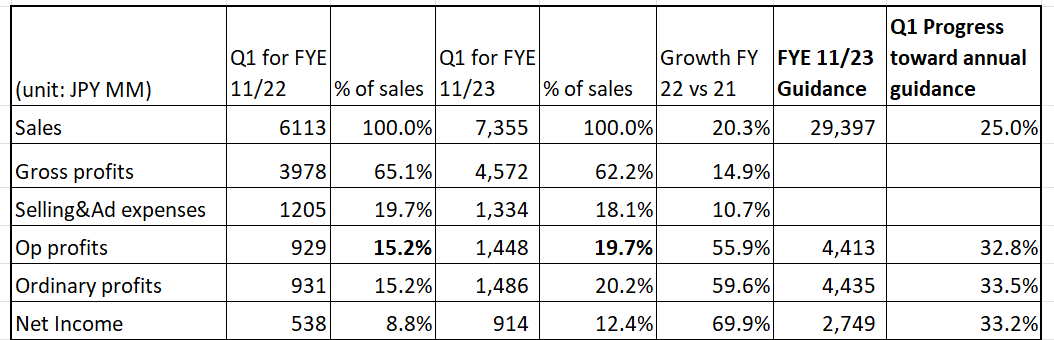

FP Partner is an independent insurance agency nationwide offering products from multiple insurance companies. The company handles products from a total of 37 insurance companies and it leads “contact-driven”* insurance broker in Japan. Commission from life insurance accounted for 96% of sales in FYE 11/22. Policy holders have reached 500,000 and policies in force are 1,190,000.

*The other type of insurance broker acquires new clients who visits their shops.

1. Investment Thesis

1) Separation of two functions of insurance and financial product sales

FP has built a unique business model which separates customer acquisition functions from sales.

Out of 36,422 corporate customers, 32,164 is through partners (88.3%). 11.7% is from FP’s own sales team. Corporate partners (mainly large credit card companies, utilities and telecom providers) rose from 20 in 11/17 to 100 in 2/23*.

These prospects are vetted by the partners and are already willing to meet sales and planning personnel. FP matches them with its financial advisors through its FP’s proprietary system. Therefore, insurance sales professionals/financial advisors can focus on selecting the best products for a client. This ensures a constant service quality and removes prospect acquisition burdens from financial advisors.

*accumulated numbers from 12/22 to 2/23.

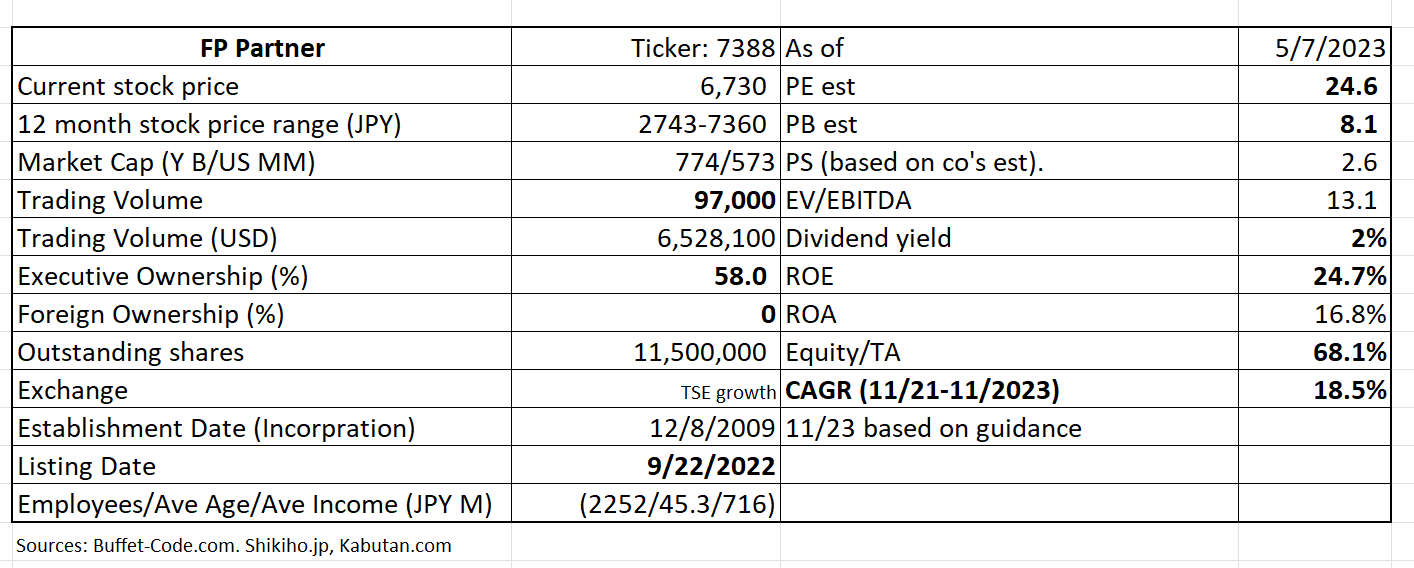

2) Constant sales and profits growth over the last 5 years.

Supported by an increase of partner entities above, the Company has grown at an average growth rate of 17.6% from FYE 11/18 through 12/22.

3) Not a simple insurance broker

FP has multiple product offerings, based on a customer’s changing needs throughout his/her life cycle:

1. The customers’ purpose: Asset building and preservation through life stages and the generations

Products offered: Mutual Funds, Foreign Currency Denominated Insurance, Money held in Trusts, Will preparation/execution, Retirement Funds

2. Purpose: Household Budgets, College Funds, Housing loans

Products offered: Financial planning

3. Purpose: Life Insurance

Strength in this area: can offer timely and frequent consultation throughout a customer’s life cycle. Many consultation venues are available, including home visits.

4) Relationship with multiple insurance companies (not a broker of a sole insurance company)

FP has established business relationships with 38 insurance companies (27 life and 11 Property and Causality) to satisfy multi-dimensional needs of their clients.

Furthermore, as of FYE 11/21, the number of affiliated companies reached 100 (5x from 20 of FYE 11/17). This included telecommunications companies, electric power companies and credit card companies. Some have established joint ventures, such as au Financial Partner. As mentioned earlier, attracting customers primarily through corporate partners allows the company’s sales staff to concentrate its efforts on the proposal of products based on the customers’ unique financial needs.

This large partner network resulted in enforced policy contracts of 1,240,784 as of 1Q for FYE 11/23(+ 21.2% a year ago quarter). the company also acquired 50,760 new contracts (+ 6.6%) and new clients of 30,244 (+ 8.1%). The number of prospects also rose to 36,422 (+13.6%). The company confirmed that around 30% of prospects typically sign the contracts.

5) Money Doctor

FP offers financial advice to prospects on a free-of-charge basis at its stores. These meetings often lead to cross sell opportunities of the company’s insurance and finance service products.

6) MDRT (Million Dollar Round Table)

MDRT is an international association of financial professionals founded in the US. The organization recognizes insurance professionals who have sold a certain amount’s worth of life insurance.

In theory, MDRT agents, being top performers in their industry, are expected to be highly ethical, upholding not only their agency’s code of ethics but also MDRT’s. Top-performing insurance agents have proven that they are able to effectively advise clients. FP boasts an industry leading number of MDRT holders with 566 MDRT achievers (28%) out of 2014 financial advisors as of FYE 11/22.

7) Growth through transferred policies

Against tightening regulations in Japanese insurance industry, costs of running insurance agencies are rising, making “sufficient scale operations” a critical differentiation factor. Also, aging sole operators who can’t find appropriate successors, are forced to discontinue their agencies. FP has built a nationwide branch network (137 branches and shops), thus, is viewed as an ideal recipient of transferred insurance policies. The company reported that over the last 5 years, 10,575 (11.6%) operators closed its doors. As a result, the number of transferred policies are rapidly rising from 15,134 in FYE 11/21 to 19,981 during 11/22. Management expects the number will jump to around 50,000 in 11/23.

8) First Dividend Payout in FYE 11/23

Management believes that the company’s earnings are in a steady upward trajectory which has given them a confidence to initiate JPY 100/year dividend. Annual payout ratio is planned to be 40%.

9) Reasonable mid-term business plan

The company plans on growing sales at CAGR of 17% over the next two years to reach JPY 41,015 MM. Operating profits are expected to grow at CAGR of 18.6% to JPY 6,384 MM. The driving forces behind this growth are:

1) increase in qualified financial advisors.

2) openings of Money Store shops

3) active sourcing of transferred policies

4) Enhancement of CDP (Customer Data Platform):a follow up system of customers after the contract sign ups.

10) cultivate partnership with larger numbers of P&C insurance companies and reduce reliance on life insurance companies (currently 96%)

The stock is trading is at P/E of 25x which is reasonable given its estimated CAGR of 18.5% and ROE of 25%.

2. Technically Speaking

(Source: buffet-code.com)

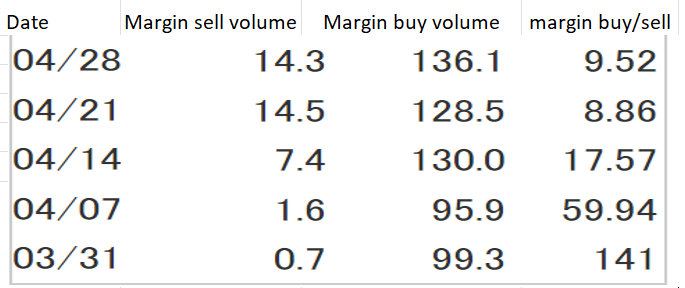

The company announced an initiation of dividends along with good results in early April. The shares reacted positively to the news and was able to rise above the trading range starting from 1/23. The stock is not heavily traded, thus, a position control is critical.

3. Business Model

The company’s main revenue source is commissions from insurance companies called ANP (annual new premium). Therefore, it is critical for FP to increase “contract points” with the prospects and its growth strategy focuses on 1) hiring of new sales/financial advisors, 2) increase of brick and mortar shops (such as Money Doctor and 3) improvement of follow-u[ system.

Life insurance: commissions are paid over 5-10 years, depending on an insurance company and a product type. 70% of ANP is received in the first year of an insurance contract and maintenance fee is 5% of ANP. 20% of ANP is paid as “insurance quality assistance fee”. All types of commission amounts have risen since FYE 11/19 to FYE 11/22 as shown below:

(Source: Financial Result Presentations for 1Q for FYE 11/23)

To the end-user base, FP offers free financial planning consulting. These meetings present great cross-sell opportunities, where appropriate, since financial planners can recommend and sell investment products such as mutual funds.

Two KPIs (key performance indicators) drive FP’s sales volume:

1) Left graph: the number of contracts (new and renewed)

The left graph illustrates both new and existing/renewed contracts are rising from 435 thousands contracts in FYE 11/17 to 1,190 thousands contracts in FYE 11/22. The contributing factors are 1) rising popularity of insurance products with investment aspects, 2) timely and frequent follow-ups for existing contract holders.

2) Right graph: The number of clients (new and existing) also have risen from 207,000 contracts in FYE 11/17 to 505,000 contracts in FYE 11/22.

(Source: Financial Result Presentations for 1Q for FYE 11/23)

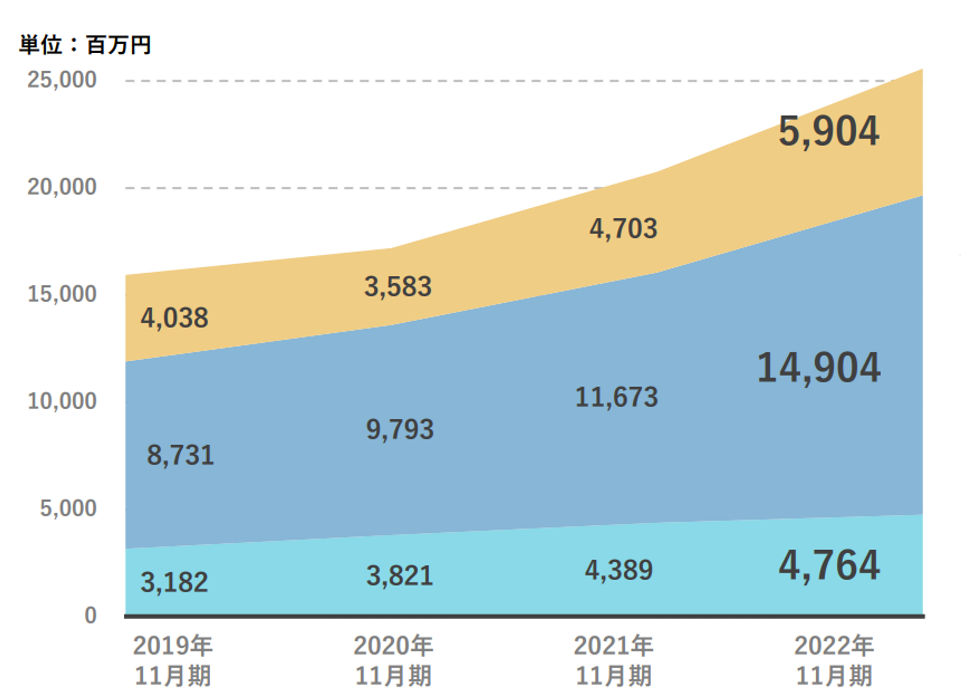

4. Financial Highlights

Financial Results for the 3 months for FYE 11/23 vs. 11/22:

The company has increased the size of the financial advisor team which worked to gain new contracts. The resulting sales increase offset higher capex (new shop openings) and selling and administration expenses, leading to higher profit margins.

(Source: Financial Result Presentations for 1Q for FYE 11/23, translated by JapaneseIPO.com)

Guidance:

Sales and profit lines progressed nicely toward annual guidance for FYE11/23, driven by sales efforts of larger financial advisor team.

5. Total Addressable Markets (TAM)

Japanese insurance market

(Source: Life insurance industry in Japan – statistics & facts by Statista as of 2/3/23)

Japanese insurance markets ranked third in the world, after the US and China. Almost 90 percent of households are covered by life insurance, and life insurance penetration (gross insurance premiums as a share of the GDP) has ranged above 5 percent. This number appears to be substantial, when defense budgets account currently account for 1% in Japan. Premium and other income of life insurance companies are high at JPY 32.01Tn ($230 Bn) and direct premium written by non-life insurance companies was JPY 0.67 Tn in 2021.

With a market share of almost 75 percent, life insurance plays an important role in the domestic insurance industry. As of 2021, there were around 42 private life insurance companies operating in Japan. Nippon Life Insurance Group, Dai-ichi Life Holdings, Meiji Yasuda Life Insurance Group, Sumitomo Life Insurance Group, and Japan Post Insurance represent key players in the market. In addition to these large corporations, there are other providers of life insurance products in Japan, such as cooperatives that offer mutual aid insurance to their members and small-amount and short-term insurance business operators, so-called mini insurers, which provide limited insurance products at low premiums.

Challenges posed by demographic shift

Amid the demographic shift that puts a strain on social security systems in Japan, consumer demand has shifted towards insurance products that cover risks associated with a long life. Over the past years, so-called third-sector insurance complementary to public insurance schemes has become an important segment for life insurers in Japan, and demand for health-related products, such as cancer and dementia insurance, has grown. Medical insurance represented the leading type of new policies taken out in fiscal 2021.

Furthermore, the government liberalized the financial sector, which led to an increasing presence of foreign insurers and a restructuring of pricing regimes. As a result, insurance agencies, which are not bound to one specific company and can therefore act like brokers, gained in importance as a sales channel. The deregulation in general resulted in fiercer competition and a phase of consolidation.

All told, FP, as an independent broker and with ability to cover larger financial needs of policy holders, is in a preferred position to gain market shares.

6. Strengths and Weaknesses

Strengths

1. A unique business model

The division of customer acquisition from consultation and final sales activities are a differentiator at this point. However, it can easily be copied by competitors. A mitigator will be that fact that FP has the largest pool of MDRT members which is very hard to be copied by peers.

2. FP’s nation-wide presence has two major merits

1) access to local planner talents who are familiar with the local needs, and

2) FP is an attractive party for transferred policies since its large network makes it easier to retiring insurance agents to look for a new agent with the least amounts of disruption for the policy holders.

Weaknesses

1. Labor intensive business model

High touch-high contact business model requires many skilled-sales persons, conducting many customer contacts. – Management efforts’ to come up with CDP contract follow up systems.

2. Money doctor is at its nascent growth stage and requires extensive financial investments to improve skillsets of its financial advisors.

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For FP, margin buy sell ratio is high at 9.5x (below 3x is acceptable), thus, the near term selling pressure is high. As mentioned earlier, a prudent position control is important.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance.