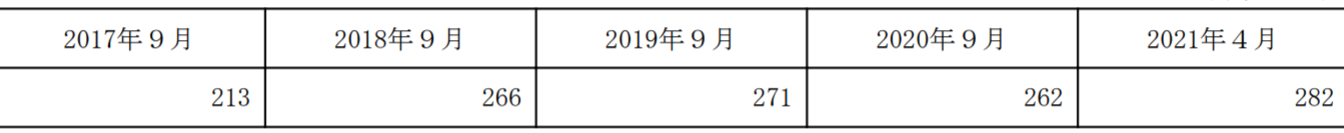

Decollte Holdings (“DE” and the “company”) is engaged in management of photo studio business that provides Photo Weddings and various anniversary photo services, and fitness business. With a solid Q1 for FYE 9/22 behind them, the company is on its way to achieve its full year sales goal of 20% increase over 2021 sales level.

DE’s business model is simple:

1) The company operates wedding photo business under the Studio brands.

2) Its anniversary photo brand consists of Hapista; and

3) Its sports gym brand consists of DE&Co (fitness business’s contributions on sales and profits are negligible).

Caution: Decollte is a micro-cap stock, thus, shares can be very volatile.

Note on my heading!

Why can a photo studio support family creation and provide a help in reversing population decline?

In Japan, many women tend to hold off becoming pregnant until they are married. It is a fact. Therefore, company such as DE which provides an alternative for expensive physical weddings can convince budget minded women in going ahead with commitments.

1. Investment thesis

1. Large TAM (total acceptable markets)

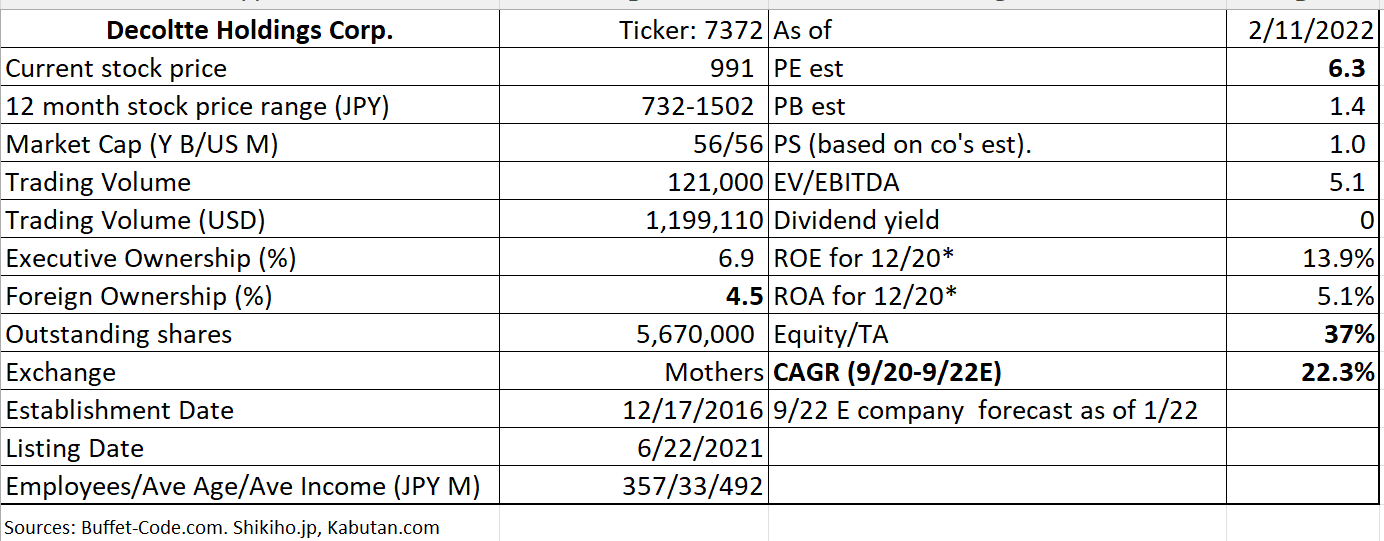

We have not been able to locate a photography industry market size in Japan. DE has been redefining itself as a “life cycle photo company” and targets to access the entire photography industry, not limiting to marriage related occasions.

The below diagram (sorry, in Japanese) lists examples of life moments which one wants to capture by taking professional pictures. For example, a maternity photo market size (left most bubble) is estimated to be JPY 17 Bn (USD 170 MM). 4 bubbles in the lower row read: kids photo (JPY 123 Bn/USD 1.23 Bn), Coming-of-age ceremony (JPY 93 Bn/USD 930 MM), Pets (JPY 190 Bn/USD 1.9 Bn) and Senior Birthdays (main one is 60 years of age, JPY 111 Bn/USD 1.1 Bn). In total, the company estimates that its to total accessible photo market is as large as JPY 1 Tn/USD 10 bn.

(Source: Q1 Financial Results Briefing for the Fiscal Year Ending 9/2022)

Actual addressable markets may not be this sizable. Nonetheless, with JPY 54.94 Bn (USD 549 MM) sales expected FYE 9/22, the company can continue to grow via studio expansions.

2. There are many ways to tie the knot

a) Many couples are opting out of costly ceremonies

(Based on the Japan Times, 11/23/21 article)

A Meiji Yasuda Life Insurance Co. survey released on 11/15/21 showed that 58.8% of newlyweds who tied the knot since the start of October 2019 did not have a wedding ceremony while 68.8% said they did not go on a honeymoon.

The survey was conducted online from Oct. 12 to 15 and 1,620 people from their 20s to 70s responded.

According to another survey conducted by Recruit Co., the publisher of bridal magazine Zexy, the average cost of weddings and receptions held between April 2020 and March 2021 was ¥2.92 million ($30,000) per couple, down ¥700,000 ($7,000) from the previous year.

The figure was the lowest since the survey was first conducted in 2005, with many couples scaling down their ceremonies and spending less than they had originally planned.

The above survey results were undoubtedly influenced by Covid impacts. However, the trend of re-directing wedding expenses to other items such as furniture and other memories (honeymoon – when the travel becomes available) may continue.

DE is the major beneficiary. A photo wedding can reserve the memory and bridal experiences but still leave sufficient funds for other experiences.

b) Rising demand for pre-ceremony photo sessions

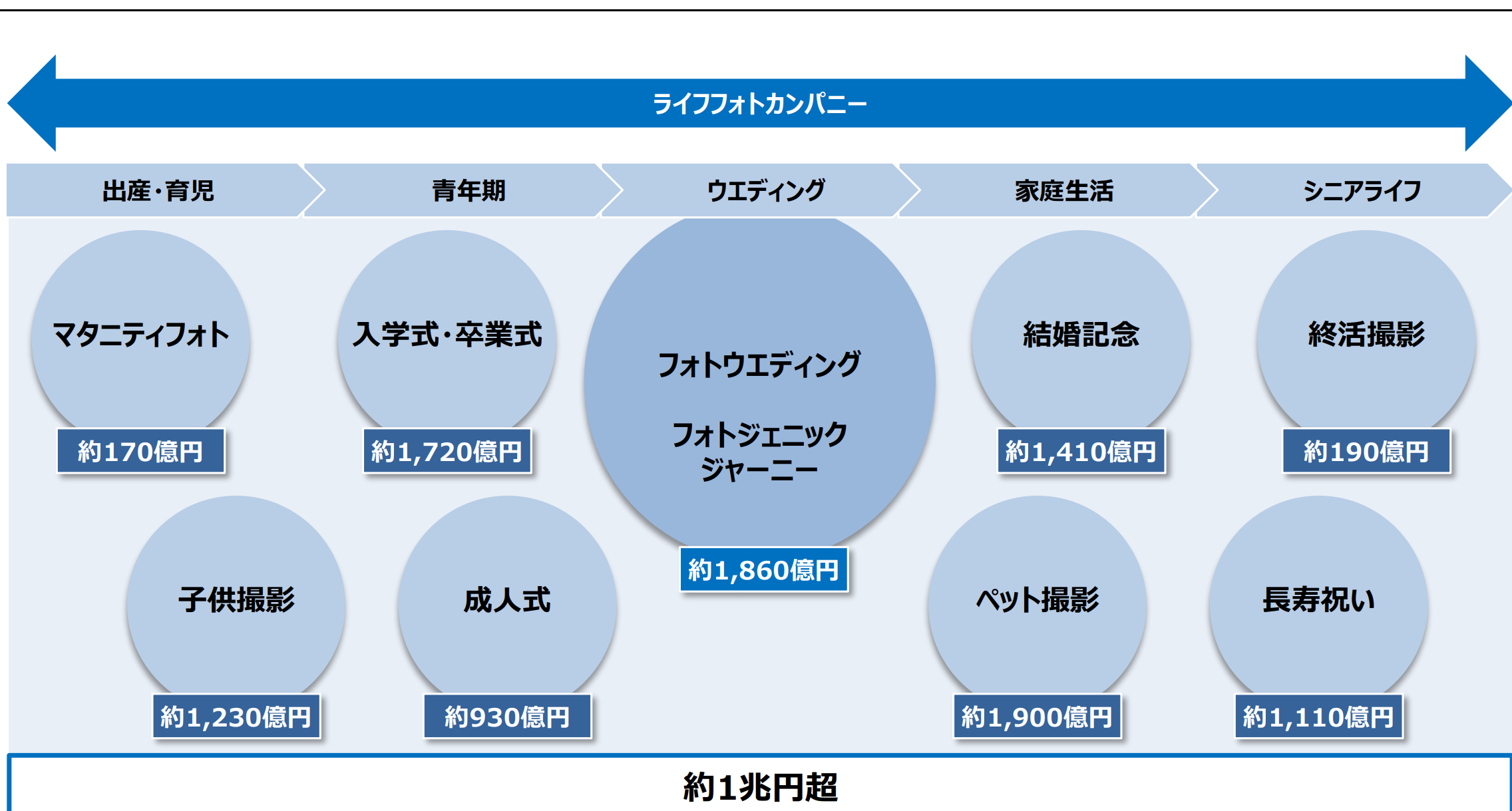

The below graph indicates that, in 2021, 71% of wedded couples ordered pre-ceremony photo sessions in addition to actual ceremony pictures. Reasons are:

1) They wanted to enjoy professional photo sessions without being occupied by greeting with the guests.

2) They wanted to create memories under creative settings, such as dressed in costumes and at exotic virtual/actual background locations

(Source: Marriage Trend Survey for 2012-2020 published by Zexy Marriage Trend Research – Recruit Marketing Partners, taken from IPO filing report as of 5/17/21

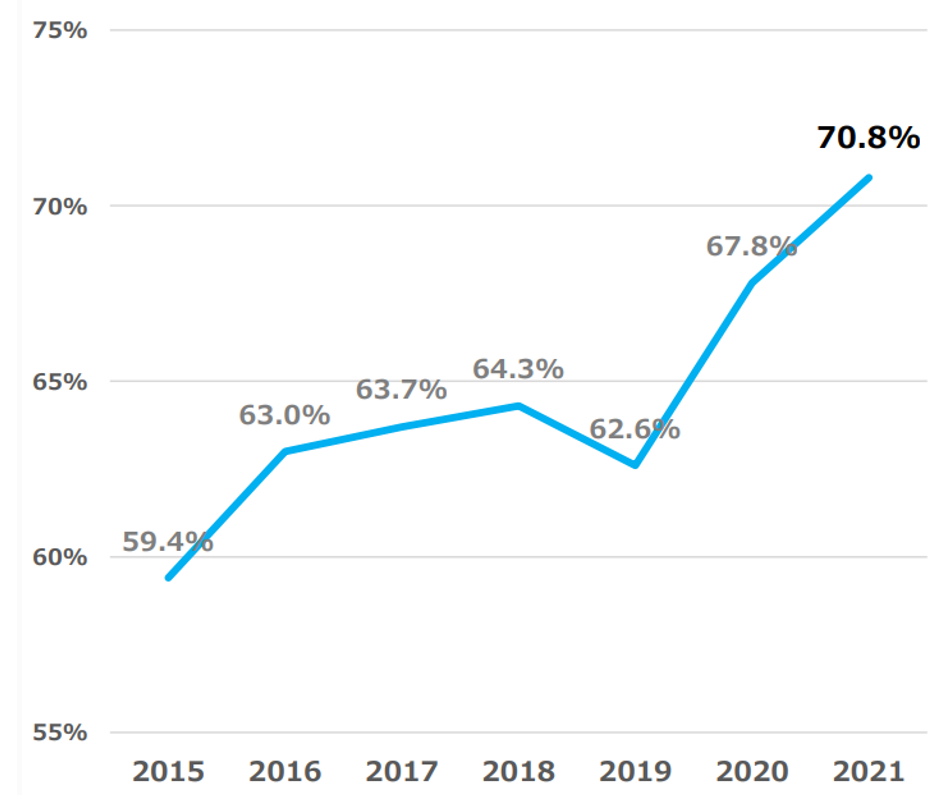

3. In-house operations to ensure quality control

a) The company DOES NOT outsource services of photographers and makeup artists so that the quality of a bridal process is controlled to be high and consistent.

As shown below, the number of the photographers and makeup artists is increasing.

(Source: IPO filing report)

(Source: IPO filing report)

Based on 24,000 wedding photo/year experience, DE has created various background settings on its own studios. Also, wedding dresses and suites, which are all made in-house, reflect most trendy styles, yet, are priced reasonably.

b) Centralized back office operations support many studios spread out in Japan, realizing scale benefits.

4. Competition – limited

Wedding photos are typically handled by “photographers for hire” who tend work under freelance contracts with wedding venues. Through its in-house operations, DE can offer unique benefits of one stop shop for a wedding package.

5. Cost effective marketing

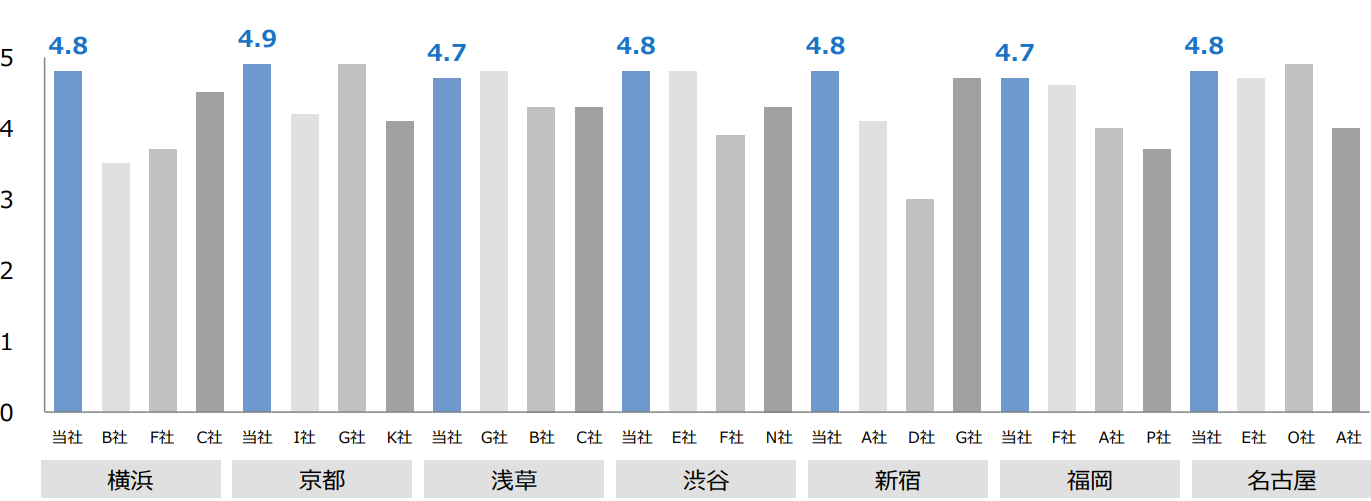

90% of customers sign up with DE’s services at its website. The traffic is driven through Google search and words of mouth. This low cost marketing can be achieved since the company enjoys good customer reviews. The below bar chart highlights 5-1 customer surveys for major metropolitan studios (from left, Yokohama, Kyoto, Asakusa, Shibuya, Shinjuku, Fukuoka and Nagoya). 5 is being the most satisfied. For all locations, DE ranks at a top vs. three peers in the particular locations.

(Source: Q1 Financial Results Briefing for the Fiscal Year Ending 9/2022)

2. Technically Speaking

(Source: buffet-code.com)

The above chart shows that the stock has taken over JPY 960 which was the top of lower price box. The next resistance level is around JPY 1,344, a 40% away.

3. Financial Highlights

The company operates in one segment: wedding photo studio business since fitness operations generate a meager 1.5% of total sales. Anniversary photo business is still at its nascent stage thus only accounts for 0.6% of photo studio operations.

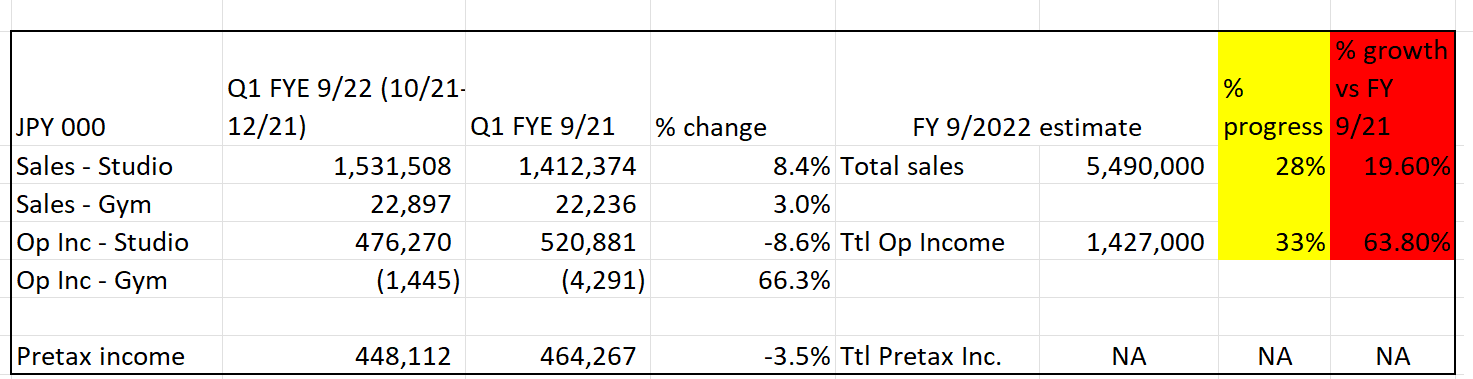

(Source: Q1 Financial Results Briefing for the Fiscal Year Ending 9/2022)

The two new studios which were opened in 2nd half of FYE 9/21 contributed to sales growth in Q1 FYE 9/22 and total sales were up 8% vs. sales of Q1 FYE 9/21. Q1 sales was 28% of total planned sales for the full year 9/22 estimate, slightly ahead of the plan (Q1 sales should be at least 25% of annual sales). The company is planning to open 4 new studios for FYE 9/22 and investing in new hires, training and equipment installment. These upfront investments pressured operating income, with studio operating income for this quarter was down 9% from the same quarter last year. Still Q1 operating income is 33% of annual plan (thus ahead of plan). With a solid Q1 for FYE 9/22 behind them, the company is on its way to achieve its full year sales goal of 20% increase over 2021 sales level.

Note: The company has adopted IFRS accounting principles under which studio rent expenses are recorded as “depreciation expenses”.

4. Strengths and Weaknesses

Strengths

1. In-house operations

Well trained photographers and makeup artists ensure the quality and consistent supply of products.

2. Growth strategy-Logical

As discussed in investment thesis 1, the company is expanding its addressable markets from a pure bridal industry to a long term life cycle memory creation.

Weaknesses

1. Large goodwill amounts

The largest shareholder – Cas Capital Fund No. 6 acquired 29.72% of DE in 2017, and goodwill in the amounts of JPY 5,635,875 (52% of total assets) was realized. IFRS does not require goodwill to be amortized. Thus, the amount remains on balance sheet, inflating assets.

Mitigant: The company estimates that there is very little asset impairment risks even if the company does not grow at all for the next 5 years.

2. Growing pains

The company is at the early stage of growth. Similar to a retail business model, the company will grow as it opens new studios. A new photo studio opening requires upfront investments such as hiring/training of photographers and makeup artists and acquisition of dresses and equipment. For example, the company spent JPY 33 MM ($302,000) to prepare for the last two studios.

These expenses have large negative impacts since the company’s top line is still relative small. However, as the company’s top line continues to grow, the relative impact of capital expenditures should become smaller.

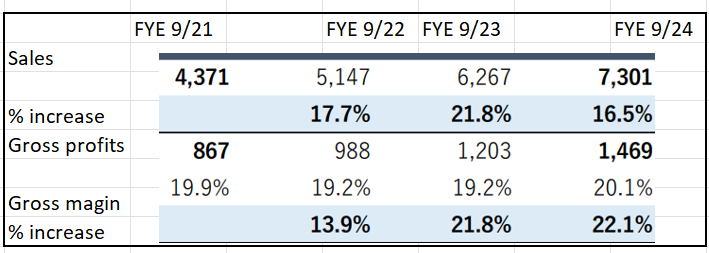

The company’s 3 year growth plan clearly shows the benefits of an increasing scale:

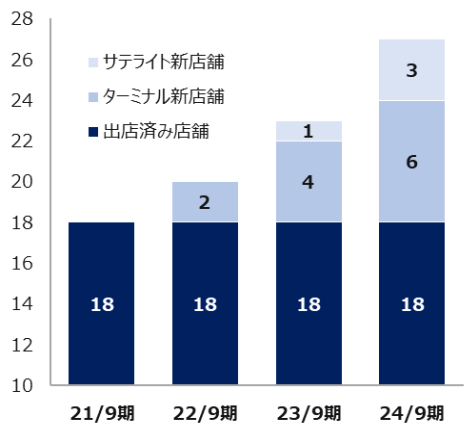

DE has the following expansion plan for studios. 18 existing studios (dark blue), 6 new terminal studios (light blue) and 3 new satellite studios.

(Source: Q1 Financial Results Briefing for the Fiscal Year Ending 9/2022)

Terminal Studios: Studios located in large metropolitan city locations, typically near major train stations with heavy passenger traffics. Annual sales: JPY 400MM ($4MM).

Satellite Studios: Studios located along the train lines which travel through the large city central train stations. Annual sales: JPY 200MM ($2MM)

The above expansion will be translated into an initial decline of gross margin since new store will not generate sufficient sales to offset necessary upfront capex. However, as the time progress, profitability contribution of these new studios will offset expenses and gross margin is expected to improve from 19.9% in FYE 9/21 to 20.1% in FYE 9/24.

(Source: Q1 Financial Results Briefing for the Fiscal Year Ending 9/2022)

5. Near-term Selling Pressure

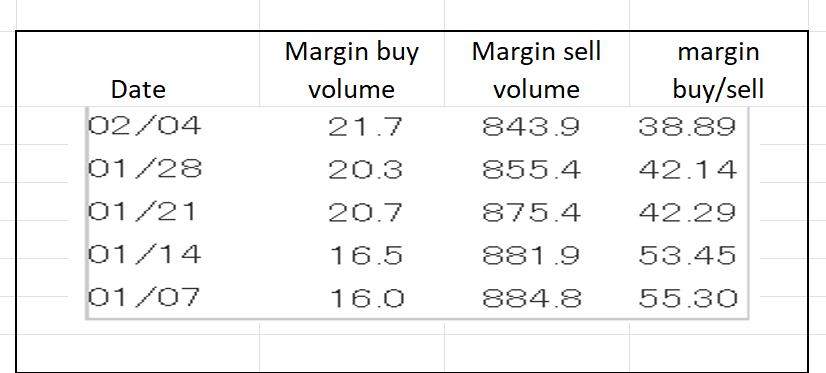

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin sell volume is high and rising, that will function as the near-term selling pressure. For DE, margin sell/buy ratio is extremely high at 39x for the week ending 2/4/22. Thus, the stock’s upside move will be very gradual. It should be noted, however, the margin sell/buy ratio has steadily declining from 1/7/22 when the ratio was 55x.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance