If you have a chance to ask management team of Japanese companies “what is one of many challenges you face?”, many will reply as follows:

“We can’t hire workers whom we need to grow with!”

Here comes Aidma to rescue!

Who is Aidma Holdings?

Aidma Holdings (“Aidma” or the “company”) supports marketing and operations of small- to medium-sized companies (employees of 10-100) through effective use of external resources. The company offers 3 main products:

1) The work innovation business is comprised of the “sales platform business,” which is a marketing support service, 2) the “mama works business,” which is a human resource support service, and 3) the “meet in business,” which provides an online communication infrastructure.

The sales platform business accounted for 82% of net sales, the mama works business for 11% and the meet in business for 7%.

The three businesses in details:

1) In the sales platform business, the company mainly supports execution of test marketing of products, by utilizing a marketing information database based on its group companies’ business activities and its own marketing support system. Sales Crowd boasts data on 170,000 Japanese enterprises.

2) In the mama works business, the company operates “mama works” is a job offering website which caters to home-based workers and has over 300,000 registered members. It provides consultation to customers how to realize efficiencies utilizing freelance workers. On the supply side, there are 600,000 workers who want to work but can’t find the jobs which meet their schedule.

3) In the meet in business, the company provides “meet in,” an online communication infrastructure internally developed by Aidma. Since the launch of the service in 11/2018, “meet in” has been introduced to over 3,400 companies.

1. Investment thesis

1) Aidma provides a solution to social woes:

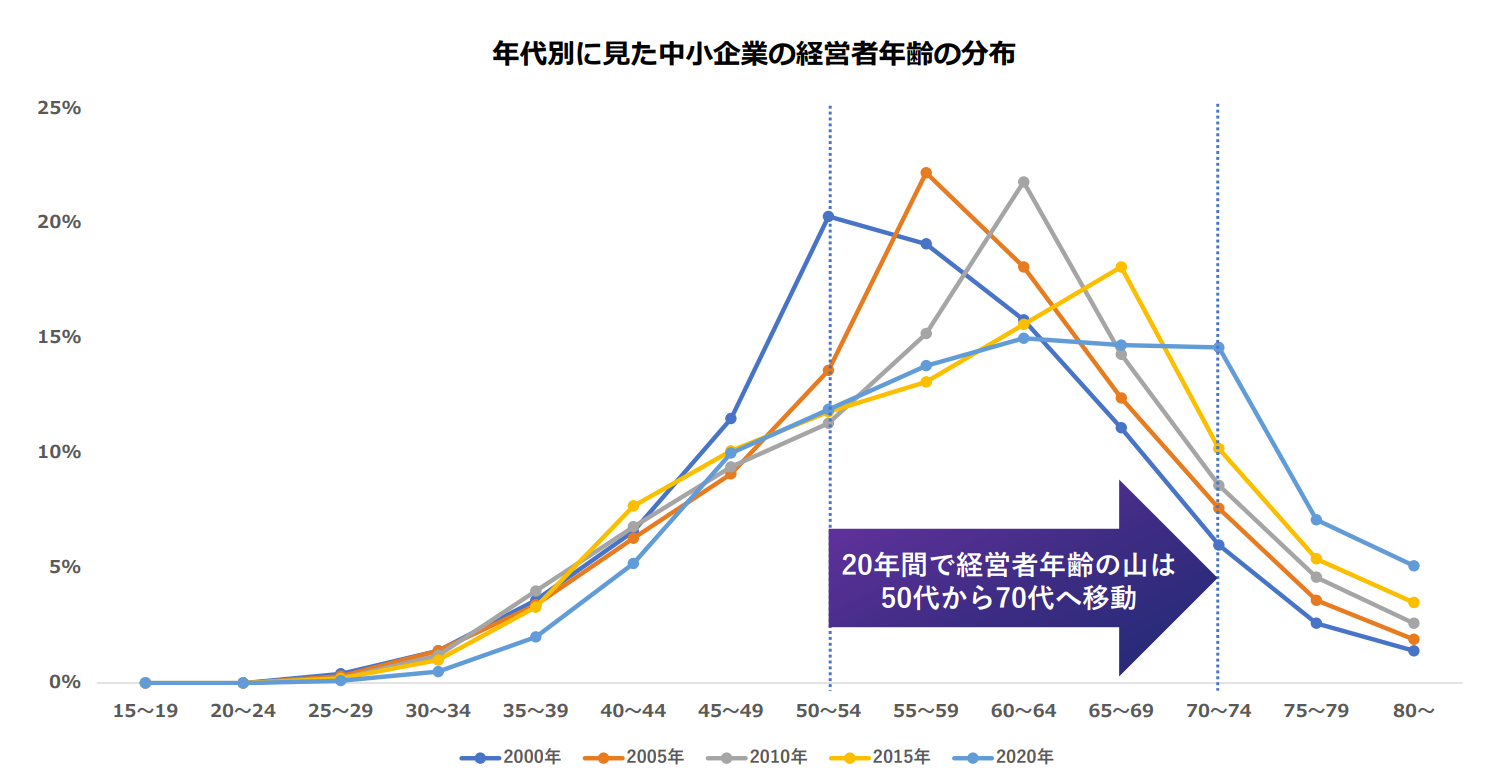

Major investment merit of Aidma can be summarized in the below graph. Average age of the leaders of Japanese corporations have shifted from 50’s to 70’s over the last 20 years. The succession is a key concern among aging top management. Aidma’s suits of technology-based products ease their workload and concern by taking over many marketing and strategic decision making from these leaders.

(Source: Small and Medium Enterprises Agency presented by the company)

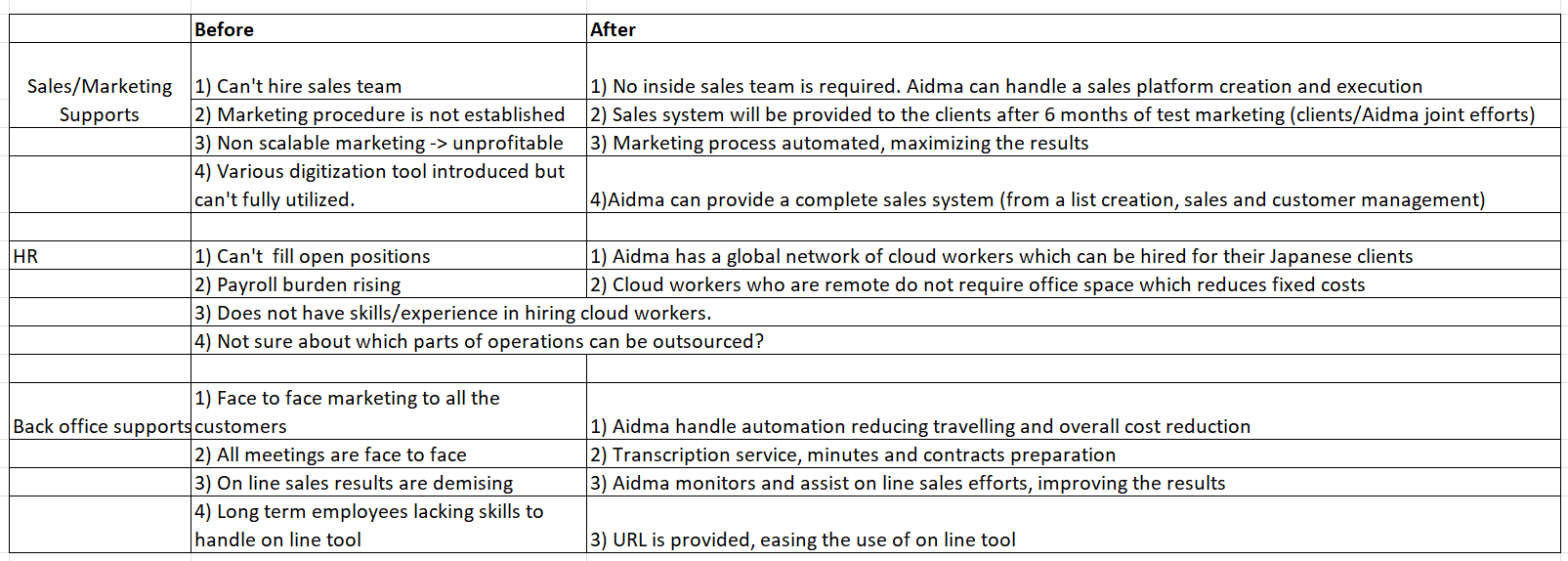

The below table summarizes BEFORE (the issues which the SMEs face) and AFTER (solutions Aidma can provide)

(Source: the company, translation by JapaneseIPO.com)

2) Competitive edge:

a) Aidma’s ability to support a company from an initial stage of a sales process through a final client support stage is the entry barrier:

1.Bizmaps: data base of 170,000 companies which can generate a workable list of prospects/target customers.

2. SalesCrowd: Cloud based sales process support (from the initial contract through the analysis of the end results). BizMall, launched in Q4 8/21, aids the client companies in building their own websites with no programing required. These newly added service are lifting ARPU and LTV (life time value of a customer)

3. meet in: on line communication tool.

b) The second differentiation factor

Aidma’s biggest assets are data accumulated on 170,000 entities located throughout Japan and wealth of user engagement data.

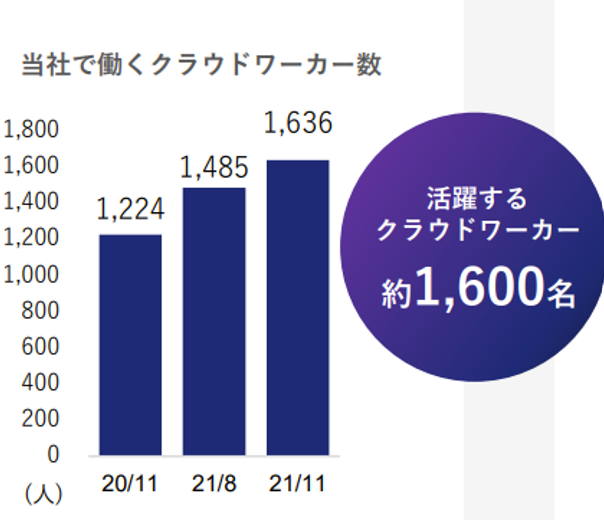

Also, as the graph shows, Aidma’s established network with cloudworkers are rapidly expanding from 1,224 in 11/20 to 1,636 in 11/21. These cloudworkers have found positions with 4,500 employers. Aidma itself is an employer of many cloudworkers and been successful in reducing operating costs.

(Source: Q1 Financial Results Briefing for the Fiscal Year Ending 8/2022)

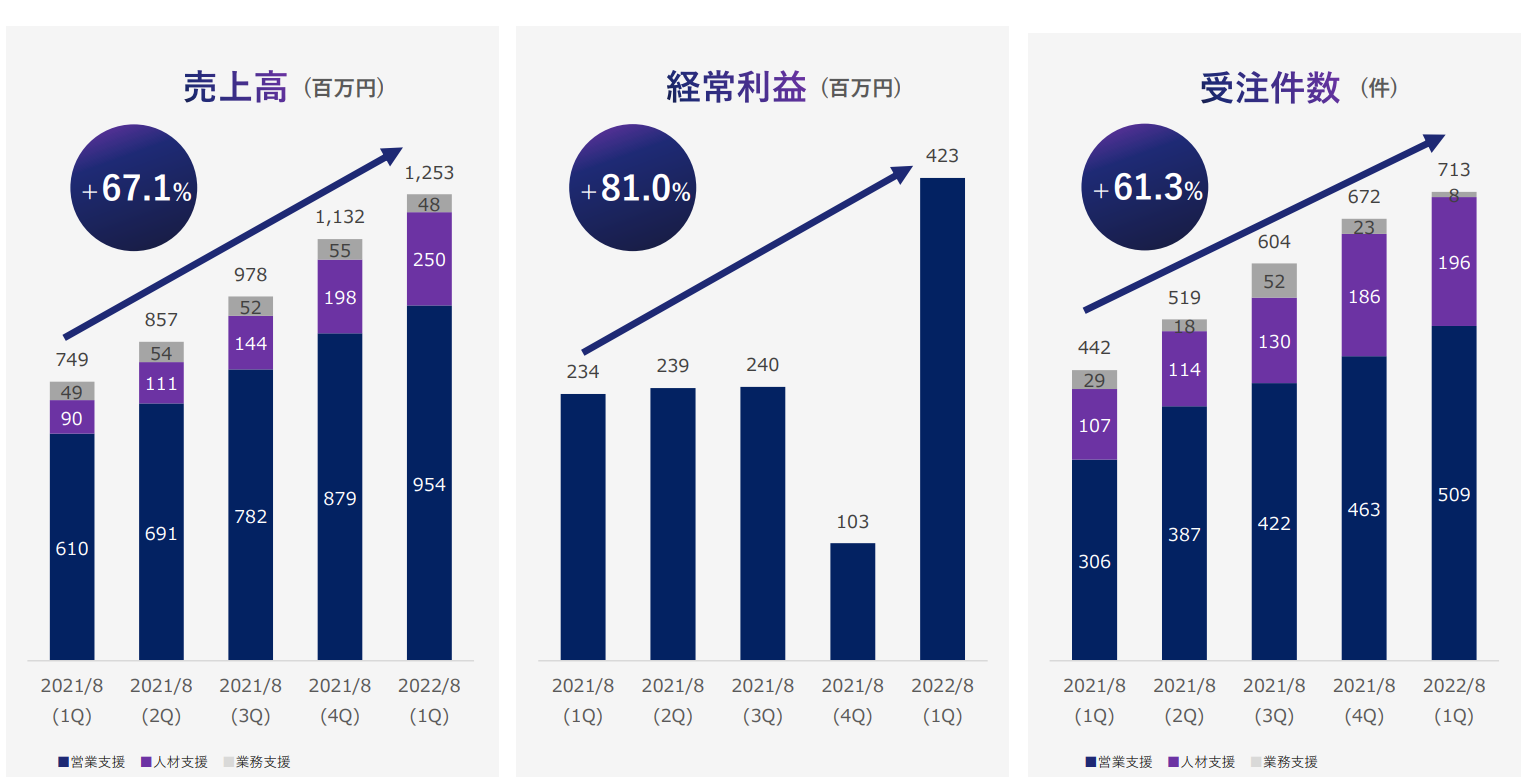

3) Steady growth

(Source: Q1 Financial Results Briefing for the Fiscal Year Ending 8/2022)

Note-Left graph: Sales growth, Center: Operating profits trend, Right: Orders/Dark blue – Sales support, Purple-support, Gray – Operational support.

The benefits of targeted spending in the system improvements, hiring and advertisement in Q4 for FYE 8/21 is evident in substantial improvement (+81%) in operating income of Q1 for FYE 8/22 vs. Q1 8/21.

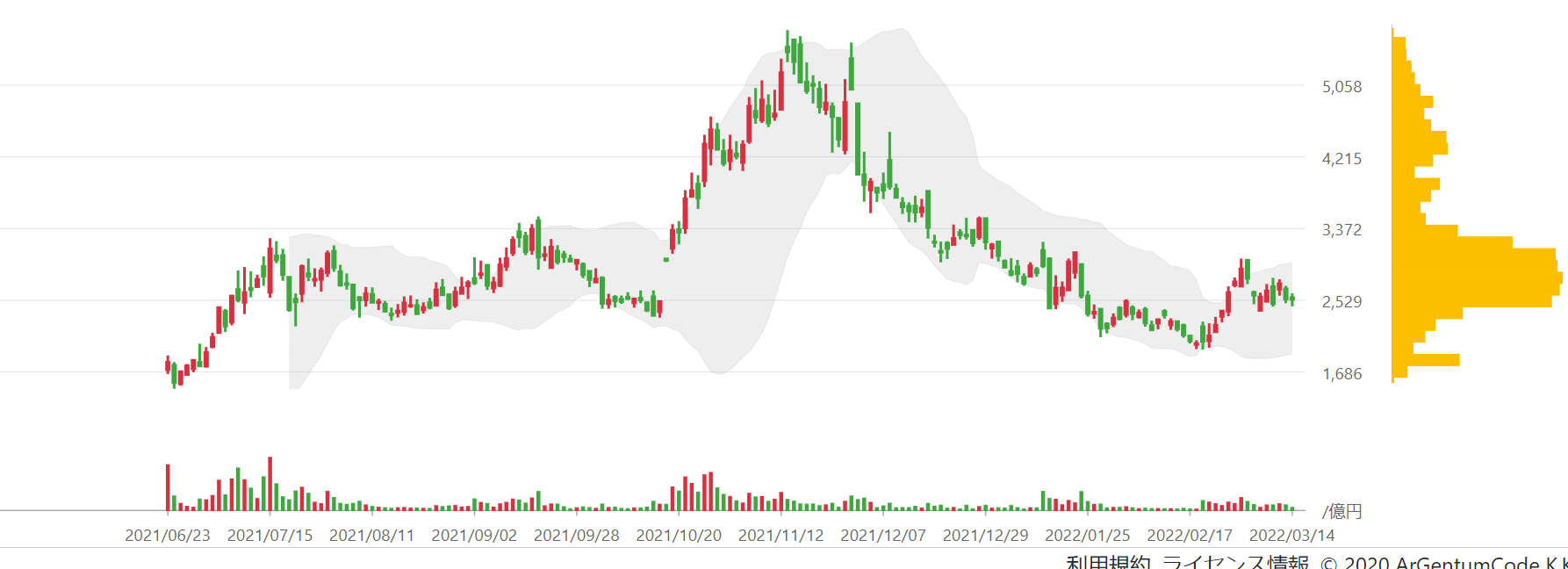

2. Technically Speaking

(Source: buffet-code.com)

The stock was on the ascending tend in Oct-Nov/2021 prompted by news that Aidma had reached an OEM contract with NTT Docomo (the largest wireless carrier in Japan) for their cloud sales platform. However, as the investors had realized that the near term benefits of the contract was limited, the stock had turned south with the markets. It is trading at around JPY 3000 which is the most heaviest price cluster. Once the shares go through the current range, the stock should not face much resistance.

Aidma trades at PE of 52X 8/22E vs. CAGR of 77% which looks reasonable.

3. Business Model

1. In mama works (the cloudworker placement service)

The company receives advertisement publishing fees from companies (2000 employer network) for which it placed job offerings and fees according to contract terms from companies for which it offered consultation. Aidma has relationships with 300,000 registered cloudworkers.

2. Sales Crowd: Aidma’s clients companies for sales support products ( has increased tenfold from 35 in 8/18 to 327 in 8/18).

The company earns monthly fees for the contract term of 13 months.

4. Financial Highlights

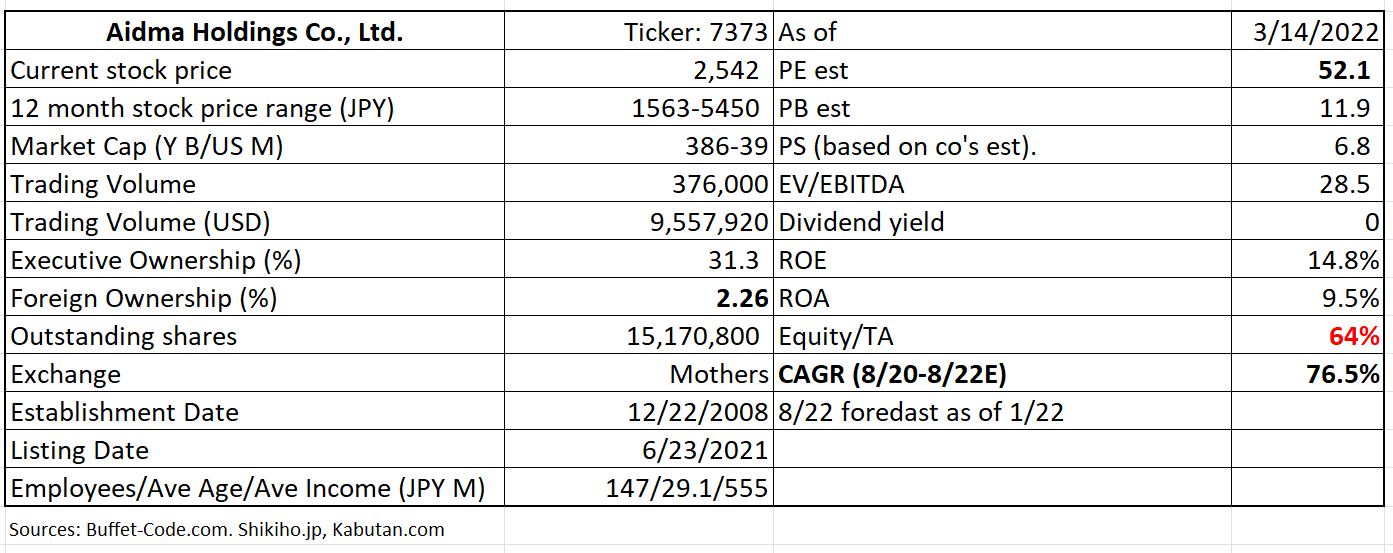

Results for Q1 for FYE 8/22 (9-11/21)

Aidma’s sales is seasonal with winter months being a slow season. Therefore, Q1 numbers are shy of 25% progress against the annual guidance. However, increased spending in system, hiring and advertisement in Q4 8/21 is bearing fruits in the most recent quarter (Q1 8/22) as % progress of sales and profits is better by 2-7% compared to a year ago quarter.

(Source: Q1 Financial Results Briefing for the Fiscal Year Ending 8/2022)

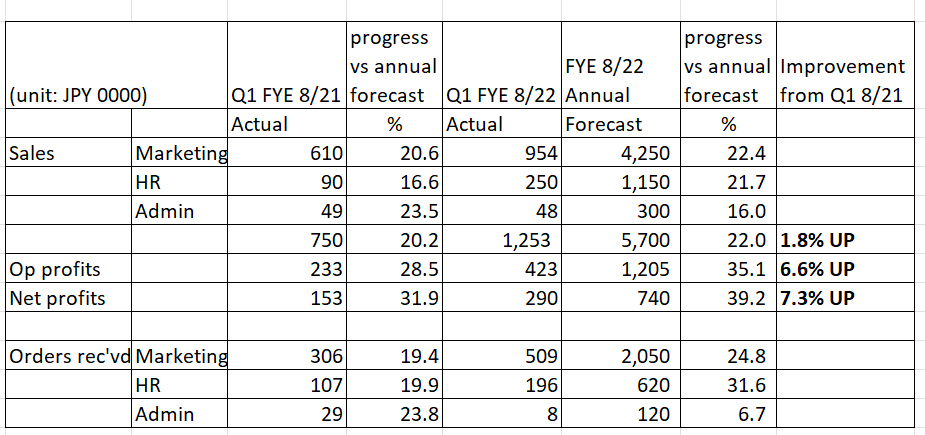

5. Total Addressable Markets (TAM)

1. The left pie chart shows that, in Japan, 70% of employment is provided by small to mid-sized enterprises. Right chart shows that number of workers engaged in sales/marketing activities has peaked in 2020 and has been on a sharp downward trend since then. This structural issue in Japanese society presents Aidma who can help clients in hiring marketing team in their terms.

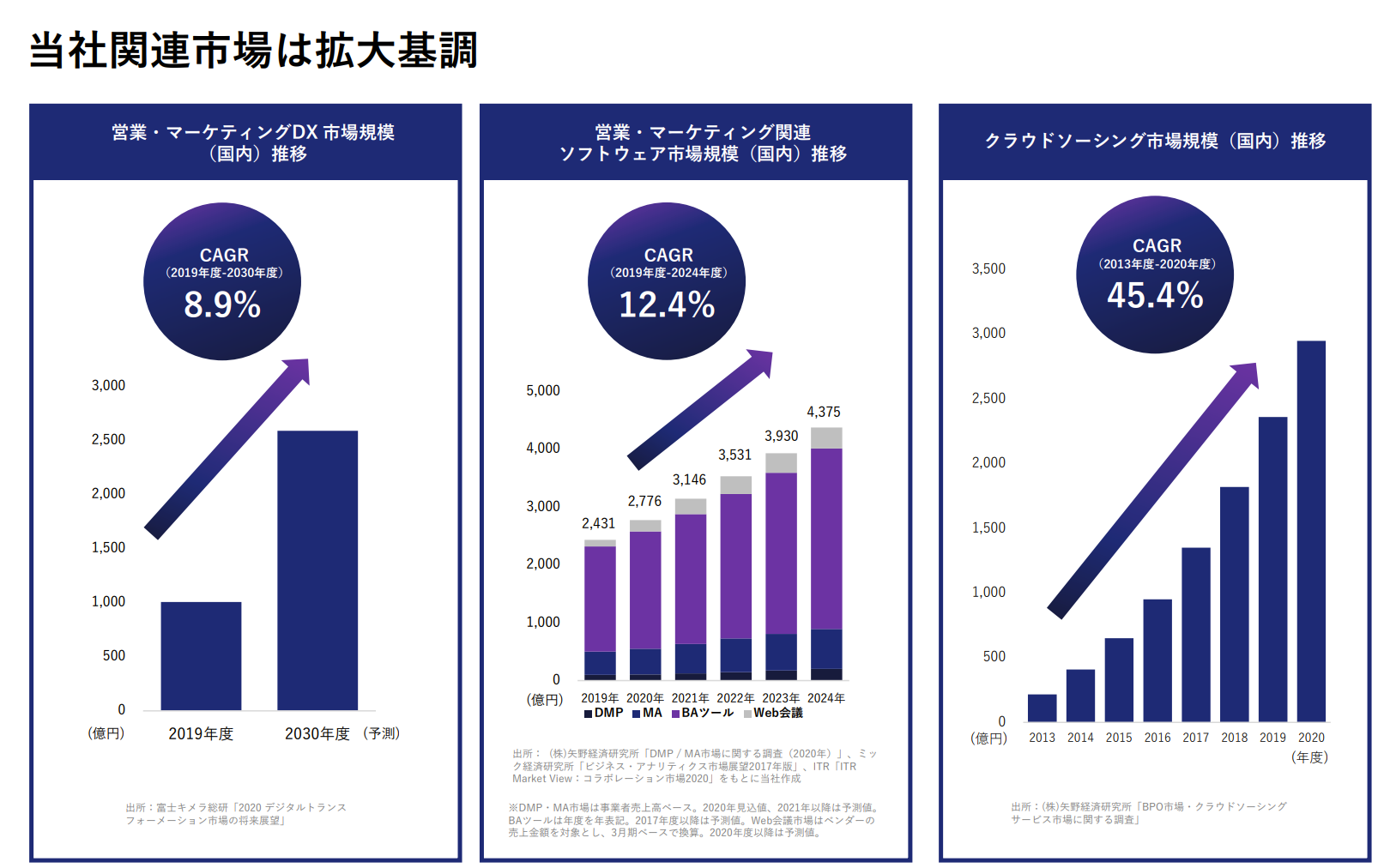

2. The below three graphs illustrate that Aidma’s three products segment presents the company an ample room to grow:

(Sources: Left Graph, Fuji Chimera Research Institute “Future of Digital Transformation Markets 2020), Center 1) Yano Research Institute Ltd “DMP/MP Markets 2020”, Center 2 Mick Economic Research “Future of Business Analytics 2017”, Center 3 ITR Market Review “Collaboration Market 2020”, Right Graph “BPO Market”.

(Sources: Left Graph, Fuji Chimera Research Institute “Future of Digital Transformation Markets 2020), Center 1) Yano Research Institute Ltd “DMP/MP Markets 2020”, Center 2 Mick Economic Research “Future of Business Analytics 2017”, Center 3 ITR Market Review “Collaboration Market 2020”, Right Graph “BPO Market”.

Left graph shows that sales and marketing digitization demand afford the players with sales CAGR of 8.9% from 2019 through 2030.

Center graph discusses that DMP, MA BA tool and Web conference software combined presents 12.4% growth potential for 2019 – 2024.

Right graph points out that cloud outsourcing market has grown 45.4% from 2013 to 2020. It seems that updated report is not available yet, but conditions conductive to cloud sourcing such as remote work arrangement and entities’ need for cost optimization, are not abating, thus, sustainable growth of cloud outsourcing will continue.

6. Strengths and Weaknesses

Strengths

1. The Growth Driver is a societal problem: labor shortage

Aidma is matching the labor (cloud workers) with the labor seekers (employers). When you provide solutions to the problems, your products are well received which lead to higher profitability.

2. Growth strategy-Logical

1) Expand client markets to larger enterprises by offering customized in-house team design help rather than connecting workers with employers.

2) Penetrate into existing clients by up-sell and cross-selling Saas based additional services (CRM, customer analytics etc.), thereby increasing ARPU (average revenue per user)

3) Expand the functionality of Digital Sales Tool, increasing again ARPU. Majority of functionality is automated and flows like the below sequence:

Approach List: Enter the existing clients data, system spits out the prospects with the similar attributes.

Approach: System sends out offers to the list of qualified cloud workers.

Leads (positive response to the above offers) acquired from the company’s customers: System send relative and appropriate client communication and information packages to the prospects.

Negotiation: Cloud workers conduct joint (with the customer) contract negotiations or solo (cloud worker alone) negotiations.

Order received: The new order and the customer data are entered in the system which again produce a new updated list of prospects.

Weakness

1. Rising expenses/investments to support growth

The company needs and has continued to report a quarterly sales growth to be able to support expenses.

2. Possible shortage of cloud workers

Nippon.com had an interesting article “The Gig Economy Reaches Japan” on 5/8/20. The life style of “gig economy” is that workers accept temporary and one-off jobs on ad-hoc basis via the Internet. This style of working is slowly gaining traction in Japan. This same article lists the below stat which frankly surprised me. According to Staffing Industry Analysts, there were 53 million gig workers in the US in 2018, making up 35% (!!) of the total workforce. This figure includes 7.9 million workers who find jobs through online labor markets—the so-called human cloud—1.3 million statement of work (SoW) consultants, and 27 million independent contractors. I could not find the more updated figure and statistics of gig workers in Japan is not found. However, gig (cloud) work assignments have just begun to gain “citizenship” in Japan. Also, the senior yet still active and capable workers who retire their full time jobs at 60-65 years old (this is still the widely enforced system in Japanese corporations) present a big pool of cloud workers.

7. Near-term Selling Pressure

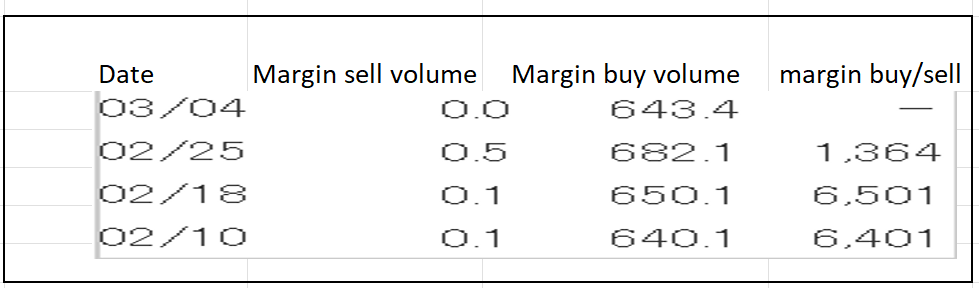

As noted in useful tips section of www.JapaneesIPO.com, when the stock’s outstanding margin buy volume is high and rising, that will function as the near-term selling pressure. For Aidma, there is basically no margin sellers. The current margin buy outstanding volume is 2 day worth of trading volume. Thus, the near term selling pressure is not a big concern.

Margin trading unit (1,000):

(Source: Kabutan.com)

[Disclaimer]

The opinions expressed above should not be constructed as investment advice. This commentary is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product. Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future performance