On May 21, 2024, the Tokyo Stock Exchange (TSE) released its presentation titled “Status after Market Restructuring and Future Follow-up.” This document reflects on the significant re-segmentation of the exchange into the “Prime,” “Standard,” and “Growth” market segments in 4/2022. The restructuring aims to align markets with clear concepts, enhancing the attractiveness of Japanese stocks to investors globally.

While the TSE’s ongoing efforts to bolster the overall appeal of Japanese equities are commendable, there appears to be a gap in their approach to elevating the quality of newly listed IPOs in the “Growth” segment.

This commentary is not meant to be an exhaustive summary but rather my quick take on the TSE’s recent measures concerning the “Growth” market.

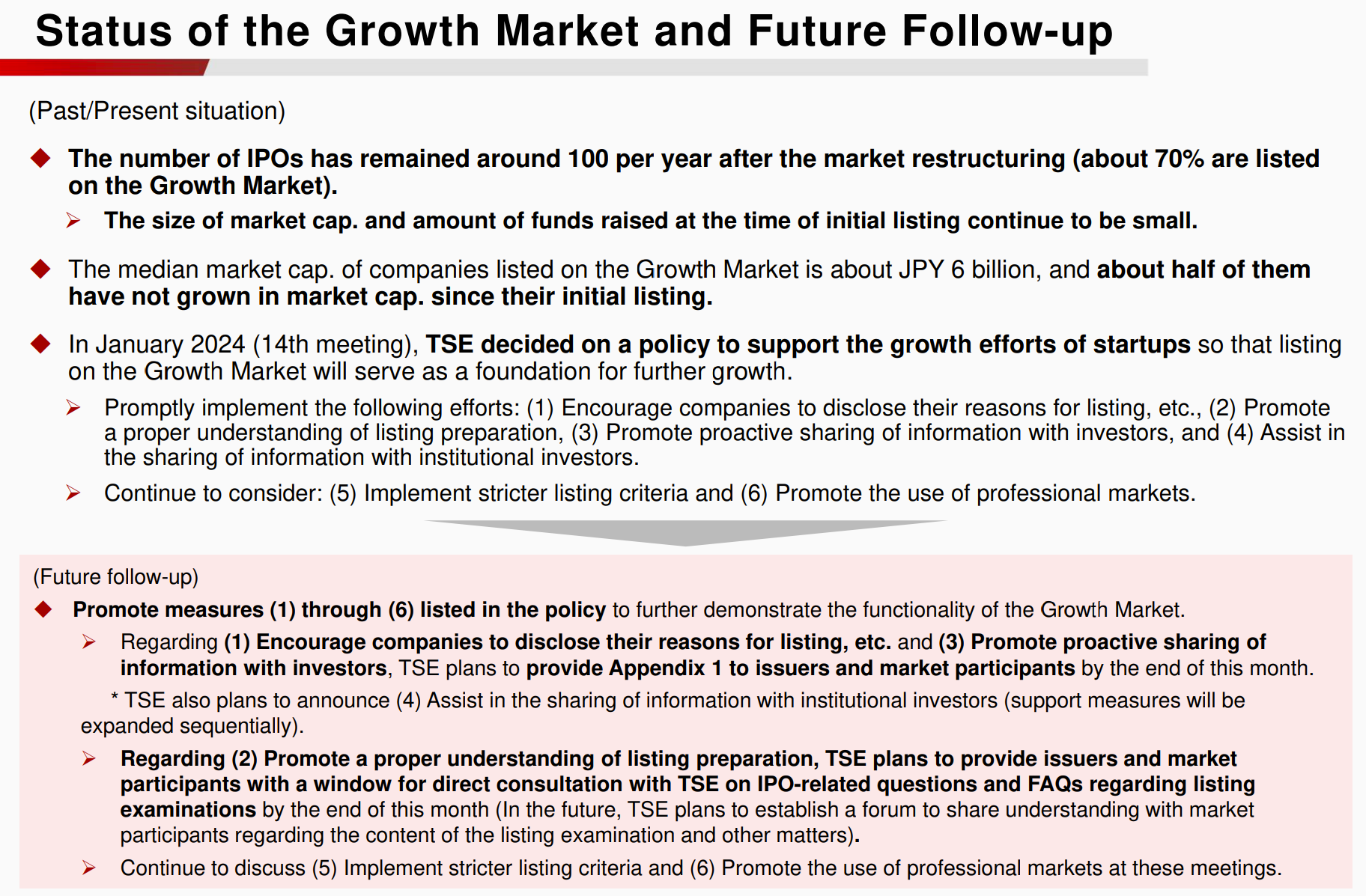

Japanese stocks took off in 2023, but small caps have underperformed larger counterparts. In the current global stock markets which favor either AI themed name or larger dividends paying names, small caps may have had tough time to compete for investors’ mind share. Nonetheless the below comment on page 37 of the TSE’s presentation is alarming. It states that the median market cap, of companies listed on the Growth Market is about JPY 6 Bn, and about half of them have not grown in market cap since their IPO. This suggests that profits may have reached its peak at the time of their IPO for the half of the newly listed companies.

Please take a look at “Future follow-up” section of the presentation excerpt below:

TSE will encourage companies to disclose their reasons for listing and promote proactive sharing of information with investors.

Sounds good.

Now please look at the very bottom line of this page, TSE states it will “continue to discuss (5) implement stricter listing criteria”. This indicates that while the conversation on enhancing listing standards is ongoing, immediate action is not yet on the horizon.

Companies pursue initial public offerings (IPOs) for various strategic reasons, such as raising capital, increasing liquidity, and enhancing their public image. A public listing can indeed solidify a company’s reputation and foster trust among customers. However, it’s also observed that for some companies, the IPO itself is the pinnacle achievement, with less emphasis on post-IPO profit growth. This can lead to a stagnation in profitability, as the focus shifts from long-term business development to the short-term success of the IPO event.

Let me pause here and ask you a question. As a global investor, would your willingness to invest in Japanese small-cap companies be influenced by the Tokyo Stock Exchange implementing more stringent initial listing criteria?