You may disapprove of uttering the words “business” and “dying” in one breath. However, a proper handling of the deceased costs money and Asukanet offers many cost savings by digitizing funeral procedures.

Asukanet (“Asukanet” or “the Company”) is a provider of personal and commercial photo publishing, memorial photographs for funeral parlors and aerial imaging services. It provides personalized on-demand printing photobooks in small lots. Photo album production is mainly for wedding halls and OEM production for NTT Docomo (the largest wireless service provider in Japan).

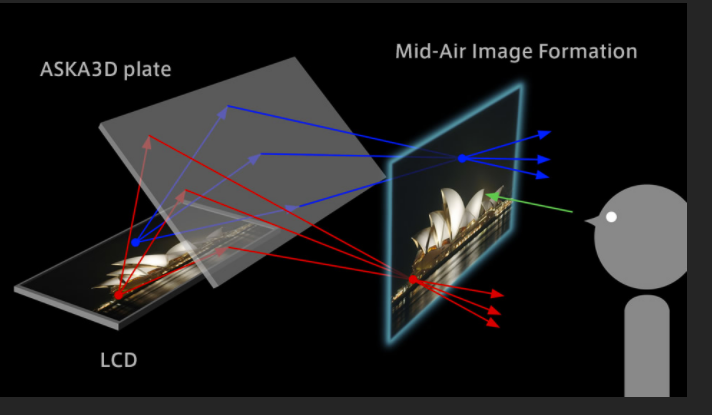

ASKA3D technology:

It is a real holography and can project clear videos and objects in midair. The holographic images are not VR images or optical illusions. They are actual videos which can be moved back and forth. ASKA3D does not require any complicated equipment. ASKA3D-Plate alone will do the job.

As seen in the below illustration, this technology sends lights emitted by an image or object through a special glass plate. Asukanet is also developing a new production method using not only glass but plastic.

(Source: the company website)

(a use case at a sushi restaurant, taken from the company’s website)

1. Investment thesis

1. Promising 3rd revenue source – ASUKA3D

Asuka3D technology enables touch operations on images on air and the company is focusing on its full-fledged expansion in and out of Japan. It can be embedded in other firms’ products, including automobiles and well as digital signage systems. ASUKA3D is already in use at cash registers in selected Aeon* department stores and 7-Eleven** is testing the products at its convenience stores.

*Aeon was the largest retailer in Japan by sales for FYE 4/20 with $73 B.

**7-Eleven is the largest convenience store in Japan, owned by Seven&I holdings with $56 B in sales.

ASKA3D’s revenue contribution is still small (2.6% of total sales) and the group has not generated the profits due to high R&D and marketing costs. But its growth is promising, driven by industry growth highlighted in TAM section below.

The aerial display group’s segment sales rose 35% in Q3 FYE 4/22 vs a year ago quarter, but segment losses widened from JPY 191M to JPY 234 as a result of higher marketing and R&D costs.

2. Funeral business (43% of total sales)– combining modern technologies such as AI with old tradition

The Company supports funeral parlors and Buddhist temples which are facing challenging operating environments.

While aging population leads to a rise in memorial service needs, the number of mourners at each funeral is declining and reducing the income for funeral parlors. Asukanet is setting itself apart in providing the industry leading support services for the entire process of a funeral (memorial service notice through its web based app->scheduling of a service itself->customizing decoration with memorial photos and flower arrangements -> acceptance of the mourners’ gifts and mailing of thank you letters ). Its core values are:

1) Provides the memorial photo processing done by experts with skills in focus restoration etc.

2) Offers customer services from 14 support centers located throughout Japan.

3) Satisfies a wide range of funeral parlor’s needs in organizing memorial service which is dictated by customers’ unique desire to remember their loved ones through video and pictures.

4) Can sell a package of funeral supplies including picture frames and special Japanese paper, etc.

As a result, the funeral group enjoyed the Q3 2022 sales growth of 11% from Q3 2021. Income grew 18%.

3. Faster recovery of Photobook business (54.4% of total sales) driven by wedding photo album needs.

The Company meets photography needs of both businesses (for the professional photographers) and consumers. Both segments suffered sales decline during Covid-induced economic closures. However, Business to Business segment has shown the quicker-than-expected rebound. Its main subsegment – wedding photo album- has recovered along with ceremony market rebound. The family photo album sector sales also rose, thanks to the company’s efforts to streamline order online system and enhance educational videos.

The end user consumer markets continued to be slow under the weight of Covid (subdued outdoor and social activities)

All told, professional market strengths offset the weakness of consumer market and sales rose Q3 2022 by 12% from Q3 2021. Income growth was substantial at 73% thanks to cost controls and improved factory utilization driven by higher sales.

2. Technically Speaking

(Source: buffet-code.com)

The above chart shows that upcoming volume cluster is around JPY 1,600 and after that, the stock should face less resistance.

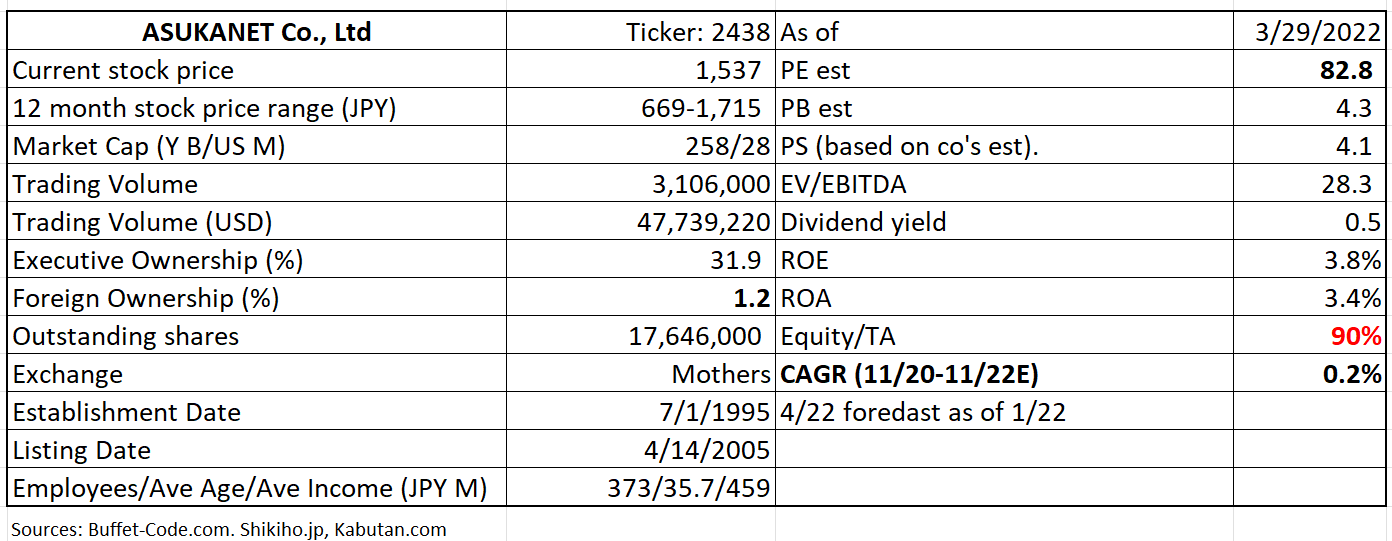

(By the below table). The stock trades at PE of 83x /22E vs. CAGR of 0.2 % which looks very extensive. Low CAGR of the last 3 years was the result of tough operating environments during COVID. PE of 83x indicates a high expectation for still unprofitable Aska3D. Therefore, initiating a position with Asukanet requires a high conviction on potential Aerial 3D display. One important mitigating factor is the company’s strong balance sheet of Equity/Asset ratio of 90%.S

3. Business Model

1. PhotoBook:

Revenues are realized through individual sales.

2. Funeral Services earn its revenues three ways:

1) Photo processing fees per processing

2) Sales of supplies such as Ink, paper and photo frames

3) Sales of Hardware such as digital signage makers

The company has introduced online memorial service notice/invitation application “Tsunagoo After” in 2021. Their web based funeral service support site – “Tsunagoo” is the one stop shop allowing 1) funeral parlor to send a service detail notice by coordinating with the families and 2) mourners to send condolence telegram, flowers and gifts. “Tsunagoo” are awarded “top service” by Japan Marketing Research Institute.

The company handles 350,000 funeral photo processing/year and is known for its high quality.

3. Aerial Display:

Domestic marketing is handled by internal sales force. Overseas (North America, Middle East and China), local companies are contracted to market ASKU3D.

4. Financial Highlights

Results for 9 months ending 1/22 for FYE 4/22 (5/21- 4/22)

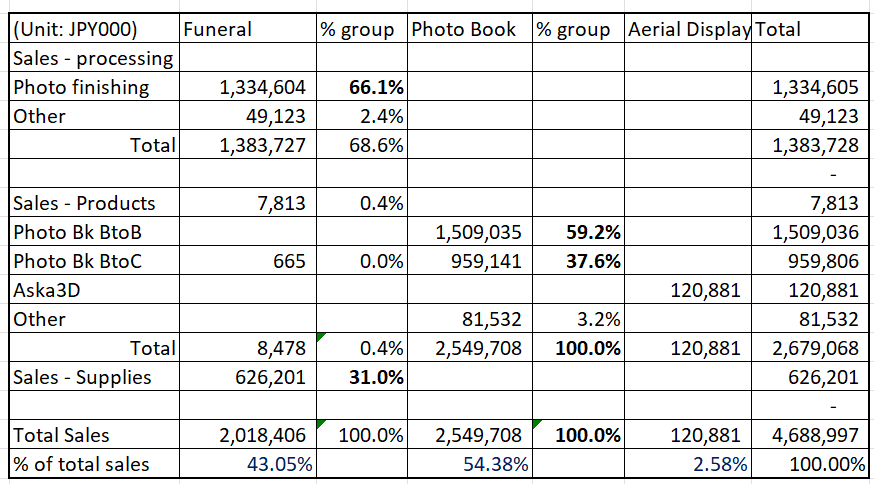

The three groups’ financial performance was discussed in investment thesis section above. The below table illustrates the structure of each group.

1. Funeral Group (43% of sales): Picture processing generates 66% of group sales and supplies sale 31%. Hard ware contribution s is small at 0.4%.

2. Photo Book (54.4%): Commercial sales (sales to professionals) account for 59% and consumers 38%.

3. Aerial Display (2.6%): Aska3D is still small in its contributions.

(Source: Financial Results Briefing for Q3 for the Fiscal Year Ending 4/2022)

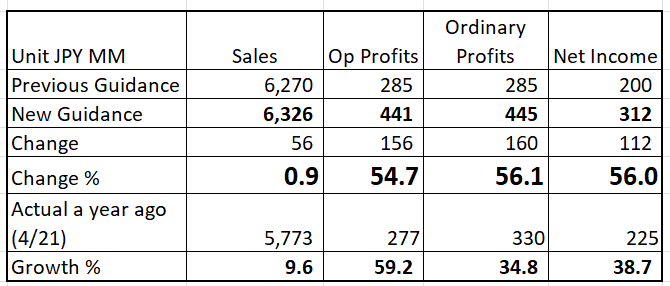

FYE 4/22 Guidance – UPPED.

The company increased its FYE 4/22 sales guidance slightly, following the faster than expected recovery from Covid bottom in two main business: Photo Book and Funeral Services. Profitability guidance increase was more meaningful at around 55%, since higher R&D expenses for Asuka3D was offset by higher factory utilization.

5. Total Addressable Markets (TAM)

A) Memorial Service Market

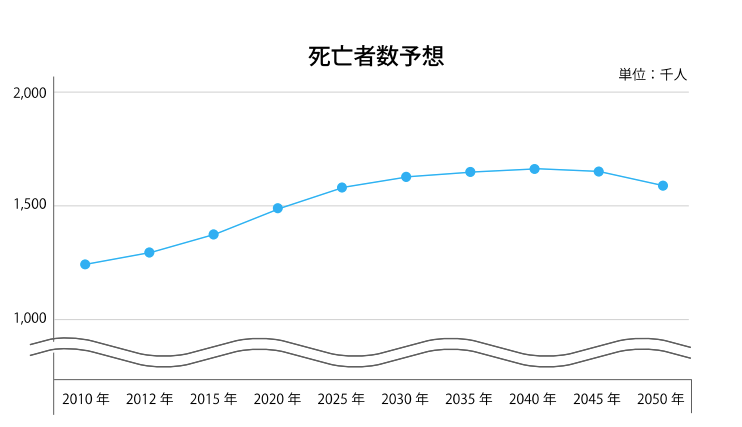

The below line chart depicts that death rate is expected to peak in 2040 and decline after that in Japan due to decreasing birth rates in recent years. In addition, there are increasing trends that both the number of mourner participation and size of a funeral are declining. It is because families of the deceased are choosing to mourn in a more private setting. Furthermore, high cost of a funeral discourages a large gathering. According to the survey conducted in 2/20 and published by Stastica, average costs of a memorial service in Japan was around JPY 1.3 million ($1,300). The costs have rapidly coming down since the number was around $2,000 in 2010.

These trends – plateauing death rates and less spending by families – are pressuring funeral parlors’ profitability. This, in turn, increases the importance of value of Asukanet’s service offerings which will help their customer (parlors) in successfully competing against their peers. That is, the Company helps its clients – mainly funeral parlors, in fending off their competitors by enabling them to service the end users (morning families) to go through the tough time with comforts.

(Source: National Institute of Population and Social Security Research taken from Financial Results Briefing for Q2 for FYE 4/22)

B) 3D Aerial Display Market

We have not been able to locate industry research covering both 3D imaging and aerial display. However, as per the two reports below, 3D imaging and aerial display markets are expected to grow individually, thus, it seems to be safe to conclude that 3D aerial display market will enjoy a respectable growth.

****3D Display Market ****

Source: 3D Display market by type (Volumetric Display, Stereoscopic, and HMD),

Technology (DLP PRTV, PDP, OLED and LED), Access Method (Screen Based Display and Micro Display) and Application (TV, Smartphones, Monitor, Mobile Computing Devices, Projectors, HMD and Others): global Opportunity Analysis and Industry Forecast, 2021-2030), published by Allied Market Research as of 2/22.

The global 3D display market size was valued at $76.50 billion in 2020, and is projected to reach $378.56 billion by 2030, registering a CAGR of 17.6% from 2021 to 2030. The growth is fueled by the expansion of industry application from defense, science and education to gaming and entertainment industries.

****Aerial Imaging Market****

Source: The Global Aerial Imaging Market, Growth, Trend, Impacts of Covid 19 and Forecasts (2022-2027) by Modor Intelligence

The global aerial imaging market was valued at $1,984.2 million in 2021, and it is expected to reach $4,532.1 million by 2027, registering a CAGR of 15.47% during the period of 2022-2027.

Although the trend of drone surveying is already becoming mainstream, the COVID-19 pandemic tipped the scale in its favor substantially. UAVs/Drones have become a go-to technology during the COVID-19 pandemic, primarily because they can accomplish tasks without contact. The market has been augmented by the technology development of ready-to-fly (RTF) devices.

6. Strengths and Weaknesses

Strengths

*Adding 3rd leg of growth engine

As discussed in Investment Thesis section, the company’s efforts to commercialize aerial display system (Asuka3D) is gradually bearing fruits. We are now in the new post-Covid “touchless” environment, which should be a trail wind for the Company.

Weakness

*Rise of copy cats

The Company is facing rising competitive forces in two main business. Management has noted that both in funeral services and photobook segments, the competitors are coping Aukanet’s offerings. To fend off these copy casts, the company is revamping up its technology (mainly AI) based products to enhance user experience and improve efficiencies.

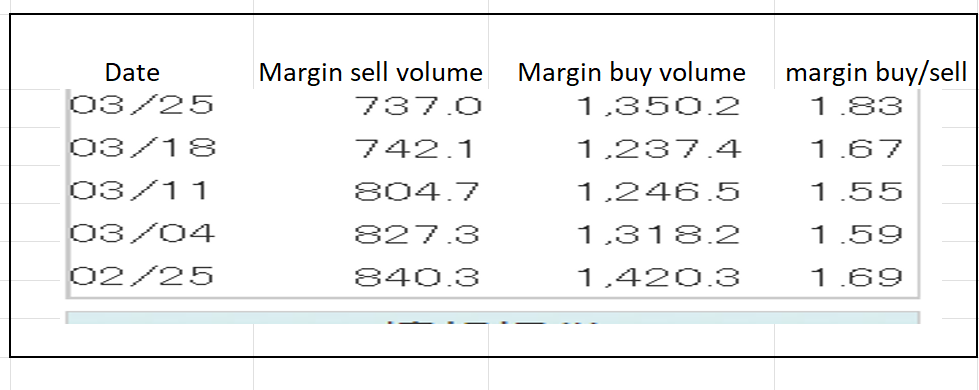

7. Near-term Selling Pressure

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Asukanet, margin buy/sell ratios is around 1.9x below a reference level of 3x. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance