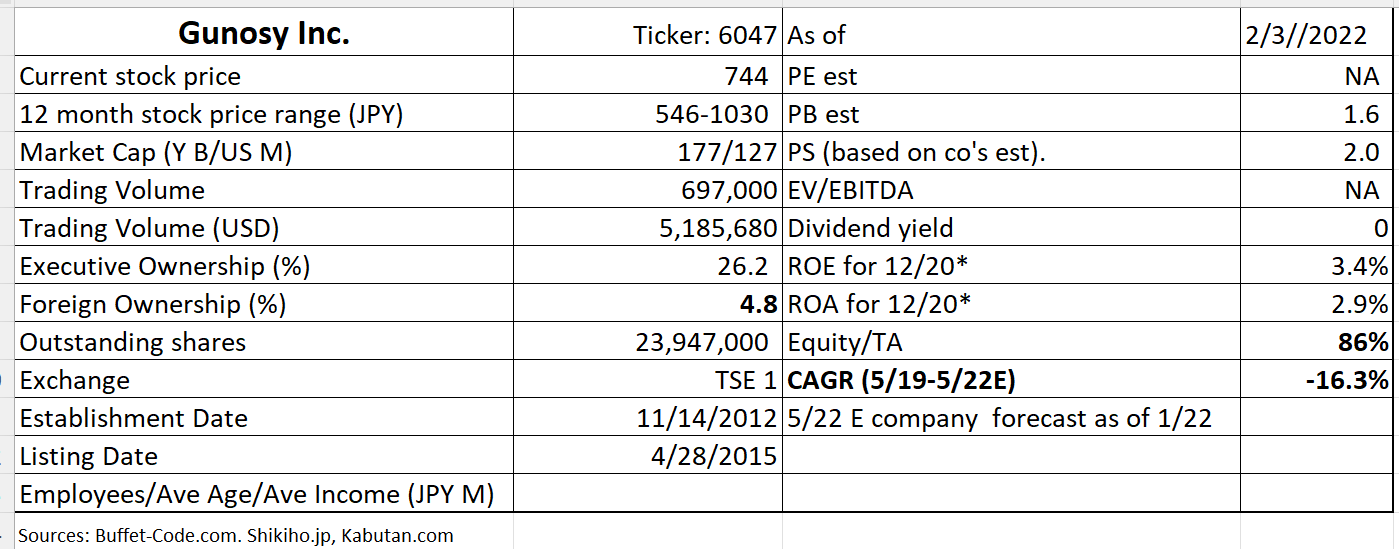

Gunosy Inc. (Gunosy or the Company) is a provider of curation application “Gunosy” which delivers articles mainly to smartphone users through collaboration with newspapers, magazines and online media. Other products – “LUCRA” offering information targeting women and “news’ ad” focusing on current news – are growing. The company is also engaged in ad network business distributing ads without using its own applications. The company has recently invested in Slice (India based Buy Now Pay Later provider) which may shift investors’ perspective on the company – from a mature company to a growth stock.

1. Investment thesis

1) Velation Gap between Gunosy and SmartNews justifiable?

Assessment: which is a better pureplay news app?

SmartNews – the Japan-based news curator/aggregator app, is a private company, thus, detailed valuation metrics are not available to me. However, the below 9/15/21 article by TechCrunch gives us a glimpse into investors’ view on its worth.

SmartNews has raised $230 MM in Series F funding. The company, since its inception, has raised over $400 MM with the business valuation at $2 Bn, the highest among standalone news app company. Thus, SmartNews commands substantially higher value than Gunosy with around $147 MM market capitalization.

Market positions of Gunosy and SmartNews

Industry data:

The below industry data is based on ICT Research Institute Co., Ltd’s “2021 Mobile News App Market Trend Survey (in Japan)” which summarized the survey results on 12/20/21.

The survey concluded that mobile news app active users reached 56.7 MM in 2020 and would have reached 58.7 M in 2021 in Japan. It also predicts that the growth will steadily continue and the active users will reach 60.36MM in 2022 and 61.83MM in 2023 (2019-2023 CAGR: 3%)

From 10/5/21 through 10/12/21, ICT Research conducted a Web questionnaire survey of 10,746 Internet users regarding the actual usage of mobile news apps.

Yahoo News is the most used with 63.5% respondents said they have used it.

The second is SmartNews with 56.2%.

Gunosy with 19.6% is a distant 4th, neck and neck with Google News with 19.5% (the 3rd is Line News)

Notables:

1) SmartNews enjoyed the largest usage increase (previously 21.4% with an increase of 34.8 points) from the previous survey (as of 4/20). Yahoo also increased its usage substantially from previous 39.8% with an increase of 23.7%. ICT estimates that these two services’ efforts to increase news contents which are popular among youth and female audience whose usage is rising from a low level is paying off .

2) Another interesting data point is the huge difference in number of relationship with publishers which is noted by Blue Bar in the below graph. SmartNews boasts ties with 3,000 global publishers which is 3x vs. 1,100 of Line News. Gnosy’s relationship number is 427. Red line indicates published articles. SmartNews once again tops at 34,201 articles vs. 1,703 with Gunosy.

The high publisher number and articles do not necessarily mean the high engagement by users.

(Source: ICT Research Ltd.)

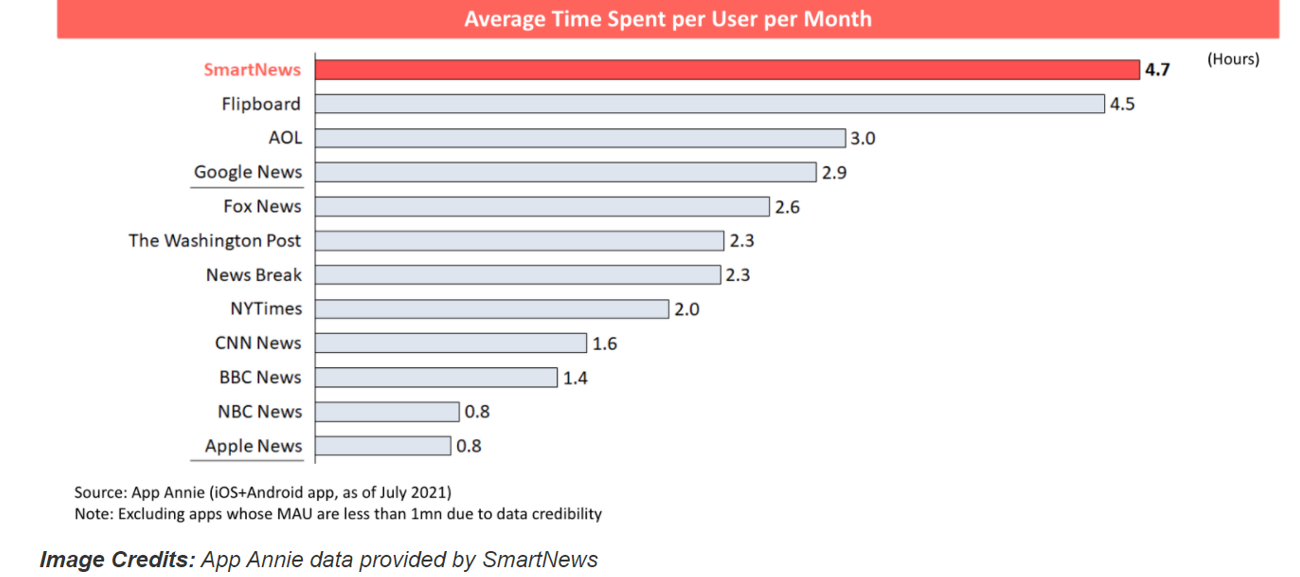

However, the below horizontal bar graph indicates that SmartNews’ users spent most hours (4.7 hours) per month.

(source: TechCrunch)

Conclusion: Victory goes to SmartNews on Assessment,

2) However, are Gunosy’s challenges are well understood by the markets, thus priced in?

(Source: TradingView)

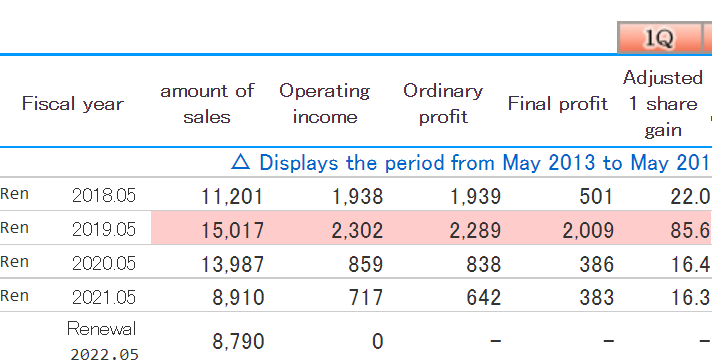

The company’s stock took double tops in 2018 and since 2019 it has been on a downward trend. This share price decline makes sense since Gunosy reached its historical high sales and operating income in 2019 and both have declined since then.

(Source: Kabutan.com)

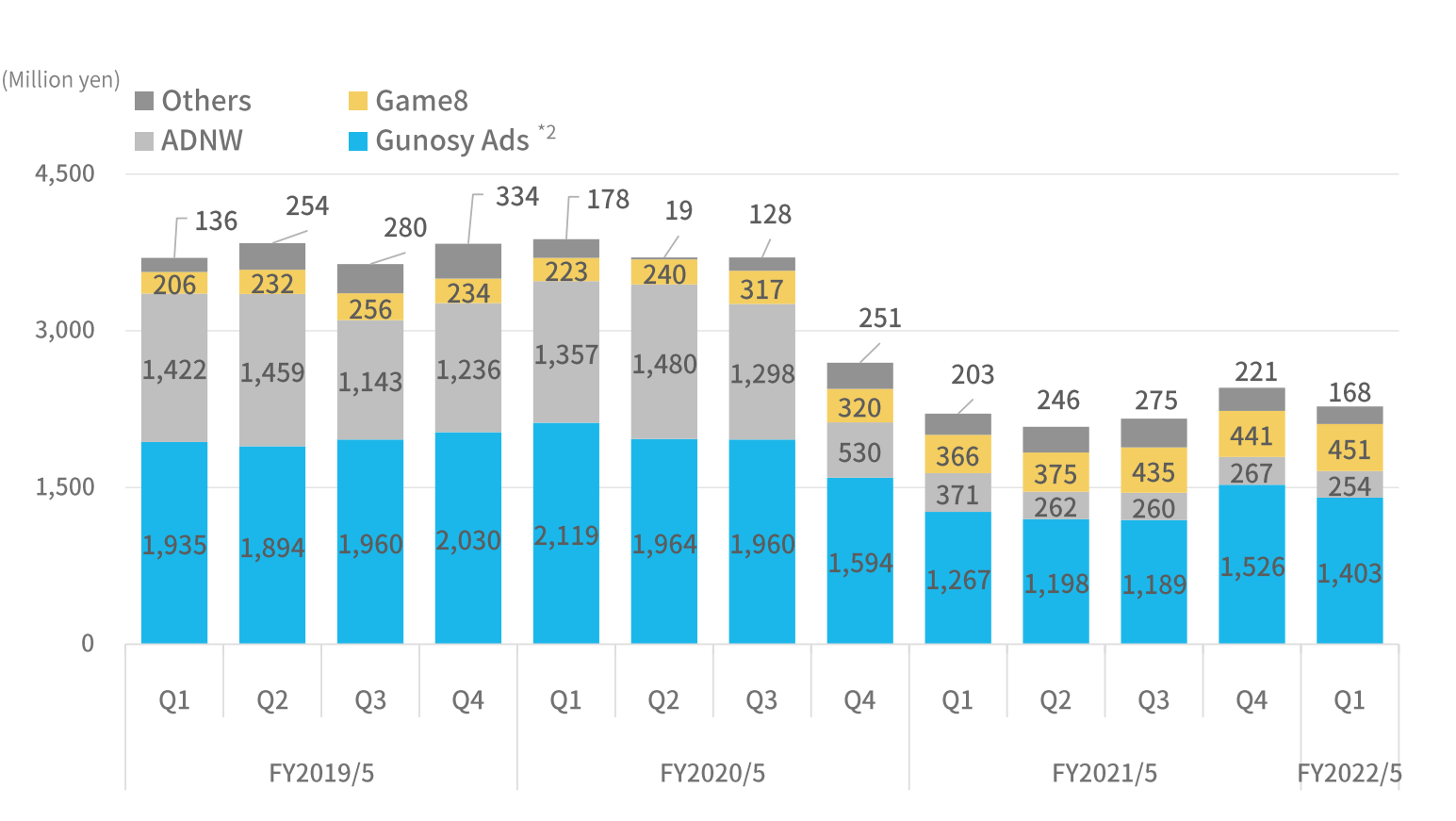

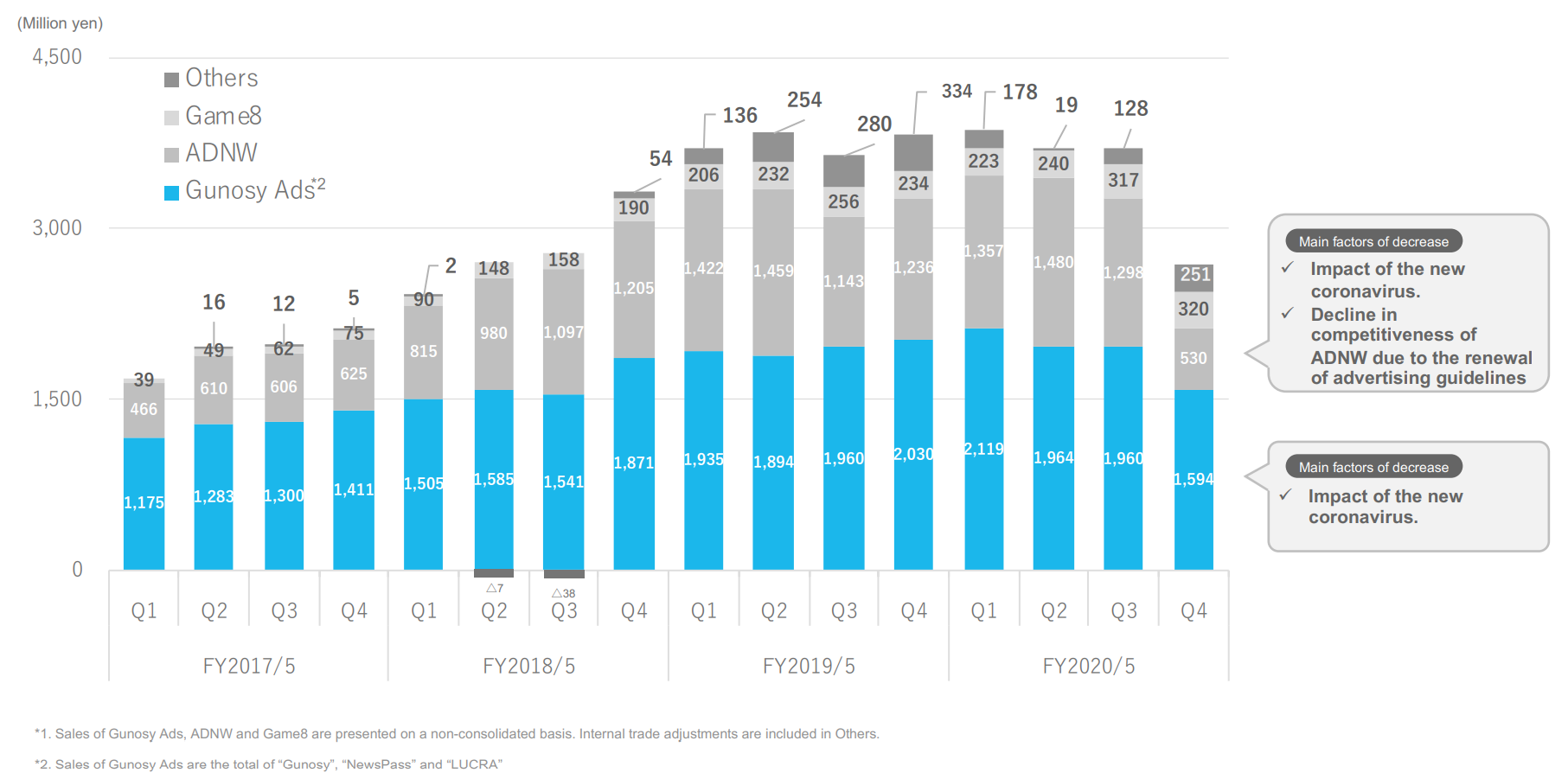

The below bar chart shows the quarterly sales trend for the last three years. You will notice a 40% drop in total sales from Q3 in FYE 5/20 to Q4 in FYE 5/20. The 2nd bar chart explained the reasons.

(Source: Q1 Financial Results Briefing for the Fiscal Year Ending May 2021)

(Source: Gunosy: Q1 Financial Results presentation for FYE 5/20)

The above bar chart shows Gnosy Ads (Gunosy, NewsPass and Lucra) in Blue suffered a decline due to Covid impacts. ADNW* (Add Network)’s sales in Light Grey declined 60% to reflect reduced competitiveness as a result of “renewal of advertising guidelines”. The company does not provide more details but it is likely as a result of Apple’s tighter user transparency control**

* Ad network, ad through 3rd party

An Ad Network is a company that aggregates available ad space across a large collection of publishers, marks up this inventory and sells to advertisers in many forms (website, video, SNS, etc). Some examples of large Ad Networks include Google AdSense.

**As widely reported, Apple has instituted new ad tracking prompt in iOS, which explicitly asks users if they want to block an app from sharing data with other companies. The European Union is considering a ban on microtargeted ads as part of a sweeping legislative proposal called the Digital Services Act.

Saving grace:

One important factor which is working in the company’s favor is that, while sales in ADNW has come down from 2019 to 2020, so did the costs in the segment. Total sales was down 36% and ADNW sales were down 60% from FY 2019 to FY 2020. However, expenses associated with ADNW was also down 60% which had led to companywide operating profit decline of 17%.

Nonetheless, to fend off ADNW sales decline, the company has pivoted to a new strategy, which is the topic of the following section.

3) New strategies to face challenges

I. a) Media businesses – Gunosy product

Investment refocused

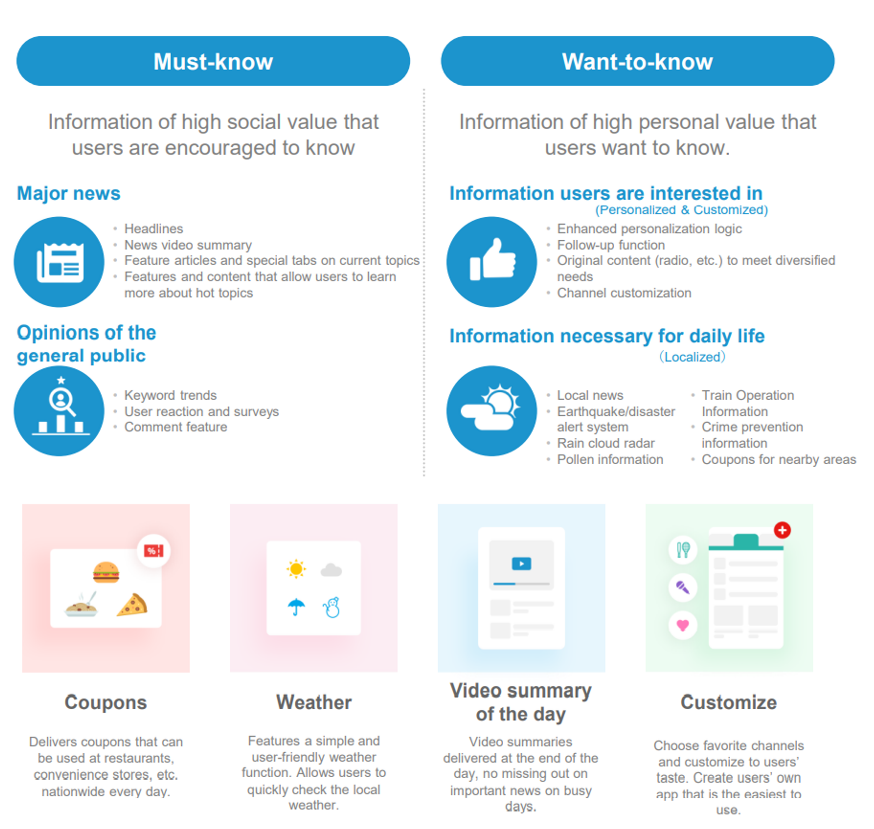

1) In order not only to survive but grow in an increasingly stringent data tracking environment, the company has refocused its investment efforts to create an application that separately delivers “must-know information” with high social value and “want-to know information” with high personal value at the lowest cost possible. Gunosy is continuously improving UX/UI apps. Examples of must-know and want to know news are shown below:

(Source: Gunosy’s mid-term growth plan released on 7/13/21)

2) For advertisers, Gunosy now aims to launch new products every year. So far, they have offered carousel ads*, video ads and dynamic ads. The company is improving ad revenues by maximizing ad effectiveness.

*Carousel Ads: an ad format which combines multiple videos and images. The company’s ad conversion rate in game apps improved 96%.

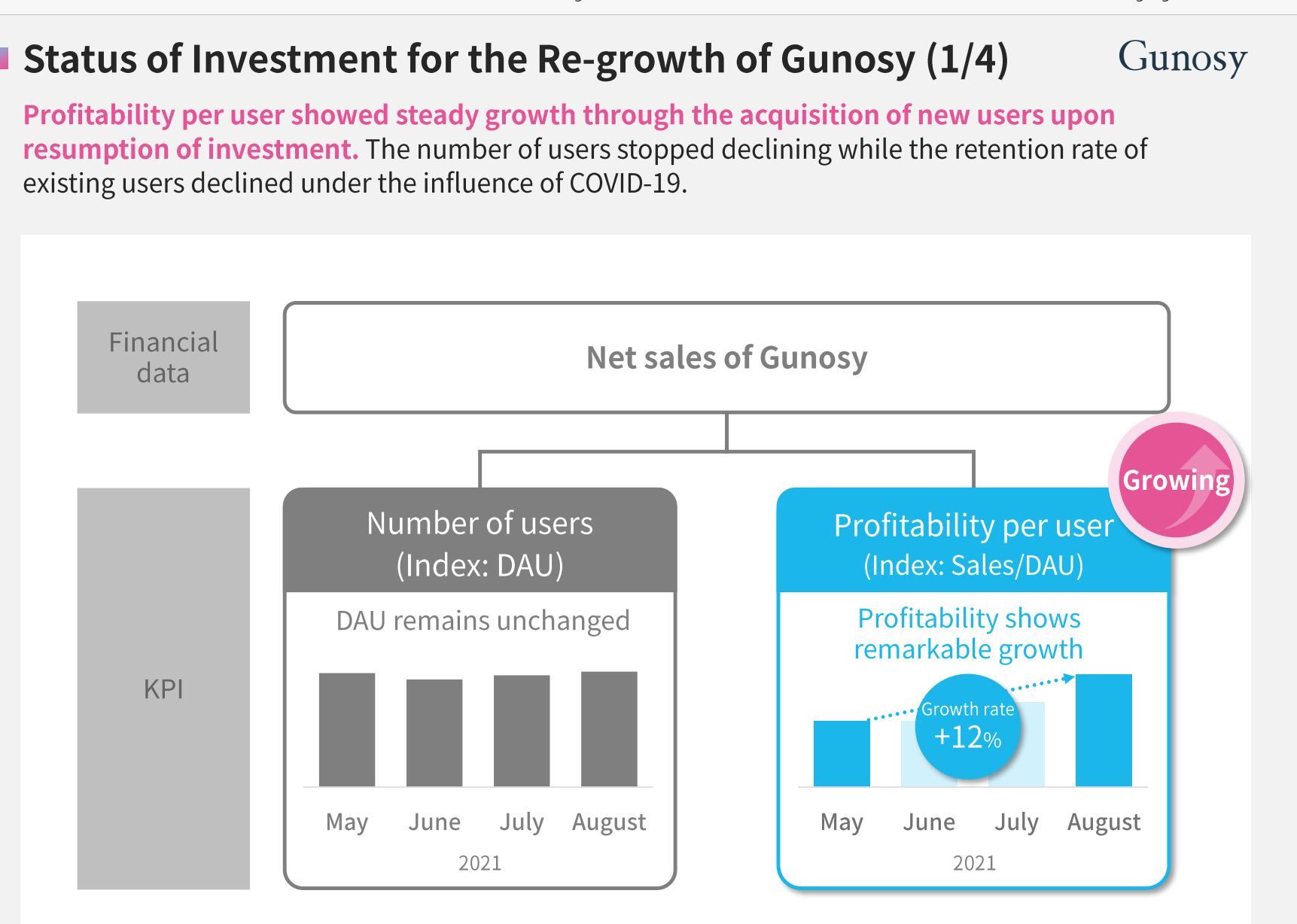

3) The benefits of these investments are gleaned by the fact that newly acquired users are more sticky and more profitable. As shown in the below chart, profitability of new users has grown 12% from 5/21 through 8/21 (exact dollar amounts improvement of profitability of the new users are not disclosed)

(Source: Q2 Financial Results Briefing for the Fiscal Year Ending May 2021)

% of new users with higher profitability also has increased 17% of total users as of 8/21.

The company is targeting the more profitable new users will account for 50% of total users by 5/22.

I b. Media business – Au

auServiceToday was launched in 4/21, to provide services geared toward KDDI’s au* users.

*au is a cell phone service brand operated by KDDI which is the 2nd largest cellular operator in Japan with 20% market share. NTT Docomo is the largest.

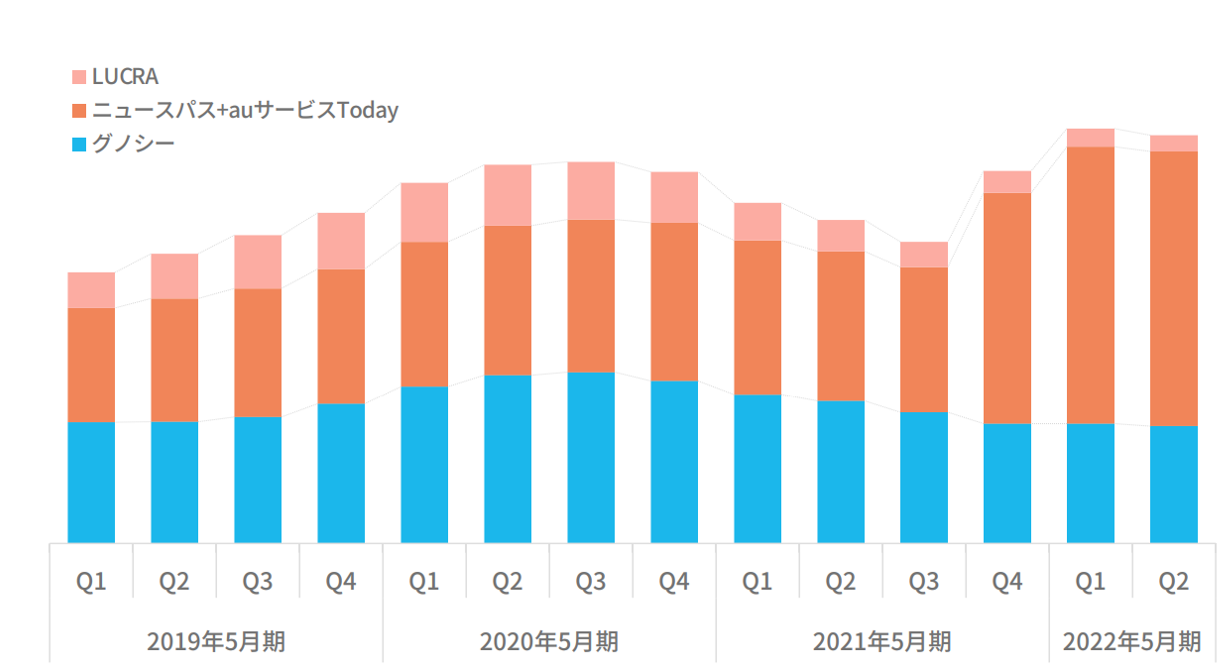

This new collaboration with KDDI has helped Gunosy maintaining MAU (monthly active users) level (see below).

(Source: Q2 Financial Results Briefing for the Fiscal Year Ending May 2021)

Pink bar: LUCRA, Orange bar: NewsPass + auServiceToday, Blue bar: Gunosy

Gunosy Tech Lab

Gunosy has established “Gunosy tech lab” which will collect and analyze consumer data (mainly from IPhone users) under Apple’s tighter privacy control policy. Machine learning will be used to customize news feed suitable for each user and implement an optimal O2O (online-to-office) strategy.

II. Game8

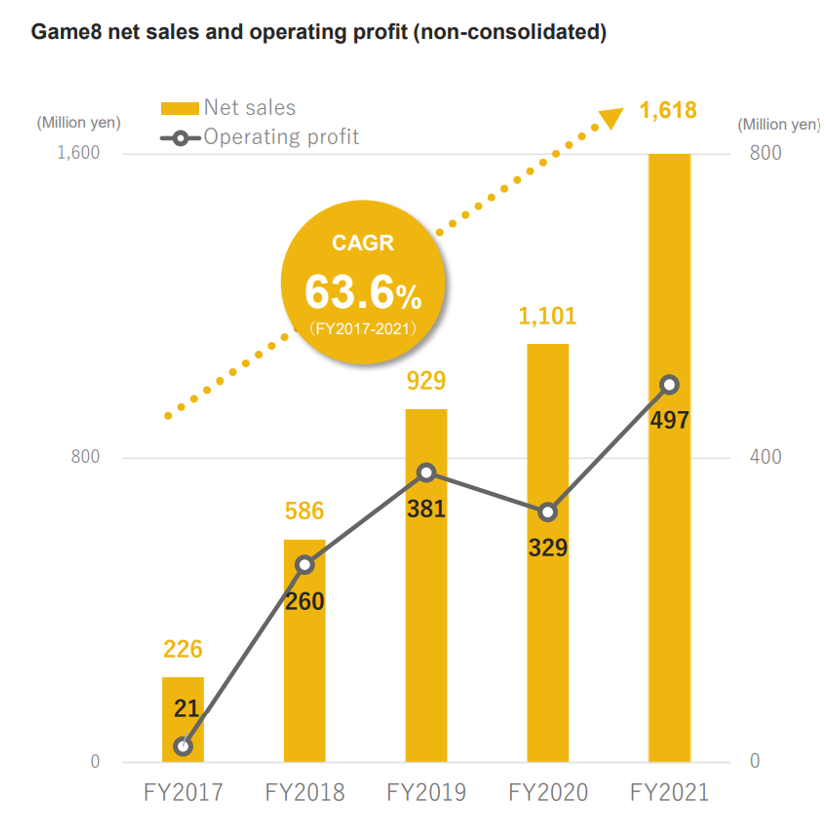

Game 8 was launched in 2014 and bought by Gunosy and has become its subsidiary in 12/2015. It has become one of the largest game walkthrough* media in Japan with over 42 million visitors per month in 2021. The growth focus now is English-speaking overseas market.

*Video game walkthrough is a guide aimed towards improving a player’s skill within a particular game and often designed to assist players in completing games. (Per Wikipedia)

(Source: Mid-term Management Plan as of 7/13/21)

RPM (ad revenue per thousand impressions) was down in FY 2020 the above bar chart, due to Covid impacts which had led to operating profit decline. Operating profits resumed its growth trajectory in FY 2021.

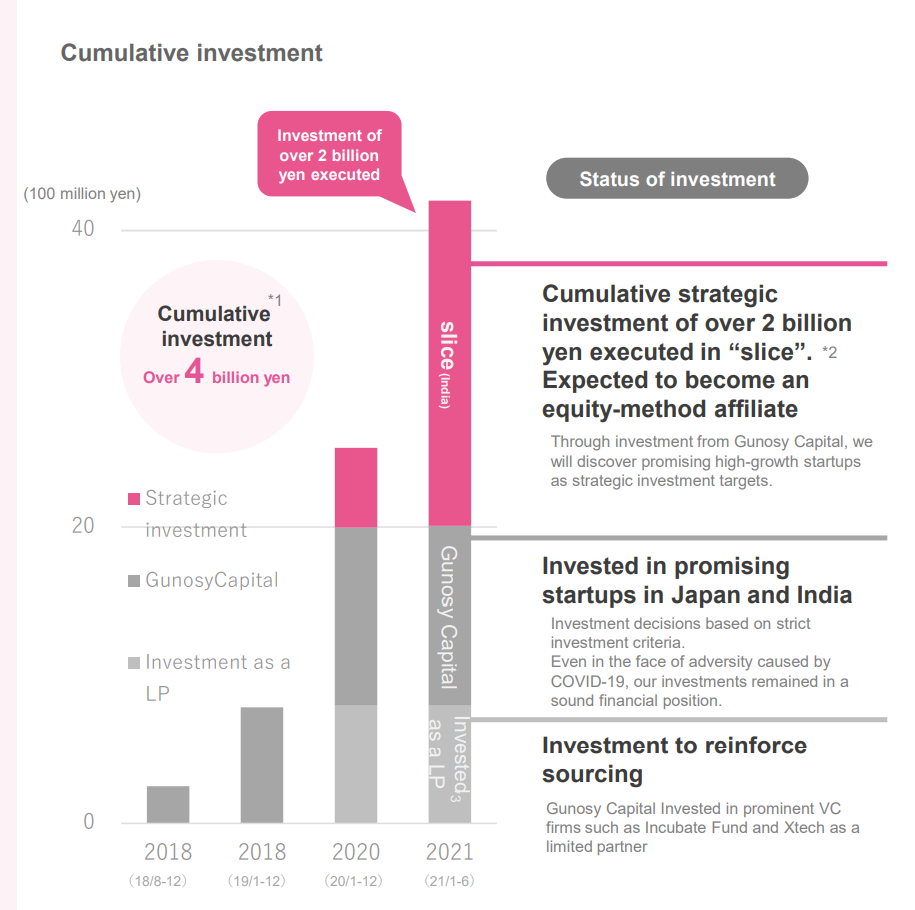

III. Gunosy Capital

Gunosy boasts a cash rich and debt free balance sheet. Gunosy Capital was founded in 2018 as 1) an effective vehicle to let cash to work for them and 2) a way to get involved in a next growth industry.

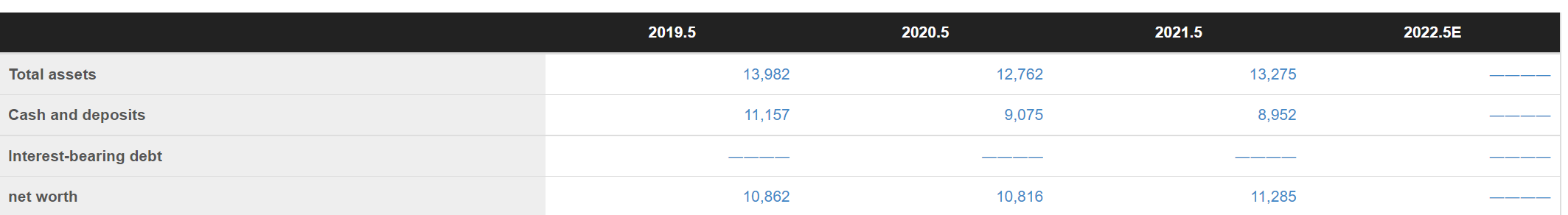

(source: buffet-code.com)

(Source: Mid-term Management Plan as of 7/13/21)

Since then, Gunosy has invested in several companies (in the amount of JPY 4 Bn/$37 MM).

One of these investments is Slice, a BNPL brand owned by GaragePreneurs Internet Pvt. Ltd. Slice raised $220 MM in Tiger Global and Insight Partners led Series B round with over $1 Bn valuation thus has become a unicorn in 11/21. Slice was just valued under $200 MM in 6/21.

About Slice:

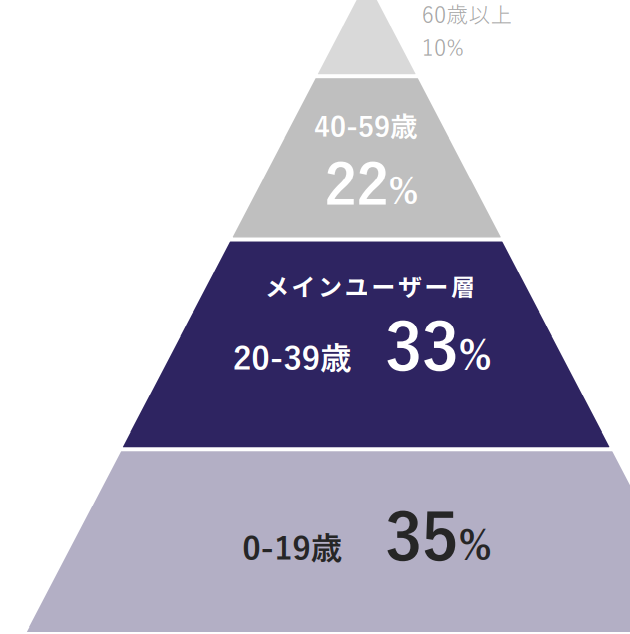

Slice is supported by the following favorable operating environment.

1) Slice operates in India which has become the breeding ground for unicorns with 30 born just in 2021.

2) Only 4.8% Indians, out of 1.8 Bn population, owns credit cards as a result of cumbersome approval process.

3) Slice is increasingly becoming popular among 20-39 year old age group whose credit scores tend to be low, thus facing difficulties in obtaining credit cards.

Note: The below population pyramid looks a complete opposite of Japan’s where + 60 years old account for almost 1/3 of the nation.

(Source: Q2 Financial Results Briefing for the Fiscal Year Ending May 2021)

4) Total lending volume (as denoted as AUM in the below chart) is growing rapidly. Slice is issuing 200,000 cards every month and its users now amount to 5 MM.

(Source: Q2 Financial Results Briefing for the Fiscal Year Ending May 2021)

5) Gunosy has announced additional investment of around $10 MM on 2/1/22. It now owns 15-20% of Slice/Garage whose profits and losses will be likely reported under the equity method. Slice may decide to invest heavily in infrastructure, thus, may incur net losses. But, on a long run, it can add non-operating income to Gunosy’s income statement.

The long and short of it

The both Gunocy and SmartNews are based on advertisement driven business model, i.e, both are exposed to Apple’s tighter personal data tracking.

Again, SmartNews’ financials are not available to me, thus, can’t gauge how much of the impacts, if any, it has sustained. But SmartNew’s US exposure is aiding in its growth whereas Gunosy with Japan focus might’ve have reached market saturation in Japan.

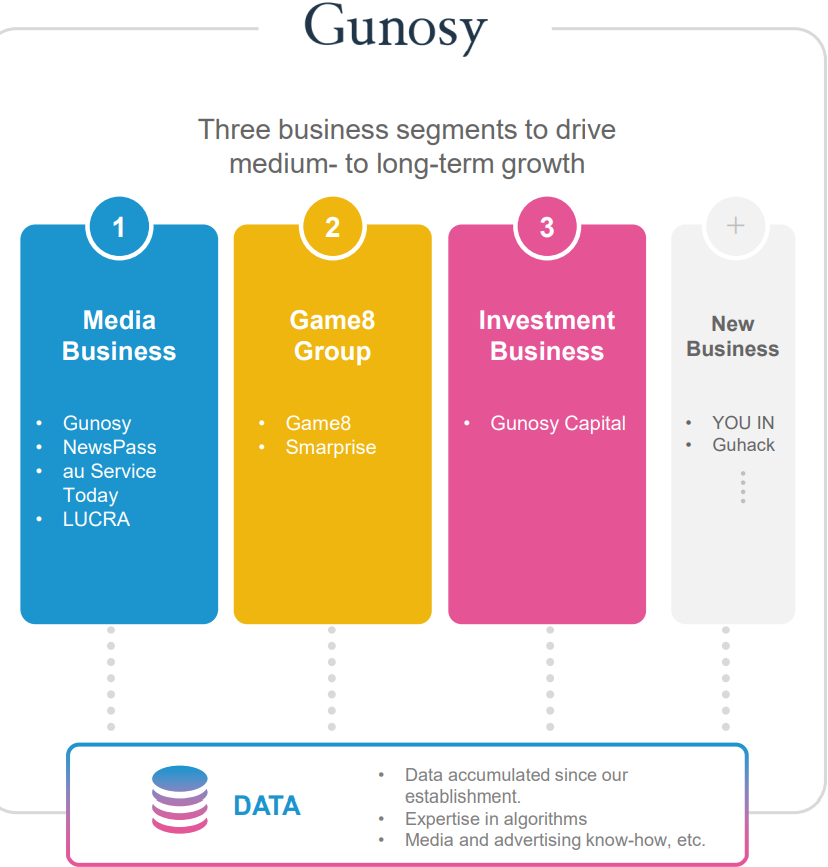

However, Gunosy has built a company with three distinct pillars, which should carry the company forward, albeit, at a different rate. Business model section visually highlights these 3 pillars.

The near term growth potential resides in Slice for which Gunosy’s stocks should get a boost.

Note: CAGR above is a minus number since Gunosy is in the process of a redirection as discussed above.

2. Technically Speaking

(Source: Buffet-code.com)

The above chart shows that the stock is currently trading at lower end of JPY 650-850 range which is the largest volume cluster. The next resistance level is around JPY 832.

3. Business Model

(Source: Mid-term Management Plan as of 7/13/21)

News Pass delivers news and information automatically selected using newly developed information analysis and distribution technology to users.

Lucra is trend information app for women. Like Gunosy, it collects data based on its unique algorithm.

4. Financial Highlights

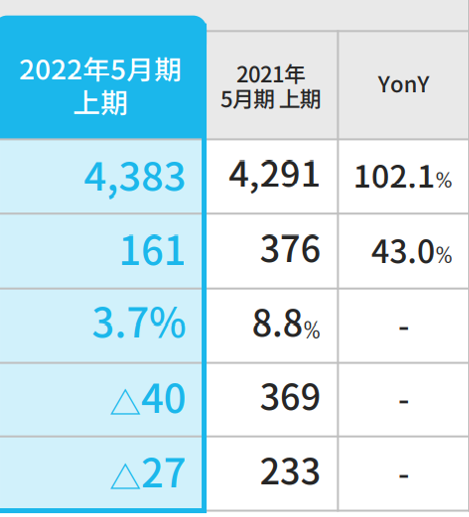

The first 6 months results for FYE 5/22 vs. FYE 5/21.

Sales was slightly up (2%), thanks to auService today’s growth offsetting revised contract terms with some gaming partners in Game8. Operating profits declined since higher advertising expenses which the company view necessary.

(unit: JPY MM)

(Source: Q2 Financial Results Briefing for the Fiscal Year Ending May 2021)

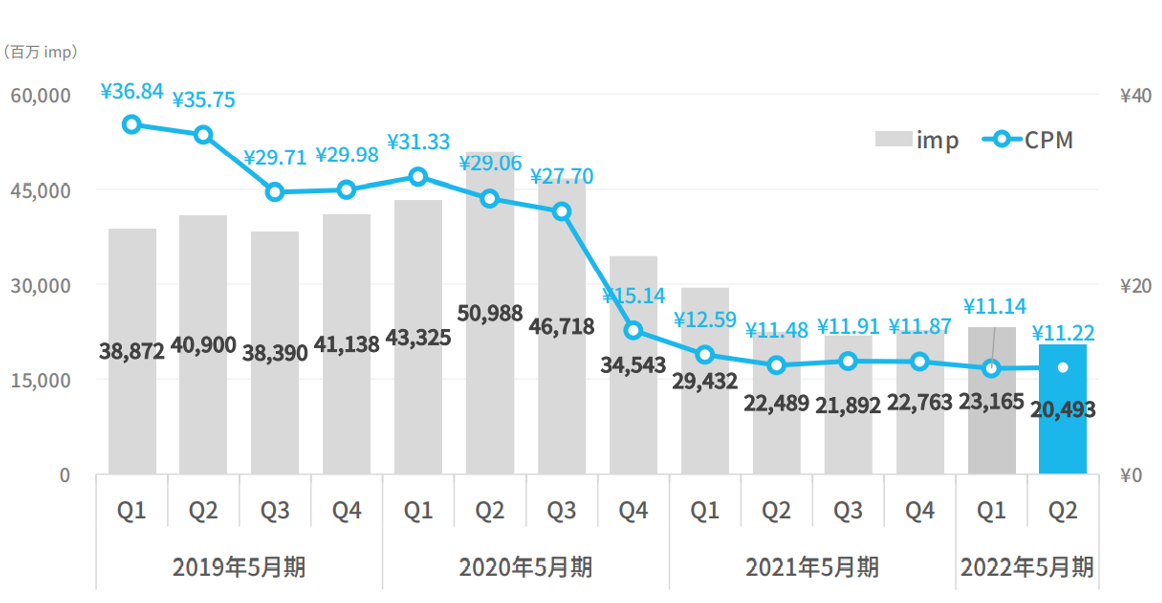

Ad Network Update. The recovery of this group is critical.

The below charts exhibit trends for imp (grey bar) and CPM (blue line chart)

(Source: Q2 Financial Results Briefing for the Fiscal Year Ending May 2021)

CPM: Costs per thousand impressions: a marketing term used to denote the price of 1000 advertisement impressions on one web page. If a website publisher charges $2 CPM, this means an advertiser mut pay $2 for every 1,000 impressions.

The company’s efforts to increase % of profitable new users are slowly bearing fruits as CPM has trended $11-12 for the last 6 quarters.

5. Strengths and Weaknesses

Strengths

1. New growth initiatives taking hold

Gunosy management is not sitting sill but has instituted many growth initiatives in Media business (such as Gunosy Tech Lab). In addition, its Strong balance sheet allows it investment in new growth areas. Slice is a prime example.

2. Steady growth of the industry

As discussed earlier, ICT Research Institute Co., Ltd estimates that the slow but steady growth of Japanese Mobile News App Market will continue and the active users will reach 60.36MM in 2022 and 61.83MM in 2023 (2019-2023 CAGR: 3%).

Weakness

1. The core market is maturing

Gunosy mainly operates in a steady but slow growing Japanese mobile app market. For midterm management plan, the company predicted that both sales and gross profits of existing businesses (news media and game8) would grow 10% year on year. This may be viewed as LOW vs. SmartNews’ growth (although SmartNew’s numbers are not disclosed). However, during the earning call for Q2/FYE 5/22, management commented that these numbers were intentionally conservative.

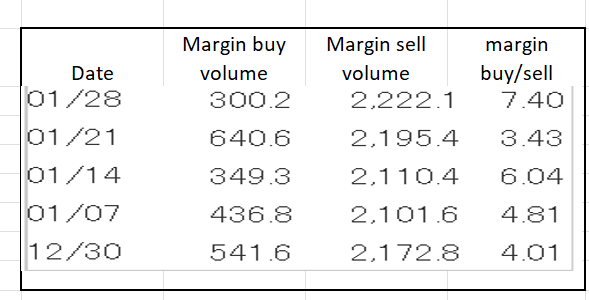

5. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Gunosy, margin buy/sell ratio is high at 7.4x, thus, upside resistance is strong. A large trading volume can address this, but upward move will be likely gradual.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance