CareNet, Inc. (“CN” or the “company”) was founded as Japan’s first medical TV station. But its main source of earnings is now “MRPlus*”, a pharmaceutical sales support site. It distributes pharmaceutical information from drug manufacturers to member doctors via MRPlus. Also engaged in the medial content service businesses. Distributes educational content targeted to doctors and medical professionals via “CareNeTV”.

*What is MRPlus?

Medical information website used by more than 400,000 members with about 50% of them are doctors.

1. Investment thesis

1) Three sources of fee income

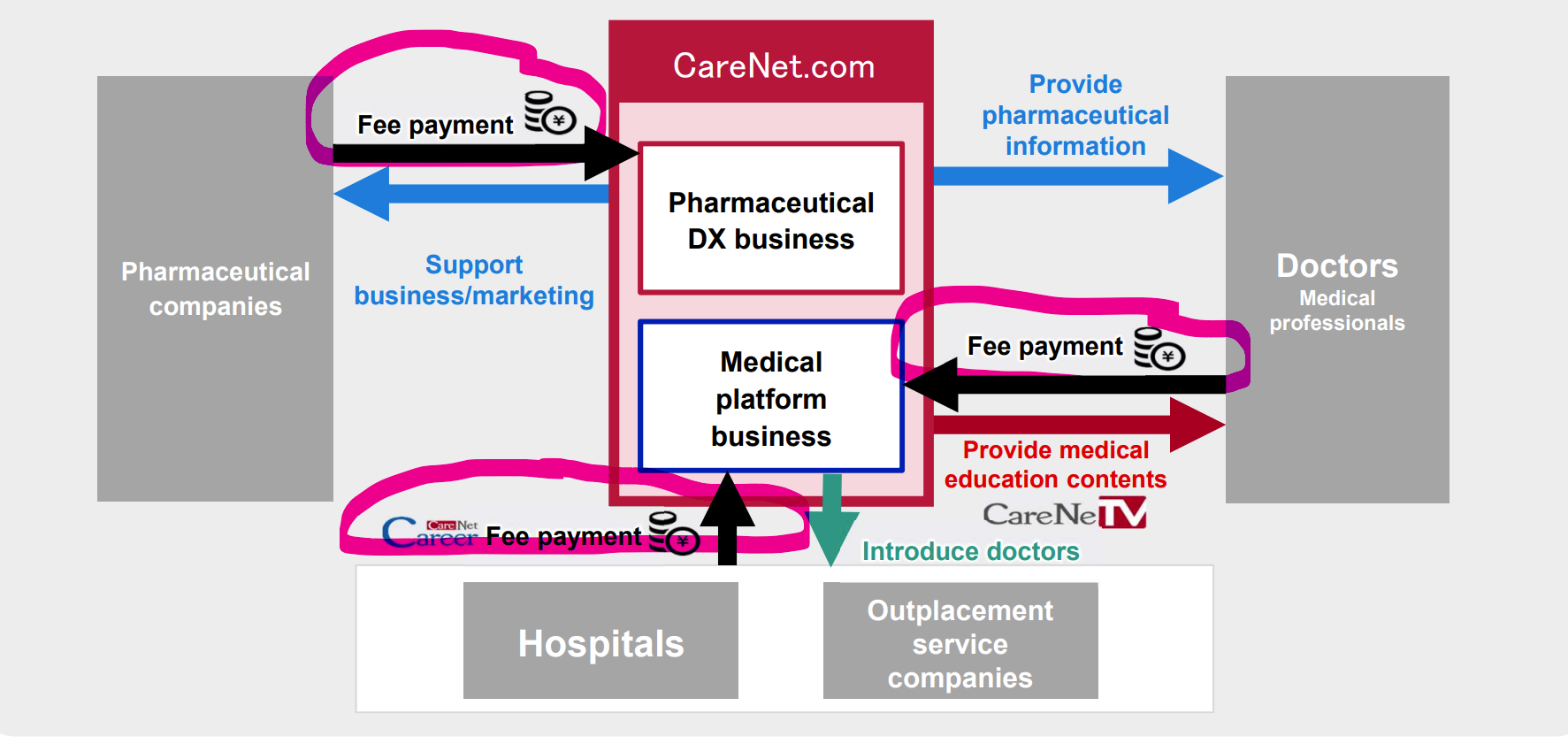

(Source: Progress report for the three months ending 3/31/22)

As the above diagram shows, CN, through CareNet.com, can earn fees from three different parties:

1) Business segment Pharmaceutical DX* business: Fee payer Pharmaceutical companies. CN earns fees for providing marketing supports via drug data dissemination to member doctors.

2-a) Business segment Medical platform business: Fee payer Doctors. CN earns fees for providing member doctors with medical education contents.

2-b) ) Business segment Medical platform business, Brand name CareerNet Career. Fee payerHospitals/medical recruiting companies: CN earns commissions for referring and placing doctors from their member database to client hospitals and recruiting companies.

*Digital transformation is abbreviated as DX in Japan.

Detailed description of each business:

1. Pharmaceutical DX Business (accounts for 90% of the company wide sales and operating profits). There are two segments under Pharmaceutical DX group:

1-a. MRPlus: The responses and reactions of viewers/doctors are quickly relayed to pharmaceutical companies which use these comments to train MRs and enhance their engagements with doctors. More than 50 drug manufactures use this service.

1-b. Online seminars: CN creates and distributes 500 online seminars annually, in order to disseminate new treatment information quickly and nationwide. These videos are conducted by KOLs (Key Opinion Leaders).

2. Medical platform: CN’s original business and CareNet.com which supports Pharmaceutical DX operations (MRPlus and on line seminars). Also, this group runs CareNeTV which distributes on-demand clinical self-study videos. These videos are viewed by 6,042 paying members/medical professionals. 2,000 videos have been created and 10 new contents are introduced every month. Fees: JPY 5,500 ($50)/month or PPV JPY 330 ($3)

2) Competitive Advantage

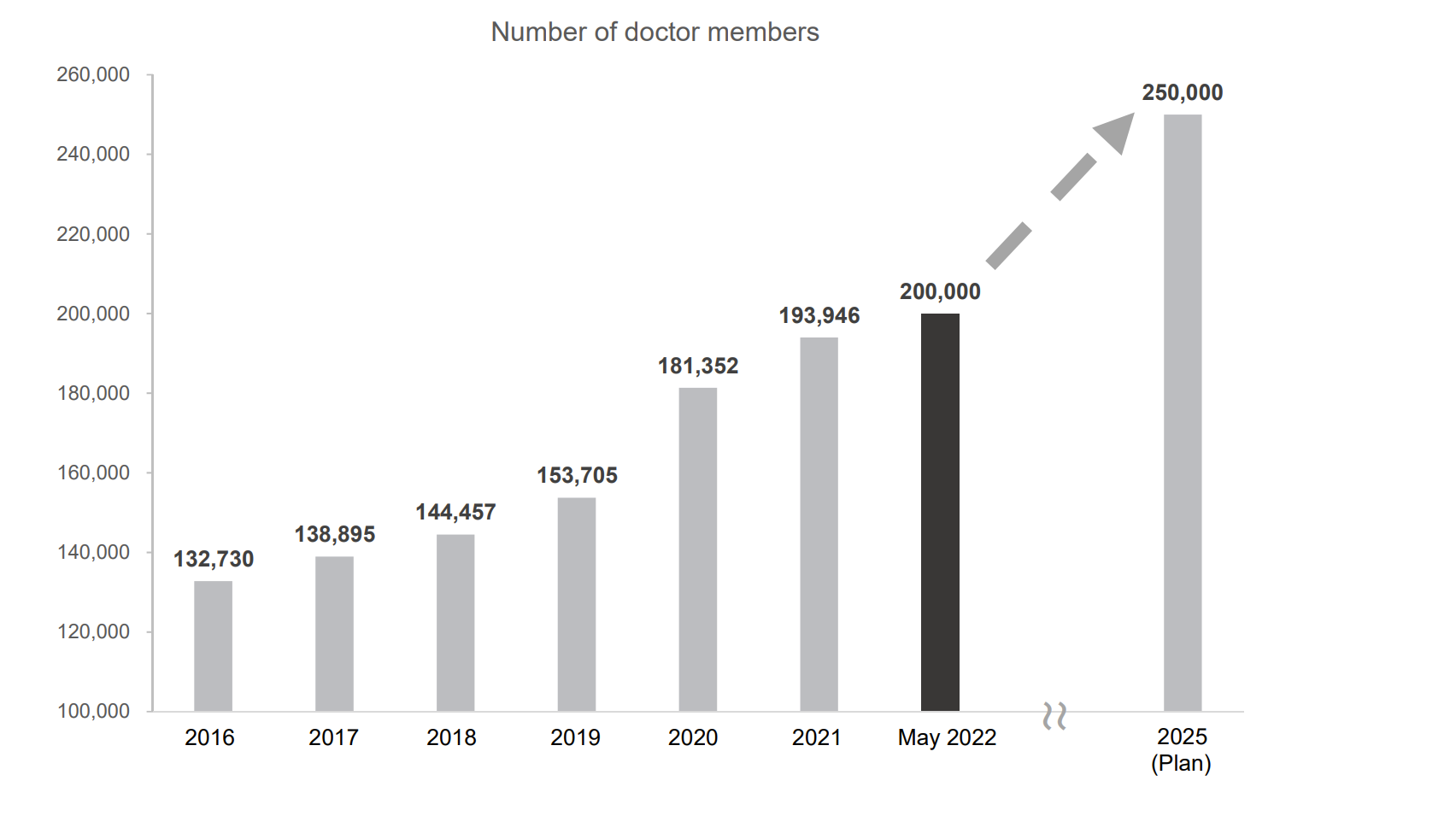

1) Doctor platforms are in general unique in that the doctors allow platforms to report their viewing activities to pharmaceutical companies. There are very few players with this privilege including M3, Medpeer and CareNet. With 200,000 member doctors (60% of all doctors in Japan), CN boasts the 2 largest member among doctor platform providers (Note: CN’s sale size is still 1/20 of that of M3).

2) Since its establishment in 1996, CN has created and distributed 2,000 medical education videos for doctors. These videos, along with 3,000 medical articles posted in CareNet.com every year, are carried out jointly with many leading medical specialists, thus are in high quality.

3) Growth plan

The company has formulated the below plan to ensure the continued growth in each business segment:

1. Pharmaceutical DX

The number of member doctors is a key performance indicator.

1-a) Expand doctor members and increase their engagement through enriched and specialized contents. The goal is to increase doctor members from 200,000 (as of 5/22) to 250,000 by 2025.

1-b) DMR team build up

The company has expanding its DMR (Digital Medical Representative), who, armed with digital skills, can link platforms and doctors’ needs.

2. Medical Platform

“Smart Clinic” project

The company is expanding their smart clinic service line up which takes the following multiple steps:

1) Remote online reservation,

2)Hybrid diagnostic interviews: in-person, remote and/or AI interviews

3) Online counseling supports to cover uninsured treatments such as anti-aging, cosmetic treatment and nutritional consultations,

4) After-treatment monitoring of patients (keep track of biometric data, etc)

5) Clinic supports in back office operations and electronic records, etc.

4) New Growth Area – Health Science for decease prevention

CN is developing a comprehensive health platform (a one-stop access), ranging from data analysis which will be fed into algorism which, in turn, assists in life style advice and intervention, when necessary.

| CareNet | Ticker: 2150 | As of | 8/8/2022 |

| Current stock price | 1,153 | PE est | 28.1 |

| 12 month stock price range (JPY) | 681-1780 | PB est | 6.1 |

| Market Cap (Y B/US MM) | 510/51 | PS (based on co’s est). | 5.7 |

| Trading Volume | 1,076,000 | EV/EBITDA | 14.7 |

| Trading Volume (USD) | 12,406,280 | Dividend yield | 0.5 |

| Executive Ownership (%) | 5.1 | ROE | 19.3% |

| Foreign Ownership (%) | 19 | ROA | 16.0% |

| Outstanding shares | 11,048,000 | Equity/TA | 82.8% |

| Exchange | TSE Growth | CAGR (12/19-12/22E) | 40.2% |

| Establishment Date | 7/1/1996 | 12/22 based on CoE | |

| Listing Date | 3/30/2021 | ||

| Employees/Ave Age/Ave Income (JPY M) | 134/39.9/890 | ||

| Sources: Buffet-Code.com. Shikiho.jp, Kabutan.com |

2. Technically Speaking

(Source: buffet-code.com)

The stock has been on a slow recovery since its March bottom. The next volume cluster is around JPY 1,400, after which the stock will not face too strong of a selling pressure.

3. Business Model

The company’s business model surrounds CareNet.com which supports three streams of fee income generated in two business segments 1) Pharmaceutical DX businesses (MRplus, and on-line tutorial videos) and 2) Medical Platform (provides platform for Pharmaceutical DX business, and operates CareNeTV and CareNet Career).

4. Financial Highlights

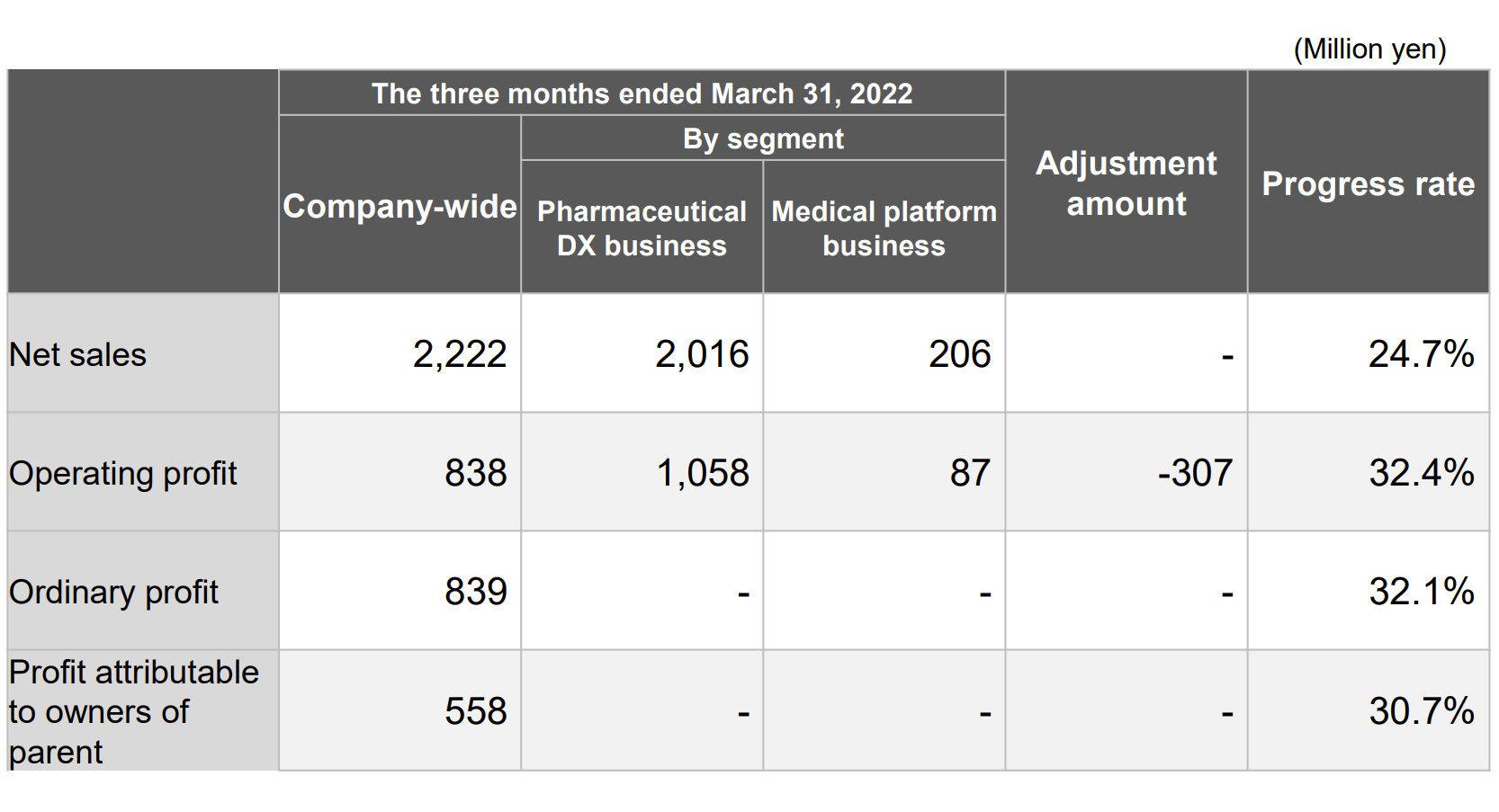

Financial results for the fist quarter ending 3/31/22

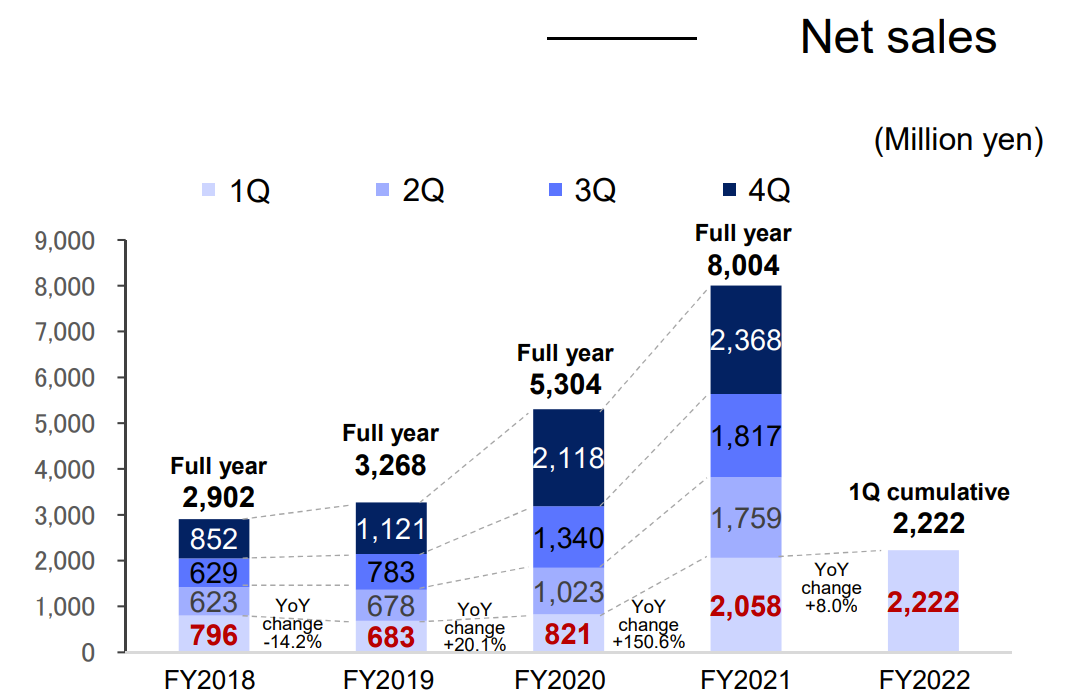

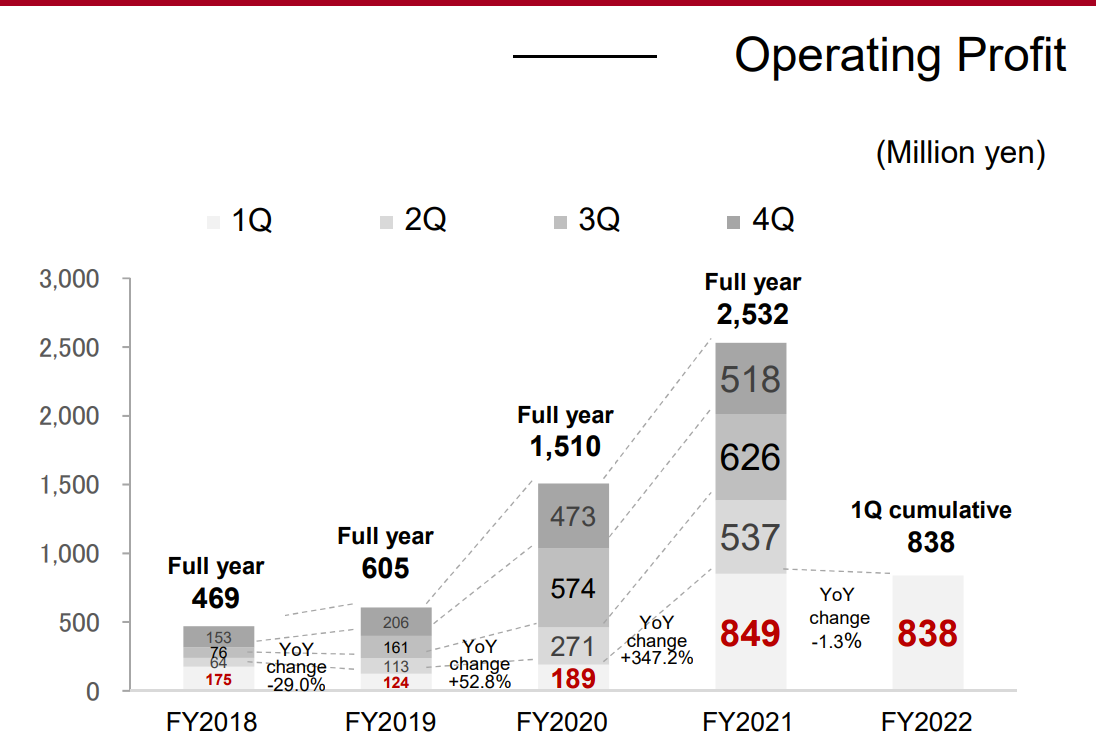

CareNet has shown a steady growth both in sales and operating profits over the last 3 years.

(Source: Progress report for the three months ending 3/31/22)

(Source: Progress report for the three months ending 3/31/22)

FYE 12/31/22 Guidance

90% of sales is generated from the Pharmaceutical DX business and most of its sales are from project orders. Operating profit growth often lags sales growth since higher orders require higher sales support and general administration expenses.

Nonetheless, the company has been able to achieve at least 25% of annual guidance in the first 3 months of 2022.

(Source: Progress report for the three months ending 3/31/22)

5. Total Addressable Markets (TAM)

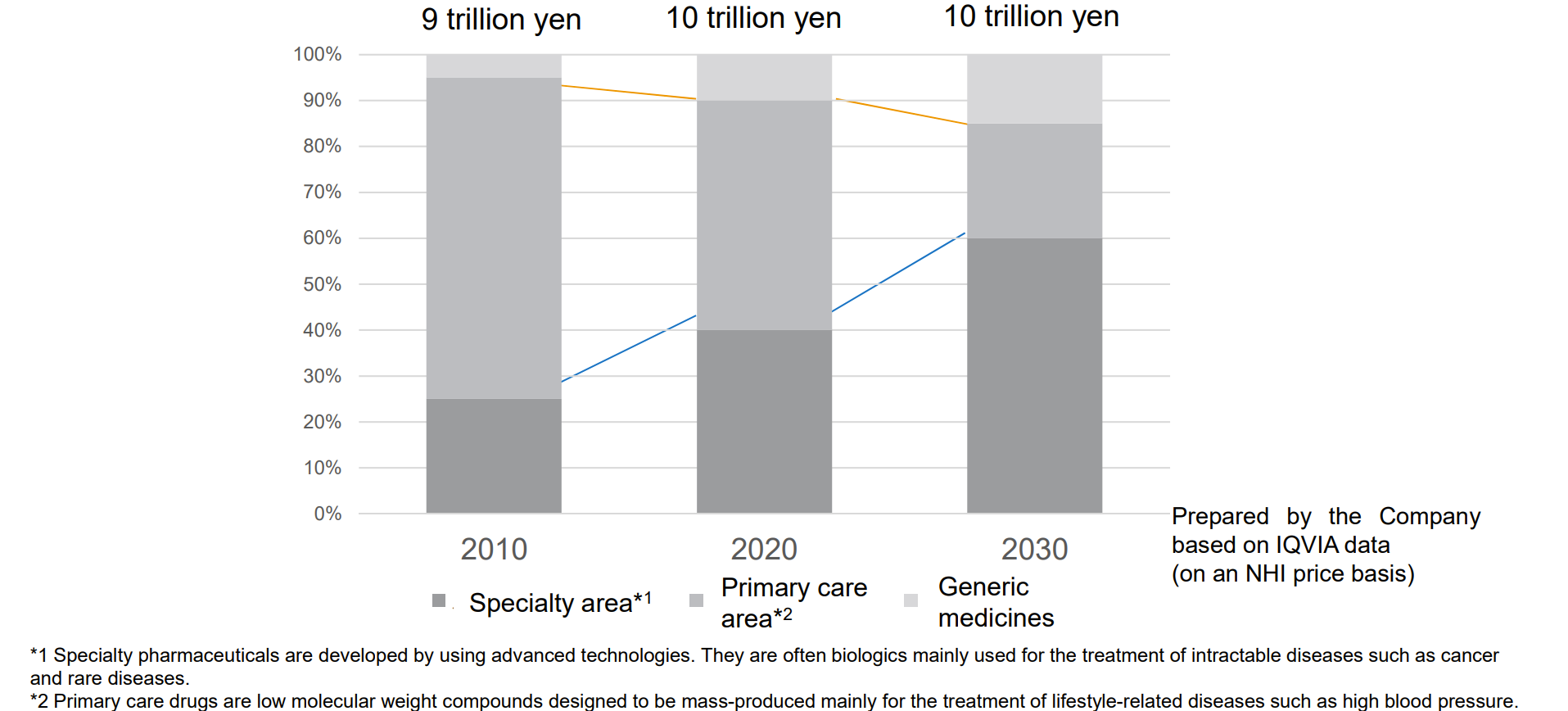

The Japanese pharmaceutical industry size as a whole will likely be flat, but as the below IQVIA* data shows, the size of a specialty drug sector will exceed that of primary care market. This is positive for CN, since it can provide a customized promotion of a drug which is required for individual intractable diseases with a highly specialized treatment need.

(Source: Progress report for the three months ending 3/31/22)

*IQVIA: a medical data provider in Japan

Also, the number of MRs is slowing declining along with the shrinking size of primary care drug market. Going forward, a hybrid medical data dissemination by humans (MRs) along with digital database will increase CN’s importance.

6. Strengths and Weaknesses

Strengths

1. Supportive industry backdrop

As discussed above, the pharmaceutical industry in Japan is ripe for digitization which is a boon for CN’s stop line.

2. The most important success driver for CareNet is the number of member doctors which has steadily risen over the last several years:

(Source: Progress report for the three months ending 3/31/22)

Weaknesses

Intensified global competition

Pharmaceutical industry is truly global and global drug giants may or may not to choose to work with CareNet to access Japanese doctors. To encourage Japanese doctors to continue working with CN, the company focuses on improving on its service and content quality.

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For CN, margin buy volume is about 1.5 day worth of trading volume. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance