Note: Beenos is covered by Shared Research which have published detail reports in English. Since these reports are accessible for no charge, I am not adding much value to reiterate what they have discussed.

Therefore, in the following write up, I would like to focus on one main concern on many investors’ mind: Is B to C (Business to Consumer) E-commerce can maintain the post-Covid high actively level in Japan and overseas?

In another words, will Pandemic Bump deflate soon?

One important fact about Beenos I would like to highlight is that management is very shareholder friendly and accessible to me with my questions. My questions are addressed in Strengths and Weaknesses section of this report.

I believe the value of this report is discussion on 1) future of cross border ecommerce and 2)how the company is mitigating the current challenges (in WEAKNESSES section).

Who is Beenos?

Beenos (“Beenos” or the Company) operates:

1.Cross-border e-commerce sites (67.6% of group sales)

“Buyee”, run by Tenso (a subsidiary), is a purchasing agency site for domestic e-commerce sites. It places orders/bids on Japanese online shopping/auction sites on their behalf and handles the shipping to an end customer’s door. Buyee offers customer supports in 10 languages. It has 2,500 partnership sites including the major eCommerce sites such as Amzon.co.jp, Rakuten, and Yahoo Auction.

The Company’s “Buyer Connect” function has recently added a valuable data “Dashboard” feature through which a customer/eCommerce site can access and analyze their buyers’ access locations, languages, buying behavior. The customer site, in turn, can adjust their promotional messages and functionality, according to these buyer behaviors.

(Source: the company site).

“Sekaimon”, a web service supporting Japanese users to purchase products at eBay.

Beenos also is engaged in:

1. Reuse products trade through its Value Cycle group (19.7% of total sales). Its subsidiary Defactostandard purchases and sells secondhand goods including high end brand name items.

2. Entertainment license (11.1%)

Beenos supports content IP (intellectual property) owners by creating systems which don’t solely rely on the sale of merchandise at live events.

Decrease in events/concerts related business under Covid restrictions were partly offset by Fan club operations and expansion of artist goods sales venues.

A new initiative in Entertainment segment is Groobee, a platform run by subsidiary Beenos Entertainment. Groobee enables the artists and celebrities to open their ecommerce sites in 5 business days.

The company’s operations are aligned well with Japanese government’s “Cool Japan” strategy which aims to promote unique Japanese “contents” overseas.

3. The incubation business (1.6%)

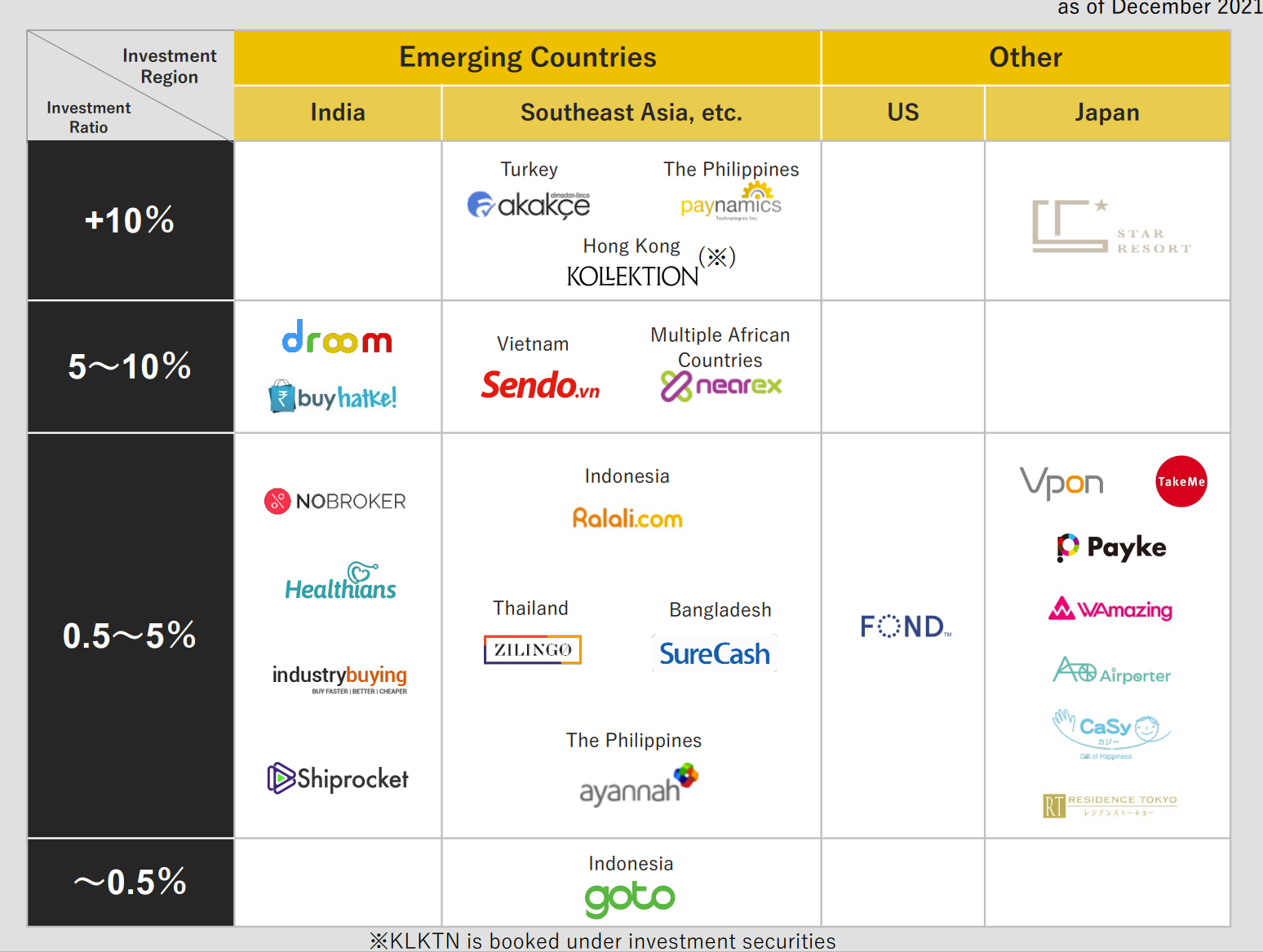

The company invests in startups in newly-emerging countries such as India, Southeast Asia, as well as in Japan.

The recent investment success includes:

1) Droom filed for IPO on NSE India in 11/21.

2) NoBroker in India raised $210MM and became a Unicorn in 11/21.

3) GoTo in Indonesia completes the first round of its pre IPO in 11/21.

E-commerce during and post Covid

Covid has brought many changes to our daily lives. People don’t stare at me when I enter a store with a mask. I do 95% of shopping on line.

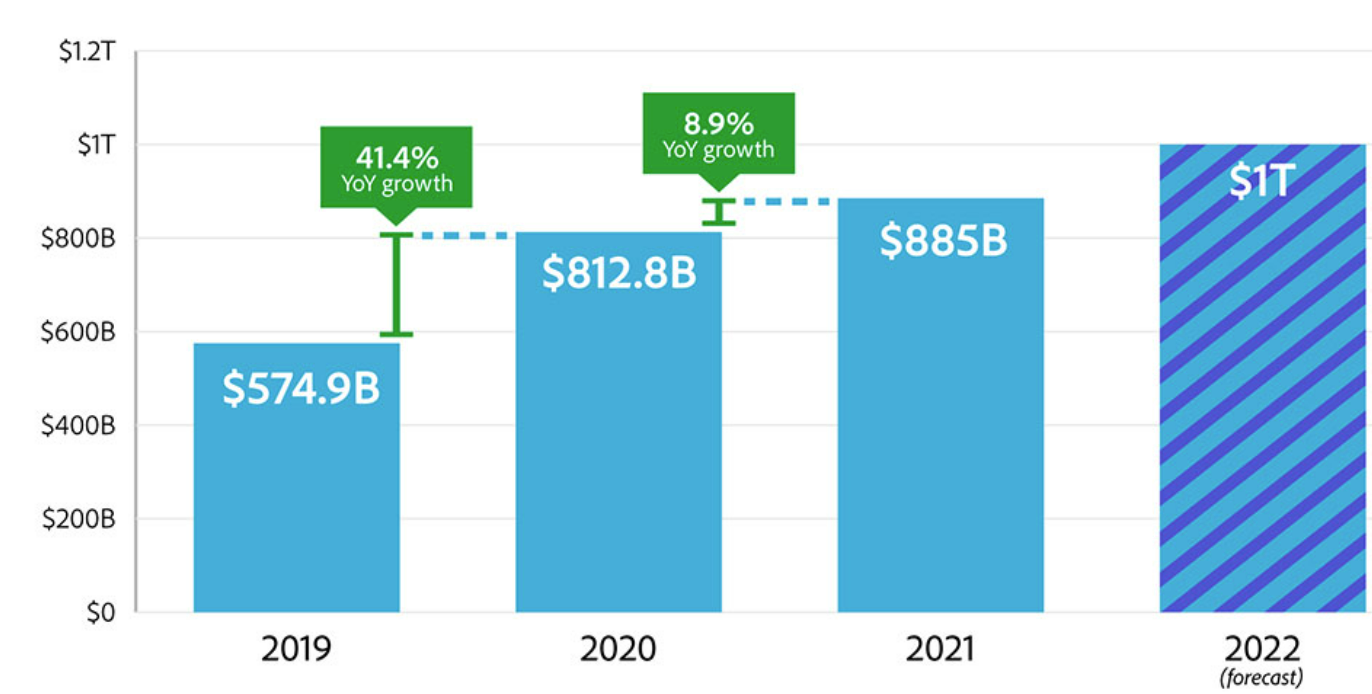

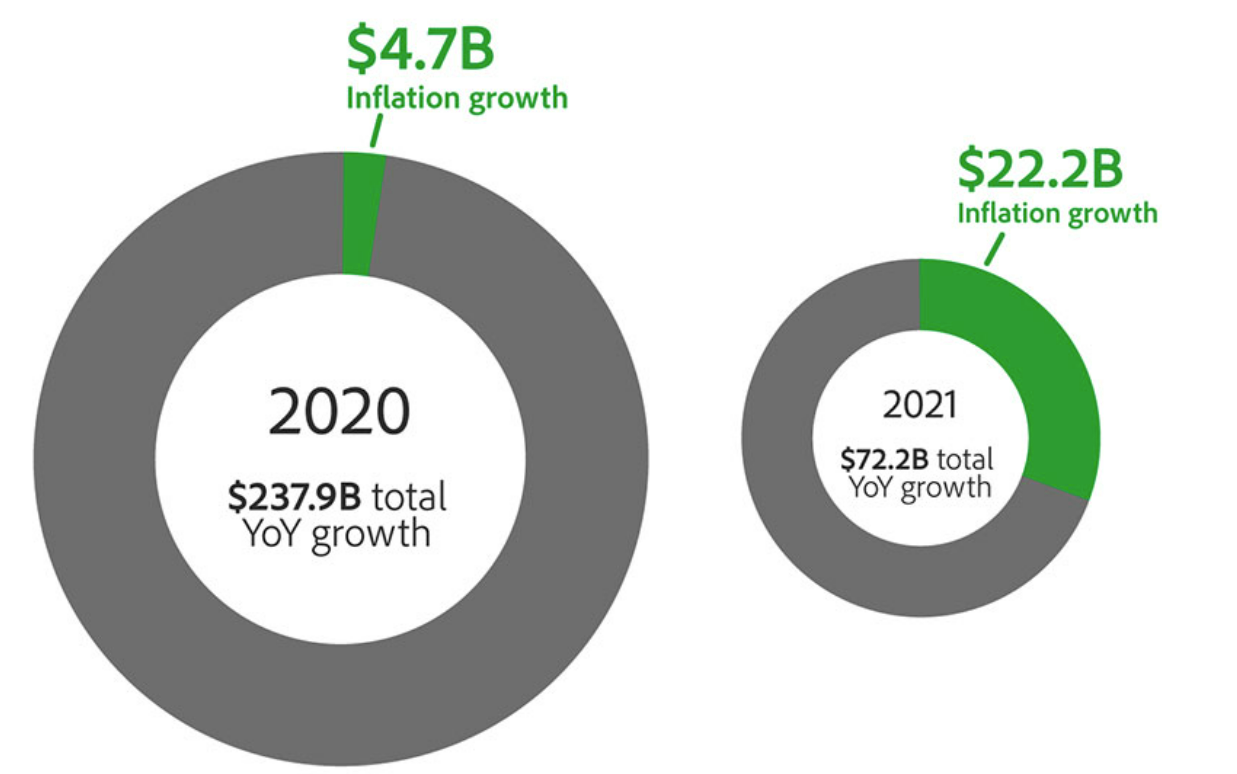

The below chart by Adobe Analytics shows us clearly the impact to global ecommerce revenues the pandemic has had, adding 8.9% sales growth for 2021. Adobe forecast the online sales grows to $1Tn in 2022.

The second pie charts provides a numerical context on inflation impacts on line sales (30% of sales increase).

(Source: E commerce Times 3/16/21 article)

(Source: E commerce Times 3/16/21 article)

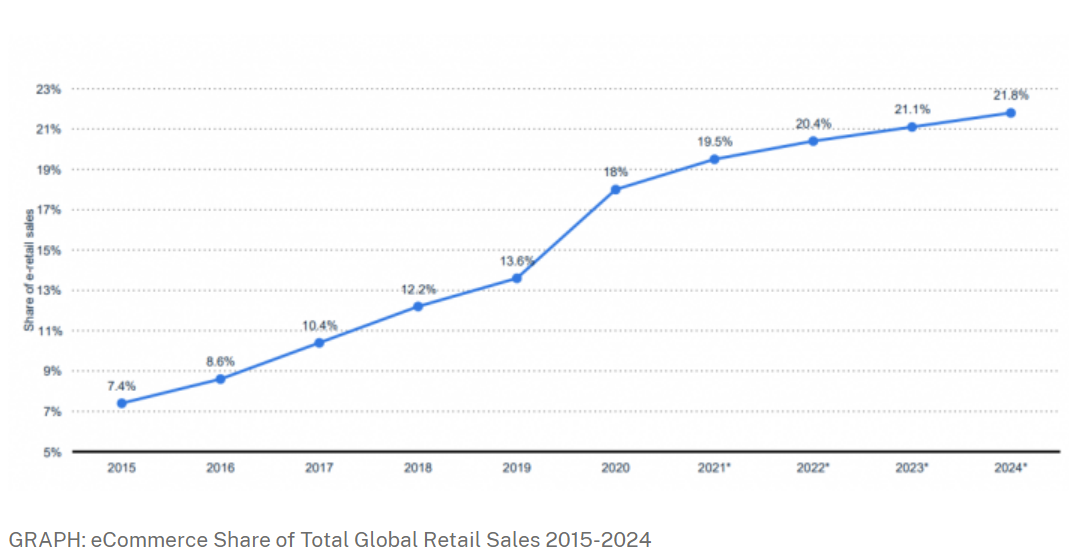

In the chart below we also see a distinct upward jog in eCommerce share of total global retail sales from 2015-2020. The trend is expected to continue through 2024 by International Trade Administration.

(Source: International Trade Administration)

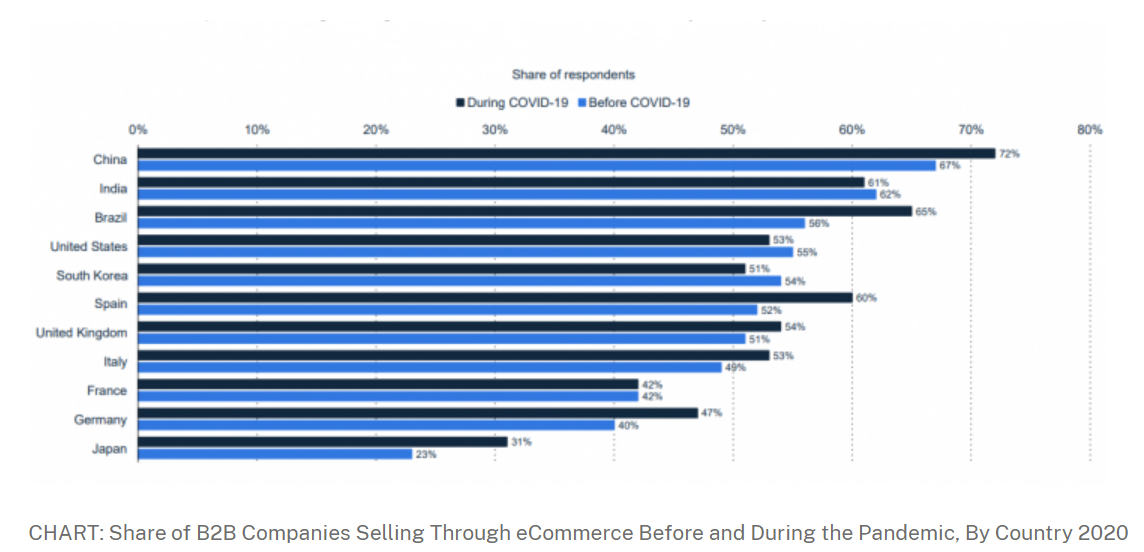

Brazil, Spain and Japan saw the largest increase in number of businesses selling online as shown below.  (Source: International Trade Administration)

(Source: International Trade Administration)

However, we are now welcoming post-Covid world with a vengeance. We are spending more time outdoors and putting higher priority in experience than in acquring the goods. Many Covid stocks are down around 50% year to date, as investors are worried that online activities will come down to pre-Covid 2019 level.

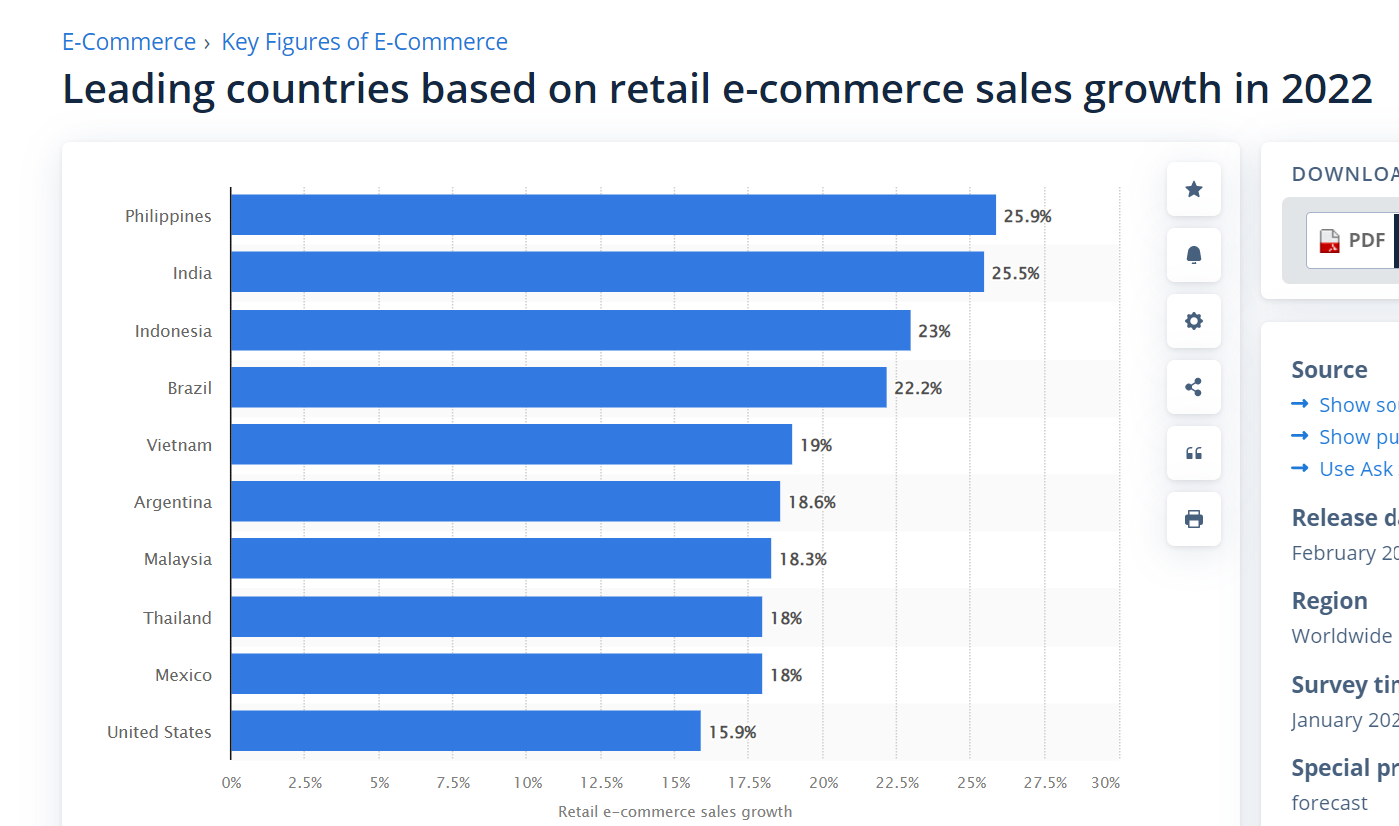

To answer this question, the following two graphs highlights the critical points for us when we are trying to see the future prospects of global eCommerce.

(Source: Statisca, E Commerce Worldwide, Statistics and Facts, as of 2/23/22)

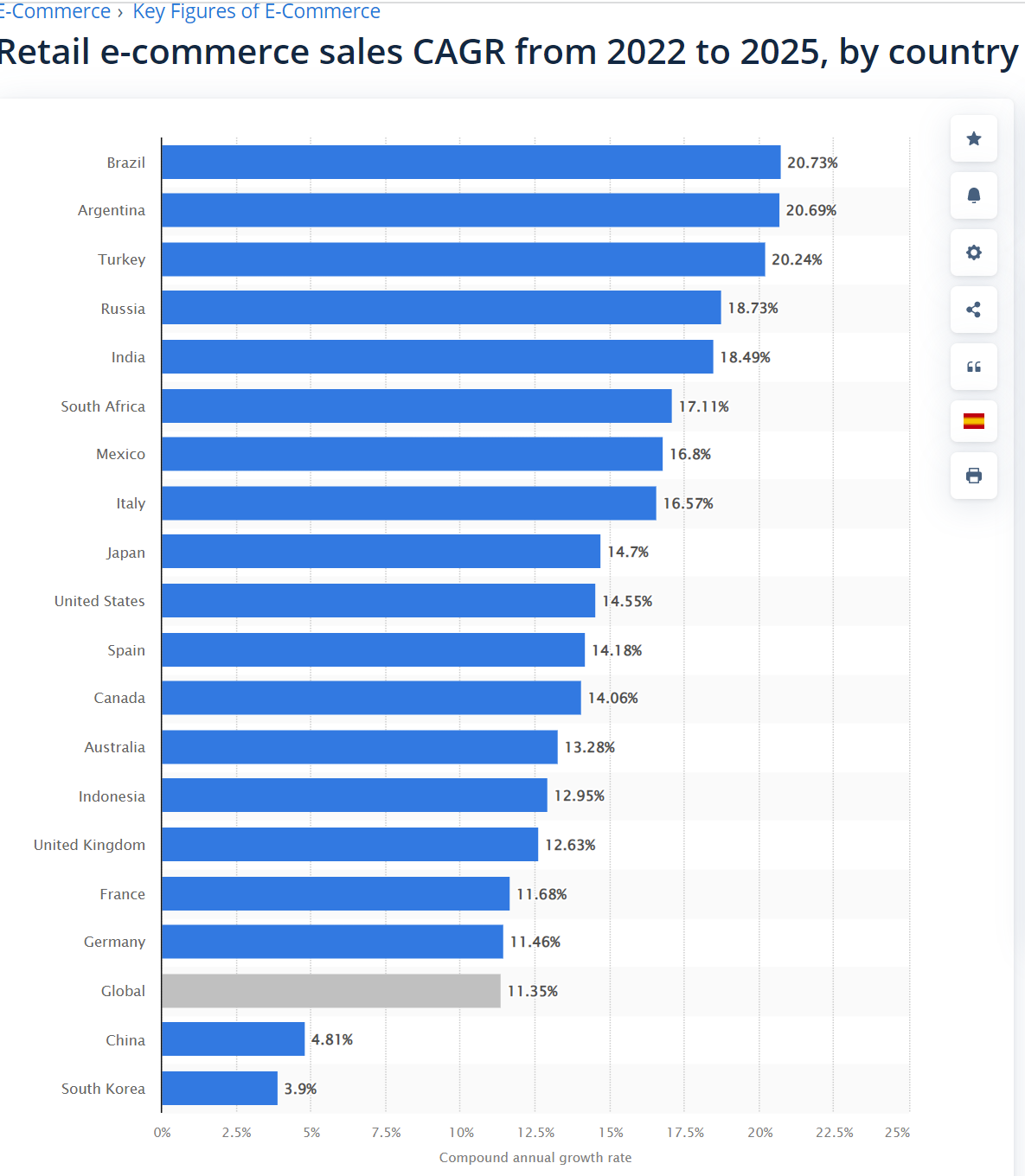

Per forecast by Stastica , global average CAGR of ecommerce sales for 2022-2025 is 11.4% and 15% for Japan and higher for many Asian and Latin American countries.

The New York Irish Emgirant’s 4/21/22 report draws even rosier picture in its 4/21/22 report “Cross-Border B2C E-commerce Market 2022”. It forecasts that that global cross border B2C E-commerce market size to reach $6,209Bn by 2030, growing at a CAGR of 26.2% from 2022 to 2030.

Thus, it is soon to write off ecommerce stocks, let alone Beetos who offers above average growth.

1. Investment thesis

1) Cross border eCommerce is still growing.

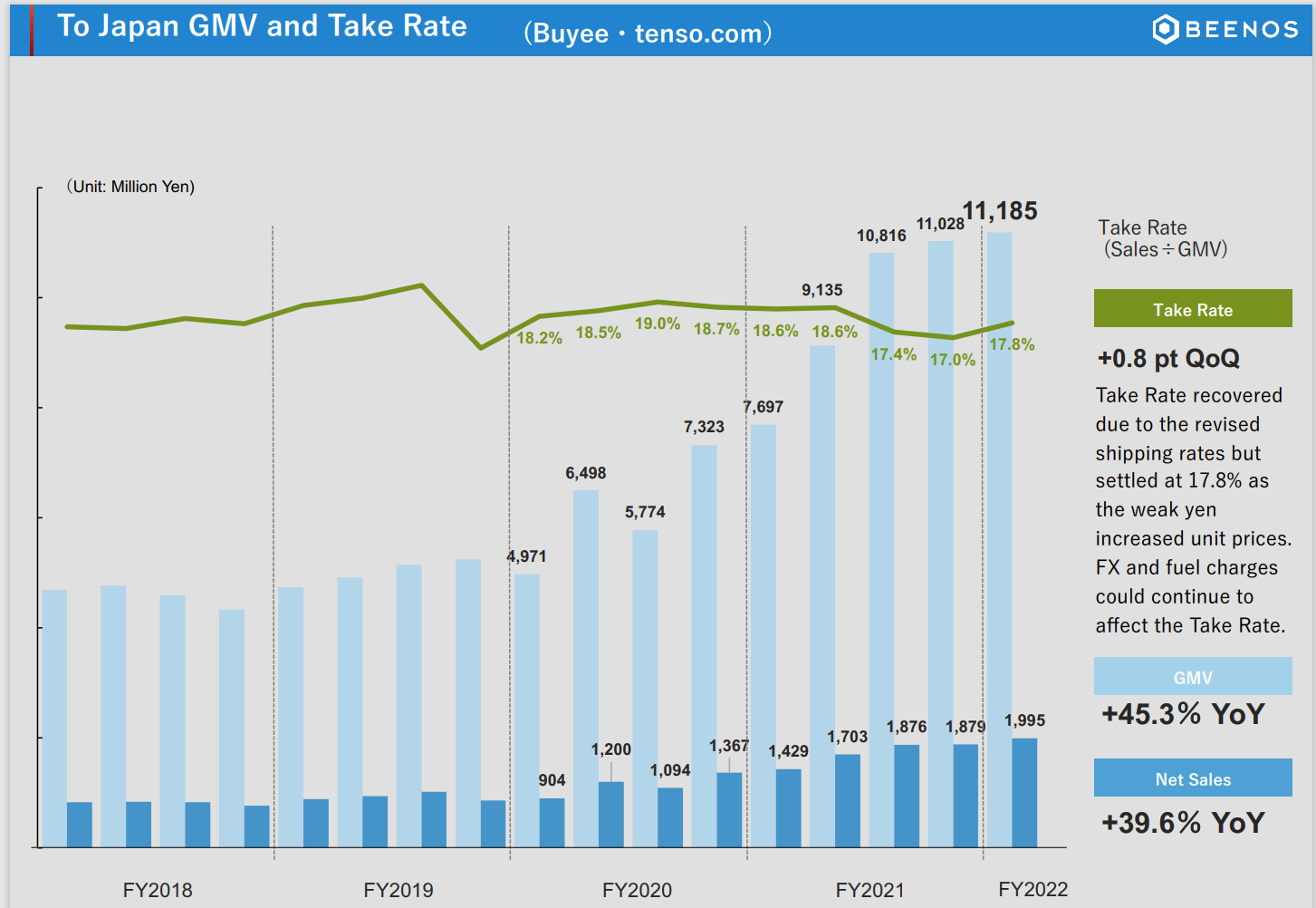

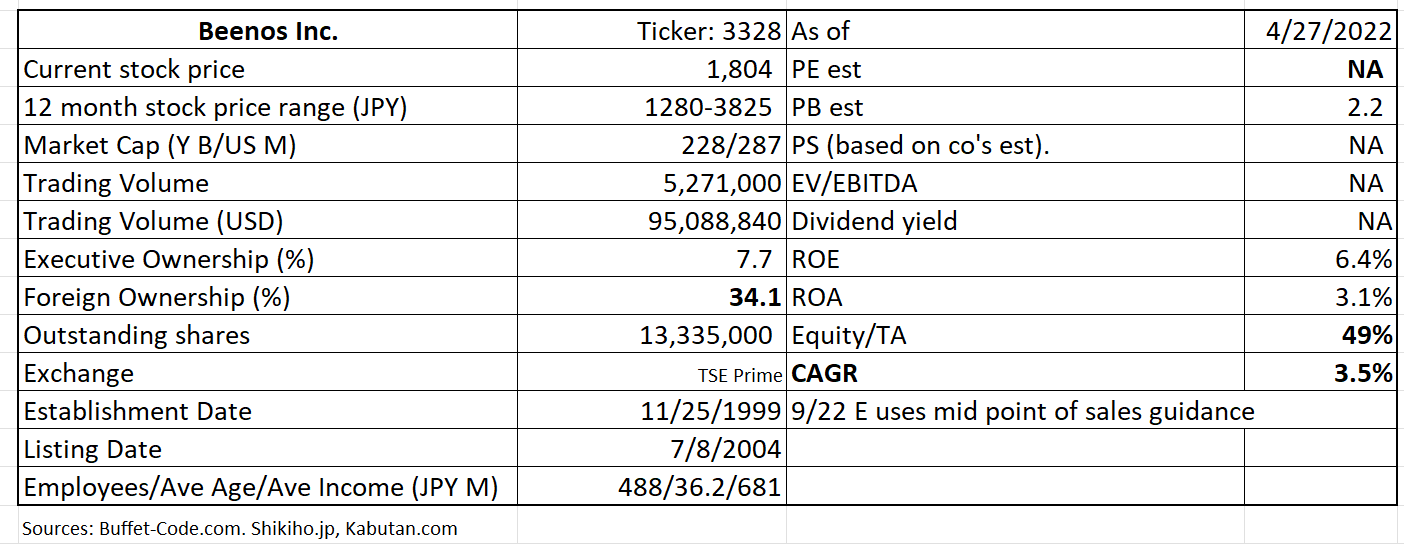

The cross border eCommerce health is seen in Beenos’ rising GMV (Gross Merchant Value). Its global ecommerce’s GMV continued to grow as Take Rate (Sales/GMV) recovered in Q1 2022 with improved shipping rates offset by weak yen which increased unit prices.

(Source: Financial Briefing for Q1 for FYE 9/22)

2) Investing in growth to reap direct investment gains

(Source: Financial Briefing for Q1 for FYE 9/22)

3) Value cycle – profits rebound potential

Value cycle increased GMM, but incurred losses in Q1 FYE 9/22, as a larger % of high ticket items with low margin pressured margins. This was mainly due to the fact that high end segments which requires different sets of procurement and appraisal skill sets were new for the company. Beenos believes the pricing and purchasing will improve with scale they are building.

The Company has not issued profit guidance for FYE 9/22, since it is hard to quantify the impacts from China lock down in Global e-Commerce group.

2. Technically Speaking

(Source: buffet-code.com)

The stock positively reacted to the announcement that Japan would invest $42 Bn to aid in infrastructure expansion in India in early March. However, it has come down along with the markets. However, yesterday’s huge volume indicates that the investors are revising Beenos. Once the stock can push through the largest price cluster (JPY 2,150), it should face the less resistance.

3. Business Model

GMV (Gross Marchant Value) drives Beenos’ bottom line. Beenos’ new initiatives, such as adding customer analytical function: “Dashboard”, offering 10 languages operations and cutting shipping costs through use of ECMS express are all geared toward increasing GMV. The below bar chart illustrates that these efforts are bearing fruits.

(Source: Financial Briefing for Q1 for FYE 9/22)

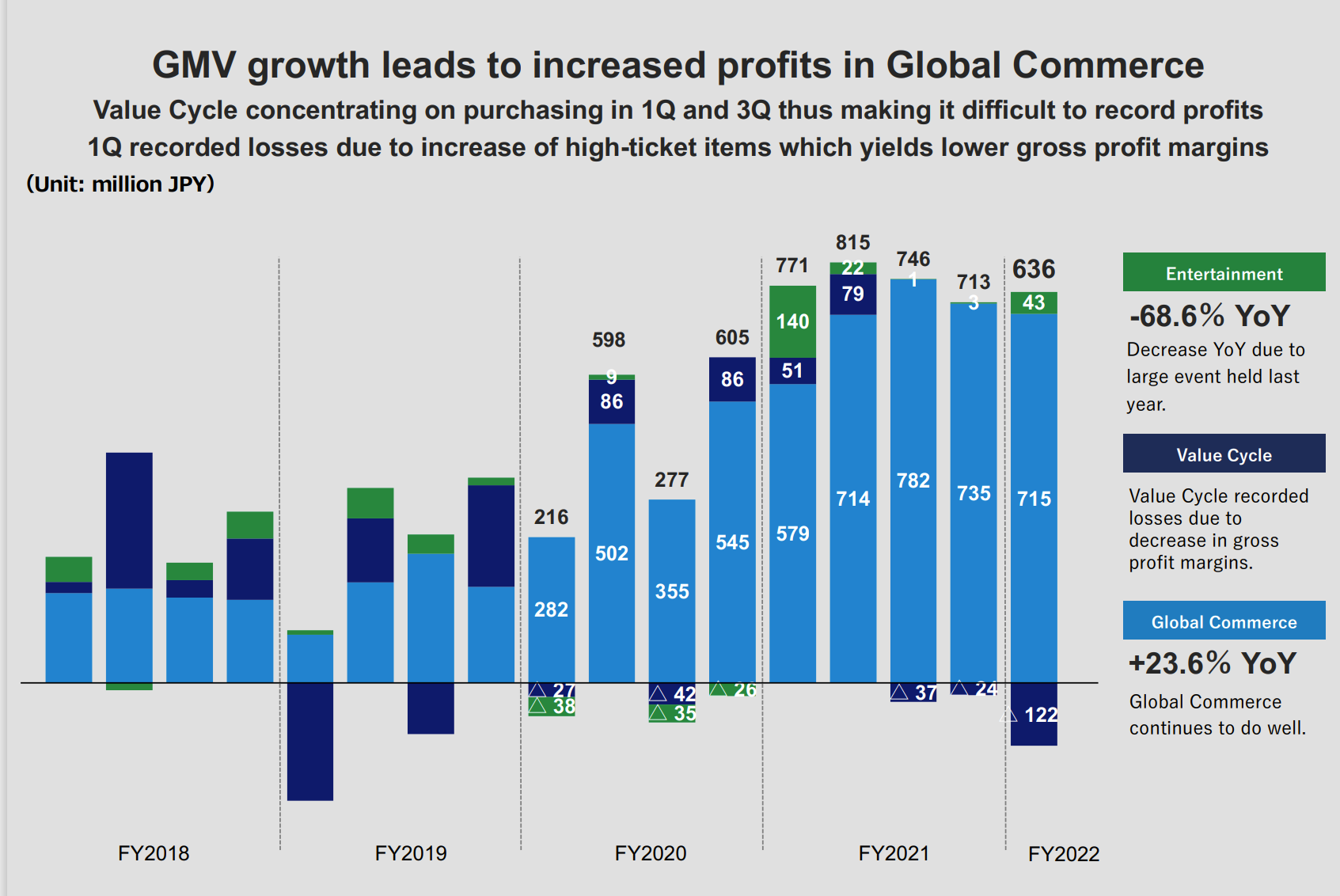

4. Financial Highlights

Results for Q1 for FYE 9/22 (10/21- 12/21)

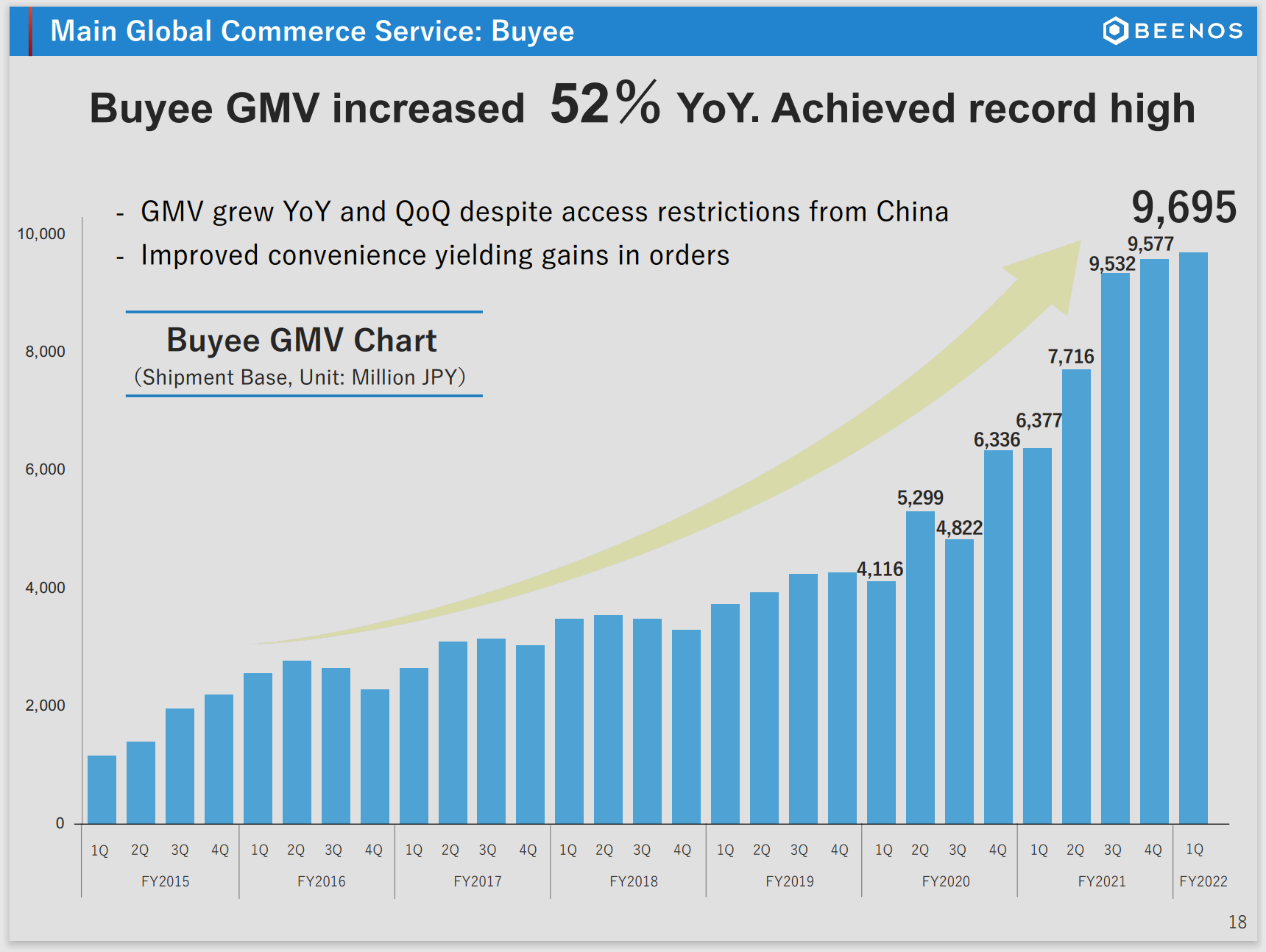

The below bar graph highlights strength (+29% from 1st quarter a year ago) of eCommerce group offset Covid weakness of Entertainment. In sum, 1st quarter company-wide sales was up 8.6% from a Q1 2021.

Note: Value and Global eCommerce are both in eCommerce group.

(Source: Financial Briefing for Q1 for FYE 9/22)

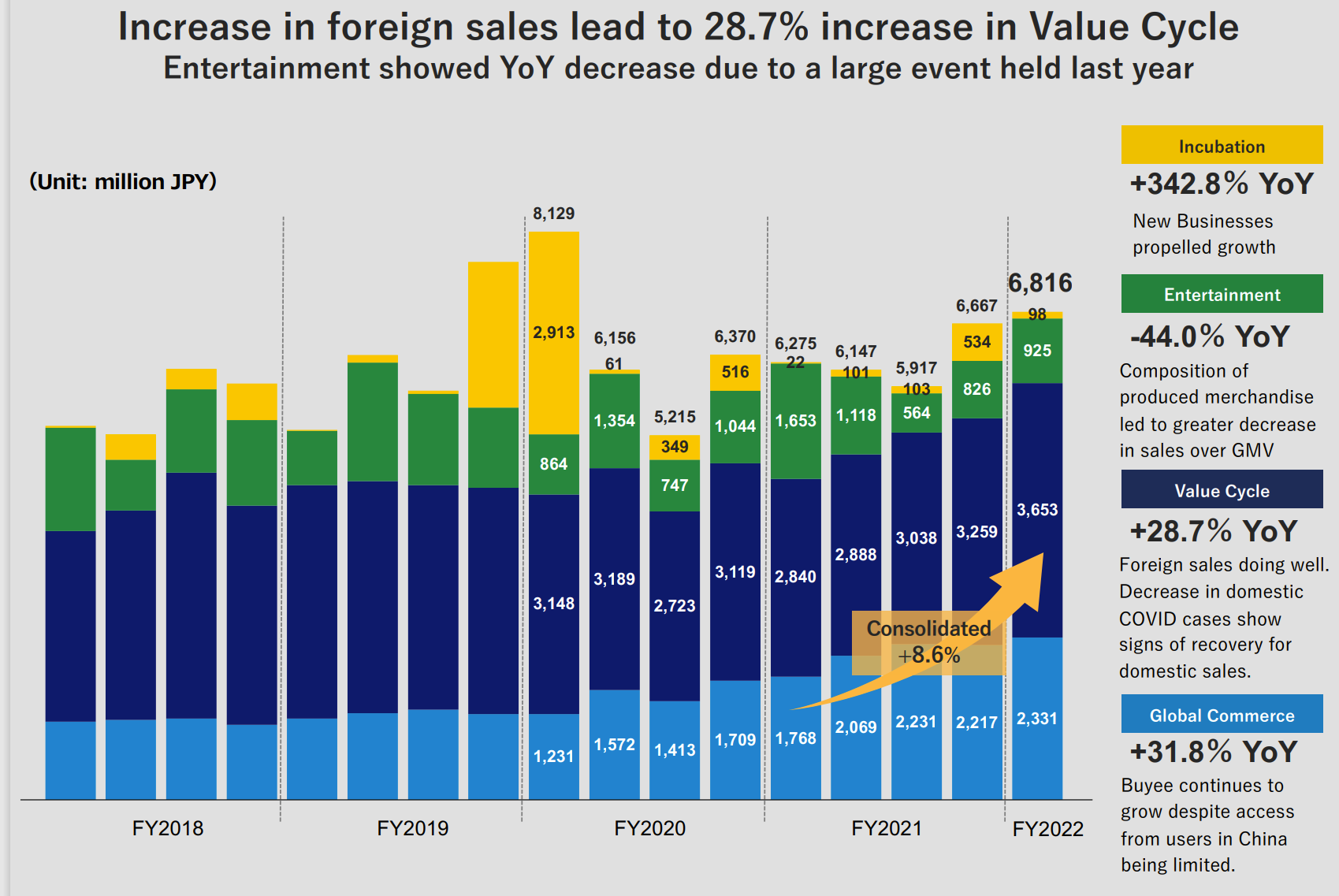

Global ecommerce operation profits continued to increase by 24%.

(Source: Financial Briefing for Q1 for FYE 9/22)

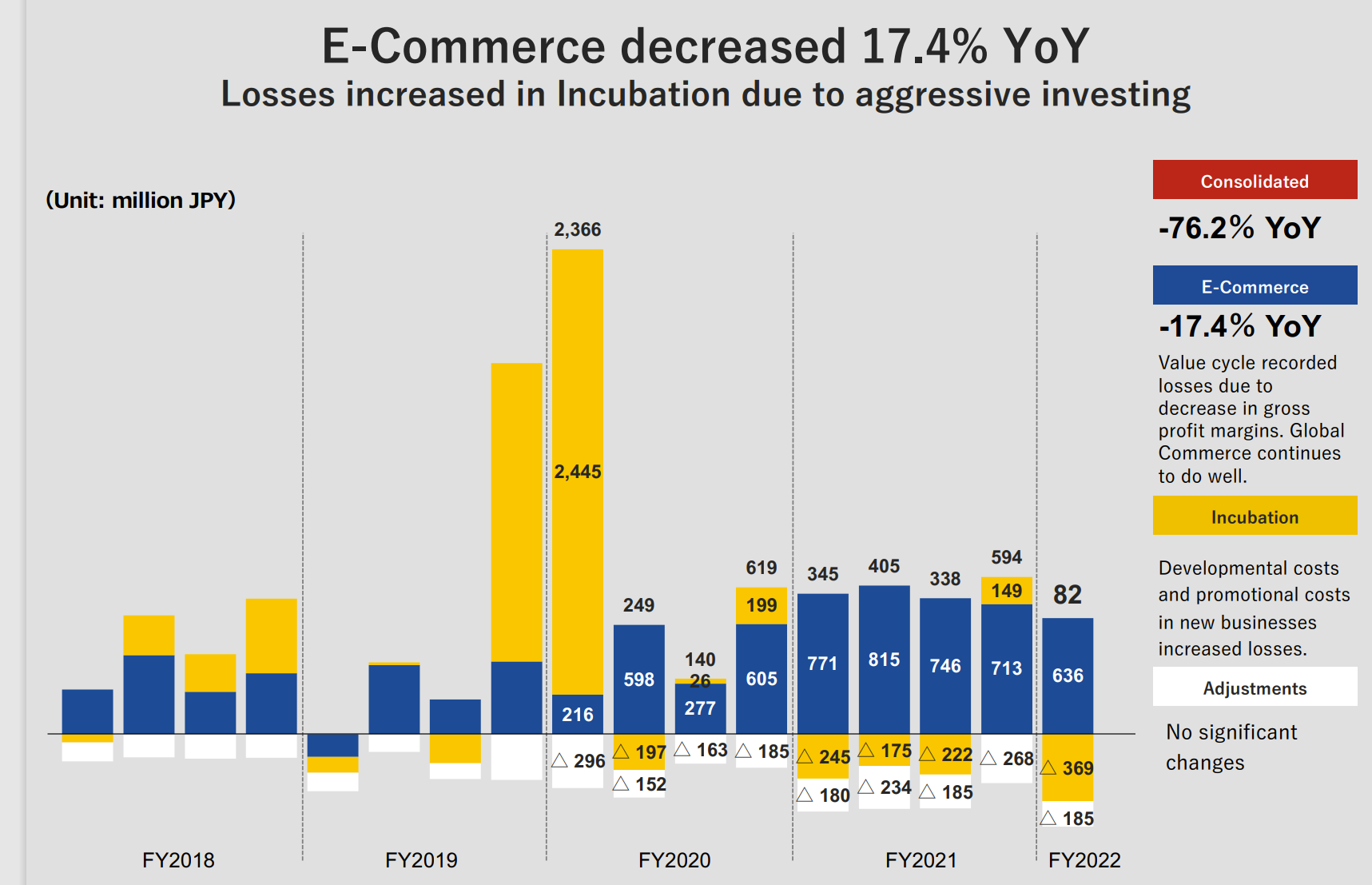

However, consolidated operating profits decreased 76% from a year ago, due to

1. Value cycle incurred losses as the company concentrates the good acquisition/purchase in Q1 and Q3 and larger % of high ticket items with low margin pressured gross margin.

2. Incubation’s losses widened as promotions and development activities were ramped up.

(Source: Financial Briefing for Q1 for FYE 9/22)

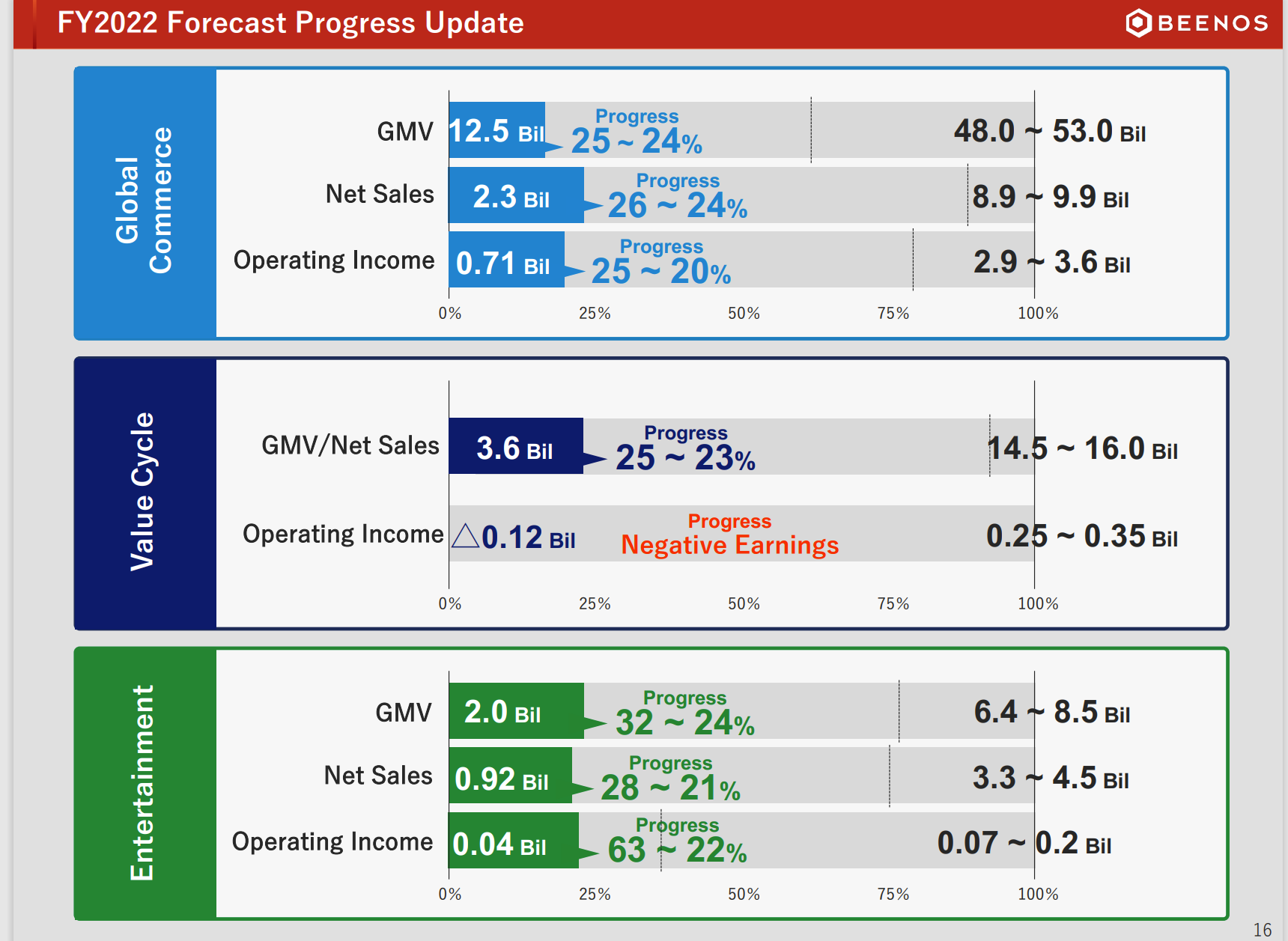

FYE 9/22 Guidance

GMV, sales and operating profit income are all progressing as per plan (reaching 25% of annual goal) except for Value cycle incurred operating losses. To improve profitability of Value Cycle group, the company is:

1) increasing foreign operations. Sales on foreign platforms such as Tmall (CHN), Vestiaire Collective (EU) and Shopee (Southeast Asia) have shown good growth.

2) The company has revamped an infrastructure to correctly handle and appraise high ticket items to improve profitability.

(Source: Financial Briefing for Q1 for FYE 9/22)

5. Total Addressable Markets (TAM)

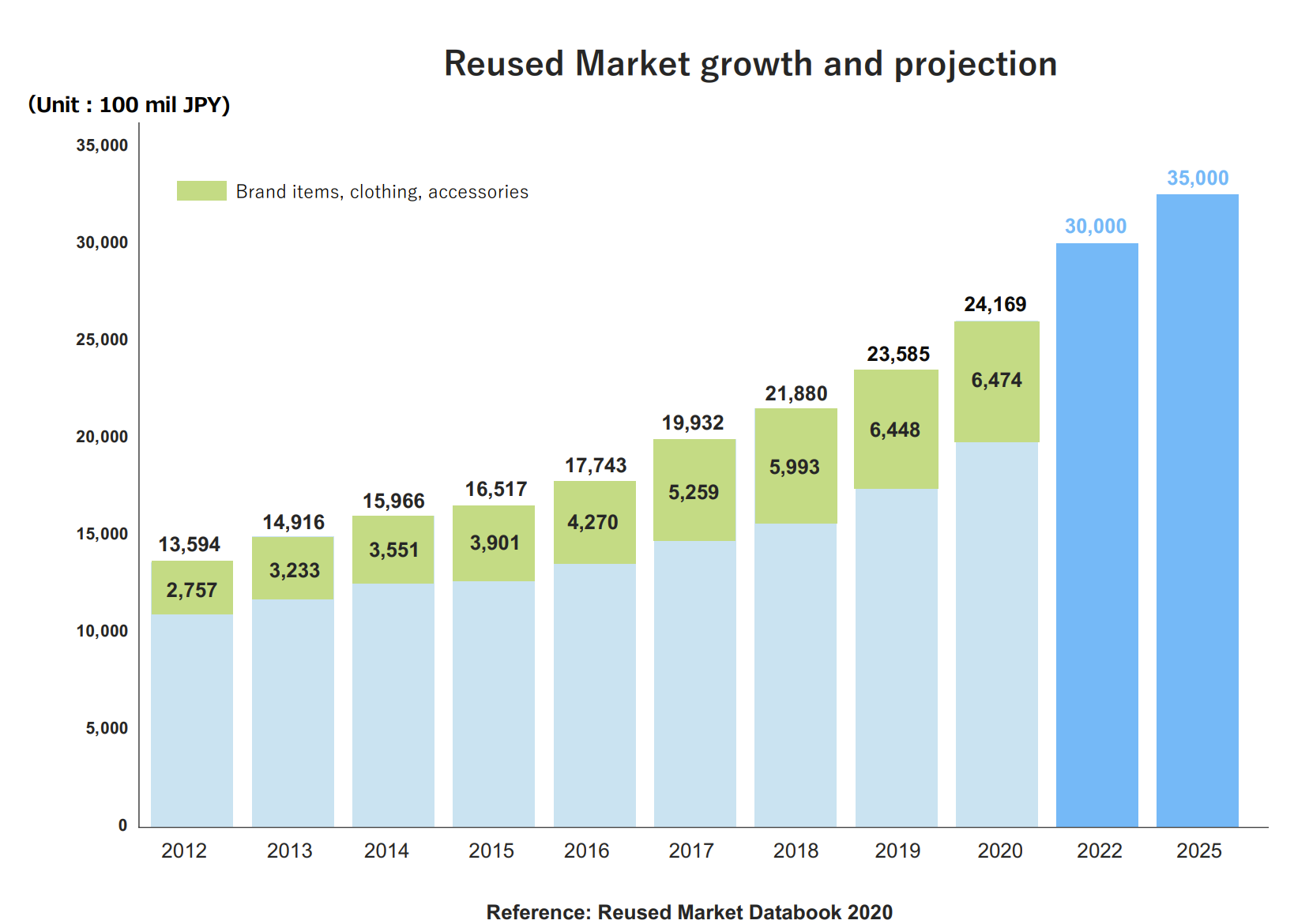

Cross Border e-commerce industry growth potential is discussed in the first section. Thus, this section focuses on Reuse Market (Value cycle by Beenos’ term) growth forecast.

The below graph forecast a solid growth (24% from 2020 to 2022 and 17% from 2022 to 2025) of the reuse market. Also, it is noteworthy that brand items are garnering a larger share in recent years.

(Source: Financial Briefing for Q1 for FYE 9/22)

6. Strengths and Weaknesses

Strengths

Beenos differs from its competitors since it forms alliance with large eCommerce sites. It continues to increase value prepositions to the customers. For example, the new function “Dashboard” allows the customers to “know your customers better” and finetune their product offering to better service their buyers.

Its services aim to reduce international trade barriers. Beenos has expanded the use of lower shipping cost service “ECMS Express” from Taiwan to US, S Korea, Hong Kong and Singapore.

Weaknesses

1) There is always a risk that their customer ecommerce sites will start to internalize translation, payment processing and logistics operations. Nonetheless, at this point, Beenos offers much better cost performance which their customers can’t refuse. Specifically,

a) Based on experience the company built through supporting 2,700 customer ecommerce sites, the company can provide unique services including country specific regulatory knowhow and volume driven lower shipping costs.

b) Sellers’ eCommerce sites are not charged any fees by Buyee.

c) From a buyer’s perspective, Beenos can offer cheaper shipping and handling costs by consolidating multiple products which the buyer buys from different sellers.

2) Value Cycle segment with operating losses

The current growth strategy of this segment is to focus on cross border selling of Japanese high priced used items since 1) they are known for their high quality overseas and 2) high ticket items are hard to transact at CtoC auction sites such as Mercari.

The Company has sacrificed near term profitability in order to establish the company reputation as a “highest bidder”. Lack of experience in dealing high ticket used products resulted in mispricing, which should be corrected as the company gains experience in high end segment. Also, opening of physical stores to buy reused items face to face should benefit both sellers and the company in accurately pricing the products.

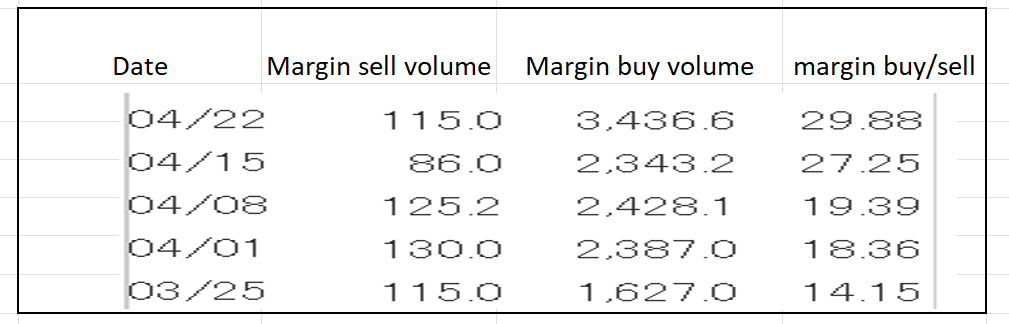

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Beenos, margin buy/sell ratios is e high at 30x as of 4/22. The acceptable level is around 3x. However, margin buy volume is about 3 day trading volume worth. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance