Forewarning:

I don’t need to remind you that the escalation of the conflict between Russia and Ukraine and the Western sanctions against Russia have raised concerns about supply shortages caused by the inability to export Russian-made non-ferrous metals products, prompting prices of non-ferrous metals, crude oil and natural gas to rise.

Against this backdrop, Dowa’s stock is trading at its historically highs but I believe it will come down once the current violence is controlled (if not resolved). However, tight supply situations of wide range of metals and energy will continue since exports from Russia will not resume immediately. Likely it will not be too late to include Dowa in your portfolio AFTER the stock markets calm down and the stock will resume the ascent based on the long term growth prospect, not on the near term fear.

I am not a big fan of commodity-related stocks since there are many elements of businesses which are beyond management control. However, Covid induced supply disruption and post-Ukraine change in natural resources distribution map will make energy stocks earn a place in your portfolio.

Who is Dowa Holdings?

The mainstay business of Dowa Holdings (“Dowa” or the “Company”) is copper/zinc/rare metal smelting. In addition, the company provides recycling services on scraps from automobiles, consumer electronics, mobile phones. Akita Zinc, a subsidiary, runs one of the largest eletrolytic zinc smelteries in Japan. Dowa also handles soil decontamination and waste treatment services. The company is expanding waste treatment services overseas, mainly in Asia. 43% of sales is generated overseas.

1. Investment thesis

1) Energy sourcing has changed:

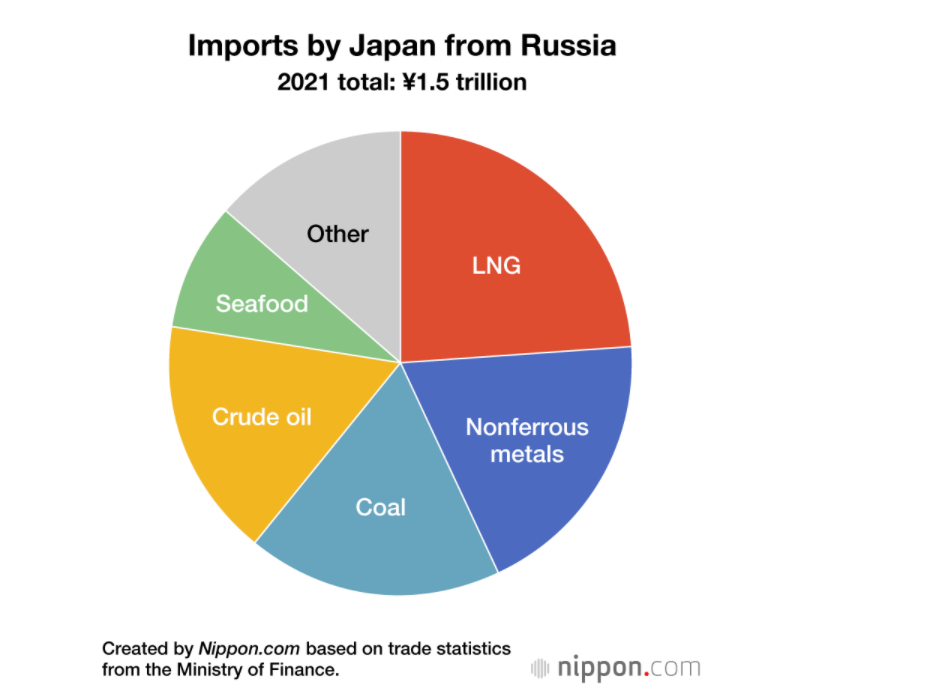

The below pie chart (from Ministry of Finance) visualizes the energy resources Japan imports from Russia in 2021, Japanese imports from Russia rose 34.8% from 2020 to JPY 1.5 Tn which represents 1.8% of total import value of JPY 84.6 Tn. Nonferrous Metals is the 3rd largest resources Japan imports from Russia. If Japan bans Nonferrous Metal import from Russia, demand for Dowa’s recycled metal should rise.

(Source: Nippon.com as of 3/4/22)

2) Competitive advantage:

Dowa’s competitive advantage is its history. Dowa has begun its very first mining operations of the black ore at the Kosaka mine (located in Akita prefecture/North West Japan) The black/copper ore was very valuable, containing a wealth of valuable metals such as silver and gold, but was extremely difficult to process since the ores also contained many impure materials. Through many iterations of trials and errors, Dowa has built refining technologies which enables the company to extract all the metals intertwined in ores. These technologies are the foundation of Dowa’s metal processing/recycling operations.

Dowa has started to apply its experience in mining and smelting to recycling operations as early as in the 1970s. Its strength lies in its ability to offer one stop operation from 1) extraction of metals from scrapped electronic and automobile components, 2) process/treatment of hazardous waste, 3) transportation of waste to the controlled landfill facilities and 4) soil remediation and environmental impact assessment.

3) New growth initiatives:

a) Fastest growth is expected from Dowa’s Electronic Materials business over the next years. The core product in the Electronic Materials Segment has been silver powder which has many industrious applications thanks to its high conductivity. Semiconductors, automobiles and consumer electronics – all of them which are expected to grow – use silver powder-based functional materials.

b) Dowa’s Lithium Iron Batteries (LiB) recycling operations are not yet profitable, but management believes that since it can use the existing heat treatment factories with very little initial investments, its path to profitability is shorter than its recycle competitors.

c) PGM (platinum group metal) prices are surging, so is need for PGM recycling volume. The Company’s competitive edge is in its efficient collection of recyclable scraps.

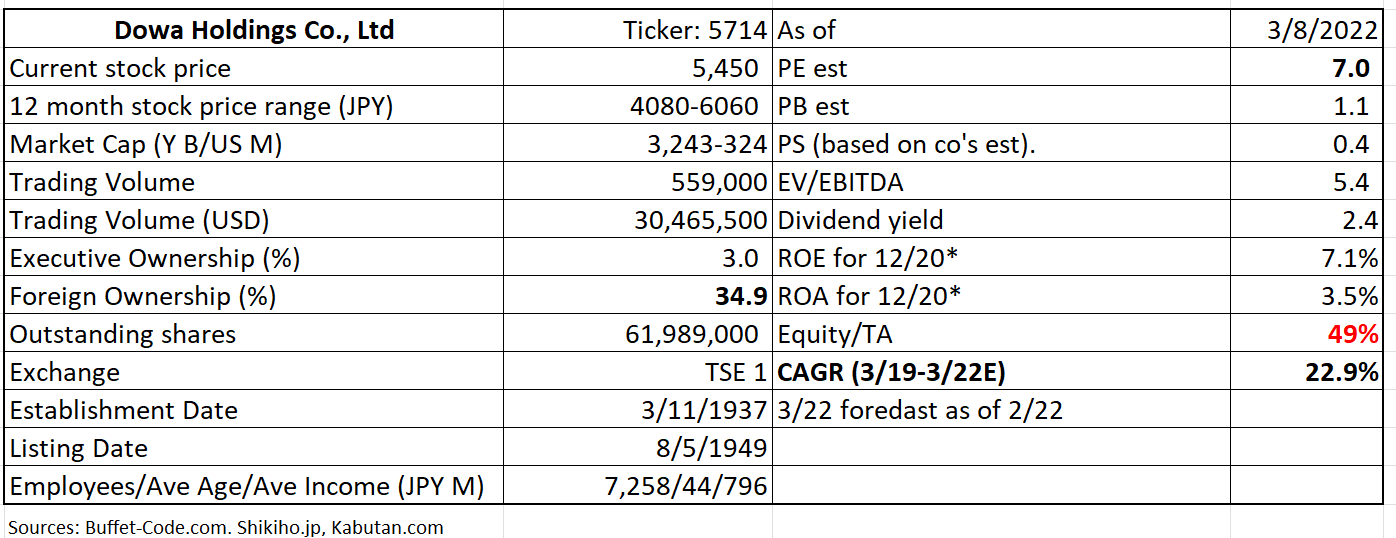

4) Reasonable valuation:

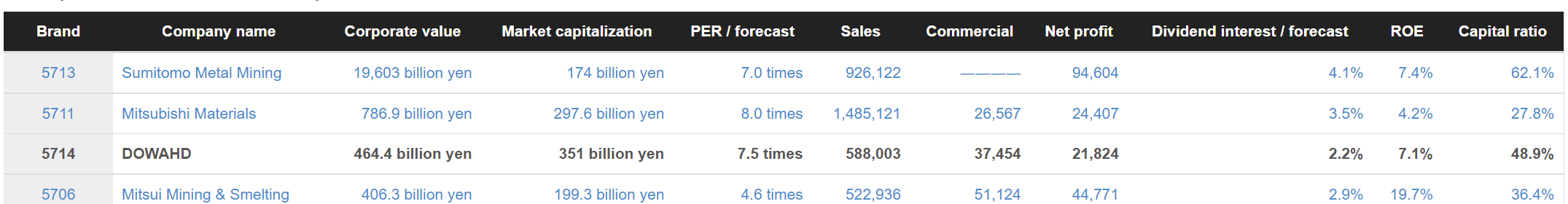

(Source: buffet-code.com)

Note: Commercial in heading should read operating income.

As shown above, nonferrous metal-related stocks tend to trade at mid-single PE due to cyclical nature of their businesses. However, once Dowa’s LiB and Electronic Materials recycle operations scale, multiple expansion should follow.

2. Technically Speaking

The above chart shows that the stock may have started to remove “froth” created by “knee jerk buying” prompted by Russian attack on Ukraine. JPY 5,000 is an interesting price point, since it used to a resistance level, not is the support.

(Source: buffet-code.com)

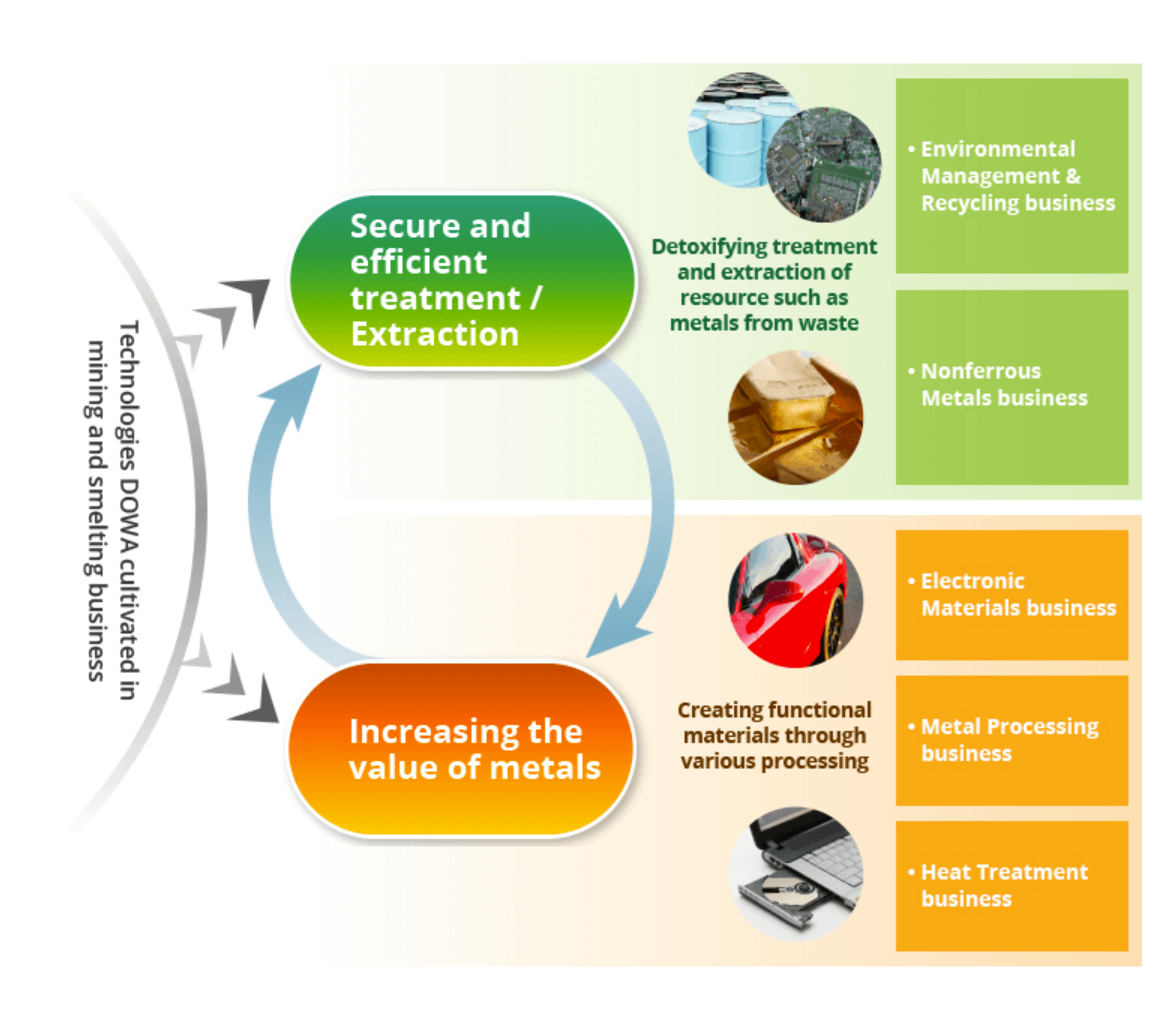

3. Business Model

The below graph is Dowa’s business model which is a cycle of metal production/smelting, manufacturing of high end functional materials and recycle of scraps generated from final products using the functional materials. Recycled metals become part of smelted metal and a new cycle begins.

(Source: Financial results briefing for Q3 ending 12/31/21 for FYE 3/22)

4. Financial Highlights

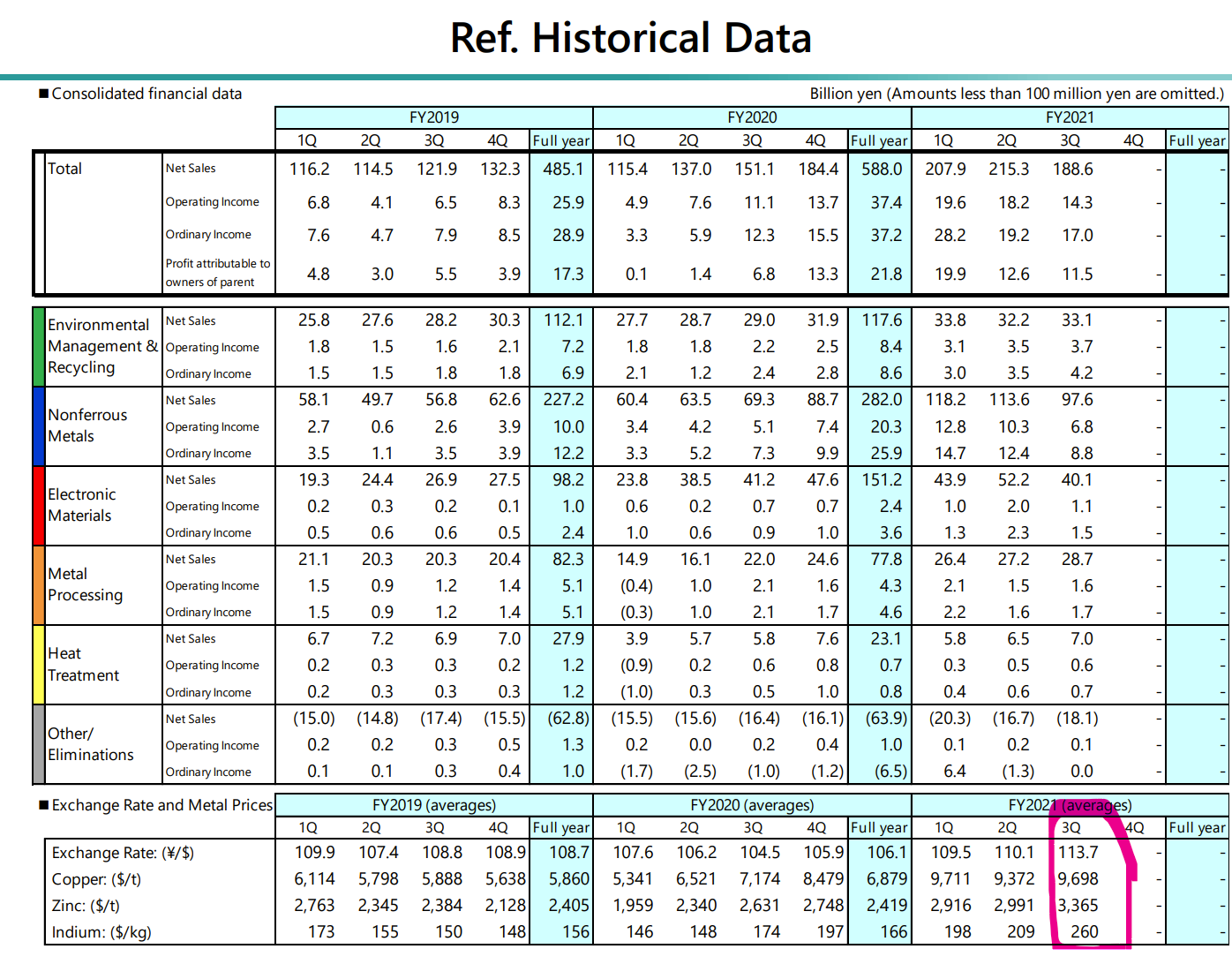

The below table highlight 3-year history of profits and losses. As the prices of metals have firmed up, both sales and profits of Dowa have appreciated meaningfully. The first three quarters of FYE 3/22 have already surpassed a full FY 2020 top and bottom lines.

(Source: Financial results briefing for Q3 ending 12/31/21 for FYE 3/22)

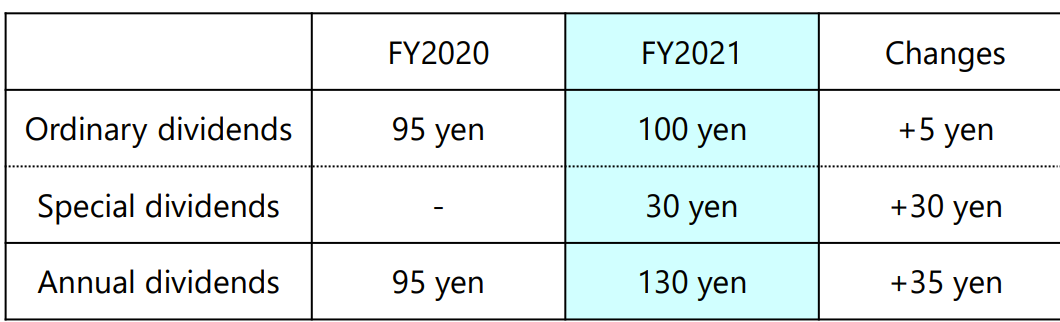

The company upward-revised its FYE 3/22 guidance after its equity based subsidiary announced their earnings. It also increased its dividend payout and announced special dividends to reflect strong financial results as follows:

(Source: Financial results briefing for Q3 ending 12/31/21 for FYE 3/22)

5. Total Addressable Markets (TAM)

(Source: Processed Nonferrous Metal Global Market Report 2021 issued by Business Research Company as of 12/2020)

The below report is as of 12/2000 thus is bit stale. However, it illustrates the underlying and sustainable demand for nonferrous metal. Now that shipment of many natural resources from Russia is banned and price of nonferrous metal will likely range in higher pricing band in the near future.

The global processed nonferrous metal market is expected to grow from $1,216.94 Bn in 2020 to $1,263.62 Bn in 2021 at a compound annual growth rate (CAGR) of 3.8%. The growth is mainly due to the companies rearranging their operations and recovering from the COVID-19 impact. The market is expected to reach $1,611.83 billion in 2025 at a CAGR of 6%.

Asia Pacific was the largest region in the global processed nonferrous metal market, accounting for 73% of the market in 2020. Western Europe was the second largest region accounting for 10% of the global market.

Rapidly growing urban populations are expected to drive the demand for nonferrous metal products in the forecast period.

In sum, demand picture is friendly for Dowa’s mid-term horizon.

6. Strengths and Weaknesses

Strengths

Dowa’s business model of being able to smelter AND recycle with many value adding activities in between is its main strength.

Weakness

1. Cyclical business prone to metal price fluctuations:

As you can see in the previous financial highlight section, there is direct correlation between Dowa’s profitability and price of nonferrous metals. It is impossible to offset these price volatility. The company has implemented the mitigating measures:

1) As the company which is engaged in a full cycle of metal operations (from processing to recycling), Dowa can control its input prices somewhat.

2) The company is increasing its presence in high growth/high margin electronics material businesses, although the group’s contribution is still small at this point (8% of first 9 months’ operating profits for FYE 3/22).

2. Possible slow down in Heat Treatment segment:

There is a widely held belief that the proliferation of EVs will reduce the number of automobile parts which require heat treatment. However, the number of auto production (EVs and combustion engine vehicles combined) will rise, limiting a decrease in heat treatment demands. Management is aware that the mix change of cars in the market will introduce the change in auto parts which require heat treatment. Thus, they will develop heat treating technology which will be aligned with the shift in treated auto parts. This “development” capability is its competitive advantage.

8. Near-term Selling Pressure

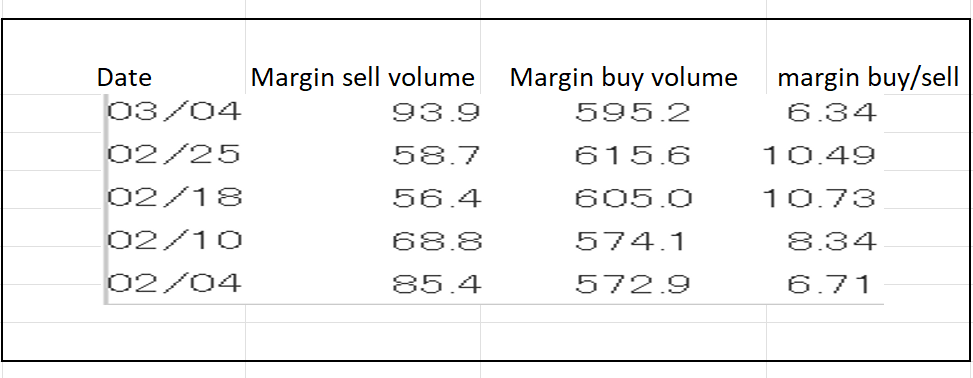

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Dowa, margin buy/sell volume is high at 6-10 vs. 3-4 viewed acceptable. However, current margin buy volume of around 600,000 shares can be absorbed in one day, thus, not a cause for a concern.

Margin trading unit (1,000):

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance