Are Japan stocks a Bargain?

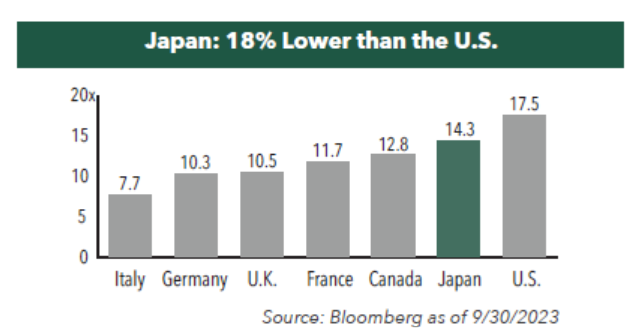

- Price-to-Earnings: Japanese large-cap equities, as represented by the Tokyo Price Index (TOPIX), are currently trading on a P/E multiple of 14.3x 2023 forward earnings, 18% lower than the U.S.

(Source: Hennessy Funds)

(Source: Hennessy Funds)

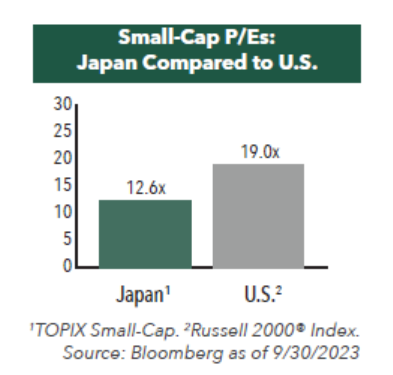

- Japan Small-Caps are also trading at a discount to international peers. Small-cap stocks in Japan are trading on just 12.6x 2023 forward earnings, and at a 34% discount to U.S. small caps trading at 19.0x.

(Source: Hennessy Funds)

The notion of Japanese stocks being undervalued is not new. Despite this, investors who see Japan as a bargain haven’t significantly driven up stock prices. This could be due to a belief among some investors that Japanese stocks are not undervalued, or possibly even overvalued.

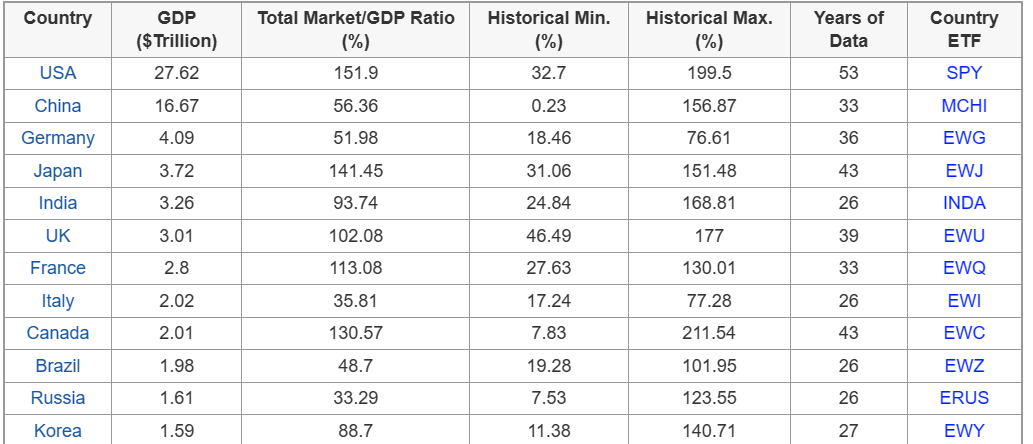

Let’s look at the Buffett Indicator. It is the ratio of a country’s total stock market value to its GDP.. In essence, it compares the value of all stocks (which represents the present value of all their future earnings) to the value of the country’s total output (GDP), which is the monetary value of all final goods and services produced in a country in a given period of time Thus, if every economic activity in the country were corporatized, GDP would basically reflect the aggregate annual sales of all the companies. This relates very closely to a price-to-sales ratio.

The table below lists the top 12 countries’ buffet indicators as of 10/27/23 provided by “gurufocus”.

Based on the Buffet Indicators, Japan is expensive at higher than 100%. Historically, it is also expensive since its current 141.45% is not too from its 10 year high of 151.48%

So which is it? Is Japan undervalued or not?

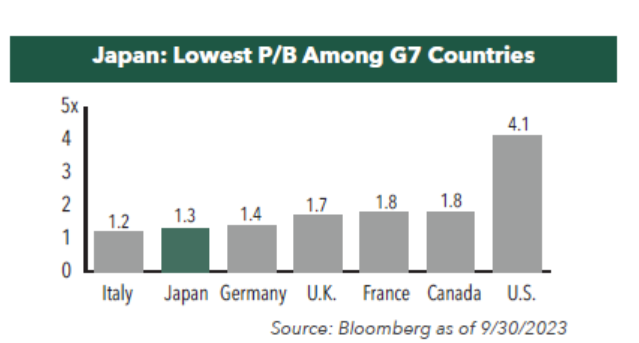

The valuation of Japan hinges on market sentiment. Currently, investors seem to prioritize the Price/Book (P/B) ratio. The Tokyo Stock Exchange’s unusual appeal to companies with a P/B ratio below one earlier this year, urging them to improve their P/B or risk delisting, has been attributed to the market’s strength in early summer.

If a company’s PB ratio is below one, the market is valuing the company at less than its assets are worth. In another words, a PB ratio of below one indicates that investors are very skeptical of the company’s profitability and growth potential.

In its “33-year highs – but why?” report issued on 6/26/23, Schroders pointed that 53% of stocks in TOPIX was traded at PB of below one. There are many ways to improve P/B ratio, two major ones being investing in tangible and intangible assets and increasing shareholder returns. The aforementioned Schroders’ report commented that the both of these measures can be instituted, since 50% of Japanese companies are net cash (cash on their balance sheet is larger than their liabilities).

Currently, based on the year-to-date return, it appears that investors may be placing their bets on companies with low P/B ratios, anticipating their successful implementation of initiatives to increase their P/B.

TOPIX and Nikkei 225 returned 17.58% and 22.79% year to date, respectively, vs 11.47% of SP500. Nasdaq100’s outperformance of around 35% is driven by Magnificent 7 (Meta, NVDA, TSLA, GOOGL, MSFT, AAPL and AMZN) which may not be a good comparison.

Do you think Japanese stocks are undervalued?