EDP (“EDP” or the “Company”) was established in September 2009 for the purpose of commercializing the large diamond single crystal production technology developed by the National Institute of Advanced Industrial Science and Technology (AIST)*. Mr. Naoji Fujimori, CEO, served as the director of the Diamond Research Center at AIST prior to founding EDP.

*AIST: The National Institute of Advanced Industrial Science and Technology (AIST), one of the largest public research organizations in Japan, focuses on “bridging” the gap between innovative technological seeds and commercialization.

Diamonds are generally considered to occur in nature, but synthetic diamonds began to appear about 10 years ago and are called laboratory-grown diamonds (LGDs).

In addition to jewelry applications, diamonds are increasingly used as abrasive grains the cutting and polishing of hard materials such as stone, due to their hard traits.

Two ways to produce LGD:

1) HPHT (high-pressure, high-temperature): This traditional method produces LGD from carbon material in apparatuses that mimic the high pressure, high temperature conditions of natural diamond formation in the earth.

2) Chemical vapor deposition (CVD): involves filling a vacuum chamber with carbon-containing gas that crystalizes on a synthetic diamond seed. This method uses lower temperatures and pressures than HPHT. The CVD requires a lower upfront equipment cost than HPHT but may require subsequent treatments to improve the color of the diamonds grown. This 2nd method is the one used by EDP which explains that CVD produces diamond as though “frost were formed”. The gas pressure is about 0.1 atmosphere, which is lower than atmospheric pressure, and the temperature is about 1000 degree to peel off the diamond that is produced.

To peel off, EDT uses the technology called “electrochemical etching” developed at AIST* This method enables it to directly produce a planar diamond without going through granular diamonds. If the company has a seed crystal, it can duplicate it to form a planar diamond with the same size. Times have changed, and single crystal diamonds used to be limited to small granular diamonds, but now single crystals of 10/10mm or larger and mosaic crystals of 30×20 mm are available.

Mr. Fujimori, pioneered the development of CVD method at AIST. The company’s relationship and backing of AIST is one of the major investment thesis of EDP as discussed below.

1. Investment thesis

1) Industry growth

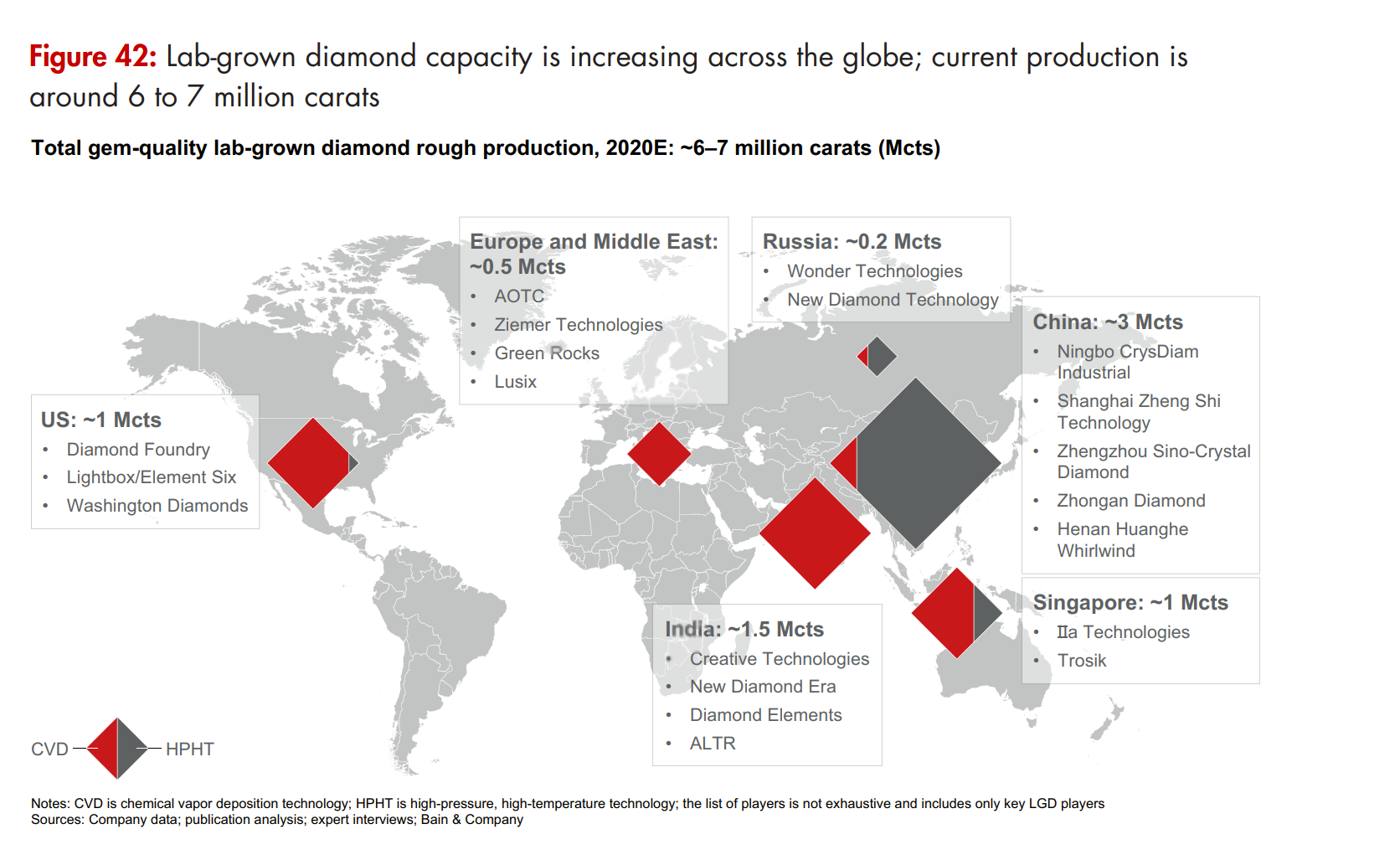

The below research by Bain illustrates LGD production has increased in all the regions:

(Source: The Global Diamond Industry 2020-2021, Bain & Company)

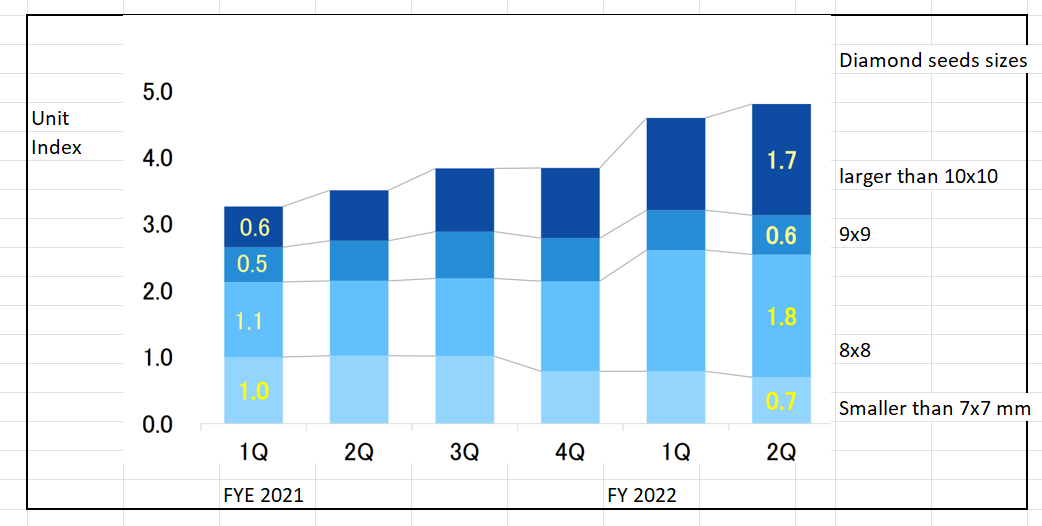

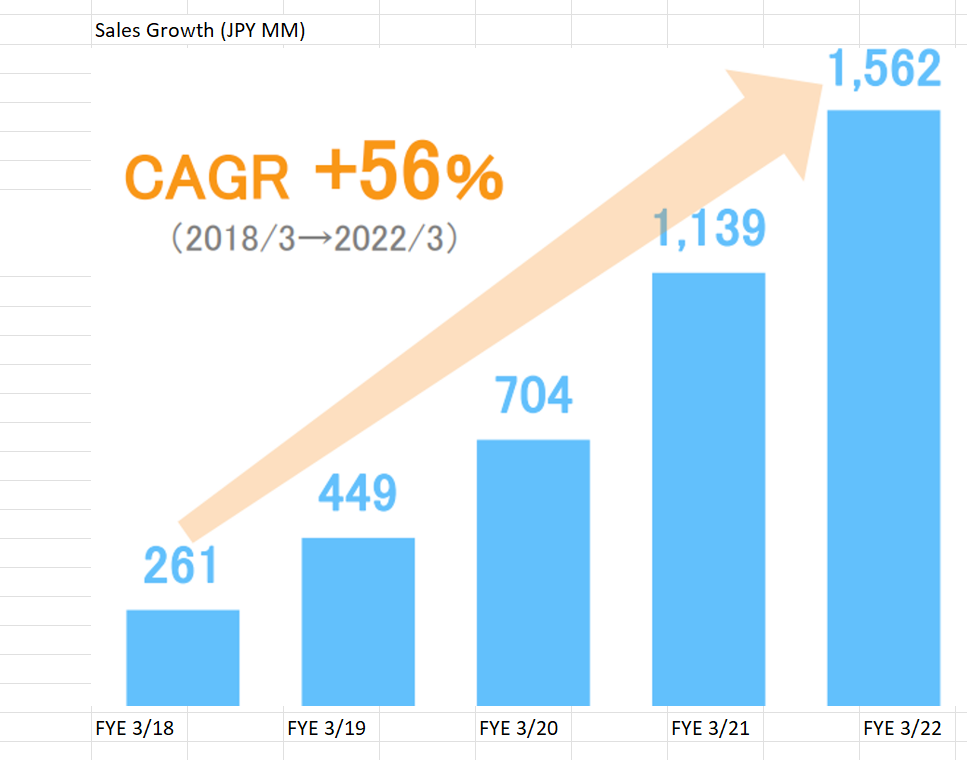

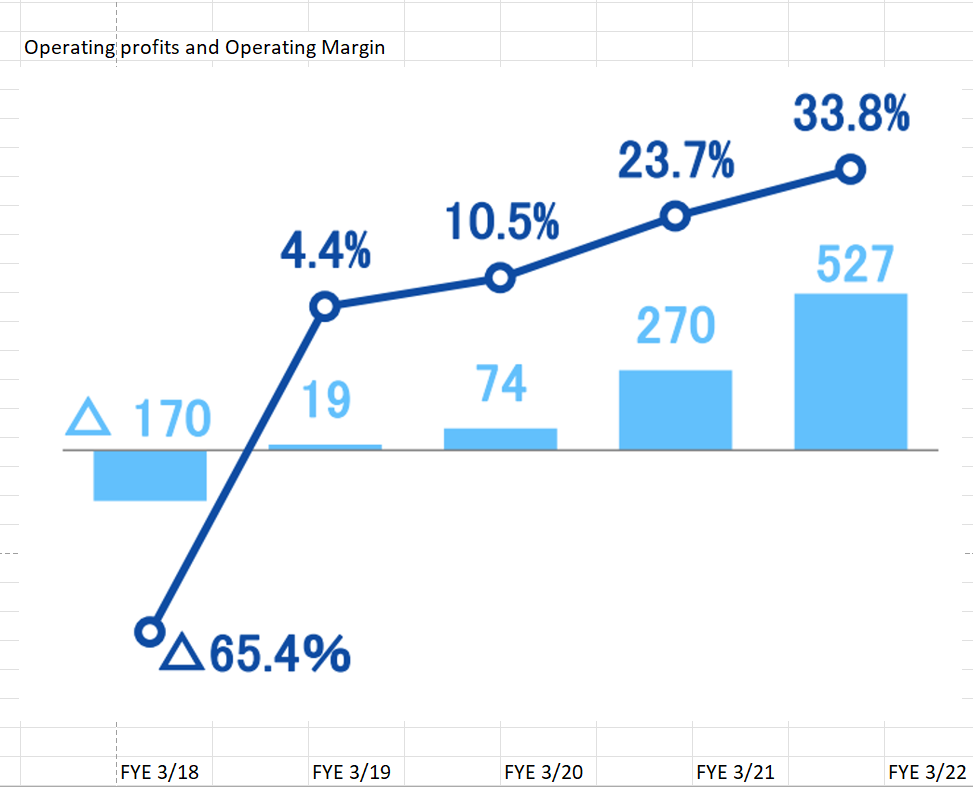

The increasing acceptance of LGD has EDP many RFPs, all of which the company has not been able to honor with contracts. As a result of this robust demand, the company has enjoyed sales CAGR of 56% over the last 5 years. Rising sales has helped profitability to improve from losses in FYE 3/18 to JPY 1.6 Bn in 3/22. In addition, the recent technological advancement expanded the size of crystal diamond seeds. The below graph depicts a steady rise in diamond seeds sizes. Shipments of seeds whose size is 7×7 mm is indexed at “1” as of 1Q for FYE 2/21. This small size seed shipment decreased to 0.7 during Q2 for FYE 2/23.

(Source: Financial Results Briefing for the 2nd quarter of FYE 3/23)

Larger seeds carry higher unit prices and better profit margin. Consequently, operating margin has steadily improved during the same period as shown in line graph of the second chart.

(Source: Financial Results Briefing for the 2nd quarter of FYE 3/23)

(Source: Financial Results Briefing for the 2nd quarter of FYE 3/23)

2) Strong tie with AIST (government agency)

The company has continued to be engaged in R&D efforted jointly with AIST and holds 17 LGD related patents. EDP has a sole use right of these patents. Also, not all production procedures are listed in patent documents which functions as a technical entry barrier.

3) Expanding applications

While lion’s share of LGD applications are for jewelry at this point, LGD’s excellent properties such as hardness, thermal conductivity, insulation and light transmission. These properties make LGD as excellent semiconductor materials. Thus, high volume industrial applications are cultivated these days.

4) EDP’s sales currently depend on its capacity

Against the strong demand for LGD, the company has been forced to turn away some customers. This capacity constraints are eased with the launch of the 2nd factory (Shima factory) which started its full scale production in 11/22.

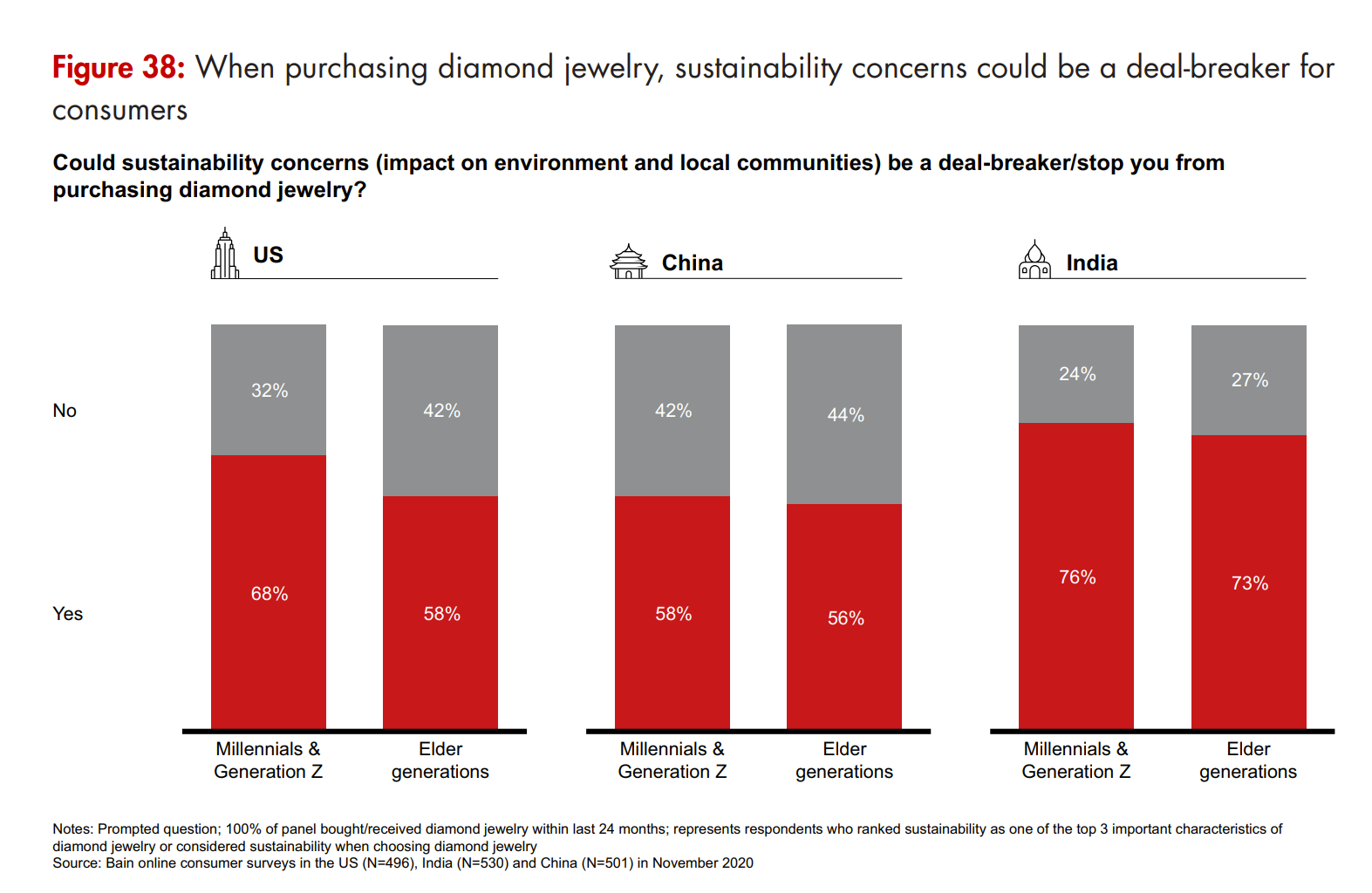

5) Consumer’s purchase decision is changing

The below graphs highlight that the preference of consumers, younger generations in particular, to buy products with sustainability in mind of late. This consumers’ ESG driven buying behavior should further support volume increase of LGD.

(Source: The Global Diamond Industry 2020-2021, Bain & Company)

3) High operating leverage

The largest valuable costs are electrify to power the production of hydrogen from water. Electric bills account for a few % of sales. Fixed costs are mainly factory deprecation and labor costs which don’t increase at the same pace with sales. Thus, profitability grew faster than sales.

2. Technically Speaking

(Source: buffet-code.com)

The above chart shows that the shares have rebounded nicely at a support level of JPY 16,000 and is hitting a resistance level of JPY 25,000. The stock needs to push through this line with a large volume to notch higher.

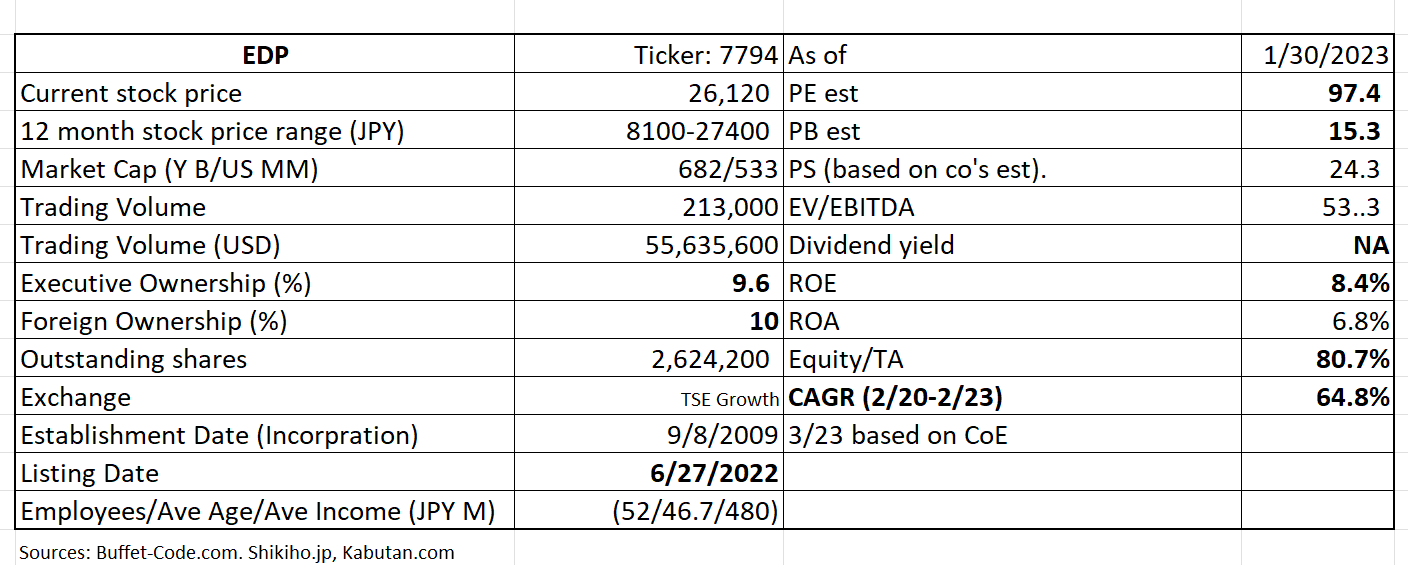

PE of 97x appears very toppy but evaluated against CAGR of 65%, PEG would be 1.5x, which is within an acceptable level.

3. Business Model

The company sells its diamond crystal seeds to two types of customers: LGD producing companies (60% of sales) and trading companies which in turns sells seeds to LGD processing firms. Currently top 4 companies account for 78% of the entire sales. To mitigate this concentration risk, EDP 1) requires the customers to commit at least 6 months of contract and 2) cultivates numerous small clients. As the technology of creating larger LGD revolves, the number of firms entering LGD jewelry markets should increase, expanding a customer pool for EDP.

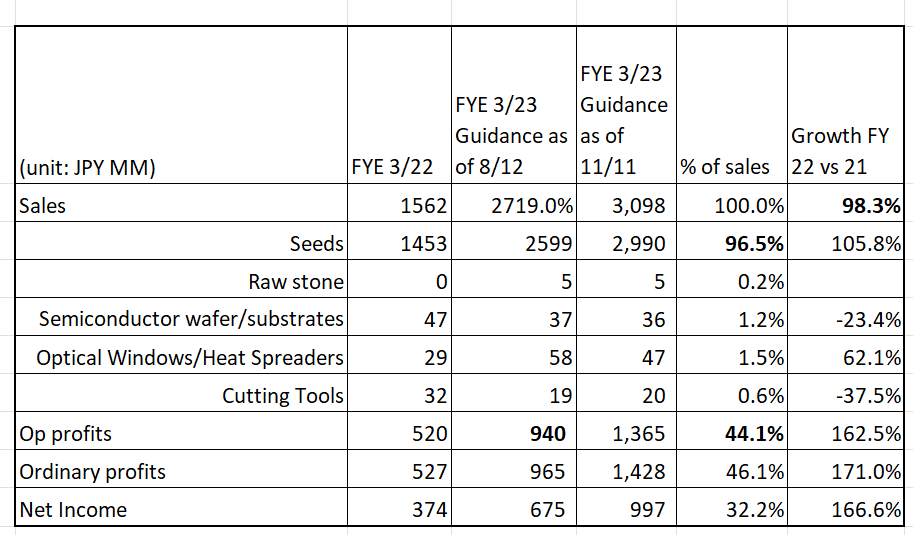

4. Financial Highlights

The company upped its FYE 3/23 guidance in 11/22, supported by

1) Steady overall LGD demand and an increase in diamond sizes are driving seeds demand higher than expected,

2) The capacity expansion has enabled the company to meet robust customer demand,

3) EDP has been able to improve factory productivity. Also, larger diamond sizes carry better margin. These factors combined have led to better operating margin

(Source: Financial Results Briefing for the 2nd quarter of FYE 3/23, translated by JapaneseIPO.com)

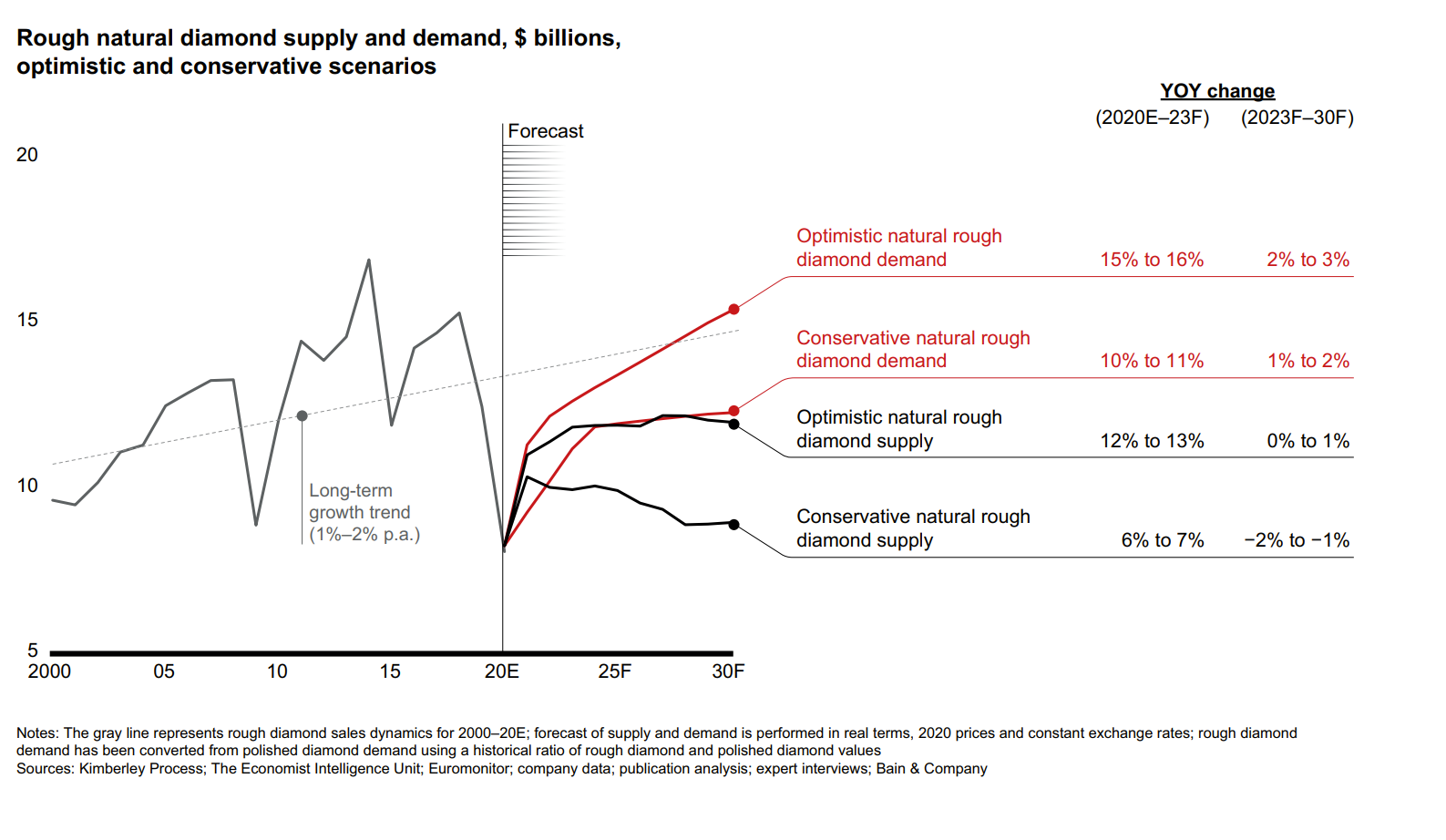

5. Total Addressable Markets (TAM)

Bain, in the below chart, expects that natural diamond demand will be pretty much flat for 2023 through 2030 (best case scenario +3%, worst case -2%).

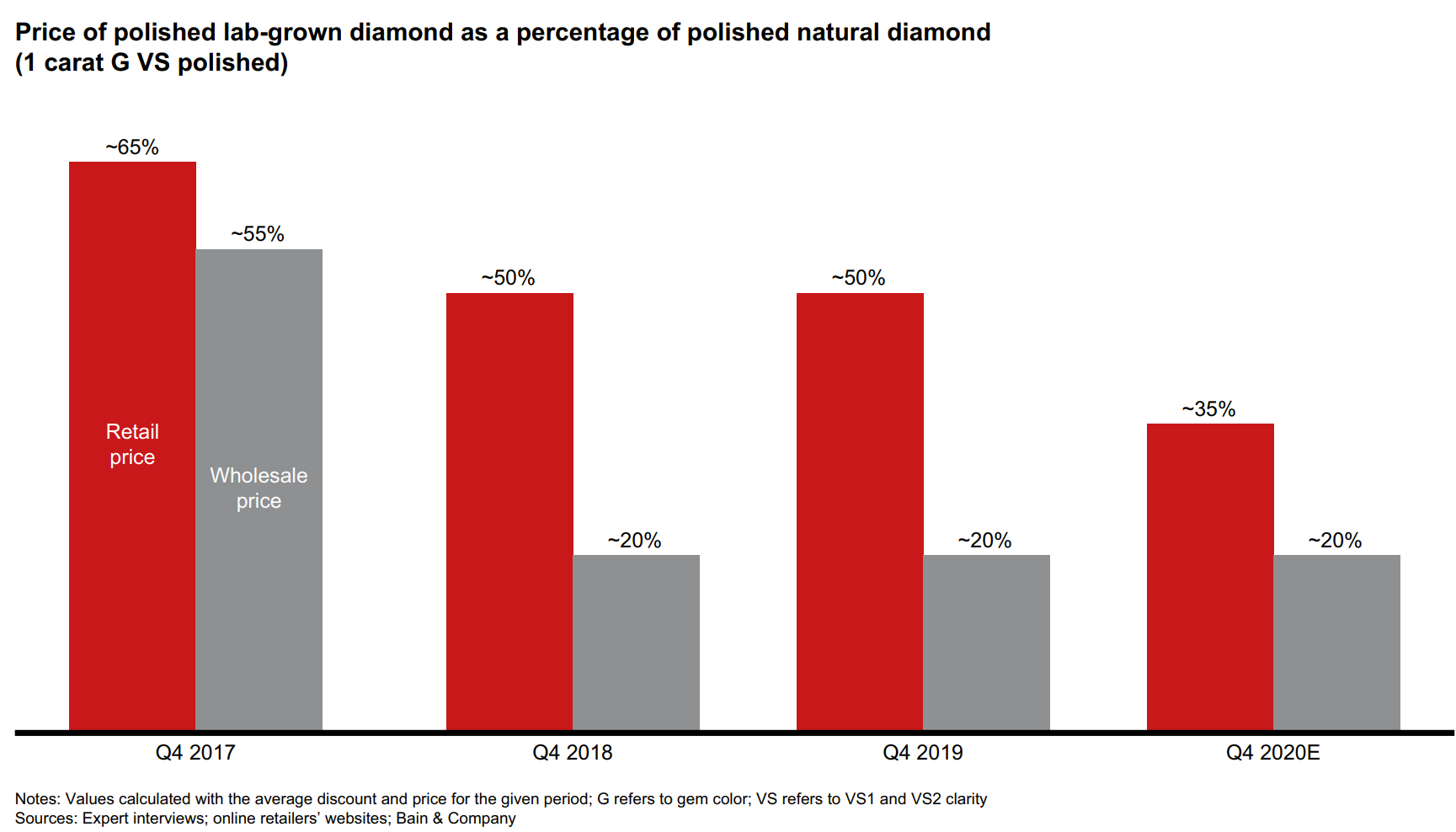

However, the below bar graph highlights price of LGD has shrunk from 65% of natural diamonds in Q4 2017 to 35% in Q4 2020 (expected). This price drop will likely spur a hike in LGD purchase among price conscious consumers.

(Source: The Global Diamond Industry 2020-2021, Bain & Company)

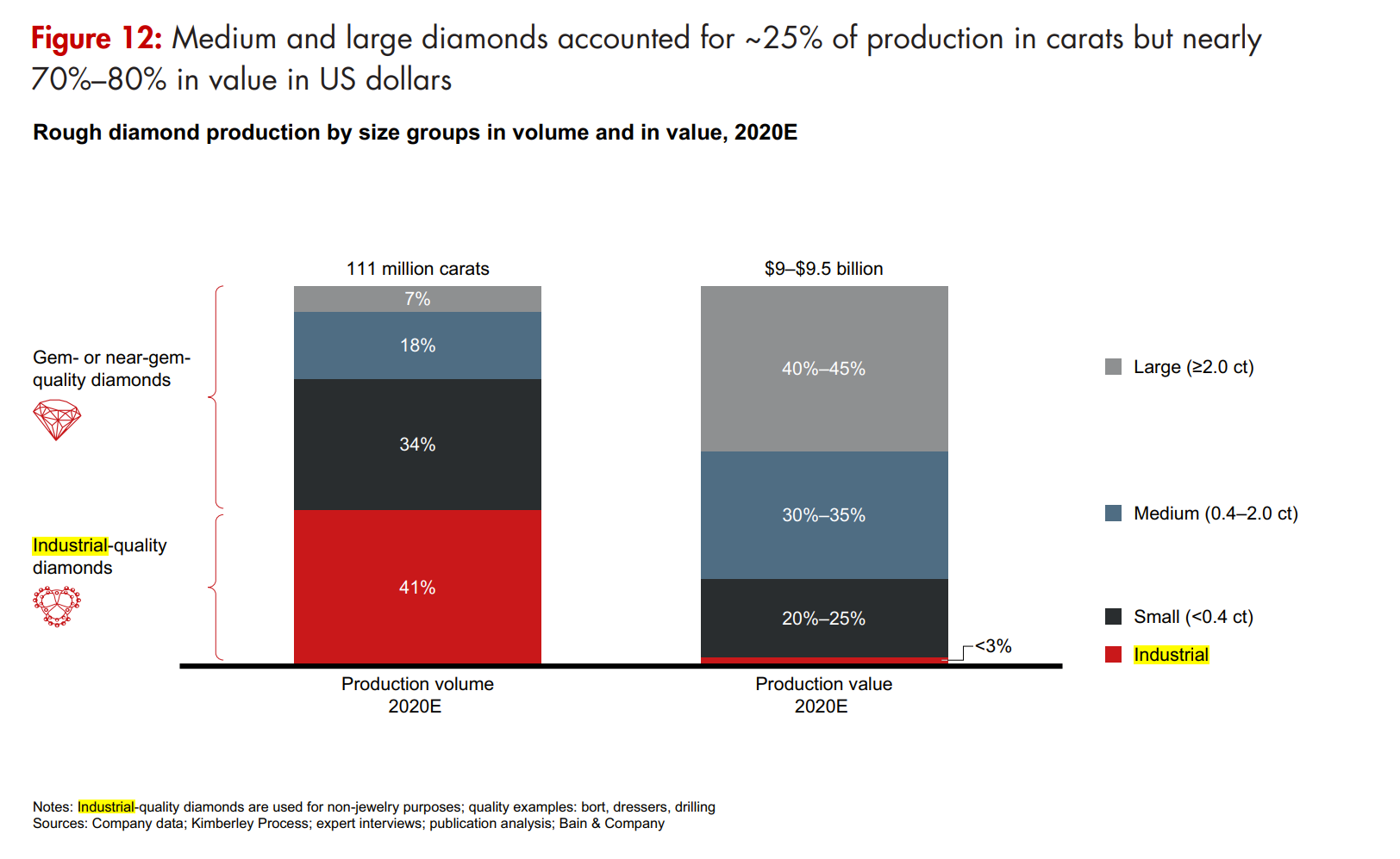

The diamonds are still predominantly used for jewelry applications, especially in terms of value amounts. However, as mentioned earlier, applications of LGD for industrial use will be expanded as the size and ease of LGD processing will improve.

(Source: The Global Diamond Industry 2020-2021, Bain & Company)

All told, steady demand growth is expected for synthetic seeds produced by EDP.

6. Strengths and Weaknesses

Strength

EDP’s strengths as an investment vehicle are all the stock drivers listed in the above “Investment Thesis” section. A particular emphasis should be on the fact that EDP, with AIST backing, is in a great position to enjoy a steady LGD growth.

Weaknesses

1. Reliance on top 4 clients

EDP has implemented the measures to mitigate this high concentration risk by 1) requiring a 6 month contract and 2) cultivating numerous small clients (as discussed earlier).

2. Recession risk

Diamonds are still mainly used for discretionary items such as jewelry/accessories. When/if economy turns recessionary, consumes will likely postpone or cancel diamond purchases. However, LGDs are increasingly more affordable than natural diamonds. Also, globally, diamonds are preferred “gifts” vs. “cash”. Thus, its sales decline will likely not as severe as natural stones.

7. Near-term Selling Pressure

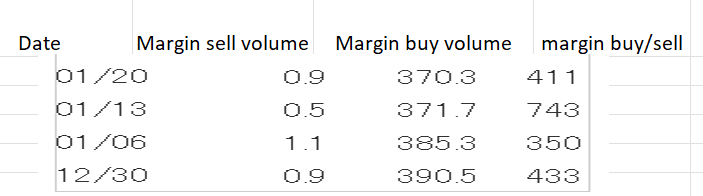

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For EDP, margin buy sell ratio is high but margin buy volume can be absorbed in 1-2 day volume. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance