Since their inception in the 1970s, these stores have evolved beyond their initial role as simple retail outlets. They have transformed into a vital part of the social infrastructure that offers a wide array of services, including financial and administrative ones.

These stores, often referred to as “CVS”, provide a variety of fresh, high-quality products at everyday fair prices, ranging from groceries and household items to cosmetics. The food selection is particularly noteworthy, offering a broad array of meals, snacks, and sweets. Popular items such as onigiri (rice balls) and oden (hot soup dishes) are readily available.

The market is dominated by three major players: 7-Eleven, Lawsons, and Family Mart. Each offers their own unique selection of products and services, catering to the diverse needs of their customers.

The mature industry

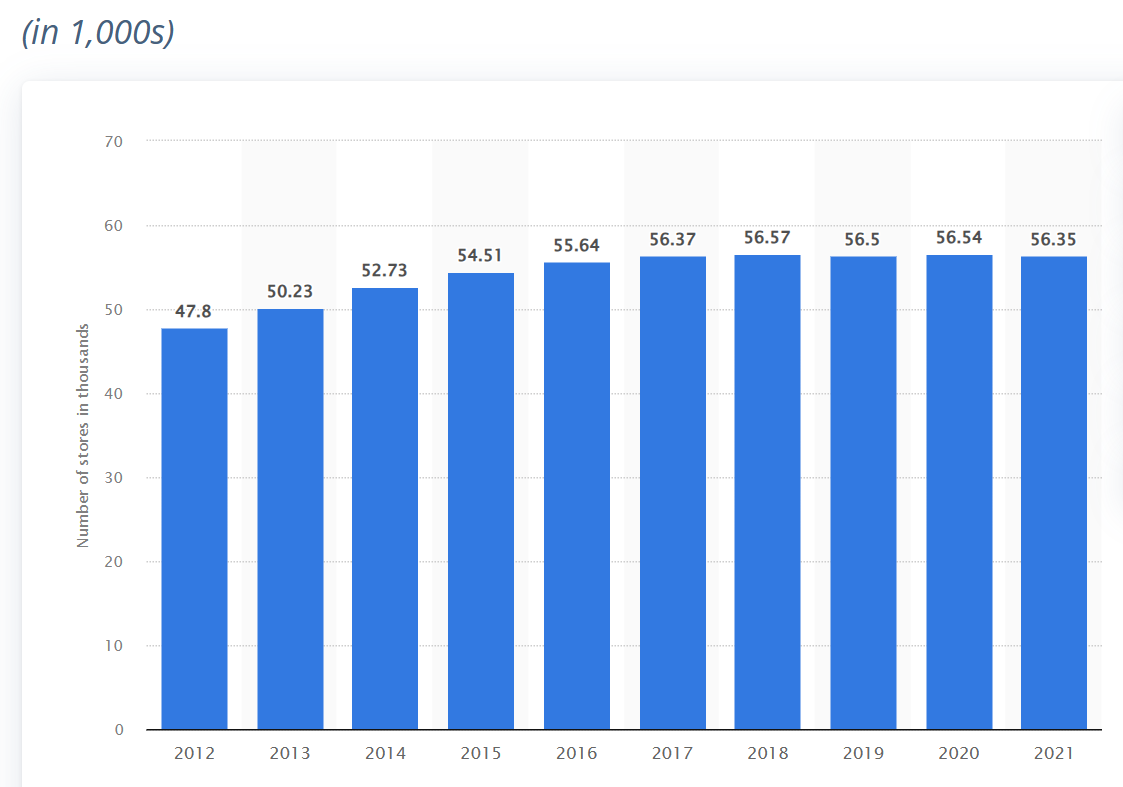

However, the market appears to have reached a point of saturation. The number of convenience stores in Japan jumped from 6,308 in fiscal 1983 to 58,340 in fiscal 2018, but then fell to 56,350 stores in 2021(per Statista). With the current Japanese population standing at 123 million, this translates to one CVS for every 2,000 people. Given that Japan’s total retail sales exceeded ¥150 trillion, and CVS accounted for around 8% of total retail sales, it can be concluded that the Japanese CVS industry is indeed saturated.

(Source: Statista: Convenience store numbers in Japan 2012-2021 dated 8/28/23)

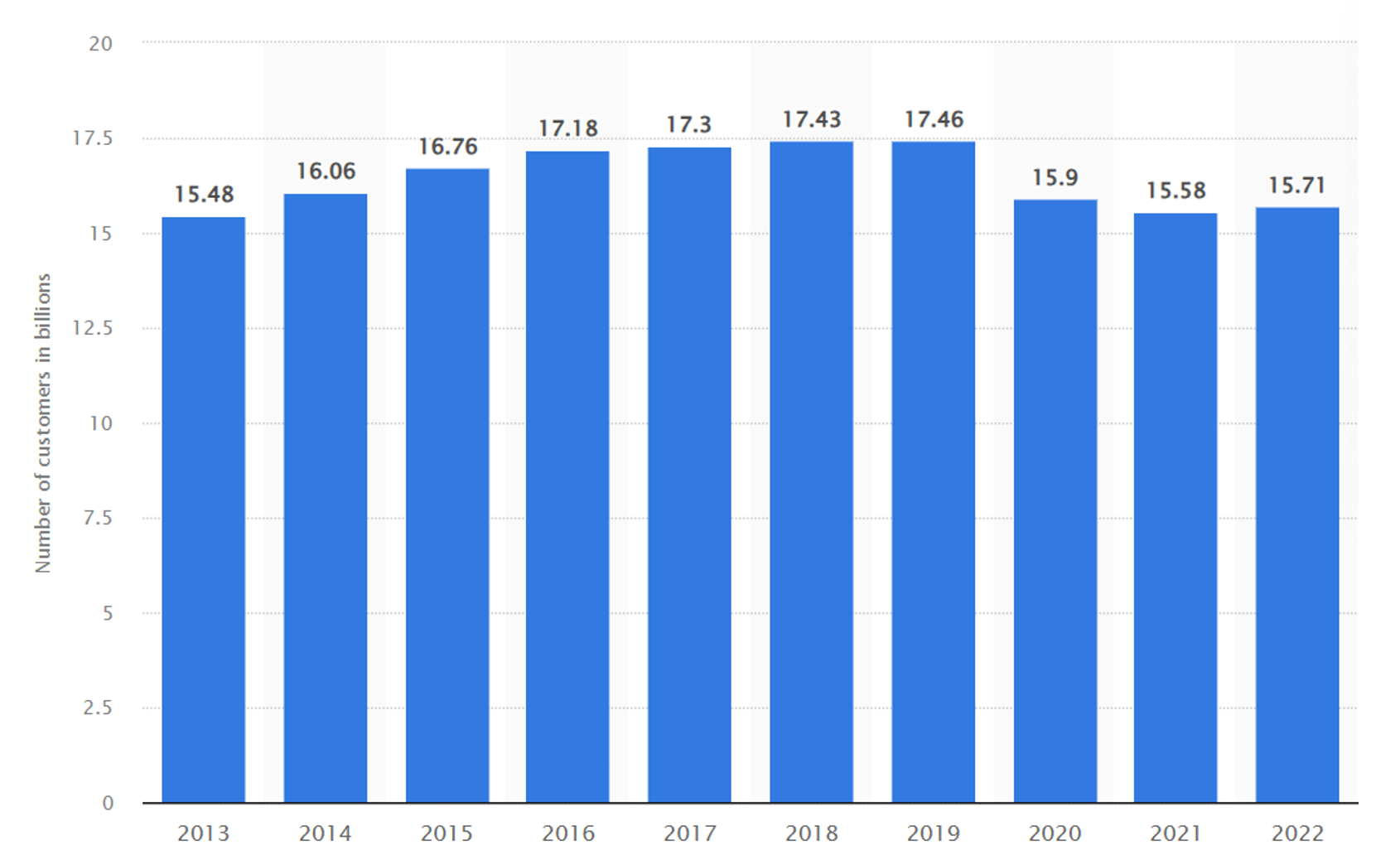

Against this maturing industry back-drop, the below chart highlights a declining trend in CVS customer visits. A sharp traffic drop in 2020 was due to a prefoliation of Covid-induced work-from-home arrangements. Many workers trend to frequently stop by a CVS during office hours for a quick snack or an easy-to-eat lunch. It is not clear that how many of these work-related-transactions will come back post-covid era.

(Source: Statista: Number of convenience store customers in Japan 2013-202, dated 4/19/23)

This saturation and a declining trend in customer visits has led to a state of oligopoly. As of October 31, 2023, there were 21,483 Seven-Eleven stores, 16,519 Family Mart stores as of September 30, 2023, and 14,601 Lawson stores as of March 2023. These three leaders account for more than 90% of the CVS market in Japan.

These remaining “three majors” enjoy sound financial backing: Seven Eleven is owned by the retail behemoth “Seven & I”, and Family Mart and Lawson are owned by global trading houses, Itouchu and Mitsubishi Corp, respectively.

The growth paths forward.

Looking forward, the CVS industry is facing challenges, yet its future holds promising opportunities. The three market leaders are trying to maintain, and even expand, their sales by adapting to these challenges and innovating to meet changing consumer needs.

- Demographic shift

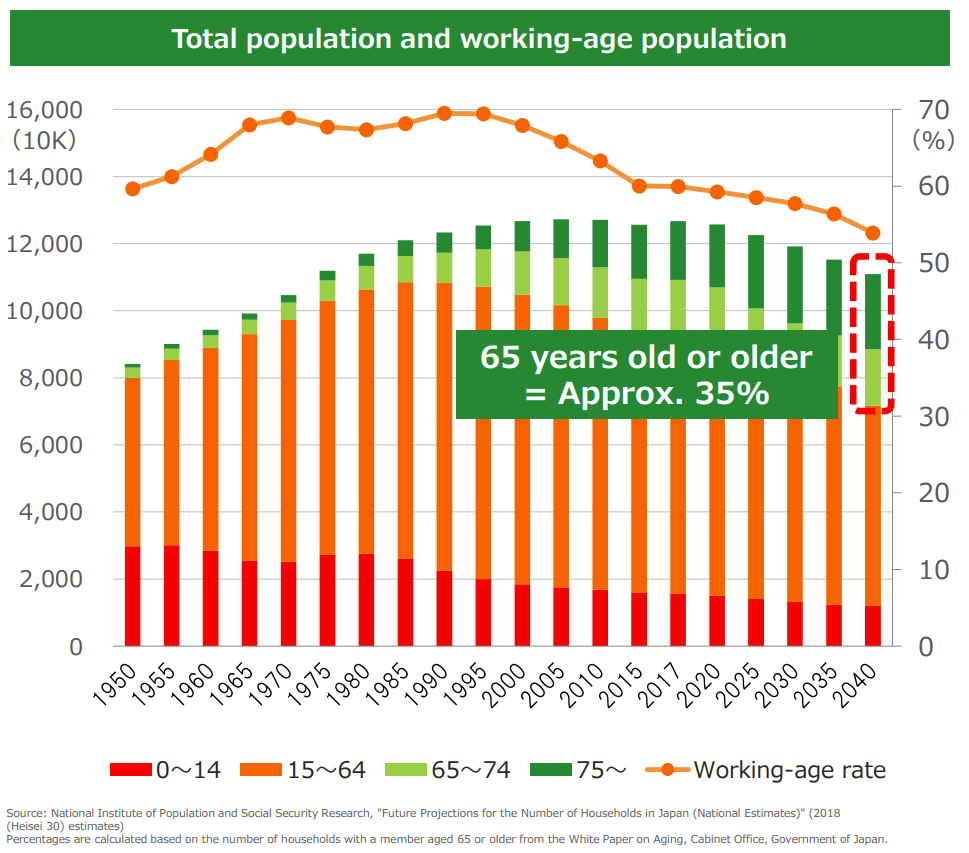

Any retail industry discussion in Japan cannot be done without referring to a major demographic shift. The below graph clearly depicts shrinking and aging of population. In 2040, the total population will decrease to approx. 110 million (with 35% being over 65 years old).

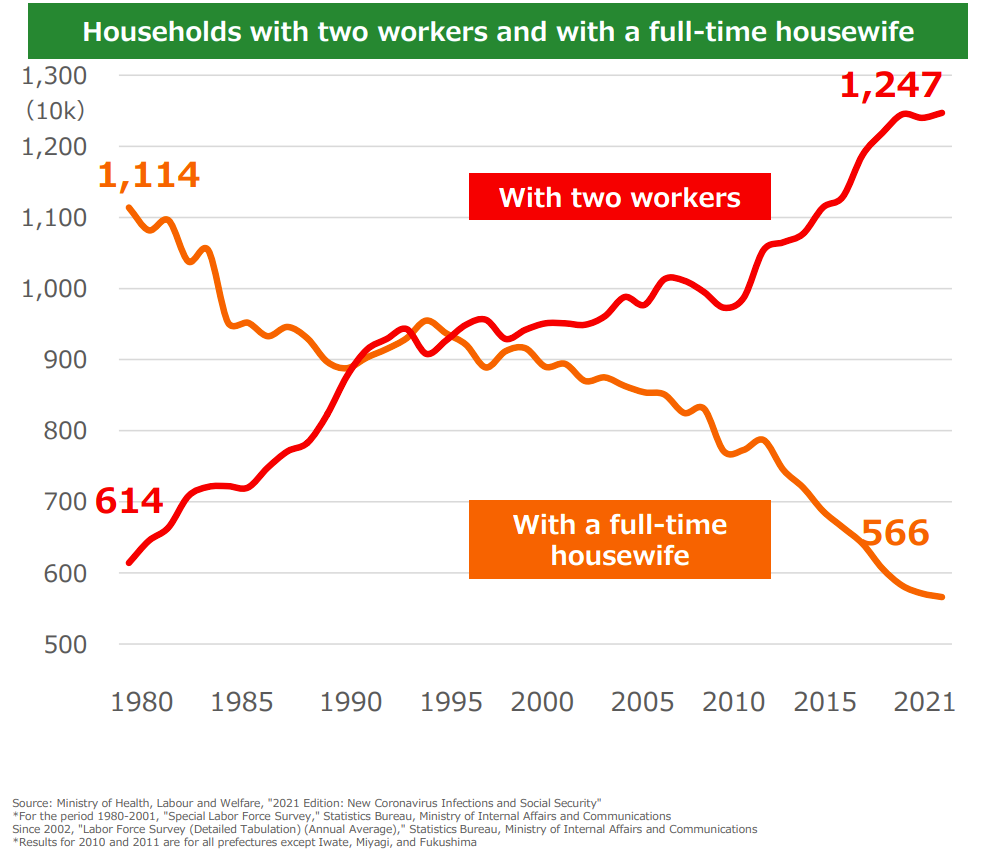

In addition to a shift in demographics (a decline and aging of the population), 4 in 5 women in their early 30s are now working according to the “Annual Health, Labor and Welfare Report 2020” released by the Ministry of Health, Labor and Welfare. The number of double income households continues to rise, reaching 12.47 million in 2021.

(source: Seven&I)

In the context of the current social landscape, the prepared meal industry is poised to benefit from several trends:

- The aging population is increasingly opting for meals that are easy to procure and prepare.

- The country’s marriage rate is decreasing, leading to a higher number of single-person households, who tend to cook less than larger households.

- As more women enter the labor market, there is less time available for cooking and shared meals. Time-constrained dual-earner households also prefer ready-to-eat meals that can be conveniently purchased.

The prepared meal industry highlights

Statista highlighted some key points in their 10/23 update:

- The revenue in the Ready-to-Eat Meals market in Japan is expected to amount to US$63.13 Bn in 2023

- The market is projected to grow annually by 1.09% (CAGR 2023-2028).

- The retail sales of home-meal replacements are forecast to grow to about ¥9.6 Tn in fiscal 2025.

This rising tide toward home-meal replacing products has not escaped the other food retailers, such as grocery stores and department stores. Thus, it is critical for CVS industry to differentiate their offerings.

For instance, Seven&I, in collaboration with its manufacturing ally, Warabeya*, has strategically decided to concentrate on enhancing their meal offerings. The primary products of these ready-to-eat food providers typically include cooked rice and daily dishes such as lunch boxes, rice balls, sandwiches, croquettes, and vegetable salads.

One of their key current initiatives is the expanded offering of frozen ready-to-eat meals. This not only caters to the growing consumer demand but also facilitates inventory management due to the longer shelf life of frozen meals, thereby accommodating bulk purchases. Warabeya is actively working towards augmenting its product lines of frozen meals.

Furthermore, Seven&I is planning to boost the production and distribution of its own brand products, demonstrating a commitment to providing high-quality, convenient meal options for its customers.

*Warabeya is indeed a manufacturing partner with Seven&I accounting for almost 80% of their sales. My company report on Warabeya will be posted here shortly.

No one can predict the future. However, we can’t forget that Japan is known for its fortitude in improving food technology. The CVS majors backed by their financial resources are expected to persistently introduce new products. This continual innovation should serve to bolster their sales in the foreseeable future. After all, instant noodles were indeed originated in Japan. The first instant noodles were launched in 1958 by Nisshin Foods.

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance.