Founded in Aichi Prefecture (where Toyota head office is located) in 2002, the sales outlets of GOODSPEED (“GS” or the “company”) are dedicated to sales of used SUVs (Sports Utility Vehicles), Minivans, and imported cars. This SUV specialization drives (!) the investment thesis for GS.

Used car industry in Japan presents an interesting investment opportunity.

Why?

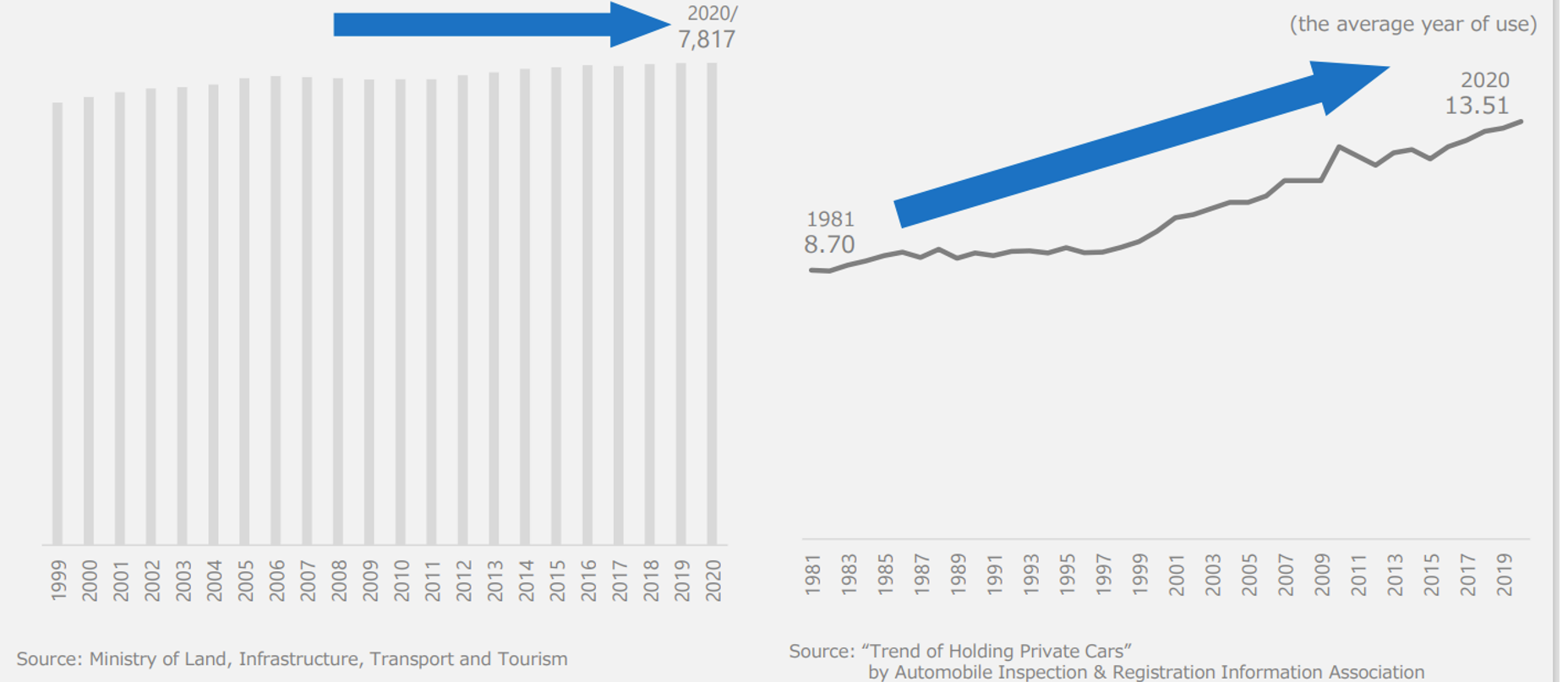

1. Automotive industry have long been a key player in Japan’s economic growth. However, the car ownership in Japan decreased 2007 – 2009 but has turned up slightly since then (left bar chart). Nonetheless, the car ownership in Japan is not expected to grow much due to 1) population (drivers) decline and 2)millennials are shunning cars. Also drivers are keeping their car longer: the average car age was 8.7 vs. 13.51 in 2020 (right chart).

(unit: 1000 cars)

(Source: Financial Result briefing for 1Q FYE 9/22)

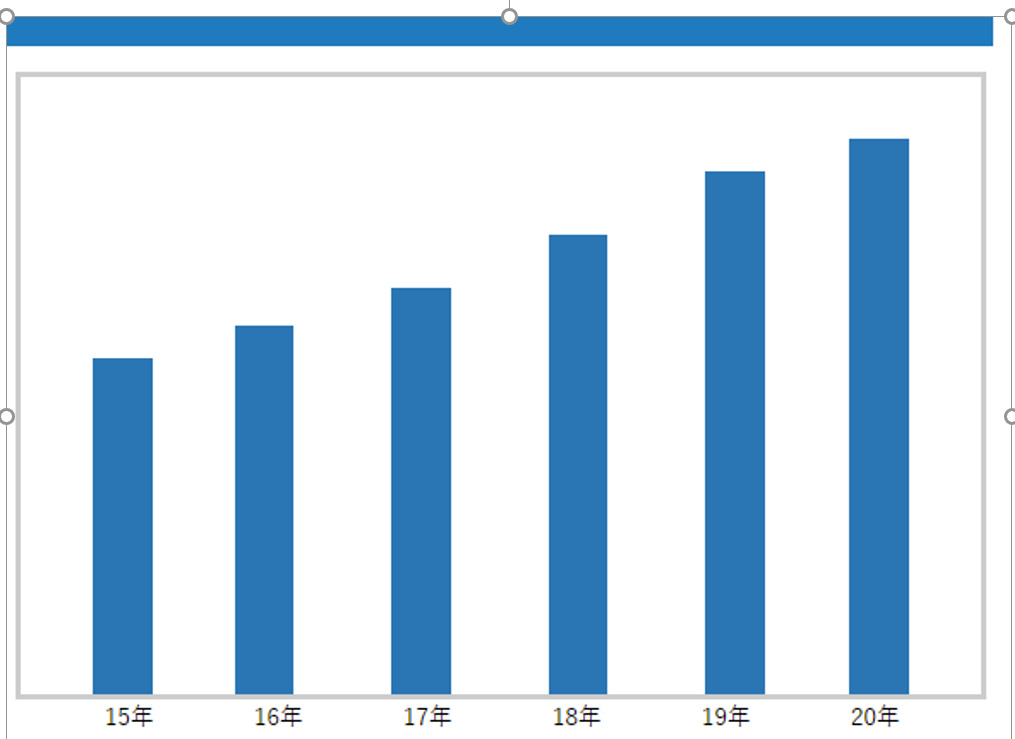

Against this auto industry backdrop, used car sales has still shown a mild growth, as illustrated in the below graph:

Used car industry wide sales trend for 2015 through 2020.

(Source: Gyoukai Doukou Search.com, Used car industry report 11/21).

The used car sales growth is likely due to a small to no wage growth in the last 30 years, since used cars are cheaper than brand new cars. In 2020, added reason was consumers’ desire to commute or travel in a private car rather than risking a Covid exposure in public transportation.

New car production constraints caused by parts and semiconductor shortage in the Covid environment in the second half of 2021 also increased demand for used cars as alternative to new cars.

Still on a long run, used car sales should gradually decrease to reflect 1) population decrease and 2) environmental concerns.

This will lead to consolidation by industry leaders. History shows that consolidation have many benefits: higher sales, greater pricing power, more profits, enhanced branding, and the growth of the value of the underlying assets.

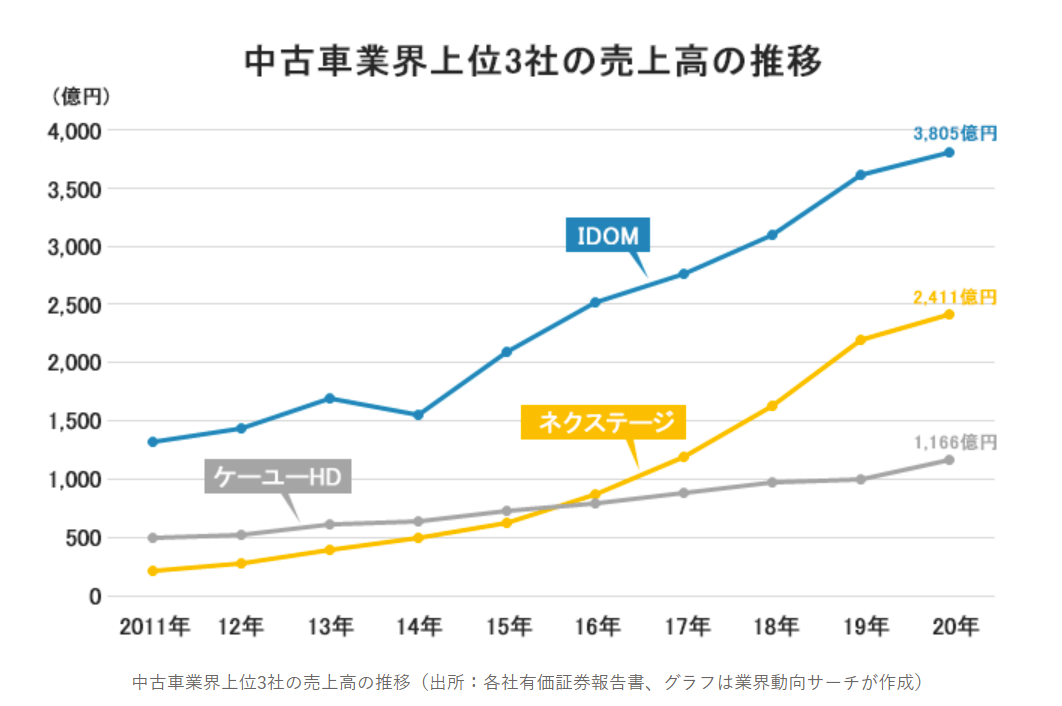

The below graph shows the rising sales trends of the top 3 players in the used car industry since 2011 through 2020. Blue line is IDOM, Orange: Nextage and Gray: KU-Holdings. We can see the sales growth of the IDOM and Nextage have accelerated over the last 5 years, likely taking shares of small and less efficient peers.

(Source: Gyoukai Research)

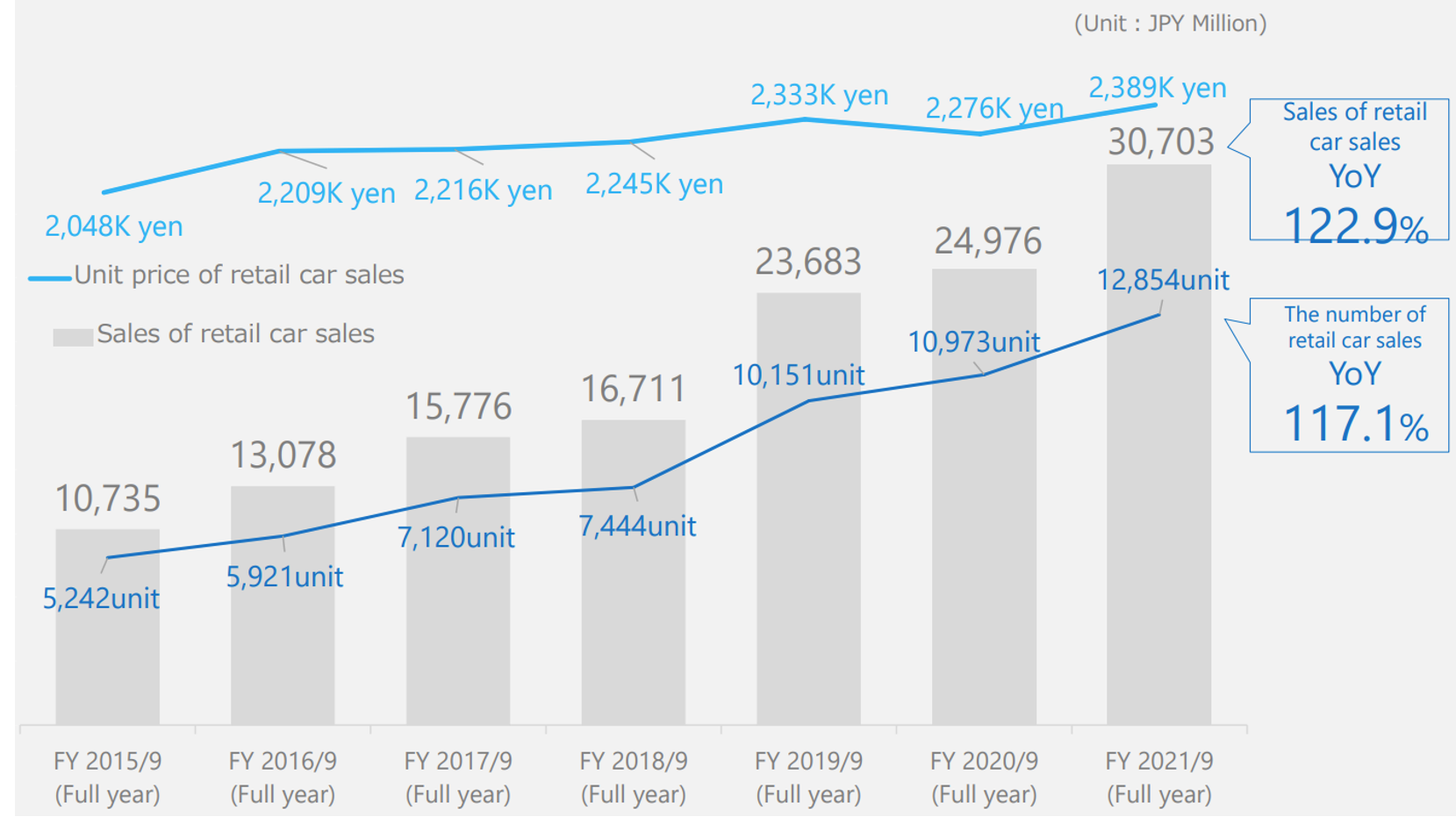

GS has experienced the similar growth trajectory:

(Source: Financial results briefing for FYE 9/21)

However, even No 1 player IDOM has still only 5% of the industry wide sales, as the Japanese used car market is mainly comprised of small mom & pop shops and is very fragmented. These small companies often lack of economy of scale, thus, inefficient. They often grapple with lack of succession plan, as the current owners age and their children are rarely interested in succeeding the business.

GS can acquire these companies and their customers as their expand market presence. GS can be an acquisition target as well (although management appears not be interested in putting the company for sale).

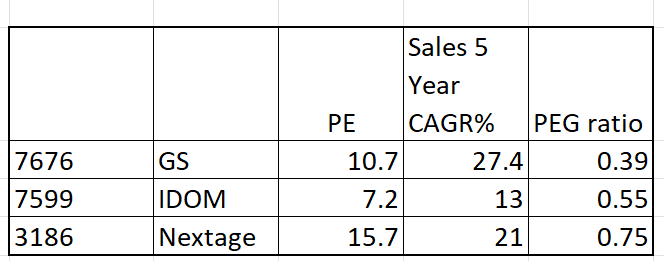

Valuation gap between GOODSPEED and two leaders is highlighted below:

1. Investment thesis

1. Multiple investment merits:

As illustrated above, GS can grow through : 1) organic growth through geographical expansion or product mix increase or 2) being acquired.

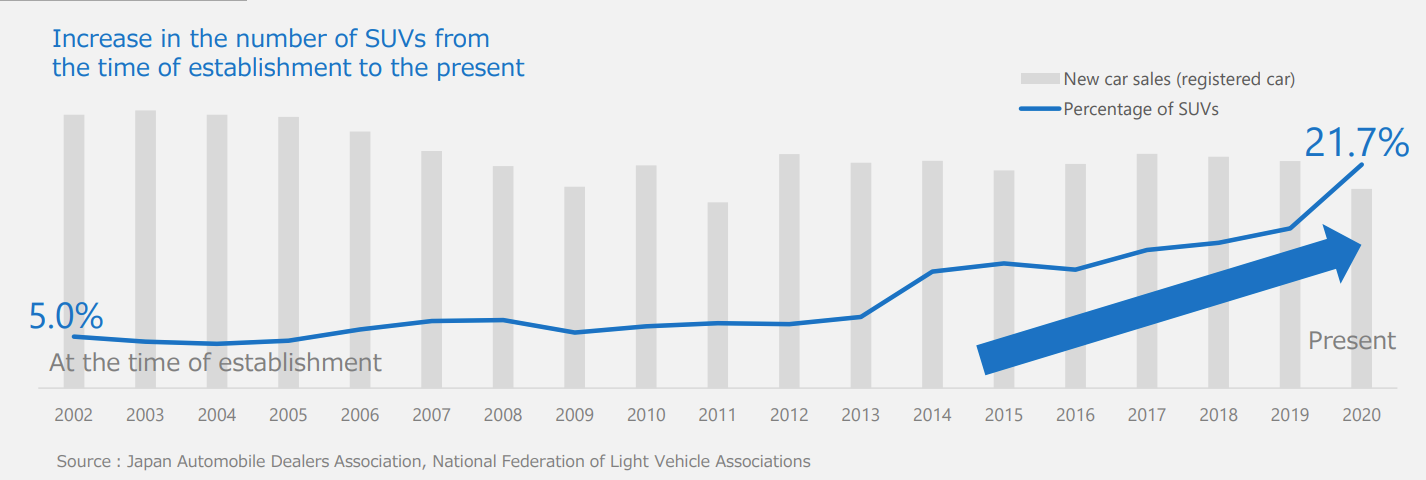

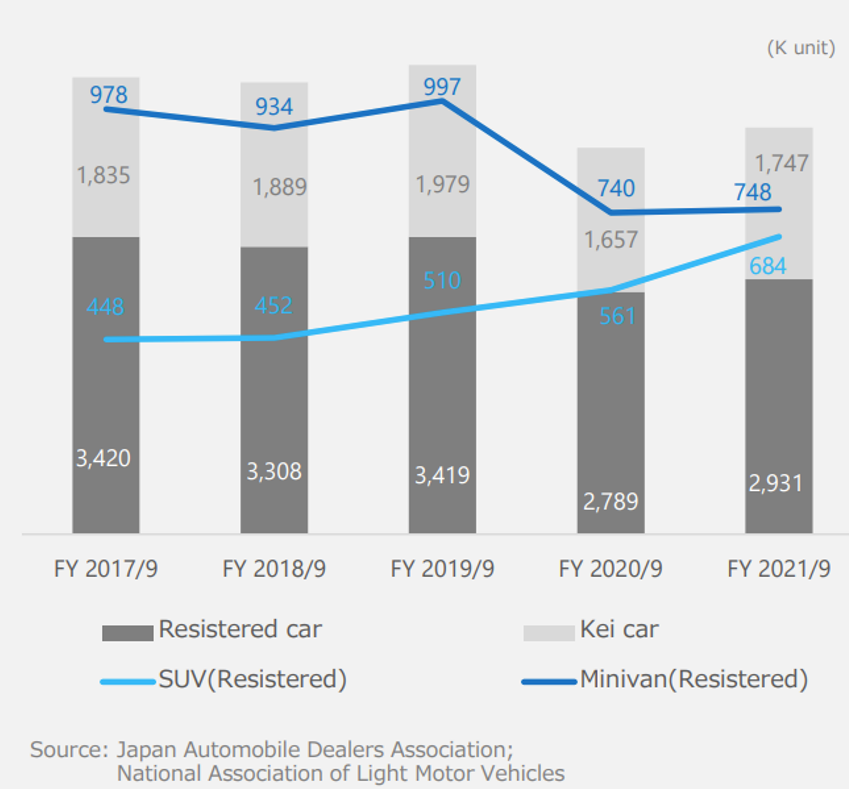

GS’ strength and focus on SUV market should support its growth and make it as an attractive target, since SUV is growing its popularity to 22% in 2020 from 5% of the entire new car sales in 2002 when the company was founded.

(Source: Financial results briefing for FYE 9/21)

(Source: Financial results briefing for FYE 9/21)

Note: Kei Car (or Keijidoushya) is light automobile/microcar and is the Japanese vehicle category for the smallest highway-legal passenger cars with restricted dimensions and engine capacity.

The kei-car category was created by the Japanese government in 1949 with the regulations which specify a maximum vehicle size, engine capacity, and power output. The owners may enjoy both tax and insurance benefits.

2. The company’s narrow specialization:

Their specialization on SUVs, Minivan and imported cars allow the sales agents to accumulate product knowledge and provide buyers with a customized advise. It also makes it easy for them to build sufficient inventory in makes and models of SUVs and Minivans.

3. Sales growth initiatives abound:

The company has numerous auxiliary services which carry much higher gross margin of 53% vs. 13% of car sales related businesses. These services include car inspection and maintenance operations, gas station, car rental, insurance agency. This ability to provide whole slew of services under one roof is a key differentiator compared to smaller peers. See Business Model section for detailed discussions.

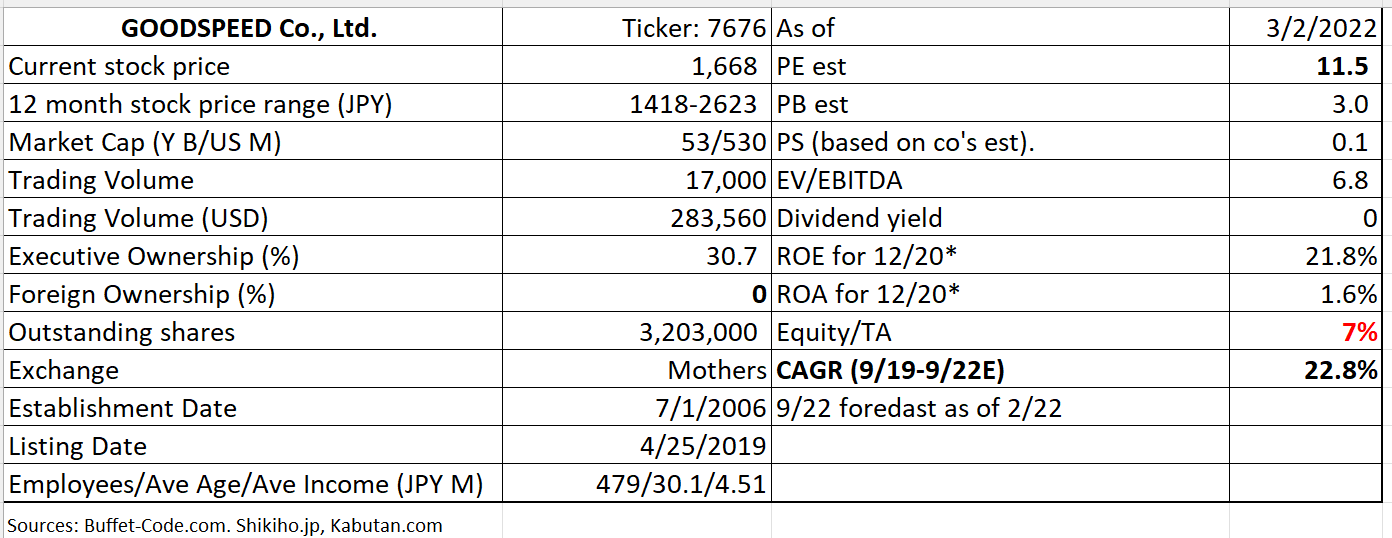

Note 1: Capital adequacy is low since the company is driving growth through retail front expansion.

Note 2: According to Shikiho, there is no foreign owners at this point. Once, the foreign institutional investors discover GOODSPEED, the stock can appreciate meaningfully.

2. Technically Speaking

(Source: buffet-code.com)

The above chart shows that the stock has taken over JPY 1,700 which was the top of lower price box. The next resistance level is around JPY 1,900 a 11% away.

3. Business Model

1. The biggest sales driver: retail car sales

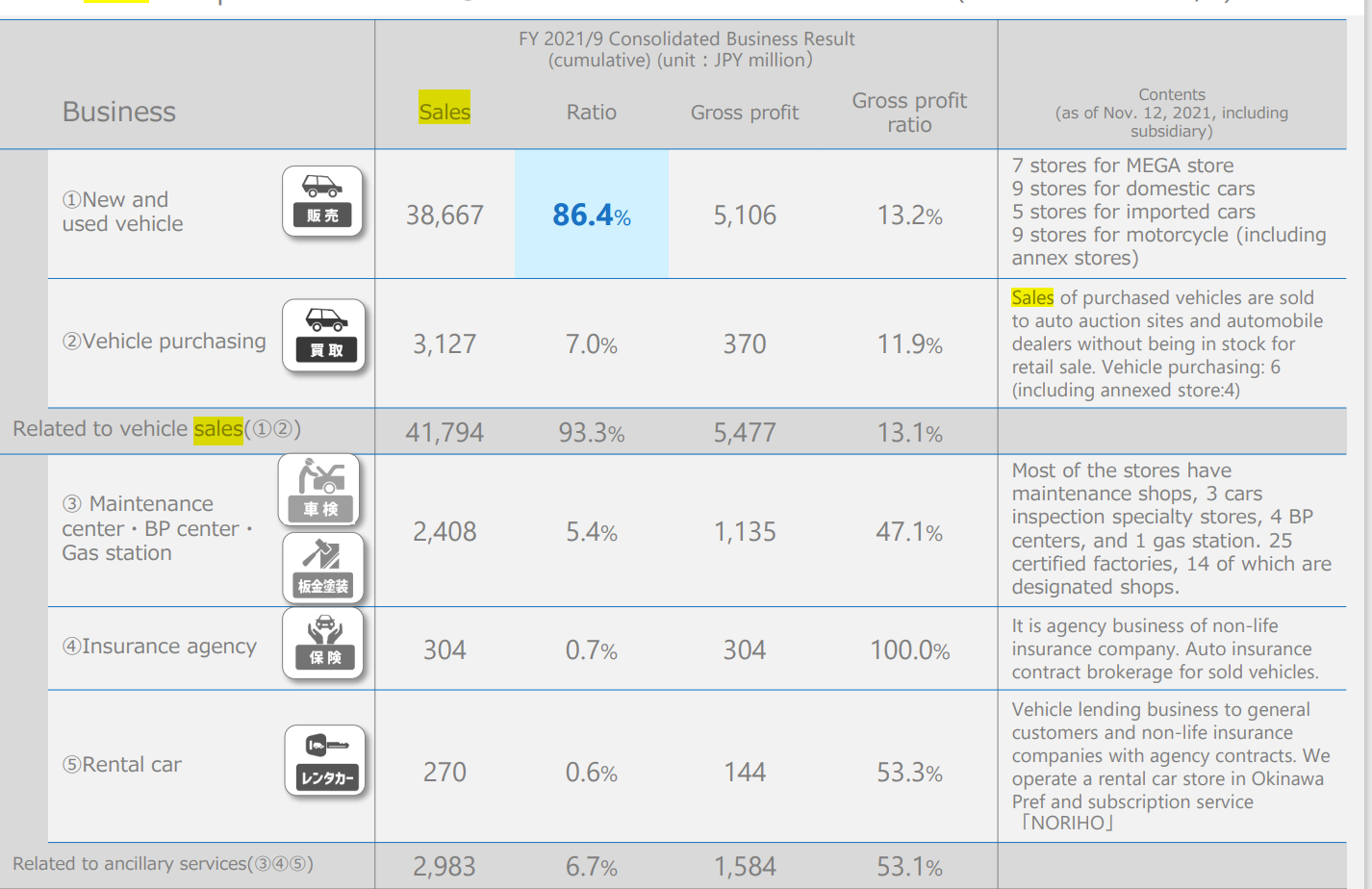

Vehicle sales to both retail buyers and professionals on auction account for 93% of total sales. Store sales have higher gross margin vs. auction sales.

- The company continues to expand its retail footprints by opening 3-4 MEGA stores a year. For this year, management has already procured the desirable sites. Current regional focus is in central (Tokai) Japan, around Aichi Prefecture. Product focus is newer used cars with 5 years or younger cars with a mileage of less than 50,000 km (31,000 miles). 80% of inventory is bought through auctions, but the company is increasing in house purchase capacity through its buying only stores with on site evaluation team.

- Financing plan: Warrant issued to support this growth via Daiwa securities. The conversions to common shares started in 12/21.

(Source: Financial results briefing for FYE 9/21)

2. Auxiliary services expansion:

These services include vehicle inspection and maintenance services as well as insurance agency operations and car rental. The ownership years are getting longer, thus, it is critical for GS to provide after-sales services such as maintenance, regular check up (Japanese cars are required to go through extensive 2 year inspection.

3. Financial Highlights

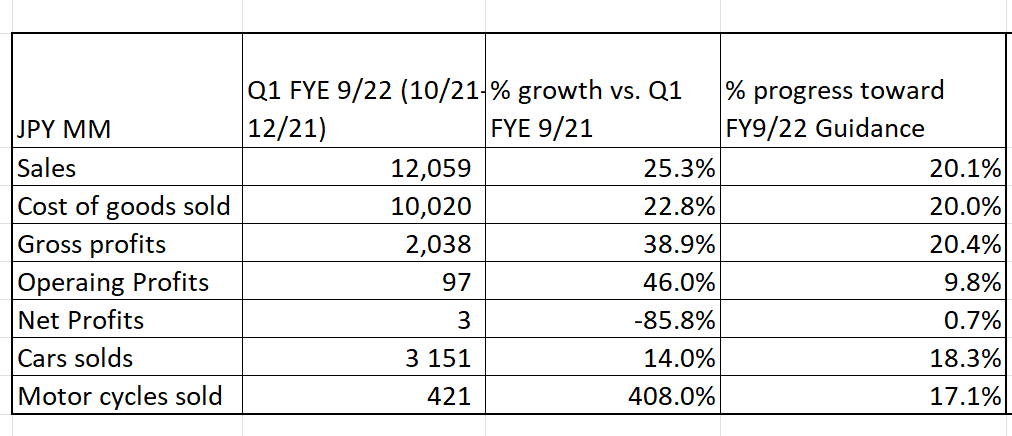

Results for Q1 for FYE 9/22 (10-12/21)

Operating profits were up 46% but due to high interest burden from higher borrowing to support store expansion, net profits were down 86%.

Both sales and profits reached 20% of annual guidance, shy of 25% typically required for one quarter. Management emphasized this is not a cause for a concern, since

1) Q1 (Oct – Dec) is a seasonably lowest quarter. For them, the active sales seasons are Q2 (Jan – March) and Q4 July-Sep, Summer sales + SUV and Minivan high sales season

2) Some sales miss can be explained by low inventory as a result of brisk sales in the previous quarter which cleared the inventory quicker. Inventory needs to be high since 80% of the customers is directed through 3rd party used car sites. When inventory is high, probability of customers clicking on GS’s cars.

3) Also negative impacts on sales came from sales decrease of repair insurance operations: “GS warranty” .

The framework of insurance operations is described below:

A buyer buys a warranty policy along with a car. The payments go to the insurance company which insures the car. No income is recognized by GS. The buyer brings his/her car to the Good Speed’s repair bay when the problems occur after the purchase. GS contacts the insurance company to see if the repairs are within services covered by the policy. If the answer is YES, GS gets paid for the repair from the insurance company, not from the customer.

Previously, the insurance company applies its policy rule rather loosely but in FY 9/21, the insurance company reviewed its policy and the acceptance rate went down i.e., insurance income decreased. Further aggravating a situation was the repair mechanic shortage which forced GS to send away repair customers.

3) Operating profits reached only 10% of annual guidance since the company increased accelerated hiring to address the above mechanic’s shortage and purchase agents. The company plans to increase purchase agents who will be placed to the stores which are dedicated to buy used cars from the owners, rather than at auctions. GS plans to increase labor force in all the areas to to staff the new stores.

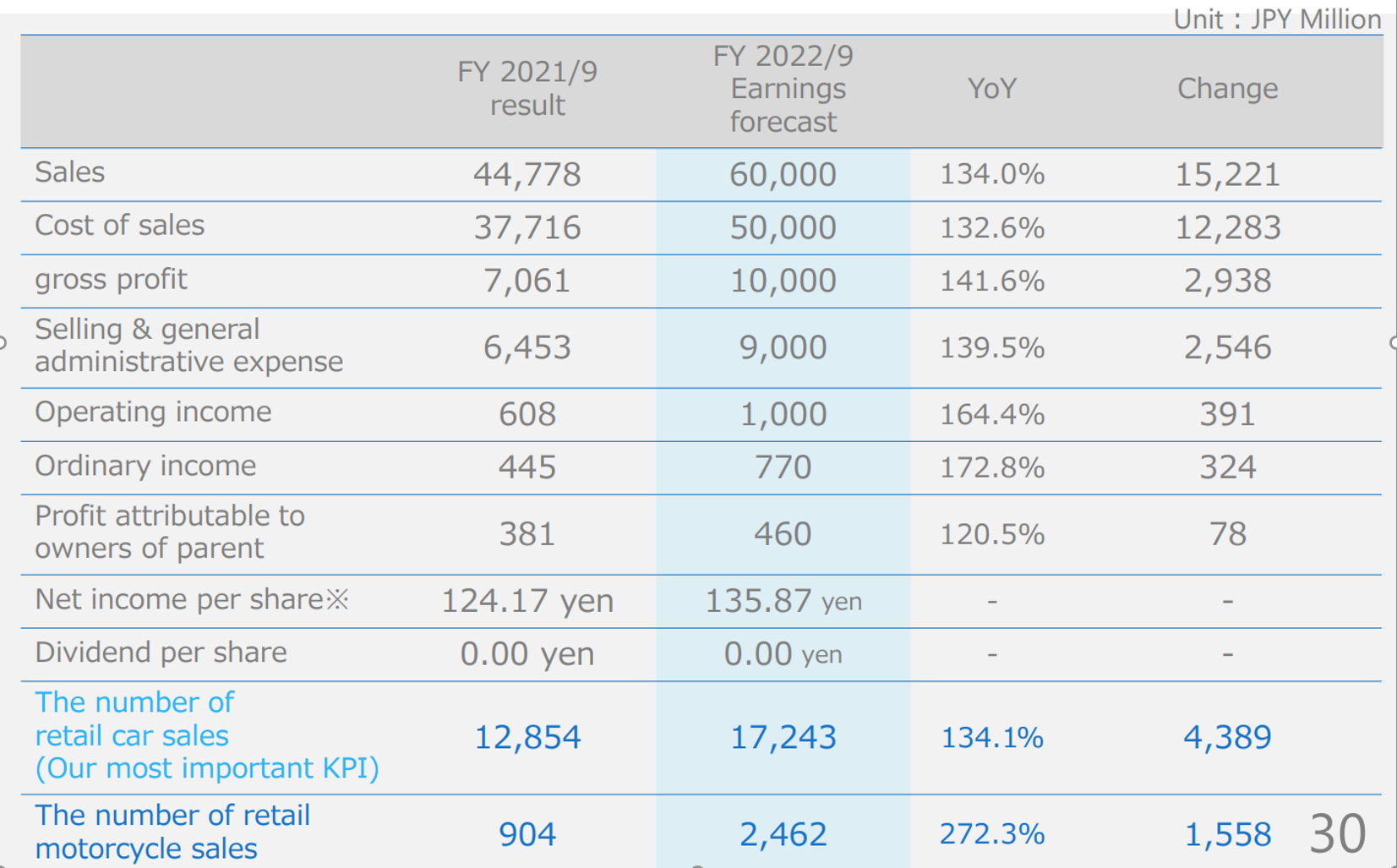

Guidance for Fiscal Year Ending 9/22

The company continues to expand its foot print to improve scale and retail sales by opening MEGA stores. Strengthening auxiliary service offering is also a focus to improve margins and customer loyalty.

(Source: Q1 Financial Results Briefing for the Fiscal Year Ending 9/2022)

4.Total Addressable Markets (TAM)

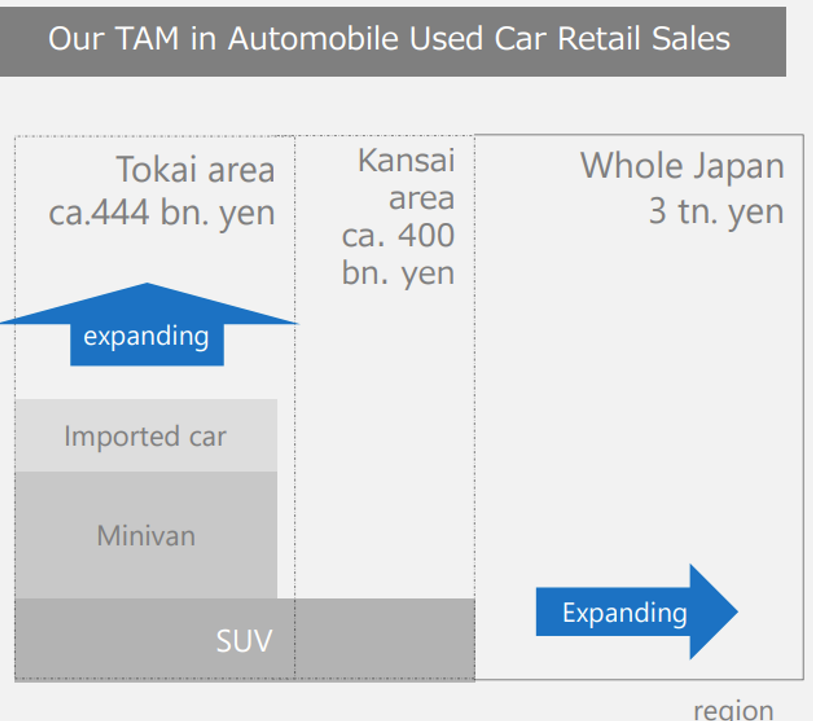

The company considers the Japanese used car retail market as their TAM. As shown in the below graph, GS plans to expand by 1) first moves its footprint to Tokai area (central Japan), 2) then opens stores in Kansai Area (estimated market size: JPY 400 Bn/$4 Bn) and 3) finally to the nationwide (market size: JPY 3 /$30Bn). Kobe store (Kansai region) was opened in 2021. The company bases market size estimates on Yano Research Institute’s “Used Car Distribution Overview 2020 Edition and Automobile Inspection & Registration information Association’s “List of car ownership by prefecture”.

In terms of the number of used car sold, 2,620,000 used cars changed hands in 2020 whereas GS sold 10,973 for FYE 920. Thus, market share is less than 0.5%. 27,000 used car retailers, the majority of which are small, exist in Japan. All told, huge growth potential awaits GS.

5. Strengths and Weaknesses

Strengths

1. Sweet spot

The company has built a reputation as “the go to place for used SUVs” which are the highest growing used car segment.

2. Growth strategy-Logical

GS as a retail company needs to grow through strategic openings of new store fronts. In the fragmented used car space in Japan, the company can absorb small players which are not equipped to offer needed services to help the customers over each stage of the car ownership.

Weakness

1Q 9/22 progress disappointing –

1Q sales was 20% of the full year guidance. But this was mainly due to 1) seasonality, 2) low inventory and 3) GS Warrant policy change

6. Near-term Selling Pressure

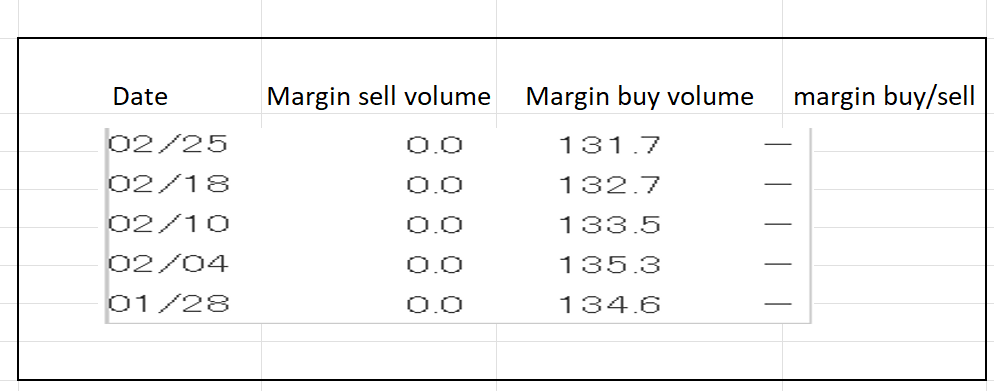

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For GS, there is no margin sellers and margin buy volume is gradually decreasing as of 2/25/22. The current margin buy outstanding volume is 10 day worth of trading volume. Thus, the stock’s upside move will be very gradual.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance