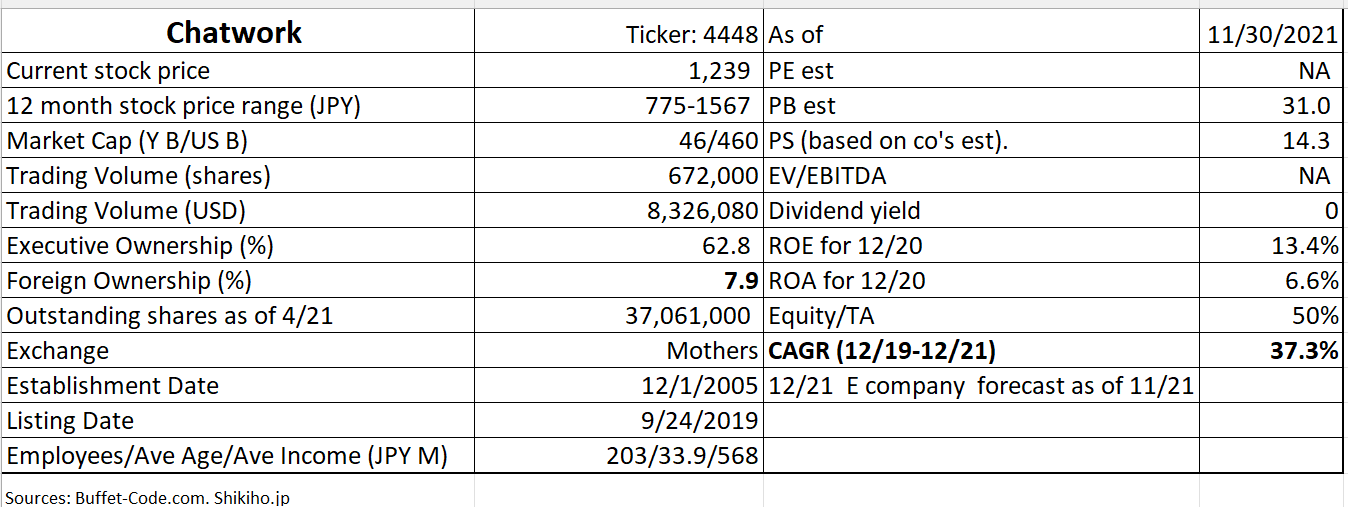

Chatwork Co., Ltd (Ticker: 4448): Japanese Slack and a pure play!

Ever since Salesforce acquired Slack for $27.7 Bn in 12/20, I have been looking for a Japanese version of Slack. Salesforce finds a growth potential in messaging apps, correct? Chatwork is a leader in Japanese messaging app space. On top of that, it is a standalone company, not like Slack and Teams (which is of course owned by Microsoft). Thus, if you would like to benefit solely from a rapid growth of business messaging industry, Chatwork is the stock for you.

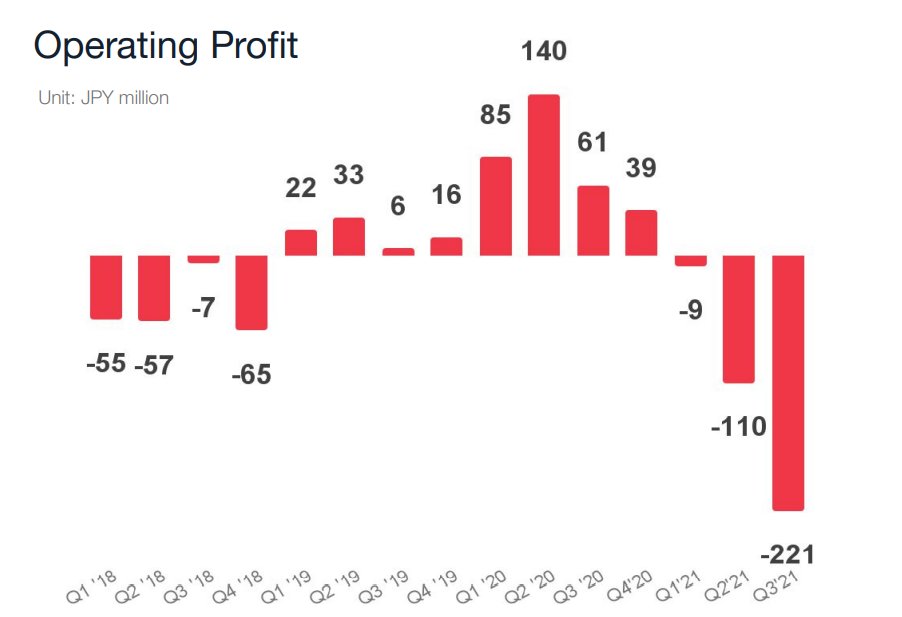

However, the stock was harshly punished when the company reported losses in Q2/21. Chatwork explained that these losses were caused by high upfront investments in marketing and new hires to support future growth. However, investors got concerned that the company would be over-spending since its ARPU (average revenues per user) was relatively low at JPY 464/month.

Chatwork is running on a SaaS business model for which investors are rather accepting of early year net losses. In fact, Freee has never generated profits and Slack’s GAAP operating loss for FYE 3/21 was $283.1 MM (granted this was a substantial improvement to a $588.3 MM loss in FYE 3/20). In case of Chatwork, incurring net losses was damaging to the story, since it was net profit positive in 2019.

Chatwork’s stock is now trading at around JPY 1,250, recovering from JPY 755 reached in this summer. What drove the stock higher was smaller net losses guided for FYE 2021, thanks to better controlled expenses.

Thus, the investors are sensitive to the long-term strategic value of the company’s investment. I would focus on analyzing the soundness of their investments.

1. Who is Chatwork?

Chatwork (“Chatwork” or the “company”) is a pioneer in business chat, with the largest number of users in Japan and adopted by more than 332,000 companies. Its mainstay product “Chatwork” boasts user-friendly handlings with a simple user interface, allowing other companies’ services to link with it. In addition to the basic chat function, the company can offer other packages, including task management, file sharing, video conferences, telephone answering. The services can handle other languages such as English, Chinese, Vietnamese and Thai.

2. Investment Thesis

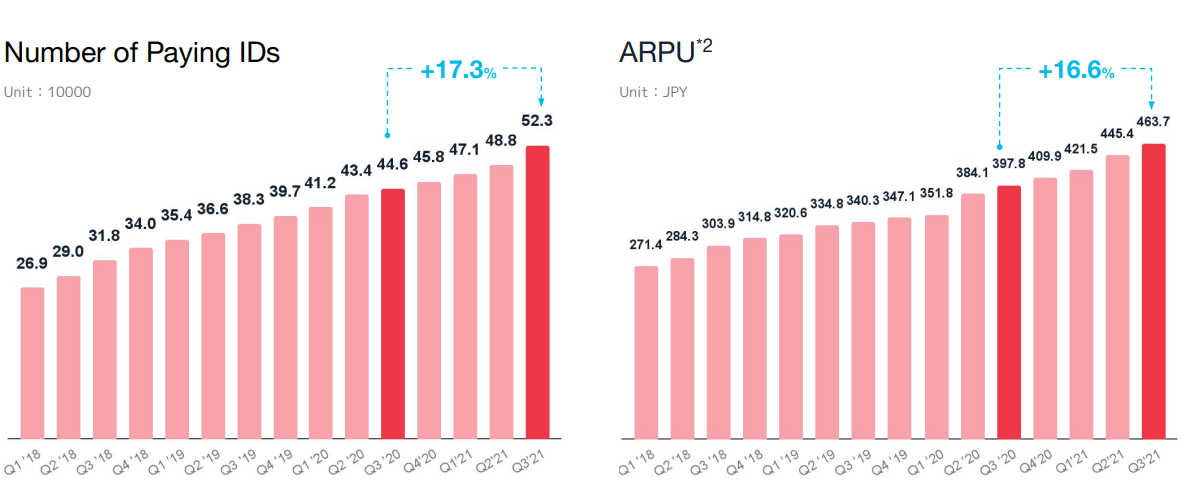

1) Leader in growing industry. Business chat in Japan is expected to grow at CAGR of 12% for next 5 years, as discussed in TAM section. As shown below, paying customer IDs and ARPU (average revenues per user) in Q3 21 have rose 17.3% and 16.6%, respectively, compared to Q2 21. The company’s top line is expected to rise at CAGR of 37% for 12/19-12/21.

(Source: Presentation Material for financial results of Q3 of FYE 12/21)

2) With Q3/21 earnings announcement, the path to profitability is clarified. CFO, during the earnings call, noted that the company would manage the delicate balance between customer acquisitions and expense control and plan on regaining its profitability within the midterm business plan period (2021-2024)

3) Chatwork is a SaaS company, which enjoys the steady sales stream, and was already net income positive once. This ARR (annual recurring revenues) focus business model tends to command higher stock multiples such as price to earning ratio.

Note on the chart: The stock is currently trading below JPY 1,325 where many traders bought the stock and hold it with unrealizes losses. Thus, for the stock to go higher, it needs to push through this price point with heavy volume.

(Source: Trading View)

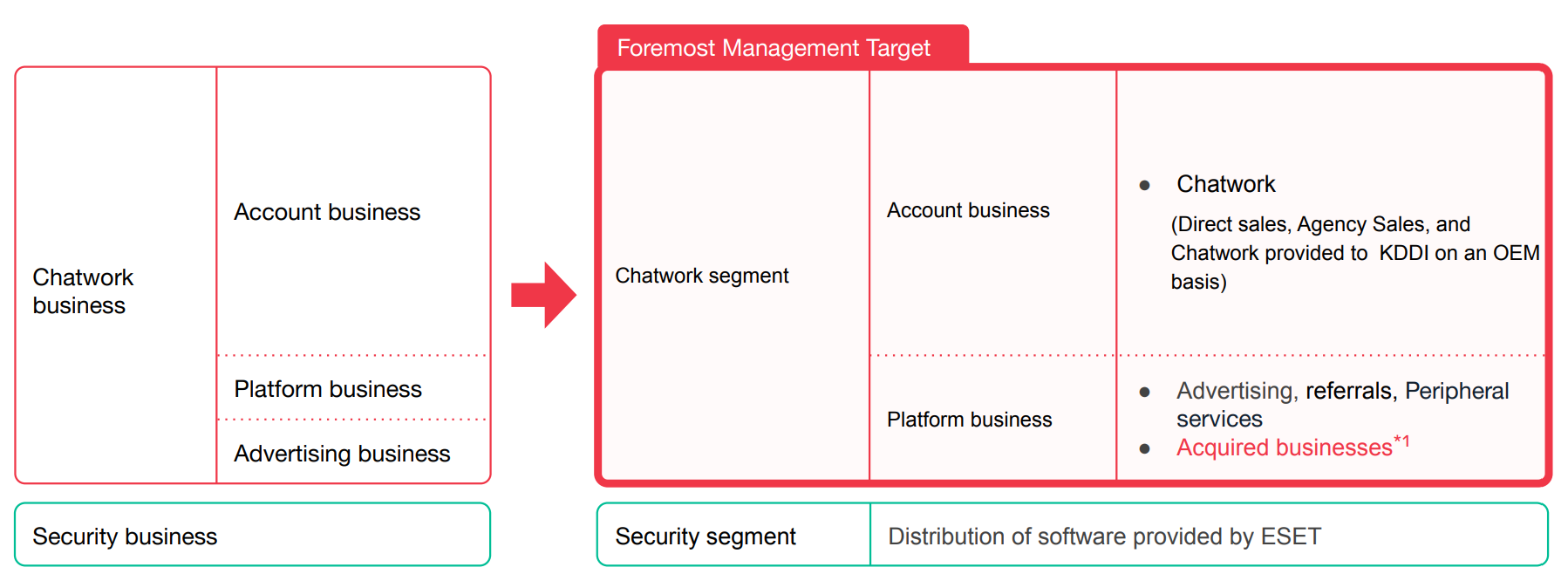

3. Business Model

Chatwork acquired cloud storage business in 7/21 which was consolidated in Q3 21 financial results: The shift in segment breakdown post- acquisition is shown below.

(Source: Presentation Material for financial results of Q3 of FYE 12/21)

1. Account business:

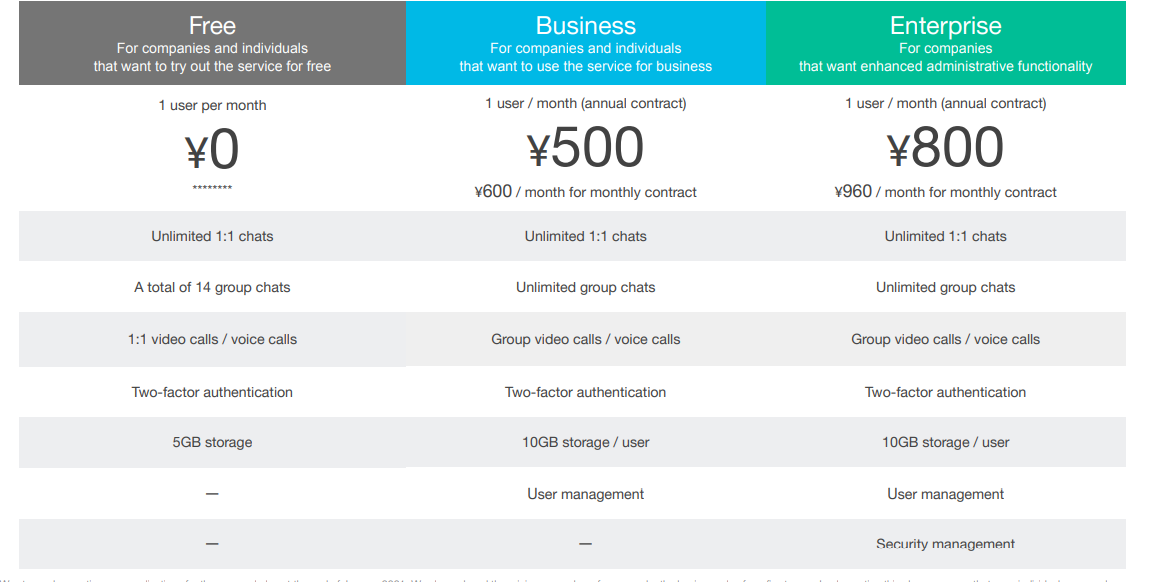

Chatwork’s core business chat operations. Chatwork first acquires trial users for no charges by offering the following services. Trial users typically sign up with Chatwork after seeing web/TV commercials or being refereed by current users.

(Source: Chatwork’s corporate site).

Note: KDDI is a one of the largest telecommunication companies in Japan.

The company has recently instituted a change in pricing in two service packages:

1) Regular:

When/if the customer entities determine that they need larger storage space and unlimited group chats, they are encouraged to upgrade their service, according to the below price list.

(Source: Presentation Material for financial results of Q3 of FYE 12/21)

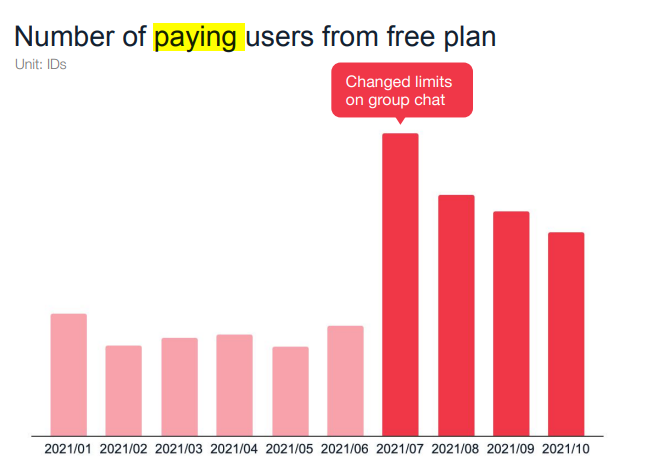

In 7/21, Chatwork reduced the group chat limit from 14 to 7, which prompted a jump in free to paying customer conversion. As the many heavy users are done with converting to payment models, the number of newly converted customer is decreasing. The declining speed seems to be slowing, as the newer users discover the value of having unlimited group chat options.

(Source: Presentation Material for financial results of Q3 of FYE 12/21)

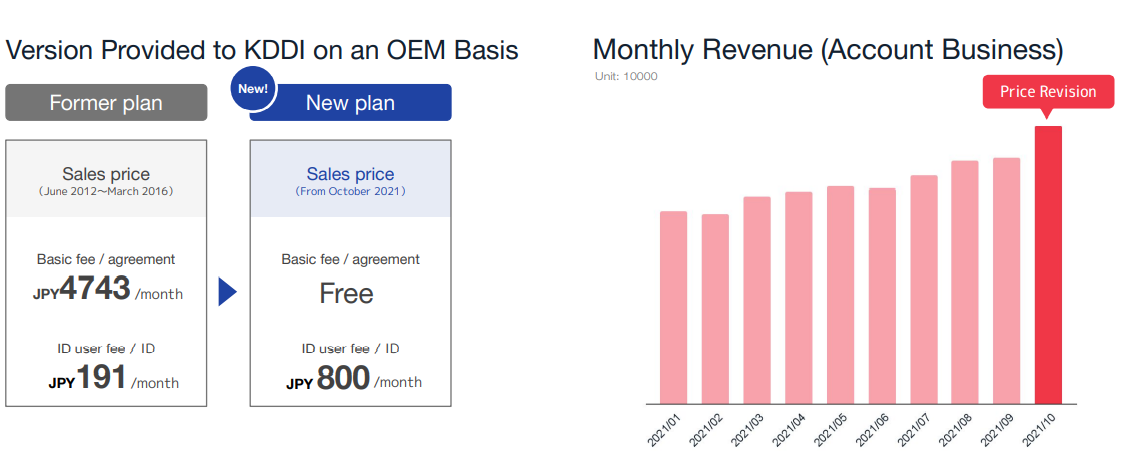

2) OEM:

The company also revised the pricing for KDDI (OEM) plan as below. After this pricing change, the revenues rose while churn rate remained relatively unchanged. The company wide churn rate for Q3 21 was 0.3% for all user IDs and 1.9% for paying IDs.

Note: Churn rate: Churn rate of the number of registered IDs, averaged over the 12 months from 7/20 to the end of 9/21.

(Source: Presentation Material for financial results of Q3 of FYE 12/21)

As a result of overall pricing hikes, ARPU has risen 16.6% in Q3 21 vs. Q3 20, as noted earlier.

2. Platform business:

The partner companies outsource to Chatwork such functions as 1) applying for government subsidies (Chatwork Subsidies), 2) answering calls and sending call summaries as chats (Chatwork Phone calls) and 3) factoring (Chatwork Factoring, in conjunction with Money Forward).

Another service under Platform division is incorporating ad and commercials with free chat services. These ad revenues partially support Chatwork’s free service offerings.

The above 1 and 2 businesses are classified as “Chatwork segment”, which is the core growth driver and accounts for 93% of the company wide sales.

3. Security segment:

Chatwork functions as a secondary Japanese agent for ESET (a Slovac internet security company that offers anti-virus and firewall products. The 1st agent is Canon IT Solutions.

4. Financial Highlights

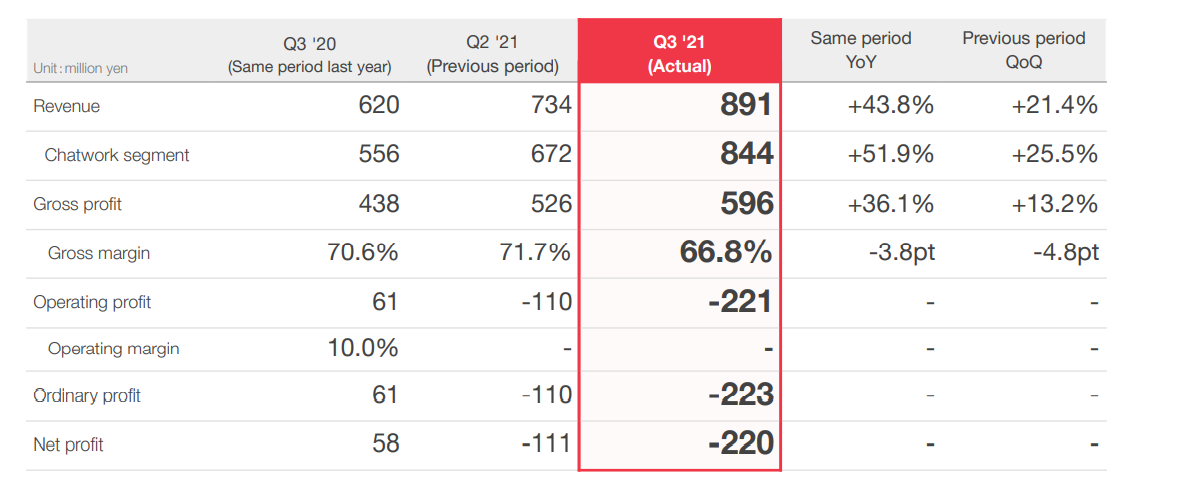

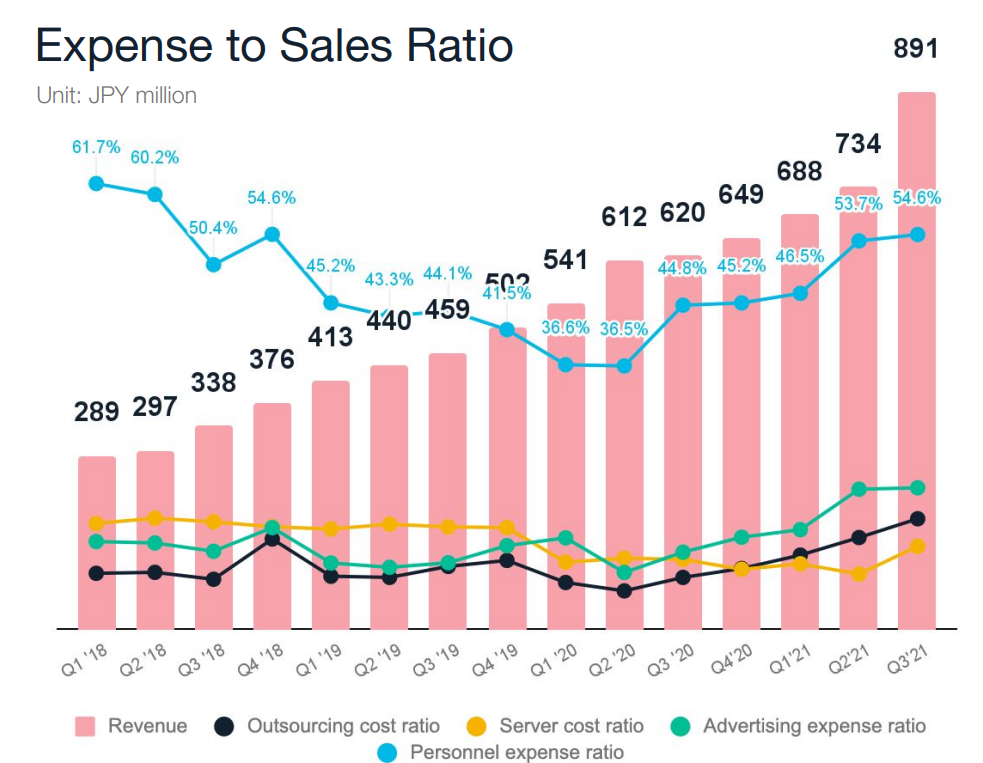

Revenue from the core Chatwork segment shows a strong showing, growing 52% year over year. However, the company recorded operating losses and net losses due to higher personnel and advertising costs. The company started advertising on TVs which are wide reaching, but the most expensive medium.

(Source: The company’s Q3/21 financial results presentation as of 11/12/21)

(Source: Presentation Material for financial results of Q3 of FYE 12/21)

(Source: Presentation Material for financial results of Q3 of FYE 12/21)

5. TAM (Total accessible markets)

1. Survey by Slack presents that remote work-related industry will steadily grow.

There is a widespread belief among us those employees tend to prefer remote work arrangement. Slack quantities this belief by conducing the survey of 10,447 knowledge workers in the US, Australia, France, Germany, Japan and UK form 4/26 to 5/6/21. The knowledge workers are defined as employed full time and working with data, analyzing information or thinking creatively.

The survey shows that flexibility ranks 2nd only to compensation in determining job satisfaction: 93% of knowledge workers want a flexible schedule, while 75% want flexibility in where they work. Furthermore, one in 5 (21%) knowledge workers is likely to jump to a new company in the next year and more than half (56%) are open to looking for a new position. Therefore, keeping their employees happy at work is critical for employers to retain their skilled workforce.

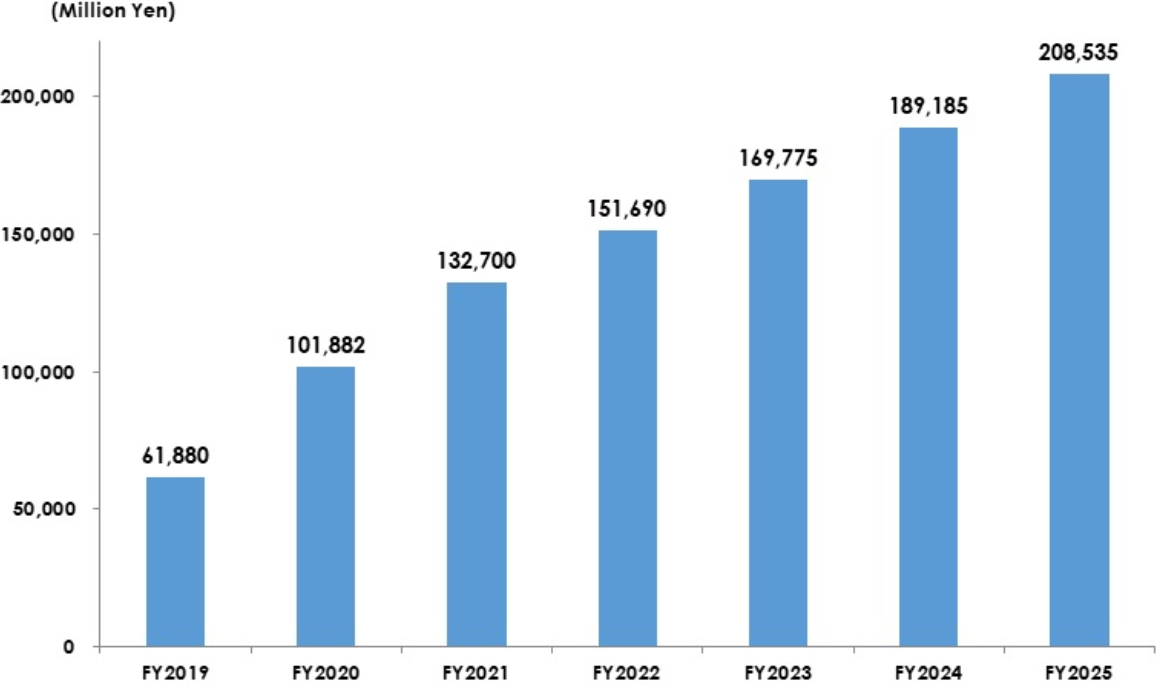

2. Telework industry market size estimate in Japan

The below chart represents “Telework-support Applications Market Size Transition and Forecast” prepared by Yano Research Institute published on 10/7/21. Their research shows that Telework Support Application Market size” in FY 2020 rose by 64.6% to JPY 101,882 MM ($1,019 MM). 5 year CAGR(2021-2025) is estimated at 12%. The telework support application includes the below 7 types:

1) web conference solutions, 2) business chat tools, 3) enterprise cloud storage, 4) workflow solutions, 5) electronic contract services 6) virtual office tools and 7) remote health management solutions.

While the above market estimate includes a broad virtual office support system, we can infer that market which Chatwork can address is growing quickly.

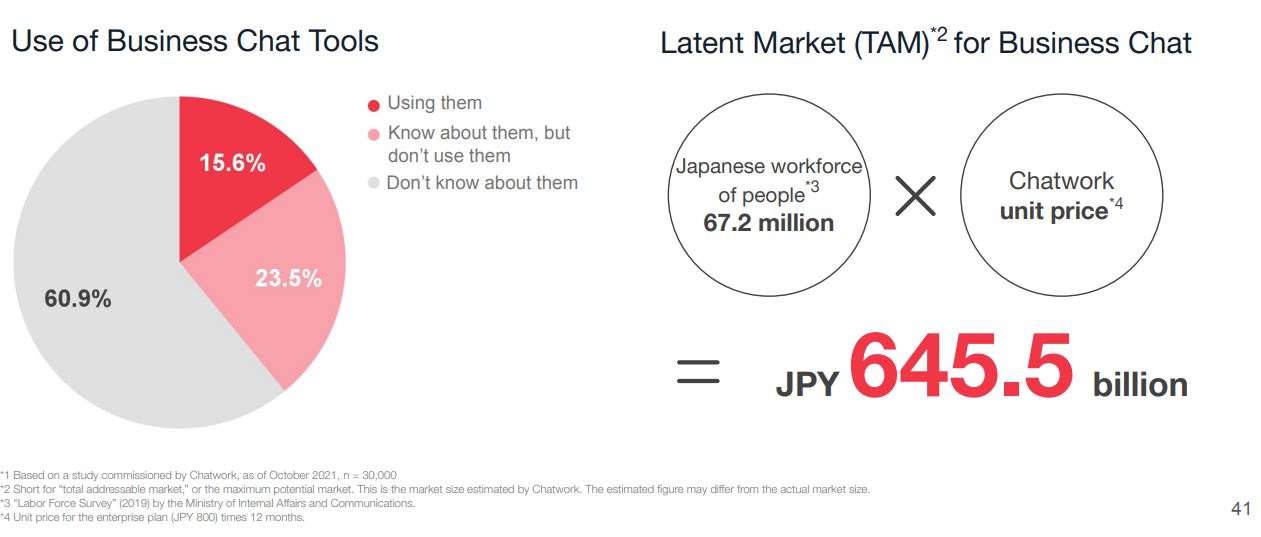

The below market estimate is presented by Chatwork itself.

(Source: Presentation Material for financial results of Q3 of FYE 12/21)

The above TAM estimate seems to be a bit high at $6 Bn since it assumes all the workers in Japan would adapt Chatwork app. The right TAM figure likely falls somewhere between $6Bn and $1Bn reported by Yano research. Again, the market opportunities are abound, since only 16% of workers are using business chats.

6. Strengths and Weaknesses

Strengths

1. Industry Tailwinds

As we just witnessed in the preceding section, the business environment surrounding the company is very favorable.

2. Competition well controlled

The company’s major competitors are Slack and Microsoft (Teams division). These players are formidable in sizes, however, they don’t directly compete with Chatwork, since these three players target different user segments. Slack focuses on tech-savvy engineers and Microsoft on enterprise segments. Chatwork targets less tech-initiated small to mid-entities (SMEs). In fact, Chatwork believes traditional phones and emails present the major competition. The company has placed several marketing campaigns, such as TV commercials, to show potential customers how Chatwork can improve efficiency when used in conjunction with, or in lieu of, phones and email communications.

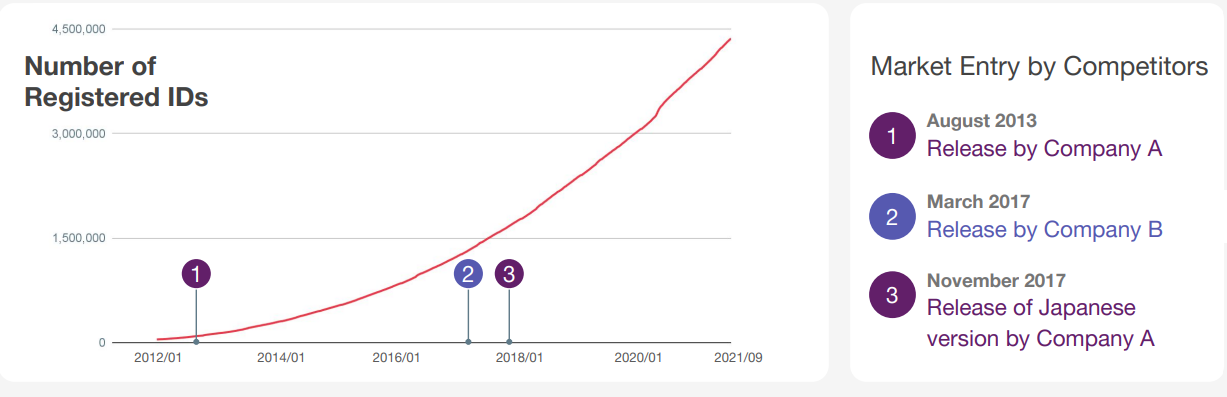

The below graph beautifully highlights the increase in registered user IDs which was not deterred by the entry of competitive forces.

(Source: Presentation Material for financial results of Q3 of FYE 12/21)

Weaknesses:

1. Low liquidity of the shares

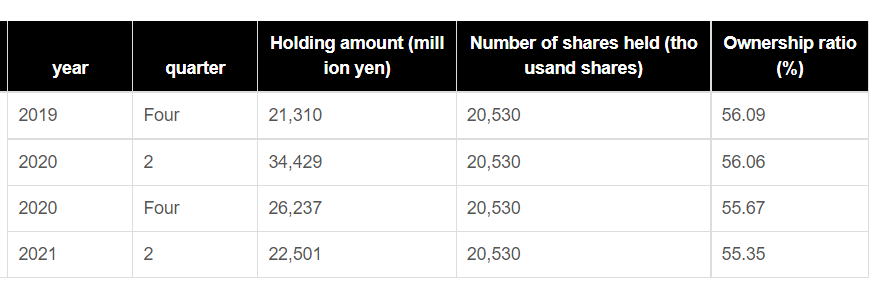

The below table exhibits a declining but still high ownership of the founder/CEO Mr. Yamomoto. The decline of his ownership is not a result of sales, but gifting to employees as restricted stocks (incentive compensation). To my inquiry, investor relations noted that they were aware of high founder ownership and was working on a plan to improve liquidity.

(Source: Buffet-code.com).

2. High upfront investment

The company is willing to conduct massive marketing and increase its workforce rapidly to increase the visibility of its services. Since its ARPU is low at JPY 464/month, the customer’s LTV(life time value)/CAC (customer acquisition costs) can’t be that high, thus, the company may take longer than its plan to reach profitability. I sent an injury on LTV and CAC to Chatwork IR (investor relations) but was told that these numbers are not disclosed.

I believe there are two mitigants to this high upfront investment phase.

Mitigant 1:

(Source: Presentation Material for financial results of Q3 of FYE 12/21)

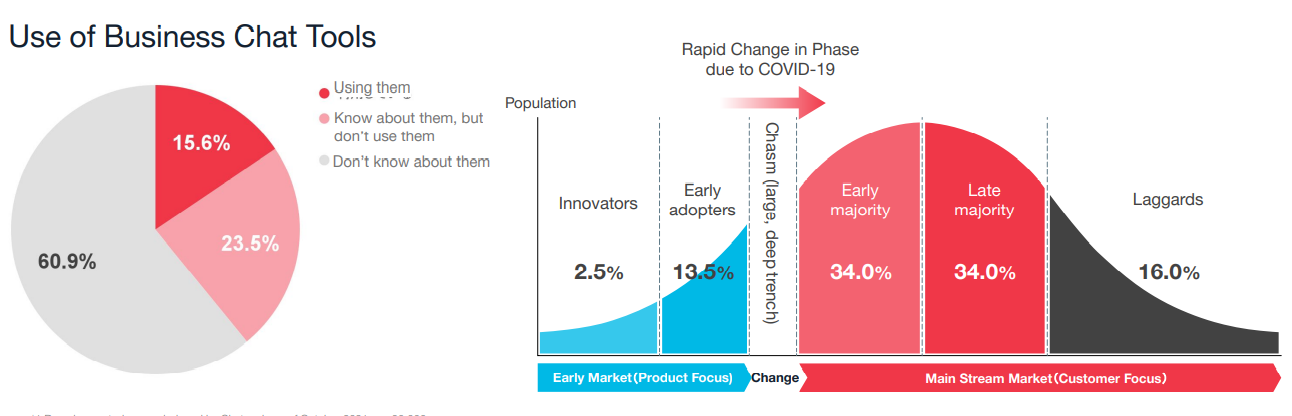

The left pie chart is based on a study commissioned by Chatwork, as of 10/21, n=30,000.

“Chasm” in the right graph is from Geoffrey Moore’s “chasm theory” which hypothesizes a deep barrier that must be crossed in order for new products and technologies in the high-tech sector to move from early stage to mainstream adoption.

The company believes that business chat industry is just about to cross the chasm and move from early adoption stage to early mass market phase, accelerated by Covid-induced proliferation of remote work arrangement. Chatwork is investing a lot, to take advance of this market expansion since once companies sign up with a business chat app, switching costs are very high, thus they tend to stay with Chatwork for a long term.

Mitigant 2:

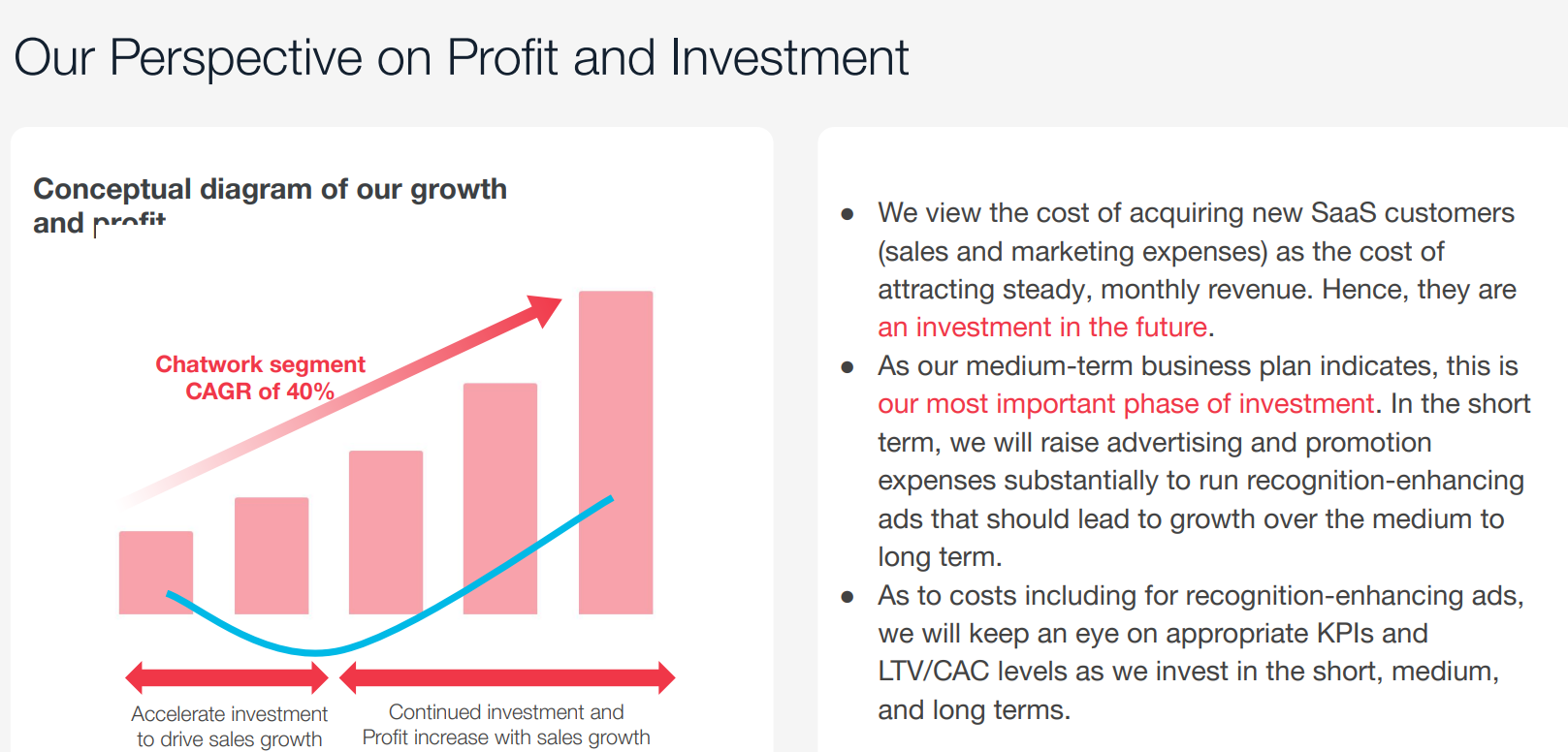

The company was profitable in 2020 which indicates that the company can turn to profitability even now, if it reduces its “upfront investment’’ in marketing and labor force building. During earnings presentation, management emphasized that high expenses were for future growth. They even dedicated one page on presentation to explain what these spending could achieve (the page is attached below). They seem to be aware of and sensitive to the investors’ concern on high expenses.

(Source: Presentation Material for financial results of Q3 of FYE 12/21)

7. Near-term Selling Pressure

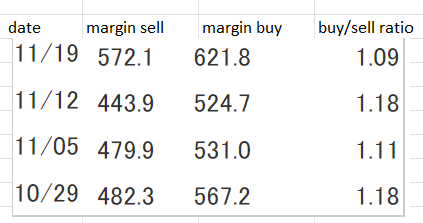

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Chatwork, almost the same amounts of margin buy volume and margin sell volume are outstanding. Therefore, we can assume that not much near-term selling pressure exist at this point.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance