(Note: This is s micro-cap stock)

Why have AI related stocks underperformed the broader markets in general? I can’t figure it out so have asked many experienced investors who have said in unison: AI applications are company/project/situation specific, thus, not scalable. The un-scalable operations tend to lead to small volume and small profits.

Then, if I can find a company whose AI offerings are scalable, the stock should go up? This is the thought behind the above tagline “Scalable AI”.

Who is EDGE Technology?

EDGE Technology Inc. (EDGE or the company) is engaged in the AI algorithm business. EDGE provides AI solution services, AI education services, and develops and sells AI products. AI solution services incorporate AI algorithms into existing businesses and systems, and implement and operate them. AI education services include services such as education courses for individuals specializing in AI technology, corporate training, and paid employment agencies specializing in the AI field. AI product service is a service that sells products that implement AI.

What is edge AI?

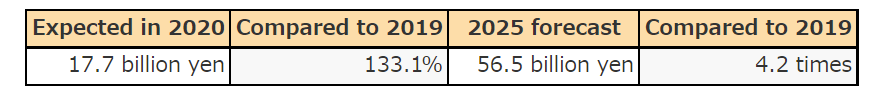

(Source: “2020 Artificial Intelligence Business Comprehensive Survey” completed 10/12/20 by Fuji Chimera Research Institute).

Edge AI computing (AI algorithms) is to perform AI learning / inference processing functions, which are often executed on the cloud or in data centers, on embedded devices and servers on the device (edge) side. Processing on the edge side enhances real-time performance. Thus, it is expected to be installed in various devices such as consumer appliances such as home appliances, mobile terminals, and in-vehicle devices, office equipment, FA (factory robots) transportation-related, and retail-related industrial equipment. In particular, it is an indispensable technology for autonomous driving because there is no time lag (no latency) and the results can be reflected immediately. Major automobile manufacturers and automobile parts manufacturers are accelerating joint development with AI vendors for the advancement of autonomous driving.

To achieve these goals, edge computing can generate data through deep learning on the cloud to develop deductive and predictive models at the data origin point, i.e. the device itself (the edge). Factory robots access vast amounts of multimodal data from surveillance cameras and sensors and use it to detect faulty data on production lines.

The global edge computing market size was valued at USD 4.68 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 38.4% from 2021 to 2028. Edge computing introduces a great level of business complexity, as it requires an extensive range of stakeholders for IT infrastructure, connectivity, application development, traffic delivery, and service management. Edge also brings together hardware and software solutions and networking architecture that address the vast number of use cases pursued across several industry verticals. As the technology is still in the early stages of development and its implementation and operational models are yet to mature, an edge is likely to create vast growth opportunities for new entrants in the near future.

(Source: Edge Computing Market Size, Share & Trends Analysis report published by Grand View Research on 5/21)

1. Investment thesis

1) Cost efficient AI support offerings

EDGE operates in three sub-sectors under main AI theme:

1) AI Solution (83.8% of FY 4/21 sales)

EDGE offers AI solution consultation in a very cost effective way:

Process Flow:

A) GeAlne*, through its marketing efforts, contacts prospects.

B) EDGE provides a project proposal

C) A prospect requests a refined project outline

D) EDGE contacts several freelancers in its AI engineer data base

F) A freelancer accepts a project

G) EDGE goes back to a prospect with an execution plan. The team is often comprised of several engineers including EDGE’s employees.

H) A clint accepts a partial contract with an option to cancel the remainder of the contract.

I) EDGE signs up with the engineer for the partial project in H)

J) EDGE completes the entire project

K) The client pays for the whole project

L) EDGE pays the engineer the remaining fees

M)EDGE receives the feedback on their experience from both the client and the engineer.

*GeAlne is EDGE’s products. It automates marketing form creation and distributions to prospects. EDGE’s customers simply upload the lists of their prospects.

2) AI Education (9.7%, brand name: AIJobColle)

3) AI Product (6.5%, brand name: GeLane)

2) Competitive strengths – Flexibility and Scalability

EDGE’s competitive strength can be summarized in their ability to hire experienced AI engineers on a project/contract basis. The competitors tend to hire full-time engineers and train them in specific service/industry areas. By tapping into vast array of talent pool for a project, the company can service many customers, regardless of the industries/sizes and project complexities.

EDGE is a preferred employee from freelance engineers’ perspective, since:

1) The company’s ability to acquire specialized and high-price tagged contracts allow them to offer engineers high commissions.

2) EDGE is a member of Freelance Association and can offer benefits including health care, etc.

3) EDGE can provide on-going education through their training platforms.

3) Early Mover Advantage

The below is the sample list of the company’s clients. As you can see, many are the leaders of their respective industries. AI implementation is still in its early stages, thus once contacts are singed, they can last multiple years. Also, the clients tend to stay with the same AI vendor who become familiar with the clients’ unique needs, i.e., switching costs are high for the clients.

(Source: Growth plan published on 2/27/22)

4) Recurring revenue sources

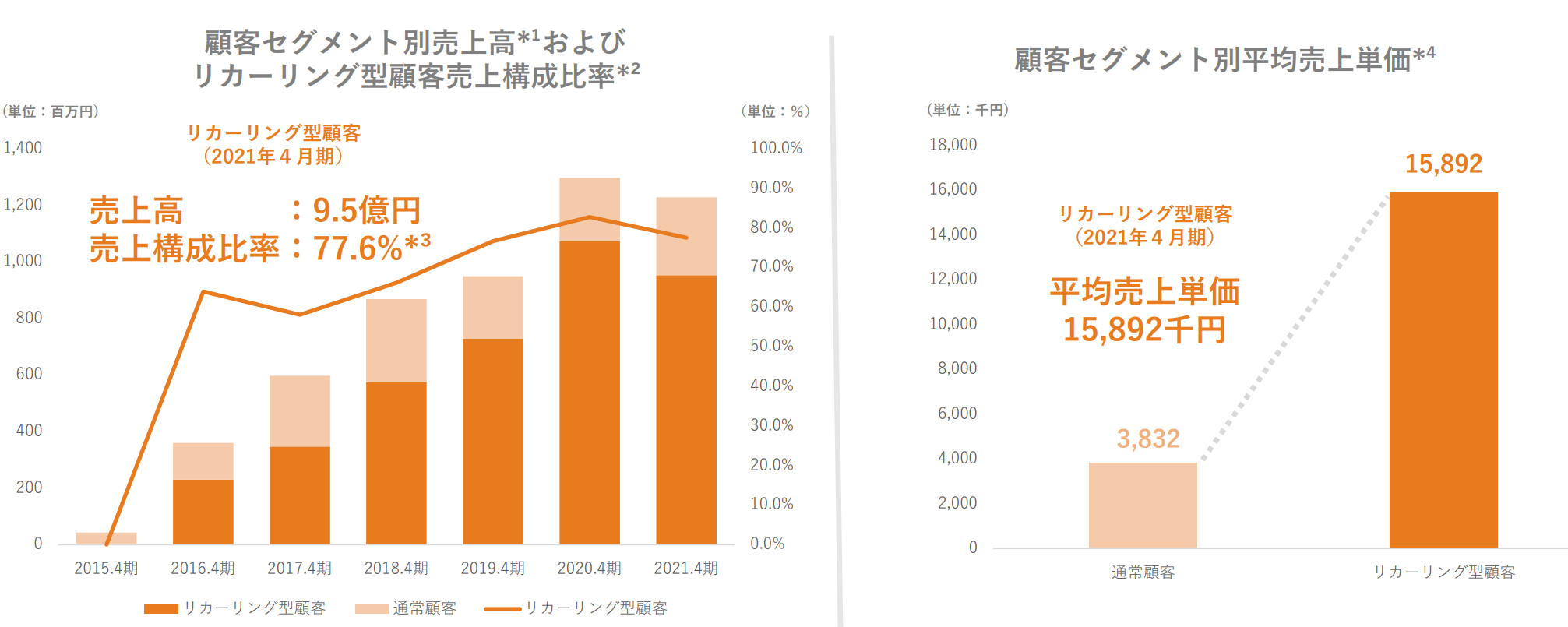

EDGE segments clients in two groups, 1) recurring client base: ones which renew their contracts over 4 quarters and 2) ones with shorter contracts. EDGE can address the clients’ wide range of AI needs and tend win lengthy contracts. As shown below, as of FYE 4/21, 78% of total sales were from recurring clients. Sales per clients were JPY 15,892M for recurring clients vs JPY 3,832 M for others.

Note:

1) Total sales was down slightly in FYE 4/21 from FYE 4/20 due to Covid related project delays .

2) Recurring clients sales as % of sales for the first 6 months of FYE 4/22 was 74.8%.

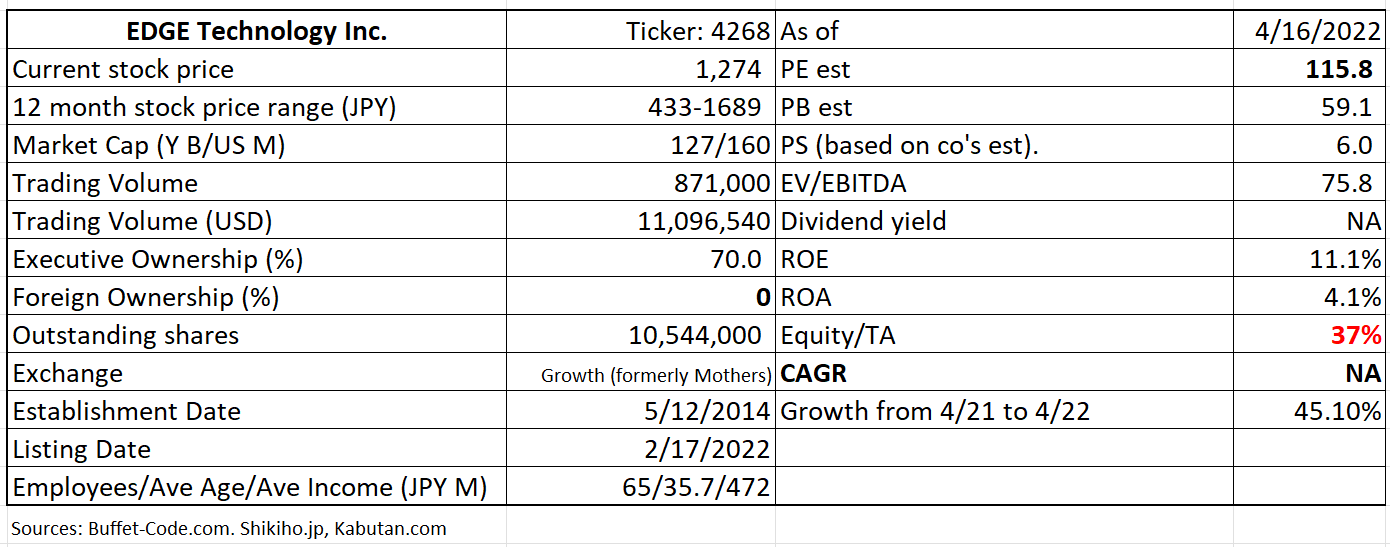

4/22 E PE of 116x indicates a high expectation placed on the stock. Thus, we would slowly build a position. Equity/TA ratio of 37% is a bit low, but with 2/22 IPO which raised $11 MM, the company will have sufficient funds to support its growth for a while.

2. Technically Speaking

(Source: buffet-code.com)

The stock appears to be forming a support level at the first volume cluster of JPY 1,156. The next volume cluster is JPY 1,500 and 1,700. The stock needs to maintain the current trading volume to shift to a upward trajectory.

3. Business Model

The company’s established tie with freelance engineers and ability to solve the clients’ AI needs in the most cost efficient ways is the company’s business model and differentiation factor.

4. Financial Highlights

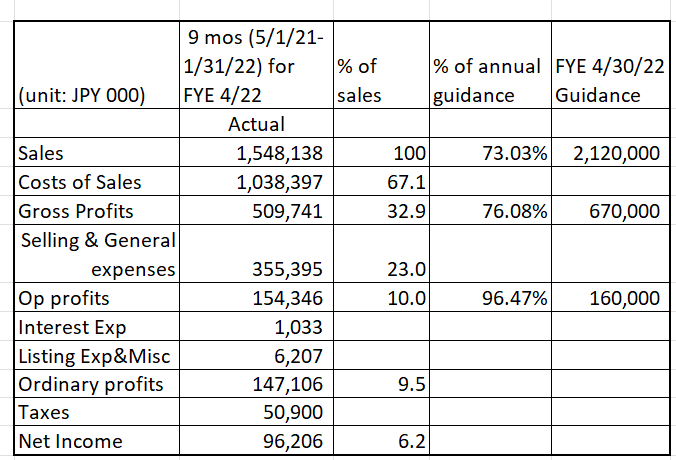

Results for 9 months ending 1/22 for FYE 4/22 (5/21- 4/22)

(Source: Financial Results Filing for Q3 for the Fiscal Year Ending 4/2022)

The company stated that it had started to prepare quarterly statements as of Q2 FYE 4/22, thus, 9 months results for FYE 4/21 was not available for comparison. While sales for the first 9 months of FYE 4/22 slightly missed the full year guidance by reaching 73% (vs. 75%) of the full year number, profitability was on track with operating profits reaching 96%.

5. Total Addressable Markets (TAM)

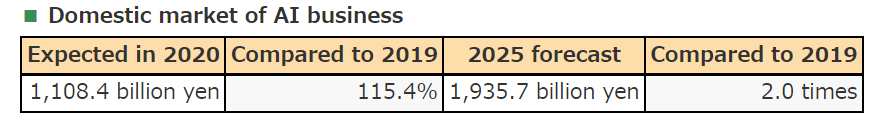

AI has begun attracting attention in 2016, but in 2019, the number of cases of shifting from demonstration experiments to full-scale introduction increased, and the market expanded significantly. As an initial stage, AI was used for the purpose of streamlining / automating simple standardized tasks. However, since then, AI has increasingly taken over more complicated projects which were the main tasks of knowledge workers.

In FY2020, due to the impact of Covid, there were temporary delays in projects and postponement of new projects. However, due to the rapid spread of remote work, many companies are actively promoting structural reforms utilizing digital technology, and even though the economic situation is deteriorating, as part of efforts to improve corporate competitiveness, AI is being adopted. Investment is expected to be prioritized, and the market is expected to increase by 15.4% from FY2019 to JPY 1,108.4 Bn.

From 2021, the use of AI is expected to increase as one of the core technologies to drive government-promoted digital transformation. Thus, the use of AI will be 2.0 times higher than 2019, at JPY 1,935.7 billion.

Domestic EDGE AI Outlook

In FY2019, the focus was on verification for prototype development, but FY2020 saw a leap to the development of concrete prototypes. Although the project was postponed during Covid, the motivation for AI utilization has not declined in industrial fields such as FA and transportation, and the market is expected to expand due to the resumption of the project in the second half of the year. From 2021, mass production of AI-embedded devices and application development will begin in earnest, and it is expected that in 2025, it will be 4.2 times higher than in 2019, at JPY 56.5 Bn.

(Source: Fuji Chimera Research Institute, AI Business Survey 2020)

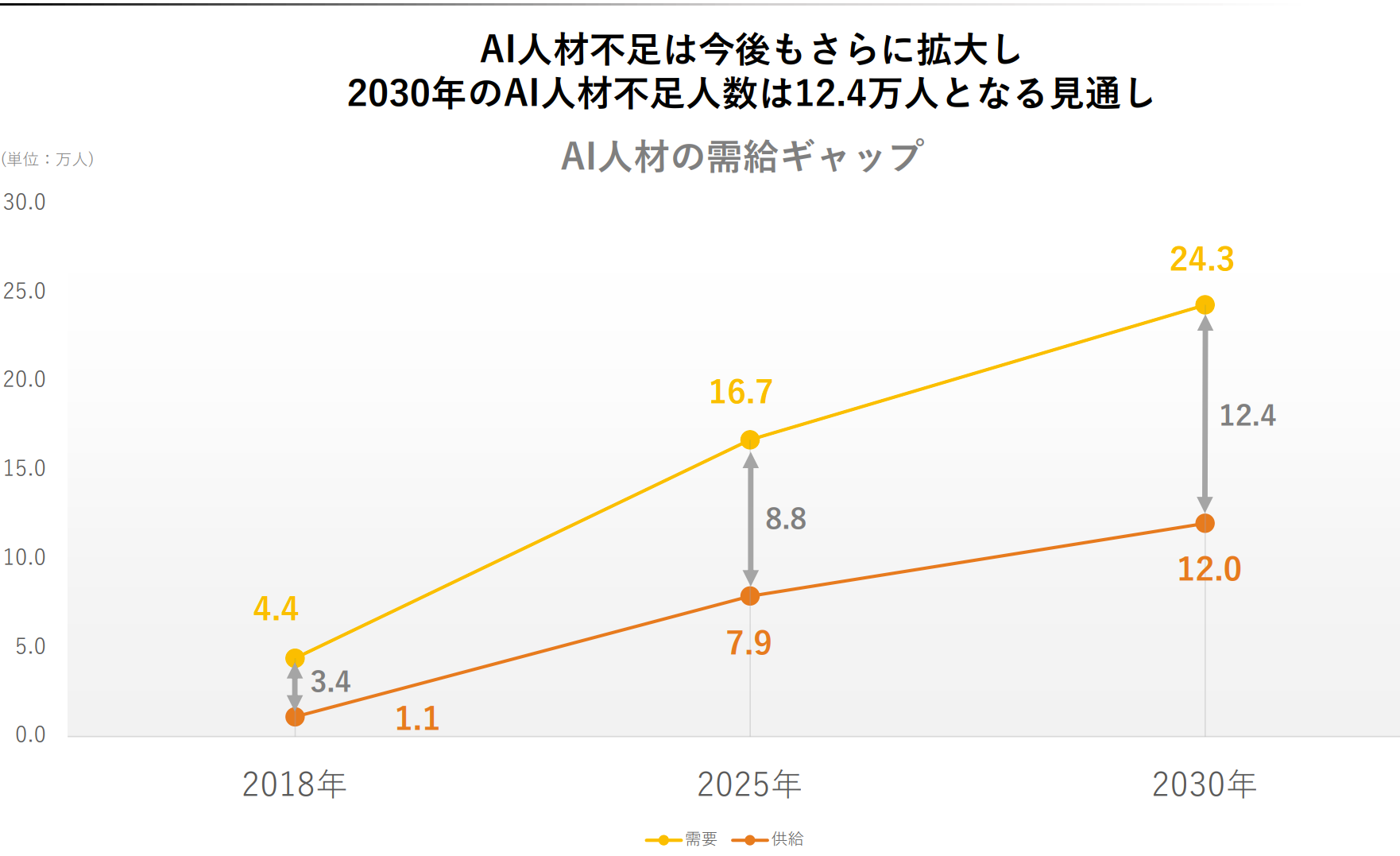

To support the growth of EDGE AI and general AI space, Japan will need many skilled engineers. The below graph illustrates that by 2030, Japan’s AI talent shortage reaches 124,000 engineers. The company is in a sweet spot to train engineers and match up employers with qualified engineers.

Note: Yellow Line, Demand for AI talents, Orange Line, Supply of AI talents

(Source: METI(Ministry of Economy, Trade and Industry) – New Innovation Eco System 2020, taken from EDGI’s growth plan presentation 2/17/22)

6. Strengths and Weaknesses

Strengths

Clear cut growth plan through securing and training AI experts

The company listed the main use of IPO proceeds was for talent acquisition. It is aware that supply of qualified AI engineers is the key performance differentiator.

Weakness

High ownership of the founder/CEO

As shown in the below table, the founder/CEO, Mr. Sumimoto, owns 67% of the company. This is a high number, limiting the liquidity of the stock. However, his ownership was even higher at around 90% of the time of IPO. Thus, it appears that the company is aware of this shareholder concern, and slowly reducing his ownership while controlling the negative impacts of stock selling by him.

(Source: Buffet-code.com)

7. Near-term Selling Pressure

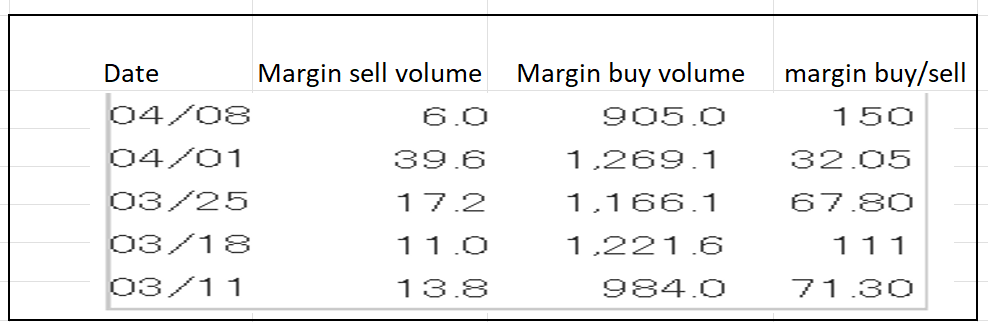

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For EDGE, margin buy/sell ratios is extremely high at 150 as of 4/8. However, margin buy volume is about a day trading volume worth. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance