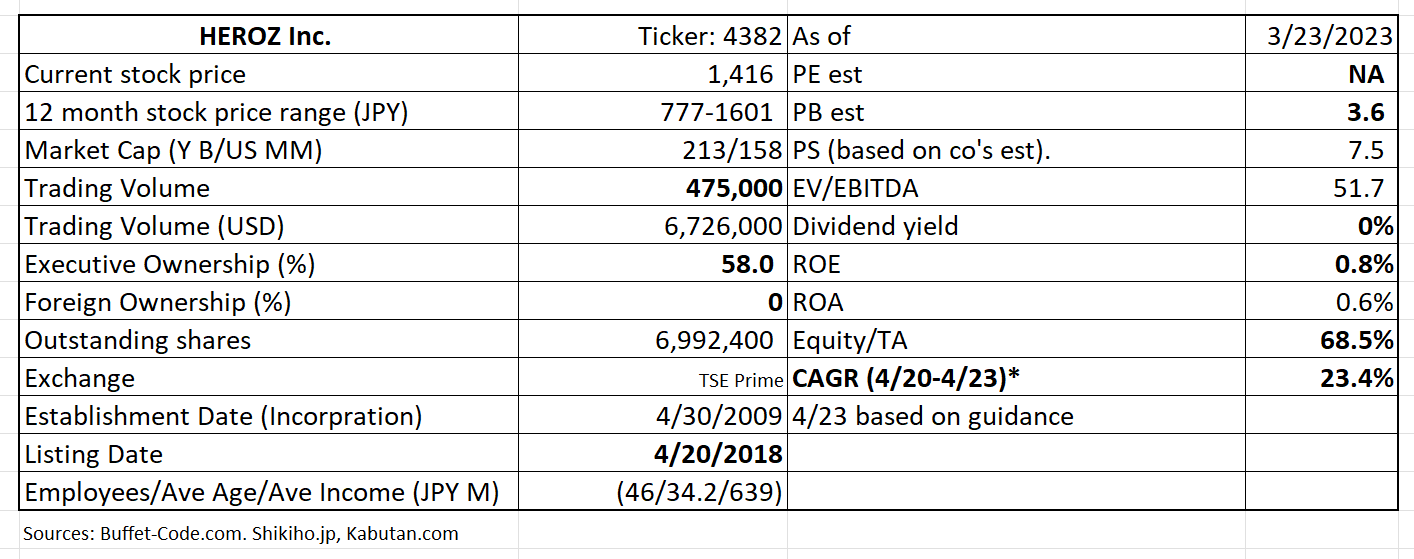

HEROZ inc. (“Heroz” or the “company”) offers AI Technologies based services, based on expertise accumulated in making and selling AI Shogi (Japanese chess), Go, backgammon and chess. The company was started in 2009 by current management members formerly of NEC. Core earnings has been subscription fees from “Shogi Wars”, a real time online shogi game application for smartphones with 4 million subscribers. It has recently started royalty-based services to entities in the finance, construction, human resources, entertainment and other industries. Main customers include Takenaka Corporation and SMBC Nikko Securities.

Heroz has consolidated Vario Secure (43% acquired in 8/22) and StrategIT (89% acquired in 9/23) as subsidiaries. The acquisition of Varo has signaled the company’s entry into AI security industry.

1. Investment Thesis

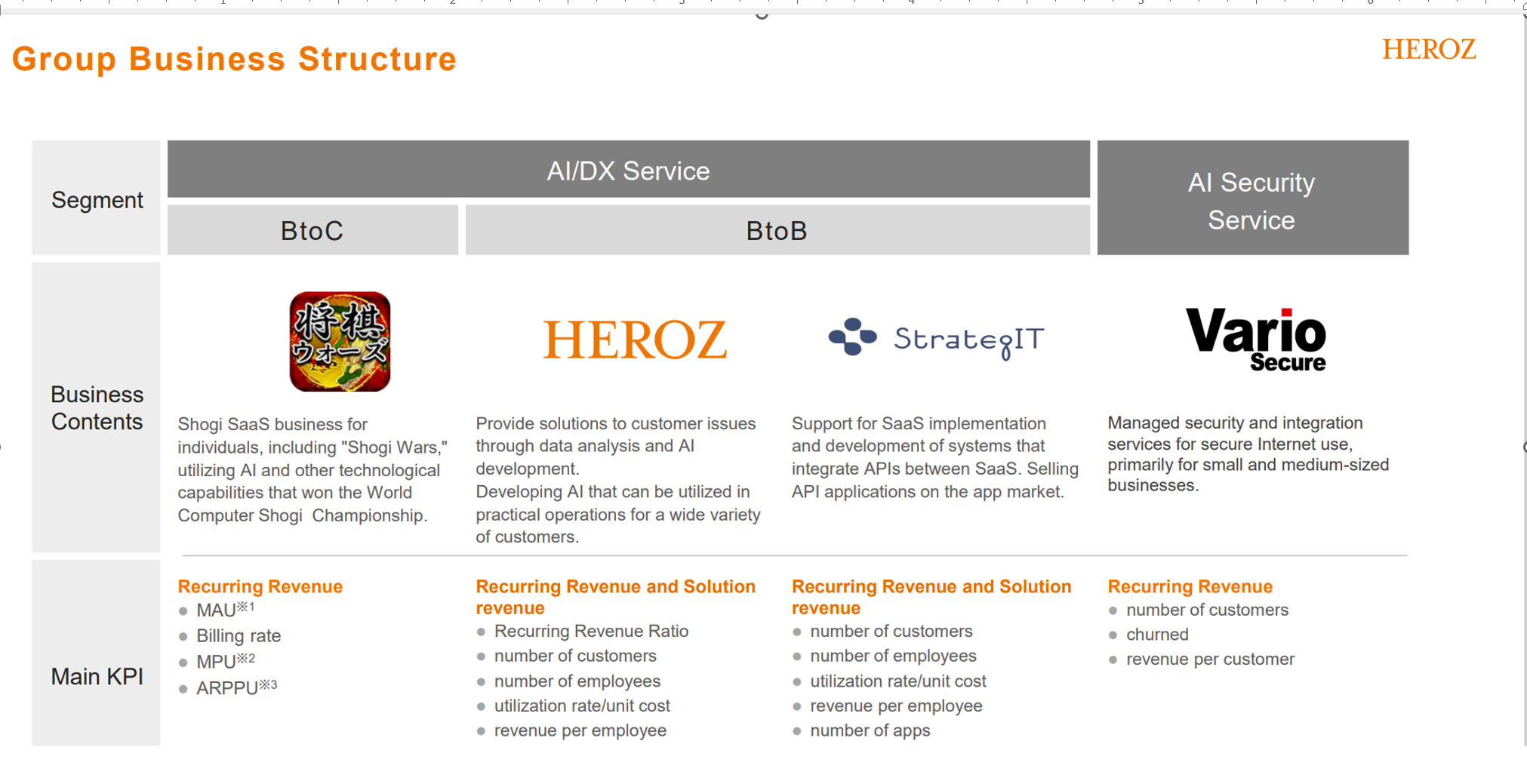

1) HEROZ’s post M&A product offerings are in three of fast growth areas in AI (offered by HEROZ), linked SaaS (by StrategIT) and AI Security (by Vario)

The below table illustrates product lines:

To summarize the above table – There are two major AI based segments.

(Source: Presentation Materials for FYE 4/2023 Q3 Financial Results)

1) AI/DX Service

1-a) BtoC: Target customers are individuals. Provides Shogi platforms, flagship product -> Shogi Wars

1-b)BtoB: Target customers are businesses. Expands knowledge base built through Shogi AI development into developing and providing AI solutions for industrial applications (mainly for Finance, construction and entertainment industries)

1-c)BtoB: Target customers (under StrategIT) provides SaaS API*assistance. A SaaS API is a cloud-based software solution that allows communication with other applications through different APIs. Thus, the software is fed by other data.

*API=application programming interface

2) AI Security Service (Vaior Secure): target customers – SME (small to midsized enterprises). Assists in managing online securities.

Strengths of each segment:

AI/DX BtoC (Heroz)

With Shogi Wars and newly released “Konshin Analytics”, the company enjoys No1. Market share in AI Shogi games and name recognition

AI/DX BtoB (Heroz)

AI engineers’ high skillsets and proven track records in finance, construction and entertainment industries. In AI developments, it is not rare that a project is abandoned at the stage of PoC (proof of concepts). With an ability to tackle high specification AI projects, the company can often complete a difficult AI development projects.

AI/DX BtoB (StrategIT)

SaaS coordination using AI is one of rapidly growing areas. Possesses a patent on Master Hub which is development platform for SaaS coordination AI.

Ai Security (Vario Secure)

Enjoys a top market share in the firewall/UTM (unified threat management) with SMEs.

2) AI can solve many Japanese woes

(Source: Presentation Materials for FYE 4/2023 Q3 Financial Results)

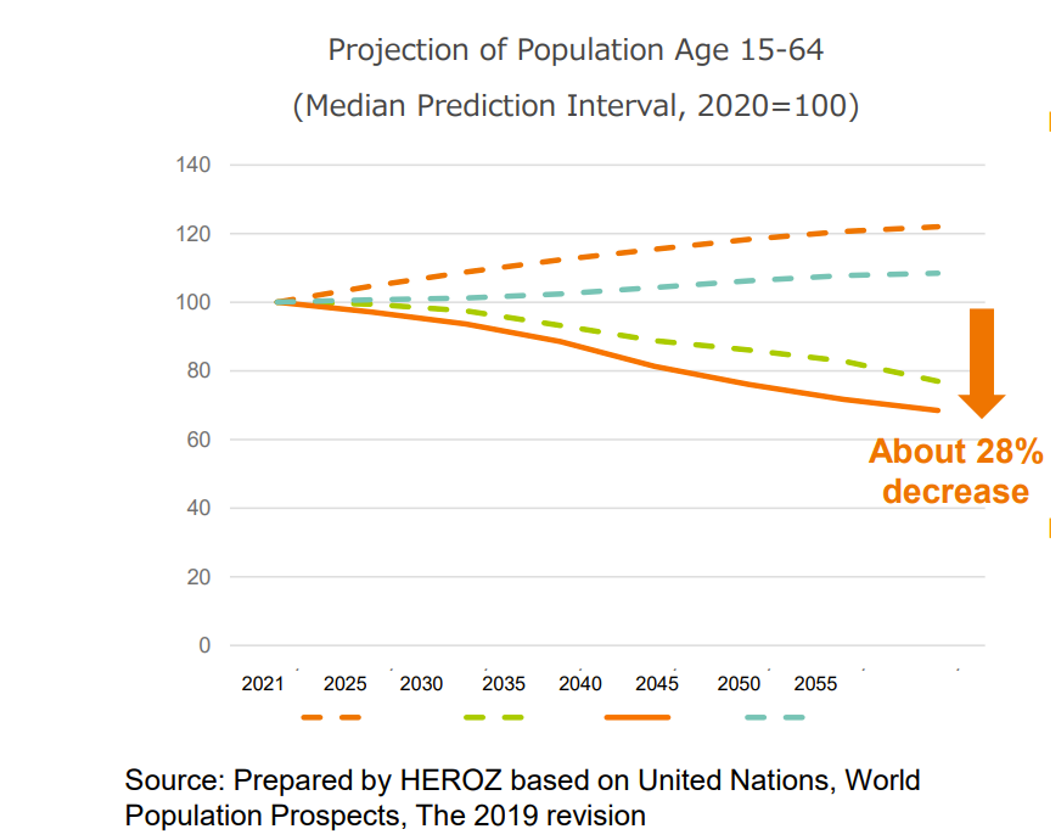

The working population is, globally and on average, forecast to increase by around 12% from 2020 to 2035 and by about 21% from 2020 to 2055. The same number in Japan is a 11% decrease from 2020 to 2035 to a 28% from 2020 to 2055. This means that the Japanese working-age population will show the largest decrease among leading GDP nations. Japan will need to replenish productive forces somehow, among which AI supports should be a forefront of mind of company executives.

Heroz’ AI can automate many daily operations, including decision-making responsibilities.

2) Huge growth potential for SaaS market

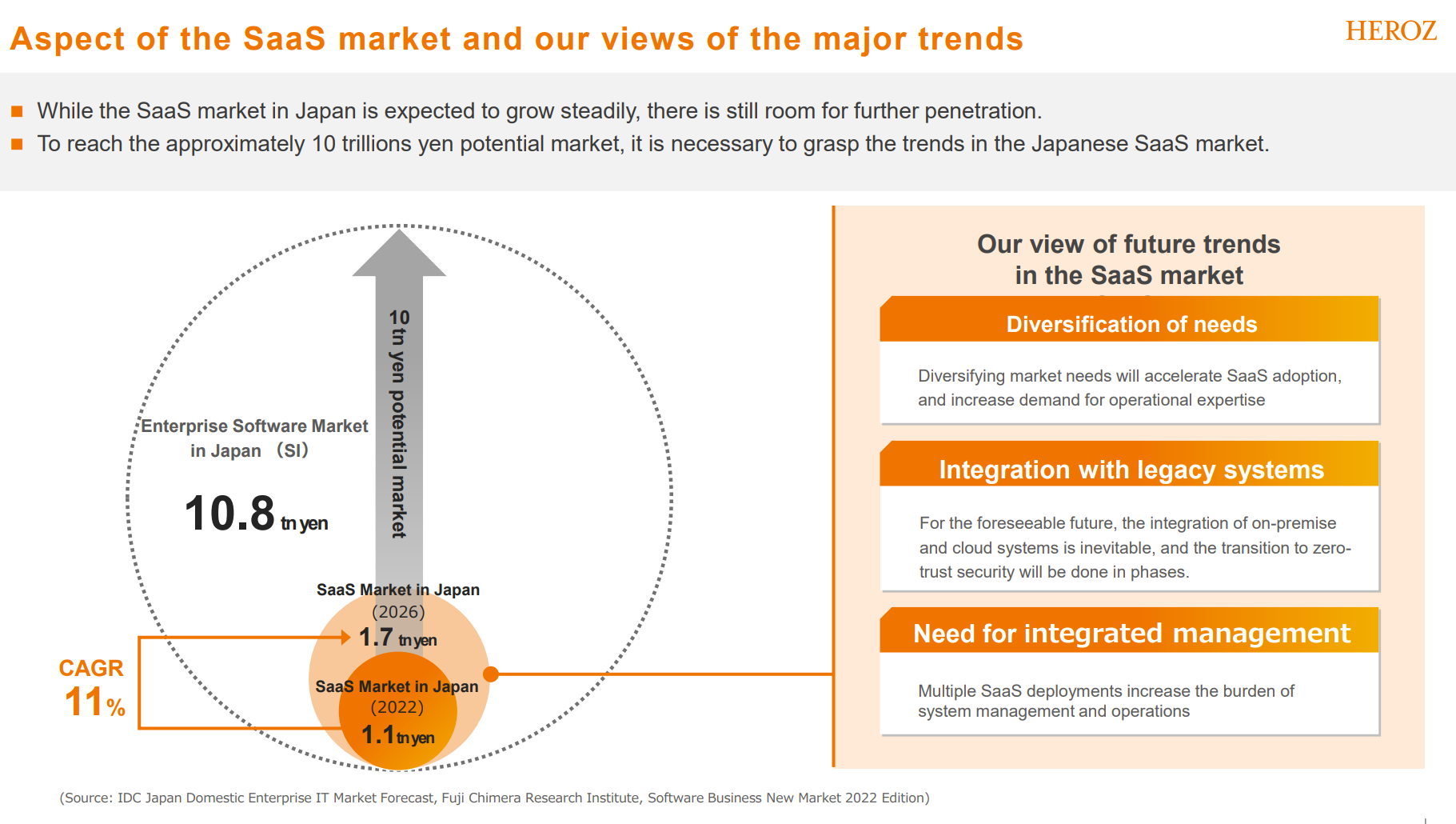

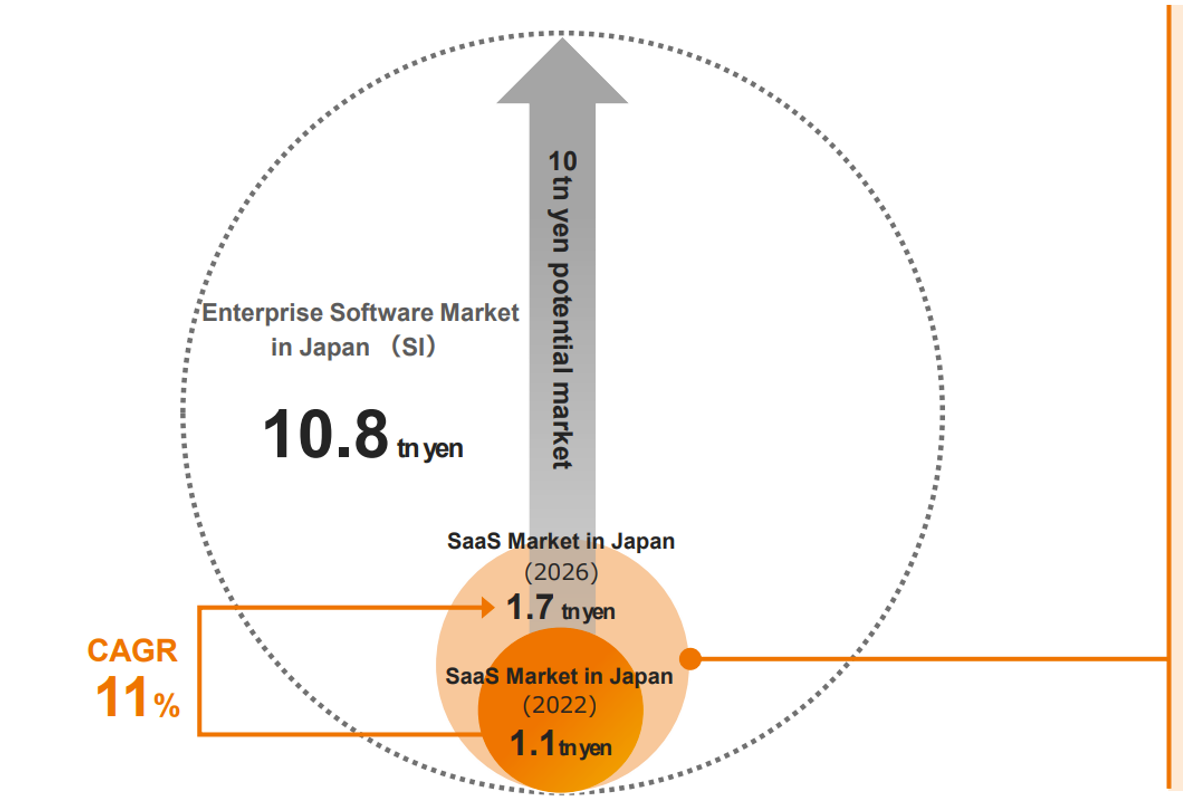

As discussed earlier, SaaS coordination using AI is one of the fastest growing segments in Japan.

(Source: IDC Japan, cited from the company’s presentation Materials for FYE 4/2023 Q3 Financial Results)

The above graph estimates Japanese SaaS market will grow at CAGR of 11% from JPY 1.1Tn in 2022 to JPY 1.7 Tn in 2026. The major growth drivers are:

1) The more diversified market needs are emerging and technology is catching up to satisfy these needs,

2) SaaS integration with legacy on-premise systems are inevitable, pushing demand for flexible SaaS, and

3) Multiple SaaS deployment increases the need for integrated management capabilities which StrategIT can provide.

*The above CAGR number is for a reference only, since the company has not restated pre-acquisition numbers, prior to FYE 4/22.

2. Technically Speaking

(Source: buffet-code.com)

The above chart shows that the shares has enjoyed the recent attention to AI related stocks. In March, it has retreated a bit, but appears to have found a near term support of around JPY 1,300.

3. Business Model

The most notable shift in HEROZ’s business model is:

Transitioning into AI SaaS model through M&As were executed to increase the share of recurring revenues:

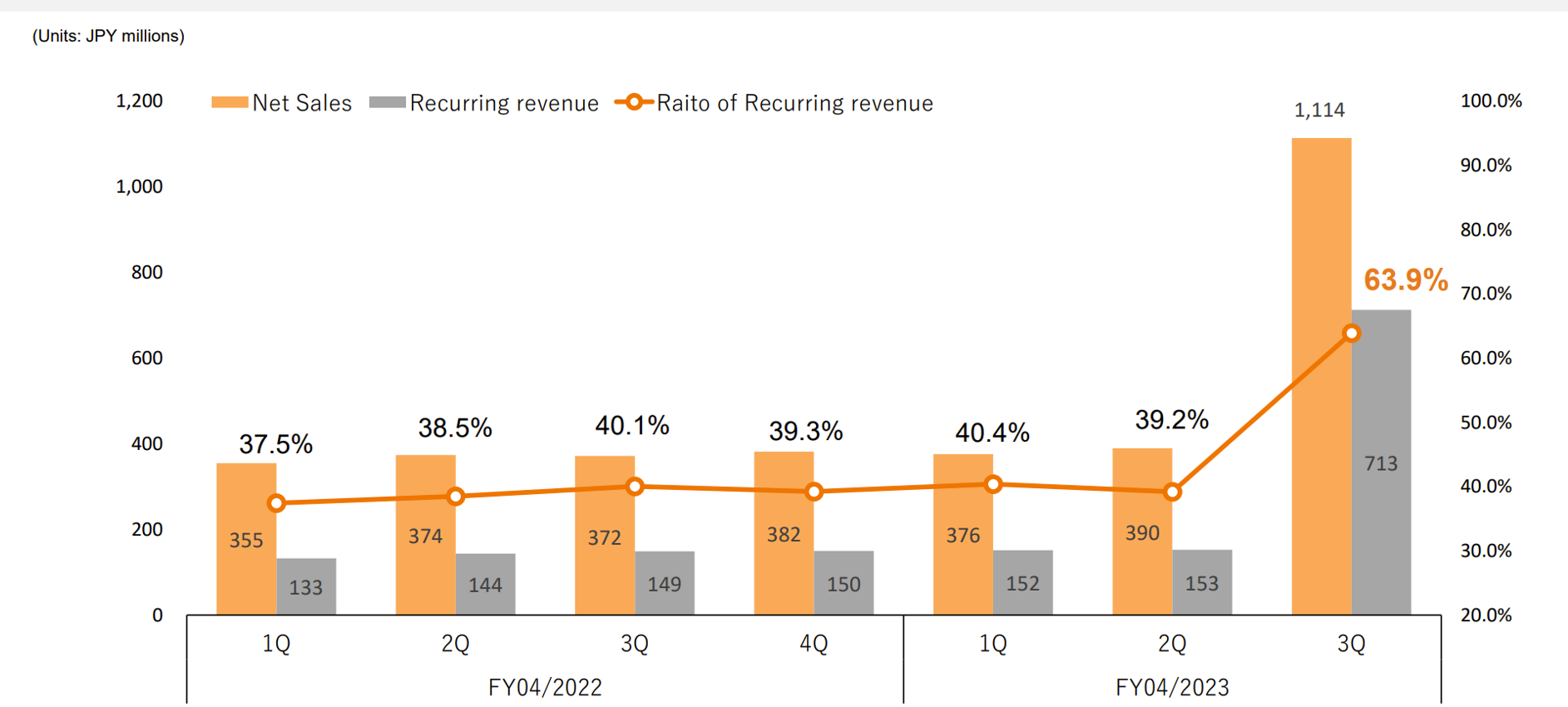

(Source: Presentation Materials for FYE 4/2023 Q3 Financial Results)

Recurring revenue ratio as a % of total sales doubled from 39.2% in 2Q to 63.9% in 3Q. The company believes that high recurring revenue ratio should improve quality of sales since the sales is “recurring”.

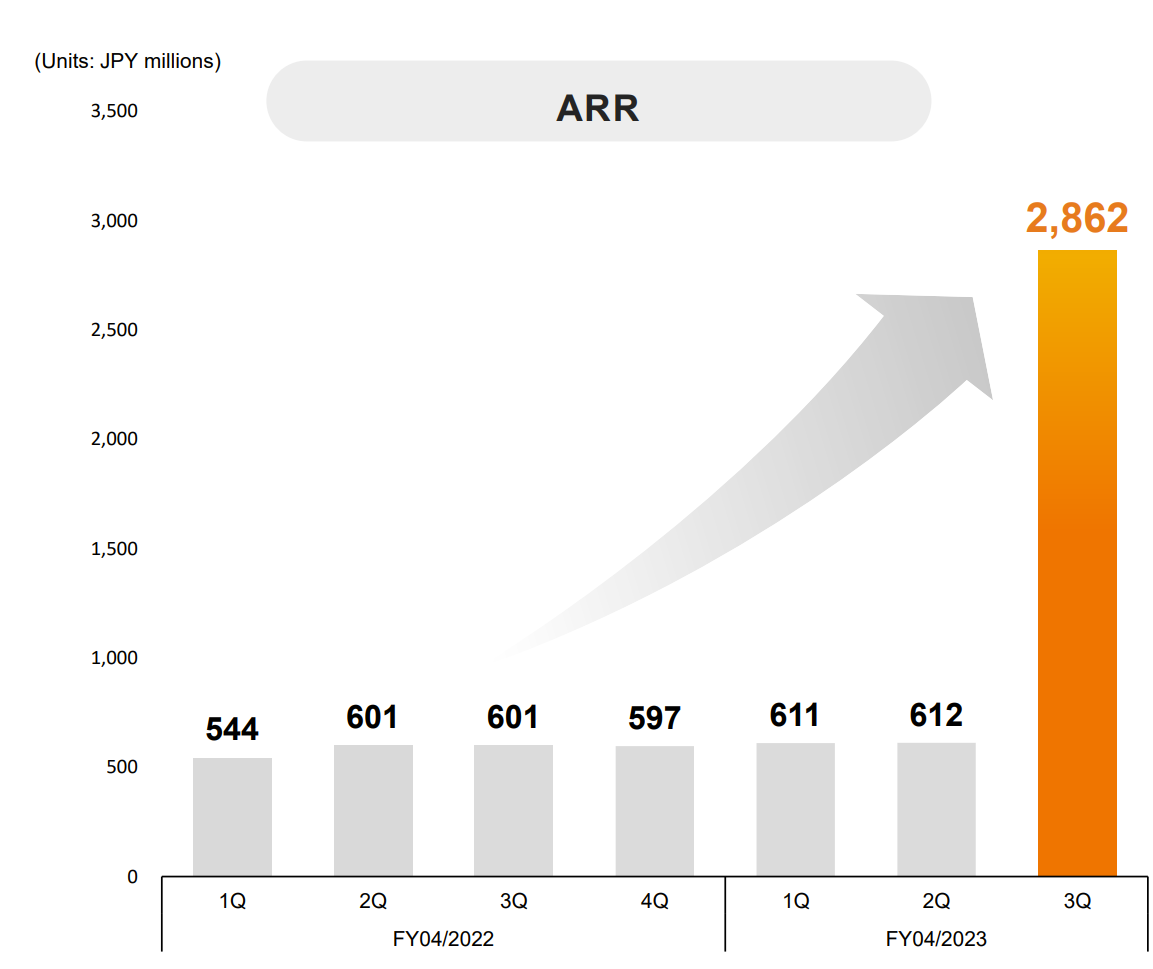

Acquisition of SaaS API and AI security businesses drove the company’s ARR by 376% to JPY 2,862 MM.

(Source: Presentation Materials for FYE 4/2023 Q3 Financial Results)

4. Financial Highlights

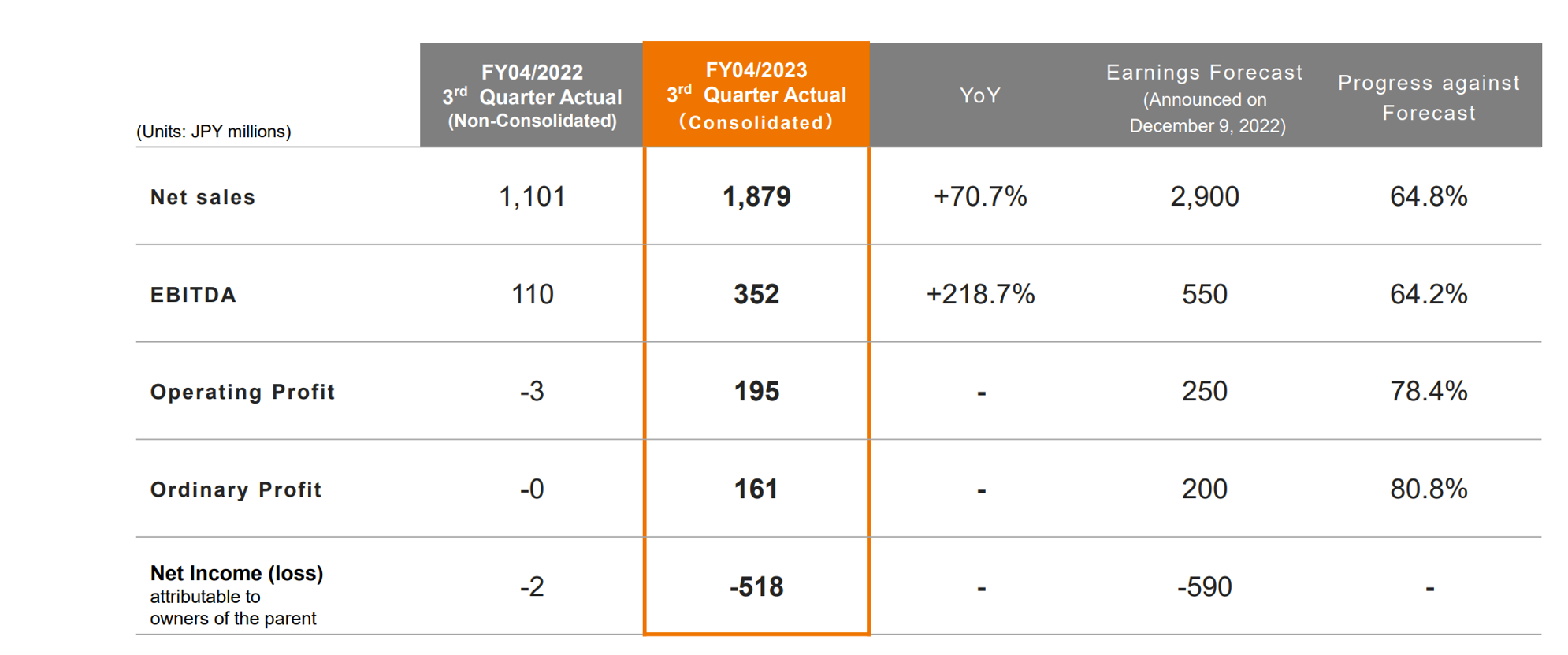

Financial Results for the 9 months for FYE 4/23 vs. 4/22:

(Source: Presentation Materials for FYE 4/2023 Q3 Financial Results)

Sales (+ 70.7% year over year) and EBITDA (+218% ) both witnessed a tremendous growth in the first 3 quarters ending 1/2023. Driving forces for these growth are acquisitions but organic sales also grew as shown below:

Organic Q3 sales growth (excluding M&A impacts) was:

Net sales JPY 1,161 MM (+5.5% Year on year)

Net sales (BtoC service) JPY 723 MM (+4.2% Year on year)

Net sales (BtoB service) JPY 429 MM (+7.8% Year on year)

The company does not disclose profit figures excluding two acquired companies.

Guidance:

Sales achieved 65% of the company’s annual guidance, below a typical 75% target. This is likely due to the fact that two new business segments were consolidated only in the last (Q3) quarter and larger contributions from acquired businesses will be expected in Q4.

Operating profits have reached 78% thanks to a contribution from high margin AI security segment.

5. Total Addressable Markets (TAM)

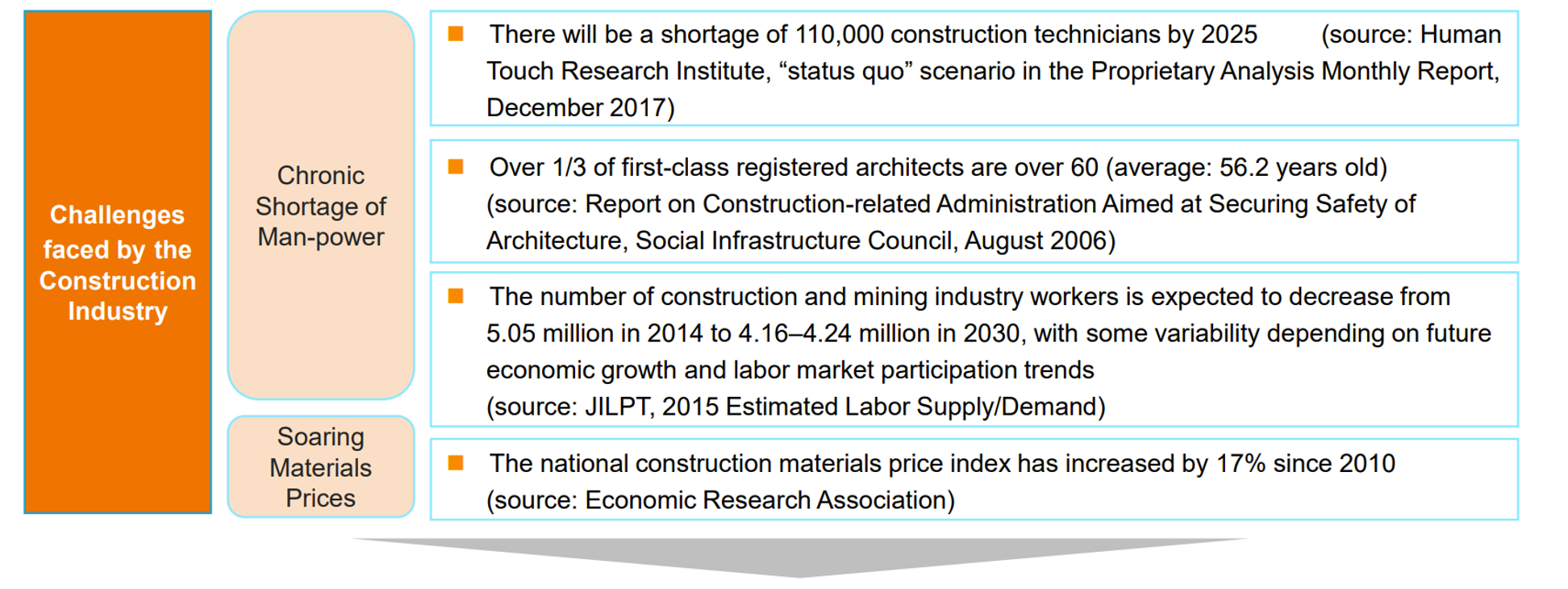

As mentioned earlier, rapid decline in working-age population in Japan has driven the adoption of AI in various segments, leading to significant efficiency improvements. Construction industry is one of these segments which also is one of HEROZ’s near term focus industry.

In 2017, the company entered a capital and business alliance with Takanaka Corp* to solidify relationship with players in the construction industry.

(Source: Presentation Materials for FYE 4/2023 Q3 Financial Results)

*Takenaka Corporation is one of 5 major general contractors in Japan.

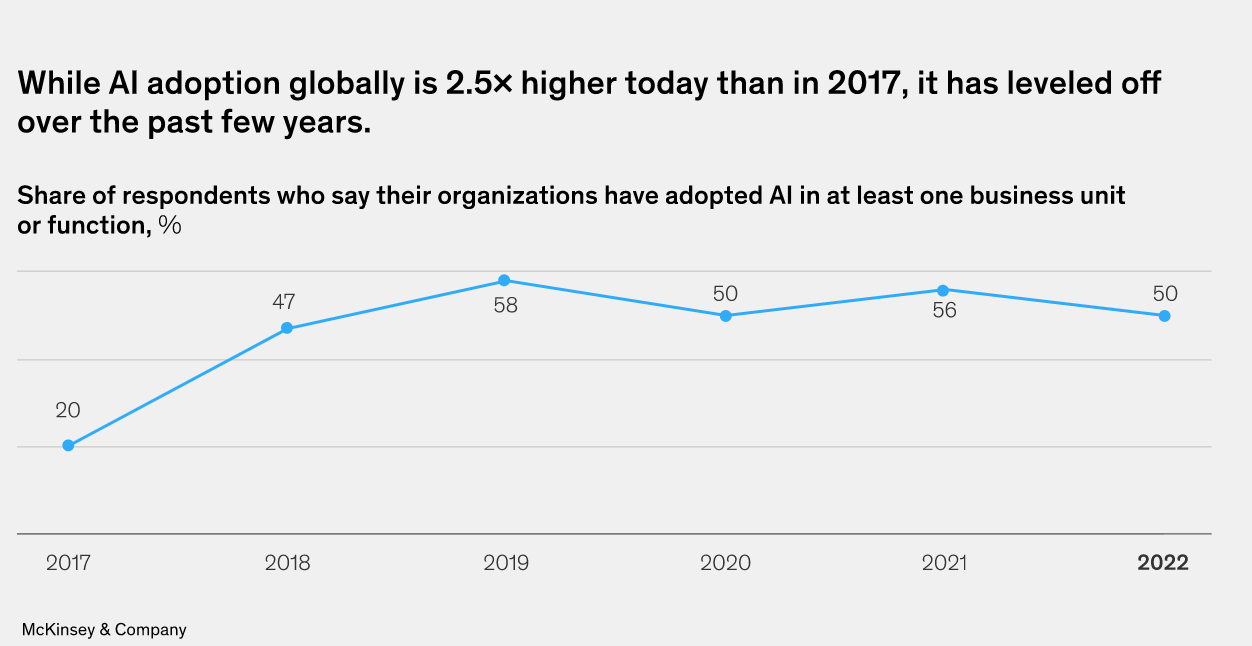

Globally, MiKensy’s survey has shown that AI adoption is 2.5x higher in 2020 than in 2017, but has leveled off over the past few years. Nonetheless, the wide recognition of ChatGPT and other AI language models will surely rekindle the corporate manager’s interests in AI in general.

(Source: The state of AI in 2022-and a half decade in review published by McKinsey & Company)

6. Strengths and Weaknesses

Strengths

1) Operate in high growth AI segments.

2) Majority of revenues are recurring

2) High market share in all three segments.

Weaknesses

Stiff competition

Investors, large established tech companies and start-ups are all vying for a space in the promising AI industry.

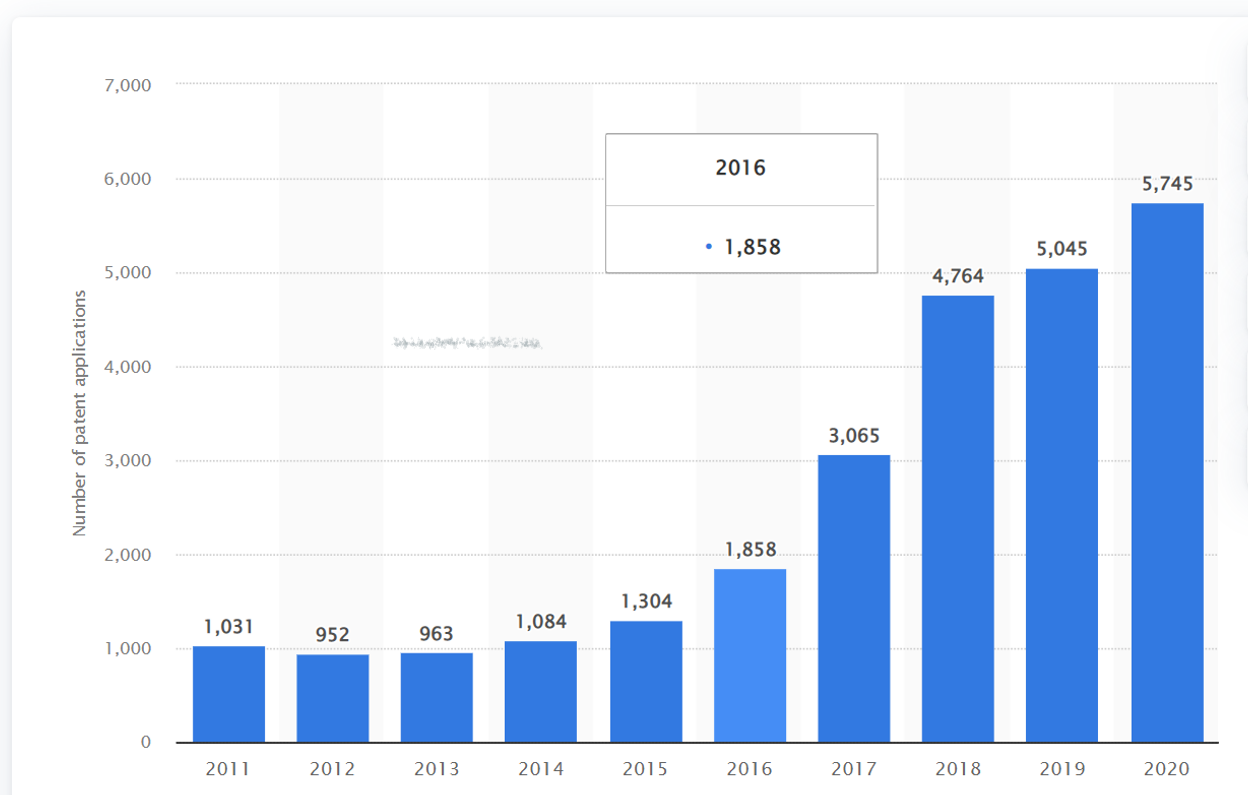

Even in Japan alone, AI-related patent applications at Japan Patent Office rose more than 5x from 2011 to 2020, as shown in the below Statista graph. This rise in patents indicates that an increasing number of companies are working for new AI applications.

-Number of patent applications related to AI at the Japan Patent Office from 2011 to 2020-

(Source: Statista Research Department, Nov., 2022)

Surely, there will be winners and losers. Heroz will likely be one of the winners, since 1) the company has taken a strategic path in which the company’s AI will be consolidated into a client’s mission critical systems and 2) it has a presence in Japan where AI will play a big role in solving social challenges.

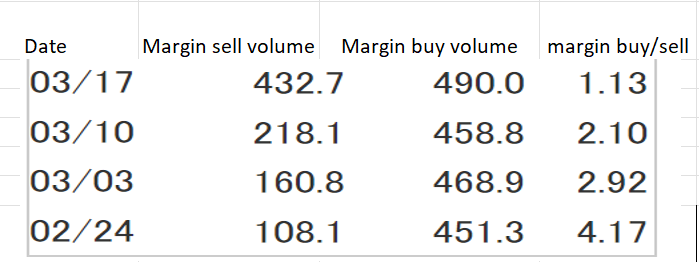

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For HEROZ, margin buy sell ratio has come down to 1.13x (below 3x is acceptable), thus, the near term selling pressure is not an issue.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance