GEO Holdings Inc. (“GEO” or the “company”) started its first rental video shop in Toyota City, Nogoya, in 1986. Since then, it has expanded its store network through M&As, and operates mainly direct-run shops nationwide. It ranked 2nd in a rental video market after Tsutaya which operates franchisee networks.

Due to a gradually decreasing media rental demand, the Company has changed its focus on its refuse shops “2nd STREET”*. Other growth drivers are foray into 1) new product segments such as smart phones and luxury brands and 2) overseas markets (mainly US/the West Coast and Southeast Asia. The company had 1,107 GEO stores as of 6/30/22 of which 88% was directly owned. The group stores, including other concepts, amount to 1,963.

*GEO acquired “For You Co., Ltd.” and renamed it to “2nd STREET Co., Ltd.”.

1. Investment thesis

1). Transformation underway:

The rental video market – GEO’s original market is on a secular decline, in age of Netflix and other streaming services. Thus, the company is reinventing its business model from a video rental company to a reuse focused network retailer. The company defines a “network retailer” as a distributor of goods which touches all aspects of consumers’ daily lives.

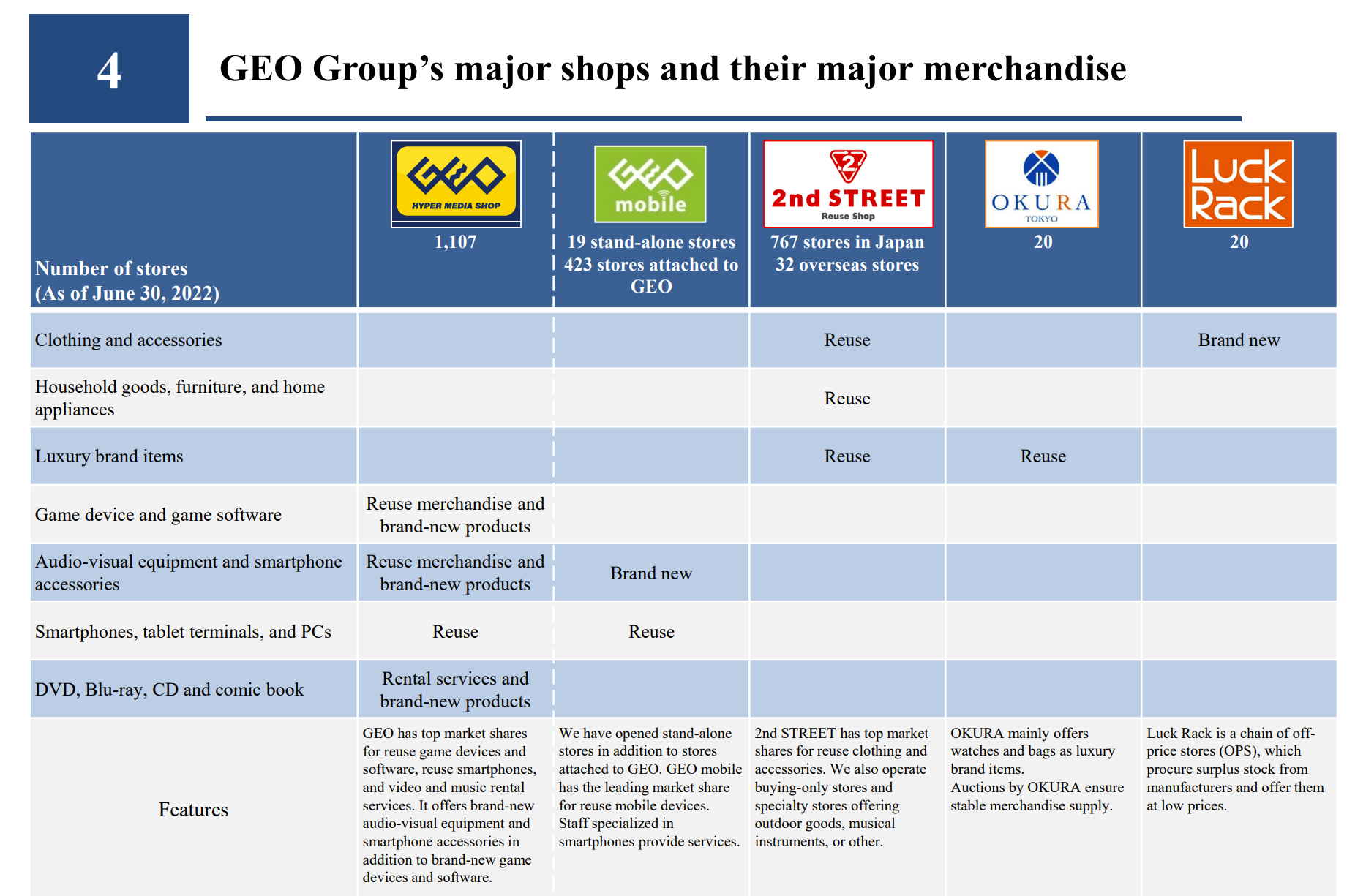

The company builds the group of stores and the most prevalent word in the below table is “REUSE”.

(Source: Briefing on the Financial Results for the 1st quarter of FYE 3/31/23)

The competitive advantages of each concept are:

1. Geo:

An 88% of GEO stores are owned by the company which sets it apart from Tsutaya. The major benefit of the organized management is that purchase and inventory management is centrally handled, which ensures the type, quantity and quality of merchandises displayed in the stores. Floor space of video rentals has been now filled with home appliances, smartphones, and food items.

2. 2nd STREET:

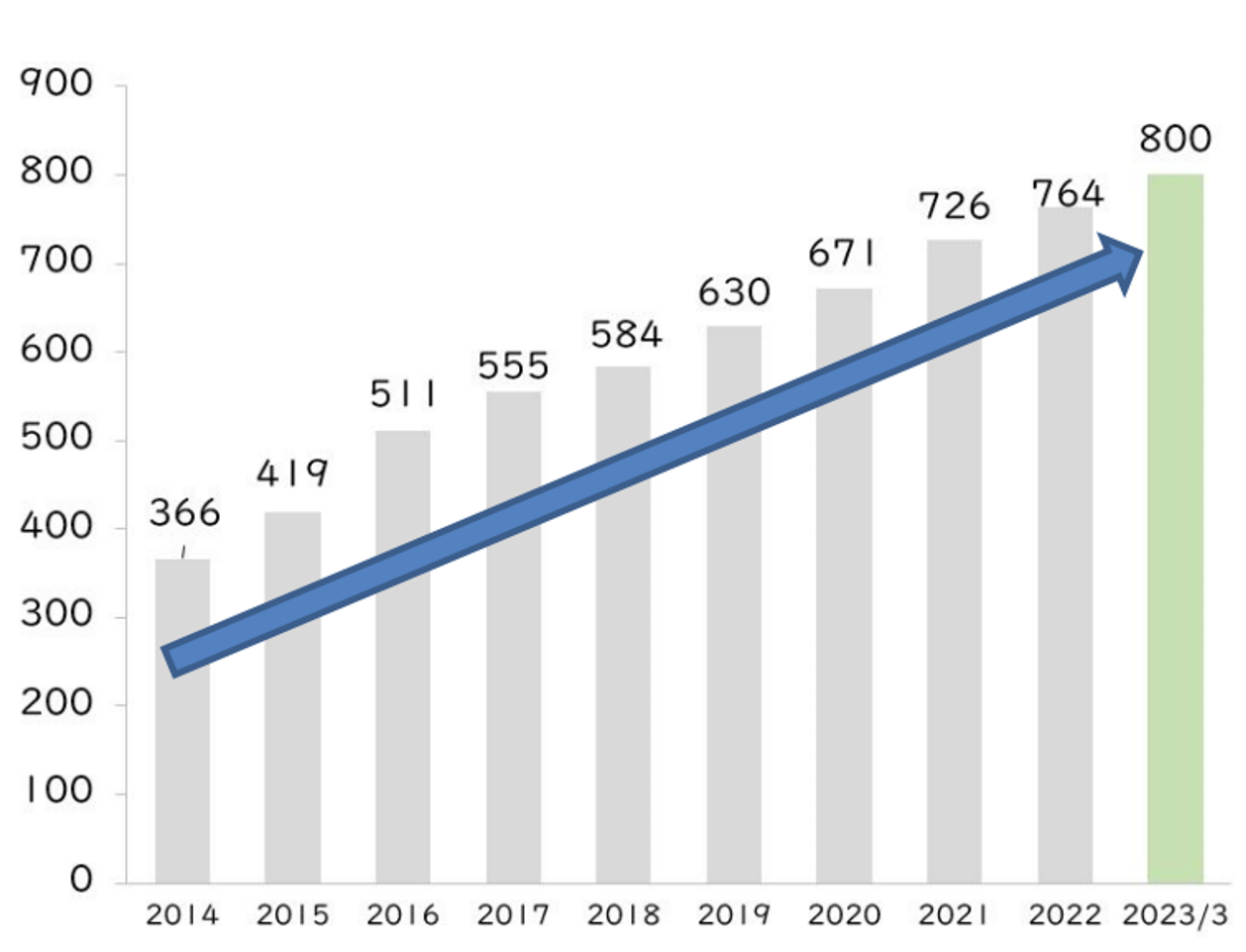

Japanese consumers are increasingly comfortable with the reused/2nd hand item transactions, which has led to the steady growth of reuse market (see Total Acceptable Market section). At the end of 2022, the company has 764 2nd STREET stores with the goal of reaching 800 by FYE 3/23.

(Source: Briefing on the Financial Results for the 1st quarter of FYE 3/31/23)

Strength: The Company has bought 70 million used items/year, encompassing a broad range of merchandise from clothing, furniture, home appliance and outdoor sport goods. This experience has given GEO a large data base on how to price the merchandise on both buying and selling. 2nd STREET buyers are well trained to conduct optimum purchase transactions.

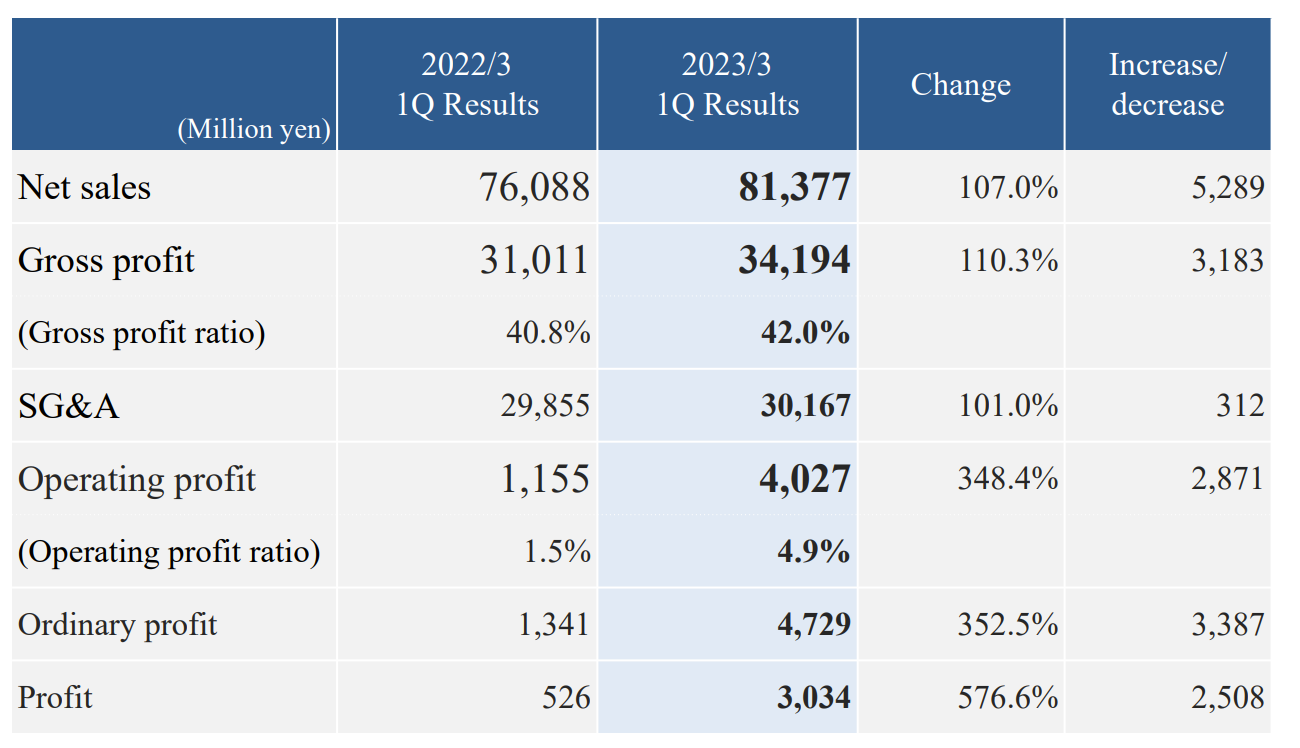

2) Operating margin is recovering and inching toward 5% which is the company’s mid-term goal:

Operating margin for 1Q for FYE 3/23 improved from 1.5% to 4.9%, driven by a rapid recovery of high margin clothing sales at 2nd STREET.

3) New Initiatives:

3-a) Overseas expansion:

GEO has begun its global expansion of 2nd STREET with the first USA store launch in 1/18. In the 1st quarter ending 6/22, the company opened total 6 new stores overseas (3 in US, 2 in Taiwan and 1 in Malaysia).

3-b) GEO bought Okura, the luxury brand focused reuse operator in 3/2020.

The 20 stores are currently in operation with some Okura location dedicated for purchasing of used luxury goods

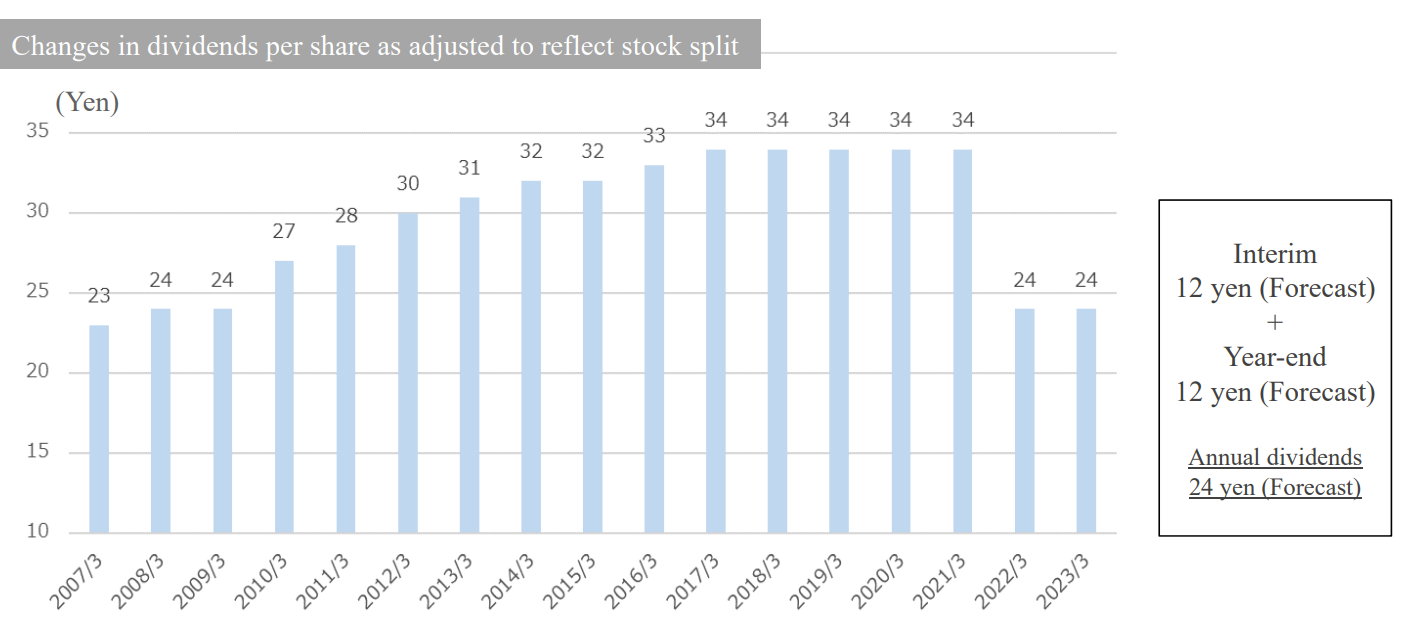

4) Dividends:

The company suffered from net losses in FYE 3/21 in the amidst of Covid, but management maintained dividends of JPY 34/share. However, dividends was prudently reduced to JPY 24 in FYE 3/22 to ensure that the company would retain sufficient cash to support future sales growth. The sales level is gradually recovering as the customers are returning to the stores. So far dividends are planned at JPY 24 level in FYE 3/23, however, given the constantly high material costs and rising labor expenses.

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

(Source: buffet-code.com)

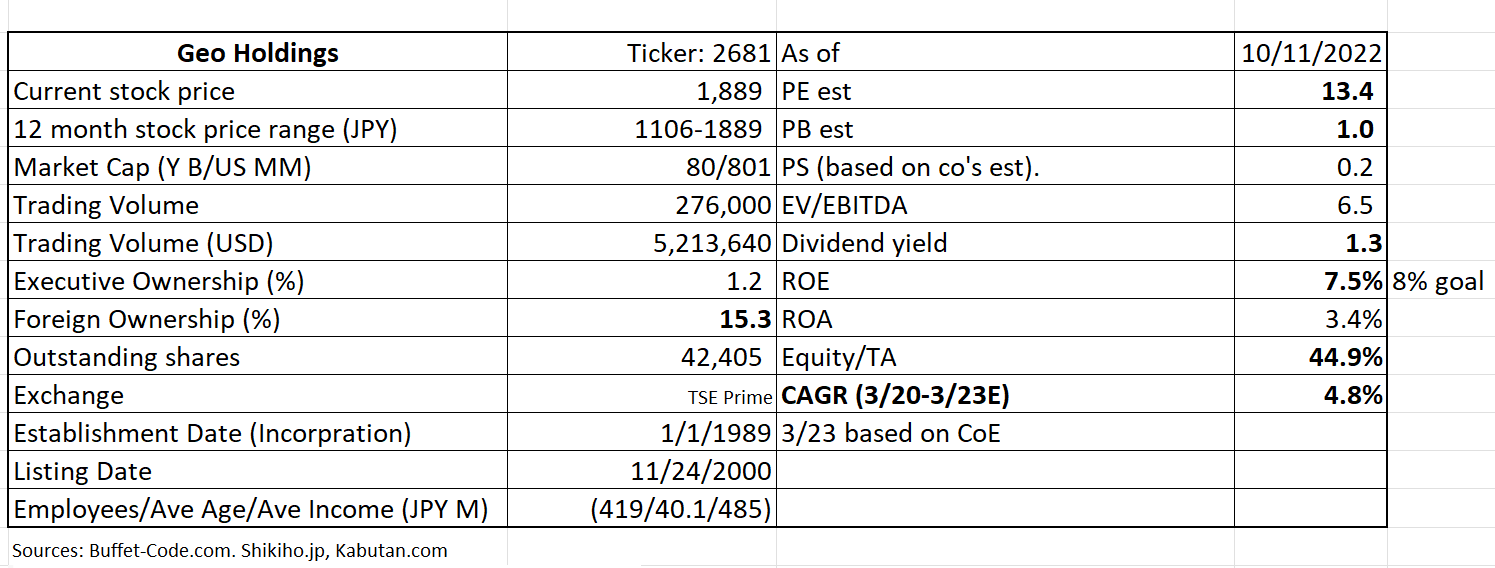

GEO shares are trading at a reasonable PE of 13.4x with a sold balance sheet of Equity to Total Assets of 45%.

2. Technically Speaking

(Source: buffet-code.com)

GEO shares are trading at its 52 week high which may be viewed as “negative” by some investors, since the stock comes under a profit taking selling pressure. At the same time, however, there are not many investors who hold the stock with unrealized losses, thus, no panic selling will be seen in a near future.

3. Business Model

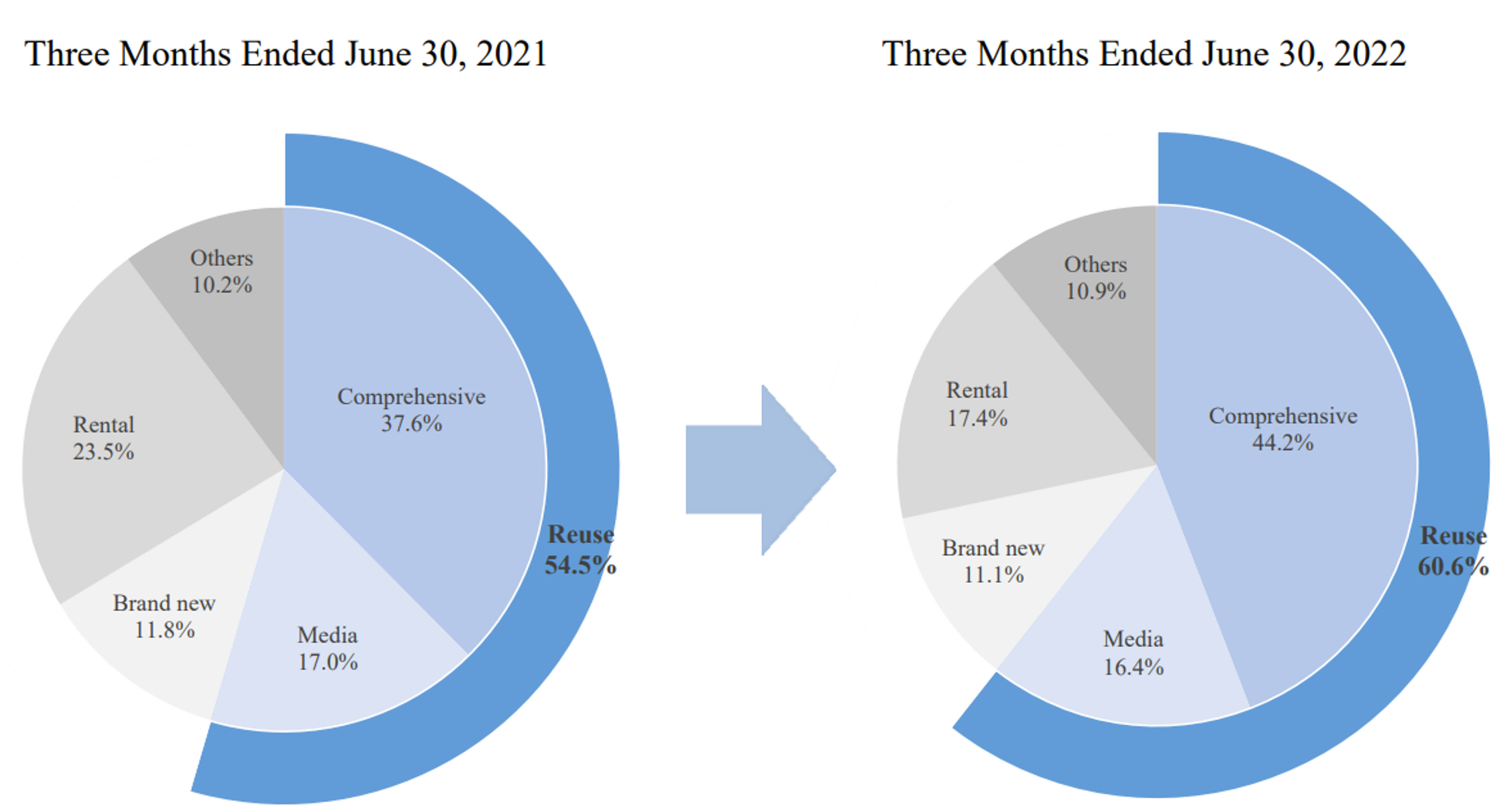

The company is transforming its business model from the one as a video rental company to a network retailer as a distributor of merchandises which touch all aspects of consumers’ daily lives. The below two pie charts show that gross profit from reuse merchandises accounted for 60.6% of the group gross profits for 3 months ending 6/30/22, up from 54.5% a year ago. The company’s profitability is highly dependent on spread between a purchase price and a sold price.

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

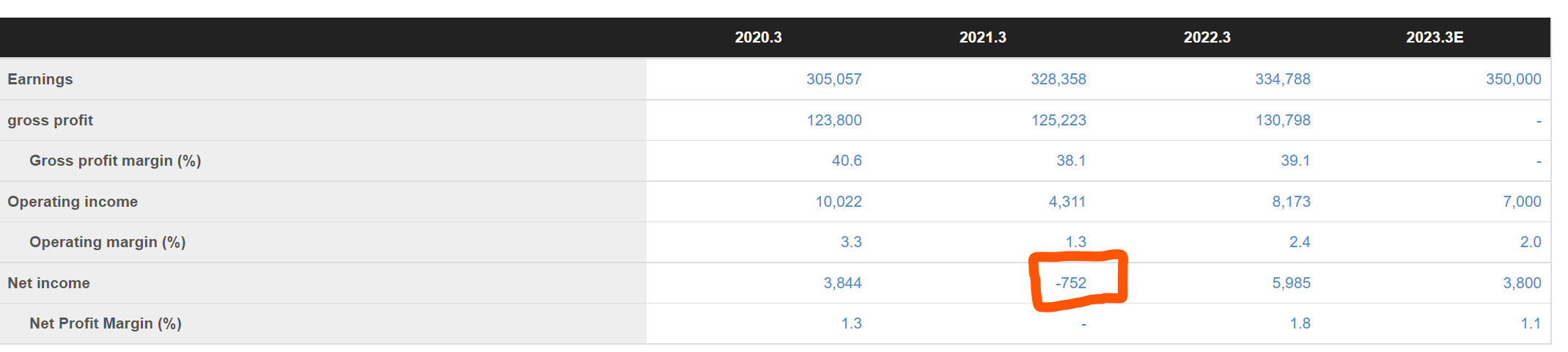

4. Financial Highlights

Financial results for the fist quarter ending 6/22 vs guidance

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

Net sales for 1Q for FYE 3/23 increased 7% year on year to JPY 81.3 Bn, driven by 1) 13 new 2nd STREET store openings in Japan (10) and overseas (3), and 2) sales of reuse clothing and accessories were strong at 2nd STREET thanks to post-Covid opening.

Operating margin for 1Q for FYE 3/23 improved from 1.5% to 4.9%, driven by a rapid recovery of high margin clothing merchandise at 2nd STREET.

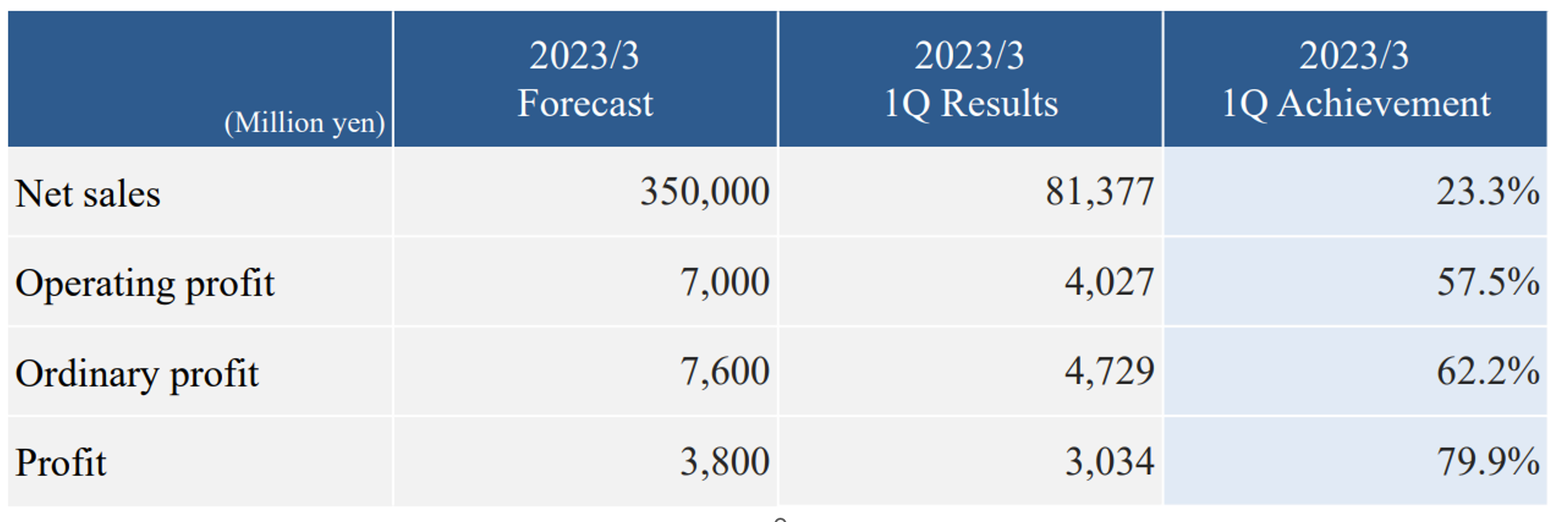

FYE 3/31/23 Guidance

The below guidance for FYE 5/23 was released in 5/22. The main assumption is the number of customers and sales/customer visit will gradually pick up as the negative Covid impacts continues to dissipate.

GEO brands had continued to experience a decline in business activities, as DVD rental sales had not ceased to go down. In addition, the supply shortage of PlayStation 5 had negative impacts on both release and sales of new game titles.

Profit increases were more impressive than sales growth. While sales for the first 3 months of FY 3/23 reached 23% of the entire year forecast (vs. 25% expected), operating profits reached 58% of the annual guidance. Strong showing of higher margin reused clothing at 2nd STREET and tight cost control contributed to overall profit increase.

(Source: Financial Highlights for the first quarter for the fiscal year ending 3/31/23)

5. Total Addressable Markets (TAM)

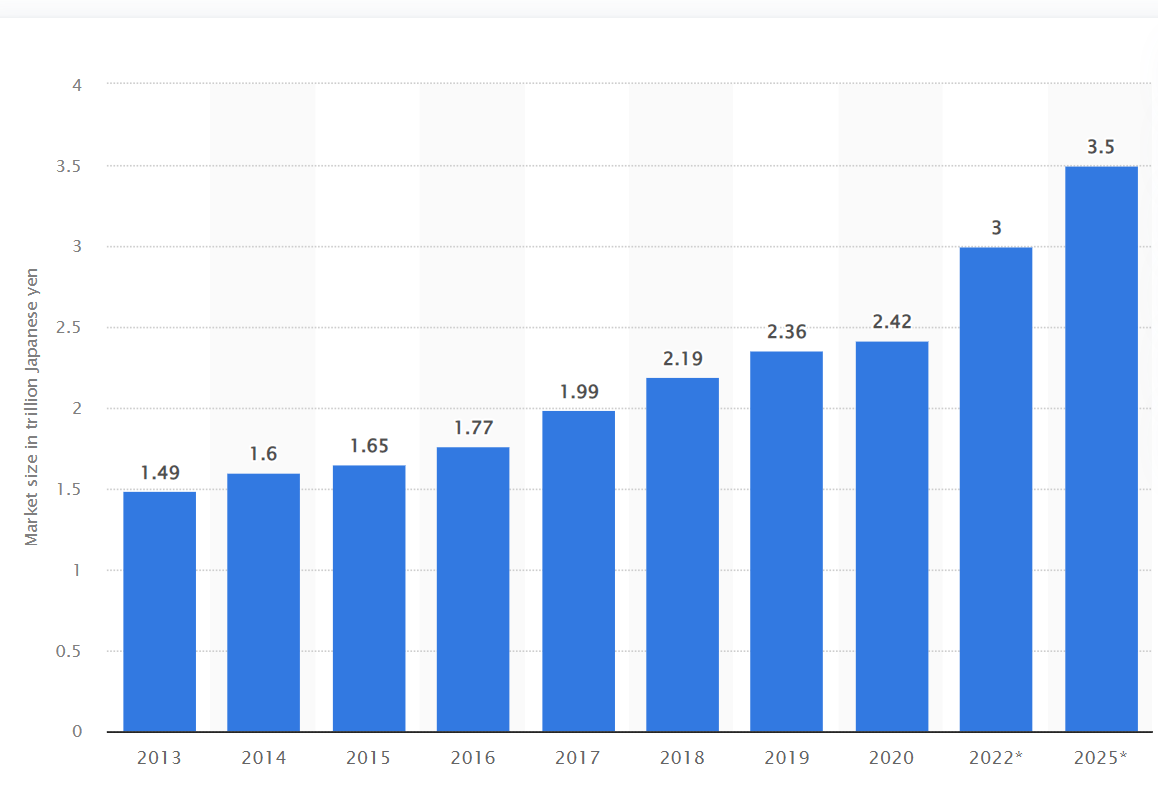

(Source: Statista, Secondhand goods market size in Japan 2013-2025, published on 2/11/22, in JPY Trillion)

As the above graph illustrates, in 2020, the reuse market in Japan amounted to around JPY 2.4 Trillion and estimated to have reached JPY 3 Trillion Yen in 2022, a 25% jump in a year. This growth and size of the market should provide GEO with an ample room for the future growth.

6. Strengths and Weaknesses

Strengths

1. Supportive industry backdrop

The above TAM discussion vindicates the management’s decision to expand the company’s product line from audio/video entertainment area to reuse market of general merchandises.

2. Early visible sign of turn around

As consumers’ daily lives are returning to “normal”, in-store shopping is gaining a traction. This will give professional buyers at GEO and 2nd STREET more opportunities to directly engage with customers in appraising in used merchandises.

Weaknesses

1. Competitive market place.

Reuse industry is growing, but attracting many new entrants. On-line players such Mercari and Rakuten Ichiba are well known as go-to places when consumers want to sell used items. However, the GEO and 2nd STREET’s network of physical stores offer consumers comfort of seeing and touching their interested items before actual purchases.

2. Skilled labor shortage

The company’s product offerings on and off-line are highly dependent on skilled buyers/appraisers to purchase and price the inventories. These buyers are in a high demand, thus, GEO needs to create and maintain a motivational work place and a training system.

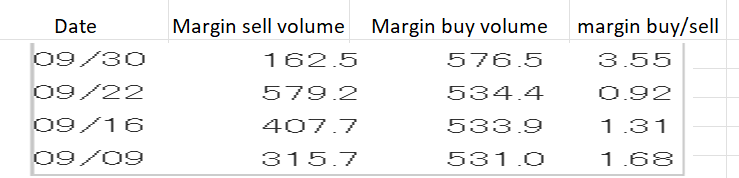

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For GEO, margin buy volume is slowing rising but margin buy/sell ratio of 3.6x is within an acceptable range. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance